albert Chan

What’s the Story?

We present five predictions for US retail for the 2020 holiday season—the most unusual and unpredictable of any Coresight Research has covered. We also feature our retail estimates for the October–December period.

Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever. Coresight Research’s coverage provides directional guidance to retailers, suppliers and vendors.

Five Predictions for US Holiday Retail: In Detail

We estimate an approximate 5% year-over-year rise in total retail sales for the holiday period—October to December. This will take total retail sales to around $1.1 trillion. Our measure of retail sales excludes food-service businesses, automobile retailers and gasoline stations.

We first published our holiday estimate in mid-October. Since then, new data has suggested further strength for retail: Recently released data for September showed US retail sales grew by an exceptionally strong 12.1% year over year, suggesting that even our estimate for very solid growth in holiday sales could prove conservative. In September, growth was driven by nonstore retailers (up 27.0% year over year), home-improvement retailers (up 23.4%), sports and leisure goods retailers (up 18.3%) and food retailers (up 11.5%).

Growth will be supported by a sustained rise in food retail sales but with pockets of solid nonfood demand, which we detail later in this report.

We present our five predictions below.

1. Shoppers Will Say “No Thanks” to Black Friday Store TripsWe expect to see a mass opt-out by shoppers of the traditional in-store Black Friday experience. Across US retail, we expect Black Friday store traffic at nonfood retailers to be down by around one-half or more, compared to Black Friday 2019, as shoppers choose to stay at home and those that venture out face inconvenience from retailers policing in-store shopper numbers. For the total holiday season, we expect total US nonfood retail traffic to be down by around 30–35%.

Sensormatic’s ShopperTrak expects Black Friday to remain the highest-traffic day of the holiday season, continuing trends from prior holiday seasons.

Black Friday demand will shift online and will be elongated as retailers stretch deals over a long period to ease pressure on the supply chain.

When we surveyed US consumers on October 27:

- Only 16% said they expect to shop in stores on Black Friday, lower even than intentions for Thanksgiving Day (see below).

- 56% said they expect to shop online on Black Friday.

On Thanksgiving Day, shoppers’ options to visit stores will be hugely reduced. A host of retailers have announced plans to keep stores closed on the day, including Bed Bath & Beyond, Best Buy, Foot Locker, Home Depot, JCPenney, Kohl’s, Lowe’s, Macy’s, Sam’s Club, Target, Ulta Beauty and Walmart. Our US Holiday Retail Databank provides regularly updated details of retailers’ plans for Thanksgiving and Black Friday.

When we surveyed US consumers on October 27:

- Just under 19% said they expect to shop in stores on Thanksgiving Day—although given the announced closures, we think many in this group may be disappointed with the options they have.

- 44% said they expect to shop online on Thanksgiving Day.

The result will be a flattening of traditional holiday-season shopping peaks—at least in stores—as visits and demand are spread more evenly across the final quarter.

3. E-Commerce Will Account for More than One-Quarter of Holiday Nonfood SalesFor the holiday season overall, we expect total online retail sales to rise by one-third (33.5%) year over year, taking e-commerce sales to around $234 billion.

- This is equivalent to 21.7% of all retail sales in the holiday quarter (versus 17.1% for holiday 2019).

- Across nonfood categories in total, we estimate that e-commerce’s share of sales will reach 27.6%.

- Across nonfood retail, we expect a low-30s-percent rise to take total online nonfood sales to $220 billion in the holiday quarter.

Supporting the expansion in total e-commerce will be sustained very strong growth in online grocery sales. We estimate a 60+% year-over-year rise in online food sales; this will take online food sales to an estimated $14 billion in the final quarter.

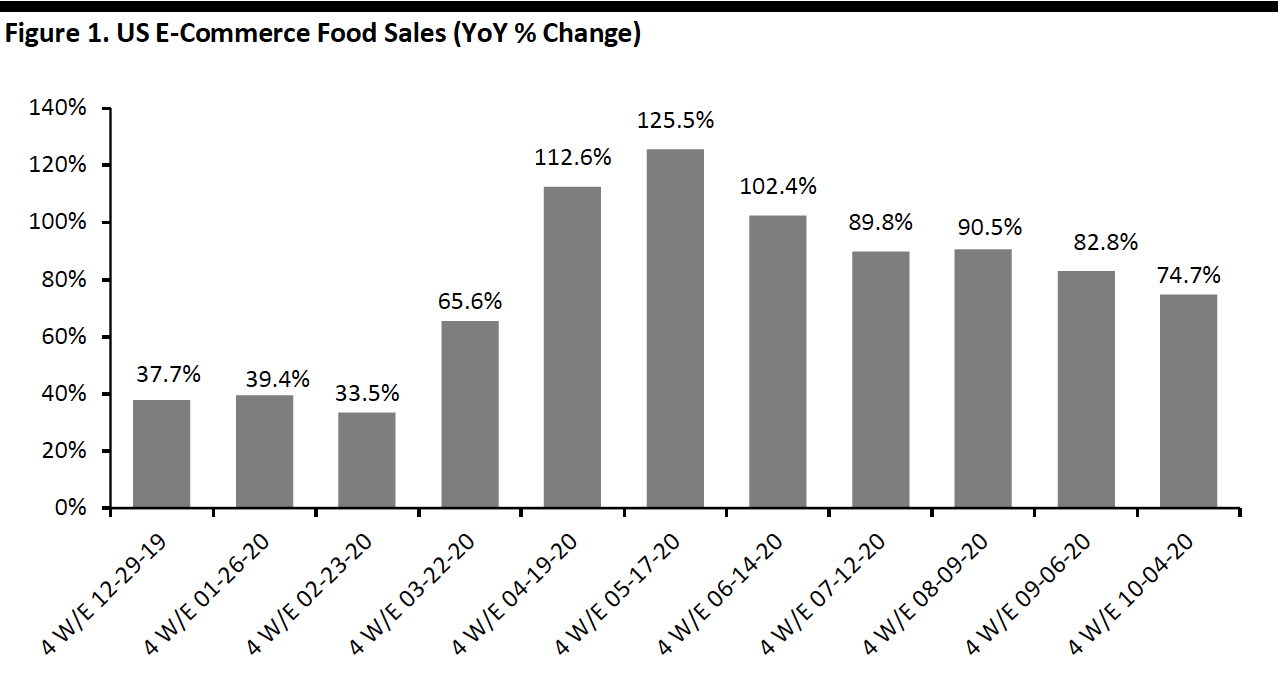

According to our most recent US CPG Sales Tracker, online food sales climbed by almost 75% year over year in the four weeks ended October 4, slowing from 82.8% in the prior four-week period.

Although we model a further incremental reduction in the pace of growth, growth of over 60% would be approximately double the rate of increase seen in the 2019 holiday season, when we saw sales increase by around 33%. Strong final-quarter growth would take the total 2020 increase in online food sales to 75% or more.

We estimate that total food and beverage retail spending (offline and online) will climb by around 9.0–9.5% year over year in the holiday quarter.

[caption id="attachment_118685" align="aligncenter" width="700"] Source: IRI E-Market Insights™/Coresight Research[/caption]

5. An Evolving Gifting Mix for 2020

Source: IRI E-Market Insights™/Coresight Research[/caption]

5. An Evolving Gifting Mix for 2020

Within major retail categories, we expect to see solid growth in furnishings and home accessories, home-improvement products, gift cards, wellness and fitness products and some electronics and small-appliance categories. In clothing and footwear, athleisure and “casual and comfort” are likely to be winning trends. When we asked shoppers what type of gifts they expect to buy for holiday 2020, clothing and footwear remained the top category (see below). This appears to confirm that holiday gifting demand for apparel overall will prove more solid than the underlying demand seen in recent months, which has been depressed by reduced need for clothing for work or social events. For similar reasons, we could see a sequential uplift for beauty categories.

According to our September survey of US holiday shoppers, the top categories that respondents plan to buy as gifts during the holidays are as follows:

- Clothing and footwear (44% of holiday shoppers expect to purchase)

- Gift cards (44%)

- Electronics (40%)

- Toys (39%)

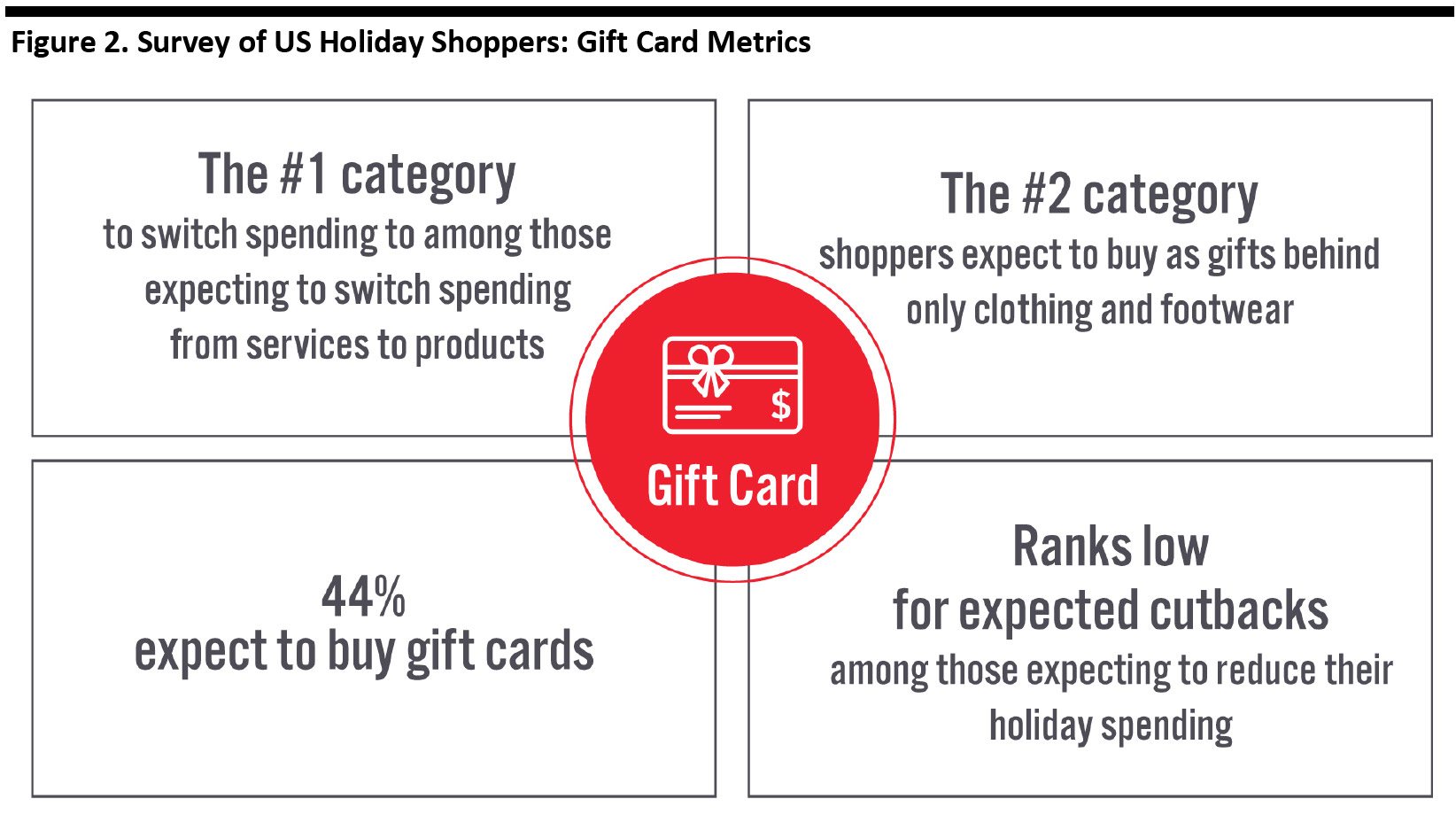

We see gift cards as a category with significant potential this year: Their format suits socially distanced shopping (including online) and gifting (including remotely). Gift cards are one solution to potential inventory shortages that could result from reduced buying-in of holiday product by retailers amid the pandemic. With shoppers having reduced spending options this year, gift cards also present an opportunity for retailers to build basket sizes through incremental gift purchases.

For the holiday 2019 season, the National Retail Federation estimated that US consumers spent $27.5 billion buying gift cards, with the average shopper buying three to four cards as gifts. Using this base figure, we think gift-card spending could exceed $30 billion this holiday season.

We include gift card metrics from our September survey of holiday shoppers below.

[caption id="attachment_118717" align="aligncenter" width="700"] Base: 1,116 US respondents aged 18+ who spend on the holidays, surveyed in September 2020

Base: 1,116 US respondents aged 18+ who spend on the holidays, surveyed in September 2020Source: Coresight Research[/caption]

What We Think

- Holiday store traffic will be down meaningfully—by around 30–35% across the season, we estimate, with deeper year-over-year declines on the traditional peak of Black Friday as doorbusters fall out of fashion with shoppers and retailers. Store traffic is likely to be more even across the season, although our survey data suggest that many shoppers are still looking to shop on Thanksgiving and Black Friday—but they will do so online.

- It is clear that the online channel will see major demand expansion this holiday season. However, we foresee capacity limits, especially in delivery-focused models, capping the year-over-year increase in sales. Those retailers that can ramp up collection services stand a better chance of fulfilling demand and capturing share.

- Brick-and-mortar retailers are likely to drive online expansion in the fourth quarter. Multichannel formats have proved to be more flexible this year, and have seen outsized growth in online sales. Heavily automated, delivery-dependent pure-play models have shown their limitations in scaling up rapidly.

- Grocery retailers in particular must stand ready for sustained strong increases in online demand. As we get closer to the holiday season peak, they should continue to find ways to ramp up capacity, such as through partnerships with delivery providers or extending physical capacity for collection services such as curbside pickup.

- Holiday demand for apparel should prove more solid than the underlying demand seen so far during the crisis. We could see a similar sequential uplift for beauty categories.

- Gift cards look likely to be a winning category this year, helped by their suitability for purchasing and gifting or sending in socially distanced ways. Retailers—especially those faced with potential inventory or fulfillment challenges—must seek to convert shoppers to gift cards. With more limited options for spending this year, retailers can encourage purchases of vouchers and cards as incremental gifts and so build basket sizes.