albert Chan

What’s the Story?

This year, Black Friday has been mainly digital—we observed traffic to US stores was materially down at many retailers, as shoppers chose to skip the historical “doorbusting” morning rush and opted to shop online instead. In this report, we discuss digital sales performance on Black Friday and during Cyber Week in the US.

Why It Matters

Consumer demand, particularly during the holiday season, is less certain this year. Our holiday coverage aims to offer directional guidance.

US Black Friday Digital Commerce Insights: In Detail

Positive Year-over-Year Sales Growth Is Below Expectations for Holiday Digital Growth

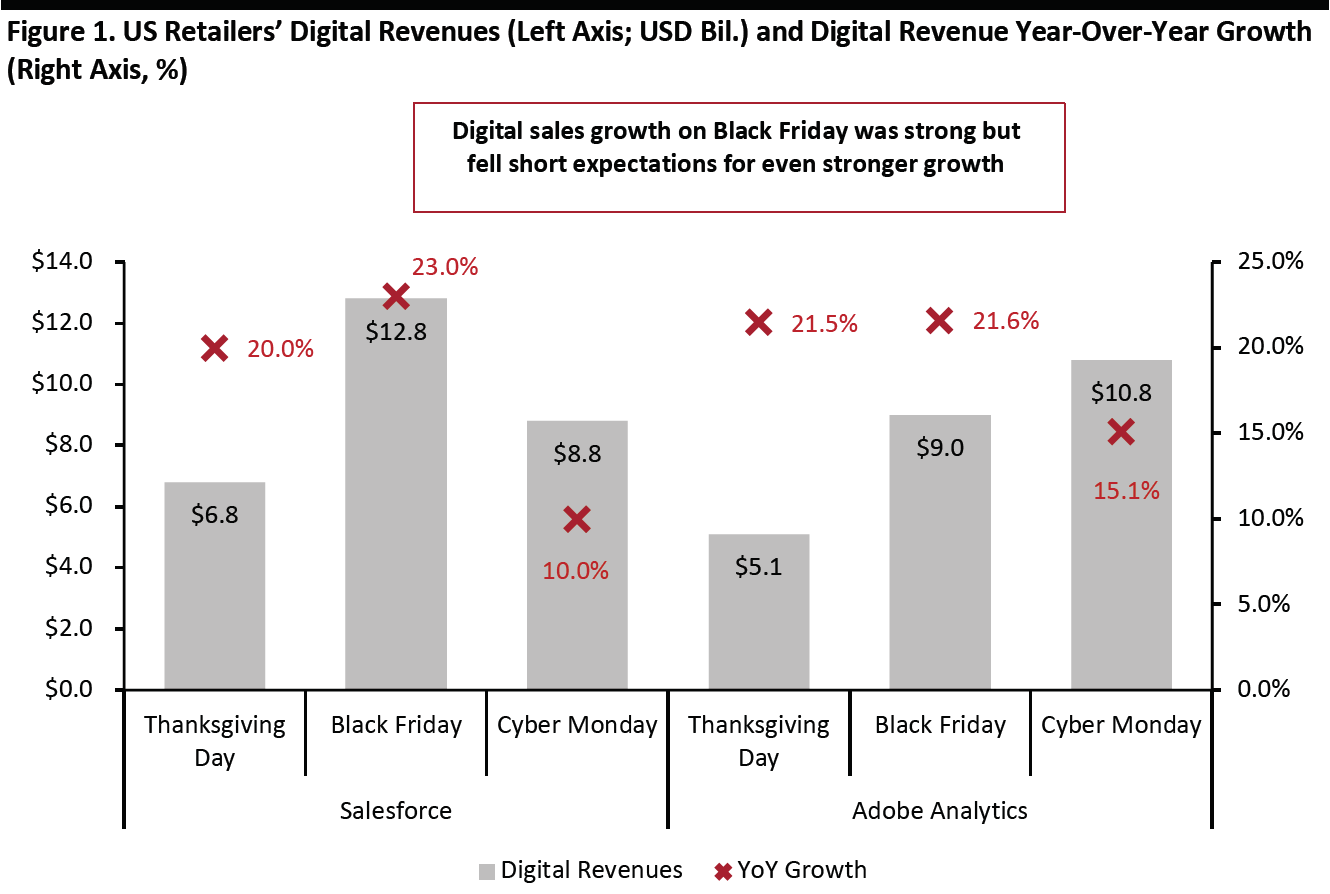

Salesforce data indicated that Black Friday digital sales were up 23% to $12.8 billion, making it the top digital shopping day during Cyber Week (November 22–30). Retailers clocked $8.8 billion in digital revenues on Cyber Monday, up 10% year over year, and $6.8 billion on Thanksgiving Day, implying 20% growth.

Digital revenue growth on Black Friday this year was well above the 14% growth that US brands and retailers recorded in 2019, according to Salesforce, indicating consumers’ growing affinity for e-commerce amid the pandemic. It is, however, lower than Salesforce’s expectations of 34% growth in digital sales during the holidays.

Adobe Analytics recorded 21.6% digital revenue growth on Black Friday, with sales of $9.0 billion, lower than the estimated $10.3 billion. The revenues Adobe recorded for Cyber Monday came in at the low end of its predicted range of $10.8–$12.7 billion but surpassed those of Black Friday, totaling $10.8 billion and representing 15.1% year-over-year growth.

These numbers also fall below our predictions for 33.5% growth in US online retail during the holiday season this year. A number of retailers that ran Black Friday deals through November, as well as an October Amazon Prime Day and concurrent sales by other major retailers, likely pulled forward some holiday spending to the period before Black Friday this year.

[caption id="attachment_120287" align="aligncenter" width="700"] Source: Salesforce/Adobe Analytics[/caption]

Source: Salesforce/Adobe Analytics[/caption]

Retailers Offering Pickup Services Record Greater Growth in Digital Sales During Cyber Week

US retailers that offered curbside, in-store and drive-thru pickup grew digital sales by 29% during Cyber Week, while those that did not offer these services grew digital sales only by 22%, according to Salesforce. Adobe Analytics recorded a 52% year-over-year rise in in-store and curbside pickup on Black Friday and 30% year-over-year growth in curbside pickup on Cyber Monday. Some 45% of Cyber Monday shoppers opted for one-day shipping while 37% opted for curbside pickup for last-minute shopping, according to Adobe Analytics.

With earlier shipping cutoff dates and additional shipping surcharges levied by carriers to handle the surge in residential delivery, it seems that consumers opted to leverage pickup services and avoid the holiday rush and additional charges.

Offering in-store pickup services also helps retailers avoid the delivery bottlenecks that we expect to see this season as consumers increasingly switch from shopping in stores to e-commerce.

Retailers Temper Discounts While Focusing on Personalized Marketing

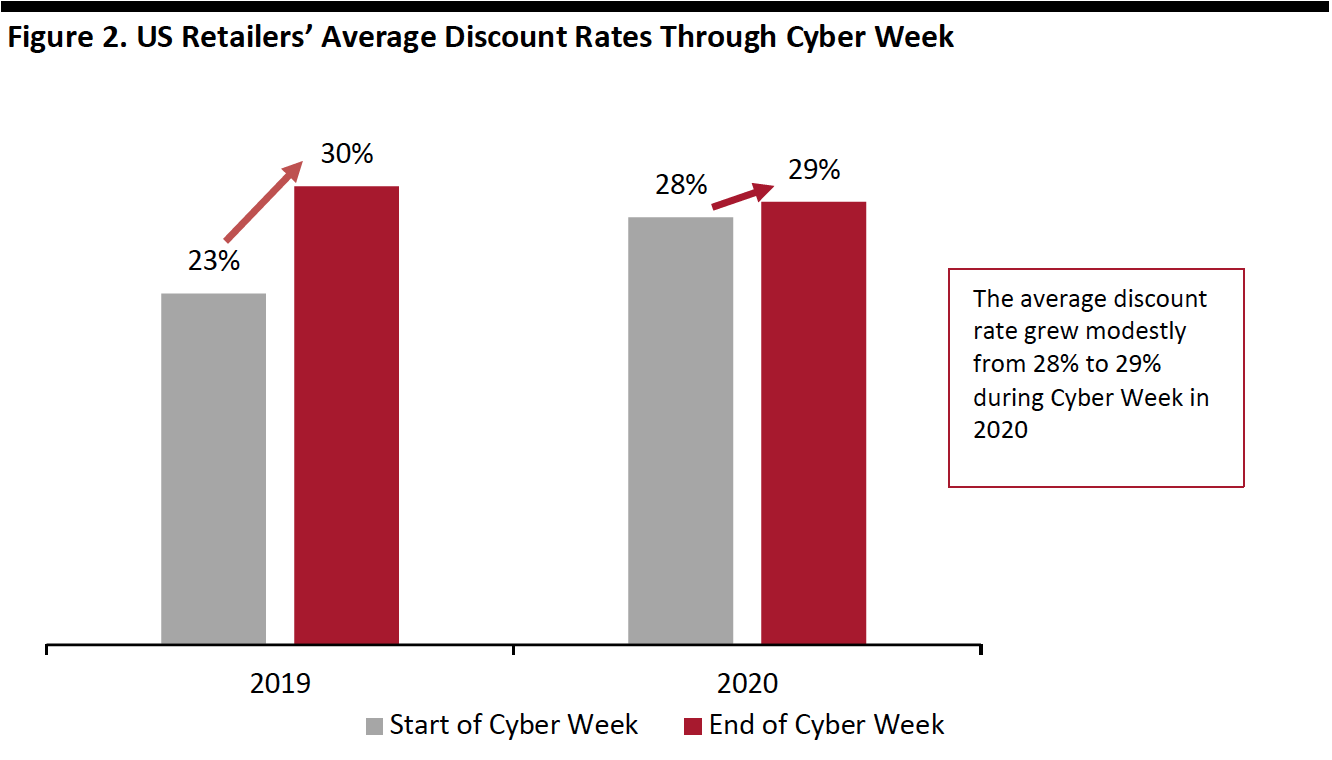

US retailers’ average discount rate was 28% on November 26 and grew moderately through the week, ending with an average discount rate of 29% on Cyber Monday. By comparison, shoppers last year were offered an average discount rate of 23% at the start of Cyber Week, ending with an average discount rate of 30% on Cyber Monday, according to Salesforce. The company also noted that personalized product recommendation views jumped 69% through Cyber Week.

A number of retailers, such as BJ’s Wholesale Club, Target and Walmart, began offering deals and discounts as early as the first week of November. This will have contributed to a more consistent discount rate across the week this year.

[caption id="attachment_120288" align="aligncenter" width="700"] Source: Salesforce[/caption]

Source: Salesforce[/caption]

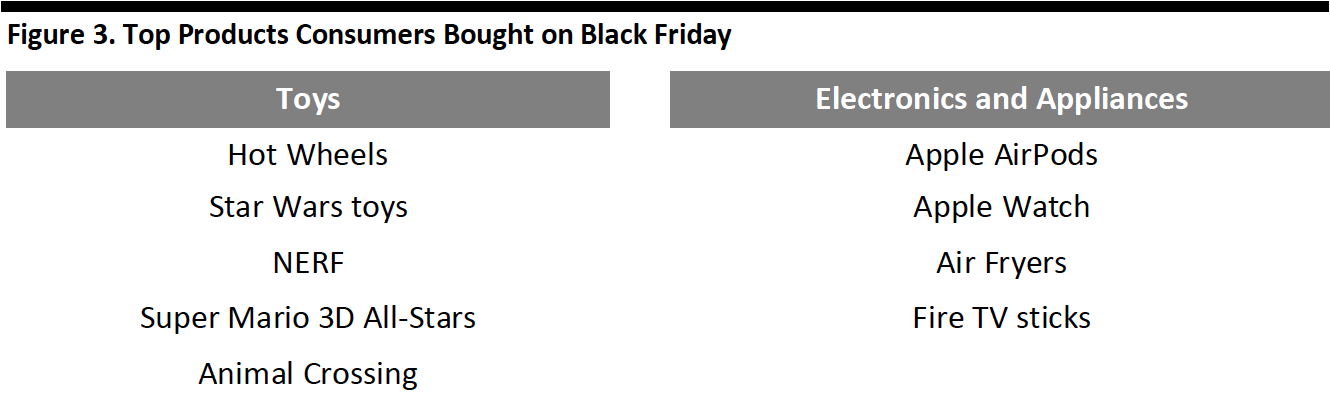

Games and Technology Among the Most-Sought-After Categories

Salesforce stated that shoppers sought gaming consoles and mobile phones on Black Friday, according to social media analysis. Adobe Analytics listed games and personal digital devices among the top five products that shoppers were buying on Black Friday. With three of the top five products being games, it is indicative of parents increasingly turning to toys and games to keep children busy as they stay home amid the pandemic.

Online shoppers saw the greatest discounts on computers (28%), electronics (26%), appliances (20%), toys (17%) and sporting goods (18%), according to Adobe Analytics.

[caption id="attachment_120289" align="aligncenter" width="700"] Source: Adobe Analytics[/caption]

Source: Adobe Analytics[/caption]

The Importance of Social Media: At-Home Shoppers Look Beyond Retailers’ Sites for Inspiration and Research

Social media platforms drove 10% of traffic to e-commerce sites and accounted for 4% of digital orders during Cyber Week in the US, according to Salesforce. Consumers engaged with brands through messaging, livestreaming and other channels, with Facebook being the top social platform on Black Friday, according to Salesforce.

What We Think

Black Friday saw weak traffic at stores but solid digital growth this year, making it the first truly digital-first Black Friday. With holiday promotions shifting earlier this year than ever before and to e-commerce, Black Friday may have lost its historical status as the bellwether of holiday retail. It remains to be seen whether these trends will be reversed in future years, but we do expect consumers to retain a degree of changed behaviors even after the crisis ends.For the rest of 2020, we expect shoppers will increasingly seek to complete remaining holiday purchases online, and retailers must offer ways to help them shop conveniently.

- Offering pickup options for online orders, such as curbside, in-store or drive-thru, will not only help shoppers receive products quicker and save on shipping costs but will also help retailers circumvent shipping bottlenecks that are likely to accompany the surge in e-commerce.

- Retailers and brands should look at ways to engage with consumers on social media as shoppers may be hesitant to visit stores and instead seek ways to research products and deals outside of e-commerce sites.