Nitheesh NH

https://youtu.be/s_Uaez0Rvxk

Five Insights from Our US Holiday Survey

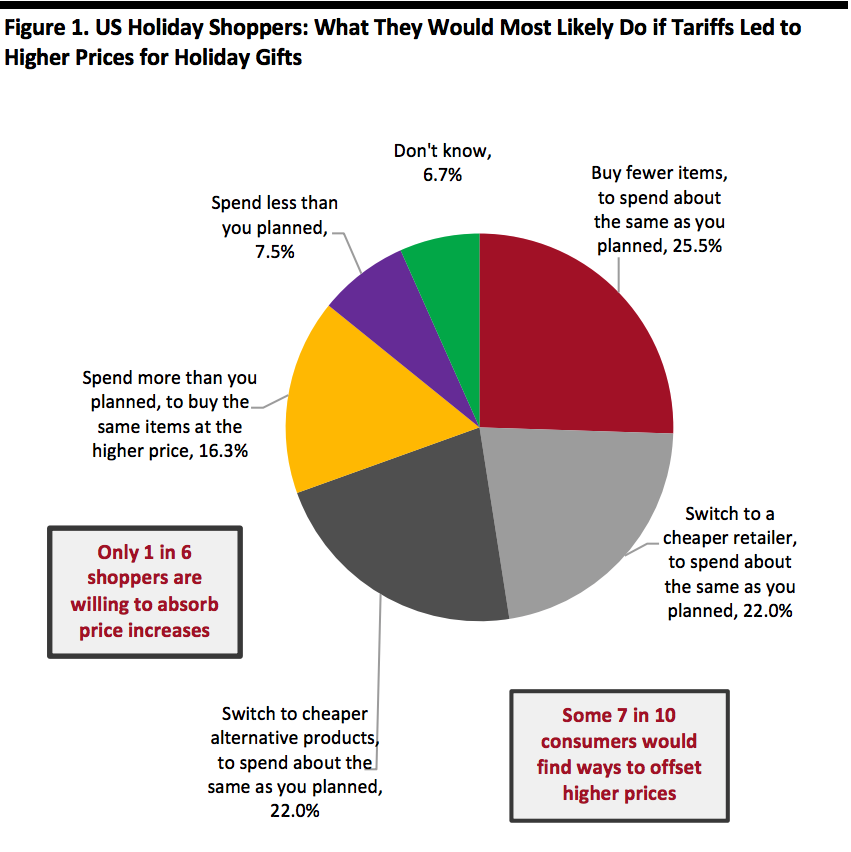

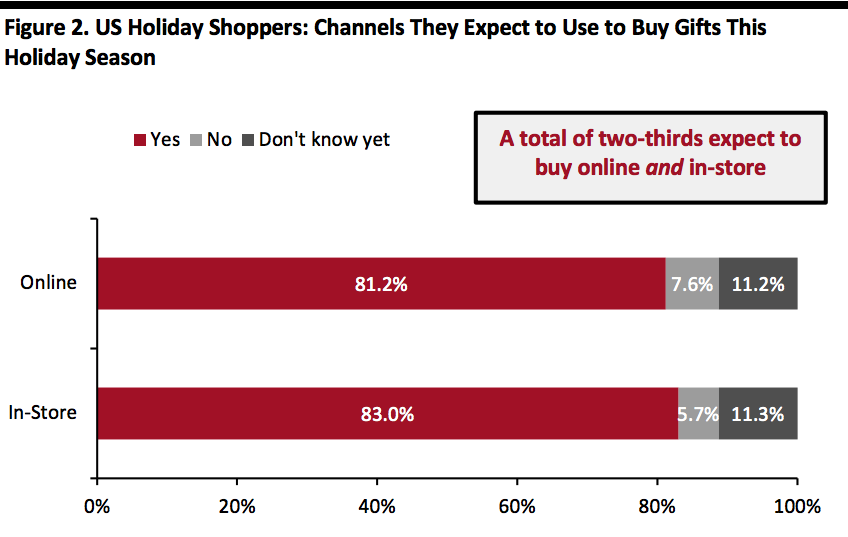

We begin our Holiday 2019 coverage with a dive into the findings of our latest US consumer survey. This report is part of our How the US Shops series, which explores shopper behavior based on original consumer research. 1. Tariff-Related Price Increases Likely to Prompt Trading Down Almost six in 10 holiday shoppers are concerned about tariffs causing price hikes on holiday gifts. If prices do rise, almost 70% said they would spend the same amount as they planned, rather than increase spending. Only 16% will absorb higher prices and spend more than planned. The implication is retailers raising prices could see consumers switch to lower-priced rivals, trading down to less expensive products or buying fewer items. Over one-quarter told us they would buy fewer items if prices rise due to tariffs, which could result in post-holiday inventory challenges. 2. Holiday Shopping Is Not a Matter of Online vs. Offline Shoppers will browse, compare and buy across channels this holiday season:- In total, 67.6% of shoppers expect to buy online and in store, while 81% expect to buy gifts online and 83% expect to buy gits in store.

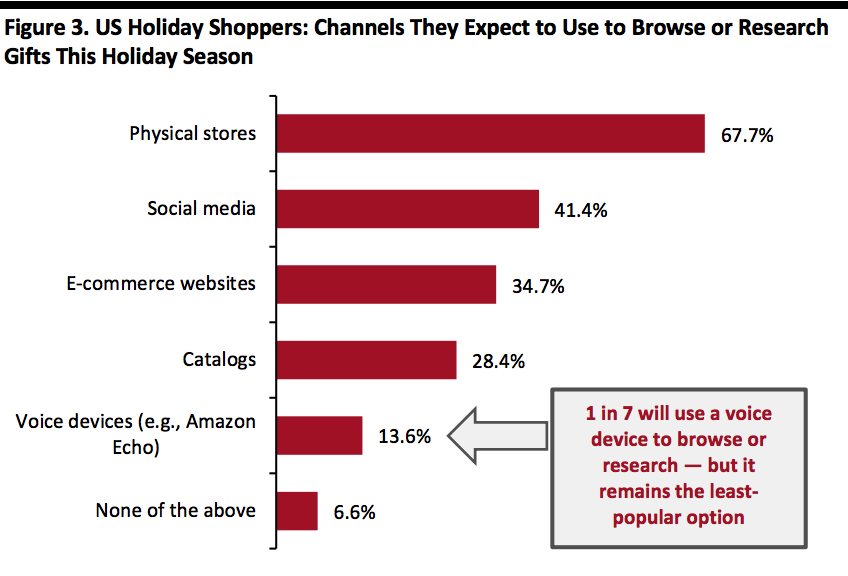

- Just over two-thirds will use physical stores for browsing, comparing products/prices and getting gift ideas.

- Social media is a more popular option for browsing, comparison and inspiration than e-commerce websites. And one in seven say they will use voice devices such as Amazon Echo.

- Buy online, pick up in store (BOPIS) service remains a niche factor when choosing a retailer: BOPIS was the lowest-ranked of all factors we asked shoppers about, suggesting a mismatch between enthusiasm for cross-channel shopping and picking up orders in store.

- Shoppers tend to think it is easier to return items bought in stores than online: 27.6% of in-store shoppers cited ease of returns as a reason for shopping that channel versus just 11.8% of online shoppers.

- But just one in 10 in-store shoppers think stores are cheaper than online, versus the one in three online shoppers who believe e-commerce is cheaper.

Six in 10 Are Worried About Higher Prices from Tariffs

Tariffs are set to be one headwind for many retailers this holiday season. We asked consumers if they were concerned the tariff dispute would mean higher prices on holiday gifts: 57.0% said they were concerned, 23.8% said they weren’t and 19.2% had no opinion. [caption id="attachment_95497" align="aligncenter" width="700"] Respondents could select one option

Respondents could select one optionBase: 1,784 US Internet users aged 18+ who expect to buy gifts for holiday 2019

Source: Coresight Research[/caption] We also asked respondents what they would likely do if tariffs led to higher prices on holiday gifts. Some 69.5% said they would spend the same amount, not increase spending to keep up with higher prices:

- Some 5% would buy fewer items, suggesting a risk of volume erosion for retailers over the holiday period, which could result in excess inventory and markdowns.

- 22.0% said they would switch to a cheaper retailer.

- 22.0% said they would switch to cheaper products.

- Only 3% said they would spend more to match price increases to buy the same items that they planned to.

- Meanwhile, 5% said they would spend less, perhaps worried that higher prices on gifts could also mean higher prices on everyday goods during and after the holiday period.

Online and In-Store Are Neck and Neck

[caption id="attachment_95498" align="aligncenter" width="700"] Respondents could select one option for each, online and in-store

Respondents could select one option for each, online and in-storeBase: 1,784 US Internet users aged 18+ who expect to buy gifts for holiday 2019

Source: Coresight Research[/caption] Online and physical stores are set to be broadly neck and neck this holiday season, based on respondents’ current expectations and reflecting shopper numbers rather than sales. In total, 67.6% expect to shop online and in-store. This confirms the trend is for cross-channel buying, and, given our question specified buying, that is before we factor in research and browsing. In fact:

- Just 4.7% expect to shop online only.

- Only 6.6% expect to shop in-store only.

Respondents could select multiple options

Respondents could select multiple optionsBase: 1,784 US Internet users aged 18+ who expect to buy gifts for holiday 2019

Source: Coresight Research[/caption] Reinforcing the prominence of cross-channel shopping are our finding on consumers’ expected browsing habits. We asked respondents where they would browse, compare products/prices or get ideas when holiday shopping:

- Just over two-thirds will use physical stores to browse and research.

- Fully 41.4% will use social media, putting it ahead of e-commerce websites as a source of research.

- And while 13.6% (one in seven) will use voice devices, this is the least popular of the options.

Where Consumers Expect to Buy

[caption id="attachment_95500" align="aligncenter" width="700"] Respondents could select multiple options; leading options shown

Respondents could select multiple options; leading options shownBase: 1,784 US Internet users aged 18+ who expect to buy gifts for holiday 2019

Source: Coresight Research[/caption] We asked respondents where they expect to buy gifts this year. Just over three-quarters of survey respondents expect to shop Walmart and/or Amazon — putting these retailers neck and neck by number of shoppers. Kohl’s leads among department stores. Reflecting demand for electronics, Best Buy ranks highly for holiday purchases: It is the only category specialist in the top five. Among Amazon Prime members:

- Fully 88.0% expect to buy on Amazon, some 938 basis points above the average.

- 78.6% expect to buy from Walmart, in line with the average.

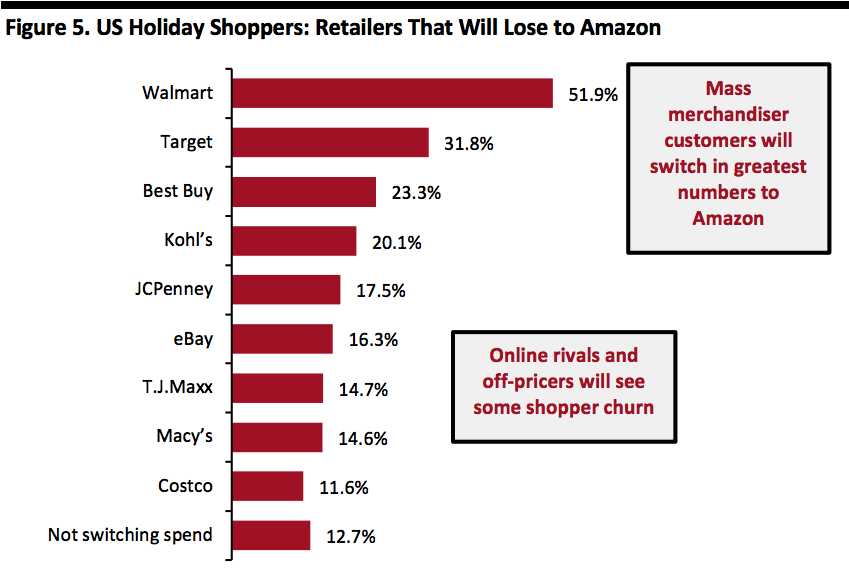

Respondents could select multiple options; leading options shown

Respondents could select multiple options; leading options shownBase: 820 US Internet users aged 18+ who expect to spend more of their holiday budget on Amazon in 2019 than they did in 2018

Source: Coresight Research[/caption] Over half of those planning to buy from Amazon expect it to capture more of their budget than it did last year. We asked those expecting to spend more at Amazon where they would be switching that spending from. Overall, the ranking closely resembles that of the expect-to-shop ranking: The biggest retailers have the most to lose.

- The results suggest mass merchandisers Walmart and Target stand to lose the most to Amazon, when measured by number of shoppers.

- Some may expect already hard-hit department stores to be the most impacted by Amazon – but in fact Best Buy leapfrogs Kohl’s to take third place in the switch-from ranking.

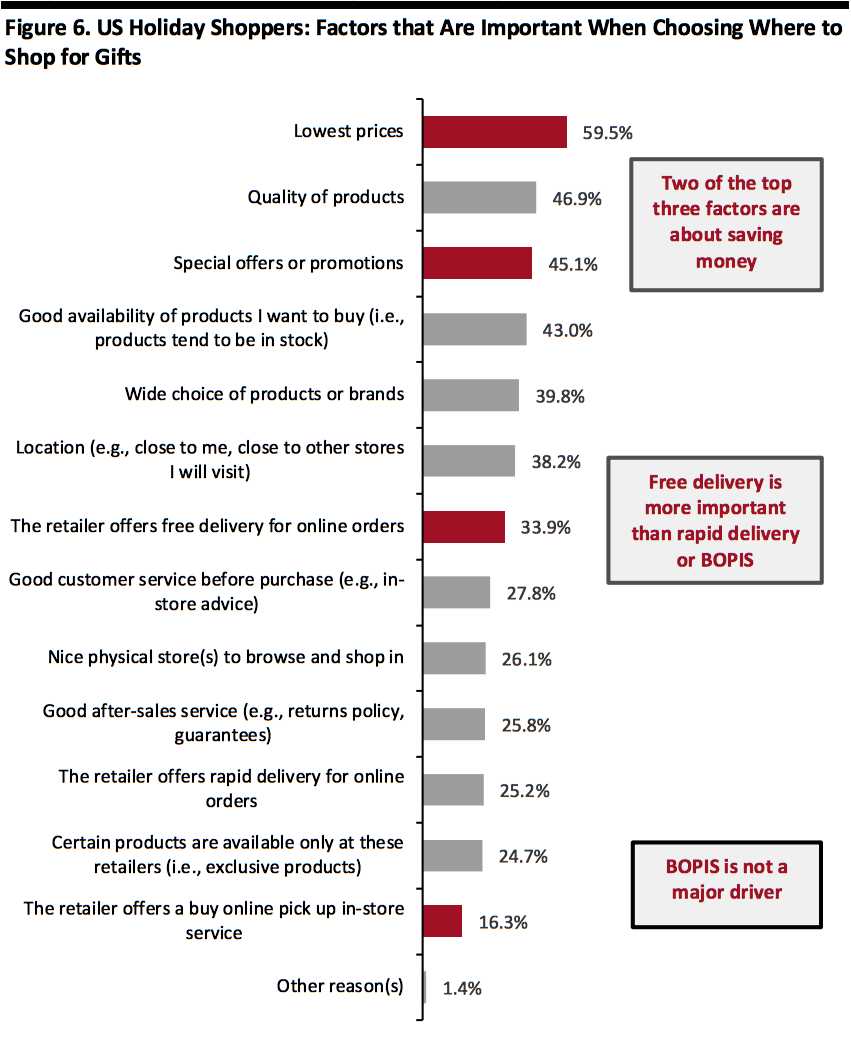

Why Consumers Choose to Shop Where They Do

[caption id="attachment_95502" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: 1,784 US Internet users aged 18+ who expect to buy gifts for holiday 2019

Source: Coresight Research[/caption] Holiday shoppers are highly price-conscious: Lowest prices is the most popular factor when choosing which retailer to buy from; and, within the top three factors, lowest prices and special offers and promotions book-end quality of products. Free delivery ranks highly, too — a further indication of shoppers looking to save money. Retail fundamentals such as availability, location are also major factors. Rapid delivery and BOPIS services are not important factors to most holiday shoppers:

- Rapid delivery is important to one-quarter of shoppers, while free delivery is important to one-third of shoppers.

- BOPIS was the lowest-ranked of all the factors we asked shoppers about, with just one in six saying it is important. This is ambivalence to BOPIS is despite the strong indications of cross-channel shopping we noted earlier.

- This suggests that omnichannel retailers hoping to fight off digital natives such as Amazon by offering in-store collection may face disappointment — though it also hints at the potential to drive up shopper awareness of, and appreciation for, BOPIS.

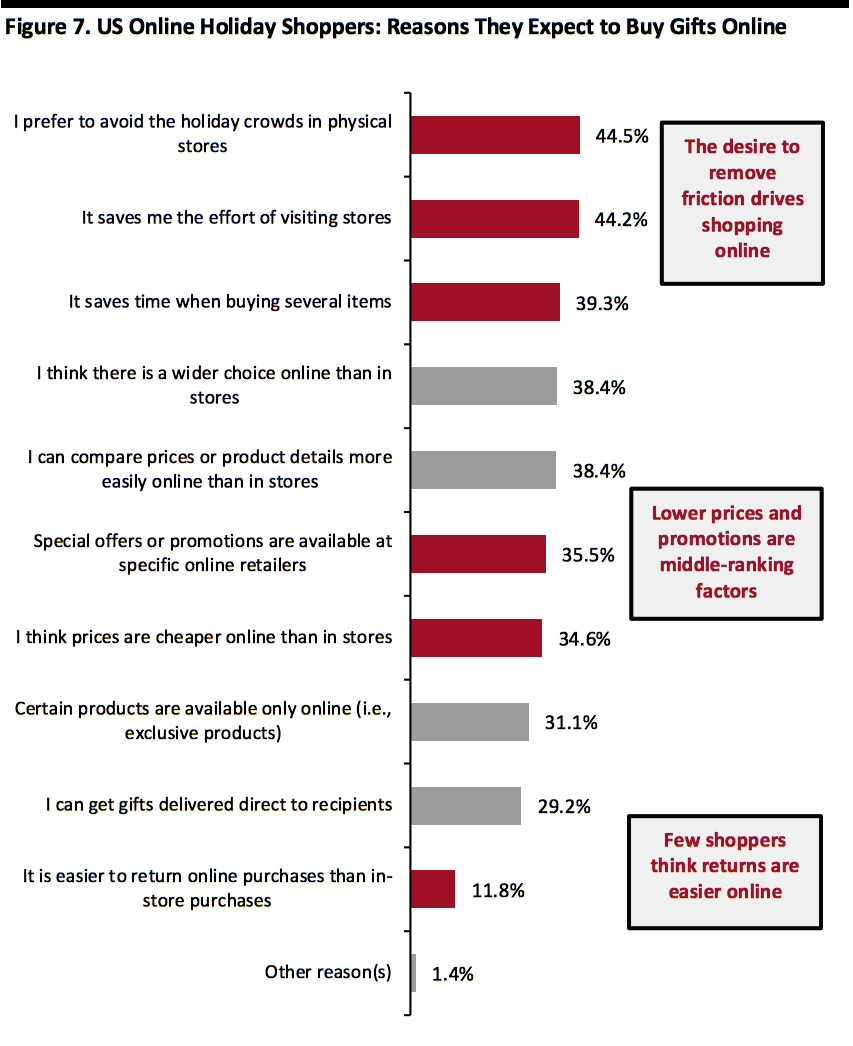

Reasons for Shopping Online and In-Store

[caption id="attachment_95503" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: 1,449 US Internet users aged 18+ who expect to buy gifts online for holiday 2019

Source: Coresight Research[/caption] The appeal of online is primarily what it removes from the shopping process:

- Shoppers turn to e-commerce to strip friction from shopping.

- That friction is represented in holiday crowds, which 44.5% seek to avoid; the effort of visiting stores, a factor for 44.2%; and, the time it takes to buy multiple items in store, which drives 39.3% to buy online.

- Online appeals to four in 10 consumers because of the ability to compare prices or specifications more easily.

- In a similar vein, choice of products is a driver for four in 10.

- One in three online shoppers believe prices are cheaper online than in stores, making this a middle-ranking factor.

- A similar proportion turn to e-commerce for online-only special offers or promotions.

- Only 11.8% think returns are easier online than in store.

- As we show below, this compares unfavorably with more than a quarter of in-store shoppers believing returns are easier in store than online.

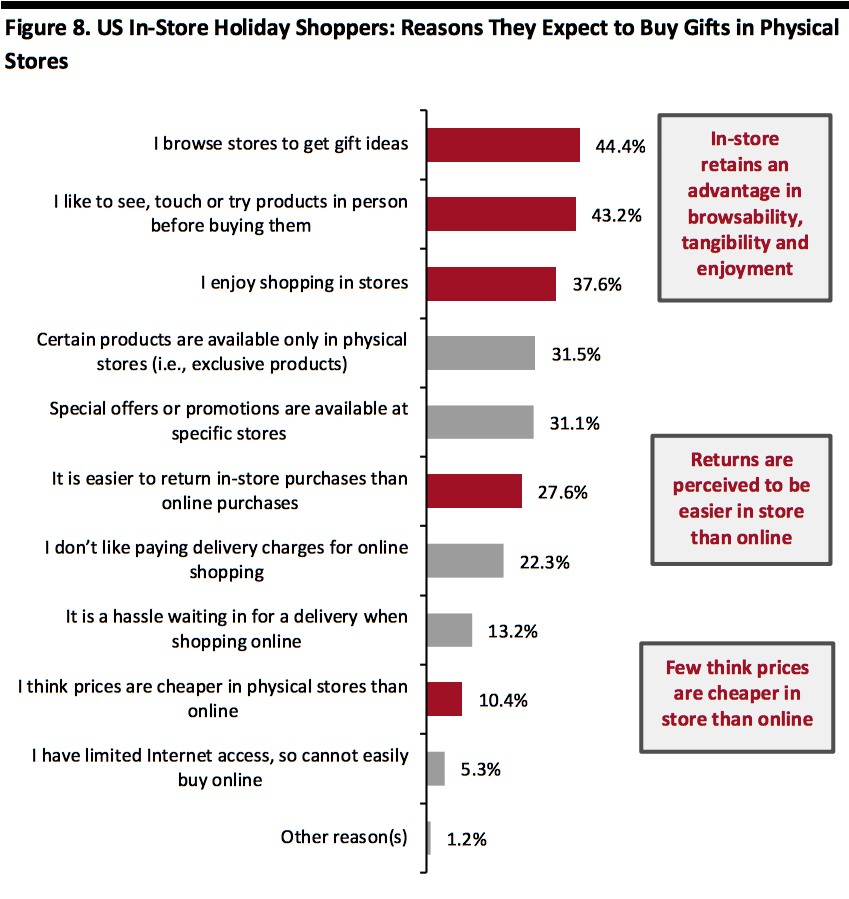

Respondents could select multiple options

Respondents could select multiple optionsBase: 1,481 US Internet users aged 18+ who expect to buy gifts in-store for holiday 2019

Source: Coresight Research[/caption] The appeal of stores remains skewed toward ease of browsing, the ability to see products in person, and the enjoyment of the experience.

- In-store browsing remains a source of inspiration. This dovetails with the finding, noted earlier, that physical stores remain the primary channel for research and inspiration this holiday season.

- This serendipitous browsing is the counterpoint to the ease of comparison online, which drives many shoppers online.

- Even while 44.5% of online shoppers want to avoid holiday crowds, a substantial 37.6% of in-store shoppers enjoy buying in physical stores.

- Shoppers tend to think it is easier to return items bought in stores than online: 27.6% of in-store shoppers cited ease of return as a reason for shopping that channel versus just 11.8% of online shoppers.

- Only one in 10 in-store shoppers think stores are cheaper than online, versus one in three online shoppers who believe e-commerce is cheaper.