DIpil Das

Hiring to Stagnate or Fall Slightly in 2019

Holiday hiring this year looks likely to stagnate or experience a slight decline compared to last year. However, hiring is expected to rise in allied sectors such as transportation and warehousing to serve growth in e-commerce.

This report focuses on US retailers’ holiday hiring plans, and is part of our Holiday 2019 series.

There were around 903,000 retail job openings listed in the US in July 2019 (latest reported at time of writing) including full-time, part-time, permanent, short-term and seasonal openings. This is 14.7% lower than the corresponding figure from last year of 1,059,000, according to the US Bureau of Labor Statistics (BLS).

Moreover, the total workforce employed in retail in August 2019 (latest available) declined 0.6% year over year to 15.7 million, according to the BLS. This data suggests hiring this year has not matched the pace of last year and hints at the possibility of a slight decline in hiring this holiday season.

The National Retail Federation (NRF) expects US retailers to hire between 530,000 and 590,000 temporary workers for the 2019 holiday season, with the midpoint of 560,000 comparing to 554,000 recorded by the NRF in the 2018 holiday season.

Market Improves for Job Seekers as Retailers Scout for Seasonal Staff

Amidst an uncertain economic environment, mass store closures and the associated structural shifts moving away from legacy retail formats, seasonal hiring is expected to be stagnant or fall slighly from last year. Retailers by and large have not changed hiring plans as consumer spending remains strong despite the ongoing trade war with China.

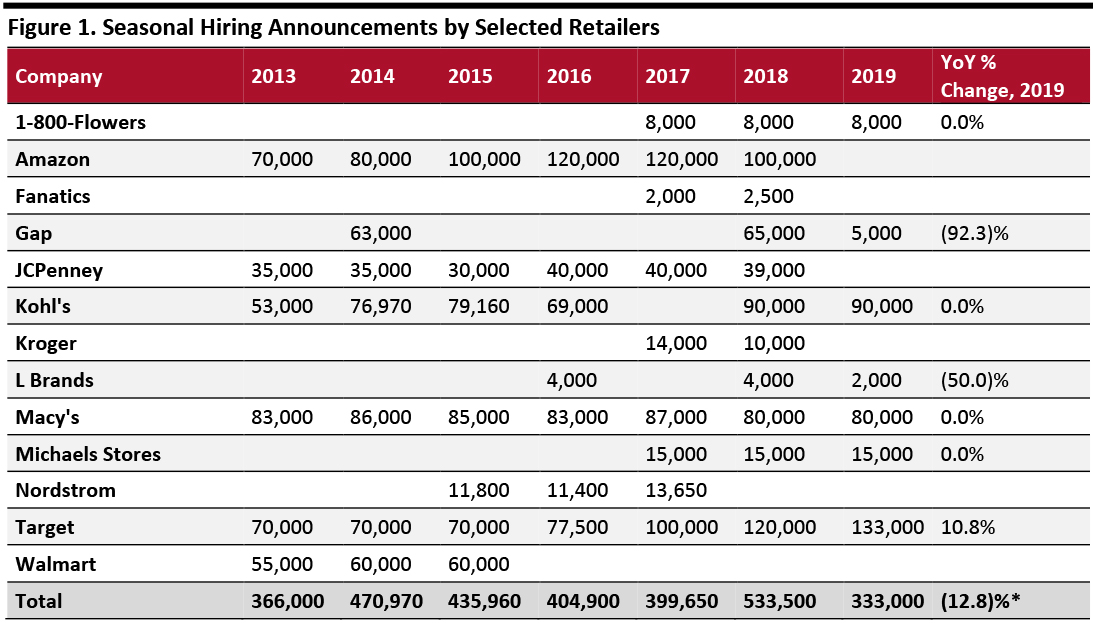

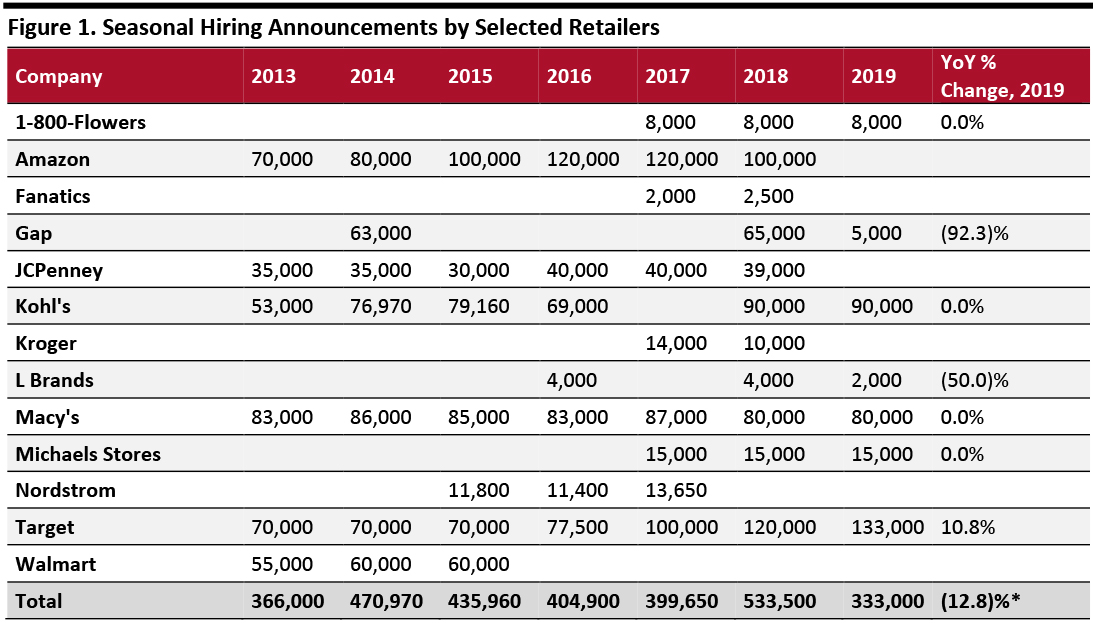

Figure 1 lists hiring announcements by a number of leading retailers from 2013-2019.

[caption id="attachment_98071" align="aligncenter" width="700"] Total includes only announcements to-date.

Total includes only announcements to-date.

*Year-over-year percentage change is on a comparable-retailer basis

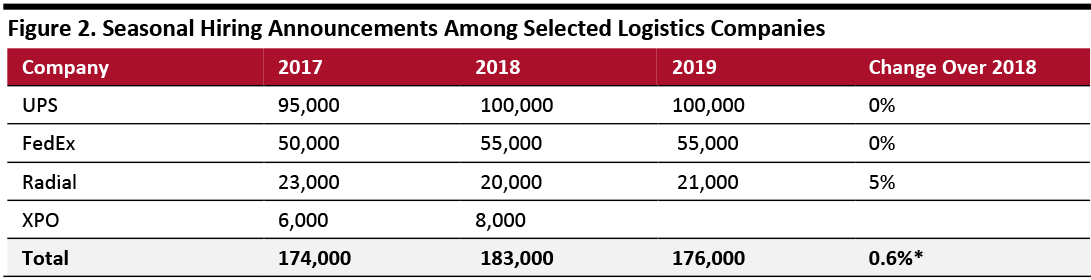

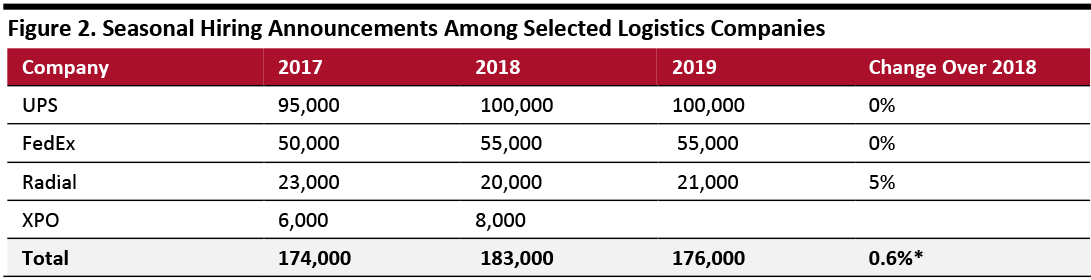

Source: Company reports [/caption] To attract more seasonal workers, retailers are offering higher hourly wages and perks. This year, Target said it will offer $13 an hour, an increase of one dollar over last year’s hourly wage. The retailer will offer additional benefits such as a 10% discount at Target, a 20% wellness discount on produce and fitness gear, flexible scheduling and a chance to earn holiday pay over Thanksgiving and Christmas. Kohl’s, which began holiday hiring in July, is offering a 15% discount, flexible scheduling and weekly paychecks. For material handlers at its distribution centers, Kohl’s offers a free onsite health center, paid breaks, a climate-controlled work environment and weekly paychecks. Gap has announced that its holiday team will get a 50% discount at Gap, Banana Republic and Old Navy stores, 30% off at Outlet and 25% off at Athleta stores. Additionally, they will also get free on-site flu shots in October, family care support and discounts on vision and dental programs. JCPenney is offering a 25% discount on its products for seasonal staff along with flexible holiday scheduling. Amazon is offering $15 an hour. L Brands is offering up to a 40% discount at Victoria’s Secret, PINK and Bath & Body Works, among other benefits. Retailers are being forced to raise wages and offer perks to lure workers in a tight labor market. However, rural and suburban retailers may be able to find workers who have lost jobs due to mall and store closures. Retailers Have Laid Out Hiring Plans Kohl’s has announced it will hire 90,000 seasonal associates this year, the same number as last year. It began holiday hiring across 500 stores in July and opened more job openings in August at stores, distribution and fulfillment centers. The company plans to hire 7,000 seasonal associates at 135 stores to expand its digital ordering pilot program. Kohl’s will host its first national hiring event on October 5 at its stores and fulfillment centers to hire 5,000 seasonal associates. “Our early hiring strategy continues to work well for us – with thousands of seasonal associates already hired and beginning their seasonal positions at Kohl’s,” said Marc Chini, Kohl’s Senior EVP, Chief People Officer, in a press release. Target announced on September 10 that it is set to hire 133,000 seasonal workers, roughly an 11% increase over last year. Of those, 125,000 openings are for store positions, while 8,000 will be at its 39 distribution and fulfillment centers. “Getting an early start with those preparations made a big difference for us last year, and it’s a great way to get the entire Target team pumped up for the most fun and exciting time of the year,” said Melissa Kremer, Executive Vice President and Chief Human Resources Officer at Target. Amazon has announced plans to hire “tens of thousands” of seasonal workers for its operations networks. Gap has announced it plans to hire 5,000 seasonal associates this year, a significant drop from the 65,000 seasonal associates it announced last year. L Brands announced in August this year its plans to hire 2,000 seasonal customer service agents at its call center in Kettering, Ohio. Macy’s announced it will hire around 80,000 seasonal staff for its Macy’s and Bloomingdales’s stores, call centers, distribution and fulfillment centers, and the retailer will hold a national hiring event on October 24. Walmart, for the fourth consecutive year, has not announced any seasonal hiring plans so far and looks set to buck the trend of increased seasonal hiring again. In recent years, the retailer has opted to give more hours to existing employees rather than hire seasonal staff. Allied sectors such as freight, transportation and logistics are seeing increased hiring activity with leading companies such as UPS and FedEx matching last year’s announced hiring numbers, and Radial announcing an increase in hires over last year. [caption id="attachment_98072" align="aligncenter" width="700"] *Year-over-year percentage change is on a comparable-company basis

*Year-over-year percentage change is on a comparable-company basis

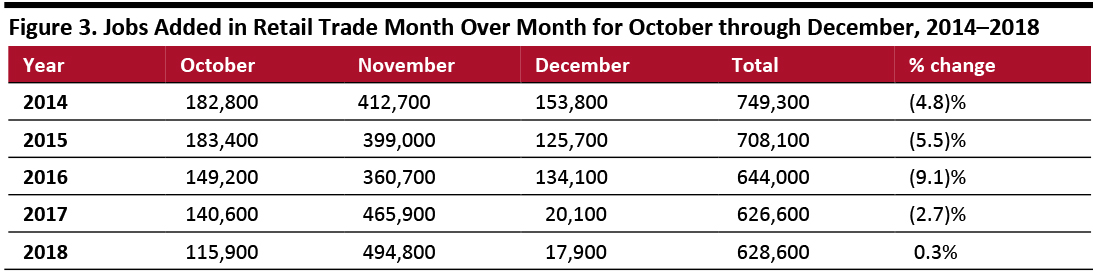

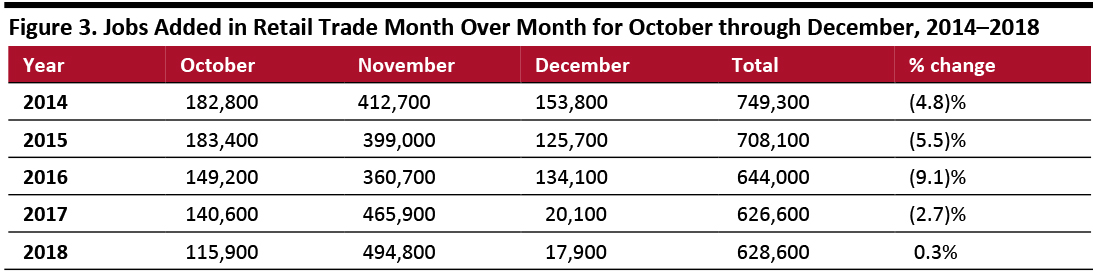

Source: Company reports [/caption] UPS expects to hire around 100,000 seasonal staff, the same as last year, as it prepares for a significant increase in package volume from November through January 2020. The company has an Earn and Learn program through which eligible student seasonal employees can earn up to $1,300 towards college expenses, over and above their hourly pay. “We expect another record peak season this year, with daily package deliveries nearly doubling compared to our average of 20 million per day. In order to make that happen, once again we’re recruiting about 100,000 people for some of the country’s best seasonal jobs,” said Jim Barber, UPS COO, in a statement. FedEx has announced it expects to hire over 55,000 seasonal staff as it prepares for the busy holiday season. The job openings incude package handlers and other support roles with a potential for conversion to full time positions. The company is offering medical coverage, choice of day or night shift, vision and dental benefits, tuition assistance, employee discounts and the opportunity to be taken on as a full time employee. Looking Back on Holiday Hiring Numbers Some 628,600 new retail jobs were added month over month from October through December in 2018, a 0.3% increase over the 626,600 added in the same period in 2017, according to BLS data. [caption id="attachment_98073" align="aligncenter" width="700"] Source: BLS[/caption]

Key Insights

Seasonal hiring plans look set to be impacted by macro uncertainty, structural shifts away from traditional retail formats and the associated mass store closures we have seen so far this year.

The trend of increased hiring in transportation and warehousing companies continues as e-commerce continues to grow in prominence.

Source: BLS[/caption]

Key Insights

Seasonal hiring plans look set to be impacted by macro uncertainty, structural shifts away from traditional retail formats and the associated mass store closures we have seen so far this year.

The trend of increased hiring in transportation and warehousing companies continues as e-commerce continues to grow in prominence.

Total includes only announcements to-date.

Total includes only announcements to-date. *Year-over-year percentage change is on a comparable-retailer basis

Source: Company reports [/caption] To attract more seasonal workers, retailers are offering higher hourly wages and perks. This year, Target said it will offer $13 an hour, an increase of one dollar over last year’s hourly wage. The retailer will offer additional benefits such as a 10% discount at Target, a 20% wellness discount on produce and fitness gear, flexible scheduling and a chance to earn holiday pay over Thanksgiving and Christmas. Kohl’s, which began holiday hiring in July, is offering a 15% discount, flexible scheduling and weekly paychecks. For material handlers at its distribution centers, Kohl’s offers a free onsite health center, paid breaks, a climate-controlled work environment and weekly paychecks. Gap has announced that its holiday team will get a 50% discount at Gap, Banana Republic and Old Navy stores, 30% off at Outlet and 25% off at Athleta stores. Additionally, they will also get free on-site flu shots in October, family care support and discounts on vision and dental programs. JCPenney is offering a 25% discount on its products for seasonal staff along with flexible holiday scheduling. Amazon is offering $15 an hour. L Brands is offering up to a 40% discount at Victoria’s Secret, PINK and Bath & Body Works, among other benefits. Retailers are being forced to raise wages and offer perks to lure workers in a tight labor market. However, rural and suburban retailers may be able to find workers who have lost jobs due to mall and store closures. Retailers Have Laid Out Hiring Plans Kohl’s has announced it will hire 90,000 seasonal associates this year, the same number as last year. It began holiday hiring across 500 stores in July and opened more job openings in August at stores, distribution and fulfillment centers. The company plans to hire 7,000 seasonal associates at 135 stores to expand its digital ordering pilot program. Kohl’s will host its first national hiring event on October 5 at its stores and fulfillment centers to hire 5,000 seasonal associates. “Our early hiring strategy continues to work well for us – with thousands of seasonal associates already hired and beginning their seasonal positions at Kohl’s,” said Marc Chini, Kohl’s Senior EVP, Chief People Officer, in a press release. Target announced on September 10 that it is set to hire 133,000 seasonal workers, roughly an 11% increase over last year. Of those, 125,000 openings are for store positions, while 8,000 will be at its 39 distribution and fulfillment centers. “Getting an early start with those preparations made a big difference for us last year, and it’s a great way to get the entire Target team pumped up for the most fun and exciting time of the year,” said Melissa Kremer, Executive Vice President and Chief Human Resources Officer at Target. Amazon has announced plans to hire “tens of thousands” of seasonal workers for its operations networks. Gap has announced it plans to hire 5,000 seasonal associates this year, a significant drop from the 65,000 seasonal associates it announced last year. L Brands announced in August this year its plans to hire 2,000 seasonal customer service agents at its call center in Kettering, Ohio. Macy’s announced it will hire around 80,000 seasonal staff for its Macy’s and Bloomingdales’s stores, call centers, distribution and fulfillment centers, and the retailer will hold a national hiring event on October 24. Walmart, for the fourth consecutive year, has not announced any seasonal hiring plans so far and looks set to buck the trend of increased seasonal hiring again. In recent years, the retailer has opted to give more hours to existing employees rather than hire seasonal staff. Allied sectors such as freight, transportation and logistics are seeing increased hiring activity with leading companies such as UPS and FedEx matching last year’s announced hiring numbers, and Radial announcing an increase in hires over last year. [caption id="attachment_98072" align="aligncenter" width="700"]

*Year-over-year percentage change is on a comparable-company basis

*Year-over-year percentage change is on a comparable-company basis Source: Company reports [/caption] UPS expects to hire around 100,000 seasonal staff, the same as last year, as it prepares for a significant increase in package volume from November through January 2020. The company has an Earn and Learn program through which eligible student seasonal employees can earn up to $1,300 towards college expenses, over and above their hourly pay. “We expect another record peak season this year, with daily package deliveries nearly doubling compared to our average of 20 million per day. In order to make that happen, once again we’re recruiting about 100,000 people for some of the country’s best seasonal jobs,” said Jim Barber, UPS COO, in a statement. FedEx has announced it expects to hire over 55,000 seasonal staff as it prepares for the busy holiday season. The job openings incude package handlers and other support roles with a potential for conversion to full time positions. The company is offering medical coverage, choice of day or night shift, vision and dental benefits, tuition assistance, employee discounts and the opportunity to be taken on as a full time employee. Looking Back on Holiday Hiring Numbers Some 628,600 new retail jobs were added month over month from October through December in 2018, a 0.3% increase over the 626,600 added in the same period in 2017, according to BLS data. [caption id="attachment_98073" align="aligncenter" width="700"]

Source: BLS[/caption]

Key Insights

Seasonal hiring plans look set to be impacted by macro uncertainty, structural shifts away from traditional retail formats and the associated mass store closures we have seen so far this year.

The trend of increased hiring in transportation and warehousing companies continues as e-commerce continues to grow in prominence.

Source: BLS[/caption]

Key Insights

Seasonal hiring plans look set to be impacted by macro uncertainty, structural shifts away from traditional retail formats and the associated mass store closures we have seen so far this year.

The trend of increased hiring in transportation and warehousing companies continues as e-commerce continues to grow in prominence.