DIpil Das

For holiday 2019, US retail enjoyed a solid season overall, with consumers spending some 4.1% more than during last year’s holiday period (November and December). This was in line with our expectations of an approximate 4% rise. Please see our December 2019 US Holiday Retail Sales and Comparable Sales Review.

In this report, we review comparable sales growth reported by 14 major US retailers and assess post-holiday consumer survey data on BOPIS and returns from Prosper Insights & Analytics.

US 2019 Holiday Comp Results Recap

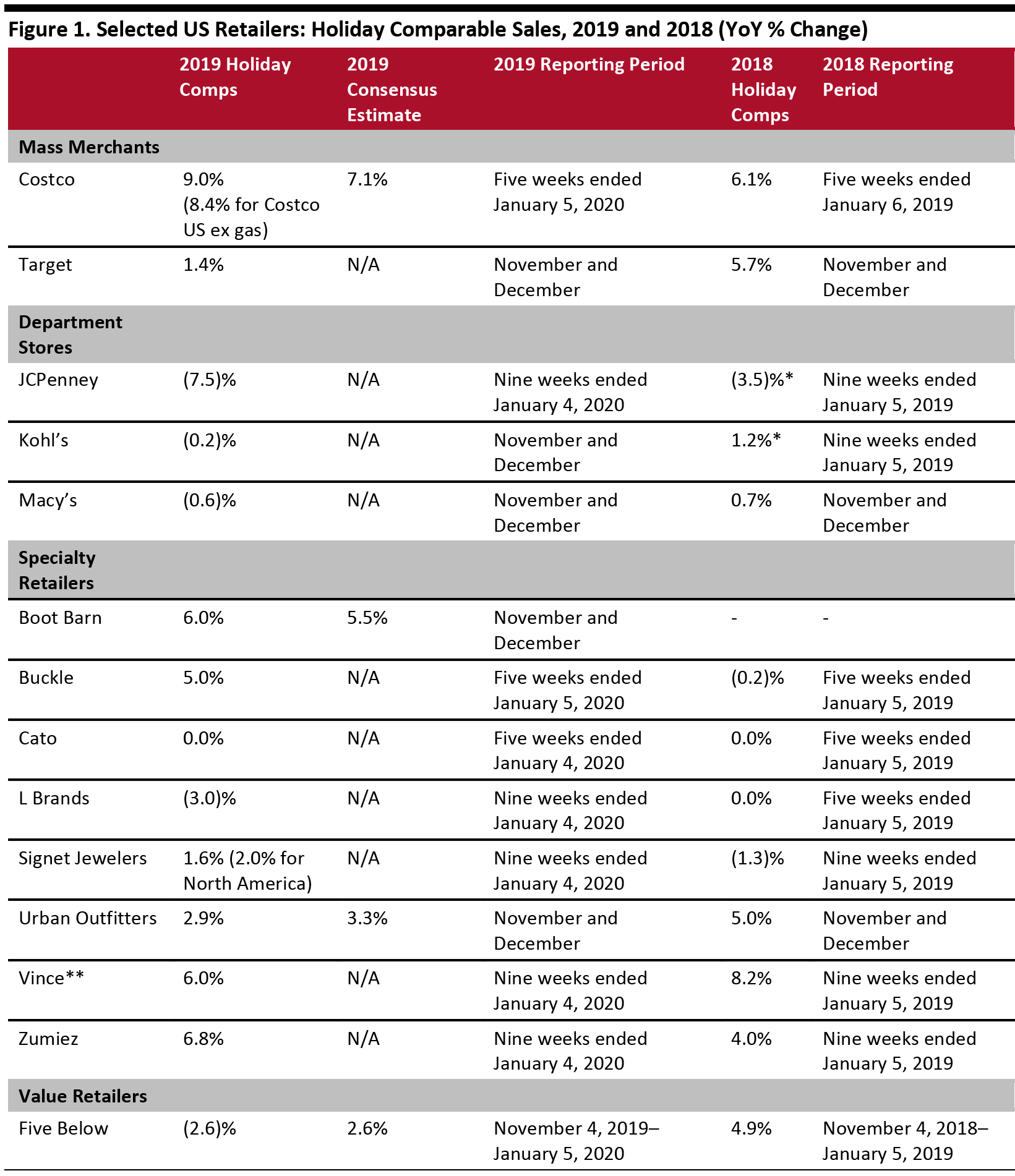

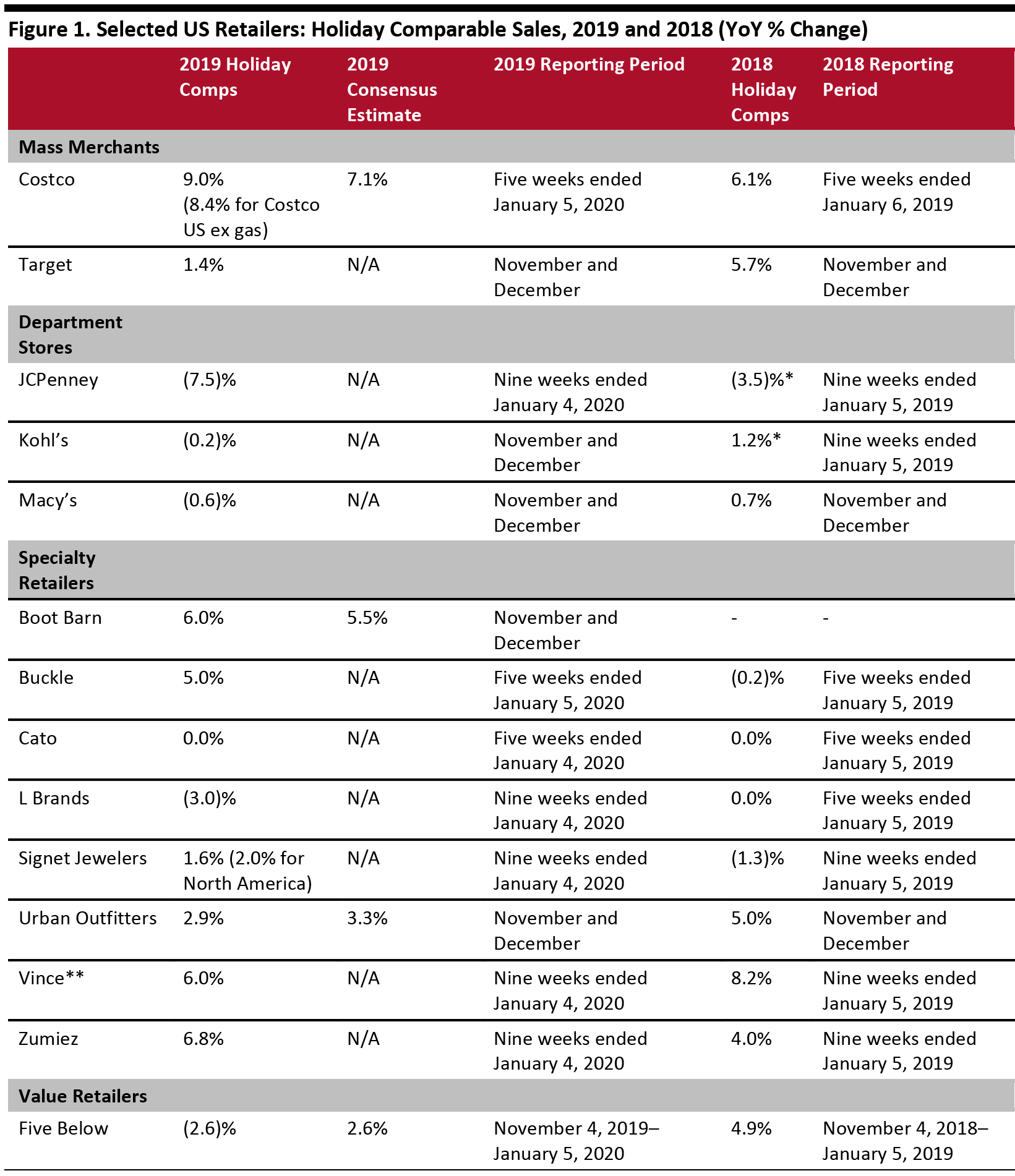

Eight out of 14 companies we tracked (57%), posted positive comparable sales growth, while four increased their rate of comp growth.

Two out of four companies for which consensus estimates were available beat consensus: Costco and Boot Barn.

Big-Box retailers Post Positive Holiday Comps

Costco and Target posted positive comps for the holiday season, although Target’s were weaker than expected. Costco reported total same-store sales growth of 9.0% for December, ahead of the consensus estimate of 7.1% and above November’s 5.3% growth. Results were driven by strong traffic and digital sales growth. Costco grew e-commerce comps 43.1% in December, compared to a 3.6% decline in November, indicating the effect of the late thanksgiving. December US-only comps stripping out changes in gasoline price grew 8.4%, versus 4% in November.

Target reported comps for the combined November/December period grew 1.4%, slower than the chain’s forecast of 3% to 4% growth and well below holiday 2018’s 5.7% comp increase. The company now expects fourth-quarter 2019 comps growth to be in line with its November/December performance.

Poor Performance by Department Stores

Department stores performed poorly, with JCPenney comps slumping 7.5% and slight comp declines at Kohl’s and Macy’s.

Mixed Performance in Specialty Retailers’ Holiday Comps

Specialty retailers such as Boot Barn, Urban Outfitters and Vince reported positive comps, but growth was slower than last year.

L Brands did not perform as well as its peers this holiday season, with a 3% comp decline in the nine-week period ending January 5, 2020. The company has since lowered guidance for Q4 EPS to $1.85 from $2.00.

Five Below Sales Fall Short Due to A Shorter Holiday Season

Five Below management pointed to the shorter holiday season when reporting negative comps, acknowledging sales did not meet expectations. But management said it expects strong inventory management and disciplined cost control to enable it to achieve a fourth-quarter gross margin in line with expectations.

The table below compares sales growth reported for the 2019 holiday shopping season, with consensus estimates and the figures for the 2018 holiday season.

[caption id="attachment_102870" align="aligncenter" width="700"] *On a shifted basis

*On a shifted basis

**Direct-to-consumer

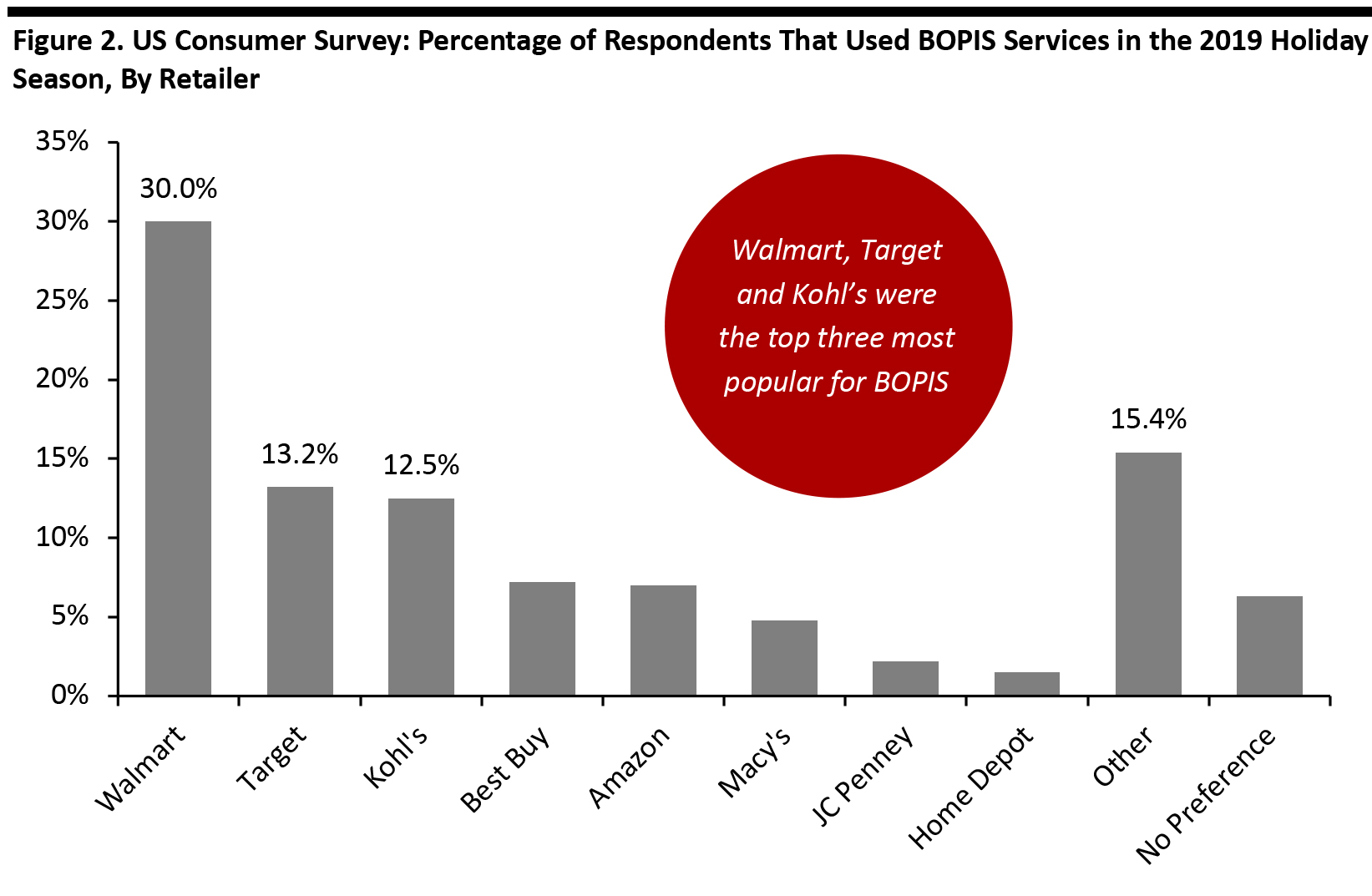

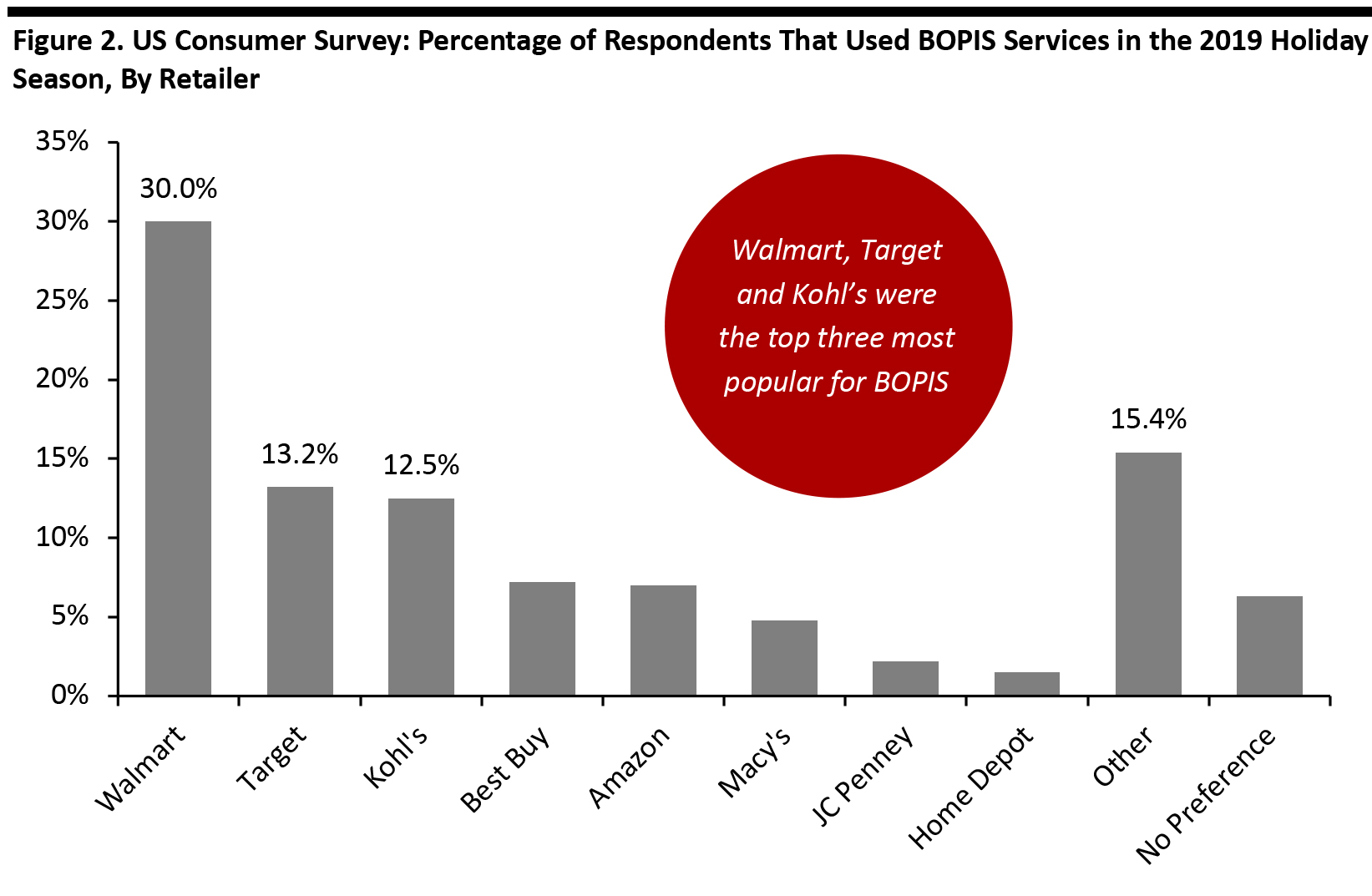

Source: Company reports/Factset [/caption] Walmart and Target Were the Most Popular Retailer Choices for BOPIS A post-holiday US consumer survey by Prosper Insights & Analytics found 33.6% of consumers used BOPIS when shopping during the holiday season in 2019. Among those who used BOPIS this holiday season, some 30.0% said they used Walmart’s, followed by Target’s at 13.2% and Kohl’s at 12.5%. [caption id="attachment_102871" align="aligncenter" width="700"] Base: 2,438 US Internet users aged 18 and above who used BOPIS in the 2019 holiday season, surveyed in January 2020

Base: 2,438 US Internet users aged 18 and above who used BOPIS in the 2019 holiday season, surveyed in January 2020

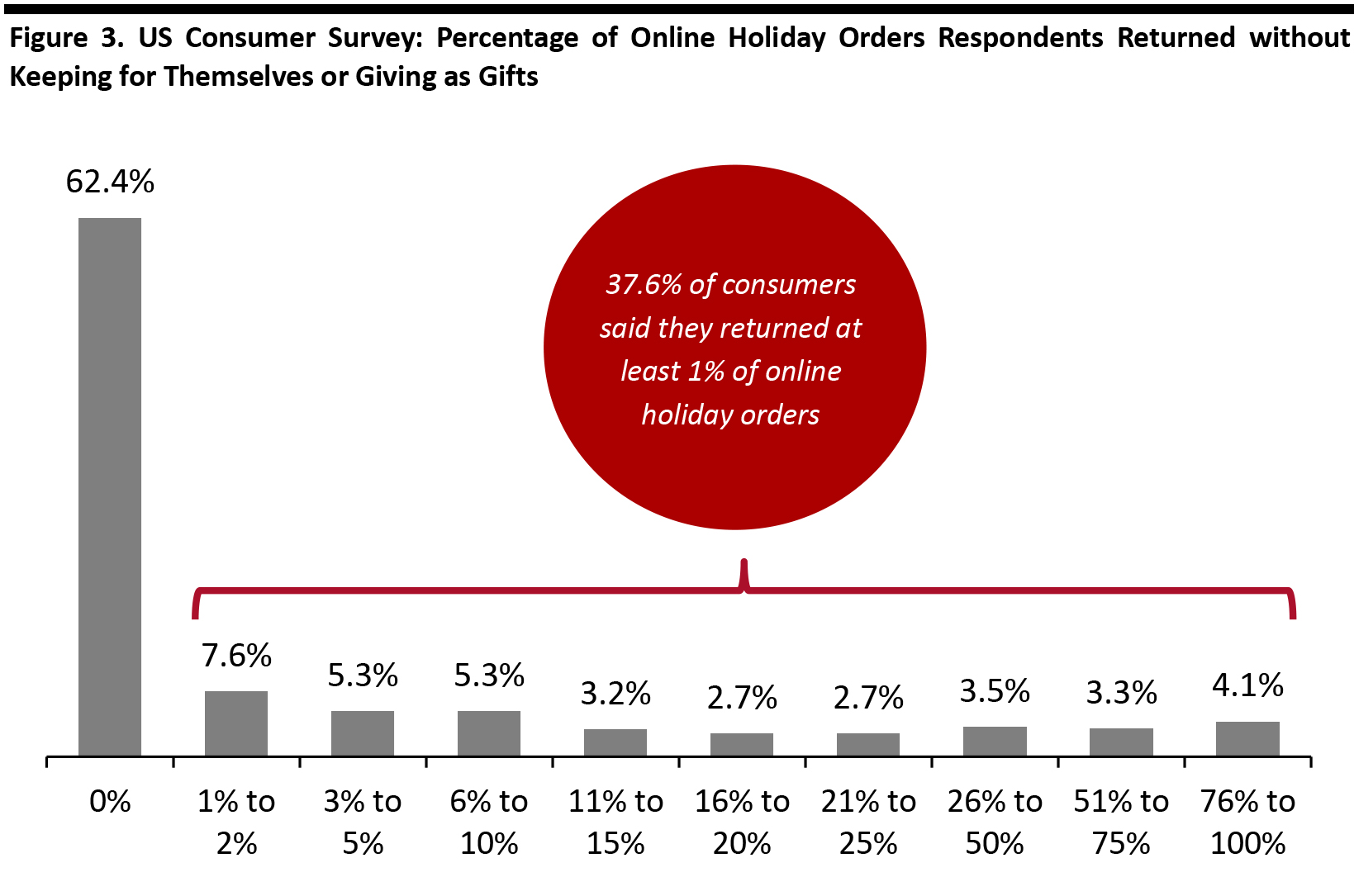

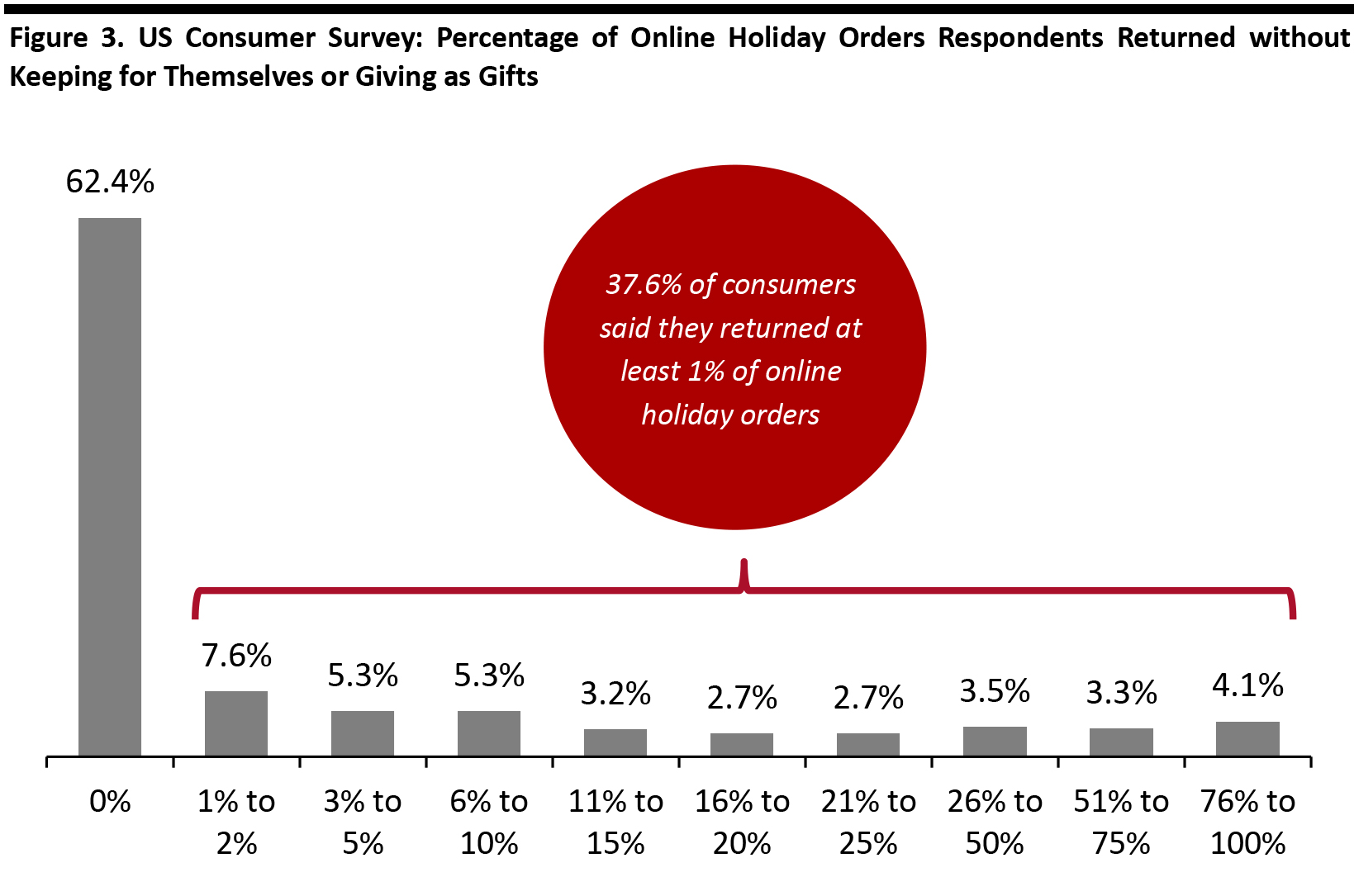

Source: Prosper Insights & Analytics [/caption] 37.6% of consumers said they returned at least some of their online holiday orders With the growth in e-commerce comes an expansion of returns. According to Prosper’s post-holiday survey, 37.6% of consumers said they ended up returning at least some of their online holiday orders, while 62.4% said they kept online holiday orders or gave them as gifts without returning. However, the nature of the survey question asked means the figures would exclude those orders returned by recipients of gifts—we later chart survey data on returns by gift recipients. [caption id="attachment_102872" align="aligncenter" width="700"] Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020

Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020

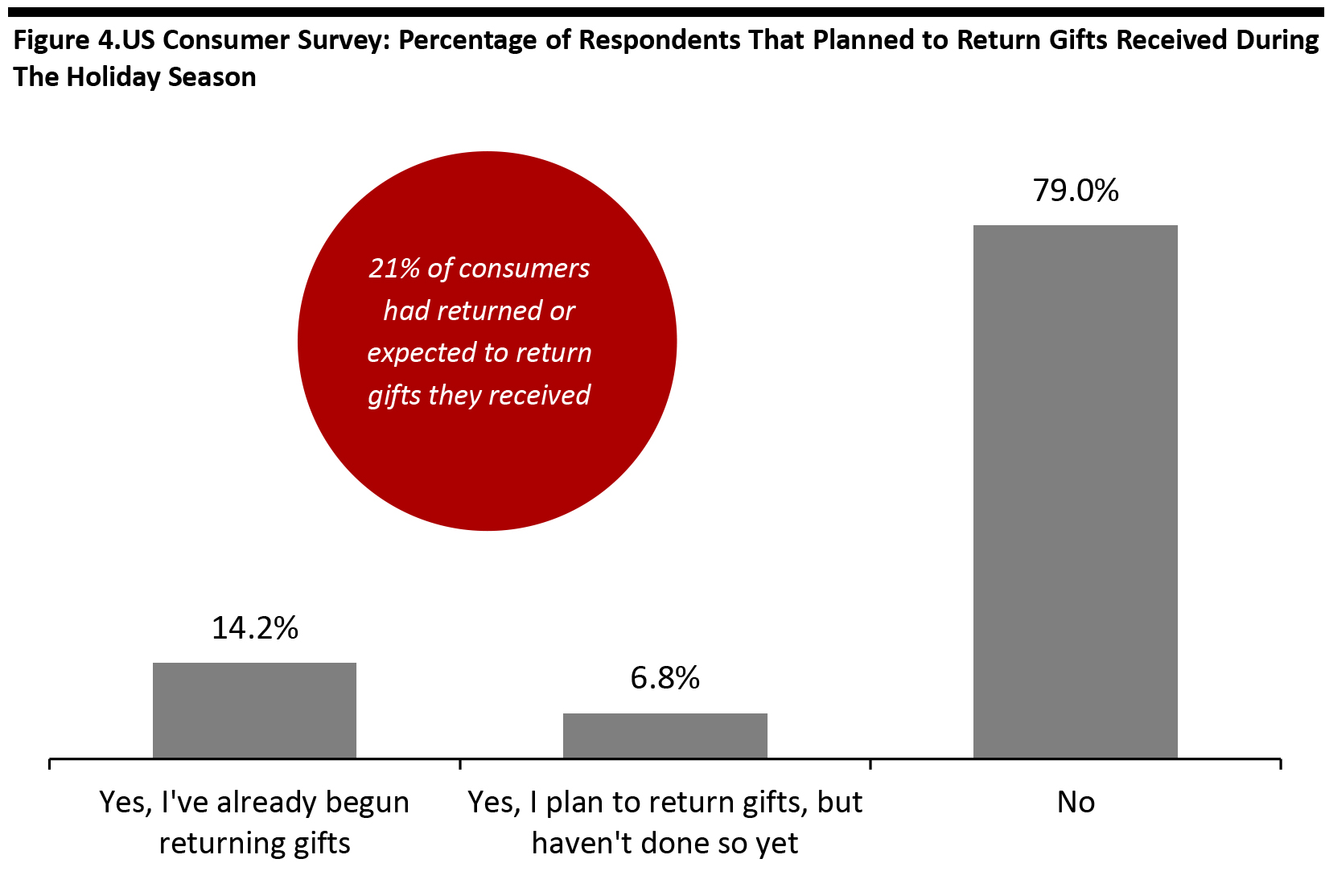

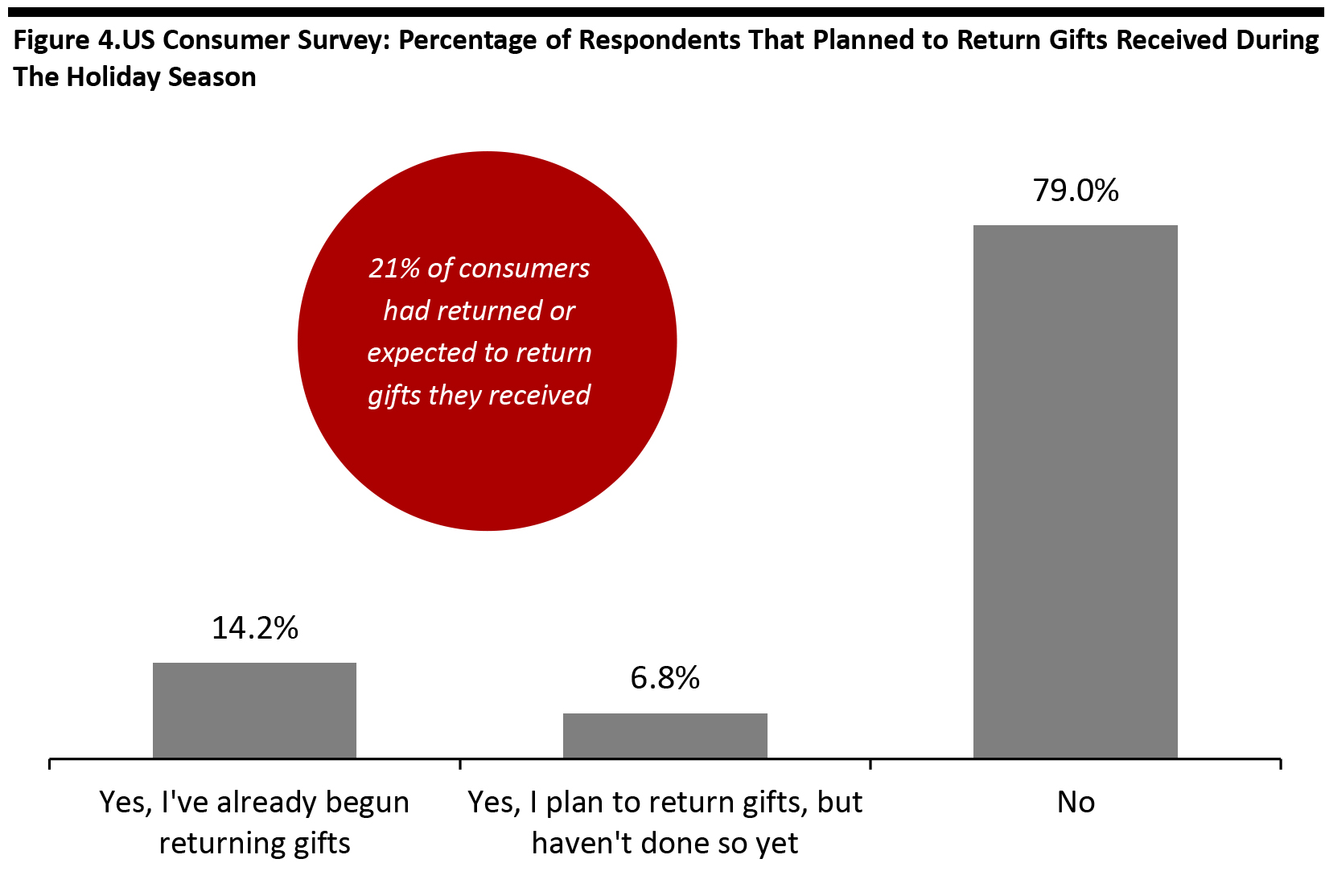

Source: Prosper Insights & Analytics [/caption] Additionally, a total of 21% said they expected to return gifts they received during the recent holiday season. [caption id="attachment_102873" align="aligncenter" width="700"] Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020

Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020

Source: Prosper Insights & Analytics [/caption]

*On a shifted basis

*On a shifted basis **Direct-to-consumer

Source: Company reports/Factset [/caption] Walmart and Target Were the Most Popular Retailer Choices for BOPIS A post-holiday US consumer survey by Prosper Insights & Analytics found 33.6% of consumers used BOPIS when shopping during the holiday season in 2019. Among those who used BOPIS this holiday season, some 30.0% said they used Walmart’s, followed by Target’s at 13.2% and Kohl’s at 12.5%. [caption id="attachment_102871" align="aligncenter" width="700"]

Base: 2,438 US Internet users aged 18 and above who used BOPIS in the 2019 holiday season, surveyed in January 2020

Base: 2,438 US Internet users aged 18 and above who used BOPIS in the 2019 holiday season, surveyed in January 2020 Source: Prosper Insights & Analytics [/caption] 37.6% of consumers said they returned at least some of their online holiday orders With the growth in e-commerce comes an expansion of returns. According to Prosper’s post-holiday survey, 37.6% of consumers said they ended up returning at least some of their online holiday orders, while 62.4% said they kept online holiday orders or gave them as gifts without returning. However, the nature of the survey question asked means the figures would exclude those orders returned by recipients of gifts—we later chart survey data on returns by gift recipients. [caption id="attachment_102872" align="aligncenter" width="700"]

Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020

Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020 Source: Prosper Insights & Analytics [/caption] Additionally, a total of 21% said they expected to return gifts they received during the recent holiday season. [caption id="attachment_102873" align="aligncenter" width="700"]

Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020

Base: 7,257 US Internet users aged 18 and above, surveyed in January 2020 Source: Prosper Insights & Analytics [/caption]