Web Developers

Source: Company reports/FGRT

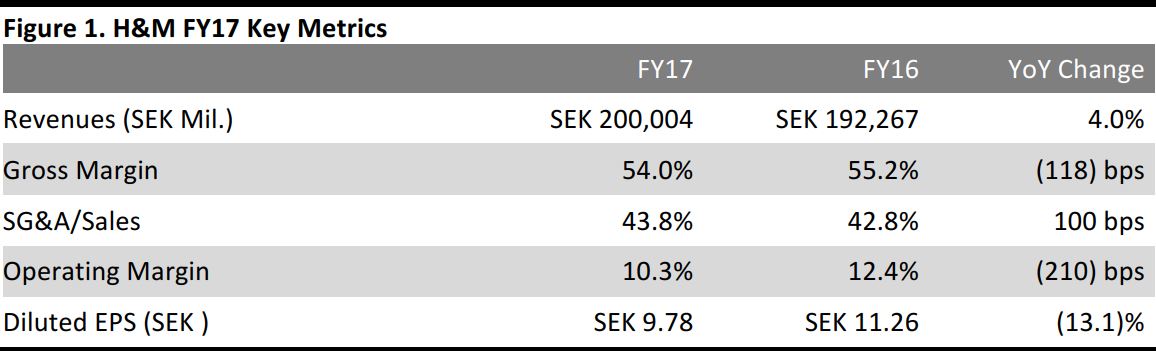

FY17 Results

In the year ended November 30, 2017, H&M reported net sales of SEK 200,004 million, slightly below the consensus of SEK 203,277, as recorded by S&P Capital IQ, and up by 4.0% year over year. For the full year:- Sales including VAT increased by 3% in local currencies and by 4% in Swedish krona.

- Gross margin diminished by 118 basis points to 54.0%. H&M noted that markdowns with regard to sales increased by 1.3 percentage points in 4Q17, due to weak autumnal sales growth and reduced footfall in H&M’s physical stores.

- SG&A as a percentage of sales grew by 100 basis points while the operating margin shrank by 210 basis points during the year. H&M observed slow sales development at its physical stores and remarked that sales from its website have not yet grown enough to offset the reduced footfall.

- Diluted EPS shrank by 13.1% to SEK 9.78 during the year, but was marginally above the consensus estimate of SEK 9.71.

- H&M opened 479 stores and closed 91 stores, taking total store numbers to 4,739 at year-end. The increase was equivalent to a 9% rise in store numbers, implying that sales growth during the year was sustained purely by new openings.

Our performance during 2017 was mixed, with progress in some areas, but also difficulties in others. We delivered growth of 3% in 2017, which is clearly below our expectations.” “… All in all, we feel 2017 was a year where we made more steps forward and did more groundwork for the future, but we have also made some mistakes that have slowed us down.

Management noted weakness in shopper traffic as more sales shifted online.