DIpil Das

In this report, we dive into the digital outlook for US retailers for the 2019 holiday season. Readers can find our all our US holiday coverage, including our shopper survey report and retail outlook here.

1. Physical Presence Matters as Consumers Shop Across Channels

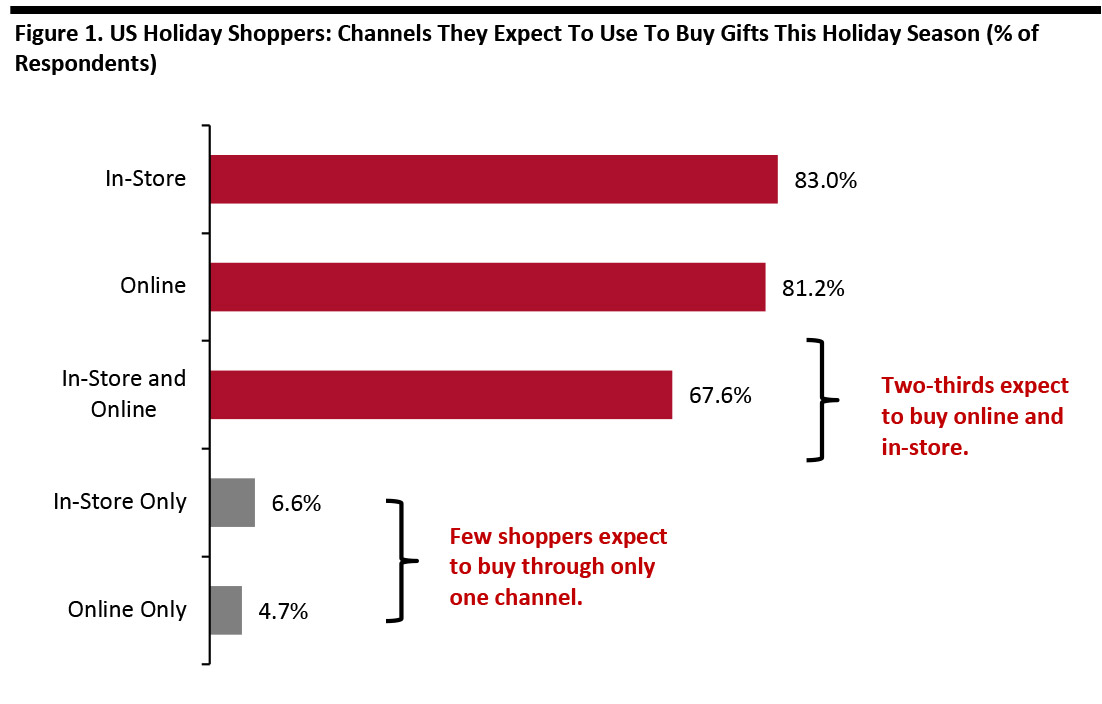

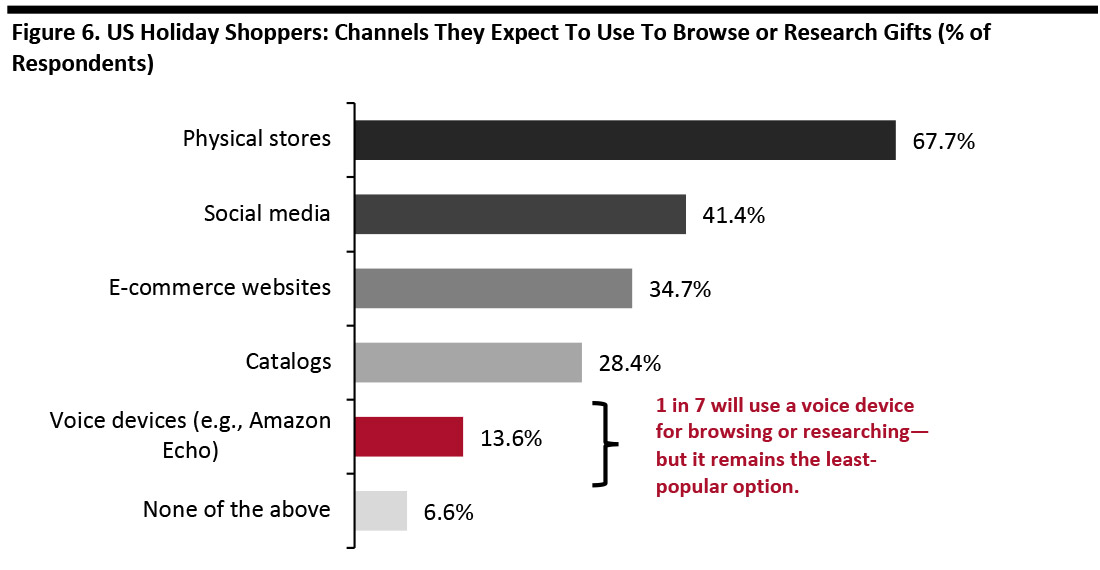

Coresight Research’s 2019 US consumer survey found that 67.6% of respondents expect to shop online and in-store for the holidays. Our survey found just 4.7% expect to shop online only, and only 6.6% expect to shop in-store only. This confirms a trend of cross-channel buying, giving retailers with both physical and digital presences a competitive edge this holiday season.

[caption id="attachment_98005" align="aligncenter" width="700"] Base: 1,784 US Internet users ages 18+ who expect to buy gifts for holiday

Base: 1,784 US Internet users ages 18+ who expect to buy gifts for holiday

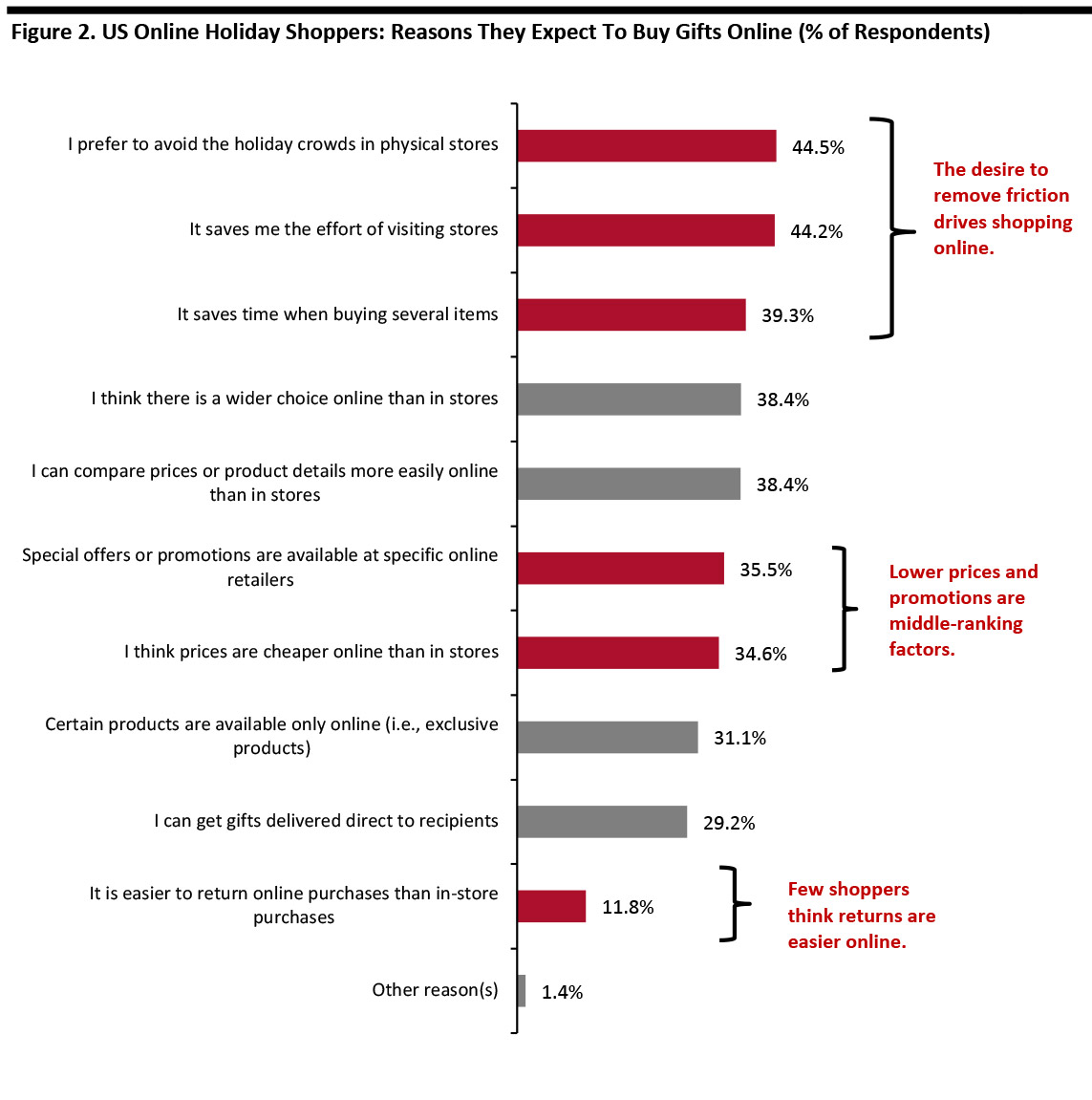

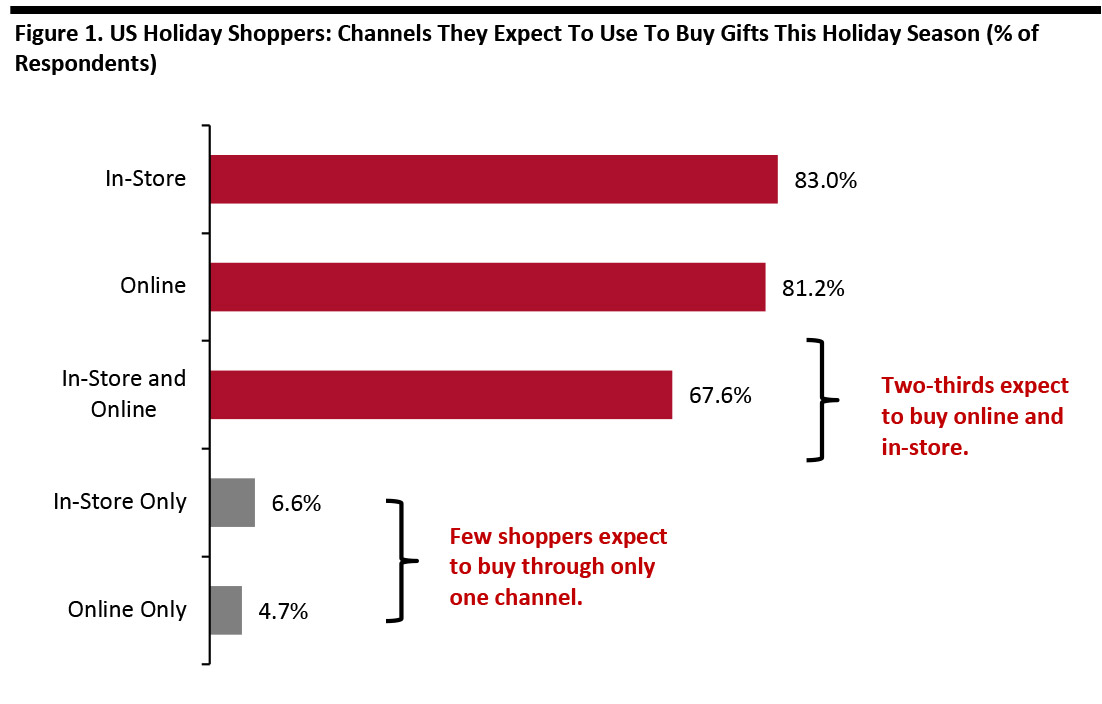

Source: Coresight Research [/caption] 2. Consumers Turn to E-Commerce To Strip Out Friction Consumers desire frictionless shopping experiences, evidenced by the results of our holiday survey, which found that friction and hassle drives shoppers to e-commerce. For example, 44.5% of those who expect to buy online seek to avoid holiday crowds; the effort of visiting stores is a factor for 44.2% of online shoppers; and the time it takes to buy multiple items in store drives 39.3% to buy online. Fundamental to holiday shopping is the ability to make comparisons between products and retailers, and consumers are seeking ways to do this more effectively. Four in 10 shoppers who expect to buy for the holidays through online channels stated that an influencing factor for this decision is that product prices and specifications can be compared more easily than in store. The reputation of Internet retailers for offering cut-priced products remains meaningful—one in three online shoppers believe that prices are cheaper online than in stores, making this a middle-ranking factor. A similar proportion turn to e-commerce for online-only special offers or promotions. In terms of the returns process, only 11.8% of online shoppers think that returns are easier online than in store—this compares to more than a quarter of in-store shoppers believing returns are easier in store than online (not charted). [caption id="attachment_98006" align="aligncenter" width="700"] Respondents could select multiple options.

Respondents could select multiple options.

Base: 1,449 US Internet users ages 18+ who expect to buy gifts online for holiday 2019

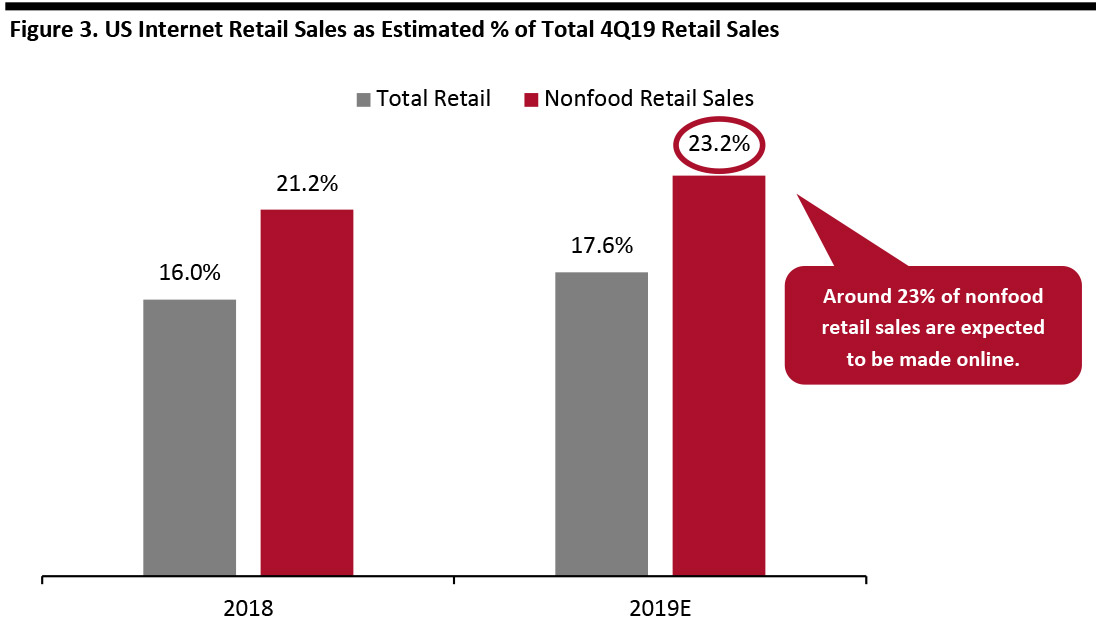

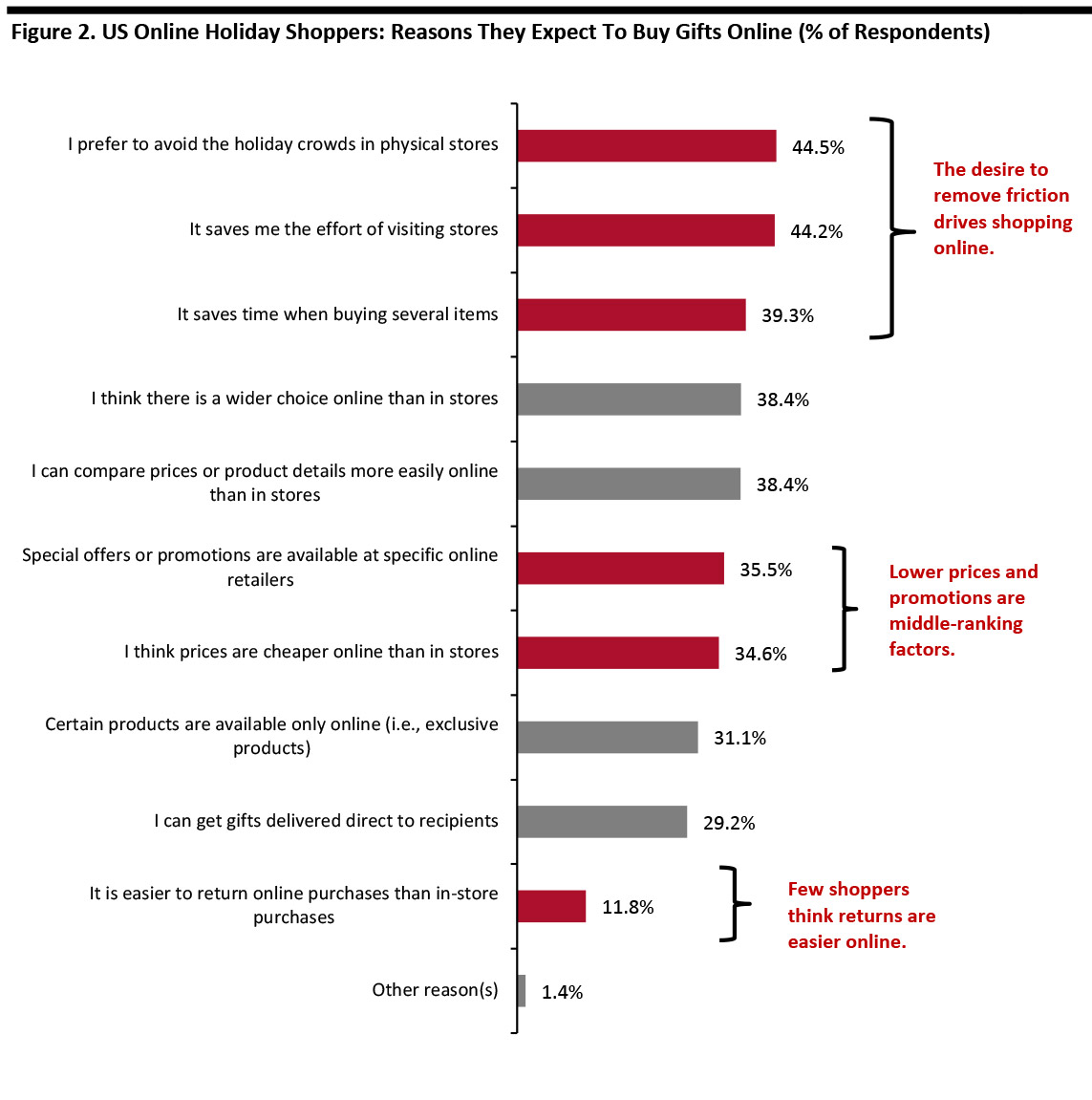

Source: Coresight Research [/caption] 3. Online Estimated To Capture 23% of Nonfood Sales E-commerce is often said to account for “only around 10%” of US retail sales throughout the year, but once we focus on core retail sales (which exclude gasoline and automobiles) and look at just the holiday season, when e-commerce’s market share typically spikes, the online channel becomes much more meaningful. In fact, we predict that e-commerce will account for nearly one-fifth (17.6%) of all retail sales this holiday season, up 160 basis points year over year. A low e-commerce penetration rate for food pulls this total down: We expect to see slightly more than 23% of all nonfood retail sales go online this holiday season, up by around 200 basis points from last year’s estimated share of 21.2%. [caption id="attachment_98007" align="aligncenter" width="700"] Total retail sales exclude automobiles and gasoline.

Total retail sales exclude automobiles and gasoline.

Source: US Census Bureau/Coresight Research [/caption] 4. Prime Will Drive Shoppers to Amazon Amazon will be many consumers’ top destination for holiday shopping, with rising Prime membership rates supporting the company’s revenue growth over the holiday season. Prime locks in loyalty and drives cross-category shopping on Amazon, and data from Prosper Insights & Analytics show that in the five years through September 2019, the proportion of US consumers with a Prime membership rose from under 20% to almost 50%. Prosper’s survey data showed a flatlining membership rate in 2018, but entering 2019, the growth in Prime membership accelerated again. Amazon hosted its annual Prime Day shopping event on July 15 and 16 this year, pushing the proportion of US respondents with a Prime membership to an all-time high of 51.1% in August 2019. However, the number fell back to 47.4% in September, behind the 9-month average of 47.5% this year. Amazon Prime Day 2019, which expanded from 36 hours to 48 hours this year, was the “largest shopping event in Amazon history.” Amazon said it added more new prime members globally on July 15 than it ever has before on a single day. Furthermore, almost the same number of people signed up for Prime membership on July 16. See our coverage on Amazon Prime Day 2019 here. The flexible Prime membership plans lower the cost of participating in Prime Day to as little as $12.99. With many consumers joining Prime and then cancelling their membership after one month, the number of Prime members several months before the holidays has become a less accurate indicator of how many Prime members there will actually be during the holiday peak. [caption id="attachment_98008" align="aligncenter" width="700"] Base: 5,000+ US adults ages 18+ surveyed in each month; data cover March 2013 to September 2019

Base: 5,000+ US adults ages 18+ surveyed in each month; data cover March 2013 to September 2019

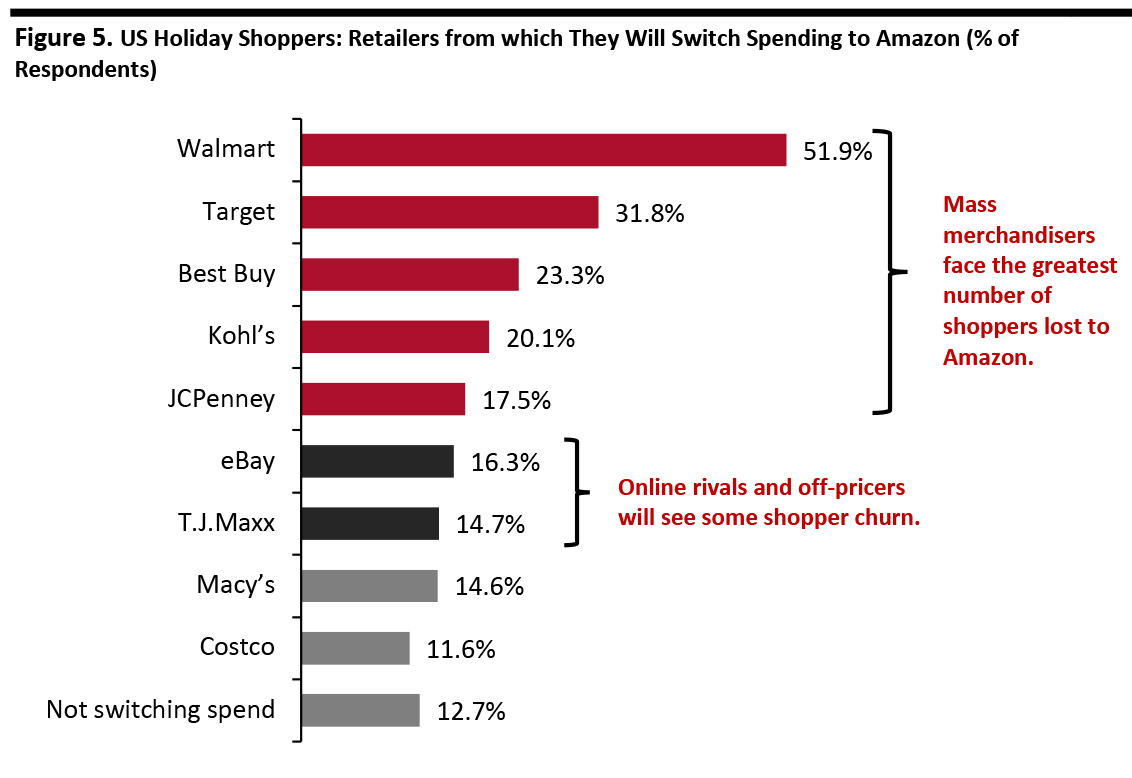

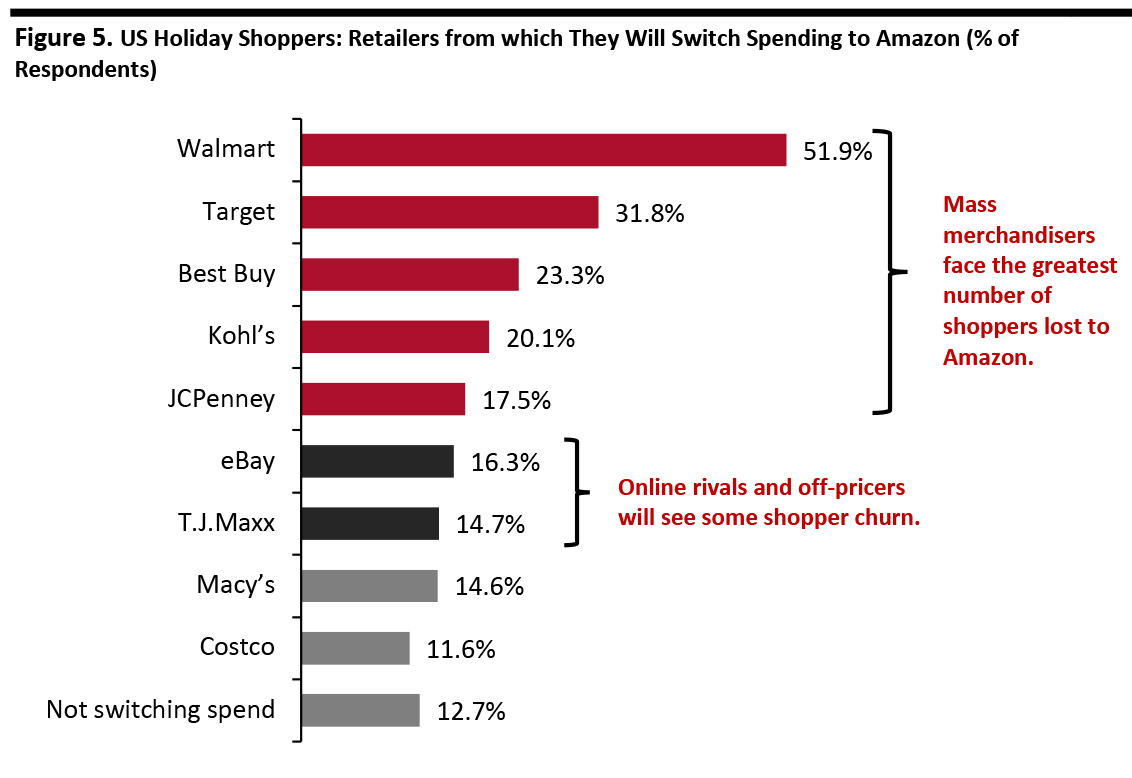

Source: Prosper Insights & Analytics [/caption] Amazon continues to hold a major share of US online retail sales, and the site remains many shoppers’ top online destination this holiday season. Respondents could select multiple options; leading options shown

Respondents could select multiple options; leading options shown

Base: 820 US Internet users ages 18+ who expect to spend more of their holiday budget on Amazon in 2019 than they did in 2018

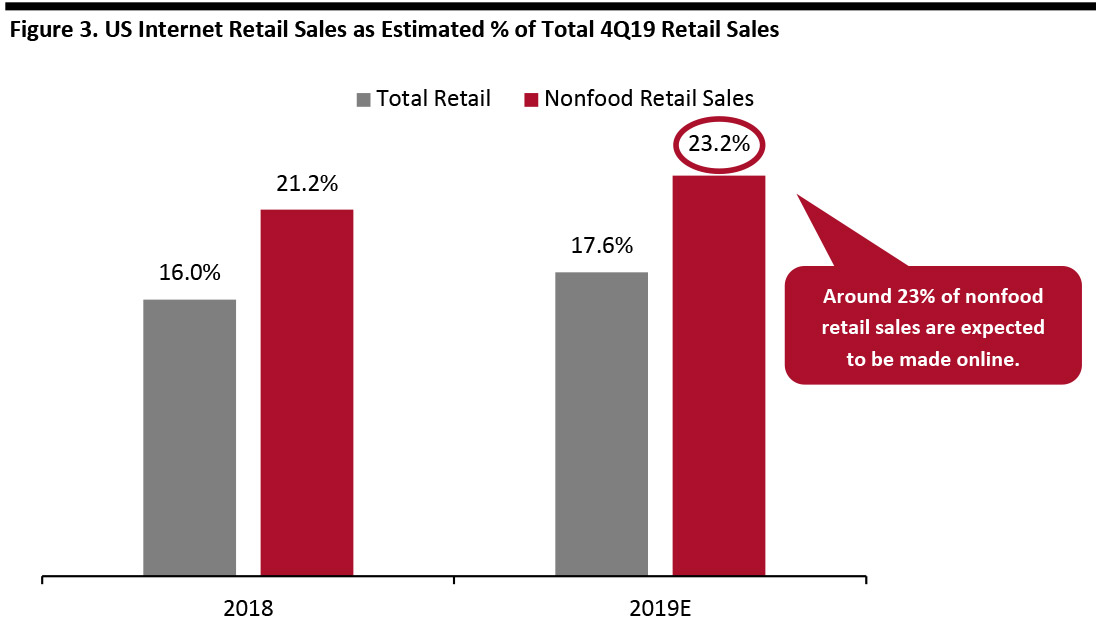

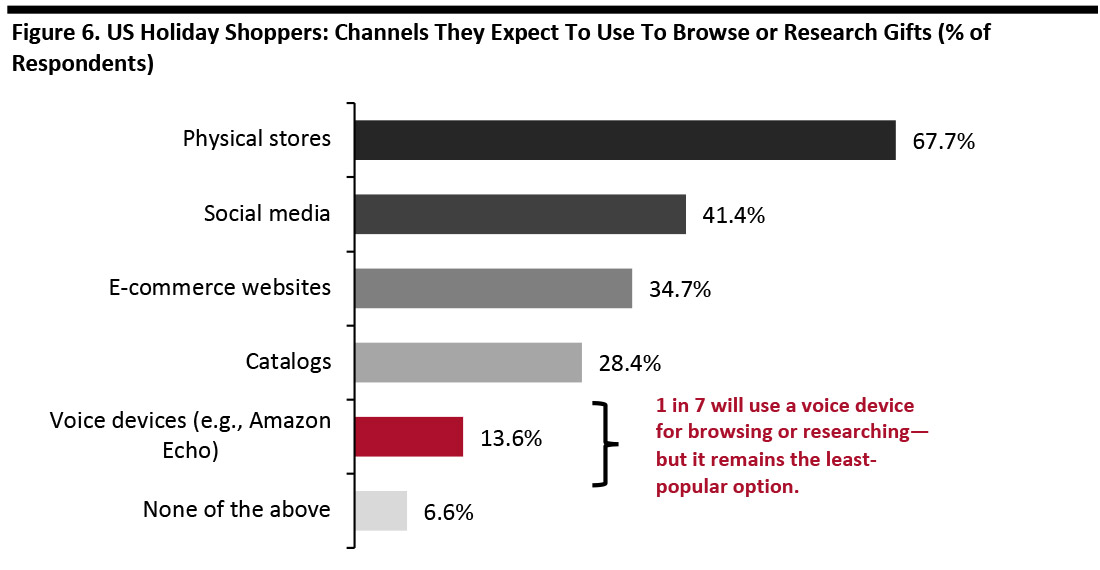

Source: Coresight Research [/caption] 5. Social Media Beats E-Commerce Websites as a Source of Research Reinforcing the prominence of cross-channel shopping are our findings on consumers’ expected browsing habits. 41.4% of those we surveyed will use social media as a source of research, putting it ahead of e-commerce websites and giving platforms and content providers the opportunity to market products to consumers. Voice devices appear to be the least popular method of browsing, although a meaningful 13.6% (one in seven) look set to use this option. [caption id="attachment_98010" align="aligncenter" width="700"] Respondents could select multiple option

Respondents could select multiple option

Base: 1,784 US Internet users ages 18+ who expect to buy gifts for holiday

Source: Coresight Research [/caption] Key Insights This holiday season, retailers should be ready to cater to cross-channel shoppers, whose research and purchase journeys will span digital and physical channels; and be prepared to provide customer service or purchase options through newer channels, including social media and voice commerce.

Base: 1,784 US Internet users ages 18+ who expect to buy gifts for holiday

Base: 1,784 US Internet users ages 18+ who expect to buy gifts for holiday Source: Coresight Research [/caption] 2. Consumers Turn to E-Commerce To Strip Out Friction Consumers desire frictionless shopping experiences, evidenced by the results of our holiday survey, which found that friction and hassle drives shoppers to e-commerce. For example, 44.5% of those who expect to buy online seek to avoid holiday crowds; the effort of visiting stores is a factor for 44.2% of online shoppers; and the time it takes to buy multiple items in store drives 39.3% to buy online. Fundamental to holiday shopping is the ability to make comparisons between products and retailers, and consumers are seeking ways to do this more effectively. Four in 10 shoppers who expect to buy for the holidays through online channels stated that an influencing factor for this decision is that product prices and specifications can be compared more easily than in store. The reputation of Internet retailers for offering cut-priced products remains meaningful—one in three online shoppers believe that prices are cheaper online than in stores, making this a middle-ranking factor. A similar proportion turn to e-commerce for online-only special offers or promotions. In terms of the returns process, only 11.8% of online shoppers think that returns are easier online than in store—this compares to more than a quarter of in-store shoppers believing returns are easier in store than online (not charted). [caption id="attachment_98006" align="aligncenter" width="700"]

Respondents could select multiple options.

Respondents could select multiple options. Base: 1,449 US Internet users ages 18+ who expect to buy gifts online for holiday 2019

Source: Coresight Research [/caption] 3. Online Estimated To Capture 23% of Nonfood Sales E-commerce is often said to account for “only around 10%” of US retail sales throughout the year, but once we focus on core retail sales (which exclude gasoline and automobiles) and look at just the holiday season, when e-commerce’s market share typically spikes, the online channel becomes much more meaningful. In fact, we predict that e-commerce will account for nearly one-fifth (17.6%) of all retail sales this holiday season, up 160 basis points year over year. A low e-commerce penetration rate for food pulls this total down: We expect to see slightly more than 23% of all nonfood retail sales go online this holiday season, up by around 200 basis points from last year’s estimated share of 21.2%. [caption id="attachment_98007" align="aligncenter" width="700"]

Total retail sales exclude automobiles and gasoline.

Total retail sales exclude automobiles and gasoline. Source: US Census Bureau/Coresight Research [/caption] 4. Prime Will Drive Shoppers to Amazon Amazon will be many consumers’ top destination for holiday shopping, with rising Prime membership rates supporting the company’s revenue growth over the holiday season. Prime locks in loyalty and drives cross-category shopping on Amazon, and data from Prosper Insights & Analytics show that in the five years through September 2019, the proportion of US consumers with a Prime membership rose from under 20% to almost 50%. Prosper’s survey data showed a flatlining membership rate in 2018, but entering 2019, the growth in Prime membership accelerated again. Amazon hosted its annual Prime Day shopping event on July 15 and 16 this year, pushing the proportion of US respondents with a Prime membership to an all-time high of 51.1% in August 2019. However, the number fell back to 47.4% in September, behind the 9-month average of 47.5% this year. Amazon Prime Day 2019, which expanded from 36 hours to 48 hours this year, was the “largest shopping event in Amazon history.” Amazon said it added more new prime members globally on July 15 than it ever has before on a single day. Furthermore, almost the same number of people signed up for Prime membership on July 16. See our coverage on Amazon Prime Day 2019 here. The flexible Prime membership plans lower the cost of participating in Prime Day to as little as $12.99. With many consumers joining Prime and then cancelling their membership after one month, the number of Prime members several months before the holidays has become a less accurate indicator of how many Prime members there will actually be during the holiday peak. [caption id="attachment_98008" align="aligncenter" width="700"]

Base: 5,000+ US adults ages 18+ surveyed in each month; data cover March 2013 to September 2019

Base: 5,000+ US adults ages 18+ surveyed in each month; data cover March 2013 to September 2019 Source: Prosper Insights & Analytics [/caption] Amazon continues to hold a major share of US online retail sales, and the site remains many shoppers’ top online destination this holiday season.

- We estimate that Amazon captured a 35.2% share of US online retail sales in 2018 overall, and we predict that this will rise to around 35.9% for 2019—these estimates include sales by third-party merchants on Amazon.com.

- Our 2019 US holiday survey found that just over three-quarters of survey respondents expect to turn to Amazon and/or Walmart for holiday gift shopping—putting these retailers neck and neck by number of shoppers.

Respondents could select multiple options; leading options shown

Respondents could select multiple options; leading options shown Base: 820 US Internet users ages 18+ who expect to spend more of their holiday budget on Amazon in 2019 than they did in 2018

Source: Coresight Research [/caption] 5. Social Media Beats E-Commerce Websites as a Source of Research Reinforcing the prominence of cross-channel shopping are our findings on consumers’ expected browsing habits. 41.4% of those we surveyed will use social media as a source of research, putting it ahead of e-commerce websites and giving platforms and content providers the opportunity to market products to consumers. Voice devices appear to be the least popular method of browsing, although a meaningful 13.6% (one in seven) look set to use this option. [caption id="attachment_98010" align="aligncenter" width="700"]

Respondents could select multiple option

Respondents could select multiple option Base: 1,784 US Internet users ages 18+ who expect to buy gifts for holiday

Source: Coresight Research [/caption] Key Insights This holiday season, retailers should be ready to cater to cross-channel shoppers, whose research and purchase journeys will span digital and physical channels; and be prepared to provide customer service or purchase options through newer channels, including social media and voice commerce.