Nitheesh NH

The NRF’s annual holiday spending survey states that US consumers plan to spend 4.0% more than they did last year. This figure corroborates Coresight Research’s expectation of a 4.0% year-over-year increase in US retail sales during the holiday months of November and December. Using data from Prosper Insights & Analytics, we offer key insights into the expectations for the holidays this year that could benefit retailers and brands as they approach the shopping season.

Spending Intention Trends across Different Age Groups

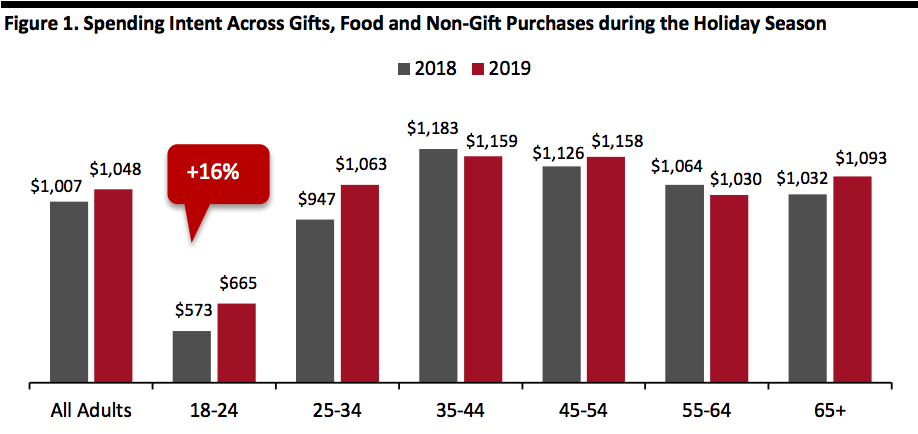

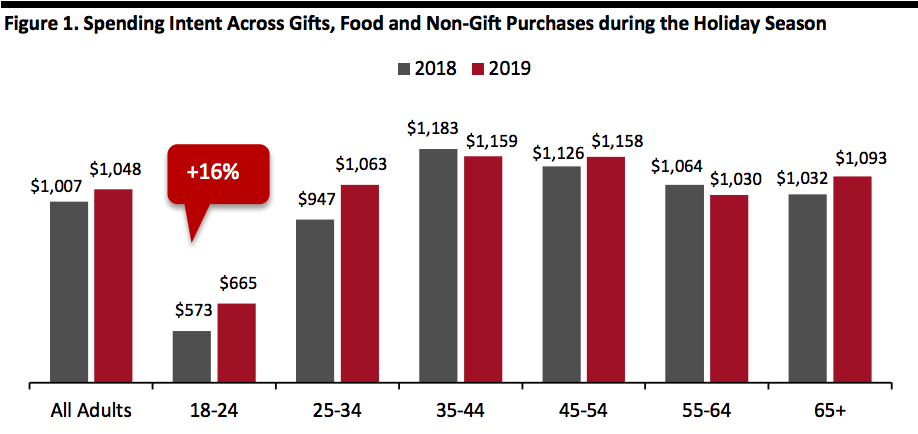

On average, US consumers are set to spend $1,048 this holiday shopping season, with those aged 35-44 continuing to be the biggest spenders ($1,159). Although Gen-Zers, aged 18-24, intend to spend the least ($665), this demographic has seen the biggest increase of 16% year over year. The spend of shoppers aged 25-34 is up 12% ($1,063), while consumers aged 55-64 fell slightly behind the overall average with a spending intent of $1,030.

However, although the average spend of all adults may be higher this year, we saw only 91.4% of the survey respondents plan to celebrate the winter holidays, which is the lowest participation rate since 2012.

[caption id="attachment_99378" align="aligncenter" width="700"] Source: NRF/Prosper Insights & Analytics [/caption]

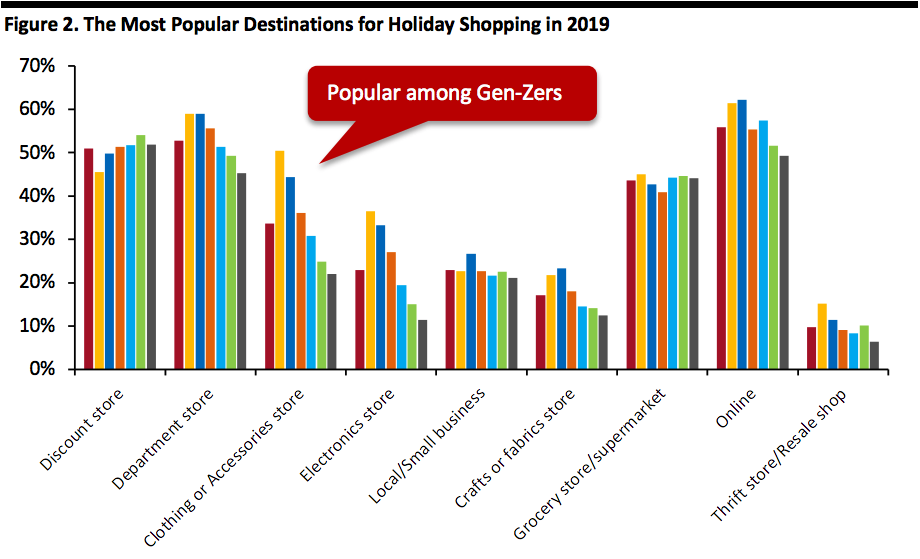

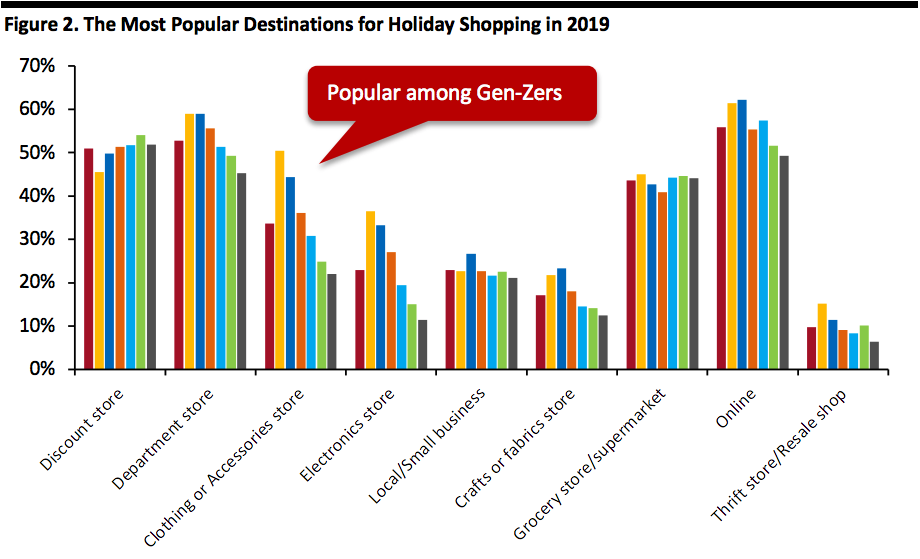

The total percentage of all adults choosing to shop at department stores is higher than the number for discount stores, showing that the former is the most popular brick-and-mortar destination for gift shopping for the fourth consecutive year.

The youngest consumer group saw 50.4% of survey respondents plan to shop at clothing or accessories stores, which is the highest rate for that destination among all age bands. Similarly, and in-keeping with the demand for apparel, 15.2% of the 18-24-yr-old consumers plan to shop at thrift stores/resale shops, a figure that is much greater than the 9.7% of all adults. Read our report on the apparel resale market here.

E-commerce is no doubt set to be the most visited shopping channel, with 55.8% of US consumers intending to shop online this year.

[caption id="attachment_99379" align="aligncenter" width="700"]

Source: NRF/Prosper Insights & Analytics [/caption]

The total percentage of all adults choosing to shop at department stores is higher than the number for discount stores, showing that the former is the most popular brick-and-mortar destination for gift shopping for the fourth consecutive year.

The youngest consumer group saw 50.4% of survey respondents plan to shop at clothing or accessories stores, which is the highest rate for that destination among all age bands. Similarly, and in-keeping with the demand for apparel, 15.2% of the 18-24-yr-old consumers plan to shop at thrift stores/resale shops, a figure that is much greater than the 9.7% of all adults. Read our report on the apparel resale market here.

E-commerce is no doubt set to be the most visited shopping channel, with 55.8% of US consumers intending to shop online this year.

[caption id="attachment_99379" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

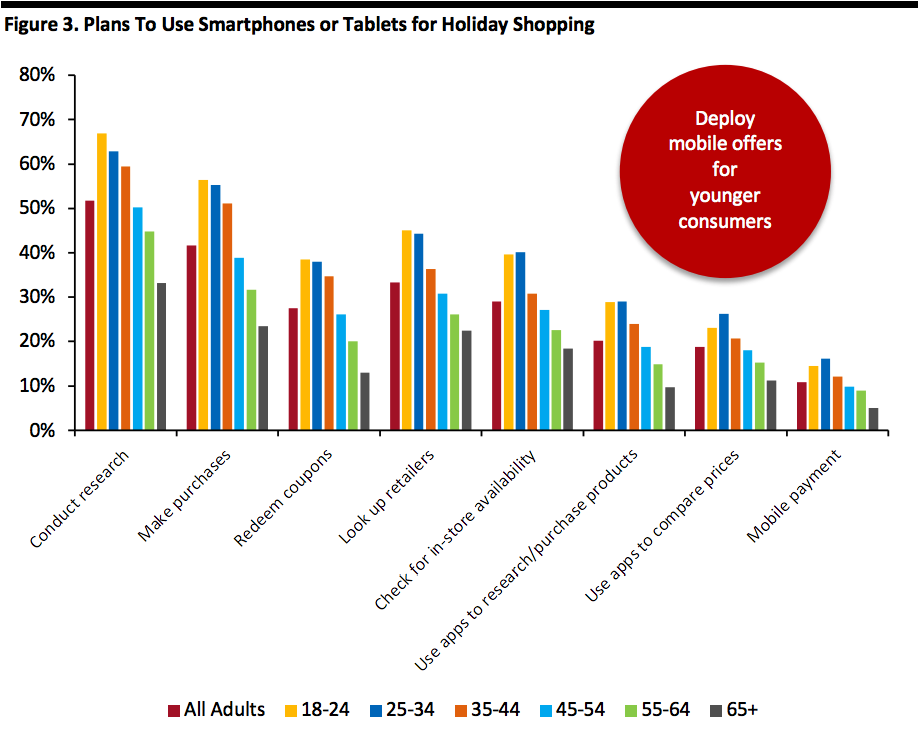

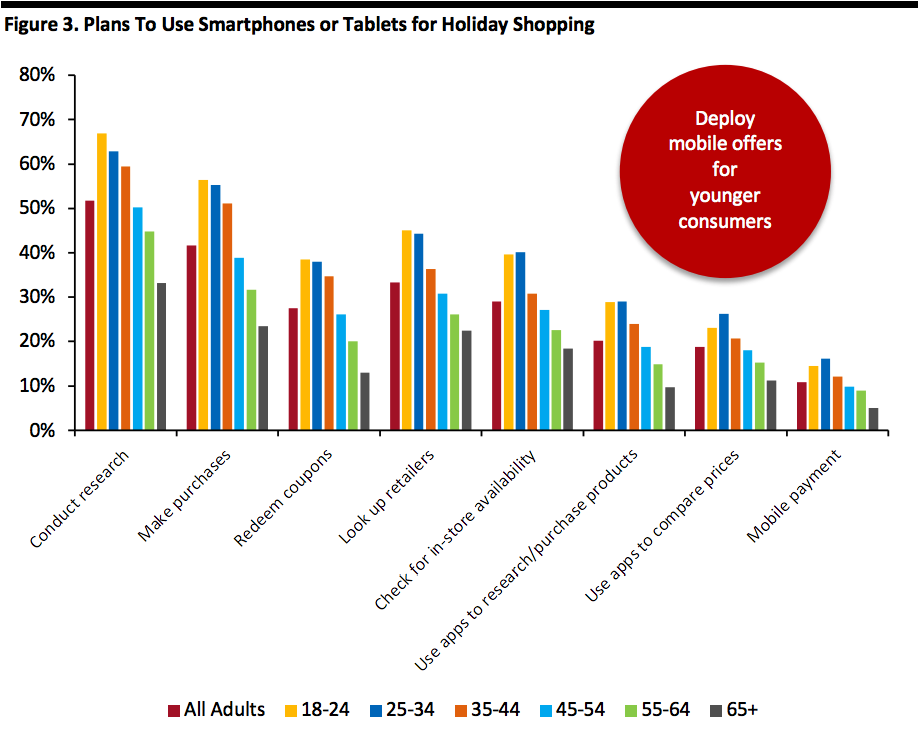

Mobile devices continue to play an important role in holiday shopping, as 51.7% of total adults plan to use smartphones or tablets to research products and compare prices this season. As might be expected, younger consumers will use them more regularly than older consumers. Purchasing products has been identified as the second-most popular way to use mobile devices (41.6% of all adults), followed by looking up retailer information (33.4%) and checking for in-store availability of products (29.1%).

Therefore, in order to remain competitive during the holiday 2019, retailers should be ready to offer consumers mobile-friendly functions that help them to search, compare and purchase products.

[caption id="attachment_99380" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Mobile devices continue to play an important role in holiday shopping, as 51.7% of total adults plan to use smartphones or tablets to research products and compare prices this season. As might be expected, younger consumers will use them more regularly than older consumers. Purchasing products has been identified as the second-most popular way to use mobile devices (41.6% of all adults), followed by looking up retailer information (33.4%) and checking for in-store availability of products (29.1%).

Therefore, in order to remain competitive during the holiday 2019, retailers should be ready to offer consumers mobile-friendly functions that help them to search, compare and purchase products.

[caption id="attachment_99380" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Key Influences on Shopping Decisions for the Holiday Season

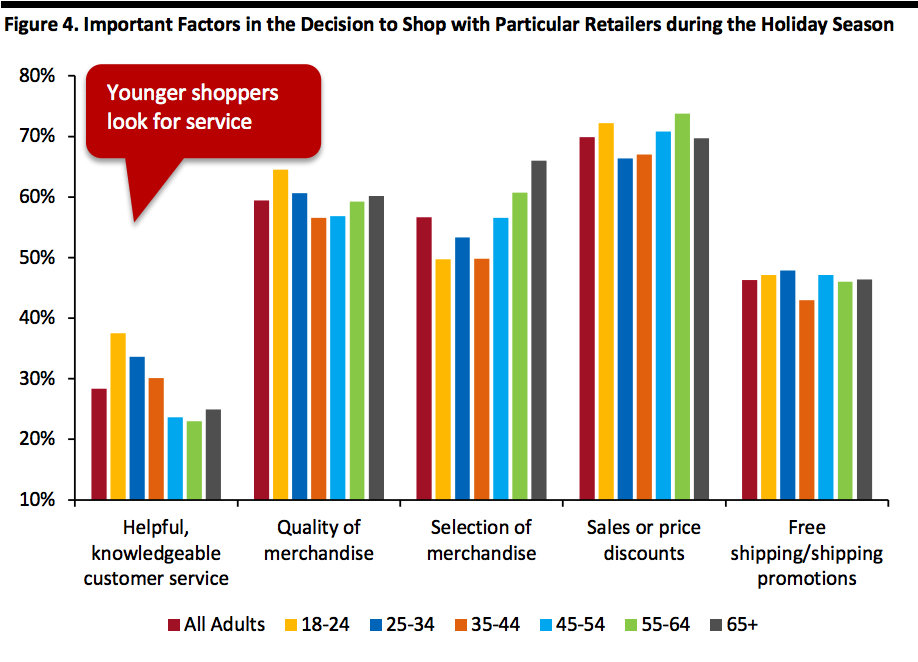

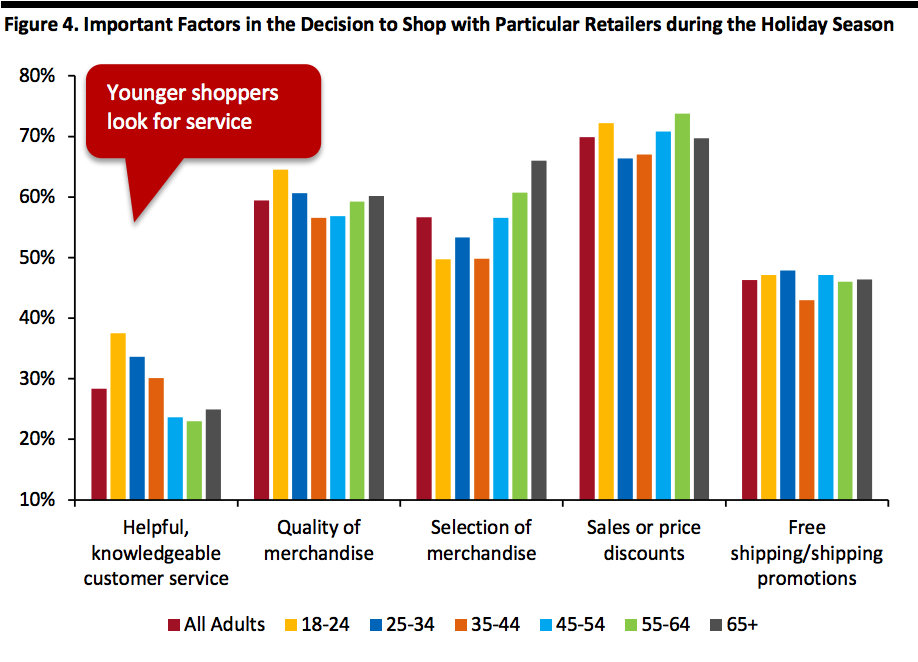

Matching the trend that was identified in 2018, roughly 70% of each age group this year considers sales and discounts to be the most important factor in choosing a particular retailer.

Quality is more important to younger consumers, whereas selection is the highest priority for older shoppers. The importance of helpful, knowledgeable customer service was highlighted by 28.3% of all adults this year, up from last year’s 25.6%. More than one-third of consumers aged 18-34 consider service to hold significance in their shopping experience, which is a much higher portion than in other age cohorts.

[caption id="attachment_99381" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Key Influences on Shopping Decisions for the Holiday Season

Matching the trend that was identified in 2018, roughly 70% of each age group this year considers sales and discounts to be the most important factor in choosing a particular retailer.

Quality is more important to younger consumers, whereas selection is the highest priority for older shoppers. The importance of helpful, knowledgeable customer service was highlighted by 28.3% of all adults this year, up from last year’s 25.6%. More than one-third of consumers aged 18-34 consider service to hold significance in their shopping experience, which is a much higher portion than in other age cohorts.

[caption id="attachment_99381" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

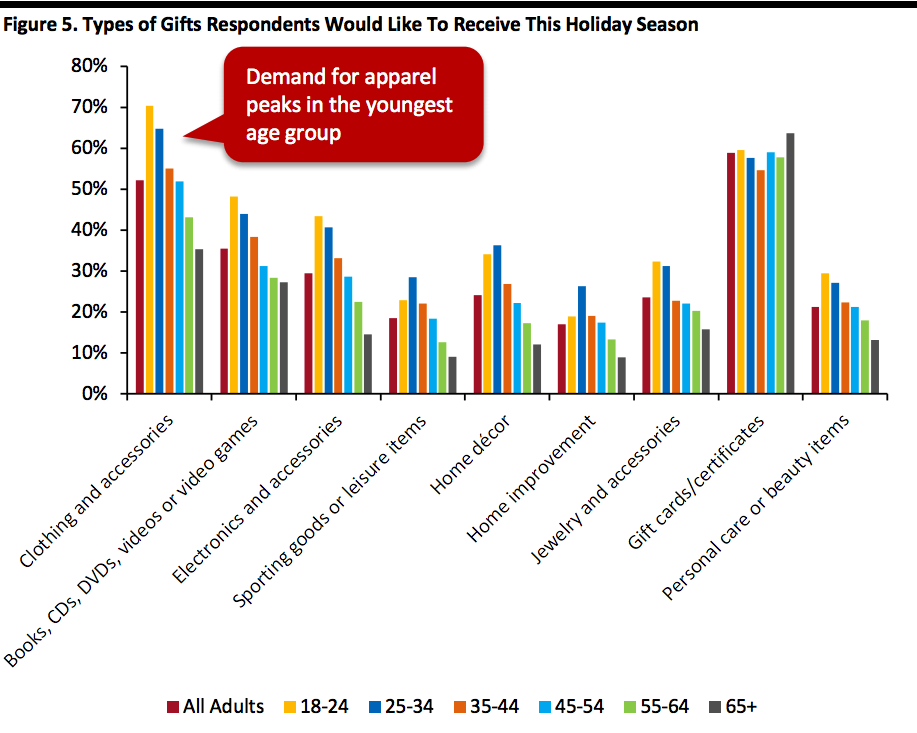

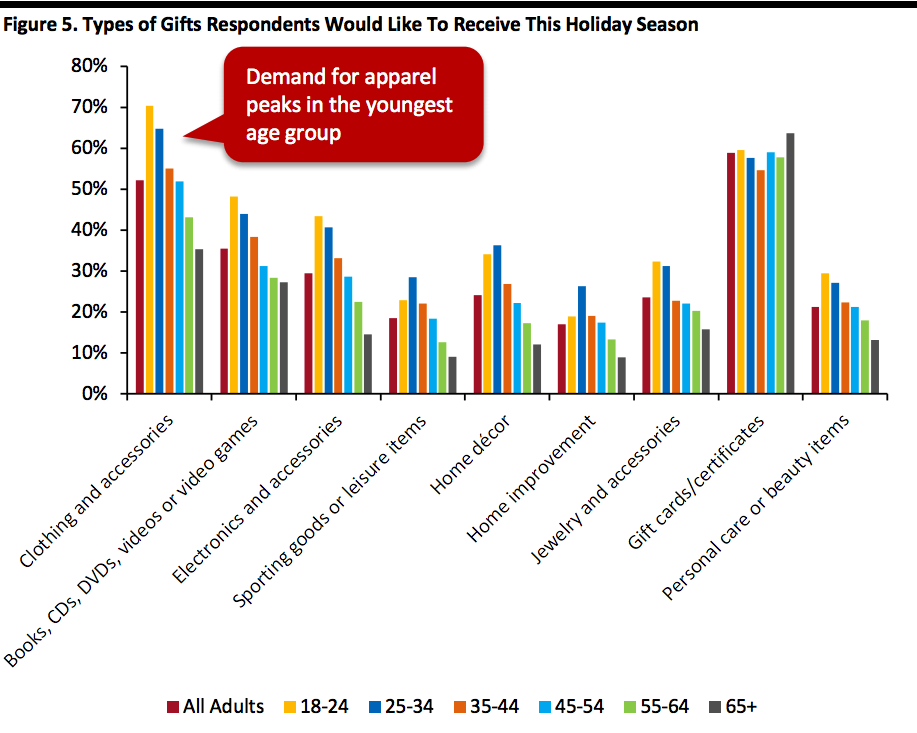

Gift cards remain the most-desired gift this holiday, with 58.8% of survey respondents choosing this category. However, not all gift cards are for retailers; consumers can purchase them from hotels, restaurants, online service providers etc. Retailers can add new stock keeping units post Christmas to appeal to consumers with gift cards.

In addition, personal care and beauty products saw a significant two-percentage-point increase in popularity for all adults, and almost 30% of consumers aged 18-34 would like to receive gifts in this category.

[caption id="attachment_99382" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Gift cards remain the most-desired gift this holiday, with 58.8% of survey respondents choosing this category. However, not all gift cards are for retailers; consumers can purchase them from hotels, restaurants, online service providers etc. Retailers can add new stock keeping units post Christmas to appeal to consumers with gift cards.

In addition, personal care and beauty products saw a significant two-percentage-point increase in popularity for all adults, and almost 30% of consumers aged 18-34 would like to receive gifts in this category.

[caption id="attachment_99382" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

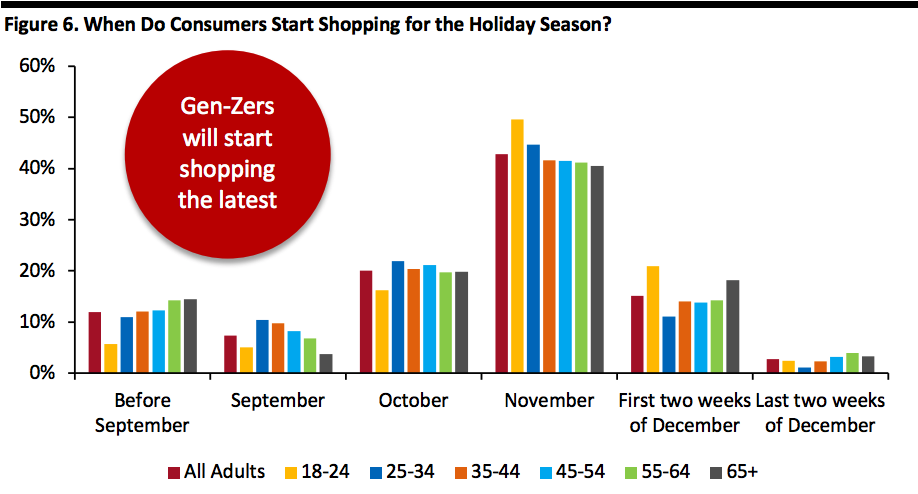

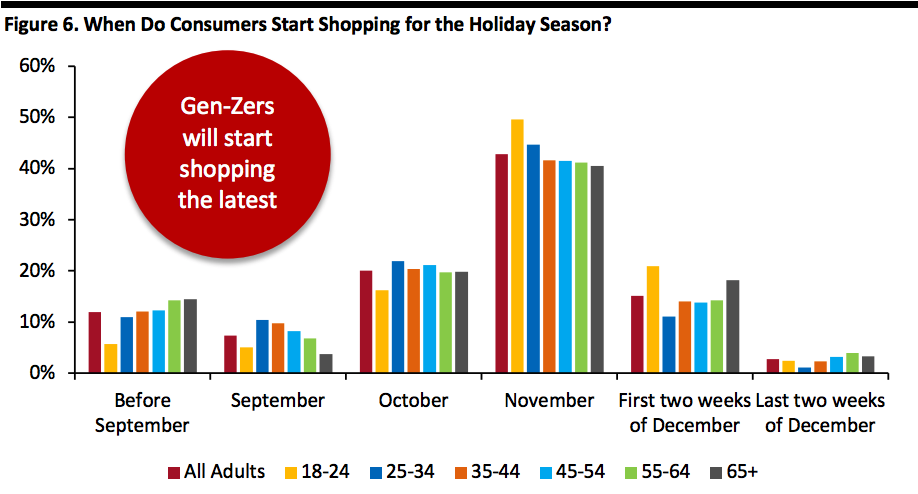

Consumers’ Preference for when To Shop for Holiday Gifts

November is set to be the peak time for holiday shopping in 2019, with almost 43% of all US consumers and 50% of Gen-Zers confirming plans to start making purchases in this month. Survey results show that 73% of Gen-Zers and 62% of consumers aged 65+ do not start shopping for the holiday season before November.

[caption id="attachment_99383" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Consumers’ Preference for when To Shop for Holiday Gifts

November is set to be the peak time for holiday shopping in 2019, with almost 43% of all US consumers and 50% of Gen-Zers confirming plans to start making purchases in this month. Survey results show that 73% of Gen-Zers and 62% of consumers aged 65+ do not start shopping for the holiday season before November.

[caption id="attachment_99383" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

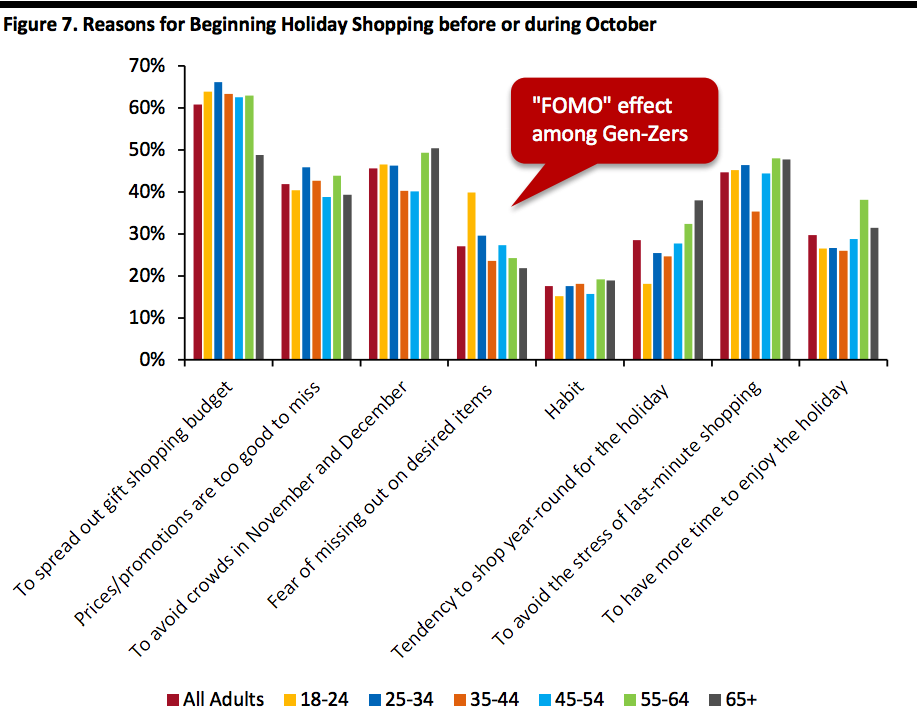

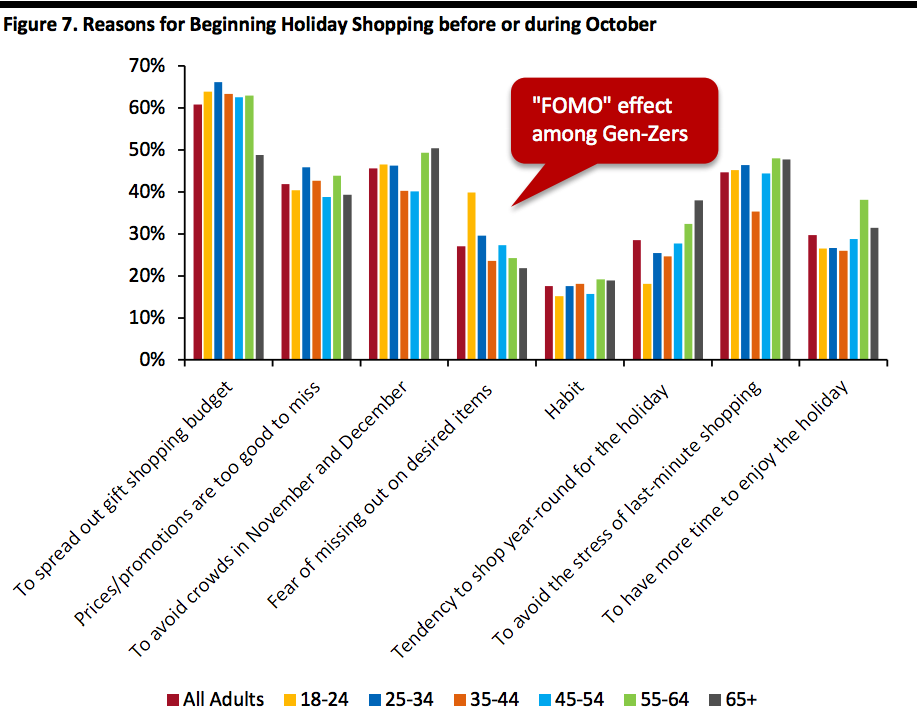

Of the consumers who begin shopping before or during October, 61% cited an intention to spread out the gift shopping budget, and 46% try to avoid the crowds traditionally associated with shopping in November and December.

The fear of missing out is well demonstrated among early Gen-Z shoppers, nearly 40% of which expressed the need to purchase desired items as soon as they could.

[caption id="attachment_99384" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Of the consumers who begin shopping before or during October, 61% cited an intention to spread out the gift shopping budget, and 46% try to avoid the crowds traditionally associated with shopping in November and December.

The fear of missing out is well demonstrated among early Gen-Z shoppers, nearly 40% of which expressed the need to purchase desired items as soon as they could.

[caption id="attachment_99384" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

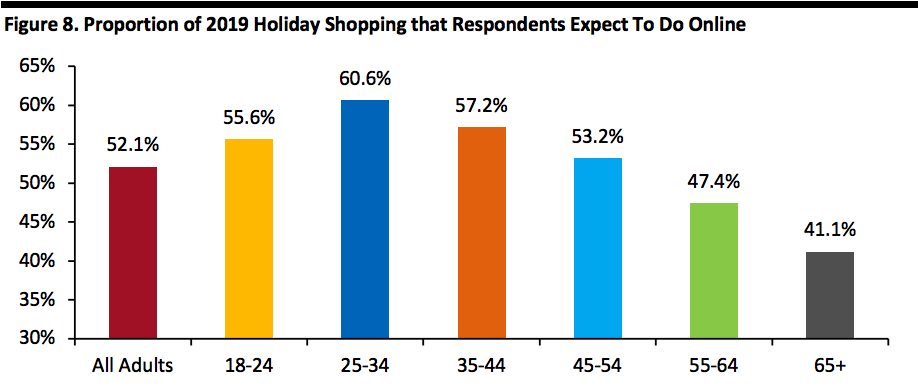

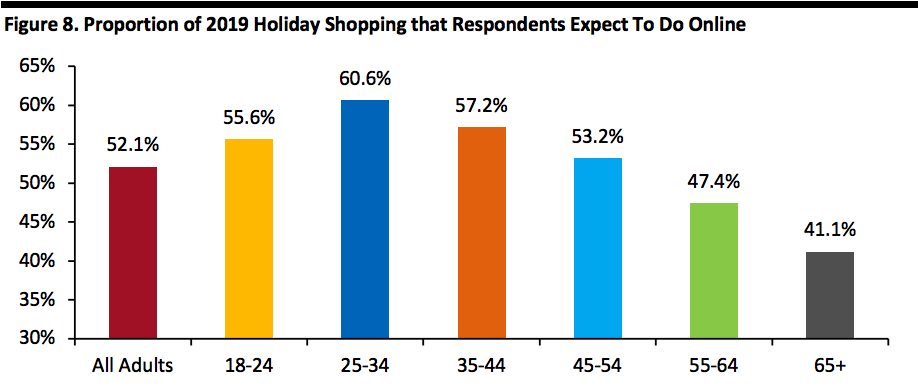

The Use of Online Platforms and Associated Services for Holiday Shopping

Aside from the oldest age group, US consumers plan to do at least half of their holiday shopping online this year. Among all adults, the average proportion of shopping attributed to the online channel is 52.1%, but that figure jumps to 60.6% for those aged 25-34. We do note that shopping does not equal buying.

[caption id="attachment_99385" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

The Use of Online Platforms and Associated Services for Holiday Shopping

Aside from the oldest age group, US consumers plan to do at least half of their holiday shopping online this year. Among all adults, the average proportion of shopping attributed to the online channel is 52.1%, but that figure jumps to 60.6% for those aged 25-34. We do note that shopping does not equal buying.

[caption id="attachment_99385" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

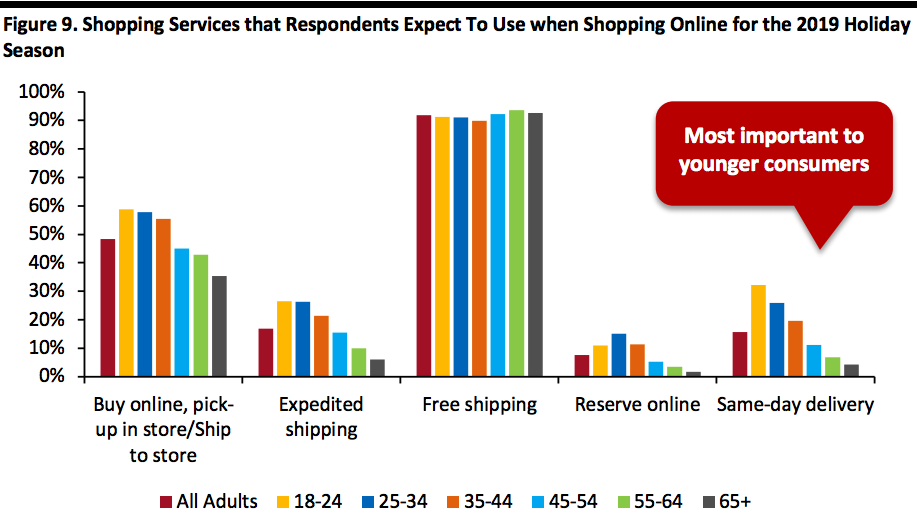

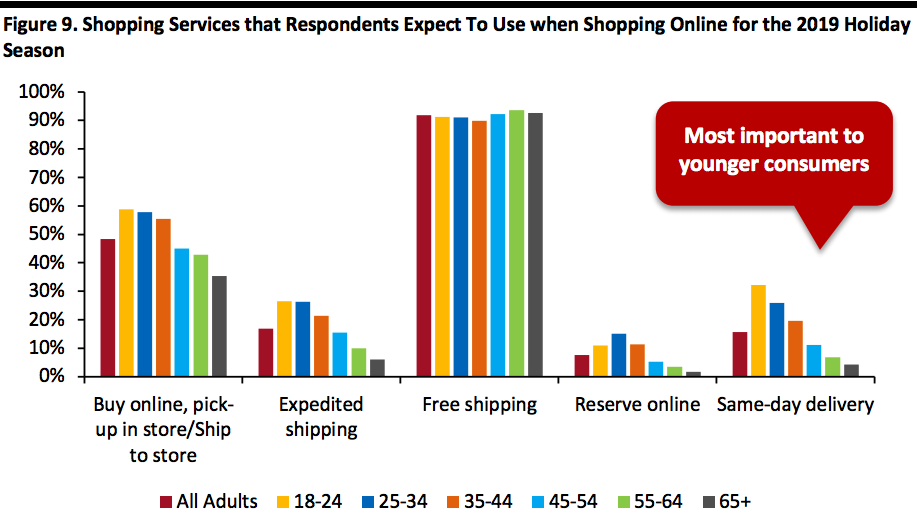

Free shipping remained the top service that consumers expect to use this holiday season, according to 91.8% of survey respondents. Meanwhile, almost 50% of US consumers plan to use “buy online, pick up in-store” or “ship to store” services.

Same-day delivery is an option that younger shoppers value more than older cohorts, with 32.2% of consumers aged 18-24 and 26% of those aged 25-34 expecting to use this service during the holiday season, contributing to 15.6% of all adults.

[caption id="attachment_99386" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Free shipping remained the top service that consumers expect to use this holiday season, according to 91.8% of survey respondents. Meanwhile, almost 50% of US consumers plan to use “buy online, pick up in-store” or “ship to store” services.

Same-day delivery is an option that younger shoppers value more than older cohorts, with 32.2% of consumers aged 18-24 and 26% of those aged 25-34 expecting to use this service during the holiday season, contributing to 15.6% of all adults.

[caption id="attachment_99386" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

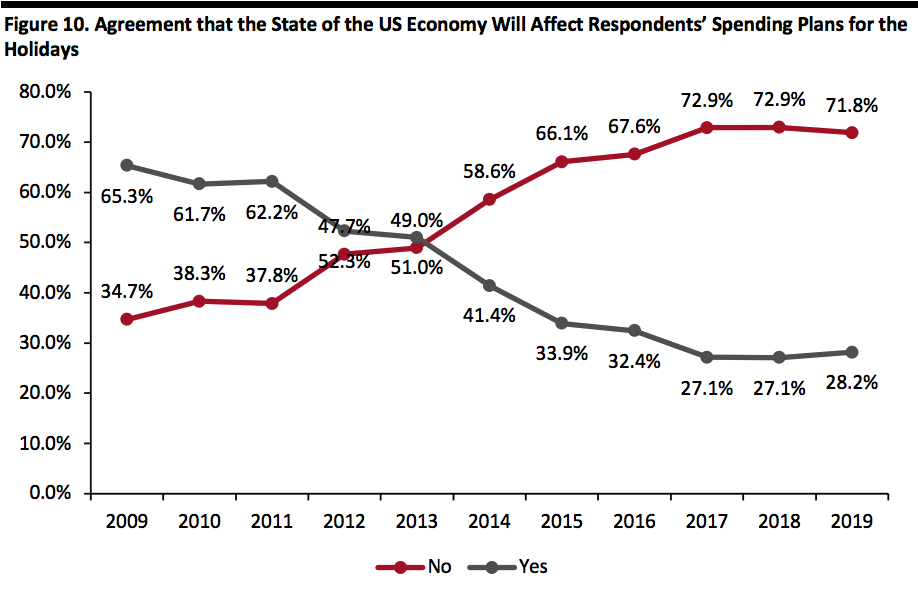

The Influence of the Economy on Spending Plans

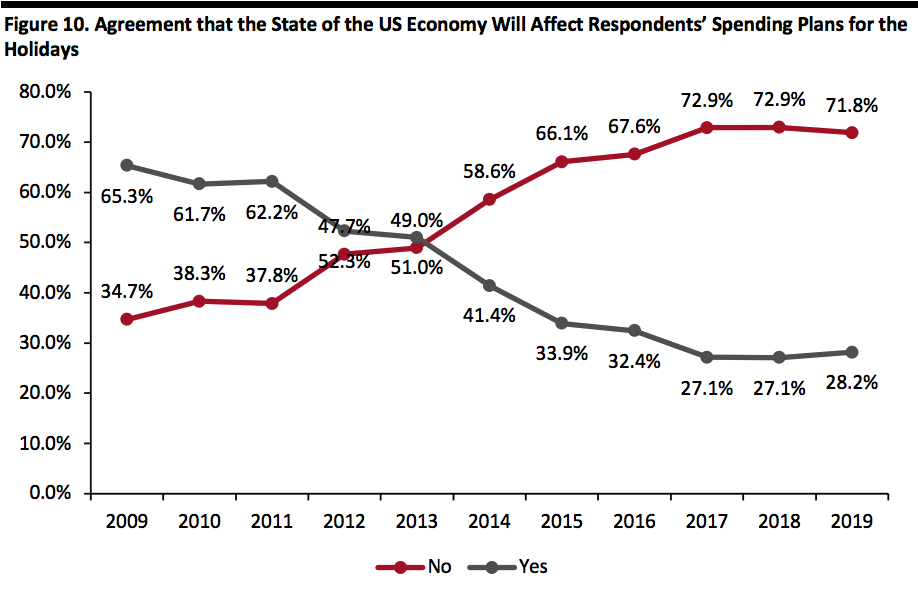

Economic conditions won’t be a deterrent to holiday spending this year: 71.8% of all adults surveyed said that economic conditions will not affect their spending plans, slightly down from 72.9% last year.

[caption id="attachment_99387" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

The Influence of the Economy on Spending Plans

Economic conditions won’t be a deterrent to holiday spending this year: 71.8% of all adults surveyed said that economic conditions will not affect their spending plans, slightly down from 72.9% last year.

[caption id="attachment_99387" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

Source: NRF/Prosper Insights & Analytics [/caption]

The total percentage of all adults choosing to shop at department stores is higher than the number for discount stores, showing that the former is the most popular brick-and-mortar destination for gift shopping for the fourth consecutive year.

The youngest consumer group saw 50.4% of survey respondents plan to shop at clothing or accessories stores, which is the highest rate for that destination among all age bands. Similarly, and in-keeping with the demand for apparel, 15.2% of the 18-24-yr-old consumers plan to shop at thrift stores/resale shops, a figure that is much greater than the 9.7% of all adults. Read our report on the apparel resale market here.

E-commerce is no doubt set to be the most visited shopping channel, with 55.8% of US consumers intending to shop online this year.

[caption id="attachment_99379" align="aligncenter" width="700"]

Source: NRF/Prosper Insights & Analytics [/caption]

The total percentage of all adults choosing to shop at department stores is higher than the number for discount stores, showing that the former is the most popular brick-and-mortar destination for gift shopping for the fourth consecutive year.

The youngest consumer group saw 50.4% of survey respondents plan to shop at clothing or accessories stores, which is the highest rate for that destination among all age bands. Similarly, and in-keeping with the demand for apparel, 15.2% of the 18-24-yr-old consumers plan to shop at thrift stores/resale shops, a figure that is much greater than the 9.7% of all adults. Read our report on the apparel resale market here.

E-commerce is no doubt set to be the most visited shopping channel, with 55.8% of US consumers intending to shop online this year.

[caption id="attachment_99379" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Mobile devices continue to play an important role in holiday shopping, as 51.7% of total adults plan to use smartphones or tablets to research products and compare prices this season. As might be expected, younger consumers will use them more regularly than older consumers. Purchasing products has been identified as the second-most popular way to use mobile devices (41.6% of all adults), followed by looking up retailer information (33.4%) and checking for in-store availability of products (29.1%).

Therefore, in order to remain competitive during the holiday 2019, retailers should be ready to offer consumers mobile-friendly functions that help them to search, compare and purchase products.

[caption id="attachment_99380" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Mobile devices continue to play an important role in holiday shopping, as 51.7% of total adults plan to use smartphones or tablets to research products and compare prices this season. As might be expected, younger consumers will use them more regularly than older consumers. Purchasing products has been identified as the second-most popular way to use mobile devices (41.6% of all adults), followed by looking up retailer information (33.4%) and checking for in-store availability of products (29.1%).

Therefore, in order to remain competitive during the holiday 2019, retailers should be ready to offer consumers mobile-friendly functions that help them to search, compare and purchase products.

[caption id="attachment_99380" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Key Influences on Shopping Decisions for the Holiday Season

Matching the trend that was identified in 2018, roughly 70% of each age group this year considers sales and discounts to be the most important factor in choosing a particular retailer.

Quality is more important to younger consumers, whereas selection is the highest priority for older shoppers. The importance of helpful, knowledgeable customer service was highlighted by 28.3% of all adults this year, up from last year’s 25.6%. More than one-third of consumers aged 18-34 consider service to hold significance in their shopping experience, which is a much higher portion than in other age cohorts.

[caption id="attachment_99381" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Key Influences on Shopping Decisions for the Holiday Season

Matching the trend that was identified in 2018, roughly 70% of each age group this year considers sales and discounts to be the most important factor in choosing a particular retailer.

Quality is more important to younger consumers, whereas selection is the highest priority for older shoppers. The importance of helpful, knowledgeable customer service was highlighted by 28.3% of all adults this year, up from last year’s 25.6%. More than one-third of consumers aged 18-34 consider service to hold significance in their shopping experience, which is a much higher portion than in other age cohorts.

[caption id="attachment_99381" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Gift cards remain the most-desired gift this holiday, with 58.8% of survey respondents choosing this category. However, not all gift cards are for retailers; consumers can purchase them from hotels, restaurants, online service providers etc. Retailers can add new stock keeping units post Christmas to appeal to consumers with gift cards.

In addition, personal care and beauty products saw a significant two-percentage-point increase in popularity for all adults, and almost 30% of consumers aged 18-34 would like to receive gifts in this category.

[caption id="attachment_99382" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Gift cards remain the most-desired gift this holiday, with 58.8% of survey respondents choosing this category. However, not all gift cards are for retailers; consumers can purchase them from hotels, restaurants, online service providers etc. Retailers can add new stock keeping units post Christmas to appeal to consumers with gift cards.

In addition, personal care and beauty products saw a significant two-percentage-point increase in popularity for all adults, and almost 30% of consumers aged 18-34 would like to receive gifts in this category.

[caption id="attachment_99382" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Consumers’ Preference for when To Shop for Holiday Gifts

November is set to be the peak time for holiday shopping in 2019, with almost 43% of all US consumers and 50% of Gen-Zers confirming plans to start making purchases in this month. Survey results show that 73% of Gen-Zers and 62% of consumers aged 65+ do not start shopping for the holiday season before November.

[caption id="attachment_99383" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Consumers’ Preference for when To Shop for Holiday Gifts

November is set to be the peak time for holiday shopping in 2019, with almost 43% of all US consumers and 50% of Gen-Zers confirming plans to start making purchases in this month. Survey results show that 73% of Gen-Zers and 62% of consumers aged 65+ do not start shopping for the holiday season before November.

[caption id="attachment_99383" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Of the consumers who begin shopping before or during October, 61% cited an intention to spread out the gift shopping budget, and 46% try to avoid the crowds traditionally associated with shopping in November and December.

The fear of missing out is well demonstrated among early Gen-Z shoppers, nearly 40% of which expressed the need to purchase desired items as soon as they could.

[caption id="attachment_99384" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Of the consumers who begin shopping before or during October, 61% cited an intention to spread out the gift shopping budget, and 46% try to avoid the crowds traditionally associated with shopping in November and December.

The fear of missing out is well demonstrated among early Gen-Z shoppers, nearly 40% of which expressed the need to purchase desired items as soon as they could.

[caption id="attachment_99384" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

The Use of Online Platforms and Associated Services for Holiday Shopping

Aside from the oldest age group, US consumers plan to do at least half of their holiday shopping online this year. Among all adults, the average proportion of shopping attributed to the online channel is 52.1%, but that figure jumps to 60.6% for those aged 25-34. We do note that shopping does not equal buying.

[caption id="attachment_99385" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

The Use of Online Platforms and Associated Services for Holiday Shopping

Aside from the oldest age group, US consumers plan to do at least half of their holiday shopping online this year. Among all adults, the average proportion of shopping attributed to the online channel is 52.1%, but that figure jumps to 60.6% for those aged 25-34. We do note that shopping does not equal buying.

[caption id="attachment_99385" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Free shipping remained the top service that consumers expect to use this holiday season, according to 91.8% of survey respondents. Meanwhile, almost 50% of US consumers plan to use “buy online, pick up in-store” or “ship to store” services.

Same-day delivery is an option that younger shoppers value more than older cohorts, with 32.2% of consumers aged 18-24 and 26% of those aged 25-34 expecting to use this service during the holiday season, contributing to 15.6% of all adults.

[caption id="attachment_99386" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Free shipping remained the top service that consumers expect to use this holiday season, according to 91.8% of survey respondents. Meanwhile, almost 50% of US consumers plan to use “buy online, pick up in-store” or “ship to store” services.

Same-day delivery is an option that younger shoppers value more than older cohorts, with 32.2% of consumers aged 18-24 and 26% of those aged 25-34 expecting to use this service during the holiday season, contributing to 15.6% of all adults.

[caption id="attachment_99386" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

The Influence of the Economy on Spending Plans

Economic conditions won’t be a deterrent to holiday spending this year: 71.8% of all adults surveyed said that economic conditions will not affect their spending plans, slightly down from 72.9% last year.

[caption id="attachment_99387" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

The Influence of the Economy on Spending Plans

Economic conditions won’t be a deterrent to holiday spending this year: 71.8% of all adults surveyed said that economic conditions will not affect their spending plans, slightly down from 72.9% last year.

[caption id="attachment_99387" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]