Nitheesh NH

Introduction: Will the UK Be In or Out by Christmas?

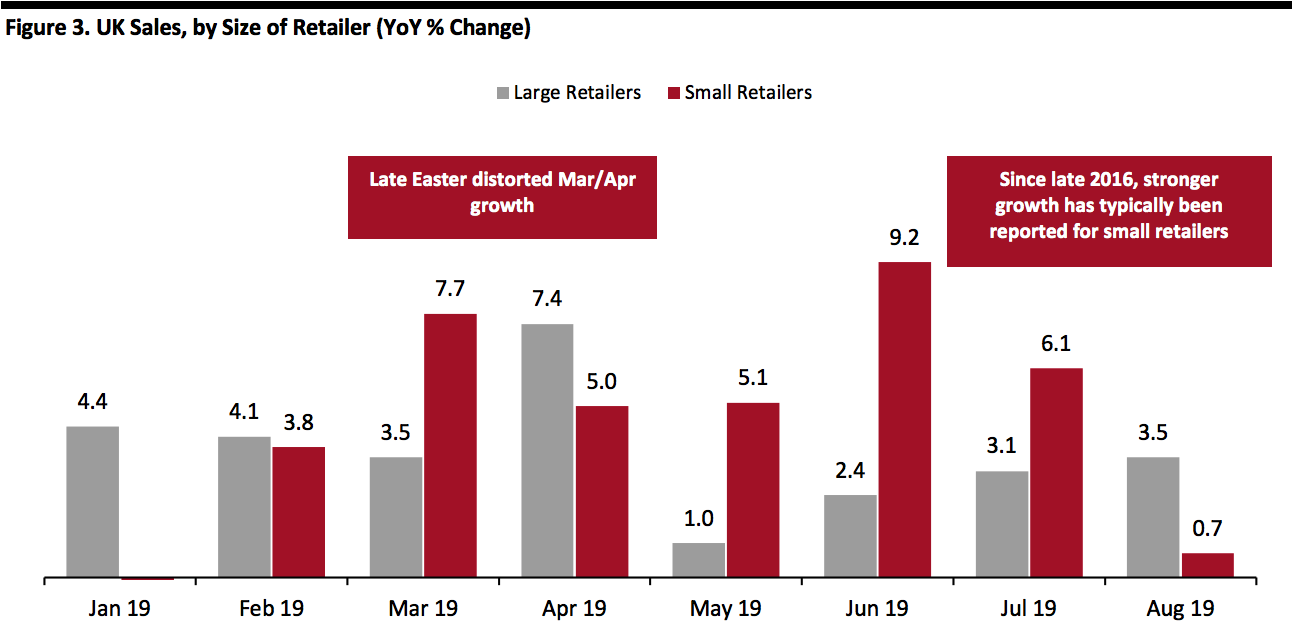

Uncertainty hangs over our UK holiday forecast. British shoppers have been dealing with uncertainty since the country failed to leave the EU in late March 2019. As we write, the deferred exit date of October 31 is approaching—but it continues to be unclear when or how the country will depart the bloc. Prime Minister Boris Johnson has pledged to take the UK out of the EU at the end of October. However, a majority of MPs recently voted to force him to request a third extension from the EU—to January 31 or as otherwise specified by the EU. This context makes it harder than ever to predict consumer behavior for the holiday season. We are likely to see one of three Brexit outcomes before the holiday peak:- The UK leaves as scheduled on October 31 with a deal—probably a revised version of the deal for which former Prime Minister Theresa May failed three times to win parliament’s support.

- The UK leaves as scheduled on October 31 without a deal—which, at the time of writing, looks somewhat more probable than leaving with a deal.

- The UK remains in the EU, until or beyond the third-extension departure date of January 31 as specified by MPs.

Solid Holiday Outlook with Potential for Growth To Strengthen

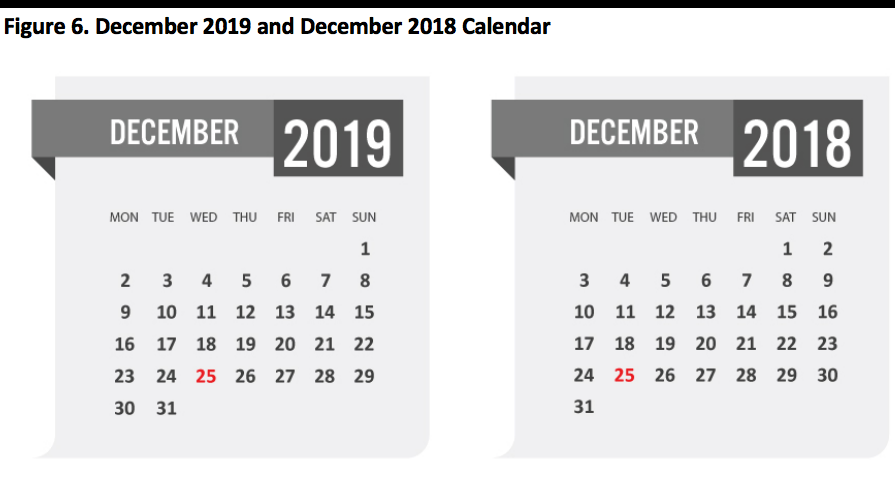

On the basis noted above and based on recent trends in retail sales, we see a solid outlook for retail this holiday season. We expect to see total retail sales grow by around 3.5-4.0% year over year, with the midpoint of 3.75% taking total holiday retail sales to £83.7 billion. This compares favorably to a 3.1% increase last year. So far in 2019, retail sales have increased at a steady pace, according to the Office for National Statistics (ONS), albeit with some softness at store-based nonfood retailers. In the three months through August, total sales were up 3.5% year over year.- We anticipate total November–December growth will be supported by modest, circa -2% growth at store-based retailers and driven by a mid-to -high-teens increase for Internet retailers.

- We estimate sales at large retailers, which include the major chains, will increase by around 3.0-3.5%; we discuss this later.

- We see scope for stronger growth should the relative certainty of a Brexit settlement release pent-up demand.

Source: ONS/Coresight Research[/caption]

Source: ONS/Coresight Research[/caption]

Slicing and Dicing Our Forecast

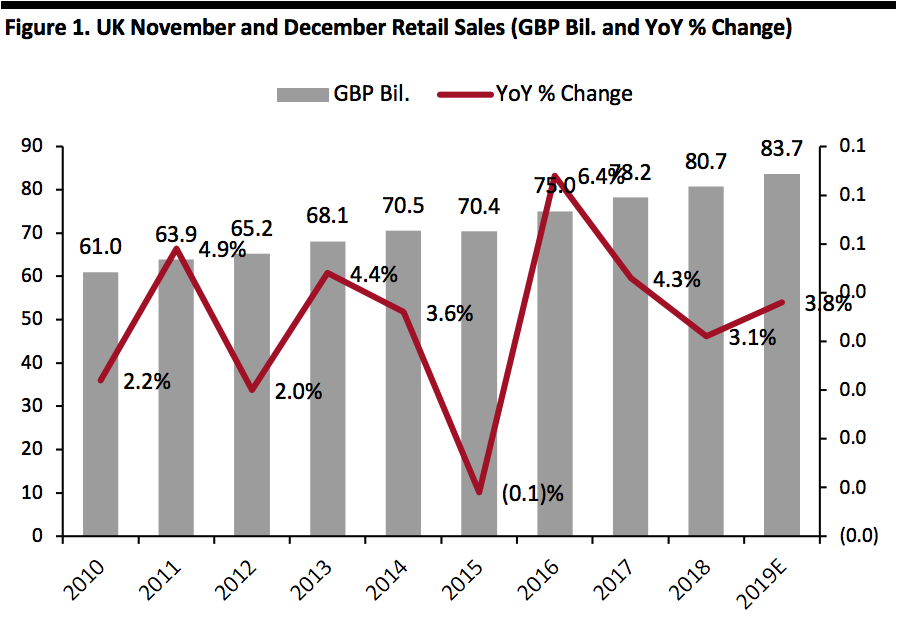

By Channel: E-Commerce Set To Capture 22% of All Sales We estimate that online will account for just over 22% of all retail sales this holiday season, up 170 basis points year over year. Rapid growth at online-only retailers will drive a faster, 270-basis point increase in the proportion of all nonfood sales going online: Some 32.6% of all nonfood spending will be online, we estimate. Based on recent trends, we estimate that total Internet retail sales will be up by around 12% year over year in November and December, versus growth of just over 13% for the same period in 2018. Recent trends suggest that Internet pure plays will comfortably outperform the total e-commerce market, by around 500 basis points: Estimated 17% growth for pure plays versus a 12% average for the channel implies meaningful gains in share for online-only retailers. [caption id="attachment_97313" align="aligncenter" width="700"] Source: ONS/Coresight Research[/caption]

Source: ONS/Coresight Research[/caption]

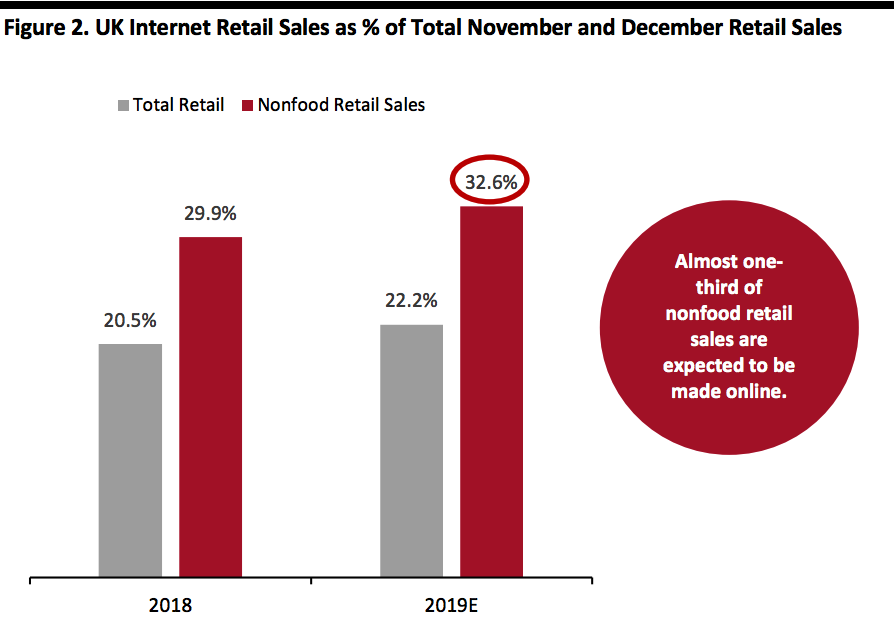

By Size of Retailer: Estimated 3.0-3.5% Growth for Large Retailers

This year, we provide a separate estimate for large retailers: We expect growth of approximately 3.0-3.5% at large retailers during November and December. Why is a split significant? Since late 2016, the ONS has generally been reporting stronger growth—and sometimes much stronger growth—for small retailers than for their large counterparts. It is hard to account for this trend, and methodological issues in the ONS’s retail sales survey may be a factor. Large retailers are the chains that dominate the retail sector. Due to the outsized growth recorded for small retailers, we feel that a figure for large retailers is a more meaningful representation of what the bulk of retailers can expect this holiday season. Our holiday estimate assumes that the trend of stronger reported growth for small retailers continues. In 2018, large retailers accounted for 78% of all retail sales, and small retailers the remaining 22%. A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers. [caption id="attachment_97314" align="aligncenter" width="700"] Source: ONS/Coresight Research[/caption]

Source: ONS/Coresight Research[/caption]

By Retail Sector: Mid-to-High-Teens Growth for Pure Plays To Drive Overall Increase

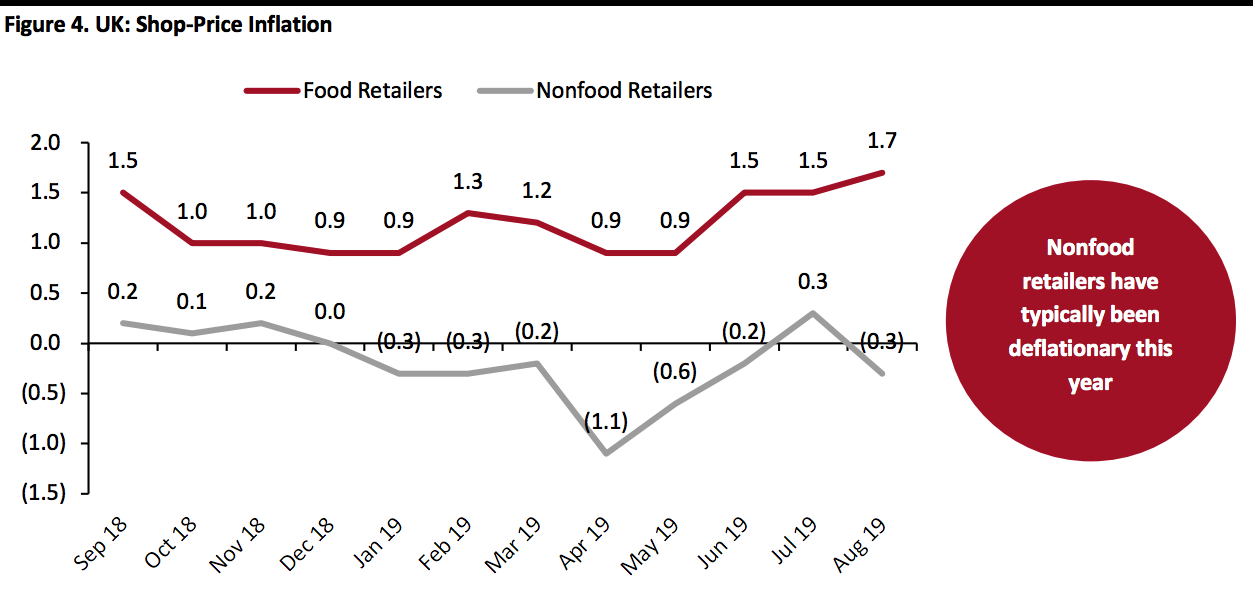

By broad sector, we expect to see the following this holiday season:- Raised inflation in food retail will support circa-2% growth at food retailers—but that translates into minimal volume gains.

- Modest deflation and structural channel shifts will hold back growth at store-based nonfood retailers to less than 2%—though a positive consumer reaction to any Brexit settlement would likely strengthen the growth rate.

- Total growth will be driven by Internet pure plays (which include a small element of mail-order retailers). This sector accounted for only around 11% of all retail sales in 2018, but an expected mid-to-high-teens growth rate will buoy the increase in total sales this holiday season: Based on recent data reported by the ONS, we expect Internet pure plays to see circa-17% growth this holiday season.

Data are for store-based retailers and exclude nonstore retailers.

Data are for store-based retailers and exclude nonstore retailers.Source: ONS[/caption]

More Positive Macro Environment than in 2018

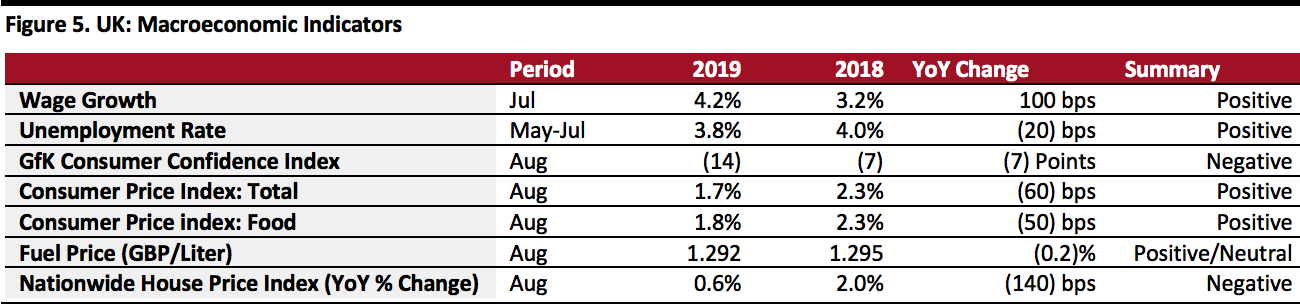

Across a number of metrics relevant to the consumer economy, we see a more positive environment than last year.- As we show below, wage growth has strengthened considerably and unemployment is down.

- Inflation in food is lower than last year and fuel prices are broadly flat—though food-price inflation has been rising in recent months, and fuel prices could be impacted by the recent reduction in Saudi Arabian oil output.

- Reduced house-price growth and lower consumer confidence are negatives—and these are likely to most impact bigger-ticket categories.

GfK Consumer Confidence Index research is carried out by GfK on behalf of the European Commission.

GfK Consumer Confidence Index research is carried out by GfK on behalf of the European Commission.Source: ONS/GfK/The AA/Experian Catalist/Nationwide Building Society/Coresight Research[/caption]