DIpil Das

What’s the Story?

Coresight Research’s US team ventured out from early in the morning on Black Friday to observe demand on what is traditionally the busiest day of the year for stores. Here are our observations and insights, together with findings from our latest consumer survey, undertaken just three days before Black Friday.Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever this year. Our holiday coverage aims to offer directional guidance.US Black Friday Insights: In Detail

A Late Start, with Store Traffic Materially Down Our overall observations are:- Shoppers skipped the historical “doorbusting” morning rush with stores seeing a pickup in traffic after 10:00 a.m. and generally stronger traffic into the afternoon and evening.

- Traffic to stores was down materially but conversion was up—but almost certainly not enough to offset the traffic declines. Our conversations with retailers appear to confirm our earlier estimate that total nonfood traffic would be down by around 50% versus last year. Consumers had been shopping deals prior to Black Friday at a number of retailers.

- Observed categories of strength included big-ticket products, such as electronics, jewelry, home and appliances (see our survey data later in this report, too).

- In terms of deals, many retailers had a single storewide discount—such as 25% off, observed at Bed Bath & Beyond and Dick’s Sporting Goods.

- Lower-than-usual inventories resulted in generally reduced levels of discounts at some retailers. At Best Buy and Target, we noted shopper disappointment with sold-out games consoles.

- Covid-19 precautions abounded, adding to lines outside stores once demand picked up later in the day.

- US consumers spent $9 billion online on Black Friday, according to Adobe Analytics; that was up 21.6% year over year and is in line with our expectations. We anticipated that year-over-year growth in Black Friday e-commerce sales would prove more moderate than the estimated 33.5% year-over-year growth in total holiday e-commerce sales, as Black Friday sales switch from being focused on a single day to taking place through November.

- RetailNext reported that total nonfood retail traffic was down 48.4% year over year on Black Friday, with the conversion rate up 4 percentage points and average transaction value up 5.9%. This yielded total store-based sales down 29.6% versus last year. In terms of traffic, apparel retailers (down 50.2%) and footwear (down 52.8%) underperformed versus home retailers (down 38.7%). Sensormatic Solutions reported that US retail traffic was down 52.1% on Black Friday.

- NYC stores unsurprisingly saw weak traffic, although Macy’s surprised with more solid shopper numbers by late morning. Its more premium peers (Nordstrom, Bergdorf Goodman, Saks Off Fifth) saw very light traffic.

- The most-shopped retailers of Walmart, Target and Best Buy (see survey data, later) saw very few early-morning shoppers, but we observed a significant pickup in demand later in the day, especially at Best Buy, where we saw lines outside the Paramus, New Jersey, store in the evening.

- At Bed Bath & Beyond, staff told us it was the quietest Black Friday morning in 20 years; at Best Buy, staff told us that it was the quietest morning in 10 years. Both retailers had seen the sale start earlier, including online.

- Bath & Body Works, Disney, Five Below and Guess? were among the names to see strong in-store demand. A number of retailers were offering curbside pickup services (such as Best Buy, Bed Bath & Beyond, Macy’s and Nordstrom) and/or BOPIS services (Costco, Macy’s, Old Navy, Target and others).

Figure 1. Black Friday Store-Visit Observations [wpdatatable id=588]

Source: Coresight Research Store-Check Images [caption id="attachment_120056" align="aligncenter" width="600"]

Best Buy, Paramus, saw a very quiet morning (left) give way to lines in the evening (right)

Best Buy, Paramus, saw a very quiet morning (left) give way to lines in the evening (right) Source: Coresight Research [/caption] [caption id="attachment_120057" align="aligncenter" width="600"]

Macy’s, Herald Square, saw solid traffic, relative to many other retailers

Macy’s, Herald Square, saw solid traffic, relative to many other retailers Source: Coresight Research [/caption] [caption id="attachment_120058" align="aligncenter" width="600"]

In Queens, Costco saw more shoppers than many other retailers

In Queens, Costco saw more shoppers than many other retailers Source: Coresight Research [/caption] [caption id="attachment_120069" align="aligncenter" width="525"]

Bath & Body Works, Long Island, saw strong merchandising and solid customer demand

Bath & Body Works, Long Island, saw strong merchandising and solid customer demand Source: Coresight Research[/caption] [caption id="attachment_120061" align="aligncenter" width="600"]

H&M, downtown NYC, saw light traffic when we visited

H&M, downtown NYC, saw light traffic when we visited Source: Coresight Research [/caption] [caption id="attachment_120062" align="aligncenter" width="600"]

Nordstrom, NYC, offered curbside pickup

Nordstrom, NYC, offered curbside pickup Source: Coresight Research [/caption] [caption id="attachment_120063" align="aligncenter" width="600"]

Saks Off Fifth, NYC, was very quiet

Saks Off Fifth, NYC, was very quiet Source: Coresight Research [/caption] [caption id="attachment_120064" align="aligncenter" width="600"]

Riverhead (Tanger Outlets, Long Island; left) and Stanford Shopping Center (Simon, Palo Alto; right) saw improving traffic trends as the day progressed

Riverhead (Tanger Outlets, Long Island; left) and Stanford Shopping Center (Simon, Palo Alto; right) saw improving traffic trends as the day progressed Source: Coresight Research [/caption] Pre-Event Survey Insights On November 24, we ran our final pre-Black Friday survey of US consumers.

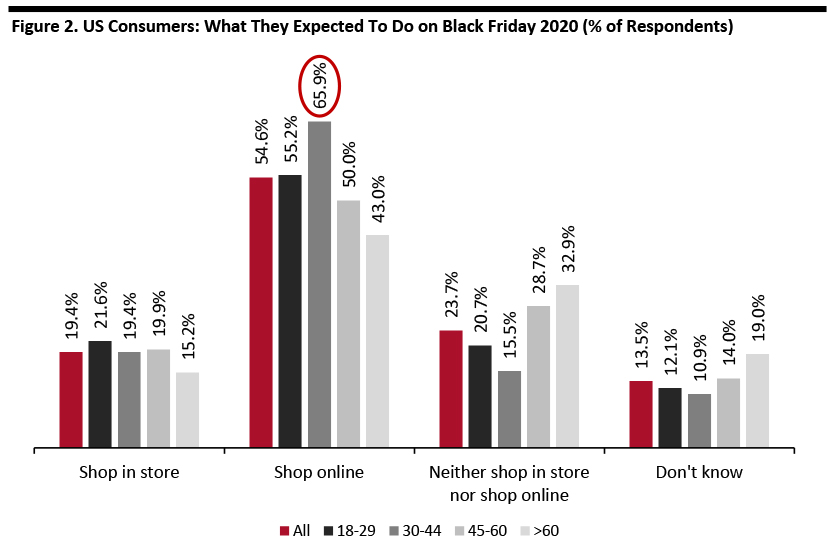

- Only 19.4% expected to shop in stores versus 54.6% online. These findings align with our observations of unusually light traffic in stores on Black Friday.

- 23.7% did not expect to shop, with a further 13.5% not knowing what they would do on Black Friday.

- Shopping online saw a strong peak among the 30–44-year-old age group, with two-thirds expecting to do so.

Base: 460 US respondents aged 18+

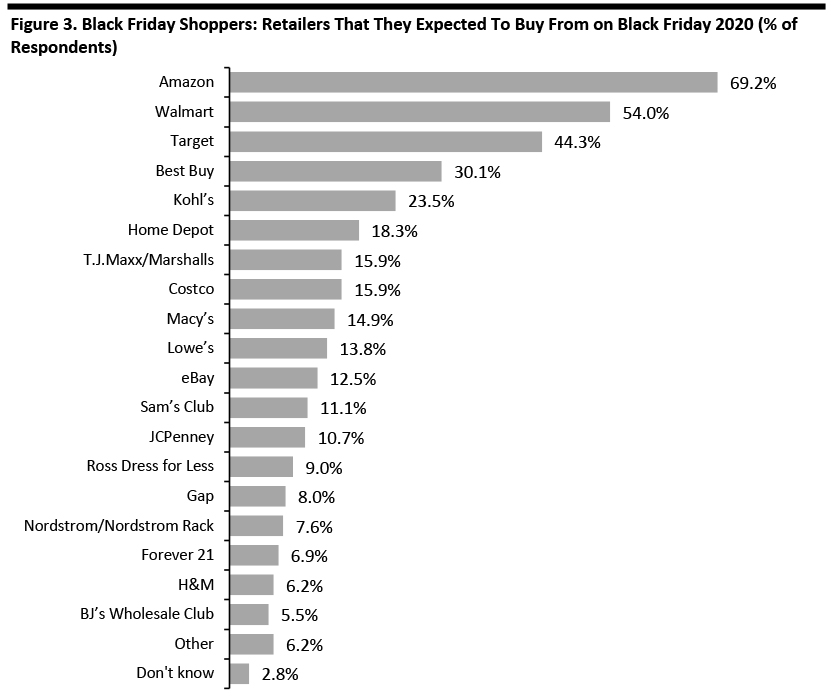

Base: 460 US respondents aged 18+ Source: Coresight Research [/caption] Reflecting a digital-first event, Amazon was the most popular retailer for Black Friday shopping. [caption id="attachment_120066" align="aligncenter" width="700"]

Base: 189 US respondents aged 18+ who expected to shop on Black Friday

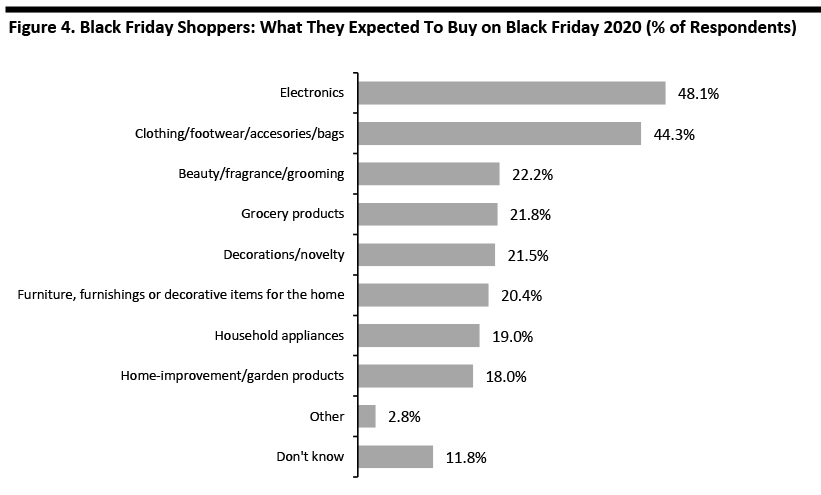

Base: 189 US respondents aged 18+ who expected to shop on Black Friday Source: Coresight Research [/caption] Electronics was the top category that Black Friday shoppers expected to shop for, although apparel and footwear was a narrow second choice. [caption id="attachment_120067" align="aligncenter" width="700"]

Base: 189 US respondents aged 18+ who expected to shop on Black Friday

Base: 189 US respondents aged 18+ who expected to shop on Black Friday Source: Coresight Research [/caption]

What We Think

Black Friday has traditionally been used by retailers and retail-watchers to take an “early read” of holiday trading and consumer demand, based on in-store demand, but the shift to an extended period of discounting and to e-commerce mean its status as a bellwether of holiday retail has now passed. Our qualitative and quantitative research confirms that 2020 was the first truly digital-first Black Friday. Will that trend be reversed in future years? Like so many other impacts from 2020, we expect a degree of retained behaviors even once the current crisis ends. So, in 2021, we are likely to see a middle ground—of greater in-store shopping versus the lows of 2020 but probably much less than we saw historically. Further diluting the significance of store visits on the day itself will be the “Black Friday creep,” turning it from one day into a weeks-long event—and we think that genie is out of the bottle. Implications for Brands/Retailers- Weeks-long discounting during the holiday peak is clearly disadvantageous to retailers, but, in the context of near-unlimited choice online and given the extension of Black Friday in previous years and the advent of final-quarter shopping festivals such as Prime Day in October and the 10.10 Shopping Festival in 2020, we think mass-market retailers will struggle to maintain price discipline next year and thereafter.

- Retailers must seek to mitigate margin erosion associated with extended discounting during the holiday peak, including through factoring that discounting into their buying plans. In 2021, retailers must prepare early for a highly promotional end-of-year peak, building those expectations into their plans for buying, marketing and pricing.