Nitheesh NH

As Black Friday approaches, we provide our initial thoughts on US consumers’ spending intentions, as well as the promotions and strategic focuses of US retailers for this shopping holiday.

Retailers Begin Promotions Early To Compensate for Black Friday Falling Late this Year

Black Friday always falls on the day after Thanksgiving. In 2019, this will be on Friday, November 29, which is a full six days later than Black Friday 2018 (November 23). This means that the number of shopping days in the traditionally defined holiday shopping period is reduced. Moreover, with Cyber Monday and Giving Tuesday falling in early December and with six fewer days between Thanksgiving and Christmas than in 2018, this year has the shortest possible holiday calendar, which is not ideal for retailers.

However, we expect any impact to be limited, as shoppers do not consciously choose to buy fewer gifts or spend less simply because a quirk of the calendar. Even so, retailers began promoting Black Friday offers early to compensate for the shortened holiday season.

Black Friday Promotions at Selected Retailers

Amazon officially announced its Black Friday 2019 deals on November 5, but campaigns have been online since October 22. The e-commerce retailer’s Black Friday sales officially start at 12:00am (EST) on November 22 and end at midnight on November 29. Amazon will have special "Deal of the Day" offers, as well as Lightning Deals, which typically offer limited stock at deeply discounted prices.

Whole Foods offered notable deals on Amazon-branded devices in 2017, right after its being acquired by Amazon. But this was not the case in 2018. This year, Coresight expects Black Friday sales at Whole Foods will still be focused on food, home goods and groceries, instead of Amazon-branded devices.

[caption id="attachment_100255" align="aligncenter" width="700"] Source: Amazon[/caption]

Best Buy is offering a new shipping policy this year that offers free next-day delivery on “thousands of items” just in time for Black Friday. Furthermore, the company will be forgoing its usual $35 minimum order requirement in many instances, which is good news for shoppers.

Best Buy will officially kick off its Black Friday sale on Thursday, November 28 at 5:00pm (EST), although some pre-holiday offers have already been made available on the company’s website.

Costco released its “holiday savings offers” on November 4, which include some of its Black Friday doorbusters, with deals on televisions, electronics, gaming systems, jewelry and food. Many of these deals are online exclusives, following Costco’s recent expansion of its online selection.

Other brick-and-mortar retailers—such as Dick's Sporting Goods and Lowe’s—are also offering online-only Black Friday specials in order to convert offline business to online.

[caption id="attachment_100256" align="aligncenter" width="700"]

Source: Amazon[/caption]

Best Buy is offering a new shipping policy this year that offers free next-day delivery on “thousands of items” just in time for Black Friday. Furthermore, the company will be forgoing its usual $35 minimum order requirement in many instances, which is good news for shoppers.

Best Buy will officially kick off its Black Friday sale on Thursday, November 28 at 5:00pm (EST), although some pre-holiday offers have already been made available on the company’s website.

Costco released its “holiday savings offers” on November 4, which include some of its Black Friday doorbusters, with deals on televisions, electronics, gaming systems, jewelry and food. Many of these deals are online exclusives, following Costco’s recent expansion of its online selection.

Other brick-and-mortar retailers—such as Dick's Sporting Goods and Lowe’s—are also offering online-only Black Friday specials in order to convert offline business to online.

[caption id="attachment_100256" align="aligncenter" width="700"] Costco will offer Black Friday deals on electronics, but only online.

Costco will offer Black Friday deals on electronics, but only online.

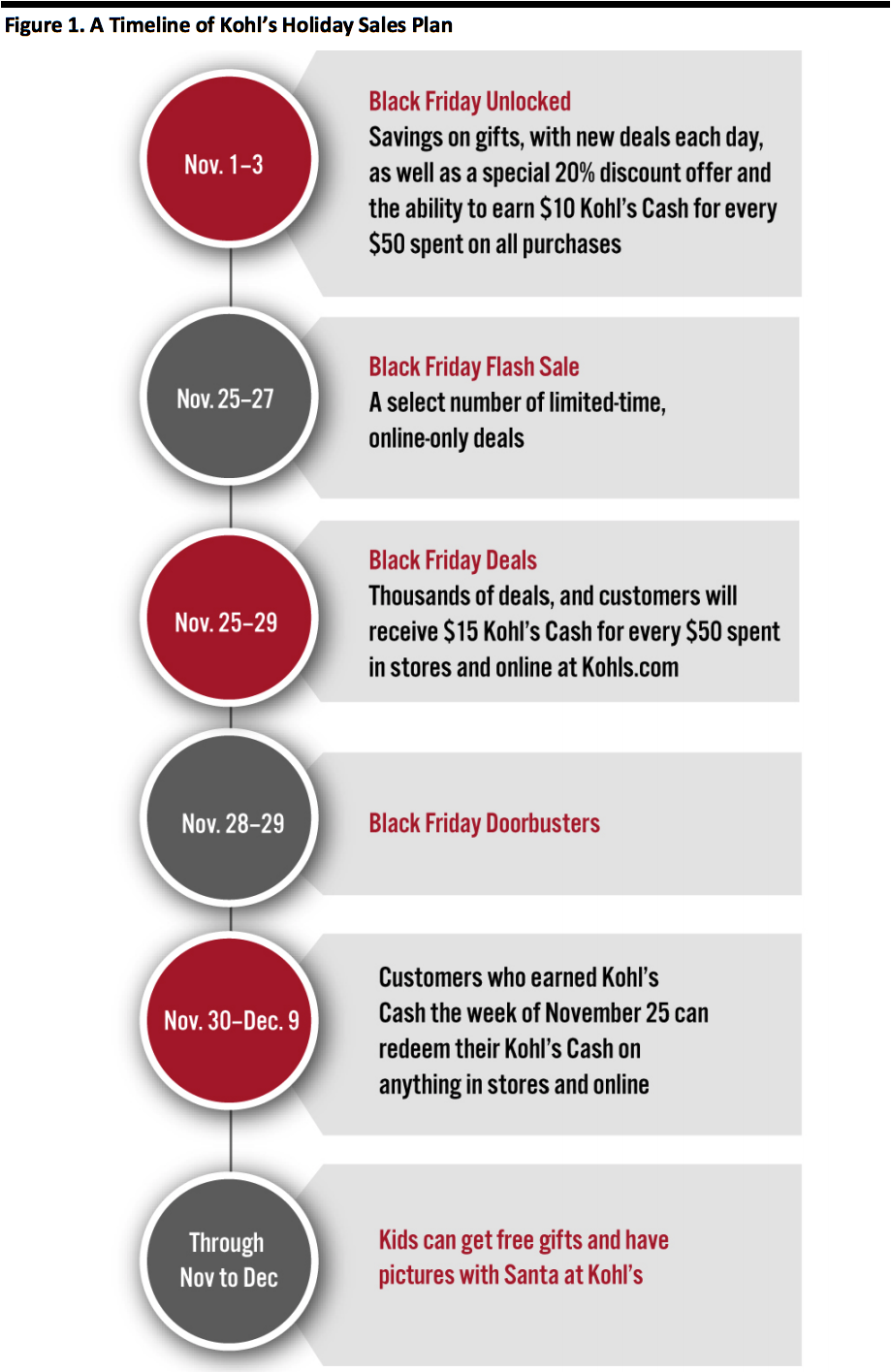

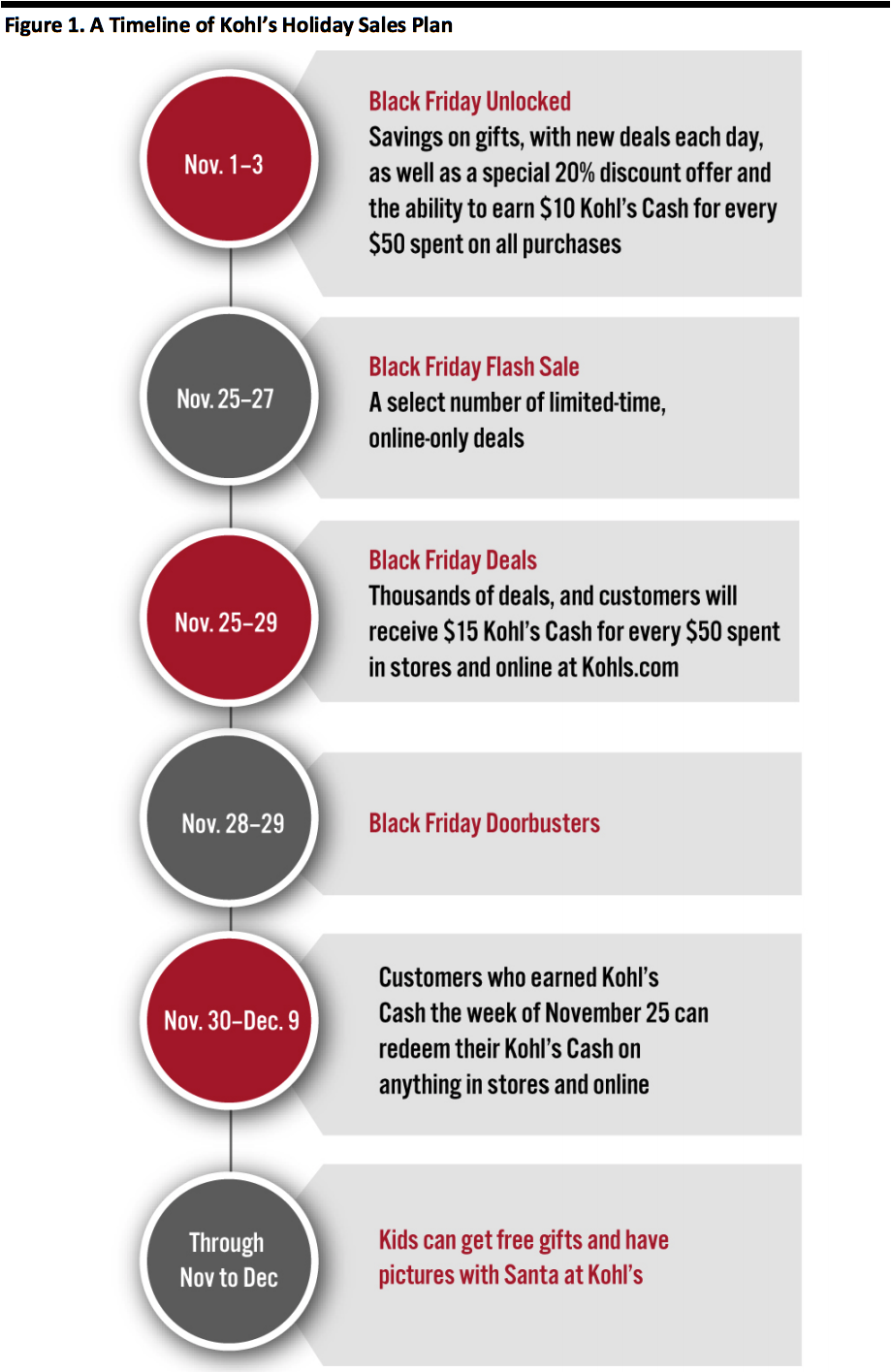

Source: Costco[/caption] Kohl’s is taking the holiday shopping season to a new level this year by kicking off early Black Friday promotions on November 1 with hundreds of deals. Kohl’s stores will open at 5:00pm on Thanksgiving Day, offering more special deals. [caption id="attachment_100257" align="aligncenter" width="700"] Source: Company reports[/caption]

Macy’s is focused on doorbusters, in order to encourage consumers to shop in its stores on Black Friday, as has been the case in previous years. The retailer's 2019 sale will begin on Thanksgiving Day at 5:00pm and run until 2:00am on November 29. Black Friday deals will continue when the stores reopen at 6:00am, with doorbusters running until 1:00pm that day. More doorbusters will then be available on Saturday, November 30, from 8:00am to 1:00pm.

[caption id="attachment_100258" align="aligncenter" width="700"]

Source: Company reports[/caption]

Macy’s is focused on doorbusters, in order to encourage consumers to shop in its stores on Black Friday, as has been the case in previous years. The retailer's 2019 sale will begin on Thanksgiving Day at 5:00pm and run until 2:00am on November 29. Black Friday deals will continue when the stores reopen at 6:00am, with doorbusters running until 1:00pm that day. More doorbusters will then be available on Saturday, November 30, from 8:00am to 1:00pm.

[caption id="attachment_100258" align="aligncenter" width="700"] Source: Macy’s[/caption]

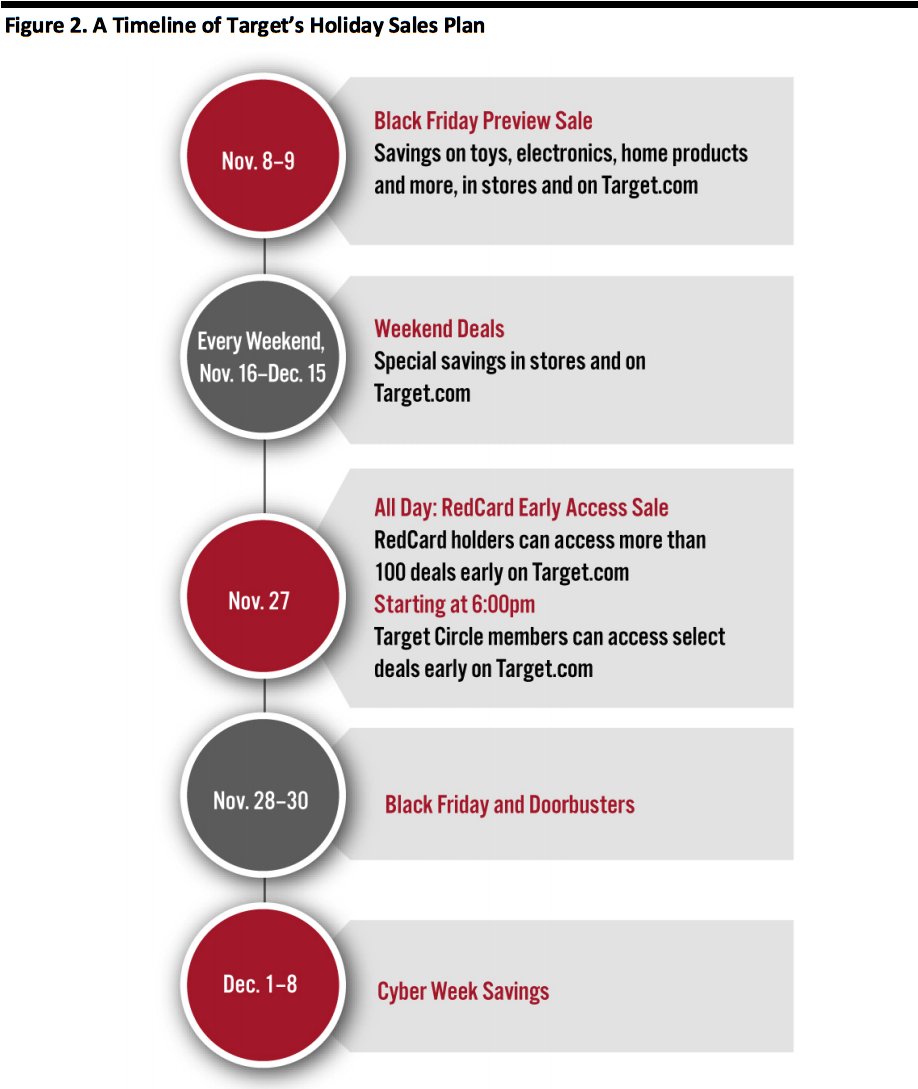

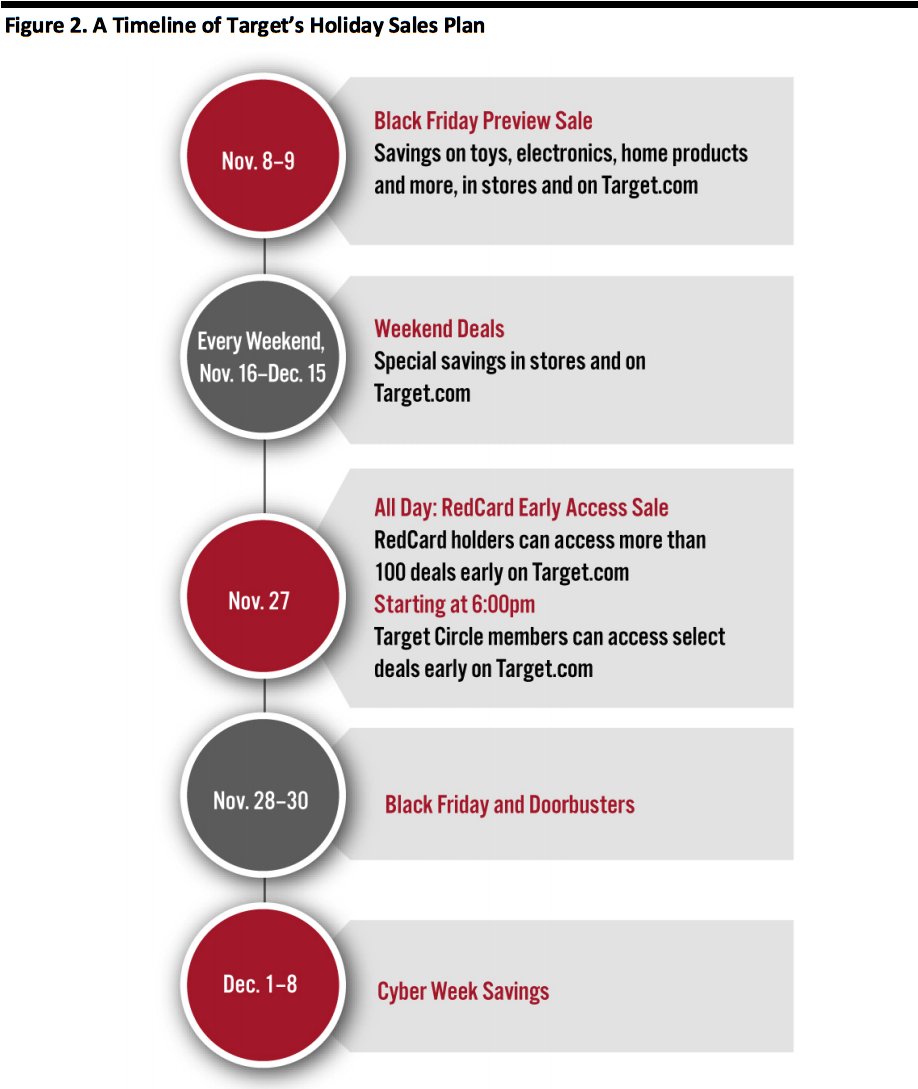

Target announced that it will open at 5:00pm on Thanksgiving Day and close at 1:00am on Friday morning, for the second consecutive year. Its “HoliDeals” campaign aims to bring consumers offers on thousands of gifts and products throughout the holiday season 2019.

[caption id="attachment_100259" align="aligncenter" width="700"]

Source: Macy’s[/caption]

Target announced that it will open at 5:00pm on Thanksgiving Day and close at 1:00am on Friday morning, for the second consecutive year. Its “HoliDeals” campaign aims to bring consumers offers on thousands of gifts and products throughout the holiday season 2019.

[caption id="attachment_100259" align="aligncenter" width="700"] Source: Company reports[/caption]

Walmart began unveiling its Black Friday deals early, including discounts on Apple iPads and Watches, Vizio TVs and Xbox gaming consoles. The retailer officially posted its promotions on November 14.

[caption id="attachment_100260" align="aligncenter" width="700"]

Source: Company reports[/caption]

Walmart began unveiling its Black Friday deals early, including discounts on Apple iPads and Watches, Vizio TVs and Xbox gaming consoles. The retailer officially posted its promotions on November 14.

[caption id="attachment_100260" align="aligncenter" width="700"] Source: Walmart[/caption]

November Is the Peak Holiday Shopping Month

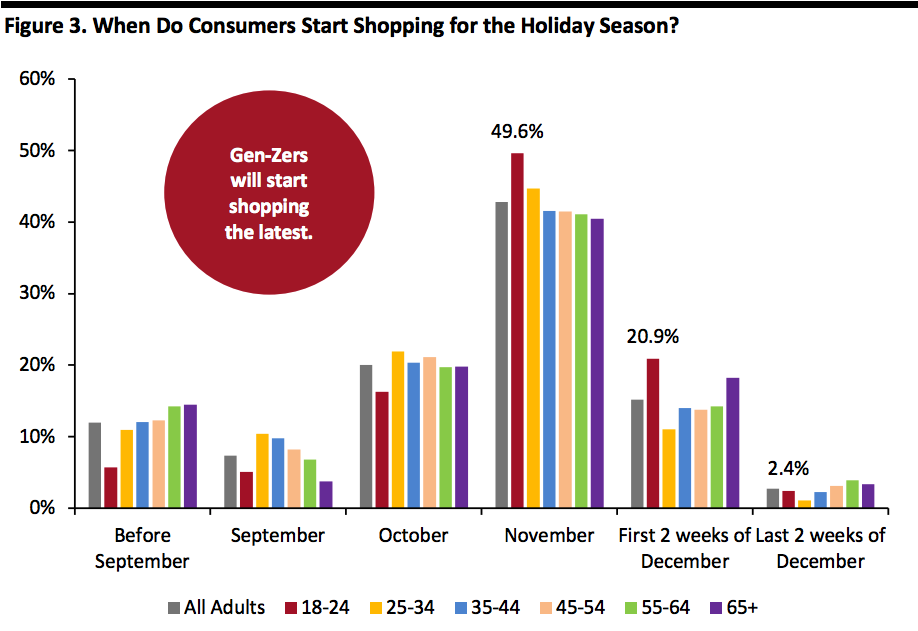

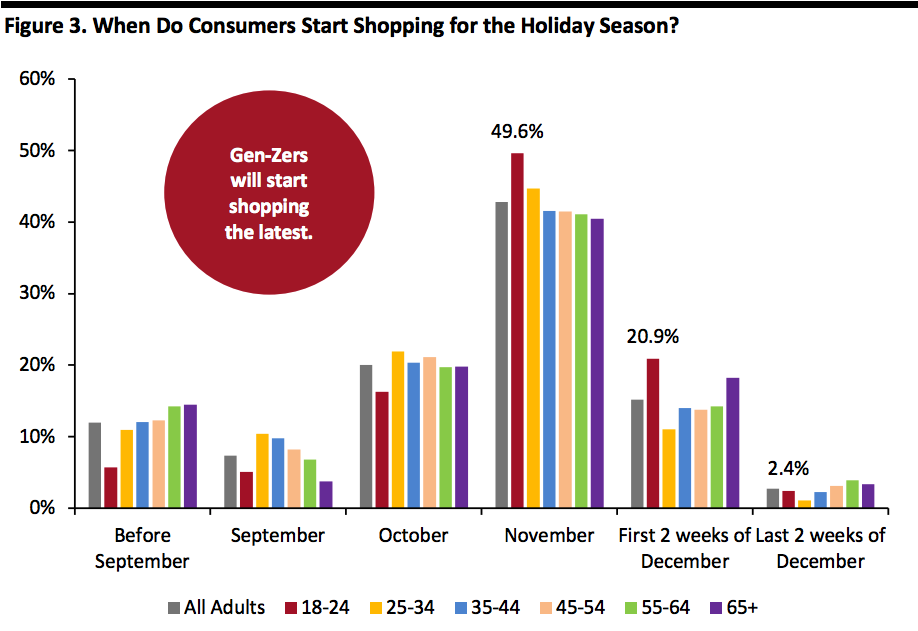

According to survey data from Prosper Insights & Analytics, nearly 43% of consumers and half of Gen Zers (aged 18-24 by Prosper’s definition) in the US will start holiday shopping in November, making it the peak retail month for the holiday season this year.

Prosper’s survey results suggest that 73% of Gen-Z consumers will not start shopping for the holiday season before November, followed by 62% of consumers age 65+. (See our Holiday 2019: Consumer Survey Insights report for more insights.)

[caption id="attachment_100261" align="aligncenter" width="700"]

Source: Walmart[/caption]

November Is the Peak Holiday Shopping Month

According to survey data from Prosper Insights & Analytics, nearly 43% of consumers and half of Gen Zers (aged 18-24 by Prosper’s definition) in the US will start holiday shopping in November, making it the peak retail month for the holiday season this year.

Prosper’s survey results suggest that 73% of Gen-Z consumers will not start shopping for the holiday season before November, followed by 62% of consumers age 65+. (See our Holiday 2019: Consumer Survey Insights report for more insights.)

[caption id="attachment_100261" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Black Friday Sales Online Are Expected To Total $7.5 Billion

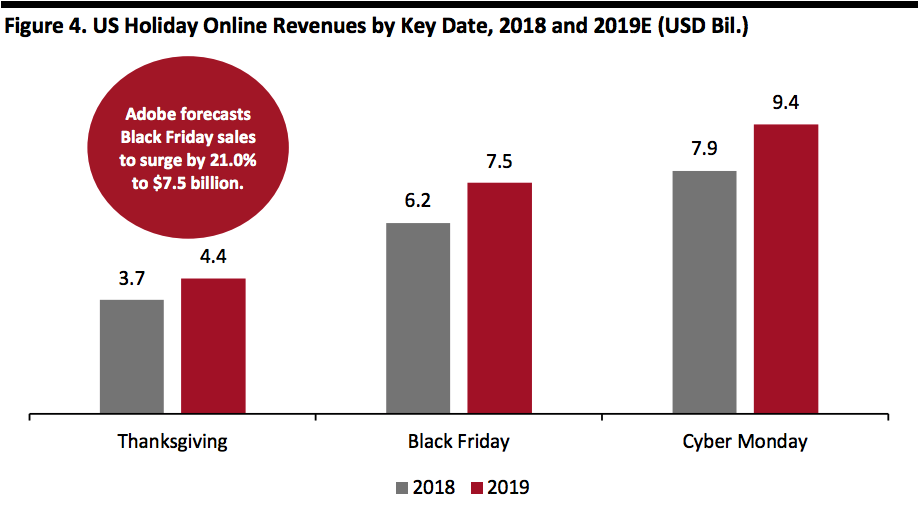

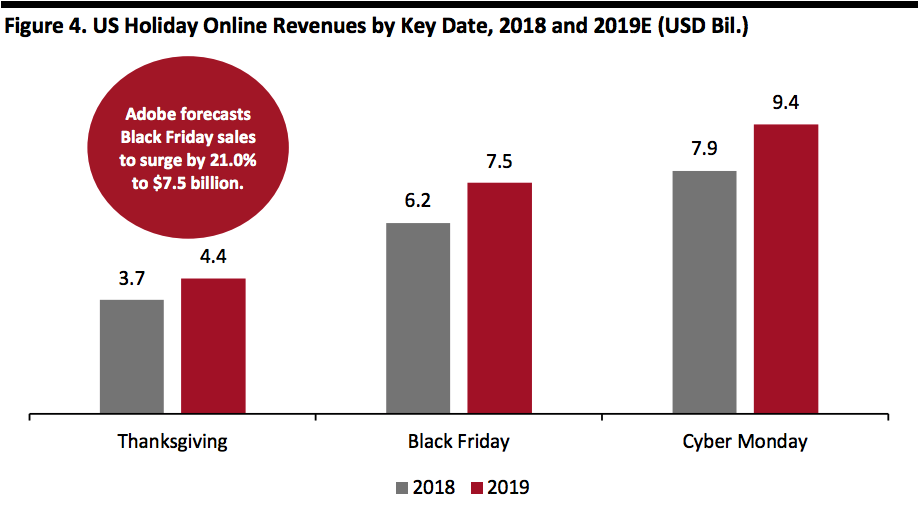

According to Adobe Analytics, Black Friday sales online are expected to see an increase of 21.0% over last year, totaling $7.5 billion. Online Thanksgiving Day sales are forecast to surge by 18.9% to $4.4 billion. Cyber Monday sales are expected to hit $9.4 billion, up nearly 19.0% from last year. Digital spending during November and December is expected to reach $143.7 billion, up 14.1% from 2018.

For the first time, Adobe is expecting online sales to surpass $1 billion each day in November and December, due to the six lost days this holiday season.

[caption id="attachment_100262" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Black Friday Sales Online Are Expected To Total $7.5 Billion

According to Adobe Analytics, Black Friday sales online are expected to see an increase of 21.0% over last year, totaling $7.5 billion. Online Thanksgiving Day sales are forecast to surge by 18.9% to $4.4 billion. Cyber Monday sales are expected to hit $9.4 billion, up nearly 19.0% from last year. Digital spending during November and December is expected to reach $143.7 billion, up 14.1% from 2018.

For the first time, Adobe is expecting online sales to surpass $1 billion each day in November and December, due to the six lost days this holiday season.

[caption id="attachment_100262" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Tariff and Trade Uncertainty Impacts US Retailers

Tariffs affect US brands and retailers that import goods from China. Tariff-hit retailers face a choice: hike prices and possibly see lower volume sales as shoppers peel away to more price-competitive rivals or defer purchases; or, absorb all (or much) of the cost of tariffs and take a hit to margins. Some retailers have expressed caution about their holiday-season sales, perhaps because 22% of US shoppers would switch to a cheaper retailer if tariffs led to higher prices on holiday gifts, according to data from a Coresight Research survey.

Best Buy said it is affected by the List 4 tariffs on products imported from China that would be subject to an additional 10% tariff, including cell phones, laptop computers, video-gaming consoles, certain toys, computer monitors and certain items of footwear and clothing. Many of Best Buy’s vendors are in the process of migrating their manufacturing out of China.

Steven Madden is moving production out of China due to the tariffs, and the retailer plans to work with suppliers to secure price concessions on the goods that will still be produced in China.

PVH (owner of the Arrow, Calvin Klein, Izod and Tommy Hilfiger brands) is not overly optimistic about the holiday selling season. In its second quarter 2019 earnings call, the company confirmed that it has placed its guidance against a backdrop of continued trade tensions and uncertainty.

US retailers that are affected by increased tariffs on imported goods from China can respond by absorbing the extra cost, increasing prices for consumers or—as we have seen above—moving production to other countries. Coresight Research will continue to track the actions taken by US companies to cope with the challenges presented by rising tariffs.

Source: Prosper Insights & Analytics[/caption]

Tariff and Trade Uncertainty Impacts US Retailers

Tariffs affect US brands and retailers that import goods from China. Tariff-hit retailers face a choice: hike prices and possibly see lower volume sales as shoppers peel away to more price-competitive rivals or defer purchases; or, absorb all (or much) of the cost of tariffs and take a hit to margins. Some retailers have expressed caution about their holiday-season sales, perhaps because 22% of US shoppers would switch to a cheaper retailer if tariffs led to higher prices on holiday gifts, according to data from a Coresight Research survey.

Best Buy said it is affected by the List 4 tariffs on products imported from China that would be subject to an additional 10% tariff, including cell phones, laptop computers, video-gaming consoles, certain toys, computer monitors and certain items of footwear and clothing. Many of Best Buy’s vendors are in the process of migrating their manufacturing out of China.

Steven Madden is moving production out of China due to the tariffs, and the retailer plans to work with suppliers to secure price concessions on the goods that will still be produced in China.

PVH (owner of the Arrow, Calvin Klein, Izod and Tommy Hilfiger brands) is not overly optimistic about the holiday selling season. In its second quarter 2019 earnings call, the company confirmed that it has placed its guidance against a backdrop of continued trade tensions and uncertainty.

US retailers that are affected by increased tariffs on imported goods from China can respond by absorbing the extra cost, increasing prices for consumers or—as we have seen above—moving production to other countries. Coresight Research will continue to track the actions taken by US companies to cope with the challenges presented by rising tariffs.

Source: Amazon[/caption]

Best Buy is offering a new shipping policy this year that offers free next-day delivery on “thousands of items” just in time for Black Friday. Furthermore, the company will be forgoing its usual $35 minimum order requirement in many instances, which is good news for shoppers.

Best Buy will officially kick off its Black Friday sale on Thursday, November 28 at 5:00pm (EST), although some pre-holiday offers have already been made available on the company’s website.

Costco released its “holiday savings offers” on November 4, which include some of its Black Friday doorbusters, with deals on televisions, electronics, gaming systems, jewelry and food. Many of these deals are online exclusives, following Costco’s recent expansion of its online selection.

Other brick-and-mortar retailers—such as Dick's Sporting Goods and Lowe’s—are also offering online-only Black Friday specials in order to convert offline business to online.

[caption id="attachment_100256" align="aligncenter" width="700"]

Source: Amazon[/caption]

Best Buy is offering a new shipping policy this year that offers free next-day delivery on “thousands of items” just in time for Black Friday. Furthermore, the company will be forgoing its usual $35 minimum order requirement in many instances, which is good news for shoppers.

Best Buy will officially kick off its Black Friday sale on Thursday, November 28 at 5:00pm (EST), although some pre-holiday offers have already been made available on the company’s website.

Costco released its “holiday savings offers” on November 4, which include some of its Black Friday doorbusters, with deals on televisions, electronics, gaming systems, jewelry and food. Many of these deals are online exclusives, following Costco’s recent expansion of its online selection.

Other brick-and-mortar retailers—such as Dick's Sporting Goods and Lowe’s—are also offering online-only Black Friday specials in order to convert offline business to online.

[caption id="attachment_100256" align="aligncenter" width="700"] Costco will offer Black Friday deals on electronics, but only online.

Costco will offer Black Friday deals on electronics, but only online.Source: Costco[/caption] Kohl’s is taking the holiday shopping season to a new level this year by kicking off early Black Friday promotions on November 1 with hundreds of deals. Kohl’s stores will open at 5:00pm on Thanksgiving Day, offering more special deals. [caption id="attachment_100257" align="aligncenter" width="700"]

Source: Company reports[/caption]

Macy’s is focused on doorbusters, in order to encourage consumers to shop in its stores on Black Friday, as has been the case in previous years. The retailer's 2019 sale will begin on Thanksgiving Day at 5:00pm and run until 2:00am on November 29. Black Friday deals will continue when the stores reopen at 6:00am, with doorbusters running until 1:00pm that day. More doorbusters will then be available on Saturday, November 30, from 8:00am to 1:00pm.

[caption id="attachment_100258" align="aligncenter" width="700"]

Source: Company reports[/caption]

Macy’s is focused on doorbusters, in order to encourage consumers to shop in its stores on Black Friday, as has been the case in previous years. The retailer's 2019 sale will begin on Thanksgiving Day at 5:00pm and run until 2:00am on November 29. Black Friday deals will continue when the stores reopen at 6:00am, with doorbusters running until 1:00pm that day. More doorbusters will then be available on Saturday, November 30, from 8:00am to 1:00pm.

[caption id="attachment_100258" align="aligncenter" width="700"] Source: Macy’s[/caption]

Target announced that it will open at 5:00pm on Thanksgiving Day and close at 1:00am on Friday morning, for the second consecutive year. Its “HoliDeals” campaign aims to bring consumers offers on thousands of gifts and products throughout the holiday season 2019.

[caption id="attachment_100259" align="aligncenter" width="700"]

Source: Macy’s[/caption]

Target announced that it will open at 5:00pm on Thanksgiving Day and close at 1:00am on Friday morning, for the second consecutive year. Its “HoliDeals” campaign aims to bring consumers offers on thousands of gifts and products throughout the holiday season 2019.

[caption id="attachment_100259" align="aligncenter" width="700"] Source: Company reports[/caption]

Walmart began unveiling its Black Friday deals early, including discounts on Apple iPads and Watches, Vizio TVs and Xbox gaming consoles. The retailer officially posted its promotions on November 14.

[caption id="attachment_100260" align="aligncenter" width="700"]

Source: Company reports[/caption]

Walmart began unveiling its Black Friday deals early, including discounts on Apple iPads and Watches, Vizio TVs and Xbox gaming consoles. The retailer officially posted its promotions on November 14.

[caption id="attachment_100260" align="aligncenter" width="700"] Source: Walmart[/caption]

November Is the Peak Holiday Shopping Month

According to survey data from Prosper Insights & Analytics, nearly 43% of consumers and half of Gen Zers (aged 18-24 by Prosper’s definition) in the US will start holiday shopping in November, making it the peak retail month for the holiday season this year.

Prosper’s survey results suggest that 73% of Gen-Z consumers will not start shopping for the holiday season before November, followed by 62% of consumers age 65+. (See our Holiday 2019: Consumer Survey Insights report for more insights.)

[caption id="attachment_100261" align="aligncenter" width="700"]

Source: Walmart[/caption]

November Is the Peak Holiday Shopping Month

According to survey data from Prosper Insights & Analytics, nearly 43% of consumers and half of Gen Zers (aged 18-24 by Prosper’s definition) in the US will start holiday shopping in November, making it the peak retail month for the holiday season this year.

Prosper’s survey results suggest that 73% of Gen-Z consumers will not start shopping for the holiday season before November, followed by 62% of consumers age 65+. (See our Holiday 2019: Consumer Survey Insights report for more insights.)

[caption id="attachment_100261" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Black Friday Sales Online Are Expected To Total $7.5 Billion

According to Adobe Analytics, Black Friday sales online are expected to see an increase of 21.0% over last year, totaling $7.5 billion. Online Thanksgiving Day sales are forecast to surge by 18.9% to $4.4 billion. Cyber Monday sales are expected to hit $9.4 billion, up nearly 19.0% from last year. Digital spending during November and December is expected to reach $143.7 billion, up 14.1% from 2018.

For the first time, Adobe is expecting online sales to surpass $1 billion each day in November and December, due to the six lost days this holiday season.

[caption id="attachment_100262" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

Black Friday Sales Online Are Expected To Total $7.5 Billion

According to Adobe Analytics, Black Friday sales online are expected to see an increase of 21.0% over last year, totaling $7.5 billion. Online Thanksgiving Day sales are forecast to surge by 18.9% to $4.4 billion. Cyber Monday sales are expected to hit $9.4 billion, up nearly 19.0% from last year. Digital spending during November and December is expected to reach $143.7 billion, up 14.1% from 2018.

For the first time, Adobe is expecting online sales to surpass $1 billion each day in November and December, due to the six lost days this holiday season.

[caption id="attachment_100262" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Tariff and Trade Uncertainty Impacts US Retailers

Tariffs affect US brands and retailers that import goods from China. Tariff-hit retailers face a choice: hike prices and possibly see lower volume sales as shoppers peel away to more price-competitive rivals or defer purchases; or, absorb all (or much) of the cost of tariffs and take a hit to margins. Some retailers have expressed caution about their holiday-season sales, perhaps because 22% of US shoppers would switch to a cheaper retailer if tariffs led to higher prices on holiday gifts, according to data from a Coresight Research survey.

Best Buy said it is affected by the List 4 tariffs on products imported from China that would be subject to an additional 10% tariff, including cell phones, laptop computers, video-gaming consoles, certain toys, computer monitors and certain items of footwear and clothing. Many of Best Buy’s vendors are in the process of migrating their manufacturing out of China.

Steven Madden is moving production out of China due to the tariffs, and the retailer plans to work with suppliers to secure price concessions on the goods that will still be produced in China.

PVH (owner of the Arrow, Calvin Klein, Izod and Tommy Hilfiger brands) is not overly optimistic about the holiday selling season. In its second quarter 2019 earnings call, the company confirmed that it has placed its guidance against a backdrop of continued trade tensions and uncertainty.

US retailers that are affected by increased tariffs on imported goods from China can respond by absorbing the extra cost, increasing prices for consumers or—as we have seen above—moving production to other countries. Coresight Research will continue to track the actions taken by US companies to cope with the challenges presented by rising tariffs.

Source: Prosper Insights & Analytics[/caption]

Tariff and Trade Uncertainty Impacts US Retailers

Tariffs affect US brands and retailers that import goods from China. Tariff-hit retailers face a choice: hike prices and possibly see lower volume sales as shoppers peel away to more price-competitive rivals or defer purchases; or, absorb all (or much) of the cost of tariffs and take a hit to margins. Some retailers have expressed caution about their holiday-season sales, perhaps because 22% of US shoppers would switch to a cheaper retailer if tariffs led to higher prices on holiday gifts, according to data from a Coresight Research survey.

Best Buy said it is affected by the List 4 tariffs on products imported from China that would be subject to an additional 10% tariff, including cell phones, laptop computers, video-gaming consoles, certain toys, computer monitors and certain items of footwear and clothing. Many of Best Buy’s vendors are in the process of migrating their manufacturing out of China.

Steven Madden is moving production out of China due to the tariffs, and the retailer plans to work with suppliers to secure price concessions on the goods that will still be produced in China.

PVH (owner of the Arrow, Calvin Klein, Izod and Tommy Hilfiger brands) is not overly optimistic about the holiday selling season. In its second quarter 2019 earnings call, the company confirmed that it has placed its guidance against a backdrop of continued trade tensions and uncertainty.

US retailers that are affected by increased tariffs on imported goods from China can respond by absorbing the extra cost, increasing prices for consumers or—as we have seen above—moving production to other countries. Coresight Research will continue to track the actions taken by US companies to cope with the challenges presented by rising tariffs.