DIpil Das

What’s the Story?

We present our initial outlook for US retail for the 2020 holiday season—the most unusual and unpredictable of any Coresight Research has covered. We provide our estimates for the October–December period, and give five reasons why our analysts have settled on those estimates.Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever. Coresight Research’s coverage provides directional guidance to retailers, suppliers and vendors.US Holiday Retail Outlook: In Detail

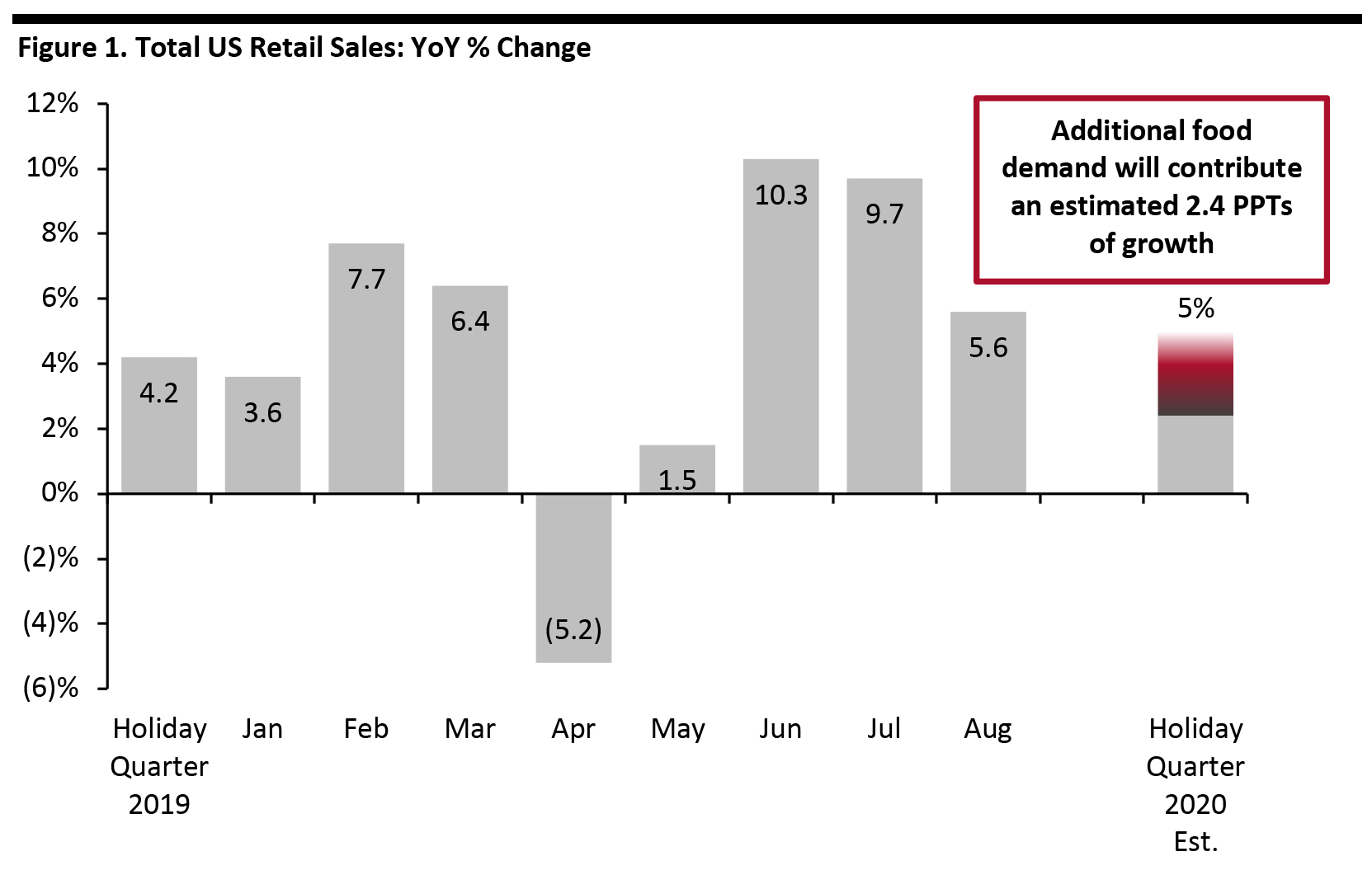

Estimating Solid Holiday Demand, but Distributed Unevenly We estimate an approximate 5% year-over-year rise in total retail sales for the holiday period—October to December. This will take total retail sales to around $1.1 trillion. Our measure of retail sales excludes food-service businesses, automobile retailers and gasoline stations. [caption id="attachment_117625" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

Categories and Sectors

Growth will be supported by a sustained rise in food retail sales (detailed below) but with pockets of solid nonfood demand such as in furnishings and home accessories, home-improvement products, gift cards and some electronics and small-appliance categories. In clothing and footwear, athleisure and “casual and comfort” are likely to be winning trends, and we anticipate that holiday gifting demand for apparel overall will prove more solid than the underlying demand seen in recent months, which has been depressed by reduced need for clothing for work or social events: Such immediate needs are less important for those buying apparel as gifts for others—they buy more because it is a “nice gift” rather than for a specific need. For similar reasons, we could see a sequential uplift for beauty categories.

We do not expect the well-documented weaknesses so far this year in sectors such as apparel specialty stores and department stores to be representative of overall nonfood demand, and our total estimate does not imply a return to positive growth for hard-hit sectors such as these.

Online Sales

We expect total online retail sales to rise by one-third (33.5%) year over year, taking online retail sales to around $234 billion.

- This is equivalent to 21.7% of all retail sales in the holiday quarter (versus 17.1% for holiday 2019) with e-commerce’s share of total nonfood sales reaching 27.6%.

- E-commerce growth will be supported by a 60+% year-over-year rise in online food sales; this will take online food sales to an estimated $14 billion in the final quarter.

- Across nonfood retail, we expect a low-30s-percent rise to take total online nonfood sales to $220 billion in the holiday quarter.

Five Factors Supporting US Retail Sales Growth of 5%

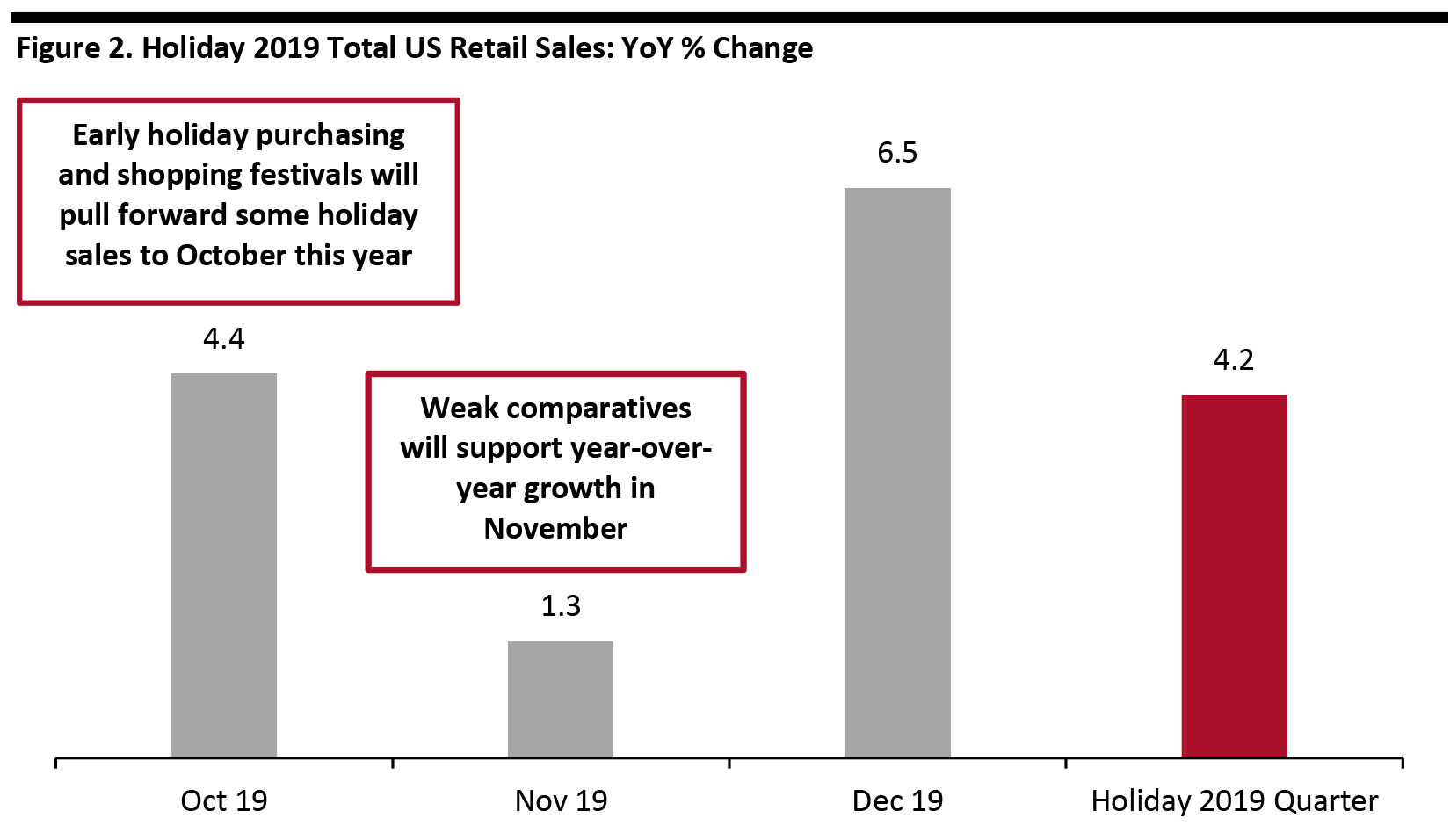

1. Food Retail Demand Will Prove Strong Sustained strong food retail demand will underpin solid total holiday retail sales. Food retail purchases account for around one-quarter of retail sales, and we estimate that food and beverages retail spending will climb by around 9.0–9.5% year over year in the holiday quarter—the midpoint of which suggests that around 2.4 percentage points of total holiday retail growth will come purely from this category. More working at home, less inclination or options to dine out and fewer social and corporate events will maintain the switch of food dollars from food service to retail in the final quarter. A rise in (likely smaller-scale) at-home entertaining in the holiday season could be a further support for growth. Total food and beverages retail spending was up 10% for the first eight months of 2020 and was up 9.8% in August (latest reported by the US Bureau of Economic Analysis). 2. Potential for a Multibillion-Dollar Switch from Services Shoppers have fewer options to spend this year, but they have broadly the same options to spend at retail. As consumers’ choices to spend on dining out, travel, nights out and other leisure activities are unusually limited, there is an opportunity for more discretionary dollars to flow to retail. In the holiday quarter of 2019, US consumers spent over $400 billion dollars on air travel, food service, accommodation and recreational and cultural services—categories in which spending options are now much more limited. While spending on these categories will not be eliminated, it will be down sharply—and consumers can redirect those dollars to retail. In our September holiday survey, 68.9% of respondents agreed (whether a little or a lot) that they expect to switch spending from services to products. 3. Shoppers Appear To Be Trading Up Reduced options for spending on experiences appears to be fueling a trading-up in retail purchases. Reporting second-quarter results, for example, Macy’s highlighted that luxury sales were booming across all categories, most notably at its Bloomingdale’s business, and attributed this to the shift in spend from services. Our holiday survey found that just over half of shoppers agreed (whether slightly or a lot) that they expect to trade up to better quality products this year; we see solid agreement levels across income groups, with agreement levels not falling below 45%, which was seen in the $10,000–49,000 household income band. 4. Pent-Up Spending Totals Hundreds of Billions of Dollars Shoppers have been saving hundreds of billion dollars as a result of changed spending habits and behaviors. As lockdowns hit in April, the savings rate reached 33.6% and has remained in double digits in the months since (compared to a pre-crisis 7–9%). Coresight Research calculates that, across the first eight months of 2020, US consumers spent $337 billion less on a range of discretionary products and services than they did in the same period of 2019. Pre-crisis, total discretionary spending had been rising at about 4% per year; this year, growth turned negative. If we add the “lost” 4% that would have been seen had trends continued on the cash decline seen so far this year, lost spending for the first eight months of 2020 totals around $416 billion. While some depressed spending has been a result of necessity among consumers, much has been a result of reduced options for spending. One consequence has been very strong post-lockdown increases in retail sales, including in discretionary sectors such as home improvement, sports and leisure goods, as well as online retail. Year over year, total sales by discretionary retail sectors were up 12.8% in June, 10.3% in July and 5.7% in August, we calculate from Census Bureau data. Holiday shopping gives shoppers a further potential outlet for those unspent billions. 5. An October Boost Could Lead to Extended Shopping October has become the kickoff for the holiday season. A shifted Prime Day, a new 10.10 Shopping Festival and competing events such as Target’s Deal Days and Walmart’s Big Save event have displaced Black Friday as the launch of the season. Retailers and consumers alike have told us that they expect shopping to start early. This will draw some spending forward from November and December—so we expect year-over-year growth to be strong in October. That pull-forward will also give shoppers more time for subsequent secondary purchases, impulse purchases and self-gifting: If they find they have crossed off their shopping list earlier in the season, the temptation may be to continue shopping through November and December. We chart 2019’s year-over-year growth rates in Figure 2. Last year, we saw a weak November and a strong December, so as retail laps these figures, we expect year-over-year growth rates to be stronger in November 2020 than December 2020. [caption id="attachment_117626" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

Three Wildcards

We note three wildcards that could have hard-to-predict impacts on holiday spending this year. 1. Election Outcome The November election is one macro factor in the shape and scale of the 2020 holiday season. Election results will always satisfy one body of consumers and displease another, and there is no real scope for detailed policy impacts to be clear in time to meaningfully impact holiday spending. However, uncertainty can hit consumer confidence and propensity to spend, so any uncertainty or dispute around the election result could prove a drag on holiday spending. 2. Stimulus Uncertainty At the time of writing, it remains unclear whether agreement will be reached on a further round of stimulus payments to consumers. Our holiday estimate factors in a softening in discretionary retail sales and, even if a second stimulus package is forthcoming, Coresight Research survey data suggest that consumers used the first round of payments to pay bills, buy food (a nondiscretionary category), pay down debt and save much more than they used them to spend on discretionary retail categories. It remains possible that consumers could react more negatively in the absence of any further stimulus measures, and spending on retail categories will weaken more substantially as a result. There is also upside potential to our estimate should a round of stimulus be agreed and implemented. 3. Store Capacity Assuming retailers implement social-distancing measures in stores, store capacity, in terms of number of shoppers, is one constraint on store-based spending this year. If a retailer allows only a fixed number of shoppers to enter each store, the proportional impact will be greater in busier periods than in quieter periods of the year: A retailer would have to turn away more shoppers from its doors at holiday time than in the summer. This supports our assumption of sustained strong uplifts in online sales.What We Think

Implications for Brands/Retailers- Retailers must capture early sales and encourage incremental spending and impulse purchasing through the holiday period: Early spending can be converted into sustained spending.

- Many shoppers are looking for ways to spend their experience dollars, and retailers should provide opportunities to trade up to premium and luxury goods: They should not assume that tough macroeconomic circumstances will drive a consistent trading down in retail purchases.

- Holiday demand for apparel should prove more solid than the underlying demand seen so far during the crisis, which has been depressed by reduced attendance at workplaces or social events. We could see a similar sequential uplift for beauty categories, for similar reasons.

- Grocery retailers must stand ready for sustained strong increases in online demand. As we get closer to the holiday season peak, they should continue to find ways to ramp up capacity, such as through partnerships with delivery providers or extending physical capacity for collection services such as curbside pickup.