DIpil Das

What’s the Story?

We take a deep dive into US consumers’ holiday 2020 shopping expectations, with results from our exclusive consumer survey, conducted on September 14, 2020.Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever. Our proprietary survey provides insights on how, when and where consumers expect to shop this holiday season—including the aspects they are undecided on given the unfamiliar context.How Consumers Will Spend and How Much

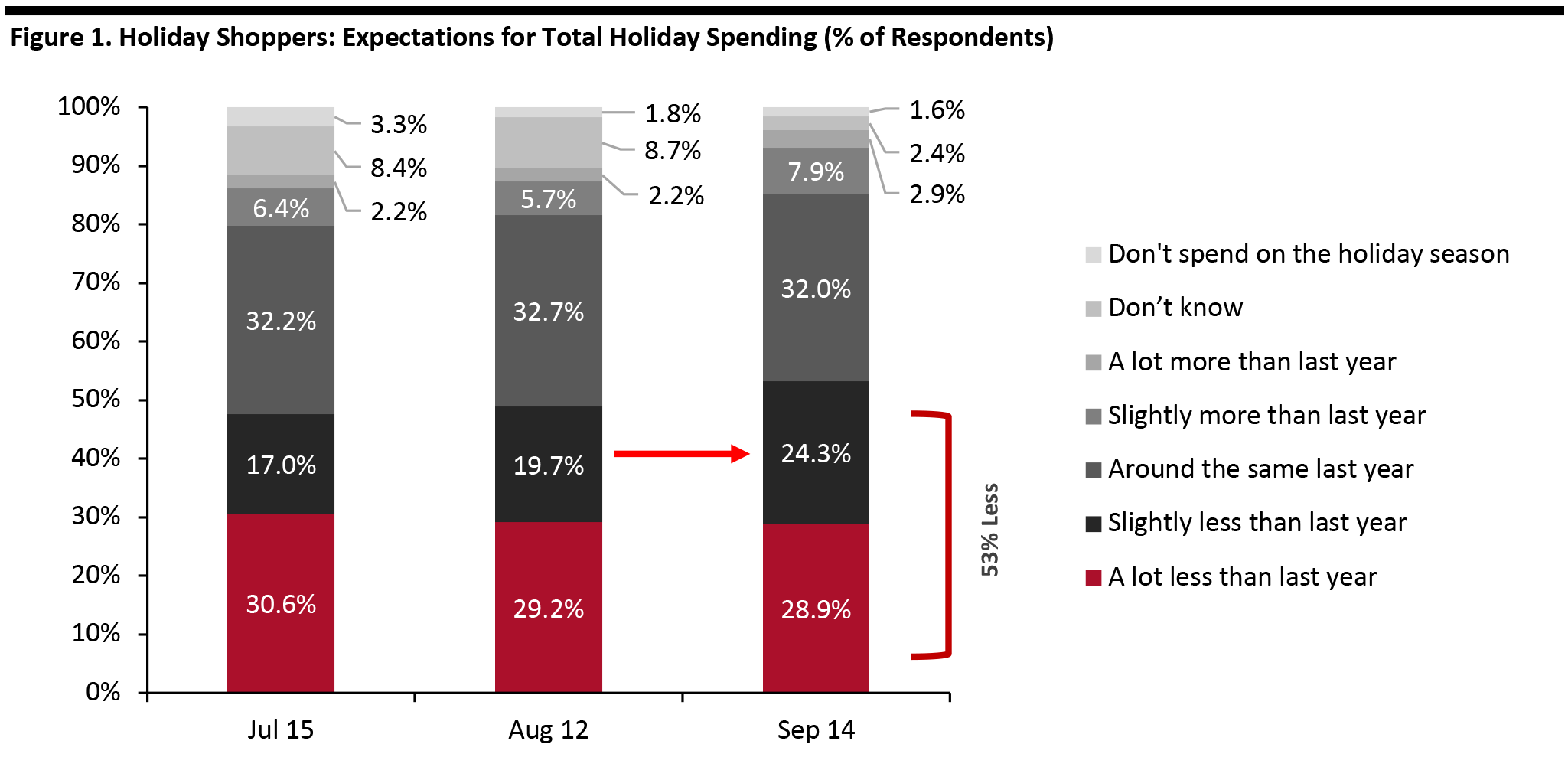

Half of Respondents Expect To Spend Less Consumers are approaching the holiday season with caution and with reduced options for spending on services:- Some 53% expect their total holiday spending to be less than last year, with almost 29% expecting to spend a lot less and just over 24% expecting to spend slightly less.

- Compared to our previous survey in mid-August, the biggest leap has been in those expecting to spend slightly less. The shifts have been in part due to shoppers having a clearer picture: Far fewer now “don’t know” how their spending will shape up.

- In total, just under 10% expect to spend more this holiday season than last, as of September 14.

Base: US respondents aged 18+ (1,134 in September, 401 in August, 454 in July)

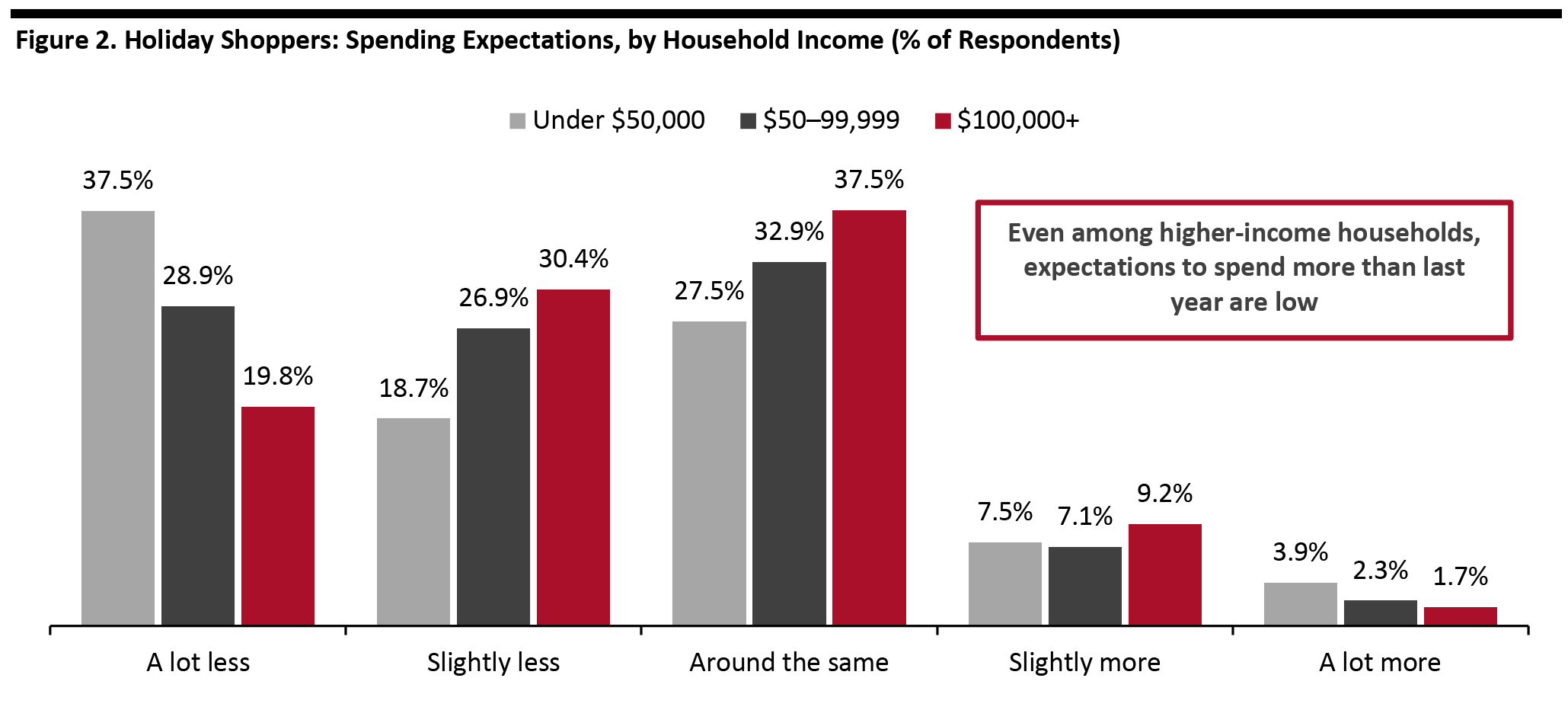

Base: US respondents aged 18+ (1,134 in September, 401 in August, 454 in July) Source: Coresight Research [/caption] Higher earners are likely to sustain any year-over-year increase in retail sales: Those with a household income of under $50,000 are almost twice as likely as those with an income of $100,000 or more to report that they expect to spend a lot less. However, it is not that higher earners have much greater expectations than those on lower incomes of spending morethan last year. Instead, shoppers in the higher income groups show a greater likelihood of spending around the same as last year or slightly less than last year, compared to those with lower household incomes. [caption id="attachment_117220" align="aligncenter" width="700"]

Base: 1,134 US respondents aged 18+

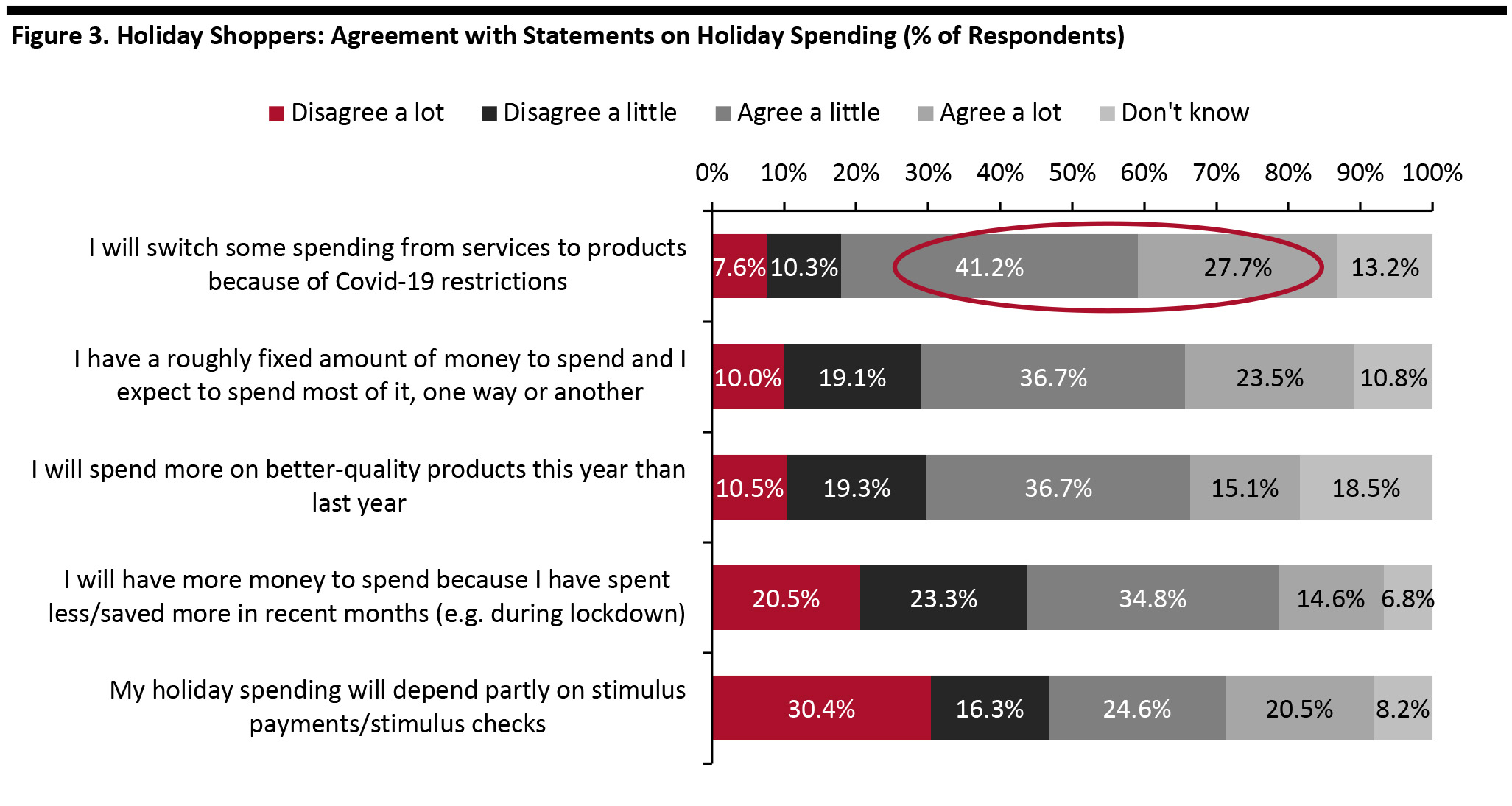

Base: 1,134 US respondents aged 18+ Source: Coresight Research [/caption] What Will Impact—and Drive—Shoppers’ Spending? In spite of somewhat pessimistic expectations among consumers, once we asked shoppers to reflect on factors that could impact their spending, our survey revealed some positive indicators for retail spending. We think these indicators suggest a meaningful upside potential for shoppers’ actual spending, versus shoppers’ current expectations for spending. Totaling those that agree a little and agree a lot:

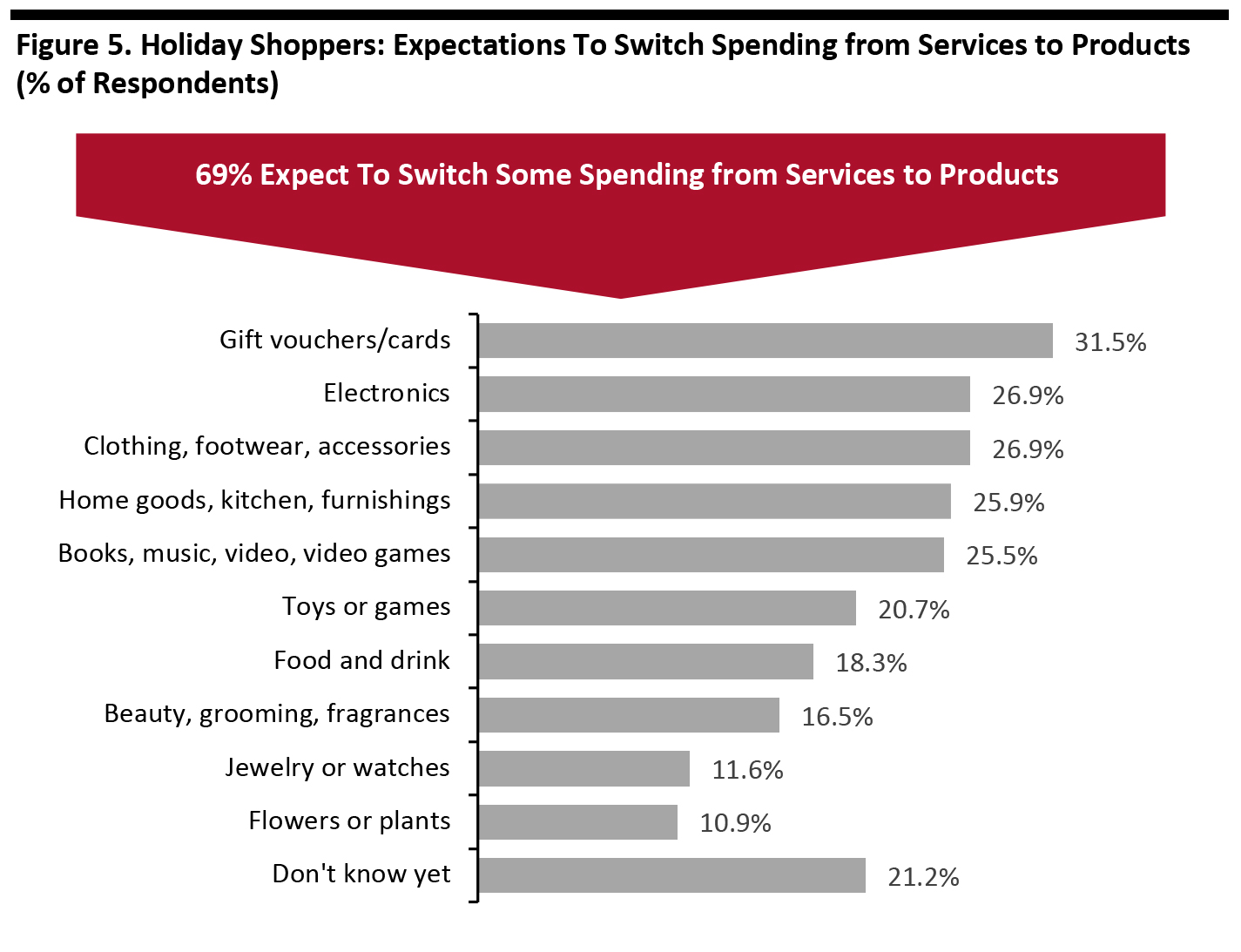

- Seven in 10 consumers (68.9%) expect to switch spending from services to products, potentially providing a multibillion-dollar boost to retail.

- Six in 10 respondents plan to spend their budgeted amount one way or another. Although some consumers may begin by budgeting less than last year, the result further implies that funds saved from experiences could be directed into retail purchases. In turn, this implies outsized opportunities to drive impulse purchases, such as last-minute stocking stuffers, as consumers browse for alternative ways to spend their budgets.

- Just over half expect to trade up to better quality products this year. This trading up could be supported by the shift from spending on services.

- Almost half of those surveyed agree that they have more money to spend because they have saved money in recent months. We calculate that US consumers spent over $300 billion less on a range of discretionary goods and services across the first seven months of 2020 than they did in the corresponding period of 2019, based on Bureau of Economic Analysis data.

Base: 1,116 US respondents aged 18+ who spend on the holidays

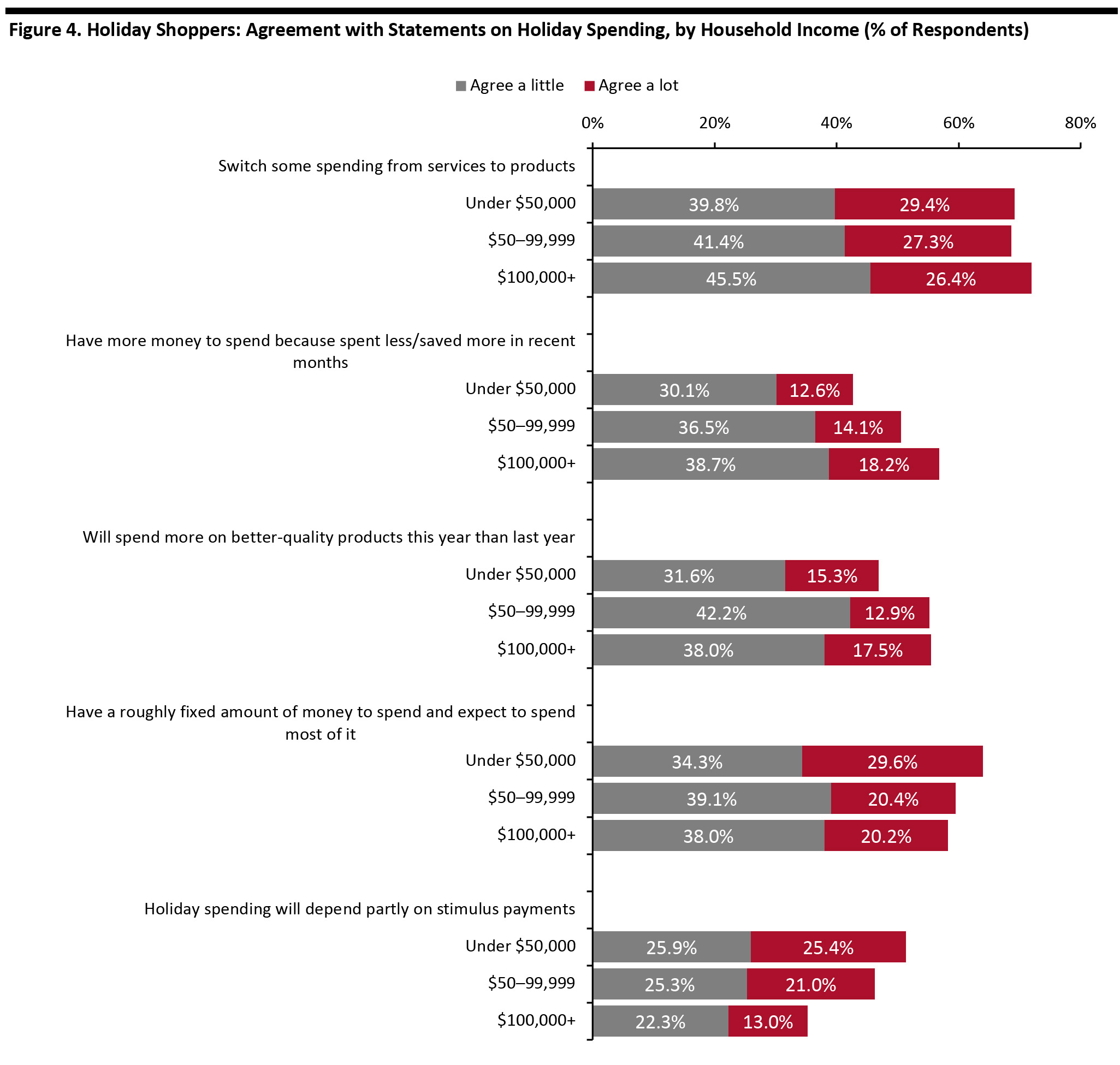

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] By household income:

- Unsurprisingly, lower-income households are more likely to be dependent on stimulus payments than higher-income households. Lower-income households are also less likely to say they have spare cash from recent saving.

- Lower-income households are very slightly more likely to spend all of their holiday budget, one way or another.

- Trading up to better quality products, is even across the $50,000–99,999 and $100,000+ income bands year over year.

Base: 1,116 US respondents aged 18+ who spend on the holidays

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] By age, our survey found that expectations to switch spending from services to products (i.e., retail) peaked at 75% among the youngest adult age group, of 18–29, and declined by age thereafter, to a low of 60% among those aged over 60. The youngest shoppers tend to have less disposable income, but are more likely to spend on services—so the high degree of expected switching bodes well for retail. Where Retail Could See Gains The counterpart to fewer spending options in services is the extra cash available for product purchases. We asked respondents that said they would switch spending from services to products to specify the product categories that they are likely to spend that money on.

- Gift cards look set to see the biggest gains from those switching spending. Retail could also see gains in electronics, apparel, home goods and media products, according to our survey.

- The positions of the top two product categories—electronics and apparel—reflect their very strong positions as gifting categories, which we demonstrate later in the report.

Base: 769 US respondents aged 18+ who expect to switch some spending from services to products for the holidays

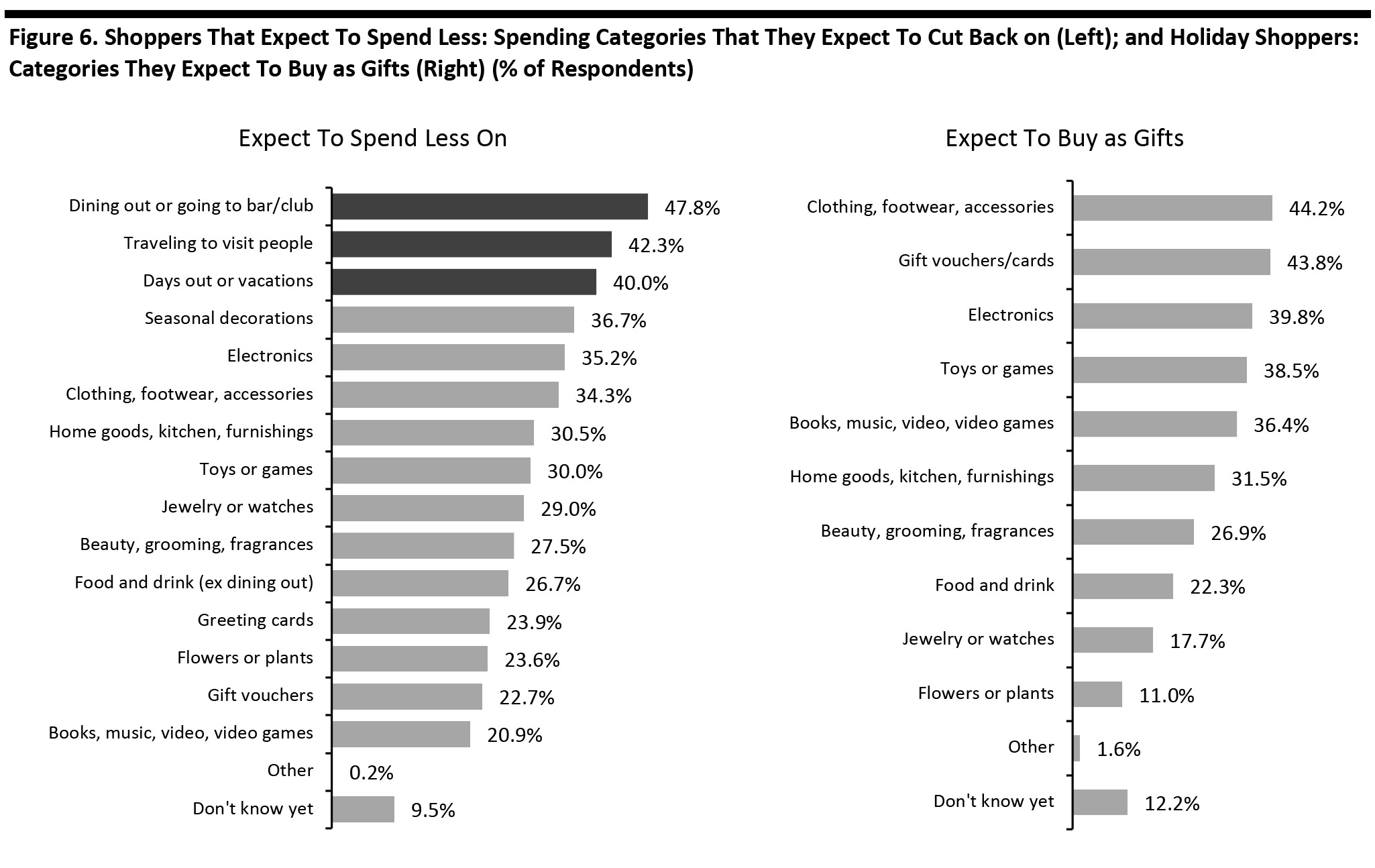

Base: 769 US respondents aged 18+ who expect to switch some spending from services to products for the holidays Source: Coresight Research [/caption] Potential Category Cutbacks and What Shoppers Expect To Buy as Gifts We asked those that expect to spend less this year than last year where they think they will make cutbacks. Services such as food services are set to be the worst hit. We also asked all holiday shoppers what they expect to buy as gifts, which is charted alongside for comparison in Figure 6 below.

- Among retail categories, our respondents said that decorations will be the most-cut category—a little surprising given it is a peripheral category, but reflective of less entertaining and hosting of events this year.

- We asked respondents to think about their overall spending—not just on gifts. So, cutbacks on clothing, for example, could partly reflect attendance at fewer social events or less dining out and reduced spending on food may be due in part to shoppers hosting fewer events for friends or family.

- Among product categories, clothing is in the top spot: Electronics and apparel swap positions in expected gifting versus expected cutbacks—but the differences are negligible. We expect apparel categories to perform better, in year-over-year terms, during the holiday peak than in prior months: Recent spending has been depressed by reduced demand for clothing for work or social events, but such immediate needs are less important as drivers of gifting spend.

- The data show the likely resilience of gift cards this year: The category ranks high as a gift option and disproportionately low for cutbacks. We see gift cards as a strong category on the back of social distancing—they are easy to buy remotely and gift remotely, whether electronically or in hard copy—and they are one solution to potential inventory or supply chain challenges this year.

Base: 603 US respondents aged 18+ who expect to spend less on the holiday season in 2020 than in 2019 (left); and 1,116 US respondents aged 18+ who spend on the holidays (right)

Base: 603 US respondents aged 18+ who expect to spend less on the holiday season in 2020 than in 2019 (left); and 1,116 US respondents aged 18+ who spend on the holidays (right) Source: Coresight Research [/caption]

When and Where Consumers Will Shop

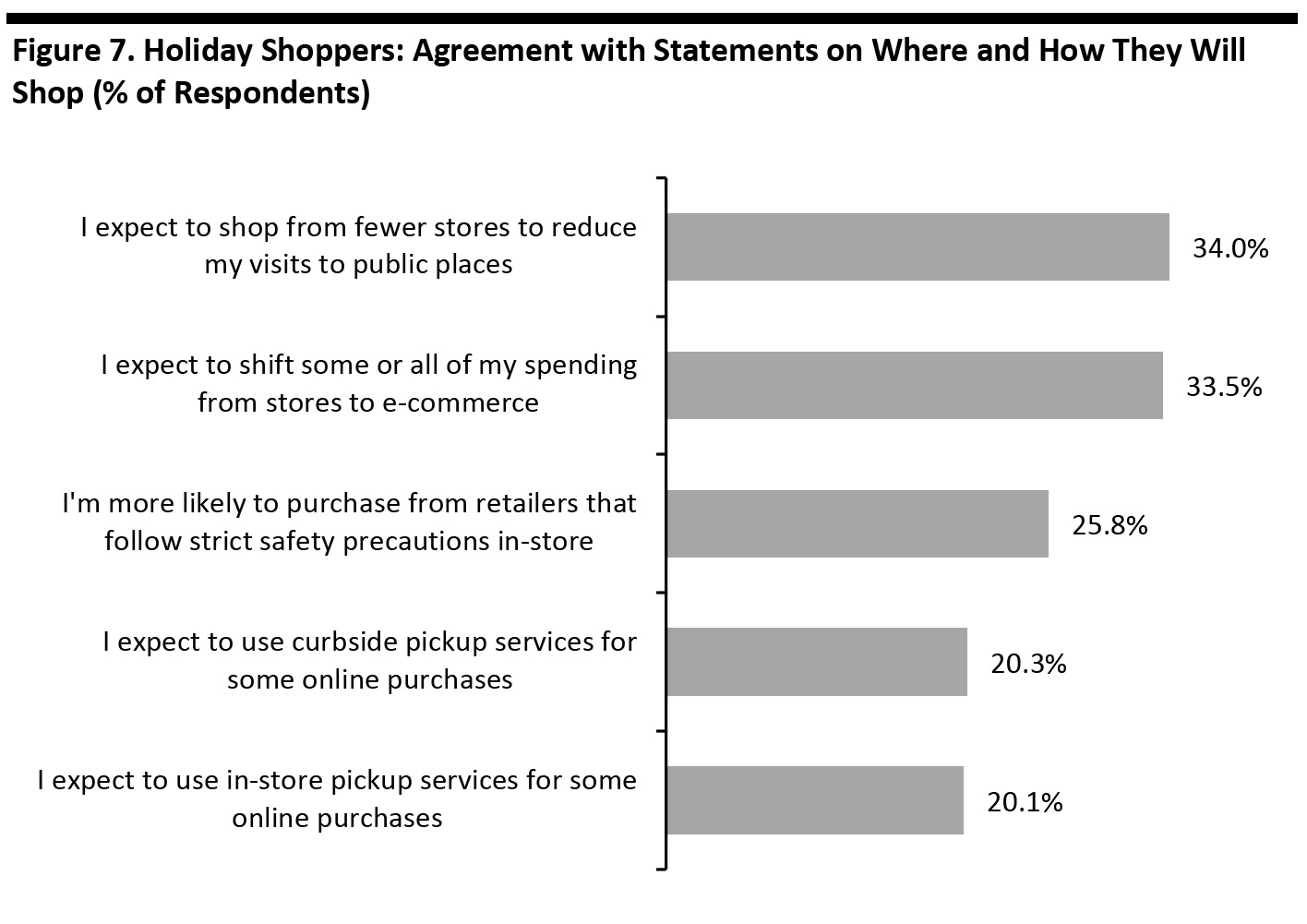

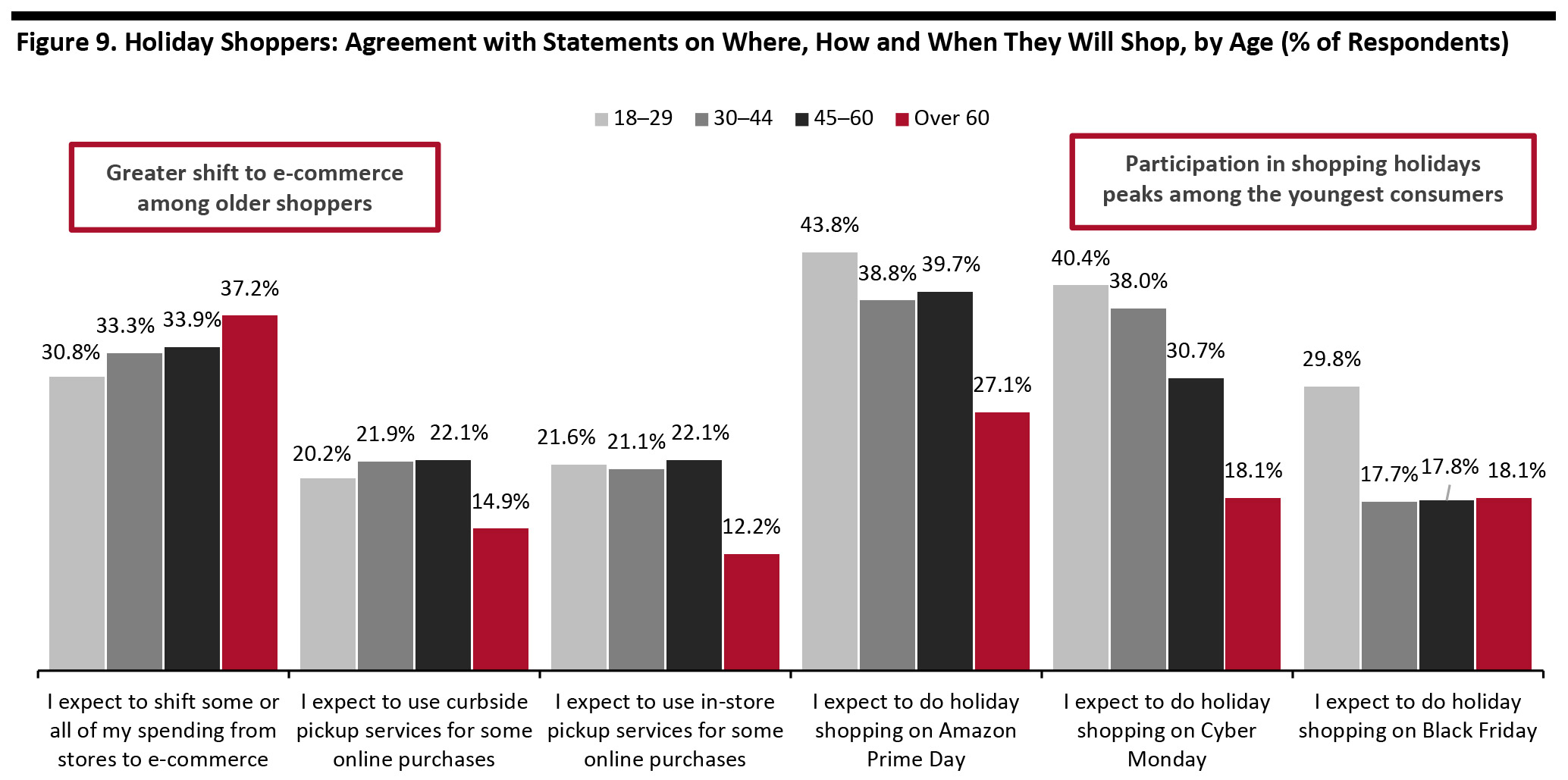

Shoppers Expect To Consolidate Their Trips and Start Shopping Early Over one-third of all holiday shoppers expect to consolidate their visits to brick-and-mortar stores, providing tailwinds for multicategory, multibrand retailers such as mass merchandisers, warehouse clubs and—potentially—hard-hit department stores. The latter must capitalize on this consolidation trend by pulling out all the stops to position themselves as one-stop shops for gift purchases. They, and others, must also provide reassurance to the 26% that will opt for retailers with strict safety protocols. At around one-third of respondents, expectations to switch some or all spending to e-commerce is a little lower than we might expect—and this could reflect the indecision among consumers about in-store shopping, which we note later in this report. Expectations to use curbside pickup and in-store pickup are roughly neck and neck. [caption id="attachment_117225" align="aligncenter" width="700"] Base: 1,116 US respondents aged 18+ who spend on the holidays

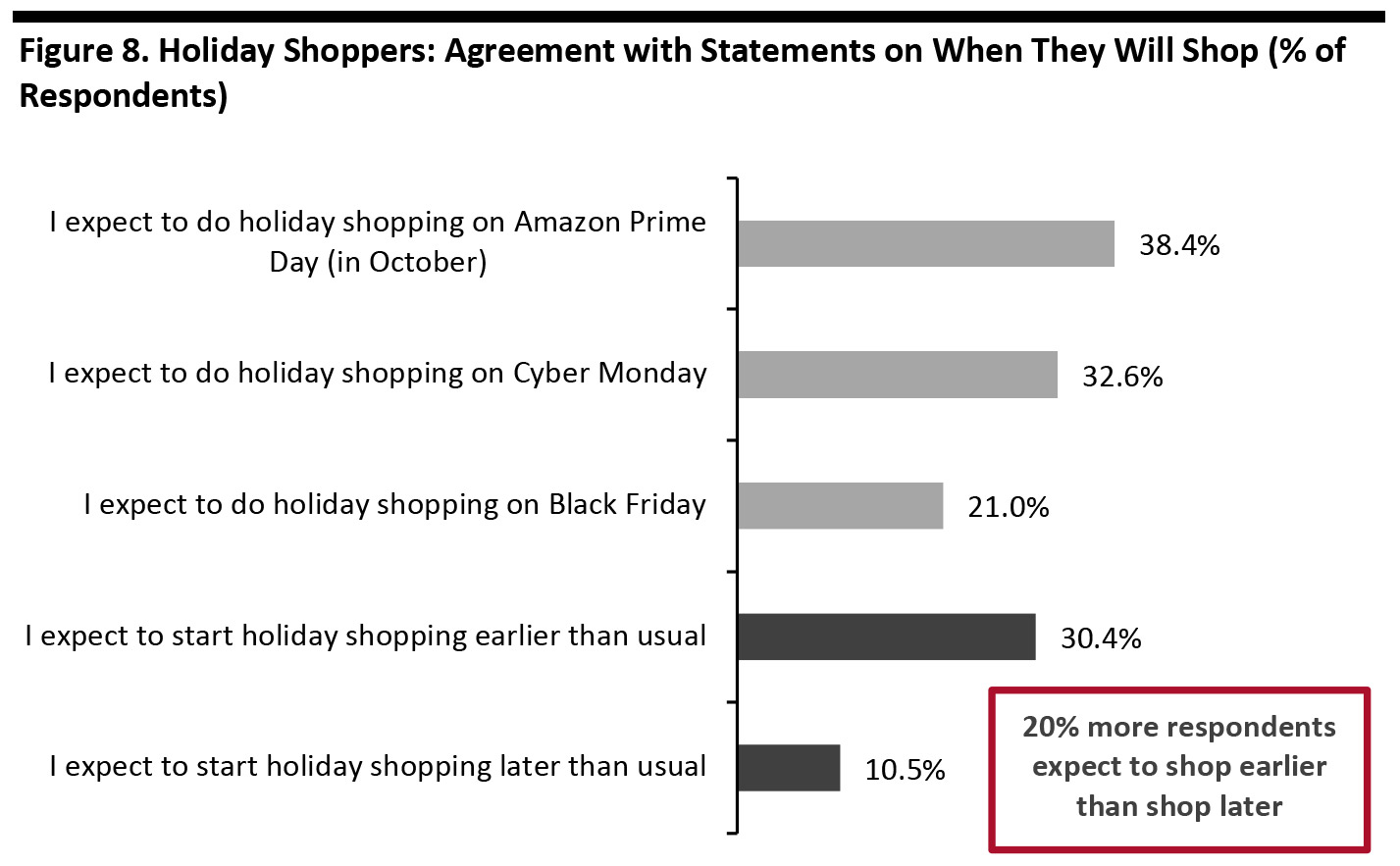

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] Amazon has confirmed that Prime Day will run October 13–14 this year, helping to kick-start an early holiday season. Almost four in 10 holiday shoppers expect to buy during the event, well ahead of the more traditional Black Friday (21%) and Cyber Monday (33%) events. Only Prime members can get Amazon’s Prime Day deals. In March, we recorded 54.3% of survey respondents personally having an Amazon Prime membership and a further 27.3% having access to Prime benefits through someone else in their household (while not having a Prime membership themselves). Three in 10 holiday shoppers told us that they expect to start holiday shopping earlier than usual this year, versus 10.5% expecting to start later. That 20-percentage-point difference is good news to retailers and fulfillment companies—pulling forward holiday shopping should help to ease the pressures on the e-commerce supply chain. We explore why these consumers plan to start shopping earlier in the next section. [caption id="attachment_117226" align="aligncenter" width="700"]

Base: 1,116 US respondents aged 18+ who spend on the holidays

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] By age group:

- Younger shoppers are more enthusiastic for shopping holidays such as Prime Day and Cyber Monday.

- Older consumers are more likely than younger consumers to shift some spending to e-commerce—possibly because, in total, they had migrated less spending online before the crisis.

- Curbside and in-store pickup appeal roughly consistently across age groups, with the exception of those aged over 60.

Base: 1,116 US respondents aged 18+ who spend on the holidays

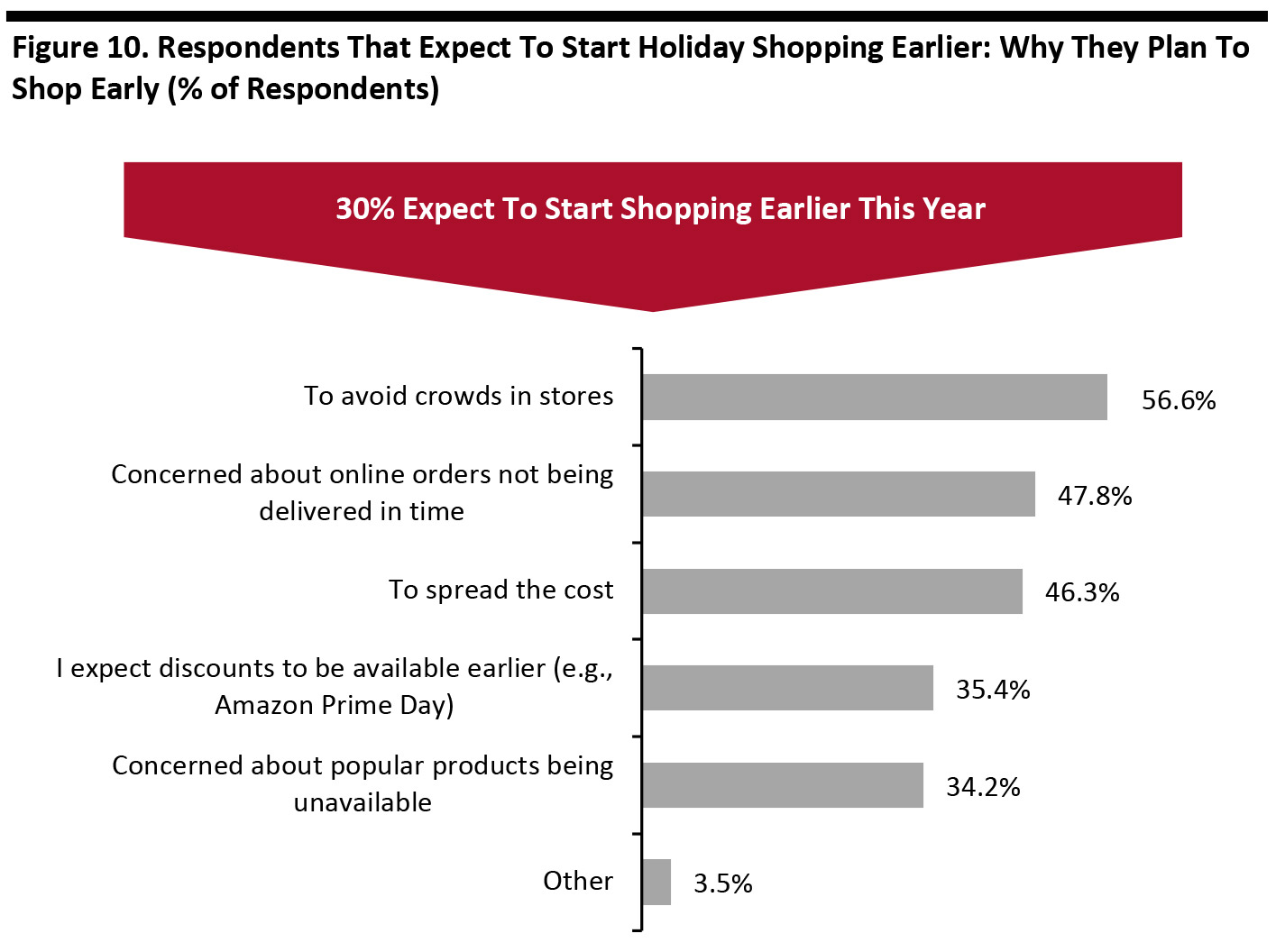

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] Why Some Consumers Expect To Start Shopping Earlier We asked those that plan to start shopping earlier why they expect to do so. Avoiding crowds was the top reason, but almost half are concerned about online orders being delivered in time and slightly more than one-third are concerned about the availability of products—suggesting that some consumers are attuned to potential supply-chain challenges. [caption id="attachment_117228" align="aligncenter" width="700"]

Base: 339 US respondents aged 18+ who expect to start holiday shopping earlier than last year

Base: 339 US respondents aged 18+ who expect to start holiday shopping earlier than last year Source: Coresight Research [/caption] Only Half Expect To Buy In-Store—Although One-Quarter Are Undecided This year is likely to see a jump in online spending—Coresight Research estimates a year-over-year rise of around 31% in online retail sales in the final quarter. This will be driven by online shoppers spending more of their budget online, rather than a big uptick in the number of online shoppers. That’s because shopping online for the holidays had already reached very high levels—possibly near-peak levels—even before the Covid-19 crisis. As shown below, the year-over-year increase in expectations to buy gifts online is therefore quite modest—from 81% in 2019 to 85% in 2020. The big difference has been in expectations to buy gifts in stores. This dropped 29 percentage points compared to last year—not just because many consumers are opting out of brick-and-mortar shopping, but also because around one-quarter don’t yet know if they will buy in store this year. Many consumers are wary and uncertain given the current background to their shopping. [caption id="attachment_117229" align="aligncenter" width="700"]

Base: US respondents aged 18+ who spend on the holidays (1,116 in 2020 and 1,784 in 2019)

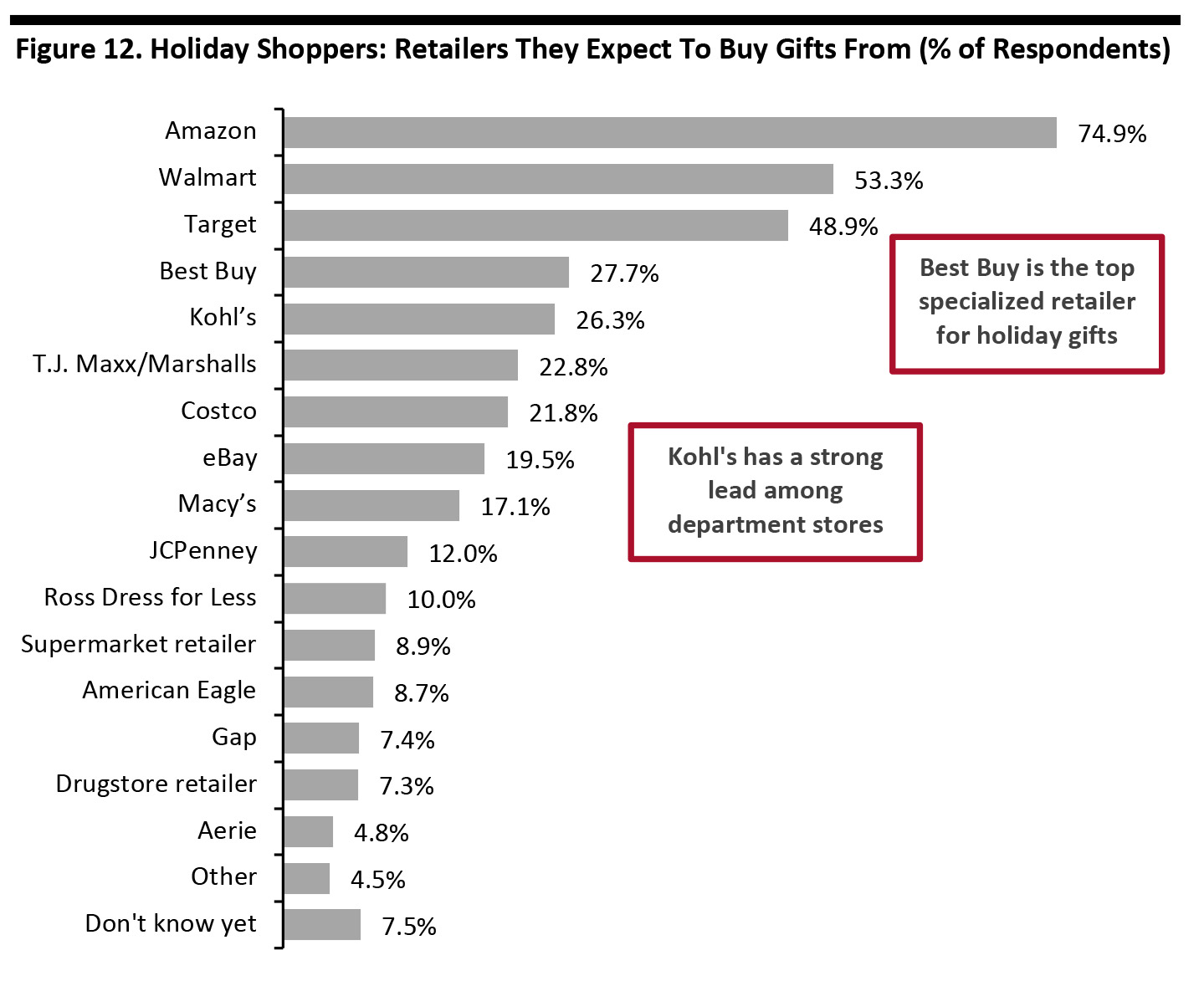

Base: US respondents aged 18+ who spend on the holidays (1,116 in 2020 and 1,784 in 2019) Source: Coresight Research [/caption] Which Retailers Consumers Will Buy From and Why So far this year, multichannel retailers have tended to outperform online-only retailers in terms of e-commerce expansion. We expect very strong online demand to be seen across the multichannel space into the holiday peak. Nevertheless, our survey suggests that Amazon will be the top retailer for gift purchases, with a strong lead over Walmart and Target. Last year, we recorded Amazon and Walmart as roughly neck and neck by shopper numbers. One advantage for Amazon this holiday season is the demand for free shipping (see the next section), which Amazon.com has a strong reputation for providing, whether for Prime members or on selected non-Prime orders. In store, the preference for consolidating shopping trips should support multibrand, multicategory retailers—which includes many of the most popular names charted below. In fact, Best Buy (electronics) is the only category specialist in the top 10, although T.J. Maxx/Marshalls has a strong skew toward apparel. [caption id="attachment_117230" align="aligncenter" width="700"]

Base: 1,116 US respondents aged 18+ who spend on the holidays

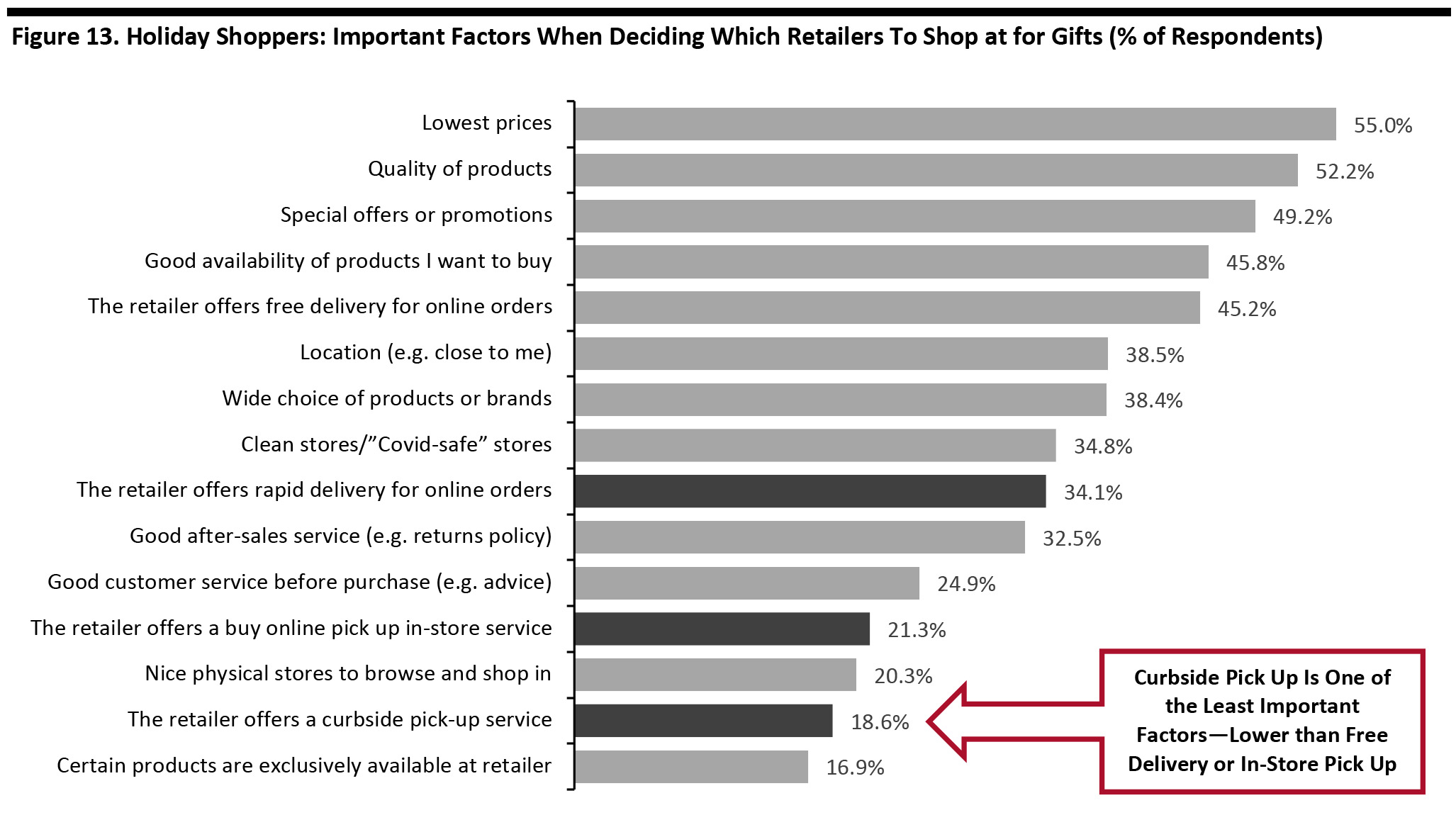

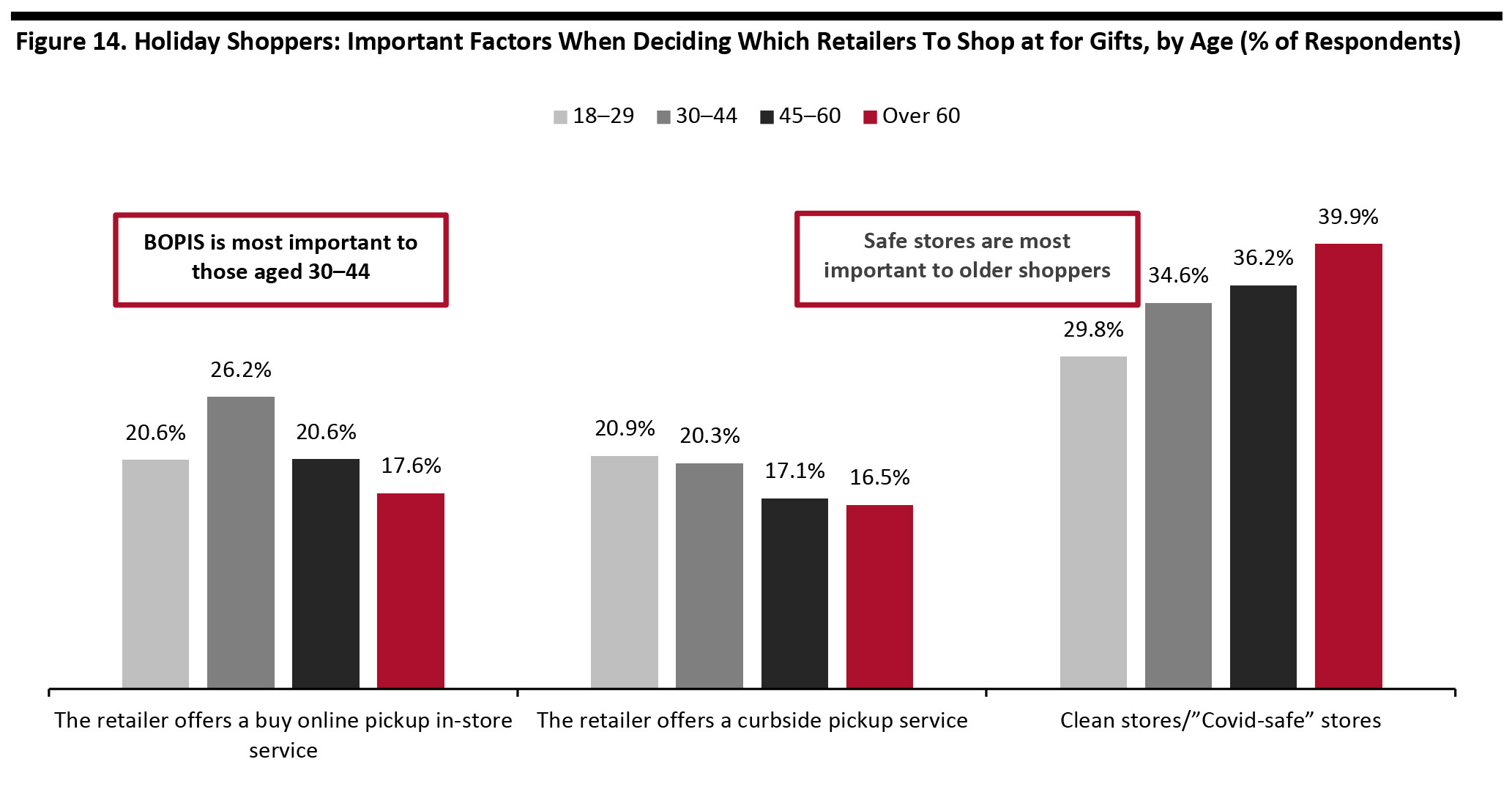

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] Traditional factors such as low prices, product quality, special offers and availability remain the dominant factors when choosing where to shop—these top four options shown below echo the ranking we recorded in our holiday survey last year.

- Clean or Covid-safe stores are a factor in decision making for more than one-third of shoppers.

- Free delivery jumped from seventh-most-important factor last year to fifth this year, reflecting the increased role of e-commerce.

- Free delivery is much more important to shoppers than rapid delivery, which in turn is more important than in-store pickup services and curbside pickup services.

- The ranking for in-store and curbside pickup approximately reflect the expectations, shown earlier, of one in five respondents to use these services.

Base: 1,116 US respondents aged 18+ who spend on the holidays

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] In-store pickup is most important to family-lifestage shoppers, aged 30–44, although we do not see a similar peak for curbside pickup. Demand for safe stores increases steadily with age. [caption id="attachment_117232" align="aligncenter" width="700"]

Base: 1,116 US respondents aged 18+ who spend on the holidays

Base: 1,116 US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption]

What We Think

Implications for Retailers Better Than Anticipated? While consumer spending expectations look pessimistic, services spending looks set to take the greatest hit and our data reveal potentially meaningful supports for retail sales—seven in 10 respondents reported that they expect to switch some spending from services to products and, with reduced spending options, around half expect to trade up to better-quality product this year. We therefore think that final spending could be stronger than shoppers’ current expectations imply, although—as ever—the increases will not be evenly distributed.- Perhaps not surprisingly, higher earners look less likely to cut their spending: Those with a household income of $100,000 or more are around half as likely to say that they will spend a lot less this year as those with an income of under $50,000. Higher-income households are also more likely to say they have extra cash from saving in the recent past, such as during lockdown. Where appropriate, retailers should cultivate demand among more affluent shoppers, including with impulse purchases in lieu of services spending.

- Expectations to switch spending from services to products peaked at 75% among the youngest adult age group, of 18–29, and declined by age thereafter. Retailers should seek to capture this additional spending among younger shoppers, targeting some of their unspent services dollars.

- Gift cards are marginally the second-most-popular gift that shoppers expect to buy.

- They are the top product category that consumers transferring spending from services to goods expect to switch spending to.

- The category ranks low compared to other categories for expected cutbacks, among shoppers that expect to reduce their holiday spending.

- Clothing and footwear comprise the top category that shoppers expect to buy as gifts.

- The apparel category ranks a solid third among those expecting to switch some spending from services to products.

- However, apparel is also in third place among product categories for cutbacks by those expecting to spend less this year.