DIpil Das

What’s the Story?

The 2020 holiday shopping season will be unlike any other, characterized by an early shopping surge, higher e-commerce shopping and consumers seeking alternative delivery options. As the pandemic wears on, retailers anticipate that the upcoming holiday season will see a spike in online penetration, which will likely drive many seasonal hiring in the coming weeks.Why It Matters

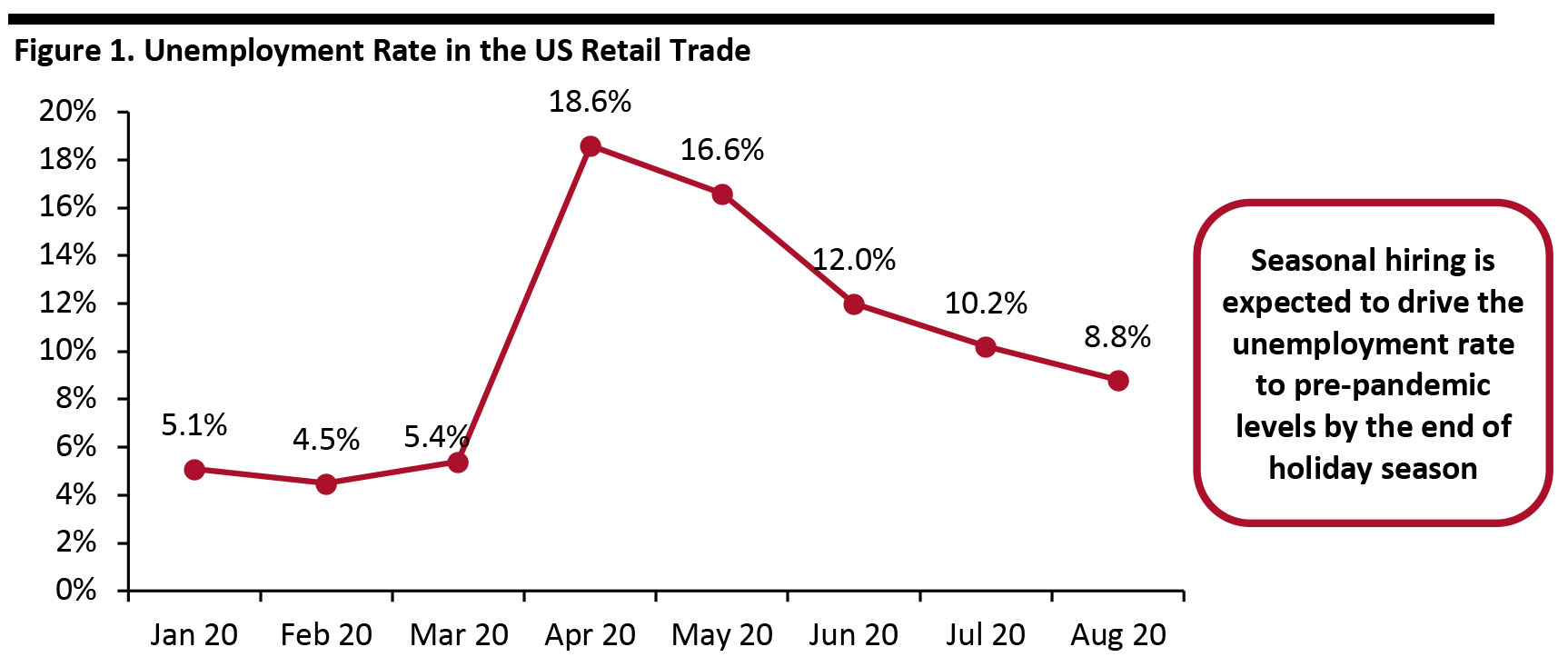

Against the backdrop of ongoing health risks, growing e-commerce trends and rampant retail bankruptcies, holiday hiring patterns for this season are likely to undergo a radical transformation. We discuss aspects of hiring that could make the 2020 season a trendsetter in holiday hiring for years to come. This holiday season, the hiring balance is expected to shift significantly toward retailers’ need to get merchandise to consumers through shipping services versus their need to staff stores. Coresight Research estimates that US online retail sales will rise by around one-third year over year in the final quarter of 2020, to account for around 21.5% of all retail sales. To maintain social distancing and to eliminate the possibility of crowds, major retailers have announced that they will be closed on Thanksgiving and are stretching promotional campaigns over an extended period to take the emphasis off Black Friday and offer more online sales. This means hiring fewer in-store workers in favor of associates who pack and ship orders to online customers. Retail bankruptcies will severely impact job creation this holiday season. Bankrupt retailers are looking to cut costs, including rationalizing their physical footprints to focus on profitable stores and direct further resources to the online channel. These dynamics will be reflected in a leaner in-store workforce and store associates being assigned to new roles, such as picking and packing items. In previous years, tight job markets made it harder for retailers to find enough seasonal workers. This season there will be a larger pool of available workers due to significant lay-offs by bankrupt retailers coupled with higher unemployment levels. Retailers will focus on providing a safe shopping experience for consumers, which will create new roles for supplementary tasks this holiday season, including staff to take customer’s temperatures and enforce social distancing measures, workers to disinfect shopping carts, and fulfillment staff for curbside-pickup services. 2020 Outlook: Hiring Likely to Stay Flat or Increase Slightly This year, holiday hiring will likely stay on par with last year or experience a slight increase compared, with hiring in allied sectors, such as shipping and logistics, broadly offsetting reduced demand in parts of traditional retail. There were around 951,000 retail job openings listed in the US at the end of July 2020, including full-time, part-time, permanent, short-term and seasonal openings. This figure is 3.8% higher than the corresponding figure from last year of 916,000 as recorded by the US Bureau of Labor Statistics (BLS). The unemployment rate in the US retail industry has been trending down since the onset of the lockdowns, indicating that the retail job market is showing signs of improvement after the onslaught of pandemic-driven layoffs. Seasonal hiring will likely help to flatten the curve further, driving unemployment rates to pre-pandemic levels by the end of holiday season. [caption id="attachment_117432" align="aligncenter" width="700"] Source: BLS[/caption]

Retailers Increase Staff Numbers To Focus on Digital Demand

Amid the ongoing economic uncertainty, retailers have been slow to announce holiday hiring plans. Among retailers that have announced plans, hiring is mainly aimed at bolstering workforces to accommodate the increase in online spending activity before the holiday season, as shoppers continue to avoid virus exposure in physical stores. Except for JCPenney, retailers that have disclosed their holiday hiring plans expect to match or increase their hiring numbers compared to last year. On a comparable basis, we have tracked a 12.7% year-over-year decline in total hiring by retailers that have announced their plans for this year.

Source: BLS[/caption]

Retailers Increase Staff Numbers To Focus on Digital Demand

Amid the ongoing economic uncertainty, retailers have been slow to announce holiday hiring plans. Among retailers that have announced plans, hiring is mainly aimed at bolstering workforces to accommodate the increase in online spending activity before the holiday season, as shoppers continue to avoid virus exposure in physical stores. Except for JCPenney, retailers that have disclosed their holiday hiring plans expect to match or increase their hiring numbers compared to last year. On a comparable basis, we have tracked a 12.7% year-over-year decline in total hiring by retailers that have announced their plans for this year.

Figure 2. Seasonal Hiring Announcements by Selected Retailers [wpdatatable id=499 table_view=regular]

*Total includes announcements as of October 8, 2020 **Year-over-year percentage change is on a comparable-retailer basis Source: Company reports

- Walmart has hired more than 500,000 associates since March. The company announced on September 23 that it is readying itself for an online-driven holiday season and plans to hire more than 20,000 seasonal workers in its e-commerce fulfillment centers nationwide. The company will offer starting hourly wages in the range of $15.75-$23.75 based on location, position and schedule.

- Target announced on September 24 that it plans to onboard 133,000 staff nationwide, in line with its hiring numbers for last year. However, the retailer noted that it is shifting its approach for holiday hiring this season. It plans to double the number of associates dedicated to BOPIS and curbside pickup services and increase the number of seasonal workers in distribution centers compared to last year.

- Amazon has not yet revealed its seasonal hiring plans. In mid-September, the company announced plans to hire 100,000 people across full-time and part-time picking, packing and shipping roles but said that these are not related to holiday hiring.

- L Brands announced on September 2 that it plans to bring on almost 4,000 associates to boost its staff at distribution centers for the holiday season. The company noted in its second quarter of fiscal year 2021 earnings call that it has ramped up its capacity to meet the online shopping surge and is operating with twice as many fulfillment centers as last year.

- JCPenney announced on September 10 that it plans to hire 1,700 seasonal workers, down from the 37,000 announced in 2019. The company had earlier reached a deal to sell its retail business to mall owners Simon Property Group and Brookfield Property and then announced that it would bolster its online operations to help it come out of the restructuring process.

- Michaels, the arts and crafts chain, announced on September 8 that it plans to hire staff for over 16,000 seasonal positions across its US and Canada stores and distribution centers, with an emphasis on bolstering its BOPIS team. According to a company statement, the retailer will offer competitive wages, flexible hours and a 30% employee discount.

- 1-800-Flowers.com announced on September 8 that it plans to quadruple its workforce for the upcoming holiday season and hire more than 10,000 seasonal employees nationwide for various positions across its gourmet foods and gift brands. The number of announced posts is up 25% compared to last year and will include full-time and part-time roles in vital areas such as customer service, distribution and fulfillment centers, and production and gift assembly. The company posted record revenue and profit growth for fourth fiscal quarter ended June 28, 2020—it anticipates the current strong e-commerce demand momentum to continue into the holiday season in its second fiscal quarter for 2021.

Figure 3. Seasonal Hiring Announcements by Selected Logistics Companies [wpdatatable id=501 table_view=regular]

*Figures are only for specific regions, and not a nationwide hiring number **Total includes announcements as of October 8 Source: Company reports

- FedEx announced on September 14 that it plans to hire 70,000 positions—an increase of 27% compared to last year—with the majority of those added to the FedEx Ground network. In an earlier announcement, the company noted that it has added capacity for material handling by opening six regional sortation facilities, four new automated stations and eight new or expanded facilities to handle large package items like TVs and furniture, as consumers are increasingly buying these items online.

- UPS announced on September 9 that it expects to hire around 100,000 seasonal associates, on par with its announcements before Christmas in 2018 and 2019. However, in August, the company said that it added 39,000 employees in the April through June quarter to handle the increase in residential deliveries.

- Radial announced on September 22 that it plans to hire more than 25,000 seasonal hires across North America, up 19% compared to announced hires in 2019. The company noted that it has ramped up its use of autonomous mobile robotics in fulfillment centers to help associates pick, pack and ship orders.

Figure 4. Jobs Added in Retail Trade for October through December, 2016-2019 [wpdatatable id=502 table_view=regular]

Source: BLS