DIpil Das

What’s the Story?

On October 31, in a severe blow to UK retail in the peak holiday season, the UK government announced a four-week lockdown for England. This lockdown forces nonessential retail stores to close from November 5 to December 2. The move was unexpected: Since September, Prime Minister Boris Johnson had been resisting calls from health advisors and opposition politicians for a short “circuit-breaker” lockdown of around two weeks amid rising coronavirus cases. The UK government has defined essential retail stores—which can remain open—as food shops, supermarkets, garden centers and certain other retailers providing essential goods. Nonessential retailers can offer click-and-collect services from their stores. This report provides an update to our previously published Holiday 2020: UK Retail Outlook from October.Why It Matters

The shape and scale of consumer demand during the holiday peak was less certain than ever, and a four-week lockdown in England has disrupted the picture even further for the UK. Coresight Research’s coverage provides directional guidance to retailers, suppliers and vendors.UK Holiday Retail Outlook Update: In Detail

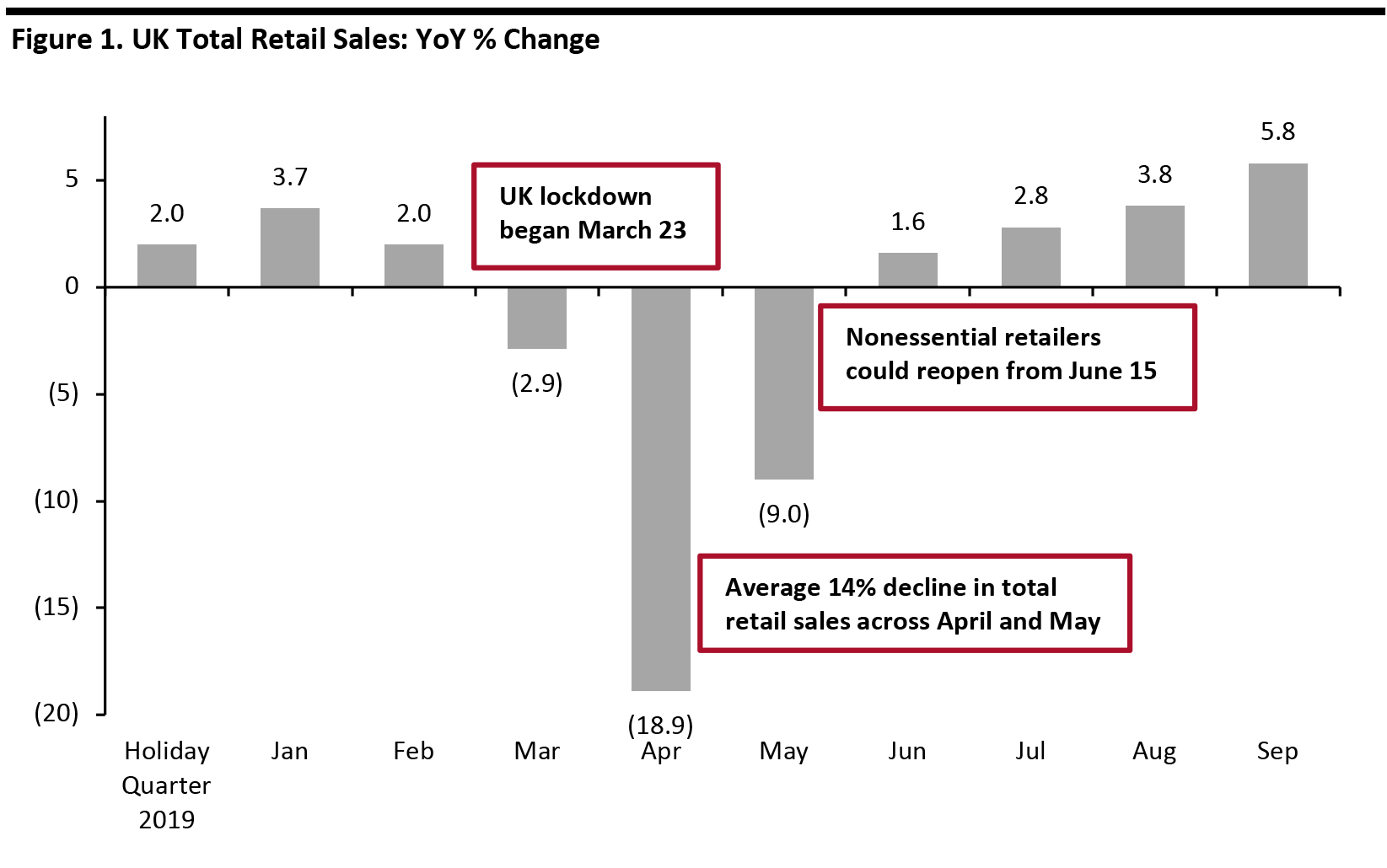

A four-week shutdown of nonessential retail represents an unprecedented blow to the sector, particularly given that retailers were looking to the holiday peak as an opportunity to help offset the impact of the first lockdown. For nonessential retail, that first lockdown ran from March 23 to June 15 (although some nonretail restrictions continued thereafter). The best guide we have to the impact on retail of a second lockdown are the trends seen in the first lockdown. Across the full shutdown months of April and May, total retail sales fell by an unweighted average of 14%. Declines during the second lockdown could be less negative than this, because underlying demand for gifting may not fall off in the way that demand for regular nonfood or discretionary purchases declined during the first lockdown (e.g., clothing for the workplace). However, total spending on holiday gifts will be hit by the impact of the lockdown on employment and incomes among some shoppers. [caption id="attachment_118729" align="aligncenter" width="700"] Source: Office for National Statistics/Coresight Research[/caption]

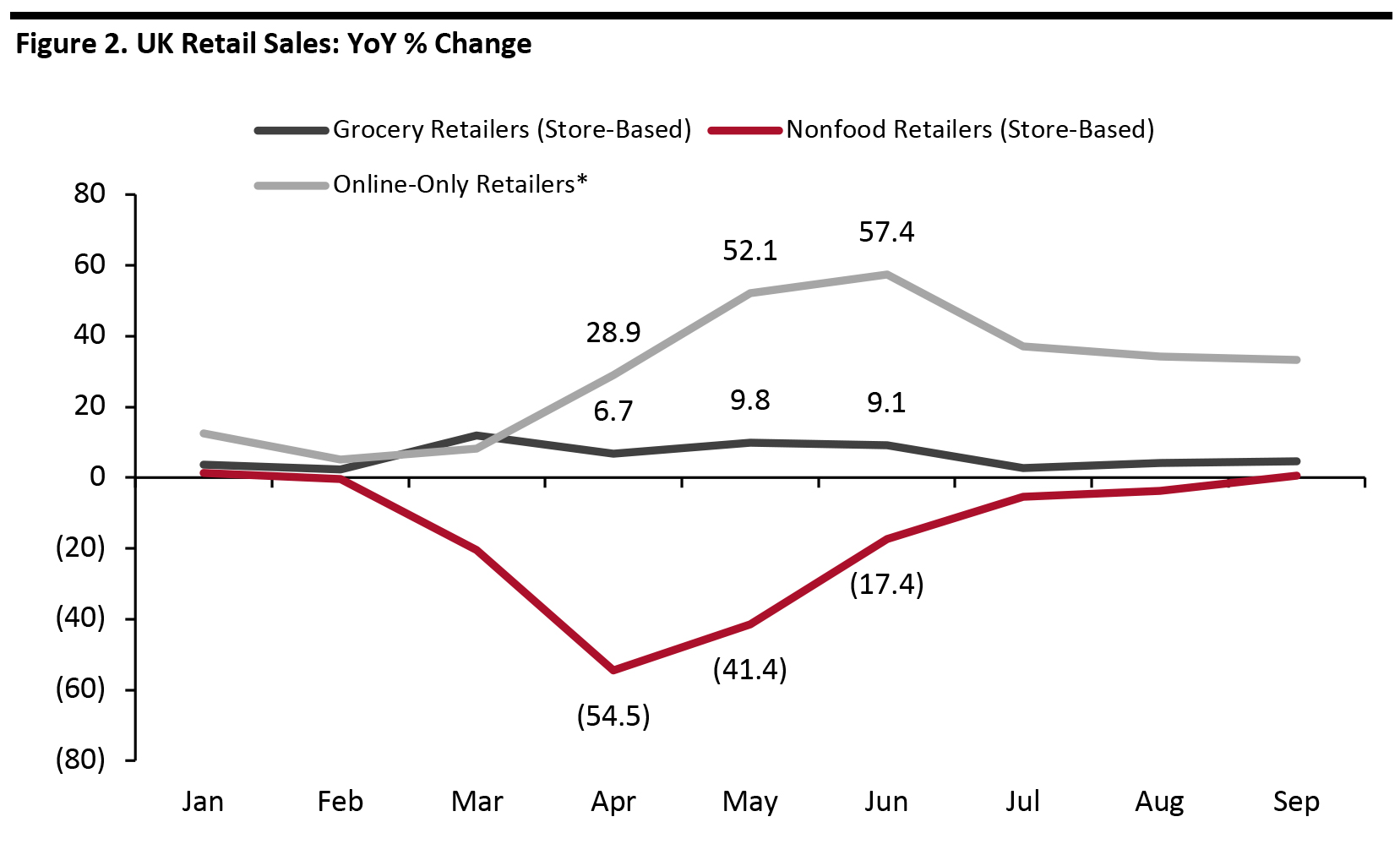

The first lockdown saw store-based nonfood retailers’ sales fall by 54.5% year over year in April and 41.4% year over year in May. This sector includes online sales by multichannel nonfood retailers, which helps to account for the decline not being closer to 100%. In addition, some nonfood retailers, such as home-improvement stores and pharmacies, were allowed to remain open.

Food retailers and online-only retailers saw growth accelerate during the first lockdown.

[caption id="attachment_118730" align="aligncenter" width="700"]

Source: Office for National Statistics/Coresight Research[/caption]

The first lockdown saw store-based nonfood retailers’ sales fall by 54.5% year over year in April and 41.4% year over year in May. This sector includes online sales by multichannel nonfood retailers, which helps to account for the decline not being closer to 100%. In addition, some nonfood retailers, such as home-improvement stores and pharmacies, were allowed to remain open.

Food retailers and online-only retailers saw growth accelerate during the first lockdown.

[caption id="attachment_118730" align="aligncenter" width="700"] *Incl. mail-order retailers

*Incl. mail-order retailers Source: Office for National Statistics [/caption]

What We Think

A four-week November lockdown will be disastrous for the retail sector overall. We can expect to see very substantial year-over-year sales declines across the store-based nonfood retail sector in November 2020. Following the UK’s announcement, Primark stated that lockdowns across a number of its European markets—accounting for 57% of its total selling space—will result in an estimated £375 million (around $485 million) of lost sales. Total retail sales could decline by double digits, year over year, during November. However, demand for Christmas gifts and other holiday-related purchases may prove more resilient than the purchases shoppers make primarily for themselves—and so total declines during the second lockdown could be less negative than those during the first lockdown. We expect to see shoppers and retailers make widespread use of the exemption for click-and-collect services in nonessential retail to capture holiday spending. Post lockdown, December is likely to see a strong bounce, as consumers scramble to get their holiday shopping back on track. However, the three-week period between the planned end of lockdown and Christmas Day is much too short to fully recoup sales lost in November. In addition, capacity will be a major constraint on meeting that December demand.- E-commerce fulfillment was already facing likely capacity challenges, and the distortion of demand caused by lockdown will intensify these challenges. We expect logistics capacity to be a constraint on e-commerce expansion this holiday season, during and after lockdown.

- Once lockdown ends, social-distancing requirements will impact brick-and-mortar capacity and therefore sales. Managing in-store shopper numbers according to a fixed capacity implies a greater year-over-year decline in shoppers during peak shopping months than during quieter periods of the year.