What’s the Story?

We present our outlook for UK retail for the 2020 holiday season—the most unusual and unpredictable of any Coresight Research has covered. We provide our estimates for the October–December period.

Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever. Coresight Research’s coverage provides directional guidance to retailers, suppliers and vendors.

UK Holiday Retail Outlook: In Detail

Pockets of Growth Support Total Retail Increase

The past several years have seen relatively solid total retail demand distributed less and less evenly, with the traditional centerground of retail winnowing as demand has fragmented to strong brands, online rivals and discount formats. This holiday season, coronavirus-induced demand will further amplify the imbalance—in particular, fueling sales of grocery, accelerating growth in e-commerce and further hitting apparel as some discretionary spending switches to alternative categories.

While we offer our topline estimates for the holiday season, we do so with the caveat that an overall demand picture is less relevant than ever.

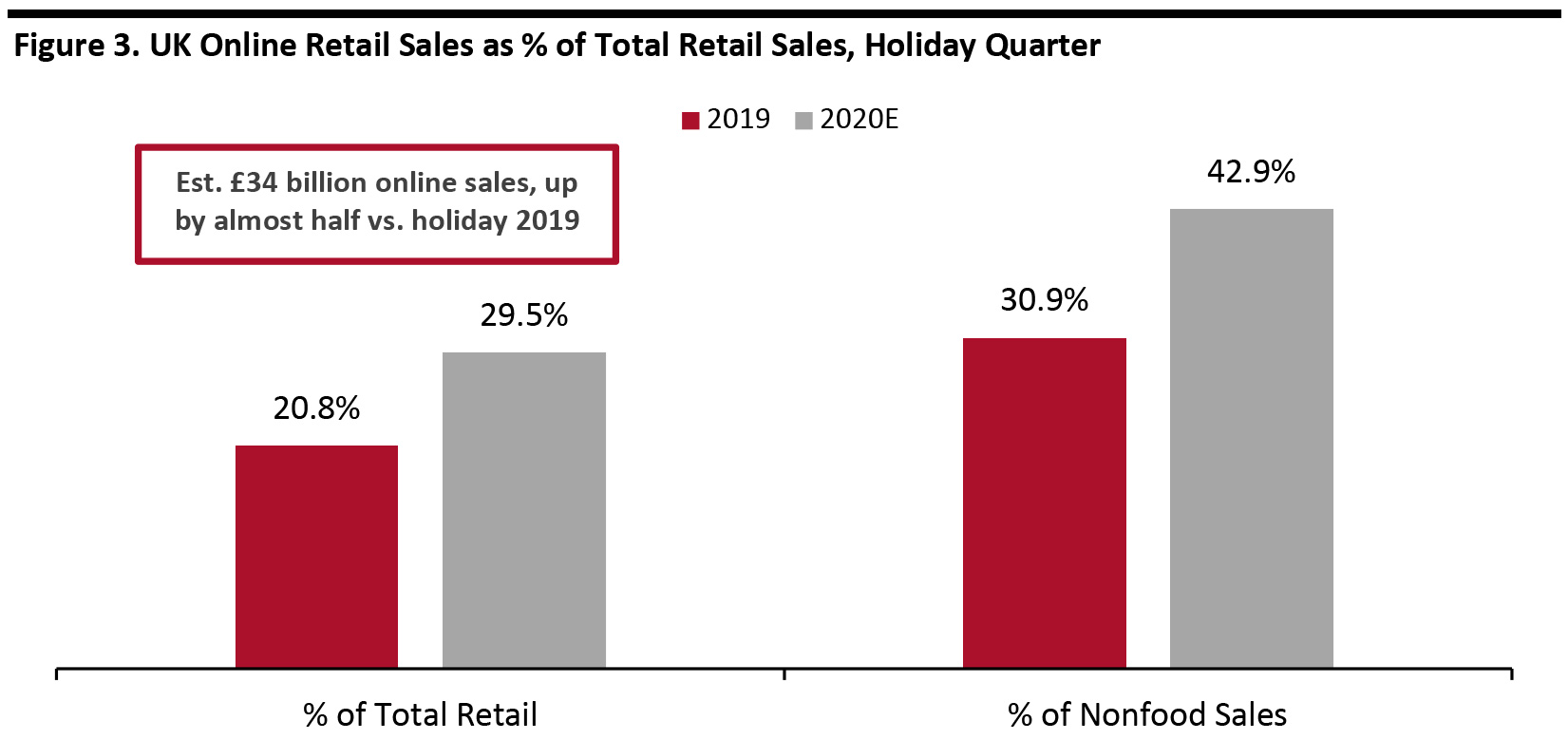

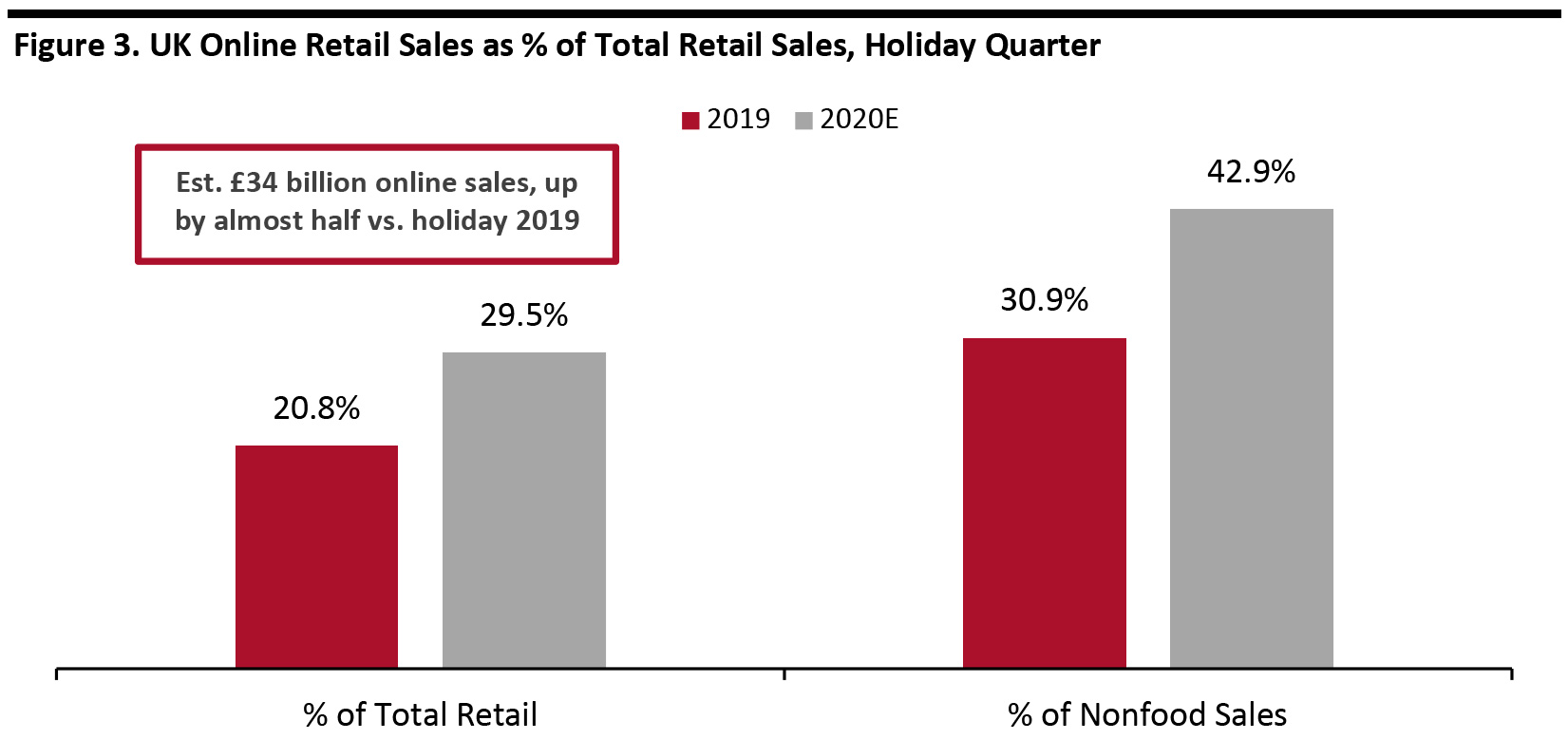

In summary, we expect solid, mid-single-digit growth in food retail as fewer options for dining out channel food spending into retail. With an estimated 47% year-over-year increase in online retail sales, we expect e-commerce to account for close to 30% of all retail sales but a much-higher 42.9% across nonfood categories in total.

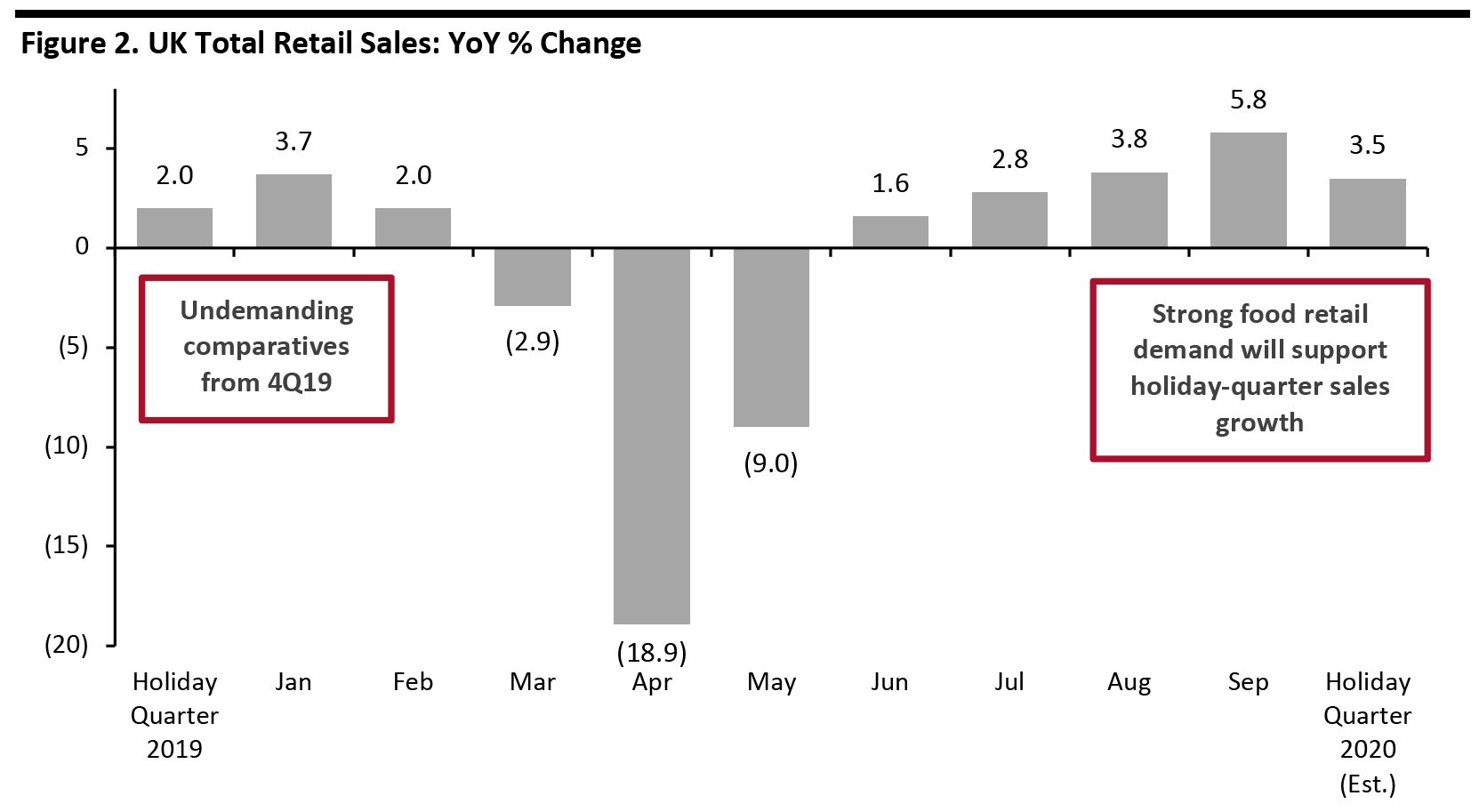

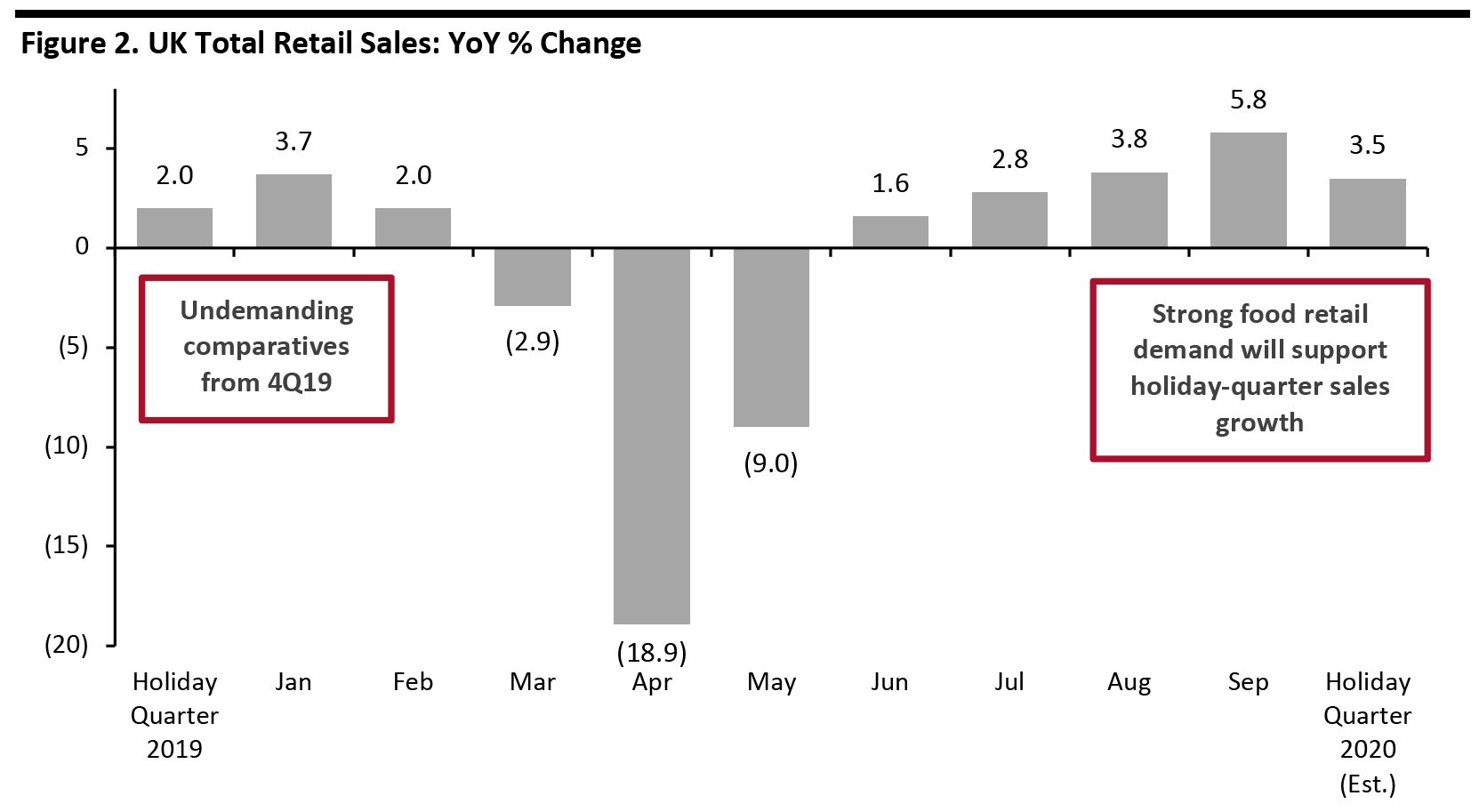

Driven by food and e-commerce, we estimate that total October–December retail sales will climb by a moderate 3.5% to £116.5 billion (around $151.2 billion). Our retail estimates are benchmarked to unadjusted figures published by the Office for National Statistics (ONS).

[caption id="attachment_118385" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

UK retail has bounced back solidly, post lockdown. September 2020 was exceptionally strong, but we do not expect to see this level of growth maintained through the final quarter. However, we do see upside potential—particularly if food retail demand grows more strongly than we currently model, in the wake of greater restrictions being introduced. A further support to year-over-year growth rates are the undemanding comparatives from the final quarter of 2019, when total sales rose by only 2.0%.

[caption id="attachment_118386" align="aligncenter" width="700"]

Source: ONS/Coresight Research

Source: ONS/Coresight Research[/caption]

Recent retail expansion has been supported by strong demand for home categories, including home improvement and furniture. As the nesting trend reshapes for the winter, we see these trends continuing through the holiday peak with strong demand for gifting categories across home. We expect to see pockets of strong demand in fitness equipment, wellness products, athleisure and electronics sustained into the holiday peak. We anticipate that apparel retail sales will be down by double digits, although alleviating from recent deeper declines as gifting purchases are less driven by functional needs related to attendance at workplaces or events.

We have headed into the final quarter with more restrictions being introduced in UK regions. These impact service industries such as food service more than they do retail—through limited trading hours, upper limits on the number of people who may gather or restrictions on the mixing of households (see Appendix). As a result, we expect to see redirected food spend renew momentum in food retail sales. Moreover, any expansion of regional restrictions or lockdowns could amplify demand for food retail, providing upside potential to our estimate. Over the peak Christmas period of December, a lack of large-scale social events and corporate entertainment and parties will further fuel food retail spending for smaller-scale gatherings and self-treating.

Capacity Challenges

Capacity is set to be a significant factor shaping the scale of peak-season sales this year—online and in-store.

- Online, retailers and shippers are facing capacity pressures in distribution. E-commerce demand since lockdown has effectively been akin to a months-long holiday season; now, that additional demand will come on top of the regular holiday peak. We expect logistics capacity to be a constraint on e-commerce expansion this holiday season, driving a tempering of year-over-year growth from recent circa-50% rates. Indications from retailers of unusually early shopping in October suggest that consumers are attuned to supply-chain challenges, and this could alleviate the extent to which capacity proves a bottleneck to overall demand.

- In store, social-distancing requirements will impact brick-and-mortar sales: Managing in-store shopper numbers to a fixed capacity implies a greater year-over-year decline in shoppers during peak shopping months than during quieter periods of the year. In store-based nonfood retail, we expect the resulting disruption to drive down brick-and-mortar sales and fuel channel switching to e-commerce.

Online Demand

Total online sales will rise by a little under half (47%) year over year to £34.4 billion (around $44.7 billion), we estimate. This equates to 29.5% of all retail sales, up from 20.8% last year. That total average is depressed by a much lower e-commerce penetration rate in food: We estimate that almost 43% of all sales of nonfood products will be online this holiday season, up from 30.9% last year.

[caption id="attachment_118387" align="aligncenter" width="700"]

Source: ONS/Coresight Research

Source: ONS/Coresight Research[/caption]

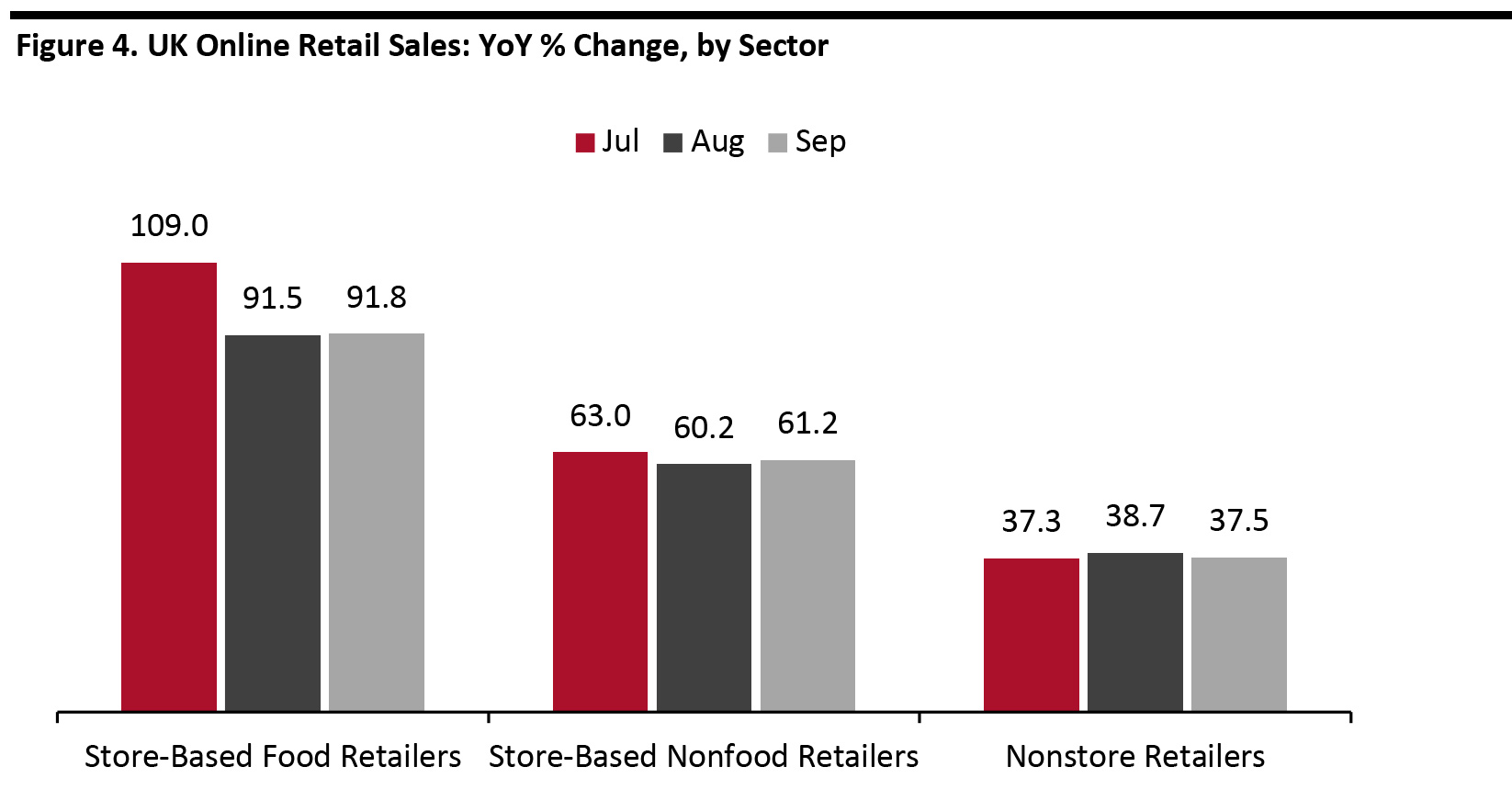

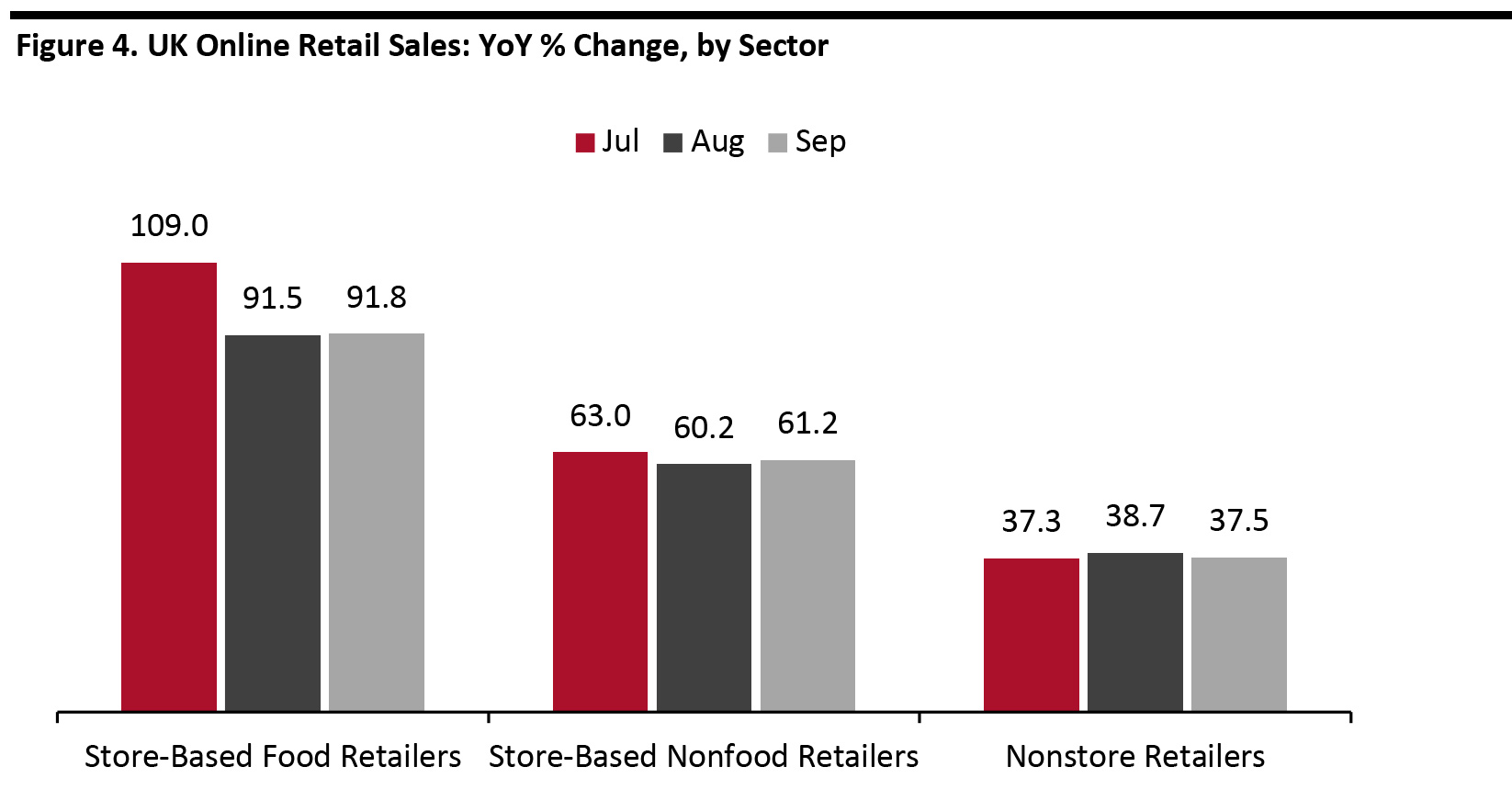

The strongest e-commerce growth will be seen by store-based retailers: Multichannel retailers have been outpacing their online-only rivals so far this year, supported by their greater ability to flex capacity, including through collection services. While the crisis has hit store-based demand significantly, it has revealed the vulnerabilities associated with relatively inelastic capacity of online-only models. Multichannel food retailers have greatly increased their capacities—market leader Tesco has more than doubled its capacity for online deliveries, for example—and this will support an increase of around 80–90% in the food sector’s online sales, year over year.

In nonfood sectors, however, the expected jump in online sales will be offset by store-based sales productivity that we expect to be, on average, deeply negative.

We chart recent online growth trends in Figure 4.

[caption id="attachment_118388" align="aligncenter" width="700"]

Source: ONS/Coresight Research

Source: ONS/Coresight Research[/caption]

What We Think

By this point, it should not surprise readers that the online channel will see major demand expansion this holiday season. However, we expect capacity limits, especially in delivery-focused models, to cap the year-over-year increase in sales. Those retailers that can ramp up collection services stand a better chance of fulfilling demand and capturing share.

Brick-and-mortar retailers are likely to drive online expansion in the fourth quarter. Multichannel formats have proved to be more flexible this year, supporting outsized growth in online sales. Highly automated, delivery-dependent pure-play models have shown their limitations.

Positive total growth in retail sales conceals highly variable demand: Food retail demand will prove strong as food-service alternatives get shut down by newly introduced restrictions and by the absence of corporate entertaining this year. Should food retail demand strengthen more than modeled, our total retail estimate may be exceeded. In nonfood, we expect to see demand for fitness and wellness products—including fitness equipment, as well as athleisure—and home categories continue into the holiday peak. Total apparel demand looks set to be down but less negative than in recent months due to gift purchases being less driven by demand (“Do I need this?”) and more by whether it is a suitable gift.

Post lockdown, e-commerce expansion has seen little sign of waning. In 2021, retail will be lapping the lockdown e-commerce peak. However, all the signs suggest that unusually strong demand for online retail will persist, requiring retailers to maintain their online expansionist strategies over the medium term.

Appendix: UK Covid-19 Timeline

The UK was put into lockdown on March 23, initially for three weeks, in an attempt to limit the spread of the coronavirus. Nonessential retail stores were closed.

On April 16, the government extended the lockdown by another three weeks.

On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23.

On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards.

On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4.

On September 14, a new “rule of six” prohibited social gatherings of more than six people, unless they are from the same household.

On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24.

On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry, in Central Scotland; retail was not directly affected, although stores were requested to enforce two-meter distancing.

On October 12, the UK government announced a three-tier lockdown system, which classifies regions based on the severity of infection rates. In the week beginning October 19, a number of regions in England, including London and Manchester, moved into higher “tiers” of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers.

On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more.

Source: Coresight Research[/caption]

UK retail has bounced back solidly, post lockdown. September 2020 was exceptionally strong, but we do not expect to see this level of growth maintained through the final quarter. However, we do see upside potential—particularly if food retail demand grows more strongly than we currently model, in the wake of greater restrictions being introduced. A further support to year-over-year growth rates are the undemanding comparatives from the final quarter of 2019, when total sales rose by only 2.0%.

[caption id="attachment_118386" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

UK retail has bounced back solidly, post lockdown. September 2020 was exceptionally strong, but we do not expect to see this level of growth maintained through the final quarter. However, we do see upside potential—particularly if food retail demand grows more strongly than we currently model, in the wake of greater restrictions being introduced. A further support to year-over-year growth rates are the undemanding comparatives from the final quarter of 2019, when total sales rose by only 2.0%.

[caption id="attachment_118386" align="aligncenter" width="700"] Source: ONS/Coresight Research[/caption]

Recent retail expansion has been supported by strong demand for home categories, including home improvement and furniture. As the nesting trend reshapes for the winter, we see these trends continuing through the holiday peak with strong demand for gifting categories across home. We expect to see pockets of strong demand in fitness equipment, wellness products, athleisure and electronics sustained into the holiday peak. We anticipate that apparel retail sales will be down by double digits, although alleviating from recent deeper declines as gifting purchases are less driven by functional needs related to attendance at workplaces or events.

We have headed into the final quarter with more restrictions being introduced in UK regions. These impact service industries such as food service more than they do retail—through limited trading hours, upper limits on the number of people who may gather or restrictions on the mixing of households (see Appendix). As a result, we expect to see redirected food spend renew momentum in food retail sales. Moreover, any expansion of regional restrictions or lockdowns could amplify demand for food retail, providing upside potential to our estimate. Over the peak Christmas period of December, a lack of large-scale social events and corporate entertainment and parties will further fuel food retail spending for smaller-scale gatherings and self-treating.

Capacity Challenges

Capacity is set to be a significant factor shaping the scale of peak-season sales this year—online and in-store.

Source: ONS/Coresight Research[/caption]

Recent retail expansion has been supported by strong demand for home categories, including home improvement and furniture. As the nesting trend reshapes for the winter, we see these trends continuing through the holiday peak with strong demand for gifting categories across home. We expect to see pockets of strong demand in fitness equipment, wellness products, athleisure and electronics sustained into the holiday peak. We anticipate that apparel retail sales will be down by double digits, although alleviating from recent deeper declines as gifting purchases are less driven by functional needs related to attendance at workplaces or events.

We have headed into the final quarter with more restrictions being introduced in UK regions. These impact service industries such as food service more than they do retail—through limited trading hours, upper limits on the number of people who may gather or restrictions on the mixing of households (see Appendix). As a result, we expect to see redirected food spend renew momentum in food retail sales. Moreover, any expansion of regional restrictions or lockdowns could amplify demand for food retail, providing upside potential to our estimate. Over the peak Christmas period of December, a lack of large-scale social events and corporate entertainment and parties will further fuel food retail spending for smaller-scale gatherings and self-treating.

Capacity Challenges

Capacity is set to be a significant factor shaping the scale of peak-season sales this year—online and in-store.

Source: ONS/Coresight Research[/caption]

The strongest e-commerce growth will be seen by store-based retailers: Multichannel retailers have been outpacing their online-only rivals so far this year, supported by their greater ability to flex capacity, including through collection services. While the crisis has hit store-based demand significantly, it has revealed the vulnerabilities associated with relatively inelastic capacity of online-only models. Multichannel food retailers have greatly increased their capacities—market leader Tesco has more than doubled its capacity for online deliveries, for example—and this will support an increase of around 80–90% in the food sector’s online sales, year over year.

In nonfood sectors, however, the expected jump in online sales will be offset by store-based sales productivity that we expect to be, on average, deeply negative.

We chart recent online growth trends in Figure 4.

[caption id="attachment_118388" align="aligncenter" width="700"]

Source: ONS/Coresight Research[/caption]

The strongest e-commerce growth will be seen by store-based retailers: Multichannel retailers have been outpacing their online-only rivals so far this year, supported by their greater ability to flex capacity, including through collection services. While the crisis has hit store-based demand significantly, it has revealed the vulnerabilities associated with relatively inelastic capacity of online-only models. Multichannel food retailers have greatly increased their capacities—market leader Tesco has more than doubled its capacity for online deliveries, for example—and this will support an increase of around 80–90% in the food sector’s online sales, year over year.

In nonfood sectors, however, the expected jump in online sales will be offset by store-based sales productivity that we expect to be, on average, deeply negative.

We chart recent online growth trends in Figure 4.

[caption id="attachment_118388" align="aligncenter" width="700"] Source: ONS/Coresight Research[/caption]

Source: ONS/Coresight Research[/caption]