What’s the Story?

We review UK retail sales and trading updates from major retailers to analyze what happened amid a substantially locked-down holiday period.

Why It Matters

Retail sales data and major retailers’ updates for the holiday peak last year can help to gauge the scale and shape of demand as we head further into 2021.

Holiday Retail Sales: In Detail

December Downturn

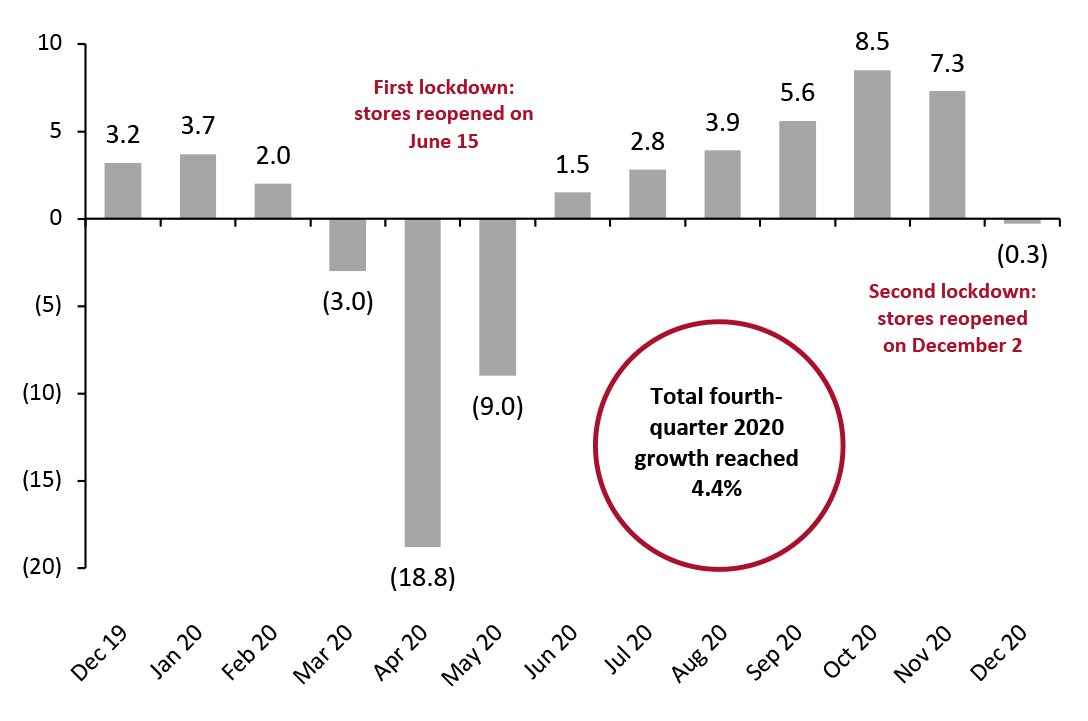

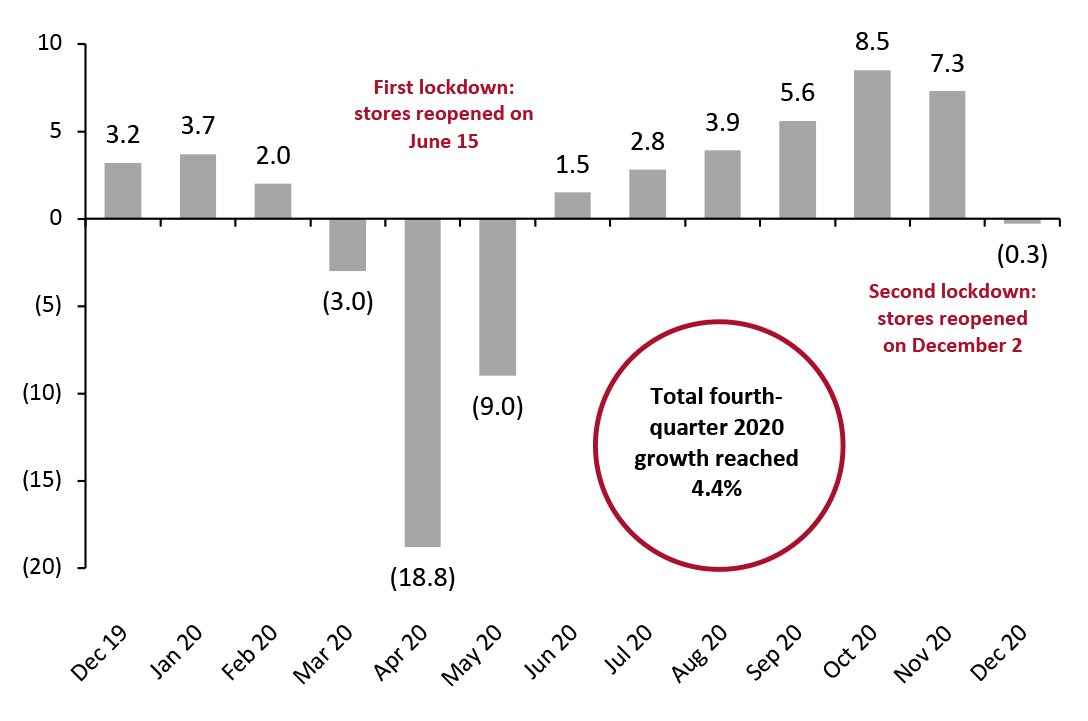

A very weak December, in which total sales fell by 0.3% year over year, followed a strong October and November. Amid a lockdown that forced nonessential stores to close until December 2 (see appendix for the UK Covid-19 timeline), November had proved surprisingly strong. Consumers appear to have pulled forward holiday purchases and they also shopped online to a great extent, as we discuss later.

Total fourth-quarter demand was strong: Total growth came in at 4.4%,

ahead of our 3.5% estimate and despite the substantial disruption to retail operations. This compares to 2.0% growth in the fourth quarter of 2019.

The Office for National Statistics (ONS) data for December covers the five-week period from November 29, 2020 to January 2, 2021—so includes three days of the lockdown that ended on December 2, 2020.

Figure 1. UK Total Retail Sales: YoY % Change

[caption id="attachment_122213" align="aligncenter" width="725"]

Source: ONS

Source: ONS[/caption]

Home and Electronics See a Strong Peak Season

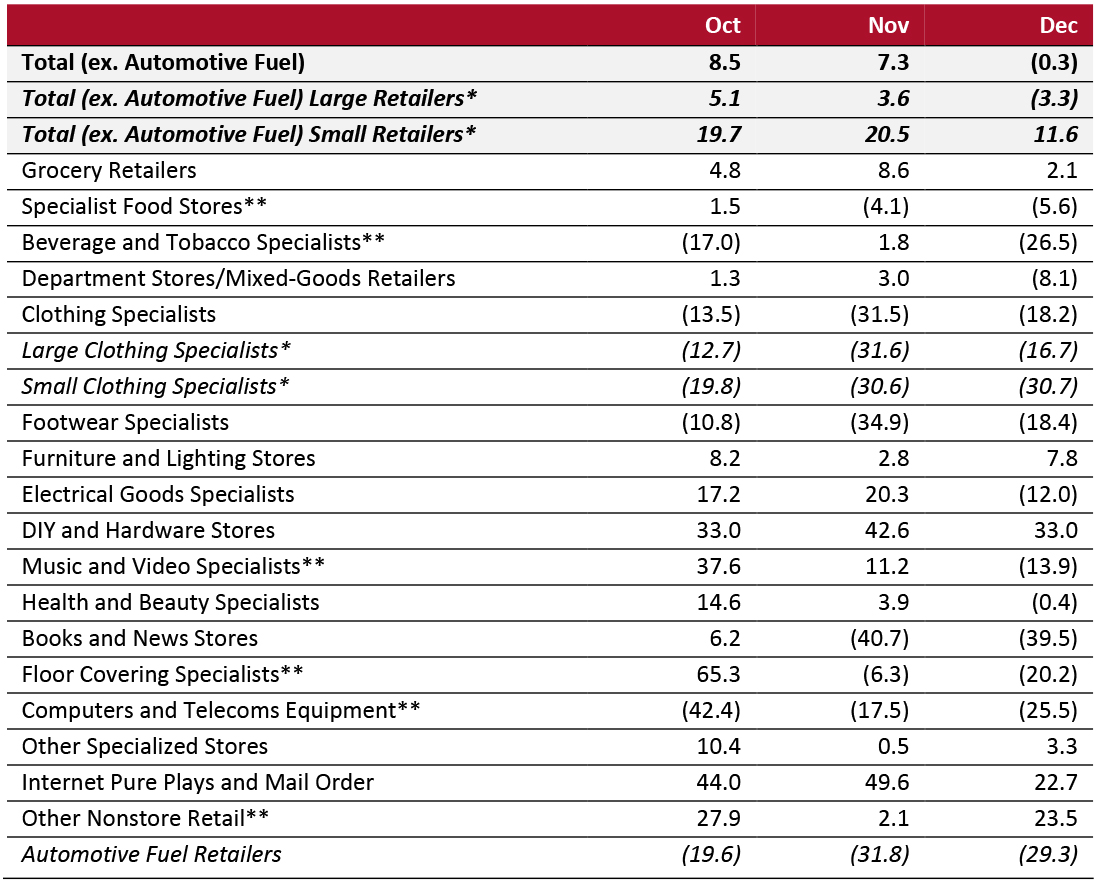

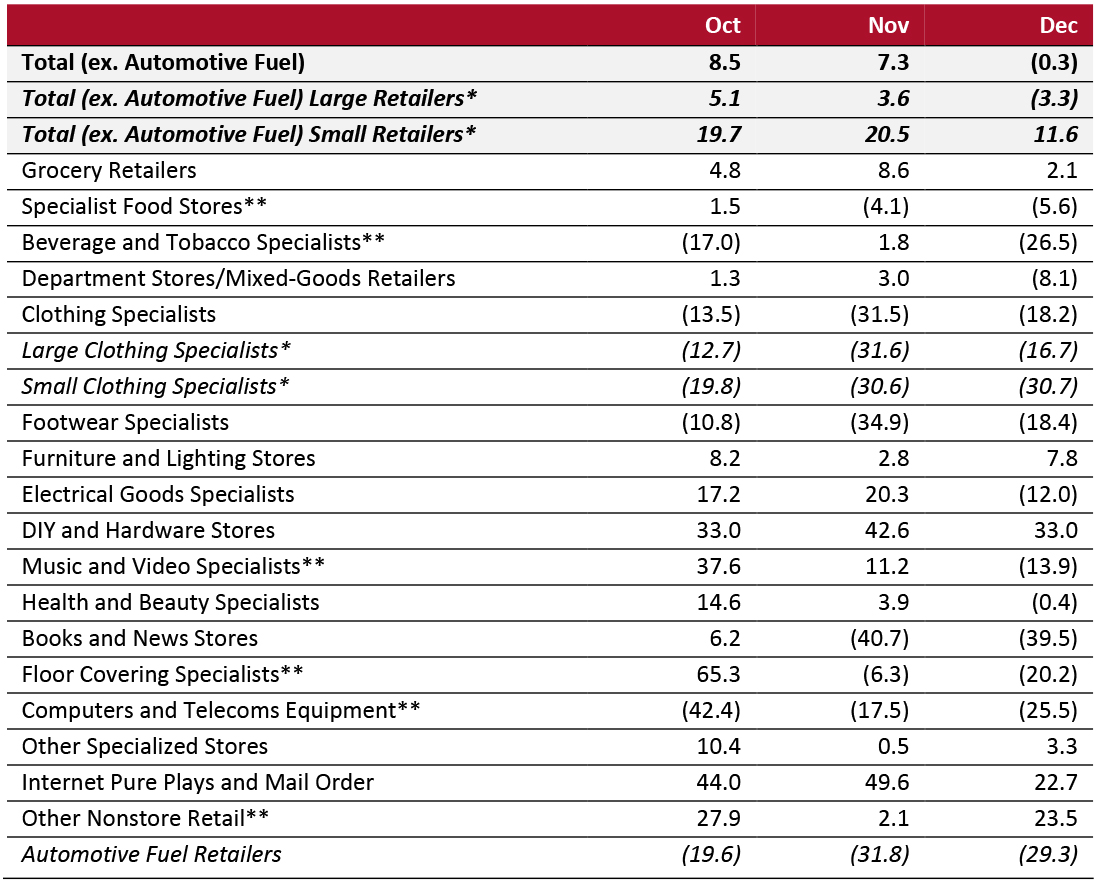

In December, large retailers, which comprise the bulk of most sectors, saw a 3.3% year-over-year drop in sales versus a 3.6% rise in November. Large retailers are defined as having more than 100 employees or revenues of over £60 million.

Grocery retail was weak in December, despite very limited food-service alternatives but possibly impacted by last-minute restrictions on social gatherings during Christmas week (see appendix).

Department stores and mixed-goods retailers also saw a slump in sales. This sector is a mix of full-line department stores (such as John Lewis) and general merchandise retailers. As we note later, none of the major department stores have yet reported on Christmas trading.

In nonfoods, the overall performance was of apparel weakness but solid spending on home and electronics categories—also borne out by retailers’ updates, which we discuss later.

- Clothing and footwear specialist retailers saw sequential improvements in December, bucking the trend seen in retail overall and a number of other sectors.

- DIY stores continued to see very strong performance through December. Likewise, furniture stores’ growth remained positive in December and even accelerated. As noted later, major furniture retailer Dunelm reported a strong holiday season.

- Electrical goods specialists saw a substantial fall in sales in December, although this followed strong prior performances, according to the ONS. As we discuss later, market leader Dixons Carphone reported a strong holiday period overall.

Figure 2. UK Retail Sales, by Sector: YoY % Change

[caption id="attachment_122214" align="aligncenter" width="725"]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

**A relatively fragmented sector, in which reported figures have traditionally been volatile.

Source: ONS [/caption]

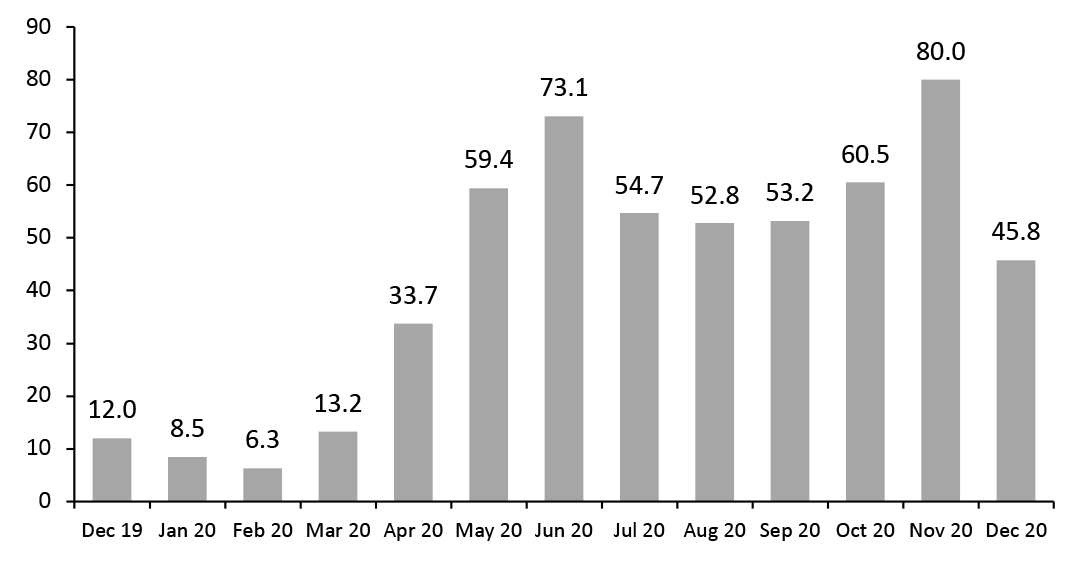

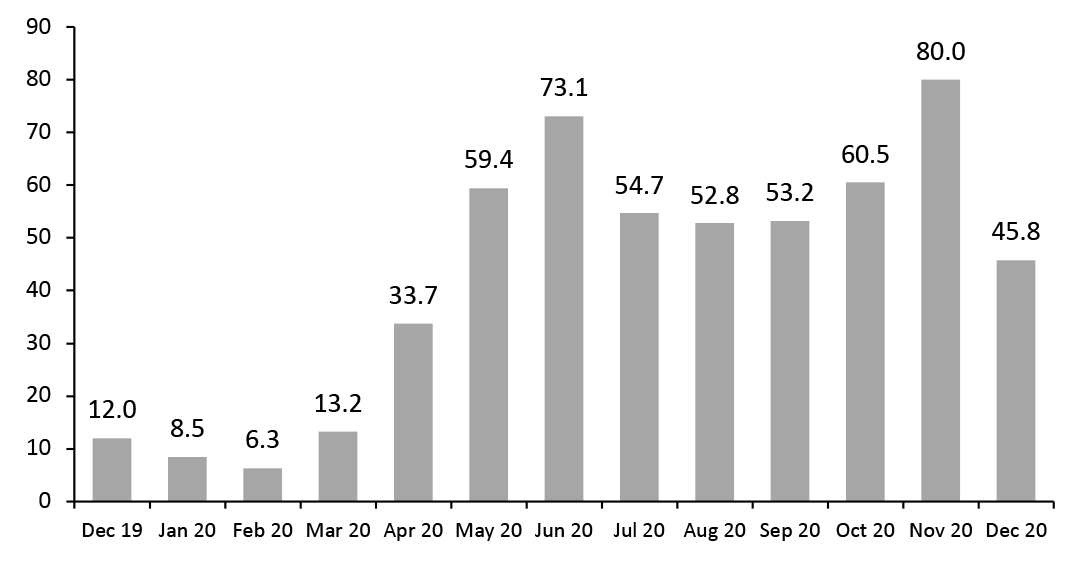

Online Sales Jump 61%

From ONS data, we calculate that e-commerce accounted for 32.0% of all retail sales in the final quarter, compared to 20.8% in the same period one year earlier; and that e-commerce accounted for 46.1% of total nonfood retail sales, compared to 30.9% in the final quarter of 2019; this was ahead of

our estimate of 42.9%.

In December, e-commerce accounted for 9.9% of food retailers’ sales and 29.8% of store-based nonfood retailers’ sales. Some 86.0% of nonstore retailers’ sales were online in December.

Total online retail sales climbed by 61.4% year over year in the final quarter, with growth peaking at 80.0% in November.

In December, online sales grew by 92.5% year over year at food retailers and 62.9% at store-based nonfood retailers, which included a 90.5% increase in online sales at department stores/mixed-goods retailers, a 47.1% rise in online sales at clothing and footwear stores, and a 34.0% increase in online sales at household goods retailers (which includes furniture and DIY). Nonstore retailers saw a 25.1% year-over-year rise in online sales in December, implying that in aggregate online-only retailers lost share of online retail sales.

Figure 3. UK Online Retail Sales: YoY % Change

[caption id="attachment_122215" align="aligncenter" width="725"]

Source: ONS

Source: ONS[/caption]

Retailers’ Trading Updates: In Detail

Apparel and General Merchandise

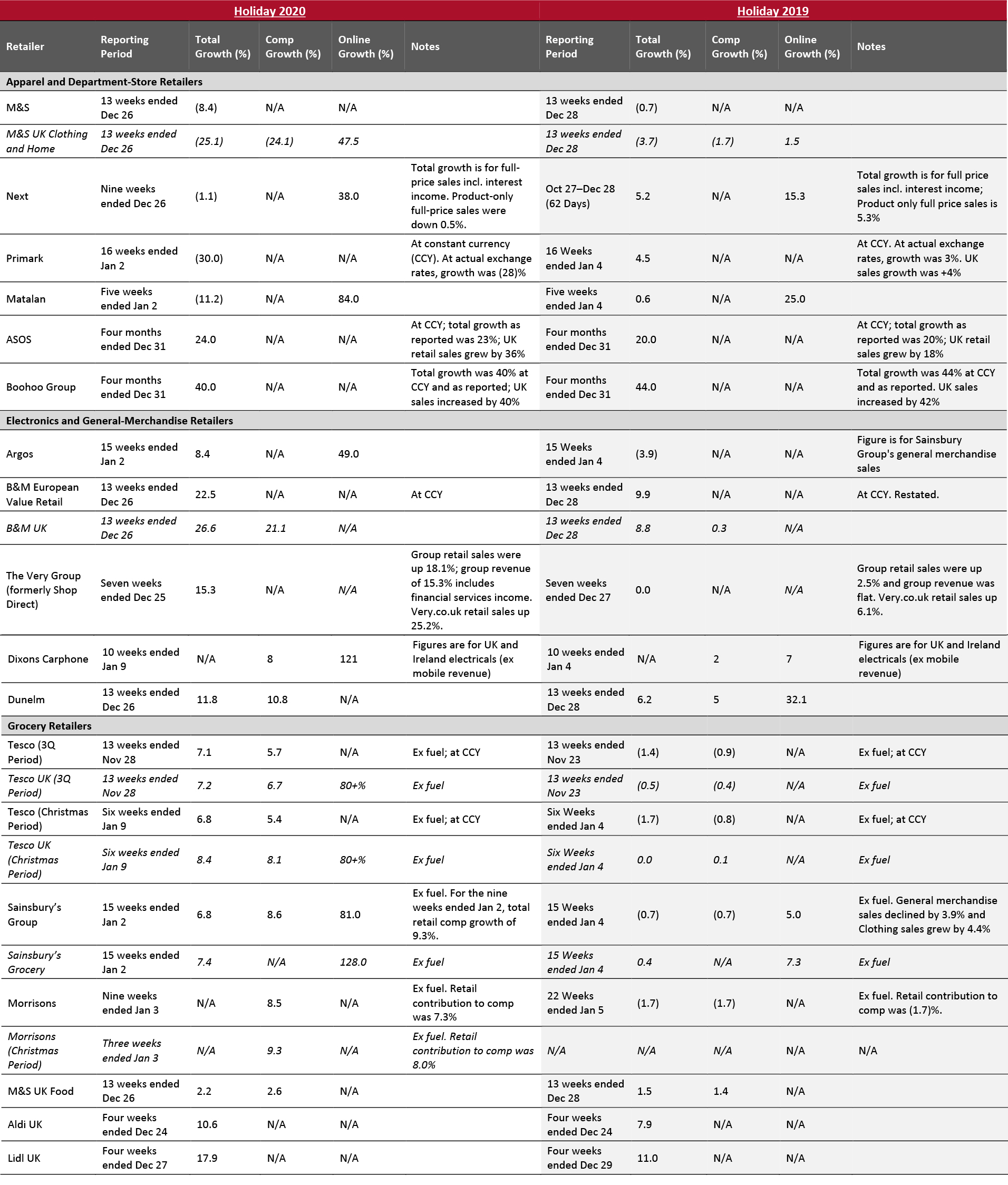

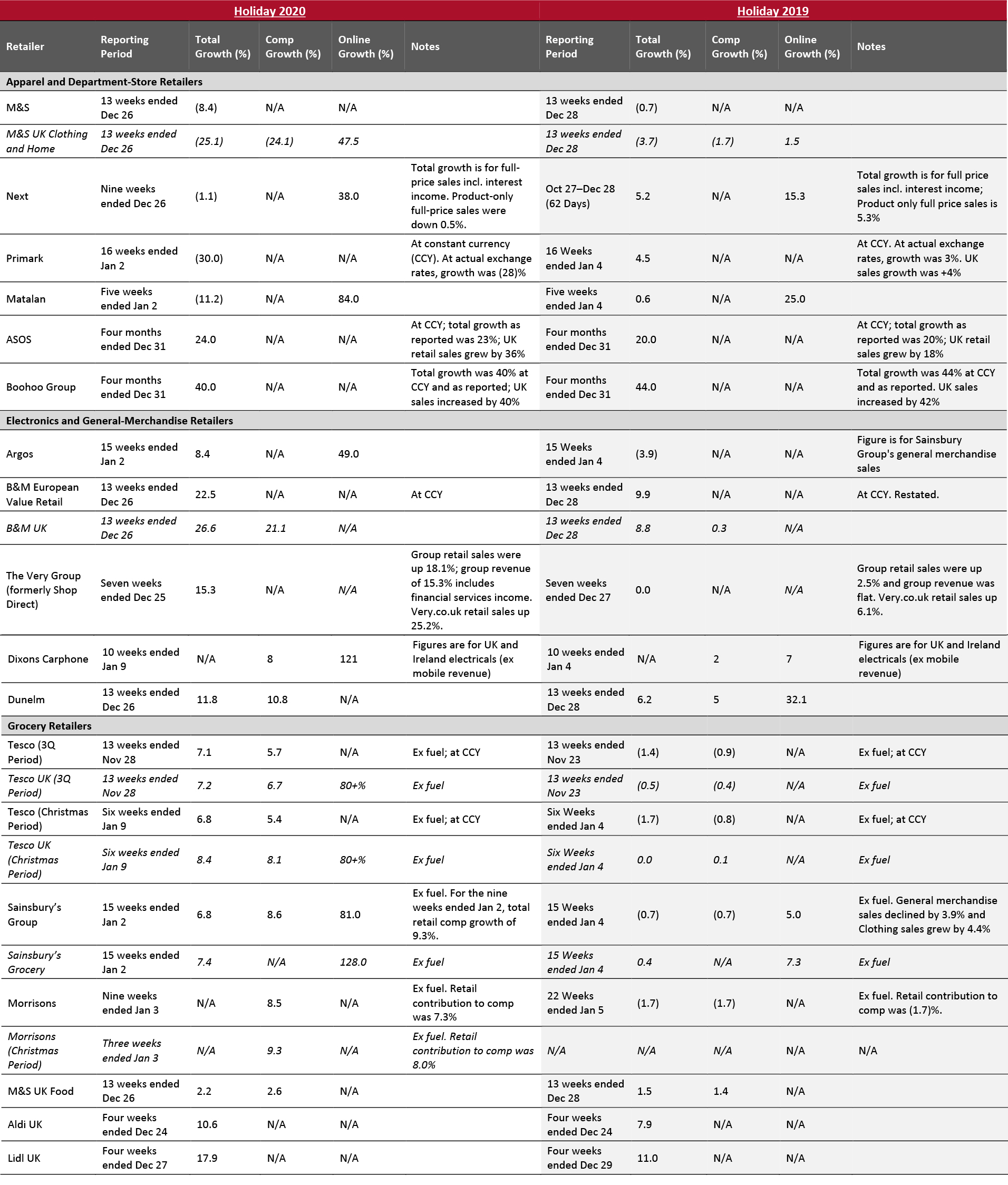

Confirming solid though unequal demand, the majority of nonfood retailers listed in the table below grew sales over the peak period—and most of those grew sales more strongly than they did in the 2019 holiday season.

Amid lockdowns and tiered restrictions, retailers with a strong digital proposition were among the winners during the peak trading season. This was not purely or even largely the online-only retailers: Argos, Dixons Carphone, Next and The Very Group were rewarded for early and consistent investments in omnichannel or online retailing.

- Sainsbury’s reported 8.4% growth in Argos sales this holiday season versus a 3.9% fall in Sainsbury’s Group general merchandise one year earlier (when a split for Argos was not provided). Digital sales accounted for 87% of Argos sales in the 2020 peak.

- Dixons Carphone’s UK and Ireland electricals comp sales accelerated from 2% in the 2019 Christmas peak to 8% in 2020, fueled by a 121% rise in digital sales.

- Next’s online growth climbed to 38% in the 2020 holiday season from 15.3% one year earlier. In-store sales were down 43% year over year in its fourth quarter of 2020.

- The Very Group grew group revenues by 15.3% this holiday season compared to flat revenues last year.

Online-only retailers ASOS and Boohoo Group reported growth rates in the same ballpark to those seen one year earlier—but in a total apparel market that continued to decline during the holiday peak.

A 47.5% uplift in M&S clothing and home sales was not enough to offset lost sales in store: Total clothing and home sales were down by one-quarter, with management pointing to a 16.8% decline before the November lockdown, a 40.5% decline during that lockdown and a 19.4% decline in December, after the lockdown ended.

The M&S numbers compare unfavorably to multichannel apparel rivals such as Next and Matalan. Among the major apparel chains included in the table below, only Primark reported a steeper total sales decline, of 30%, and Primark does not sell online.

Consumers continued to spend on home categories, electronics and appliances. Management at Sainsbury’s called out the top growth categories at Argos as furniture, major domestic appliances, televisions and gaming consoles. Dixons Carphone management reported “exceptionally strongly” growth in computing plus strengths in Apple devices, food appliances, gaming and large-screen televisions. Online appliances and electronics retailer AO World reported a 67.2% increase in UK sales in the three months ended December 31. At Very.co.uk, home category sales grew 46.2% and sales of electrical goods were up 44.8%.

Next called out home as one of its top categories, but commentary on any strength in the home category was absent from M&S’s trading statement.

Online Grocery Remains Strong

The biggest, and most digitally adept, grocery retailers reported further strong growth over the holiday season overall, supported by online demand. Tesco saw online sales rise by more than 80% and Sainsbury’s reported a 128% increase in online grocery sales. Morrisons said that its online sales more than tripled in its fourth quarter. Aldi and Lidl also reported stronger growth than one year earlier.

Omissions and Additions

We have no confirmed view of performance at the department stores (other than M&S, if that can be considered such). This year, the John Lewis Partnership scrapped its post-Christmas trading update, meaning that we have no view of performance at supermarket chain Waitrose or the John Lewis department-store chain. However, the company did remark that sales during the Christmas peak “held up better than anticipated.” Debenhams is in the process of being wound down by administrators. Moreover, Frasers Group, owner of House of Fraser since 2018, does not issue post-Christmas trading updates.

The majority of the retailers included in the table below are part of our

Coresight 100 coverage list. To provide comprehensive coverage, we have also included the following major non-Coresight 100 companies: B&M, Dixons Carphone, Dunelm, Matalan and The Very Group.

Figure 4. Major UK Retailers’ Holiday-Period Trading Updates: 2020 vs. 2019

[caption id="attachment_122216" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

What We Think

In the final quarter of 2020 overall, consumer demand proved strong, likely helped by a switch of some spending from services to retail. Rather than cutting spending amid uncertainty and temporary store closures, UK shoppers increased their spending on categories such as electronics and home, and switched purchases to e-commerce. Apparel demand continued to decline.

However, the sharp downturn in December is bad news for retail performance into early 2021. The considerable uncertainty for consumers over the ending of lockdowns and consequent economic concerns are dragging consumer confidence deeper into negative territory, with market research firm GfK reporting a downturn in January. Recent government messaging that it may take until the summer for lockdowns to be eased or ended, despite a rapid vaccine rollout, is likely to compound shopper concerns with consequent negative impacts on willingness to spend.

Appendix: UK Covid-19 Timeline

Lockdown 1: The UK was put into lockdown on March 23, 2020, initially for three weeks, in an attempt to limit the spread of the coronavirus. Nonessential retail stores were closed.

On April 16, the government extended the lockdown by another three weeks.

On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23.

On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards.

On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4.

On September 14, a new “rule of six” prohibited social gatherings of more than six people, unless they are from the same household.

On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24.

On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry. Retail was not directly affected, although stores were requested to enforce two-meter distancing.

On October 12, the UK government announced a three-tier lockdown system, which classifies regions based on the severity of infection rates. In the week beginning October 19, a number of regions in England, including London and Manchester, moved into higher “tiers” of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers.

On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more.

Lockdown 2: On October 31, Prime Minister Johnson announced a second lockdown for England for the period November 5 to December 2. All nonessential retail was forced to close, “including, but not limited to, clothing and electronics stores, vehicle showrooms, travel agents, betting shops, auction houses, tailors, car washes and tobacco and vape shops.” Food shops, supermarkets, garden centers and certain other retailers providing essential goods and services could remain open. Nonessential retail could remain open for delivery to customers and click-and-collect. Hospitality venues such as restaurants, bars and pubs were forced to close but could still provide takeaway and delivery services. Also forced to close were entertainment venues, indoor and outdoor leisure facilities, and personal care services.

Following the lockdown, UK regions were placed into different tiers, each of which had different restrictions.

On December 8, the UK’s National Health Service started vaccinations, with the aim of vaccinating the most vulnerable groups of people by February 15, 2021.

On December 21, the UK government scrapped a planned easing of rules on the mixing of households over the Christmas period. In England and Scotland, households in many areas were banned from mixing; in some areas, households could mix on Christmas Day only. The devolved Welsh and Northern Irish administrations implemented their own restrictions.

Lockdown 3: On January 4, 2021, Johnson announced a lockdown in England, effective January 5 and with an unspecified end date but with laws formally expiring on March 31. Scotland, Wales and Northern Ireland also implemented lockdowns.

On January 19, Scotland’s First Minister Nicola Sturgeon announced that that country’s lockdown would be extended until at least the middle of February.

Source: ONS[/caption]

Home and Electronics See a Strong Peak Season

In December, large retailers, which comprise the bulk of most sectors, saw a 3.3% year-over-year drop in sales versus a 3.6% rise in November. Large retailers are defined as having more than 100 employees or revenues of over £60 million.

Grocery retail was weak in December, despite very limited food-service alternatives but possibly impacted by last-minute restrictions on social gatherings during Christmas week (see appendix).

Department stores and mixed-goods retailers also saw a slump in sales. This sector is a mix of full-line department stores (such as John Lewis) and general merchandise retailers. As we note later, none of the major department stores have yet reported on Christmas trading.

In nonfoods, the overall performance was of apparel weakness but solid spending on home and electronics categories—also borne out by retailers’ updates, which we discuss later.

Source: ONS[/caption]

Home and Electronics See a Strong Peak Season

In December, large retailers, which comprise the bulk of most sectors, saw a 3.3% year-over-year drop in sales versus a 3.6% rise in November. Large retailers are defined as having more than 100 employees or revenues of over £60 million.

Grocery retail was weak in December, despite very limited food-service alternatives but possibly impacted by last-minute restrictions on social gatherings during Christmas week (see appendix).

Department stores and mixed-goods retailers also saw a slump in sales. This sector is a mix of full-line department stores (such as John Lewis) and general merchandise retailers. As we note later, none of the major department stores have yet reported on Christmas trading.

In nonfoods, the overall performance was of apparel weakness but solid spending on home and electronics categories—also borne out by retailers’ updates, which we discuss later.

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.  Source: ONS[/caption]

Source: ONS[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]