Nitheesh NH

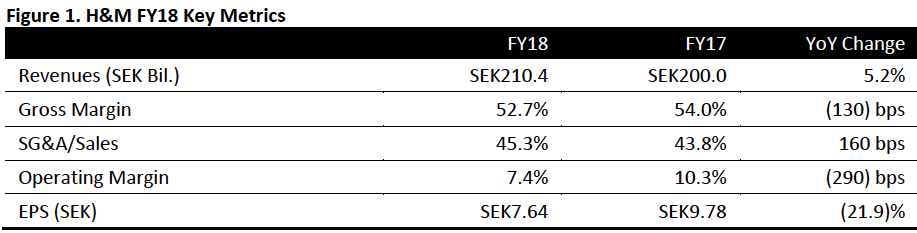

[caption id="attachment_68903" align="aligncenter" width="600"] Source: Company reports/Coresight Research[/caption]

FY18 and 4Q18 Results

H&M reported its 4Q18 and FY18 results for the periods ended November 30, 2018.

For FY18:

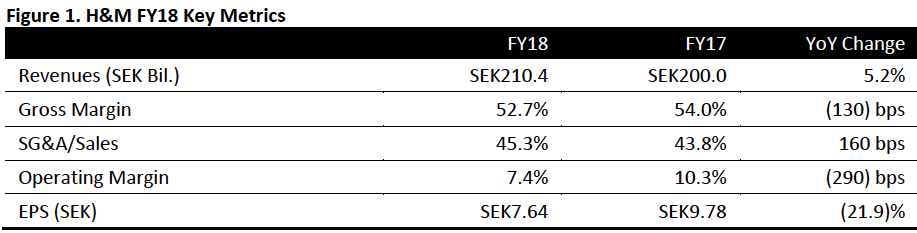

Source: Company reports/Coresight Research[/caption]

FY18 and 4Q18 Results

H&M reported its 4Q18 and FY18 results for the periods ended November 30, 2018.

For FY18:

Source: Company reports/Coresight Research[/caption]

FY18 and 4Q18 Results

H&M reported its 4Q18 and FY18 results for the periods ended November 30, 2018.

For FY18:

Source: Company reports/Coresight Research[/caption]

FY18 and 4Q18 Results

H&M reported its 4Q18 and FY18 results for the periods ended November 30, 2018.

For FY18:

- Net sales were up 5.2% year over year. In local currencies, the company grew net sales 3%. Online sales showed robust growth of 22% year over year to SEK30 billion.

- In local currencies, H&M saw a 6% fall in U.S. revenues versus an 8% increase in U.S. store numbers; a 10% increase in China revenues versus a 5% increase in store numbers; a 1% decline in Germany revenues versus a 1% increase in store numbers; and, a 5% increase in U.K. revenues versus a 4% increase in store numbers.

- Gross margin contracted 130 basis points to 52.7%.

- Operating margin contracted 290 basis points, due to higher selling and administrative costs.

- EPS fell 21.9% year over year to SEK7.4, missing the consensus of SEK7.8 by StreetAccount.

- During FY18, excluding franchises, the group opened 336 stores and closed 143 stores and through franchise partners opened 39 stores and closed three.

- The company grew net sales 12% year over year to SEK56.4 billion, compared to 9% growth in the previous quarter. In local currencies, net sales increased 6%, strengthening from 4% growth in the previous quarter, led by increased full-price sales and lower markdowns.

- The group grew online sales 24.0%, lower than the 32% growth reported in 3Q18.

- The gross margin contracted by 120 basis points to 54.2%, slightly below the consensus of 55.0% by StreetAccount. H&M noted that markdowns decreased 0.6 percentage points in 4Q18.

- The operating margin contracted 190 basis points to 7.6%, lower than the consensus of 8.8%, due to higher selling and administrative costs. The company also recorded a cost of SEK560 million in the quarter, related to the replacement of logistics systems and upcoming transitions.

- Management attributed the increase in the SG&A ratio to store and online expansion, increased investments in H&M Club and costs related to the implementation of new logistics systems in the U.S., France, Italy and Belgium.

- EPS fell 11.2% year over year to SEK2.14, below the consensus of SEK2.32 recorded by StreetAccount.

- H&M said it outperformed in a number of markets in 4Q18. In local currency, in the U.K., 38% online growth was offset by a 1% decline in store-based sales, leading to total growth of 8%. In other markets, total growth was driven by both physical stores and online. In local currencies, markets that performed well were China (+24%), India (+43%) and Russia (+27%). H&M noted that other markets such as the U.S. and Norway were more challenging. In local currencies, U.S. sales in fell 2% year over year, while revenues for Germany were up 2% and for the U.K were up 8%.

- H&M opened three new fulfilment centres with a total logistics area of around 230,000 square meters during the quarter, increasing existing capacity, particularly for online sales.

- The company noted that inventory levels were up year over year.

- Management said it is focused on store portfolio optimization and will continue to integrate physical stores and digital channels.

- For 1Q19, the company expects markdowns to be around 1 percentage point lower compared to the year-ago period and expects to see continued improvement in inventory, led by strong collections and increased full-price sales.

- Net sales for the period December 1, 2018 to January 28, 2019, increased 4% year over year in local currencies.

- In FY19, the company plans to open around 335 new stores, of which around 240 will be H&M stores. H&M plans to close 160 stores.

- The company will open new logistics centers outside Madrid and north of London at the end of 2019 or beginning of 2020.

- In FY19, according to the consensus estimates by StreetAccount, analysts expect H&M to report revenues of SEK220.6 billion, up 4.8%year over year, and EPS of SEK8.11, up +6.2% year over year.