DIpil Das

This report offers our first thoughts on 2019 holiday retail demand in the US; we will publish our full US holiday outlook later in September. Here, we provide our initial estimates for US retail demand and review the context for holiday trading.

Coresight Research estimates total US retail sales excluding autos and gas in November and December will increase 3.5-4.0% year over year. A relatively strong macro environment with a positive impact from lower gas prices support our view of this holiday season.

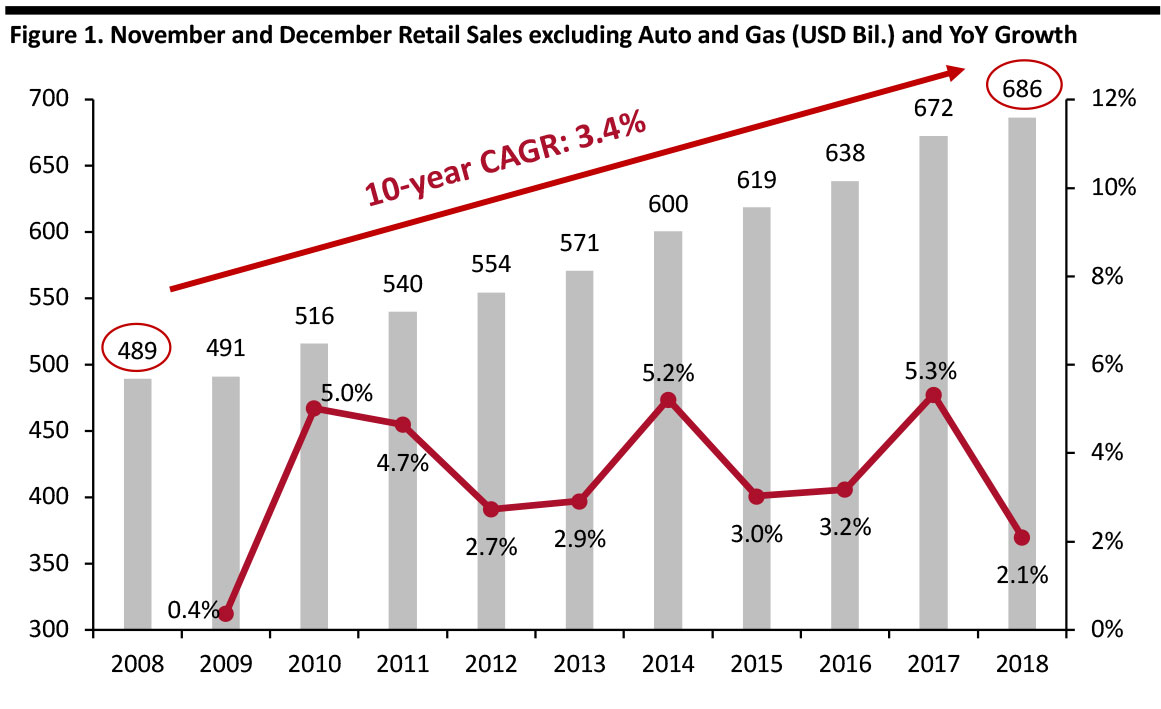

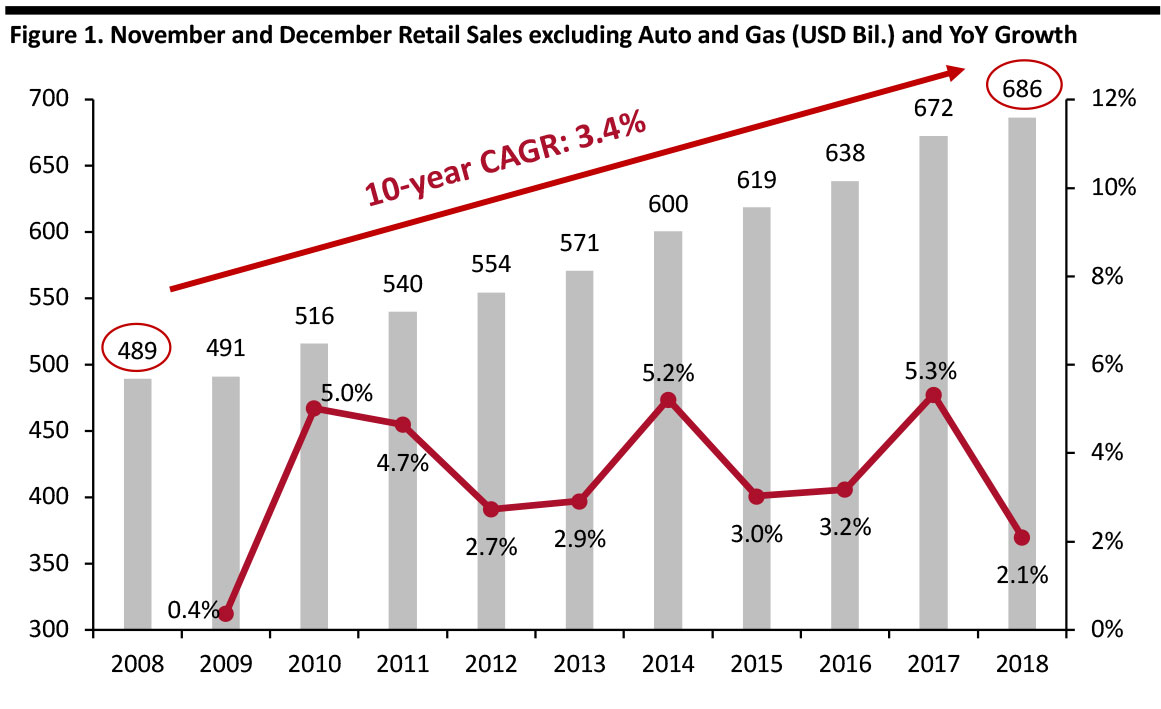

November and December 2018 retail sales reached $686 billion, reflecting a 10-year CAGR of 3.4%. Last year saw soft sales growth of 2.1% during the November-December holiday season, and we expect accelerated growth this year against those undemanding comparatives.

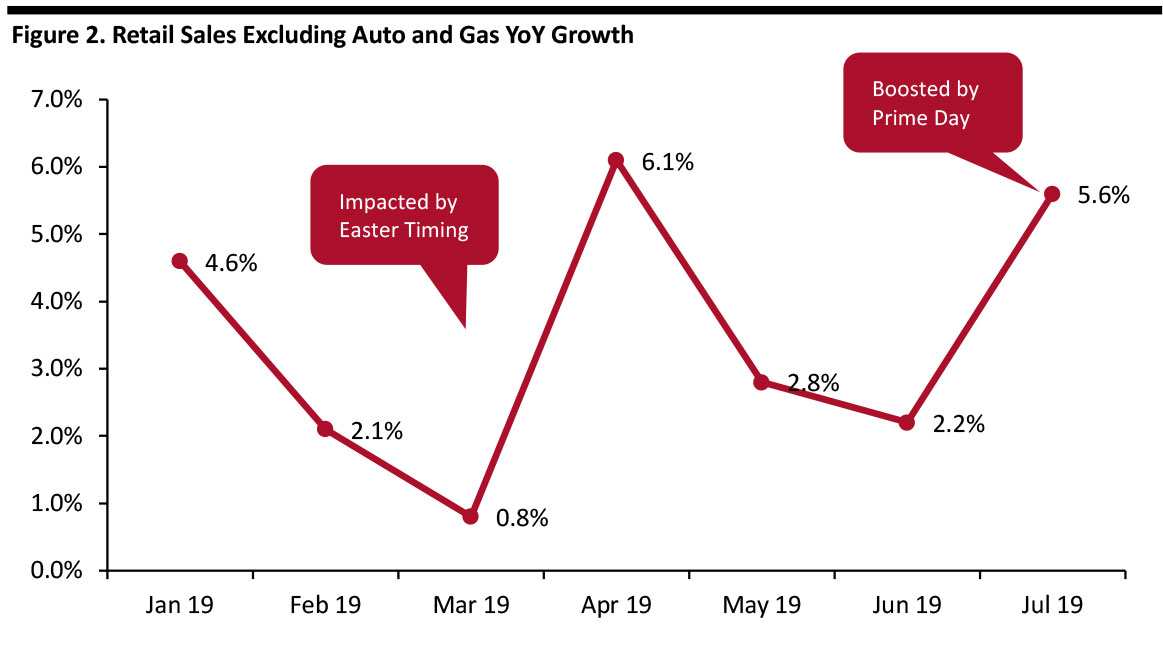

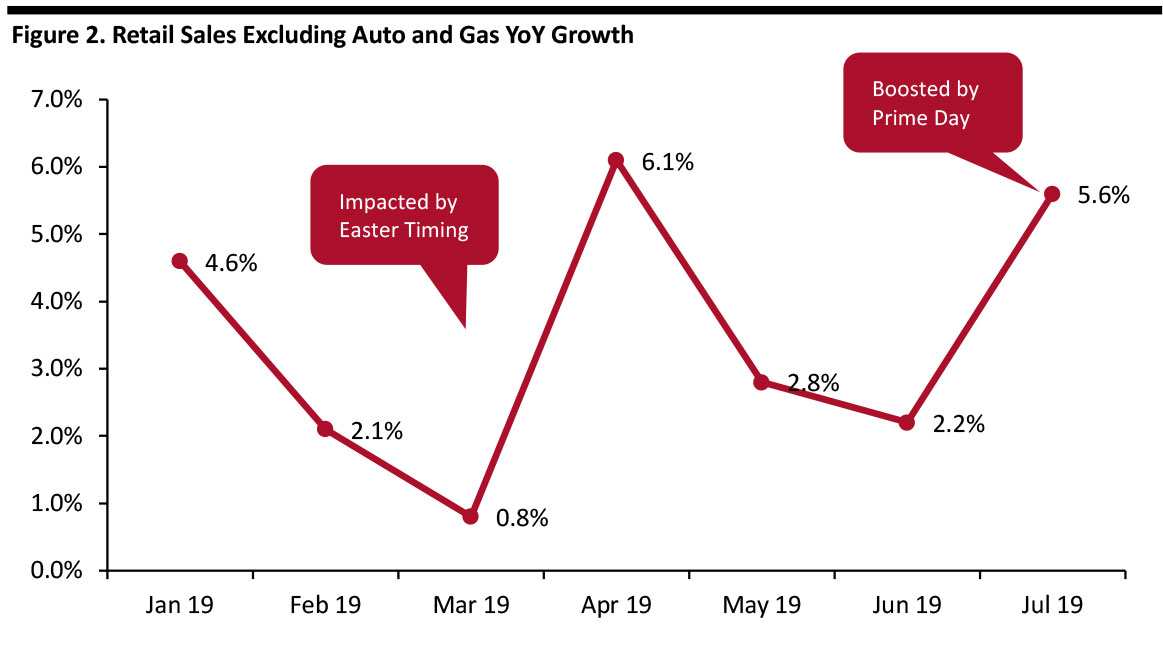

From January to July 2019, retail sales expanded 3.4% year over year to $2.1 trillion, and saw a substantial year-over-year increase of 5.6% in July, driven by the Amazon Prime Day shopping event.

[caption id="attachment_95880" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

[caption id="attachment_95881" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

[caption id="attachment_95881" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

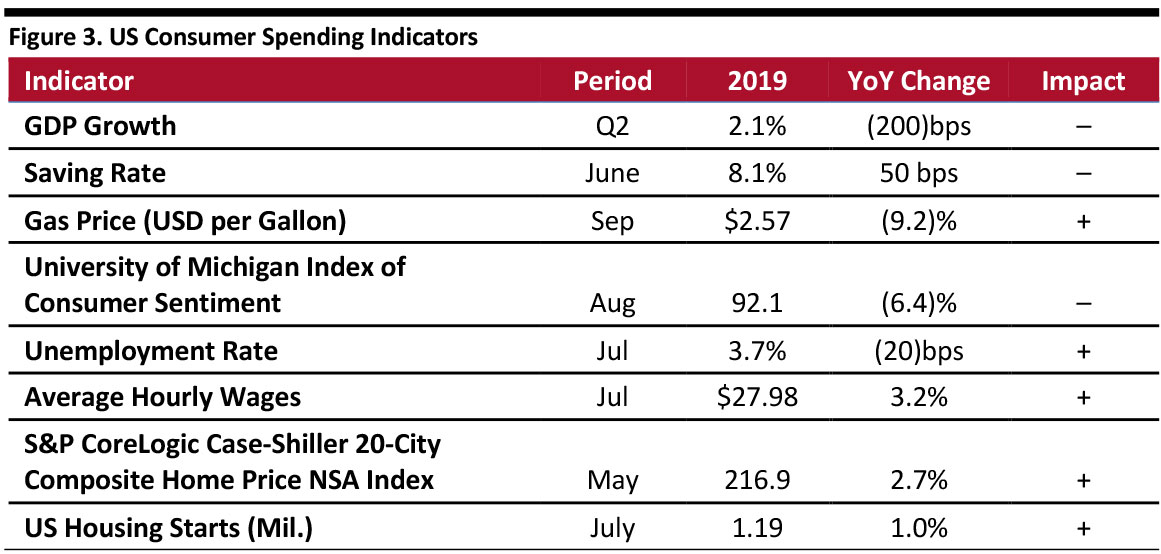

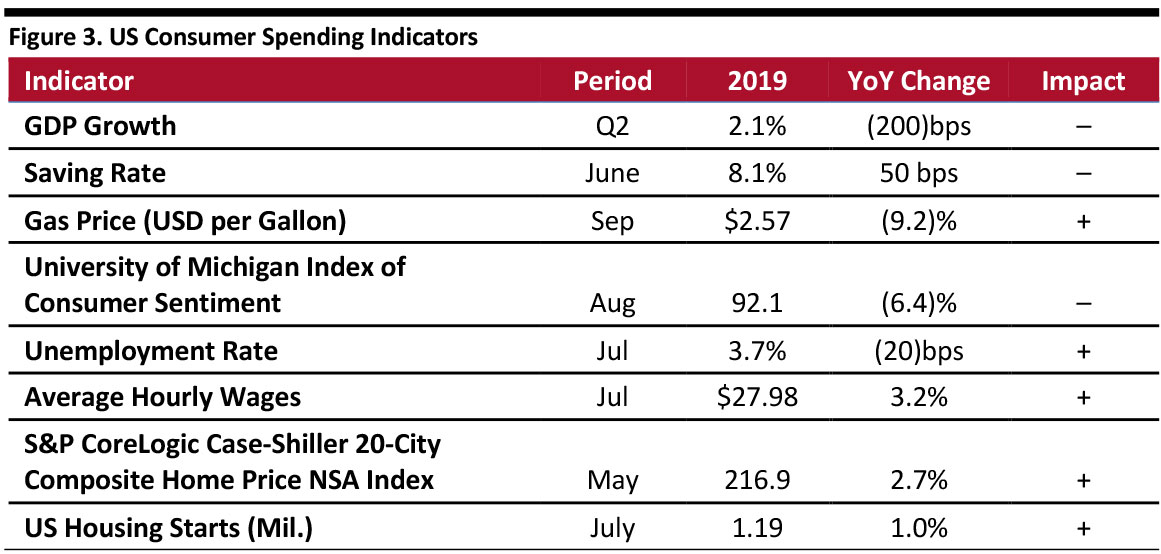

A steady economic backdrop frames this year’s holiday shopping season. Higher wage growth and lower gas prices point to the potential for higher sales.

Average gas prices per gallon were down 9.2% year over year to $2.57 in September 2019, putting more discretionary dollars in consumers’ wallets. Personal consumption expenditures (PCE) on gasoline and other energy goods was $79.7 billion, seasonally adjusted, in 4Q18, according to the US Bureau of Economic Analysis. The average gas price in 4Q18 was $2.70 per gallon and the American Automobile Association forecasts the national average will drop to $2.40 or lower this fall, 11.1% cheaper than the $2.70 average in 2018.

Assuming an 11.1% decrease in gas prices and an 8.1% saving rate for 4Q19, consumers should have an additional $8.1 billion discretionary funds available to drive increased holiday spending. We estimate the decreased gas prices alone could account for 50 basis points of incremental growth this holiday season.

[caption id="attachment_95882" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

A steady economic backdrop frames this year’s holiday shopping season. Higher wage growth and lower gas prices point to the potential for higher sales.

Average gas prices per gallon were down 9.2% year over year to $2.57 in September 2019, putting more discretionary dollars in consumers’ wallets. Personal consumption expenditures (PCE) on gasoline and other energy goods was $79.7 billion, seasonally adjusted, in 4Q18, according to the US Bureau of Economic Analysis. The average gas price in 4Q18 was $2.70 per gallon and the American Automobile Association forecasts the national average will drop to $2.40 or lower this fall, 11.1% cheaper than the $2.70 average in 2018.

Assuming an 11.1% decrease in gas prices and an 8.1% saving rate for 4Q19, consumers should have an additional $8.1 billion discretionary funds available to drive increased holiday spending. We estimate the decreased gas prices alone could account for 50 basis points of incremental growth this holiday season.

[caption id="attachment_95882" align="aligncenter" width="700"] Source: US Bureau of Economic Analysis/US Department of Labor Statistics/S&P Global/University of Michigan/Federation of Tax Administrators/Coresight Research[/caption]

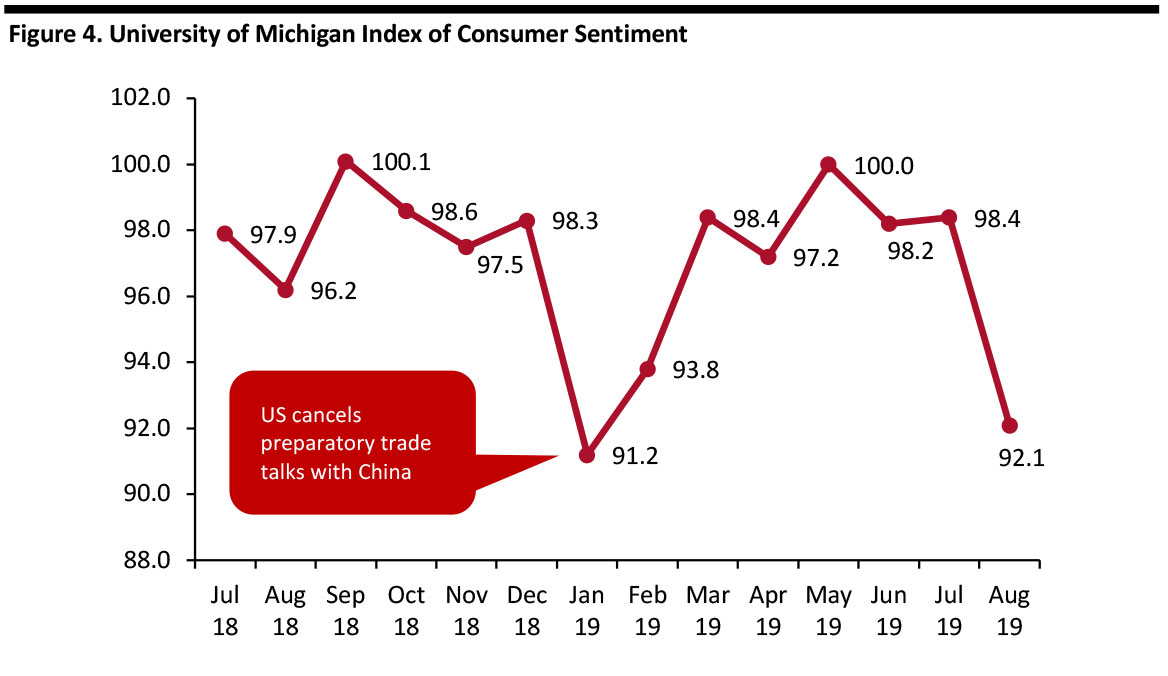

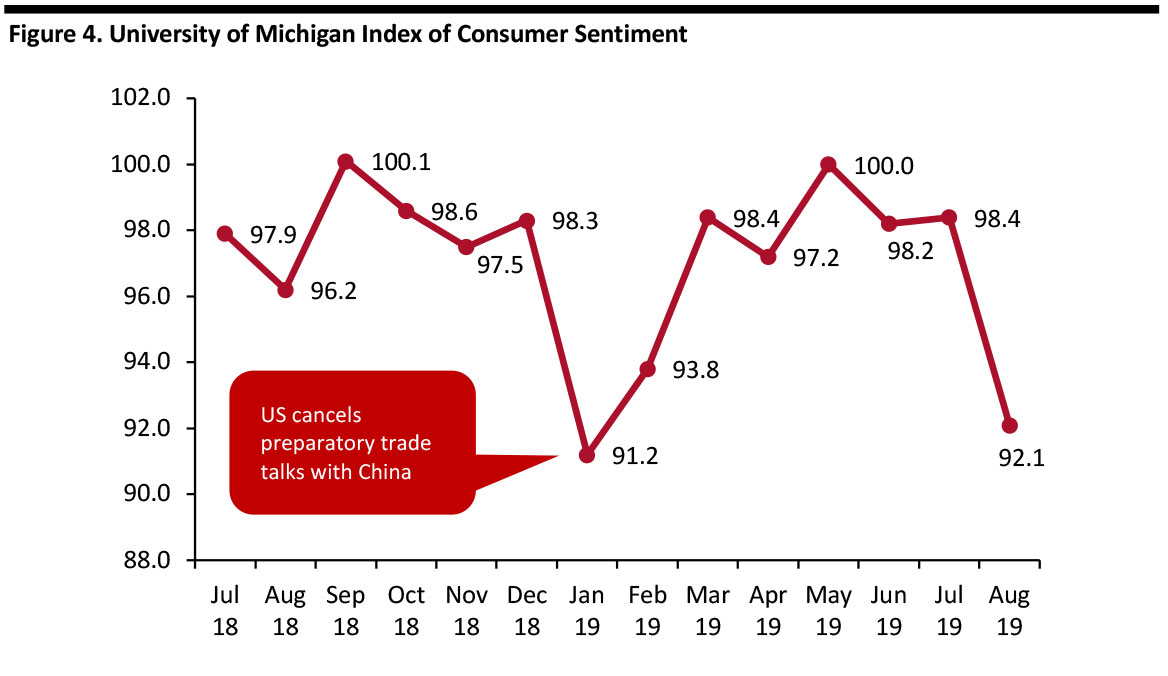

Consumer confidence has shown greater volatility since the escalation of the US-China trade conflict. On July 13, President Trump postponed tariffs on some consumer goods imported from China, including cell phones, toys and video game consoles, until December 15. Meanwhile, China retaliated with tariffs on $75 billion of US goods in two batches effective September 1 and December 15. In August, the Consumer Sentiment Index also declined, reflecting rising concern of a recession. However, at 92.1, the Consumer Sentiment Index reading compares with a 10-year average of an 84.5.

Offsetting the recent declines in consumer confidence is the 3.2% increase in hourly wages, putting more funds in consumers’ wallets.

[caption id="attachment_95883" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/US Department of Labor Statistics/S&P Global/University of Michigan/Federation of Tax Administrators/Coresight Research[/caption]

Consumer confidence has shown greater volatility since the escalation of the US-China trade conflict. On July 13, President Trump postponed tariffs on some consumer goods imported from China, including cell phones, toys and video game consoles, until December 15. Meanwhile, China retaliated with tariffs on $75 billion of US goods in two batches effective September 1 and December 15. In August, the Consumer Sentiment Index also declined, reflecting rising concern of a recession. However, at 92.1, the Consumer Sentiment Index reading compares with a 10-year average of an 84.5.

Offsetting the recent declines in consumer confidence is the 3.2% increase in hourly wages, putting more funds in consumers’ wallets.

[caption id="attachment_95883" align="aligncenter" width="700"] Source: University of Michigan/Coresight Research[/caption]

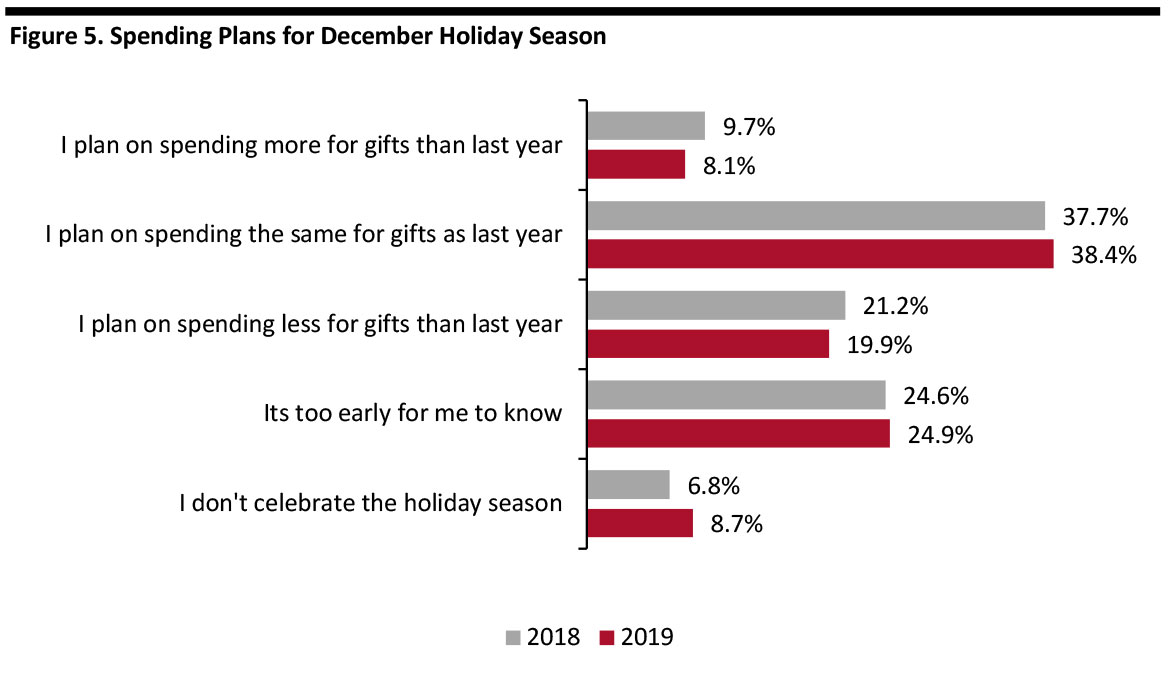

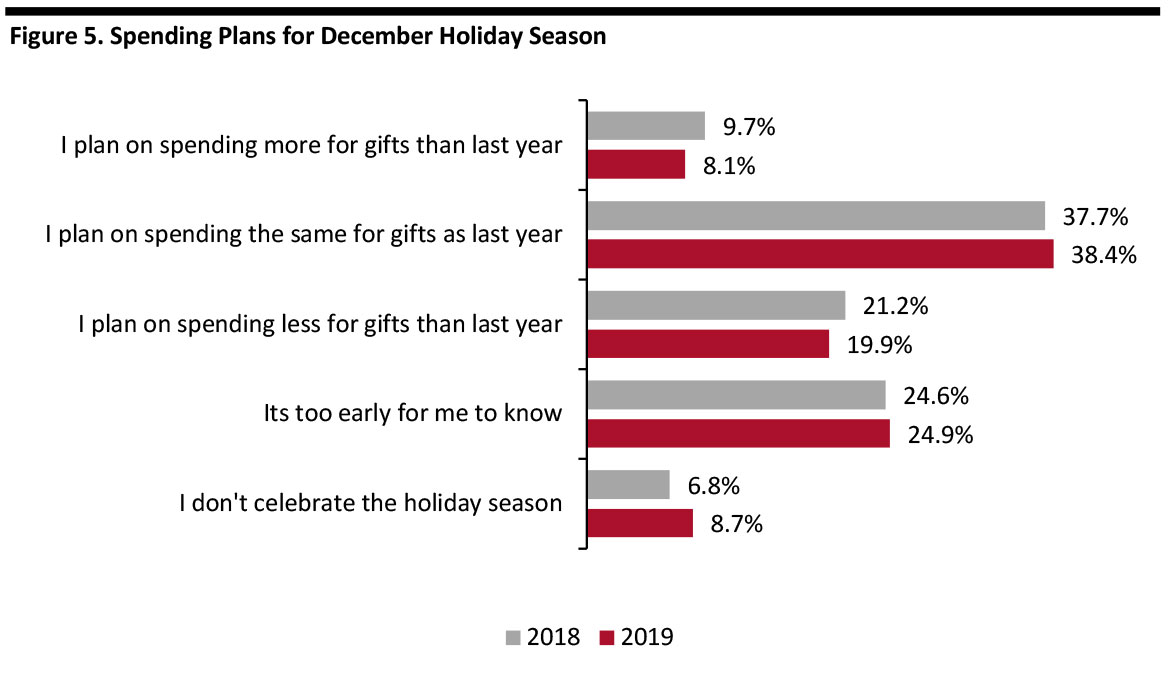

According to a Prosper Insights & Analytics survey of spending intentions for the December holiday season, 8.1% of those surveyed plan to spend more, down 160 bps year over year; but the survey also recorded an increase in the percentage of those planning to spend the same (38.4% up from 37.7%), and fewer intending to spend less (19.9% from 21.2%, down 130bps). In total, the combined intent is a positive. The increase in the percentage not celebrating the holiday, up 190 bps to 8.7%, is a trend we will be watching in future years.

[caption id="attachment_95884" align="aligncenter" width="700"]

Source: University of Michigan/Coresight Research[/caption]

According to a Prosper Insights & Analytics survey of spending intentions for the December holiday season, 8.1% of those surveyed plan to spend more, down 160 bps year over year; but the survey also recorded an increase in the percentage of those planning to spend the same (38.4% up from 37.7%), and fewer intending to spend less (19.9% from 21.2%, down 130bps). In total, the combined intent is a positive. The increase in the percentage not celebrating the holiday, up 190 bps to 8.7%, is a trend we will be watching in future years.

[caption id="attachment_95884" align="aligncenter" width="700"] Base: 7,660 US consumers aged 18+ in July, 2019

Base: 7,660 US consumers aged 18+ in July, 2019

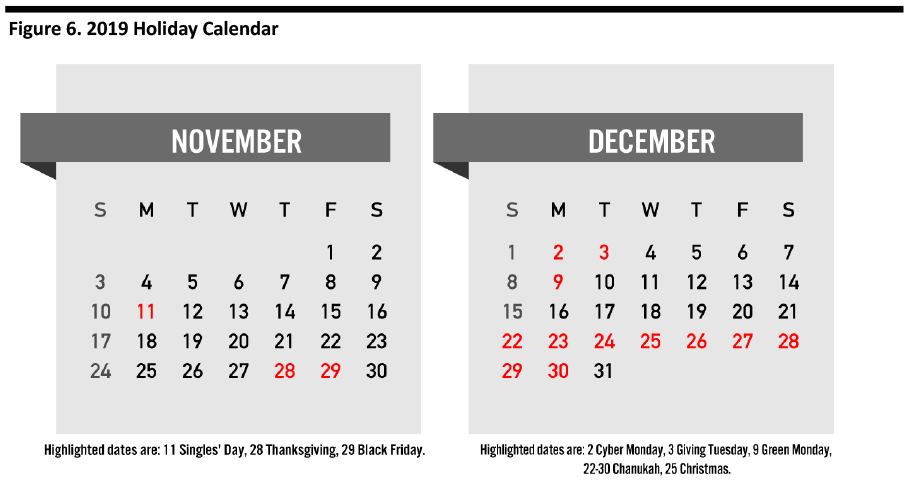

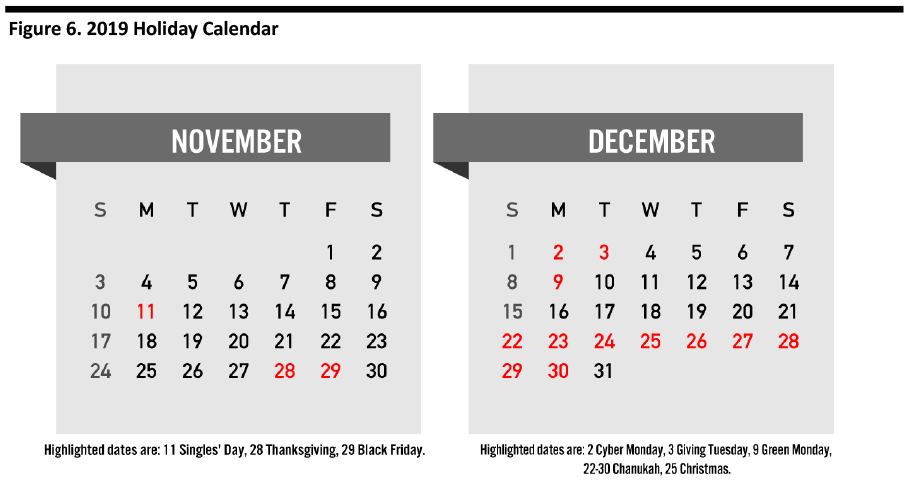

Source: Prosper Insights & Analytics [/caption] This year we have a late Thanksgiving, falling on November 28, reducing the number of shopping days. Cyber Monday and Giving Tuesday fall in early December. This year has six fewer days between Thanksgiving and Christmas than 2018 and is the shortest possible holiday calendar, which is not ideal. However, a shortened calendar can be a boost to both sales and profits for some retailers as it results in last minute shopping where price becomes less relevant and retailers that merchandise holiday gifting items in easy to purchase pre-wrapped bundles benefit. A late start to Chanukah (December 22 through December 30) overlapping Christmas along with the truncated calendar will likely have retailers nervous about daily receipts and could lead to heightened promotional offers as the season progresses. [caption id="attachment_95915" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Upcoming Holiday Shopping Reports

Keep an eye out for further reports on the 2019 holiday shopping series in the coming weeks.

Source: Coresight Research[/caption]

Upcoming Holiday Shopping Reports

Keep an eye out for further reports on the 2019 holiday shopping series in the coming weeks.

Source: US Census Bureau/Coresight Research[/caption]

[caption id="attachment_95881" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

[caption id="attachment_95881" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

A steady economic backdrop frames this year’s holiday shopping season. Higher wage growth and lower gas prices point to the potential for higher sales.

Average gas prices per gallon were down 9.2% year over year to $2.57 in September 2019, putting more discretionary dollars in consumers’ wallets. Personal consumption expenditures (PCE) on gasoline and other energy goods was $79.7 billion, seasonally adjusted, in 4Q18, according to the US Bureau of Economic Analysis. The average gas price in 4Q18 was $2.70 per gallon and the American Automobile Association forecasts the national average will drop to $2.40 or lower this fall, 11.1% cheaper than the $2.70 average in 2018.

Assuming an 11.1% decrease in gas prices and an 8.1% saving rate for 4Q19, consumers should have an additional $8.1 billion discretionary funds available to drive increased holiday spending. We estimate the decreased gas prices alone could account for 50 basis points of incremental growth this holiday season.

[caption id="attachment_95882" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

A steady economic backdrop frames this year’s holiday shopping season. Higher wage growth and lower gas prices point to the potential for higher sales.

Average gas prices per gallon were down 9.2% year over year to $2.57 in September 2019, putting more discretionary dollars in consumers’ wallets. Personal consumption expenditures (PCE) on gasoline and other energy goods was $79.7 billion, seasonally adjusted, in 4Q18, according to the US Bureau of Economic Analysis. The average gas price in 4Q18 was $2.70 per gallon and the American Automobile Association forecasts the national average will drop to $2.40 or lower this fall, 11.1% cheaper than the $2.70 average in 2018.

Assuming an 11.1% decrease in gas prices and an 8.1% saving rate for 4Q19, consumers should have an additional $8.1 billion discretionary funds available to drive increased holiday spending. We estimate the decreased gas prices alone could account for 50 basis points of incremental growth this holiday season.

[caption id="attachment_95882" align="aligncenter" width="700"] Source: US Bureau of Economic Analysis/US Department of Labor Statistics/S&P Global/University of Michigan/Federation of Tax Administrators/Coresight Research[/caption]

Consumer confidence has shown greater volatility since the escalation of the US-China trade conflict. On July 13, President Trump postponed tariffs on some consumer goods imported from China, including cell phones, toys and video game consoles, until December 15. Meanwhile, China retaliated with tariffs on $75 billion of US goods in two batches effective September 1 and December 15. In August, the Consumer Sentiment Index also declined, reflecting rising concern of a recession. However, at 92.1, the Consumer Sentiment Index reading compares with a 10-year average of an 84.5.

Offsetting the recent declines in consumer confidence is the 3.2% increase in hourly wages, putting more funds in consumers’ wallets.

[caption id="attachment_95883" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/US Department of Labor Statistics/S&P Global/University of Michigan/Federation of Tax Administrators/Coresight Research[/caption]

Consumer confidence has shown greater volatility since the escalation of the US-China trade conflict. On July 13, President Trump postponed tariffs on some consumer goods imported from China, including cell phones, toys and video game consoles, until December 15. Meanwhile, China retaliated with tariffs on $75 billion of US goods in two batches effective September 1 and December 15. In August, the Consumer Sentiment Index also declined, reflecting rising concern of a recession. However, at 92.1, the Consumer Sentiment Index reading compares with a 10-year average of an 84.5.

Offsetting the recent declines in consumer confidence is the 3.2% increase in hourly wages, putting more funds in consumers’ wallets.

[caption id="attachment_95883" align="aligncenter" width="700"] Source: University of Michigan/Coresight Research[/caption]

According to a Prosper Insights & Analytics survey of spending intentions for the December holiday season, 8.1% of those surveyed plan to spend more, down 160 bps year over year; but the survey also recorded an increase in the percentage of those planning to spend the same (38.4% up from 37.7%), and fewer intending to spend less (19.9% from 21.2%, down 130bps). In total, the combined intent is a positive. The increase in the percentage not celebrating the holiday, up 190 bps to 8.7%, is a trend we will be watching in future years.

[caption id="attachment_95884" align="aligncenter" width="700"]

Source: University of Michigan/Coresight Research[/caption]

According to a Prosper Insights & Analytics survey of spending intentions for the December holiday season, 8.1% of those surveyed plan to spend more, down 160 bps year over year; but the survey also recorded an increase in the percentage of those planning to spend the same (38.4% up from 37.7%), and fewer intending to spend less (19.9% from 21.2%, down 130bps). In total, the combined intent is a positive. The increase in the percentage not celebrating the holiday, up 190 bps to 8.7%, is a trend we will be watching in future years.

[caption id="attachment_95884" align="aligncenter" width="700"] Base: 7,660 US consumers aged 18+ in July, 2019

Base: 7,660 US consumers aged 18+ in July, 2019 Source: Prosper Insights & Analytics [/caption] This year we have a late Thanksgiving, falling on November 28, reducing the number of shopping days. Cyber Monday and Giving Tuesday fall in early December. This year has six fewer days between Thanksgiving and Christmas than 2018 and is the shortest possible holiday calendar, which is not ideal. However, a shortened calendar can be a boost to both sales and profits for some retailers as it results in last minute shopping where price becomes less relevant and retailers that merchandise holiday gifting items in easy to purchase pre-wrapped bundles benefit. A late start to Chanukah (December 22 through December 30) overlapping Christmas along with the truncated calendar will likely have retailers nervous about daily receipts and could lead to heightened promotional offers as the season progresses. [caption id="attachment_95915" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Upcoming Holiday Shopping Reports

Keep an eye out for further reports on the 2019 holiday shopping series in the coming weeks.

Source: Coresight Research[/caption]

Upcoming Holiday Shopping Reports

Keep an eye out for further reports on the 2019 holiday shopping series in the coming weeks.