Nitheesh NH

Our store visits on Black Friday 2019 were undertaken in central London, with a focus on Oxford Street in the mid- and late morning.

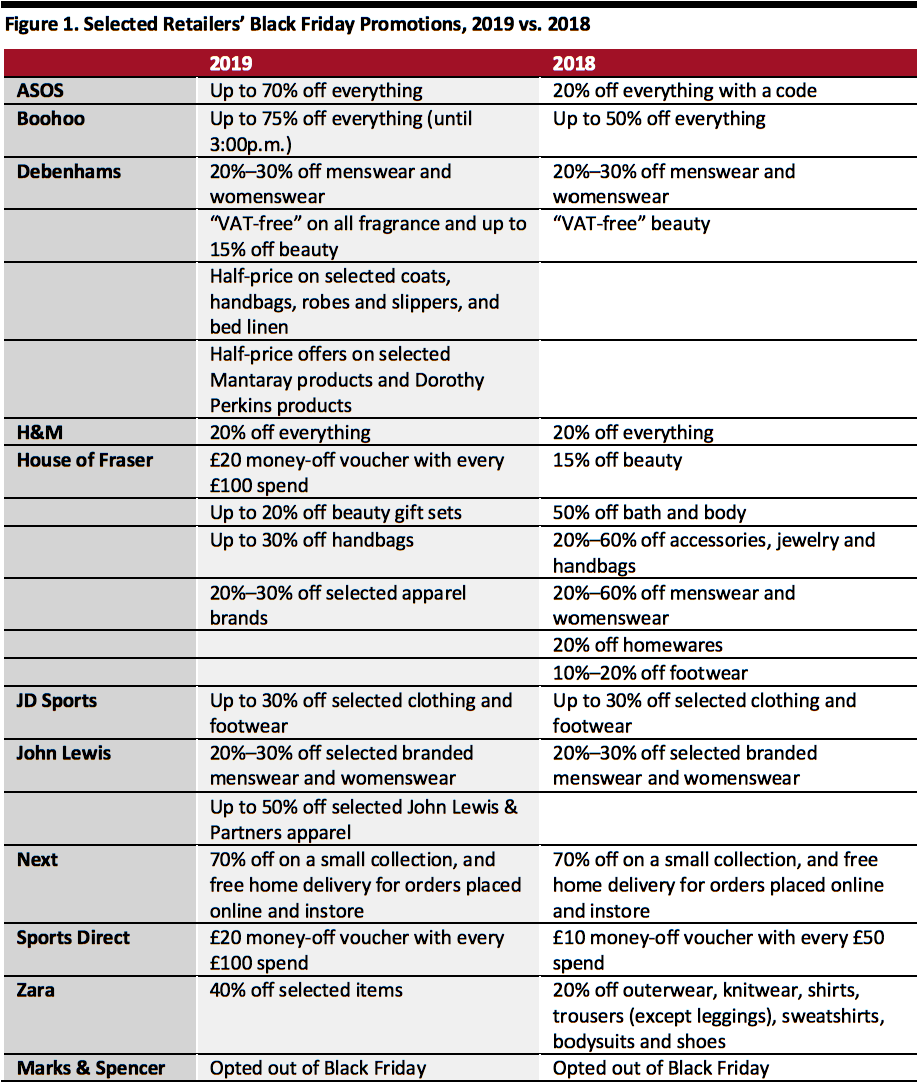

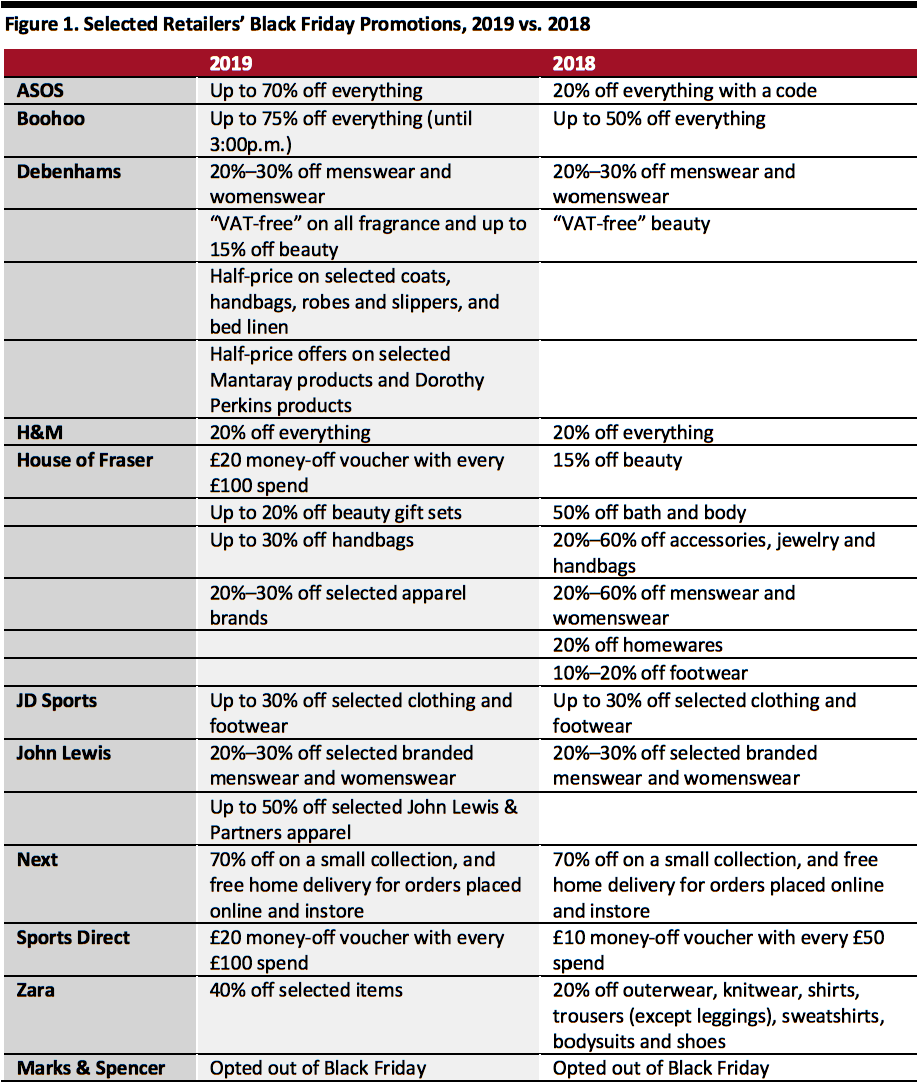

In addition to detailing the activities of individual retailers, we provide a table comparing promotions this year to those of 2018. One theme appears to be deeper promotions that have been applied more selectively: Zara offered 40% off selected products this year versus a 20% discount across a number of categories last year; ASOS offered up to 70% off everything this year (with discounts varying by product) versus a flat 20% voucher code last year.

Black Friday fell six days later this year than in 2018—pushing it further into the Christmas shopping period and after most workers’ end-of-month pay days. Barclaycard reported a 12.5% increase in transaction volumes compared to Black Friday 2018, by 10:00 a.m.

Outperforming Retailers

John Lewis is the typical outperformer on Black Friday. However, we were impressed with the demand and in-store buzz generated by department-store rival Debenhams. An abundance of staff were on hand to give out flyers and assist shoppers, and the store featured a range of product-personalization stations in high-traffic areas. It executed the event well, with dedicated Black Friday-themed windows and festive music adding to the ambiance—although the latter may be basic, it was not noticeable at rival House of Fraser (see later). Debenhams Oxford Street was rewarded with apparently strong shopper numbers by mid- to late morning.

[caption id="attachment_100528" align="aligncenter" width="700"] Debenhams executed Black Friday impressively and saw apparently strong demand.

Debenhams executed Black Friday impressively and saw apparently strong demand.

Source: Coresight Research[/caption] John Lewis also saw strong shopper traffic across departments. As ever, the electronics department was especially busy. In apparel, John Lewis offered brand-wide discounts on many premium brands, as well as deeper discounts on selected John Lewis & Partners private-label products. In many cases, brand discounts appeared to be driven by price-matching under John Lewis’s “Never Knowingly Undersold” pledge. In the store’s bustling electronics department, many shoppers appeared to be browsing nonpromotional goods—suggesting that the promise of deals may drive conversion to full-price purchases. In apparel, John Lewis focused merchandising on full-price products, again suggesting potential for cross-purchasing. This year, John Lewis started its promotions one week before Black Friday, on November 22. On the afternoon of Black Friday, Bérangère Michel, Operations Director, said: “With some of our most compelling deals having gone live overnight, this morning has been particularly busy with customers taking advantage of the new offers.” As of Black Friday afternoon, John Lewis’s best-selling products were the 2019 Apple iPad 10.2” in electronics; Calvin Klein Underwear Cotton Stretch Trunks in apparel; Dior Sauvage Spray Eau de Toilette in beauty; and LEGO Star Wars in toys. [caption id="attachment_100529" align="aligncenter" width="700"] John Lewis’s busy electronics department saw many shoppers browse full-price products.

John Lewis’s busy electronics department saw many shoppers browse full-price products.

Source: Coresight Research[/caption] [caption id="attachment_100530" align="aligncenter" width="700"] John Lewis’s regular (nondiscount) festive merchandising remained prominent, encouraging full-price sales.

John Lewis’s regular (nondiscount) festive merchandising remained prominent, encouraging full-price sales.

Source: Coresight Research[/caption] [caption id="attachment_100531" align="aligncenter" width="700"] Headline deals at John Lewis

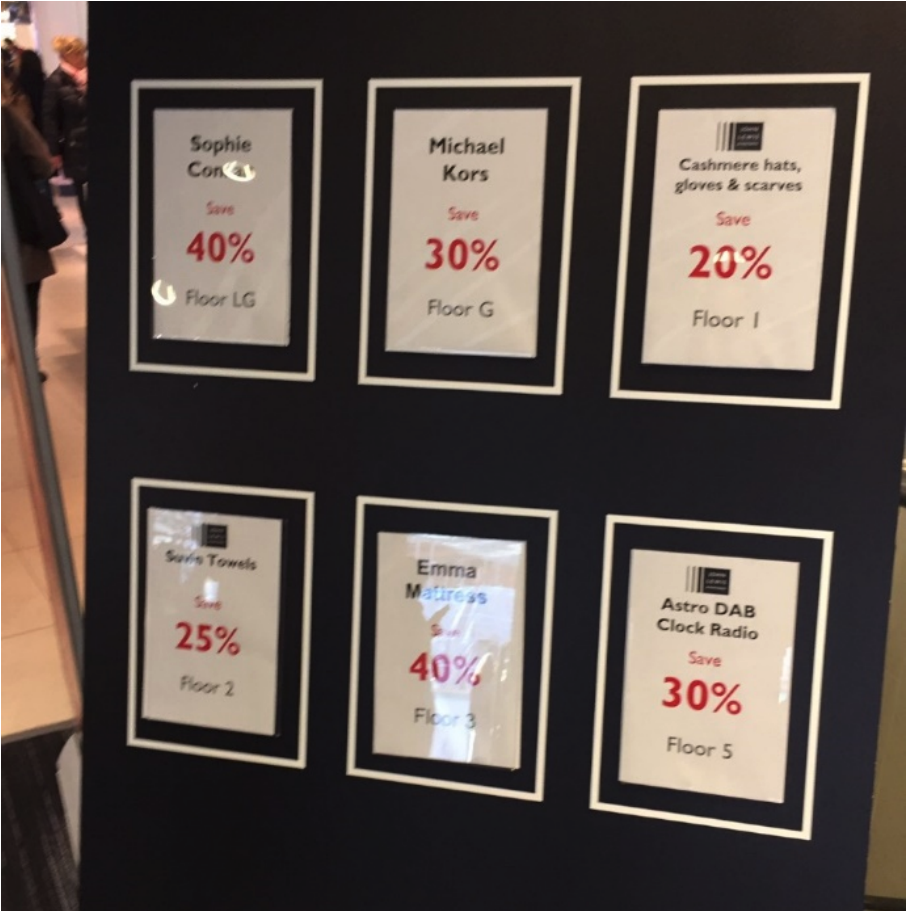

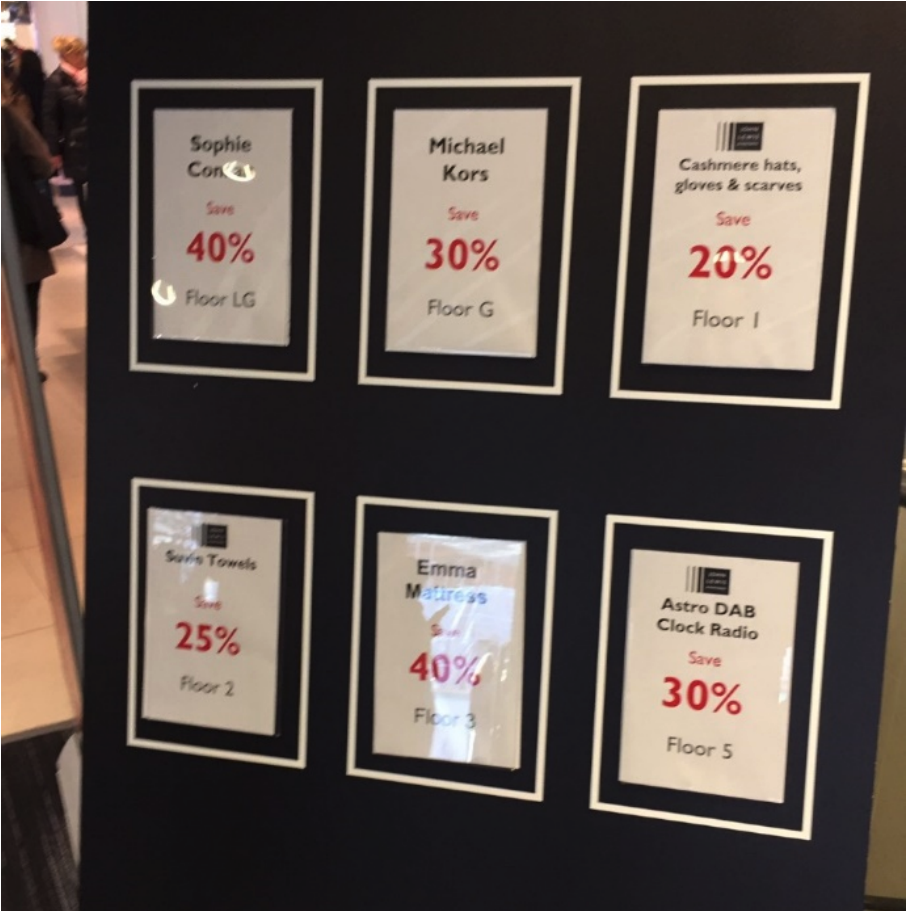

Headline deals at John Lewis

Source: Coresight Research[/caption] In the apparel specialist sector, H&M and Zara saw strong shopper traffic. H&M repeated its “20% off everything” promotion that we saw last year. Zara deepened its (selective) discounts, from 20% in 2018 to 40% this year. [caption id="attachment_100532" align="aligncenter" width="700"] H&M was busier than our image suggests.

H&M was busier than our image suggests.

Source: Coresight Research[/caption] [caption id="attachment_100533" align="aligncenter" width="700"] Shoppers were flocking to Zara by mid-morning.

Shoppers were flocking to Zara by mid-morning.

Source: Coresight Research[/caption] One Notable Underperformer Among the major department stores, House of Fraser was by far the weakest. Even by late morning, shopper traffic was very weak across womenswear and menswear. Traffic was a little stronger in beauty—but that is a pattern we saw across department stores, and it also reflects the beauty hall’s position as a “walk-through” department at the front of the store. Soft demand at House of Fraser was despite the timing being more favorable for Black Friday this year than last. However, the retailer changed its promotional offering to an across-the-board £20 voucher (for a future purchase) for every £100 spent—matching the promotion of sister chain Sports Direct. House of Fraser continued to offer selective discounts on brands and categories, but these were less prominent than in prior years (see later for our comparison of promotions). We note two further factors that are likely to have impacted Black Friday at House of Fraser: [caption id="attachment_100535" align="aligncenter" width="700"]

[caption id="attachment_100535" align="aligncenter" width="700"] House of Fraser saw subdued demand during mid- to late morning.

House of Fraser saw subdued demand during mid- to late morning.

Source: Coresight Research[/caption] Other Stores of Note Electronics is a major Black Friday category, but store traffic did not look especially strong at the UK’s biggest electronics chain, Currys PC World. We visited two of the company’s stores in central London, and while they saw reasonably solid traffic, the strength of in-store demand appeared to be much weaker than that seen at John Lewis. Currys PC World launched its deals online the night before Black Friday. The company noted that it saw two orders every second in its early trading period, with Apple Airpods, the Xbox One S and the Galaxy Tab A 10.1” proving to be the top sellers. A later press release noted strong demand for the iPhone 11; Currys PC World offered £50 off the iPhone 11 Pro and iPhone 11 Pro Max. As in recent years, Next used Black Friday for “authentic” stock clearance, with a flat 70% discount on a very limited selection of clearance products. This contrasts strongly with the across-the-board discounts offered by rivals such as H&M and River Island (which, like H&M, offered 20% off everything in store), and maintains Next’s reputation for price discipline. [caption id="attachment_100536" align="aligncenter" width="700"] Next maintained price discipline by offering (deep) discounts only on a highly limited selection of stock.

Next maintained price discipline by offering (deep) discounts only on a highly limited selection of stock.

Source: Coresight Research[/caption] Adidas’s still-new flagship store on Oxford Street offered 30% discounts on a highly limited range of products, aligning with the store’s focus on brand building. [caption id="attachment_100537" align="aligncenter" width="700"] Selected products were on offer at Adidas LDN.

Selected products were on offer at Adidas LDN.

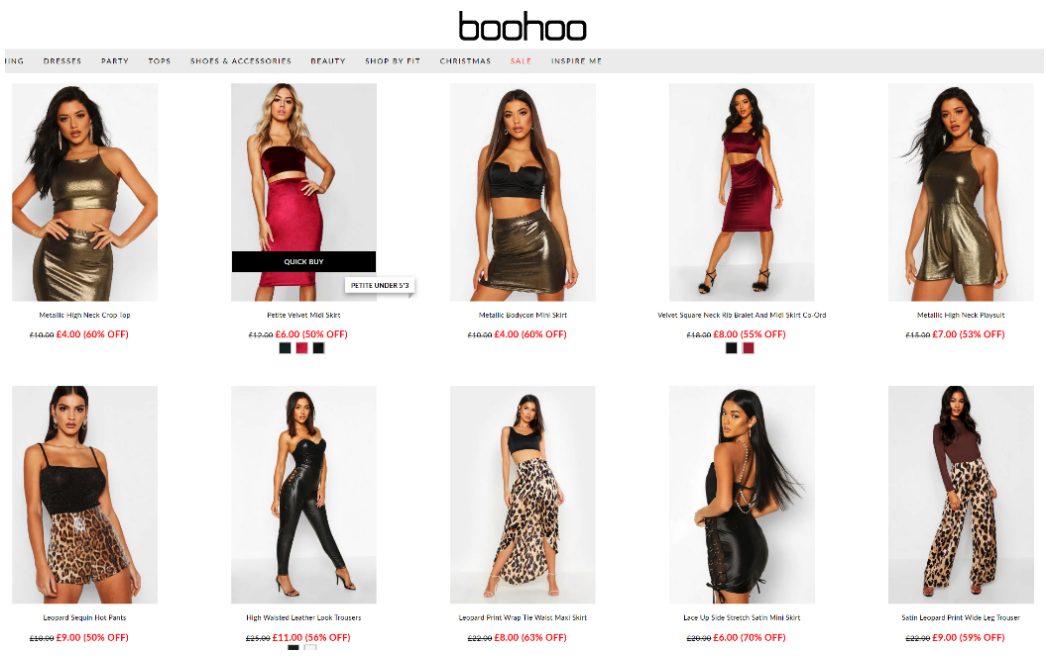

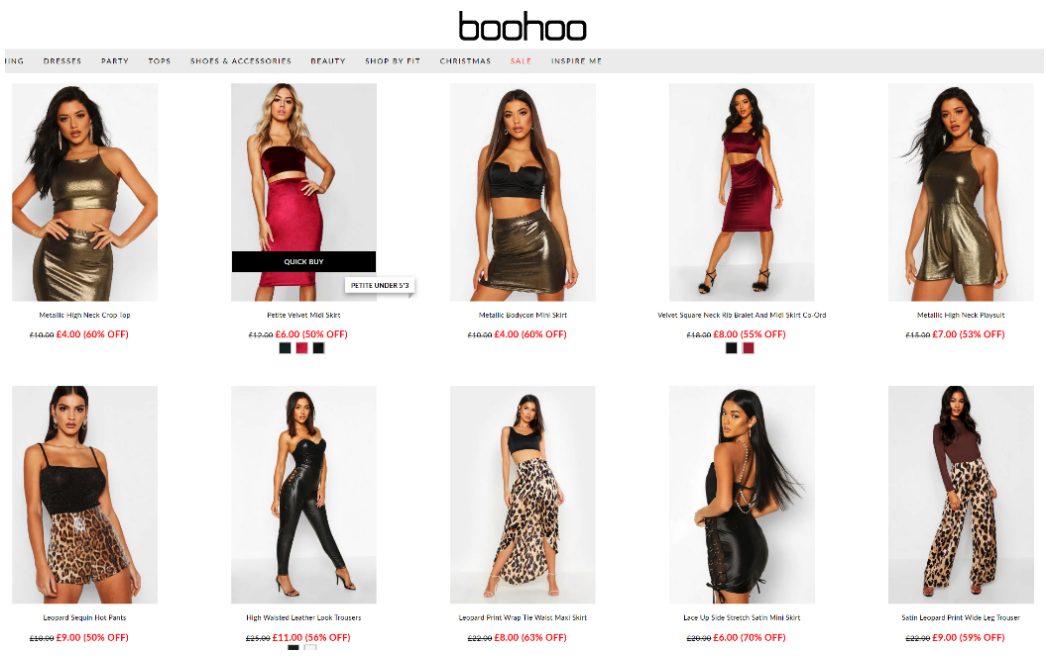

Source: Coresight Research[/caption] As in recent years, Marks & Spencer opted out of Black Friday. Online Promotions ASOS and Boohoo.com deepened their promotions year over year. Boohoo offered up to 75% off everything (versus up to 50% off last year), and ASOS switched from a 20%-off voucher code in 2018 to up to 70% off all products this year. [caption id="attachment_100538" align="aligncenter" width="700"] Boohoo.com offered discounts of up to 75% everything this year.

Boohoo.com offered discounts of up to 75% everything this year.

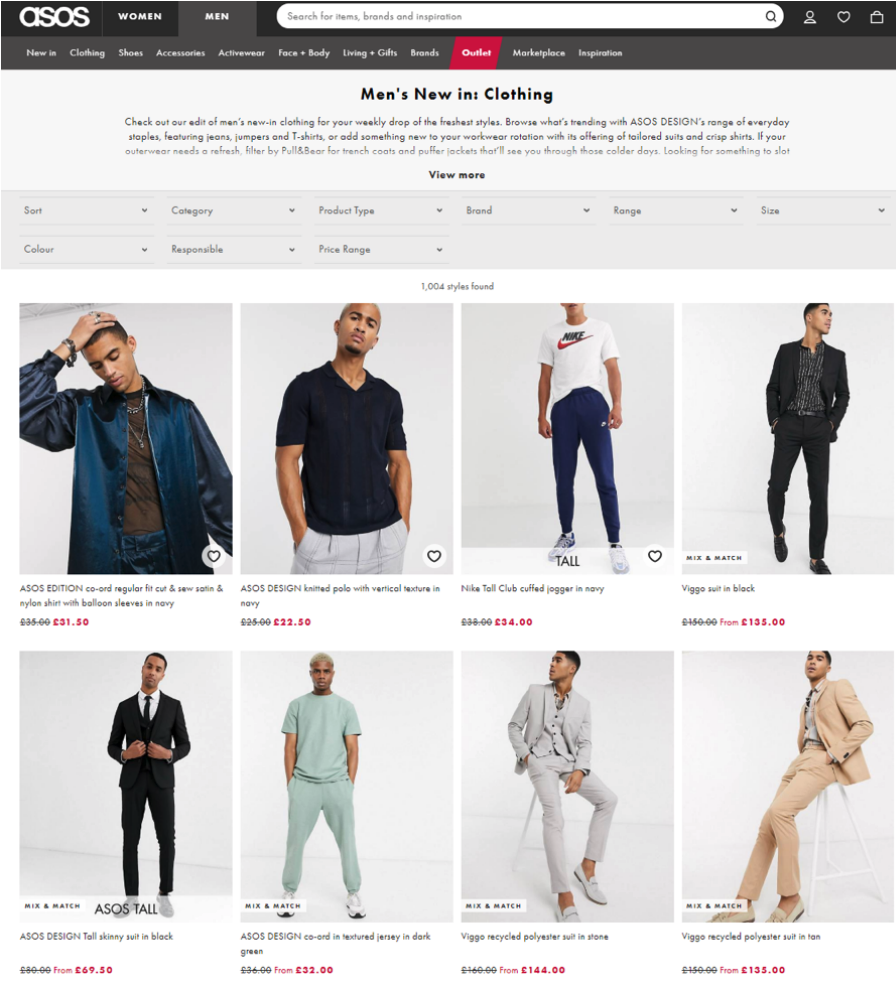

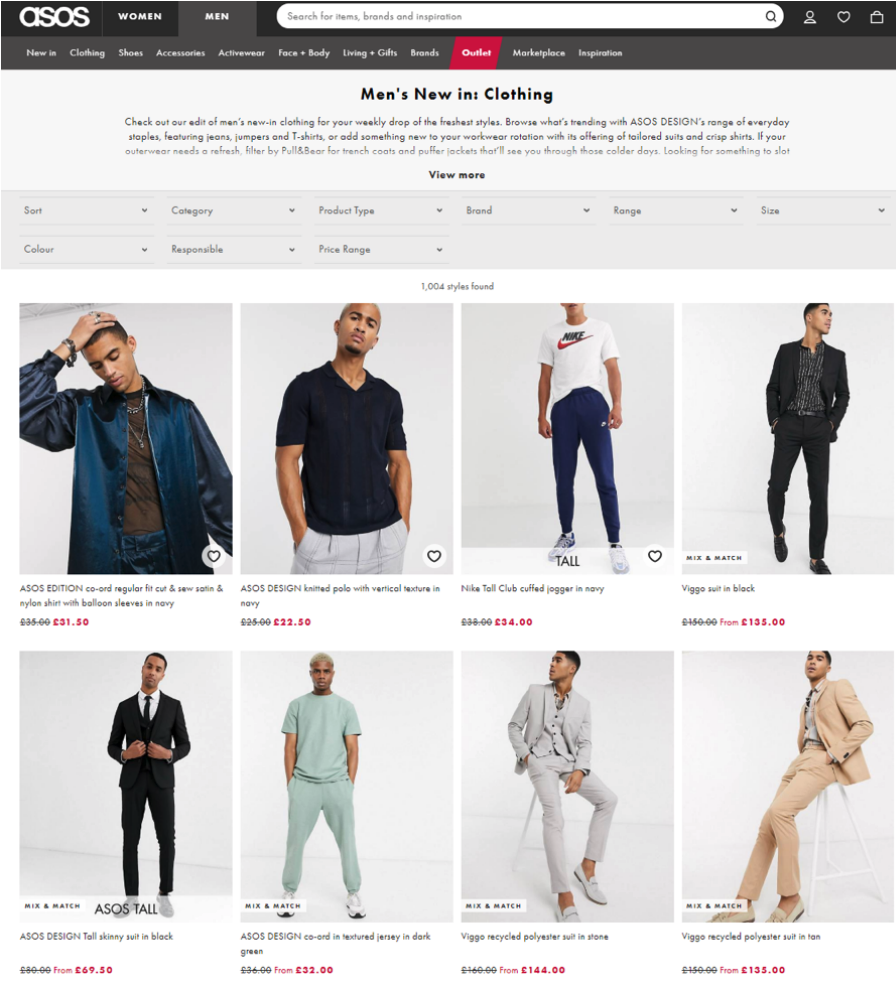

Source: Company website[/caption] [caption id="attachment_100539" align="aligncenter" width="700"] ASOS offered discounts of up to 70% on all products this year.

ASOS offered discounts of up to 70% on all products this year.

Source: Company website[/caption] Amazon UK offered Black Friday promotions for a number of categories, including Amazon devices; computing and software; headphones, speakers and music; mobile phones; TVs, movies and home cinema; toys; and video games and accessories. Its headline deals were the Echo Dot reduced by more than half (from £49.99 to £22.00), Echo Show reduced from £79.99 to 49.99 and the Fire TV Stick cut to half price, from £39.99 to £19.99. Promotion Comparisons [caption id="attachment_100540" align="aligncenter" width="700"] Source: Companies/Coresight Research[/caption]

Source: Companies/Coresight Research[/caption]

Debenhams executed Black Friday impressively and saw apparently strong demand.

Debenhams executed Black Friday impressively and saw apparently strong demand.Source: Coresight Research[/caption] John Lewis also saw strong shopper traffic across departments. As ever, the electronics department was especially busy. In apparel, John Lewis offered brand-wide discounts on many premium brands, as well as deeper discounts on selected John Lewis & Partners private-label products. In many cases, brand discounts appeared to be driven by price-matching under John Lewis’s “Never Knowingly Undersold” pledge. In the store’s bustling electronics department, many shoppers appeared to be browsing nonpromotional goods—suggesting that the promise of deals may drive conversion to full-price purchases. In apparel, John Lewis focused merchandising on full-price products, again suggesting potential for cross-purchasing. This year, John Lewis started its promotions one week before Black Friday, on November 22. On the afternoon of Black Friday, Bérangère Michel, Operations Director, said: “With some of our most compelling deals having gone live overnight, this morning has been particularly busy with customers taking advantage of the new offers.” As of Black Friday afternoon, John Lewis’s best-selling products were the 2019 Apple iPad 10.2” in electronics; Calvin Klein Underwear Cotton Stretch Trunks in apparel; Dior Sauvage Spray Eau de Toilette in beauty; and LEGO Star Wars in toys. [caption id="attachment_100529" align="aligncenter" width="700"]

John Lewis’s busy electronics department saw many shoppers browse full-price products.

John Lewis’s busy electronics department saw many shoppers browse full-price products.Source: Coresight Research[/caption] [caption id="attachment_100530" align="aligncenter" width="700"]

John Lewis’s regular (nondiscount) festive merchandising remained prominent, encouraging full-price sales.

John Lewis’s regular (nondiscount) festive merchandising remained prominent, encouraging full-price sales.Source: Coresight Research[/caption] [caption id="attachment_100531" align="aligncenter" width="700"]

Headline deals at John Lewis

Headline deals at John LewisSource: Coresight Research[/caption] In the apparel specialist sector, H&M and Zara saw strong shopper traffic. H&M repeated its “20% off everything” promotion that we saw last year. Zara deepened its (selective) discounts, from 20% in 2018 to 40% this year. [caption id="attachment_100532" align="aligncenter" width="700"]

H&M was busier than our image suggests.

H&M was busier than our image suggests.Source: Coresight Research[/caption] [caption id="attachment_100533" align="aligncenter" width="700"]

Shoppers were flocking to Zara by mid-morning.

Shoppers were flocking to Zara by mid-morning.Source: Coresight Research[/caption] One Notable Underperformer Among the major department stores, House of Fraser was by far the weakest. Even by late morning, shopper traffic was very weak across womenswear and menswear. Traffic was a little stronger in beauty—but that is a pattern we saw across department stores, and it also reflects the beauty hall’s position as a “walk-through” department at the front of the store. Soft demand at House of Fraser was despite the timing being more favorable for Black Friday this year than last. However, the retailer changed its promotional offering to an across-the-board £20 voucher (for a future purchase) for every £100 spent—matching the promotion of sister chain Sports Direct. House of Fraser continued to offer selective discounts on brands and categories, but these were less prominent than in prior years (see later for our comparison of promotions). We note two further factors that are likely to have impacted Black Friday at House of Fraser:

- The retailer has a substantially more limited private-label selection than previously, having axed the Linea and Howick brands earlier this year. This gave the company less scope for deep price cuts; the deepest discounts in prior years tended to be in private-label apparel.

- Its merchandising was underwhelming—for example, with low-end plastic signage for major brands such as Under Armour in sportswear (the sportswear section in menswear appeared to lean heavily on the kind of product stocked in Sports Direct).

[caption id="attachment_100535" align="aligncenter" width="700"]

[caption id="attachment_100535" align="aligncenter" width="700"] House of Fraser saw subdued demand during mid- to late morning.

House of Fraser saw subdued demand during mid- to late morning.Source: Coresight Research[/caption] Other Stores of Note Electronics is a major Black Friday category, but store traffic did not look especially strong at the UK’s biggest electronics chain, Currys PC World. We visited two of the company’s stores in central London, and while they saw reasonably solid traffic, the strength of in-store demand appeared to be much weaker than that seen at John Lewis. Currys PC World launched its deals online the night before Black Friday. The company noted that it saw two orders every second in its early trading period, with Apple Airpods, the Xbox One S and the Galaxy Tab A 10.1” proving to be the top sellers. A later press release noted strong demand for the iPhone 11; Currys PC World offered £50 off the iPhone 11 Pro and iPhone 11 Pro Max. As in recent years, Next used Black Friday for “authentic” stock clearance, with a flat 70% discount on a very limited selection of clearance products. This contrasts strongly with the across-the-board discounts offered by rivals such as H&M and River Island (which, like H&M, offered 20% off everything in store), and maintains Next’s reputation for price discipline. [caption id="attachment_100536" align="aligncenter" width="700"]

Next maintained price discipline by offering (deep) discounts only on a highly limited selection of stock.

Next maintained price discipline by offering (deep) discounts only on a highly limited selection of stock.Source: Coresight Research[/caption] Adidas’s still-new flagship store on Oxford Street offered 30% discounts on a highly limited range of products, aligning with the store’s focus on brand building. [caption id="attachment_100537" align="aligncenter" width="700"]

Selected products were on offer at Adidas LDN.

Selected products were on offer at Adidas LDN.Source: Coresight Research[/caption] As in recent years, Marks & Spencer opted out of Black Friday. Online Promotions ASOS and Boohoo.com deepened their promotions year over year. Boohoo offered up to 75% off everything (versus up to 50% off last year), and ASOS switched from a 20%-off voucher code in 2018 to up to 70% off all products this year. [caption id="attachment_100538" align="aligncenter" width="700"]

Boohoo.com offered discounts of up to 75% everything this year.

Boohoo.com offered discounts of up to 75% everything this year.Source: Company website[/caption] [caption id="attachment_100539" align="aligncenter" width="700"]

ASOS offered discounts of up to 70% on all products this year.

ASOS offered discounts of up to 70% on all products this year.Source: Company website[/caption] Amazon UK offered Black Friday promotions for a number of categories, including Amazon devices; computing and software; headphones, speakers and music; mobile phones; TVs, movies and home cinema; toys; and video games and accessories. Its headline deals were the Echo Dot reduced by more than half (from £49.99 to £22.00), Echo Show reduced from £79.99 to 49.99 and the Fire TV Stick cut to half price, from £39.99 to £19.99. Promotion Comparisons [caption id="attachment_100540" align="aligncenter" width="700"]

Source: Companies/Coresight Research[/caption]

Source: Companies/Coresight Research[/caption]