Introduction

Shoppers looking to research and complete their holiday purchases will turn to digital channels and tools in unprecedented numbers this year. This will drive a strong season for the online channel in both the US and the UK. In this report, we discuss the five major digital retail trends that we expect to see this holiday season.

Top Five Digital Retail Trends for Holiday 2018

1) Amazon May Lack a Prime Punch This Holiday

Amazon will be many consumers’ top destination for holiday shopping, but there are hints that it may not all go Amazon’s way this holiday. In October, the company disappointed analysts with a fourth-quarter outlook that anticipates year-over-year revenue growth of “just” 10%–20%. This compares with total revenue growth of 29.3% in the third quarter and 39.3% in the second quarter this year.

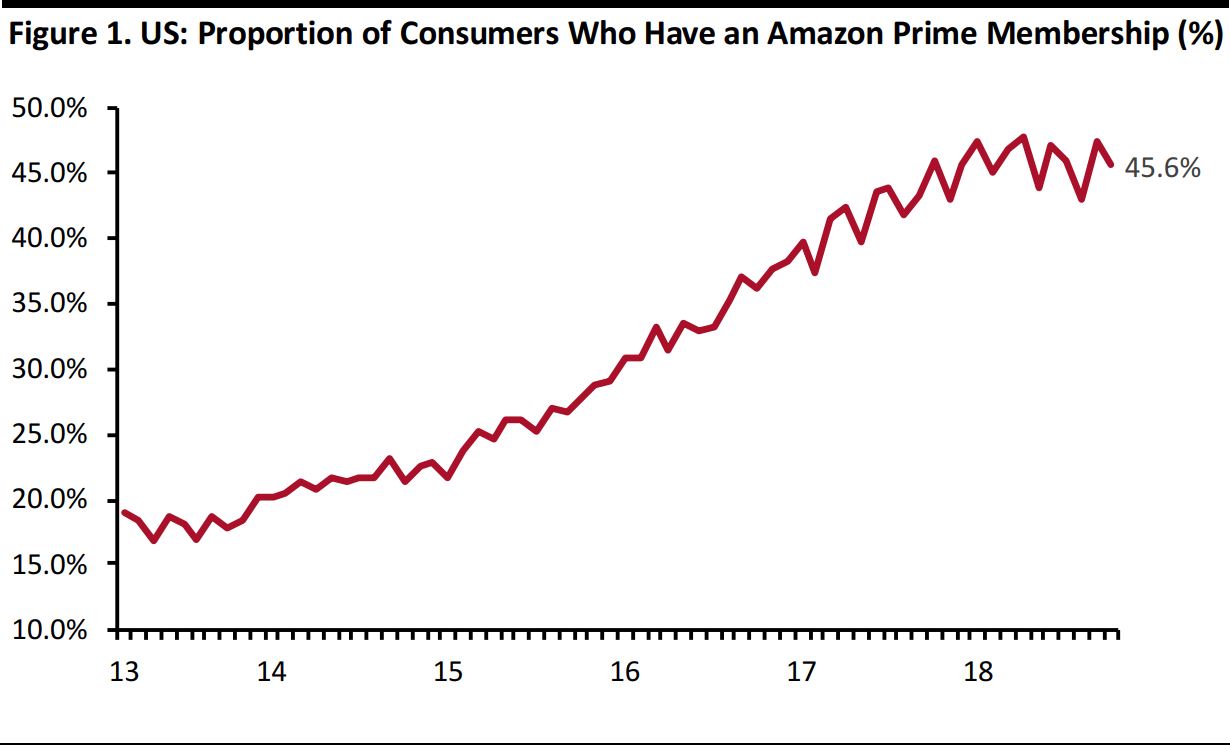

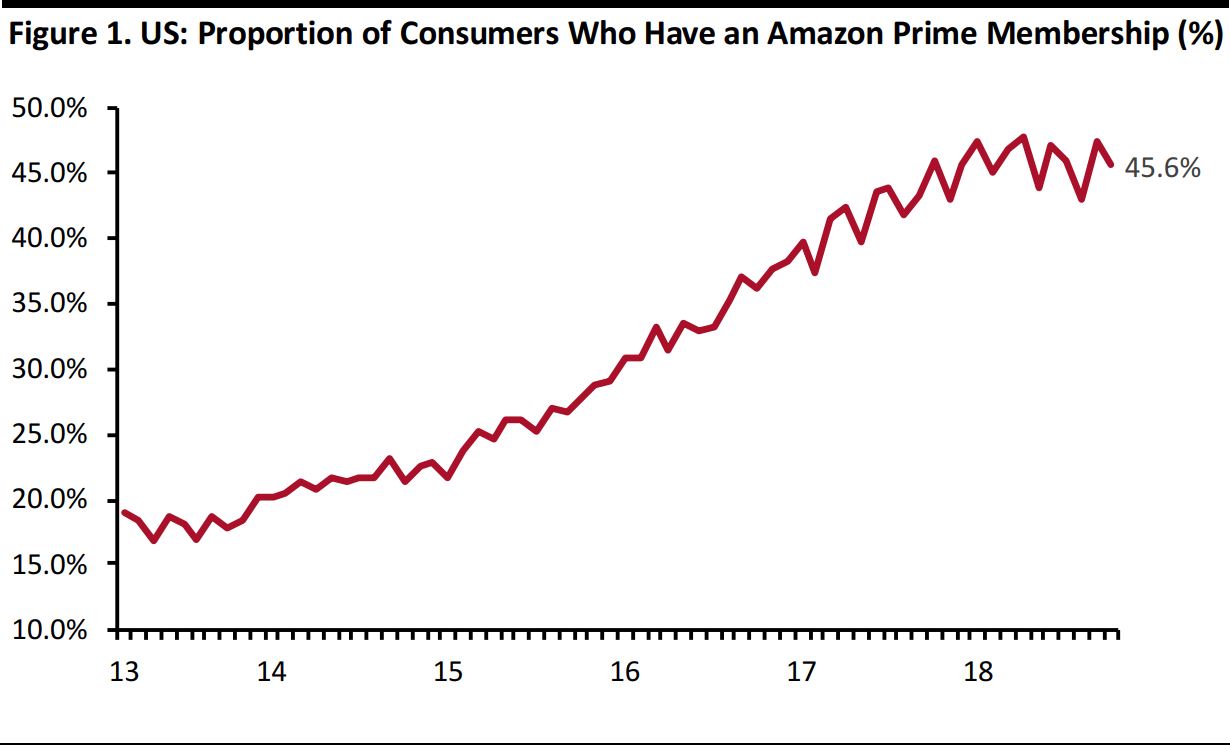

In the US, Amazon may not enjoy the same uplift from rising Prime membership rates that it has in previous years. Prime locks in loyalty and drives cross-category shopping on Amazon, and data from Prosper Insights & Analytics show that in the five years through August 2018, the proportion of US consumers with a Prime membership rose from under 20% to almost 43%. But recent Prosper data suggest that growth in Prime membership in the US has faltered over the last several months, having peaked at an all-time high of 47.8% of all US Internet users in April 2018.

Prosper’s survey data have long shown seasonal fluctuations in Prime membership levels, but we have now seen several months of—at best—flatlining membership rates. Moreover, in July 2017, Amazon’s annual Prime Day prompted a month-over-month increase in membership numbers, but there was no such jump related to Prime Day this year. The key takeaway is that, in previous holiday periods, Amazon’s revenue growth has been supported by growth in Prime memberships, but this year, it looks like Amazon may lose that support.

Base: 5,000+ US Internet users ages 18+ surveyed in each month; data cover March 2013–August 2018.

Source: Prosper Insights & Analytics

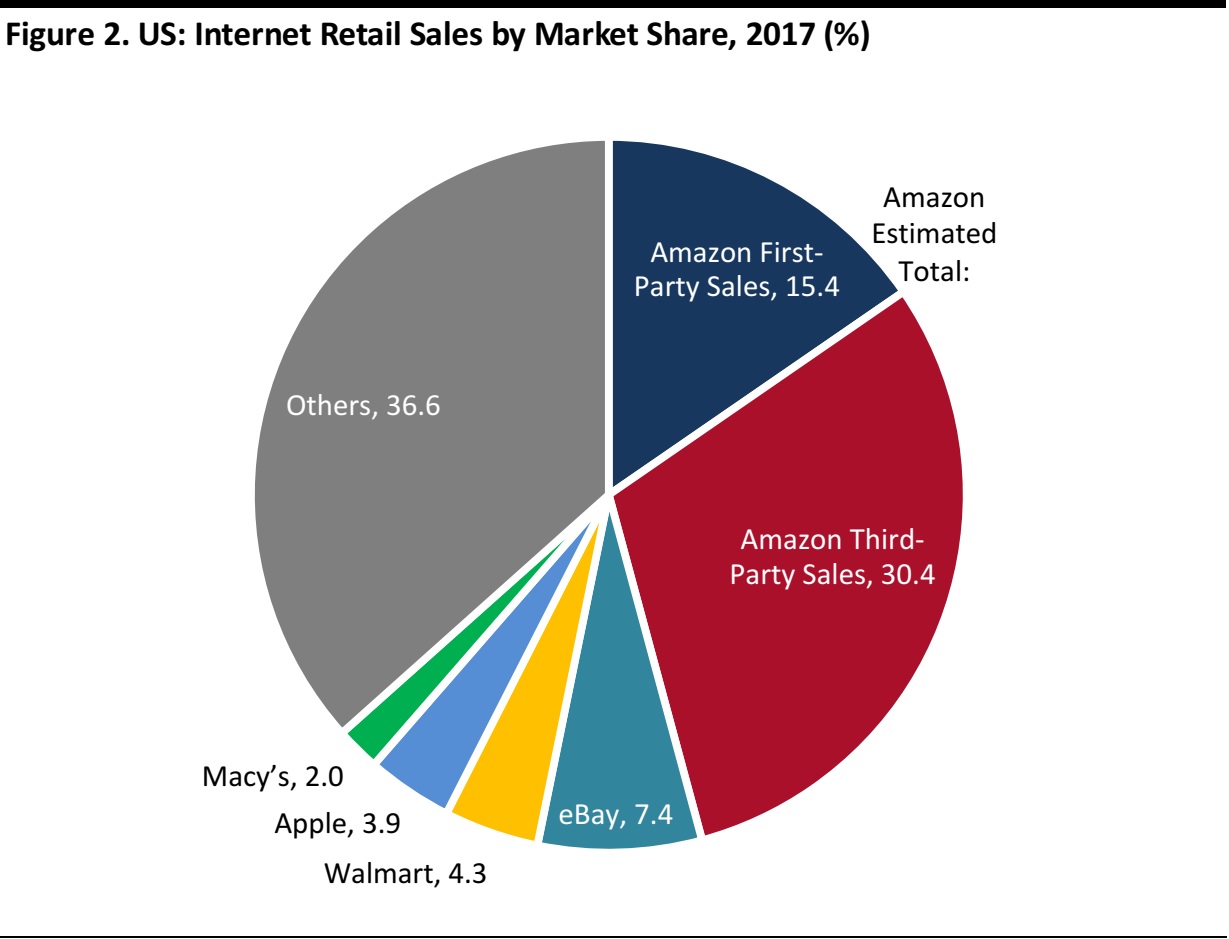

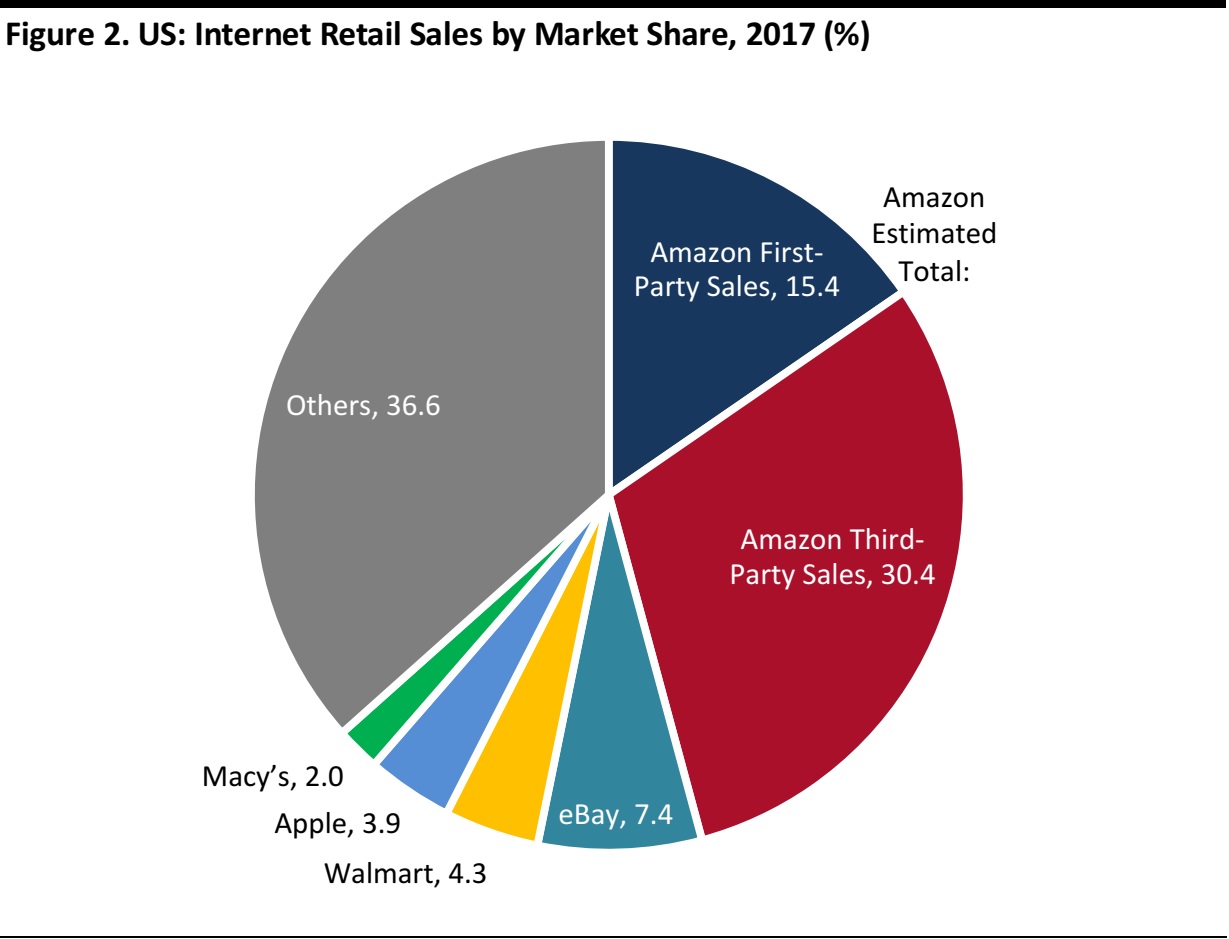

Nevertheless, Amazon holds a near-dominant share of US online retail sales, and the site will continue to be many shoppers’ top online destination this holiday season. Euromonitor International’s latest estimates suggest that Amazon captured nearly 46 cents of every dollar spent online in 2017—although third-party merchants accounted for much of this share and Amazon books only a commission on such sales rather than the full revenue.

Euromonitor’s market share data for 2017 are likely to be our best guide to how e-commerce sales will be distributed this holiday season.

Source: Euromonitor International

2) Almost All Holiday Purchase Journeys Will Involve Multiple Channels

Holiday shoppers will not be making binary choices between online and physical stores this year—they will increasingly engage with retailers on multiple channels before making a purchase. According to a September 2018 survey of US holiday shoppers conducted by Google and market research company Ipsos, 76% of shoppers expect to use three or more channels to shop this holiday.

Consumers appear to be switching between channels at various points in the shopping process. According to the same Google-Ipsos survey, US shoppers discover new products mainly through social media ads and start their research with the generic product or category before looking up brands and visiting their websites.

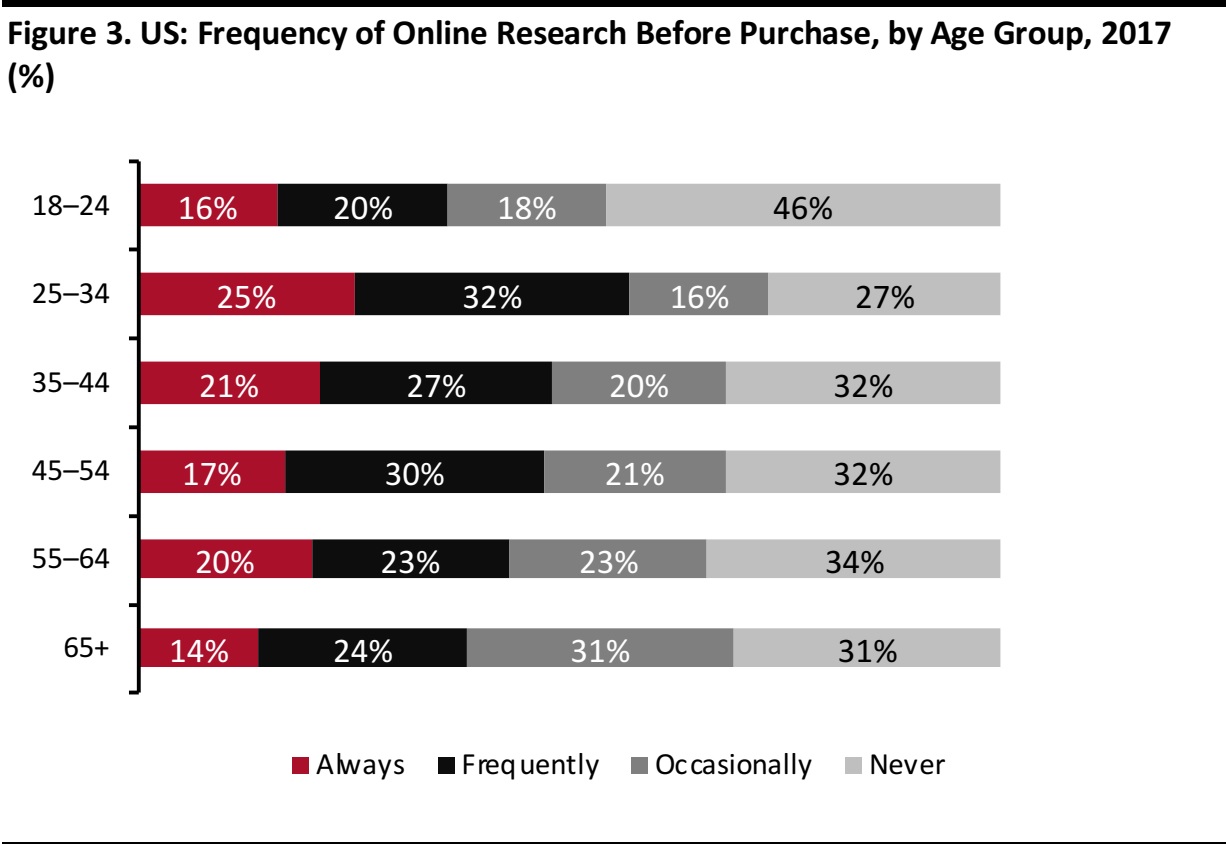

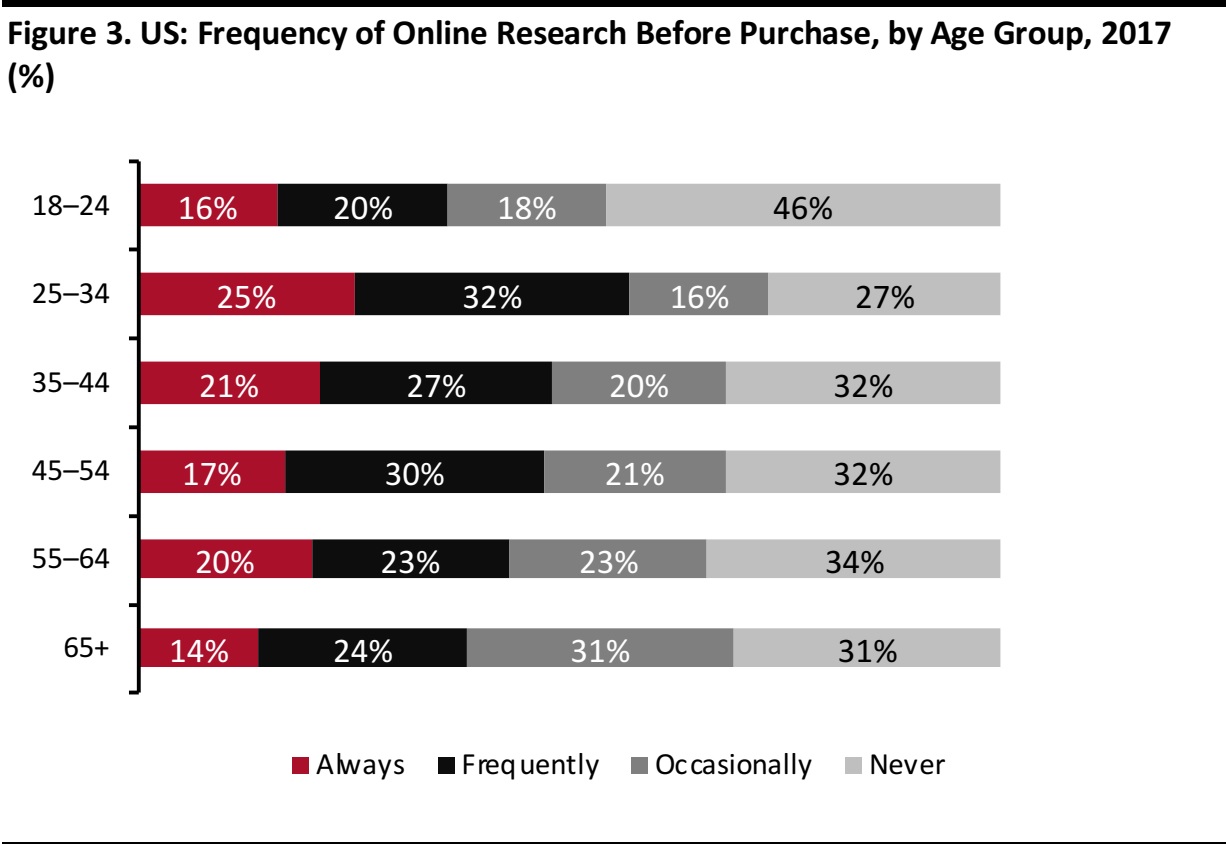

This cross-channel shopping means that retailers must provide not only the means to purchase, but also advice, across multiple channels. According to a 2017 survey by retail news website Retail Dive, US consumers of all age groups tend to undertake online research before making purchases. We expect this trend to continue and strengthen over the holiday period as more consumers research product specs and pricing information, and read online reviews, before making their final purchase.

Base: 1,288 US consumers; survey published in May 2017

Source: Retail Dive

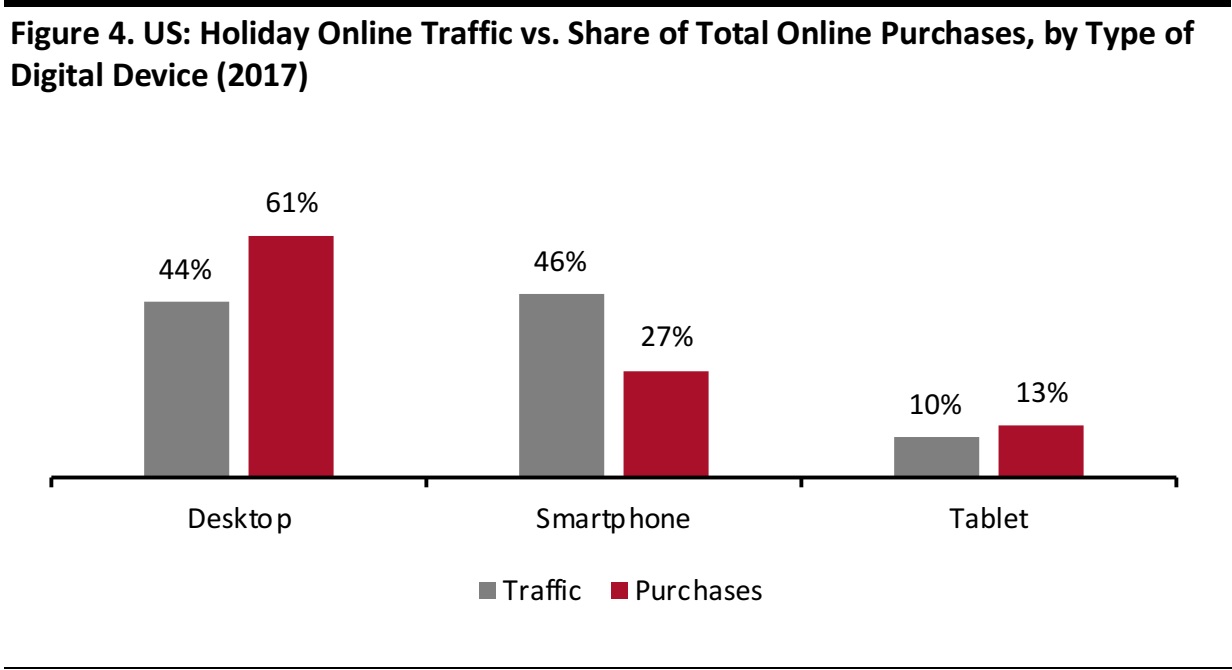

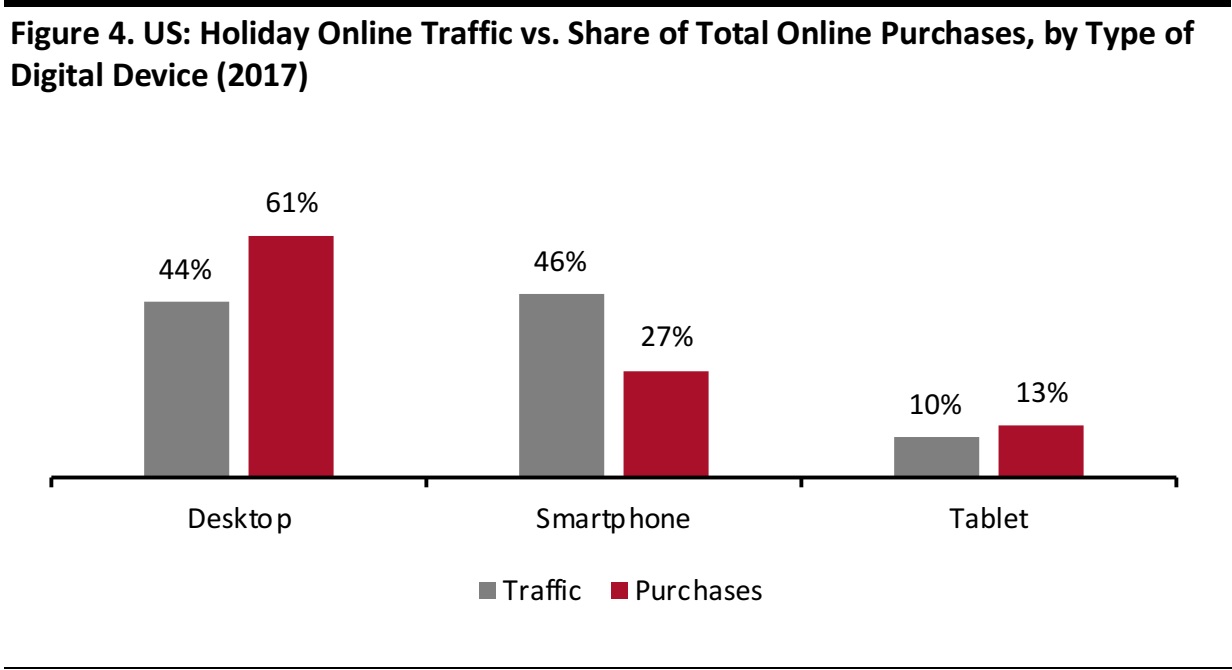

Mobile devices’ high share of website visits reflects the popularity of cross-channel shopping. During the 2017 holiday season, smartphone traffic pulled ahead of desktop traffic in the US, with smartphones accounting for 46% of traffic versus desktops’ 44% share, according to Adobe Digital Insights’ Holiday Predictions survey. This holiday season, we expect this gap to widen as smartphones become the starting point for a greater number of purchases and shoppers increasingly research products on their phones while they are in stores.

However, we expect desktops to continue to lead in terms of purchases, as they have in previous years. Desktops tend to see higher conversion rates than mobile devices, in part because it’s easier to comparison shop on larger screens. We also suspect that cross-channel shoppers’ tendency to compare prices and products on their smartphones while they are in-store, but to purchase the items they research later, after they have left the store, has a suppressing effect on conversion rates.

Shares of purchases do not sum to 100% due to rounding

Source: Adobe Digital Insights

3) E-Commerce Will Account for More than “Just 10%” of Retail Sales This Holiday Season

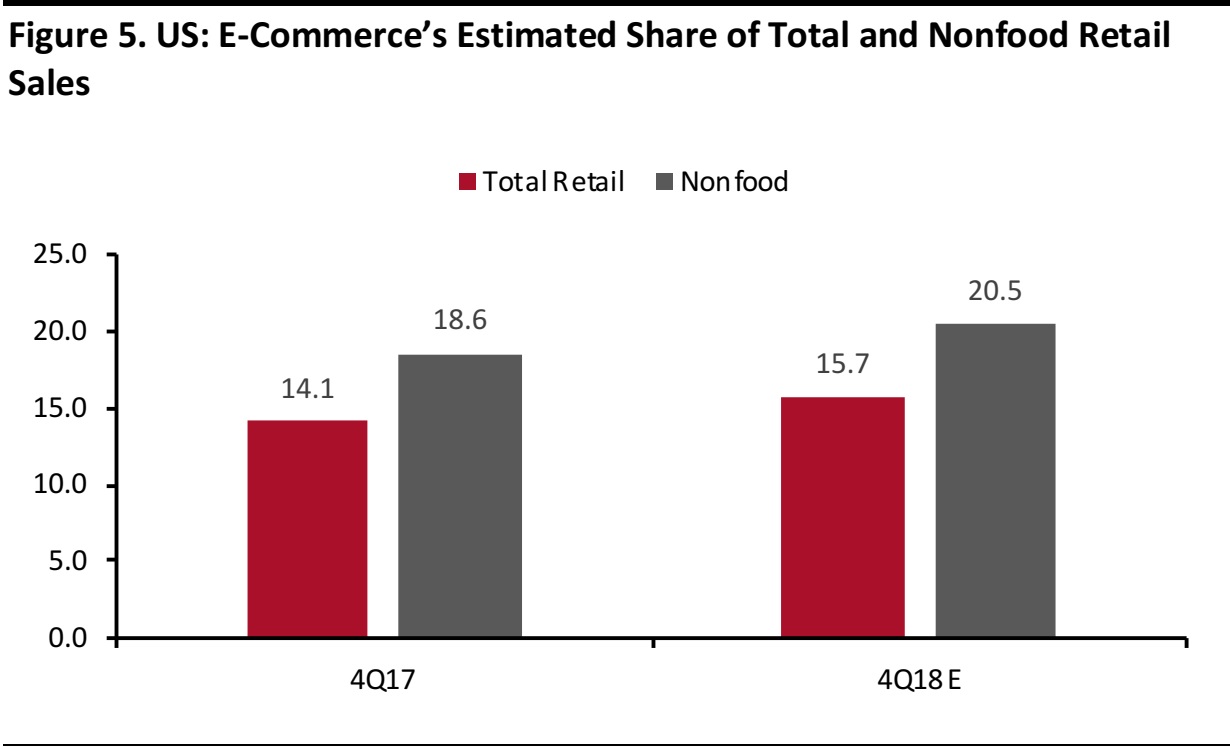

E-commerce is often said to account for “just 10%” of US retail sales throughout the year, but once we focus on core retail sales, which exclude gasoline and automobiles, and look at just the holiday quarter, when e-commerce’s share typically jumps, the online channel becomes much more meaningful. In fact, we predict that e-commerce will account for nearly one-fifth of all retail sales this holiday season:

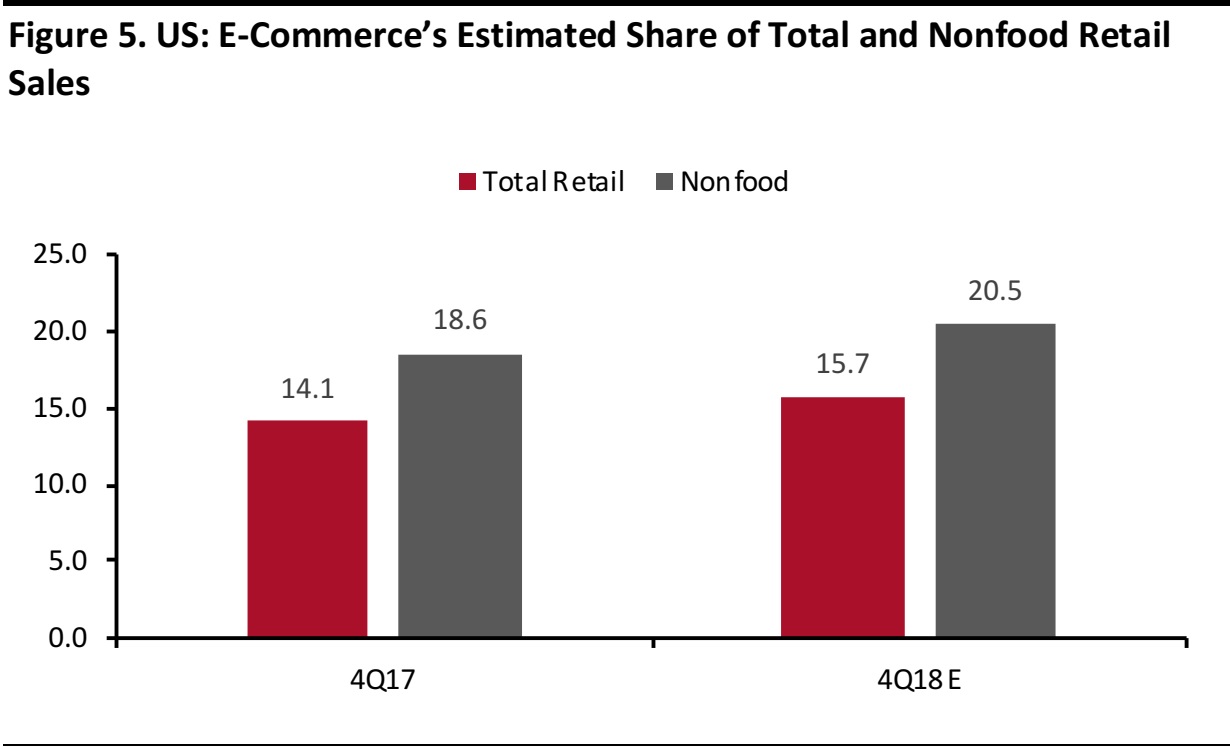

- In the US, we estimate that e-commerce will capture nearly 16% of total retail sales (excluding gas and autos) in the holiday quarter, up from 14.1% over the same period in 2017. This equates to an estimated $156 billion in online sales in the final quarter.

- We further estimate that e-commerce will capture more than 20% of all US nonfood retail sales for the first time in the fourth quarter, up from 18.6% in the final quarter of 2017.

- E-commerce’s share will be meaningfully higher than this average in some key nonfood categories. We estimate that more than one-third of consumer electronics sales and more than one-fifth of apparel sales will be made online over 2018 as a whole, and e-commerce’s share of sales in these categories is likely to be even higher over the holiday period.

Source: US Census Bureau/US Bureau of Economic Analysis/Coresight Research

In the UK, e-commerce captures a higher share of retail sales than it does in the US, and

we estimate that the holiday period (November and December) will see e-commerce reach two thresholds in the UK: it will capture more than 20% of all retail sales and more than 30% of all nonfood retail sales for the first time.

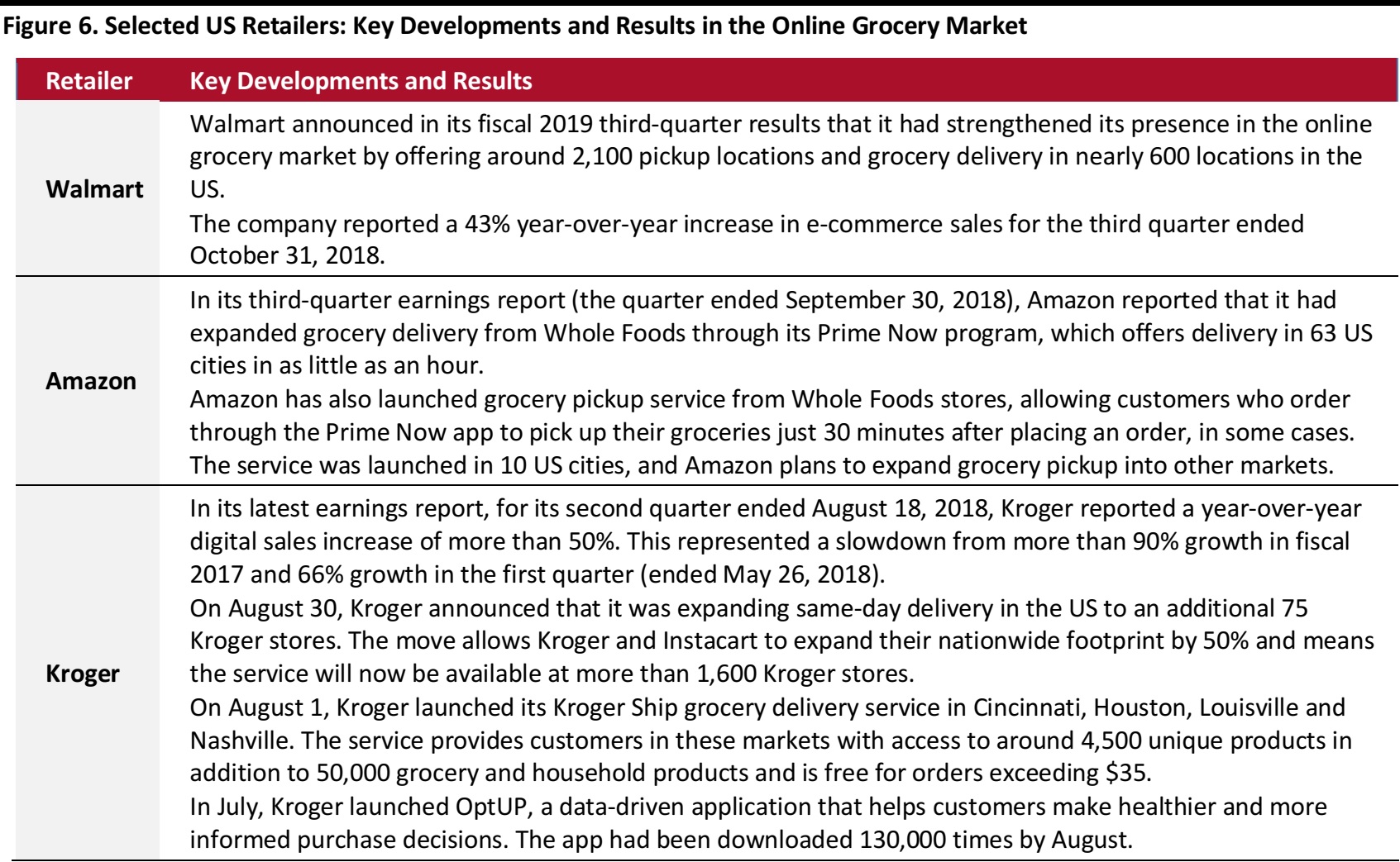

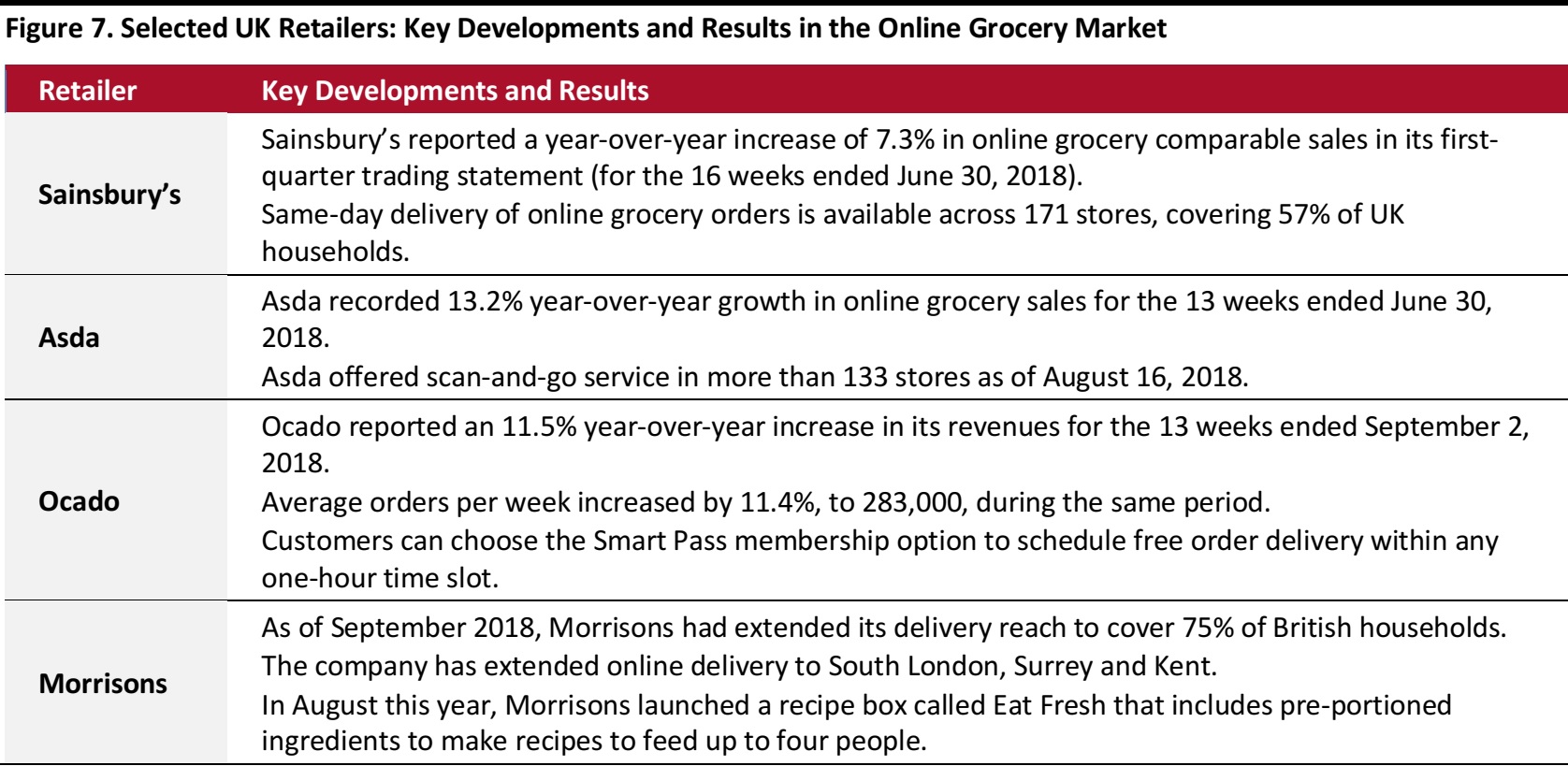

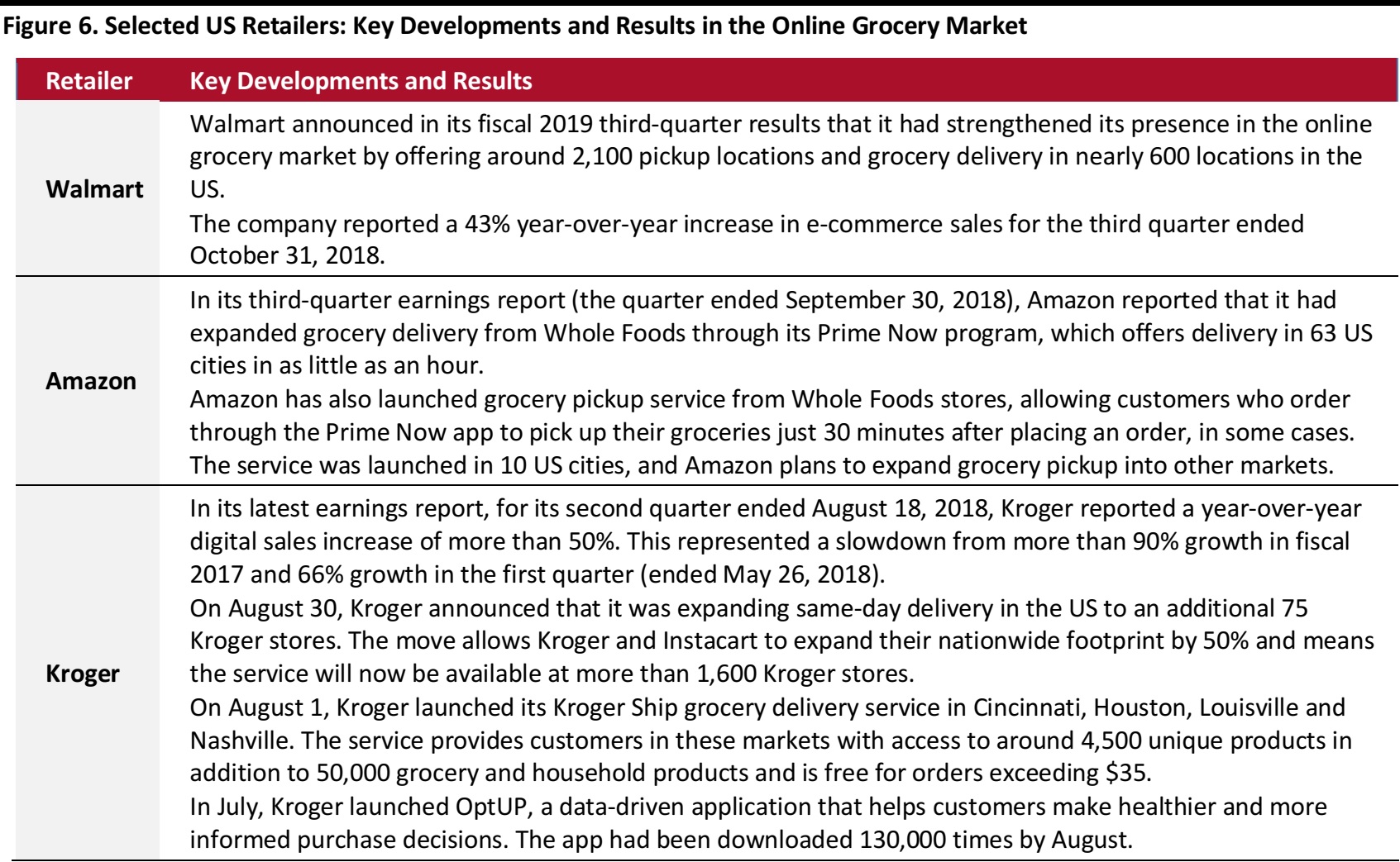

However, there is one sector where e-commerce will lag, especially in the US: grocery. We estimate that the online channel will account for a little under 3% of US food and drink sales in the holiday quarter, a percentage well below the double-digit shares that e-commerce will take for all retail and nonfood retail sales, as shown above. But even though the share will be small, we expect the online channel’s momentum to be strong as more retailers swing behind grocery e-commerce.

Source: Company reports/Coresight Research

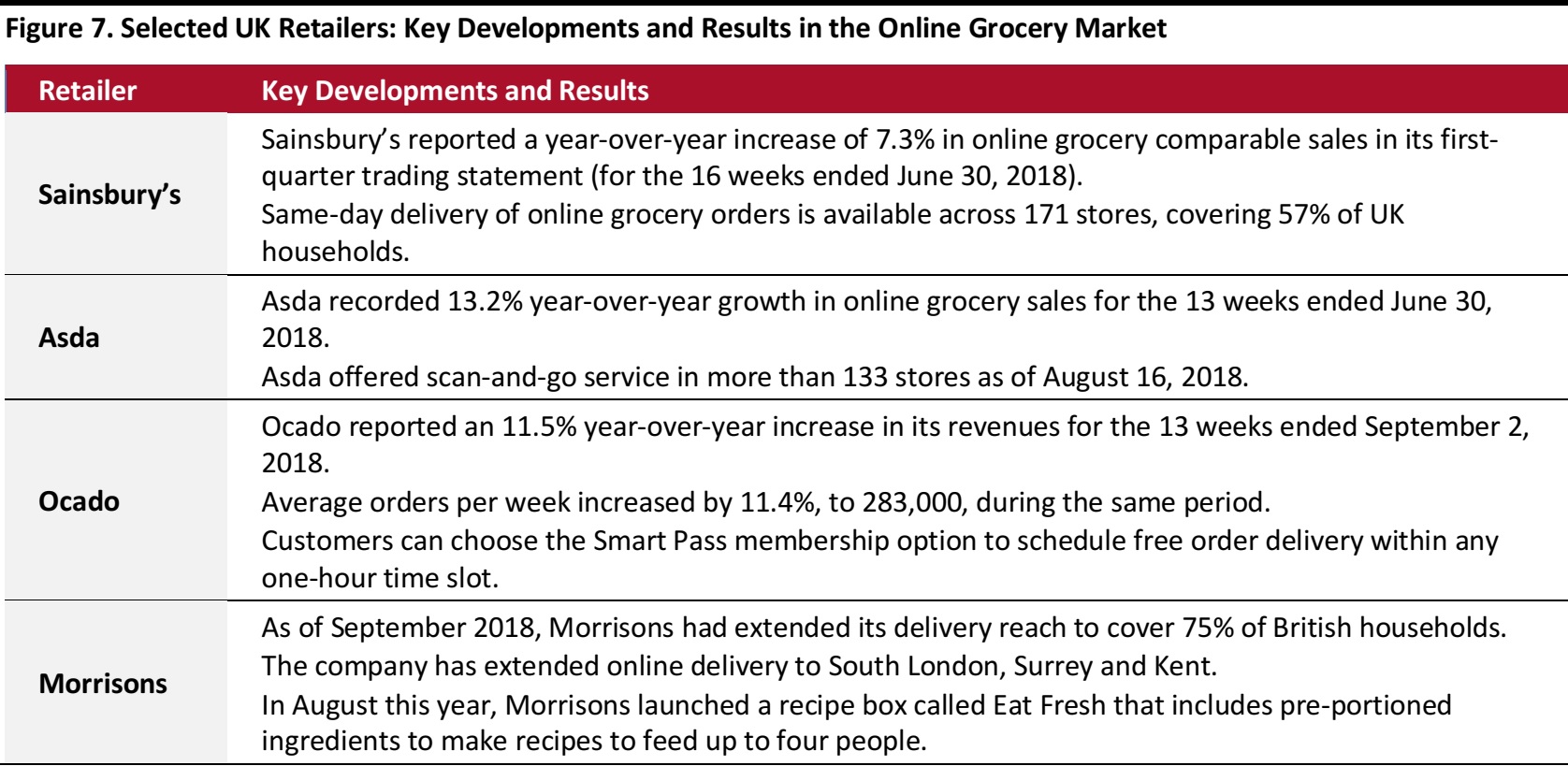

E-commerce captures a much greater share of grocery sales in the UK than it does in the US: online sales accounted for 7.5% of UK grocery sales in 2017 and that share is expected to climb to 12% by 2025, according to research firm Kantar Worldpanel. And British retailers are continuing to roll out innovative and quicker shipping methods. For example, in October 2018, supermarket chain Waitrose & Partners launched its While You’re Away grocery home delivery service, which allows delivery drivers to enter customers’ homes and put away groceries while the customers are away.

Source: Company reports/Coresight Research

4) Voice Shopping Will Be More Popular than Ever, but the Technology Still Presents Some Challenges

Voice assistants have become more popular in the US and the UK over the last couple of years and the number of users is progressively increasing. This holiday season, we expect voice assistants to play a bigger role in holiday shopping than in previous years. According to a November 2017 survey conducted by customer experience platform Narvar, smart speaker ownership increased by 42% in the US over a period of just six months last year, while the use of smart speakers to shop online increased by 41% over the same period. Those figures align with data from Adobe Digital Insights, which show that 32% of the US population owned a smart speaker in August 2018, up from 28% in January 2018.

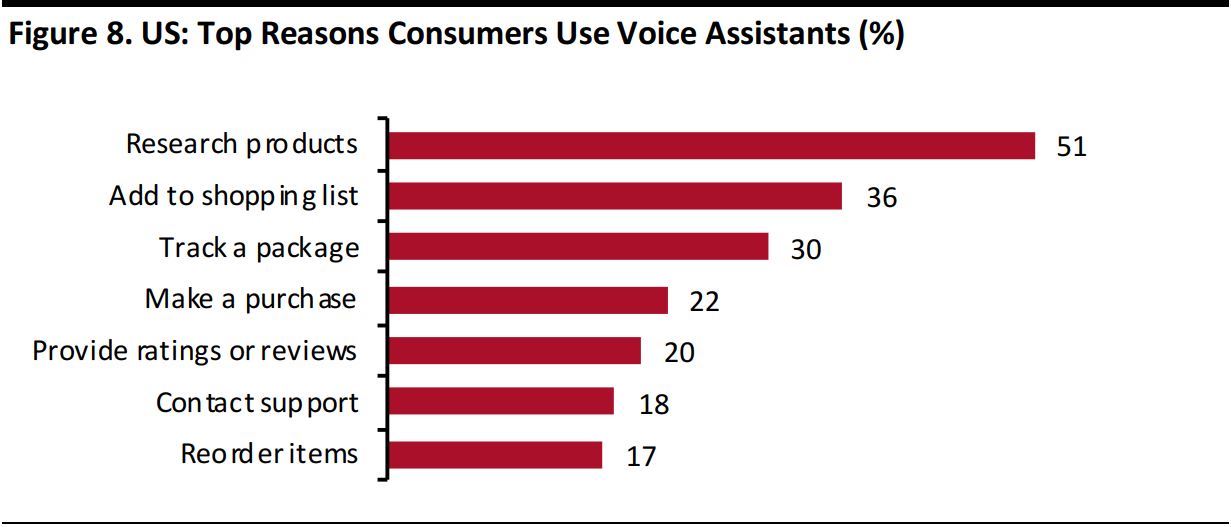

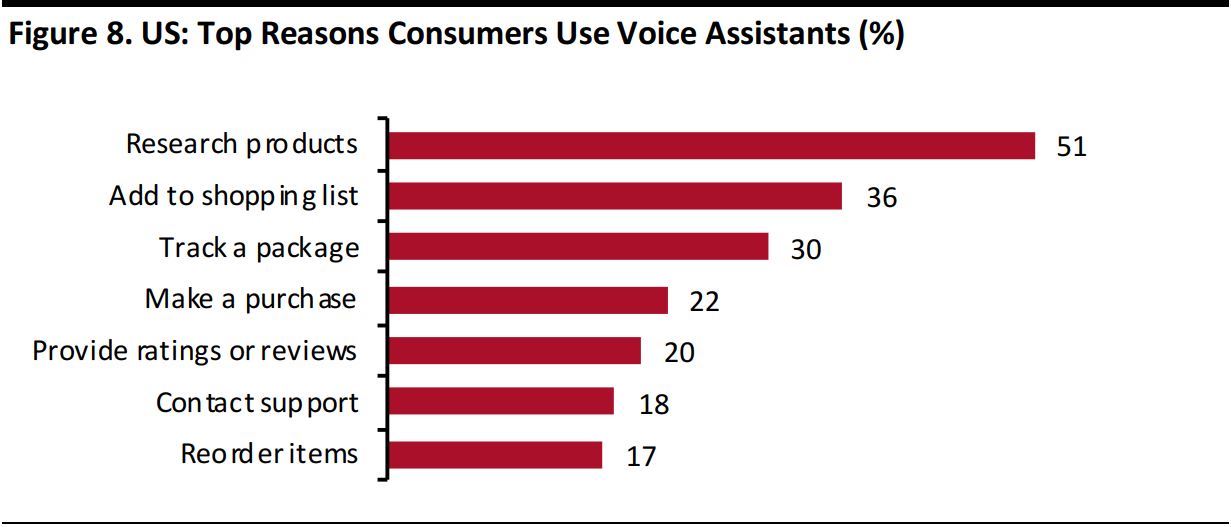

According to Narvar’s survey, the use of voice assistants is not limited to purchasing: consumers also use the devices before and after purchasing. Fully 51% of consumers surveyed said that they used their voice assistant to research products before making a purchase, while 20% said that they used it to provide ratings or reviews of products. We expect this trend to strengthen over the holiday season, complemented by multichannel shopping, which may encourage the use of voice assistants over other devices.

Base: 1,543 US shoppers ages 21–65, surveyed in November 2017; results published in April 2018

Source: Narvar

A survey conducted by Voicebot in May 2018 found that 20% of respondents had shopped using voice technology and 26.1% of smart speaker owners had shopped using a voice assistant. These assistants are also playing a bigger role in in-store applications. Some 31.3% of survey respondents stated that they had used voice technology on their mobile phone to locate a product in-store, while 25.5% had used voice technology to compare products.

Amazon’s Alexa enables consumers to complete almost every shopping function hands-free. Alexa owners can use the platform to search for new products, make purchases (including reorders), check prices and product ratings, find deals, and track packages. Amazon has extended its grocery delivery service to 63 cities for Prime members and customers can use Alexa to order groceries from Whole Foods hands-free, thereby avoiding the hassle of waiting in line at a store.

In May 2018, Google Home accounted for 26.9% of the smart speaker market, up from 18.4% in January 2018. We expect Google Home to drive sales made via voice assistant for retailers such as Walmart, Costco and Home Depot this holiday. All three of these retailers are retail partners of the Google Express marketplace platform, which allows shoppers to browse and make purchases through Google Home.

Source: Amazon.com

We predict that fast-moving consumer goods will be the products most frequently ordered through voice assistants this holiday, for three reasons: they are frequently reordered, they are low cost (which equates to low risk if the wrong item arrives) and they are bought by brand or specification rather than based on more tangible qualities.

Although voice commerce looks set to grow (from a small base), the channel still presents a number of challenges for retailers and shoppers alike:

- Retailers struggle to get shoppers to build larger basket sizes in all channels, and voice technology limits retailers’ ability to drive incremental and complementary purchases and to encourage shoppers to trade up to more expensive items. Shoppers using voice technology will typically ask for what they are looking for and buy only that item (or add it to their basket). Smaller baskets have less favorable economies of scale, especially for shipping.

- Voice commerce also limits retailers’ ability to encourage shoppers to switch to more profitable alternatives, notably private labels, as the technology makes it more difficult to present a range of products for shoppers to browse.

- Because shoppers cannot easily browse and compare products via voice commands, they are likely to use voice commerce most often to buy specific brands—and this diminishes retailers’ power. For example, shoppers are more likely to command their voice assistant to “Buy Tide” than to “Buy laundry detergent” because if they say the latter, they may not know what product they will receive or how to refine their choice further. That lack of certainty encourages shoppers to make repeat purchases of the same brands, limiting retailers’ ability to persuade shoppers to switch brands, including to private labels.

- Finally, for shoppers, the absence of visuals in the voice commerce channel makes it more difficult to double check the quantity, flavor or edition of the products they are ordering, adding another bit of uncertainty to the purchase process.

5) Social Media Sites Will Drive More Sales Traffic than in Previous Years

This holiday season, more consumers will look up trending goods on social media platforms such as YouTube, Facebook and Instagram than on conventional search engines. Consumers’ increasing tendency to research products before purchasing represents a big opportunity for social media platforms. A June 2018 report by Facebook stated that 55% of shoppers surveyed reported that Facebook was influential in their holiday shopping in 2017.

Video has also become more important in influencing shoppers. According to eMarketer, US spending on social media video ads is expected to reach $7.85 billion in 2018, a 38% increase year over year.

We expect that YouTube and Instagram will be the largest drivers of sales traffic among social media platforms this holiday because they have large user bases and are home to an increasing number of online influencers. Many consumers are quick to search for fashion goods sported by their favorite fashion icons, using queries such as “Buy Coach handbag Selena Gomez carried” or “Fendi coat Gigi Hadid wore—similar styles.” These kinds of searches return numerous listings on Google with product details or directions for how to buy the product or a similar one from other brands or retailers, and all of these searches add to online traffic and, in some cases, result in conversions to purchase.

Source: Instagram

Moreover, YouTube videos with themes such as “Shop with me” or “First impression” inspire many consumers to make a purchase while watching the videos or after. These videos enable consumers to do some research on products they plan to buy and also encourage them to look up similar products on company websites or apps. We expect social media to be a major research tool for holiday shoppers this year, as shoppers are increasingly using these platforms to discover and research products and even to recommend styles and ideas to friends and family.

Key Takeaways

The digital retail space has become more competitive than ever and digital holiday sales this year will be stronger in the US and the UK than in previous years. This holiday season, retailers should:

- Stand ready to cater to cross-channel shoppers, whose research and purchase journeys will span digital and physical channels.

- Be prepared to provide customer-service or purchase options through newer channels including social media and voice commerce.