Source: Company reports/Coresight Research

3Q18 Results

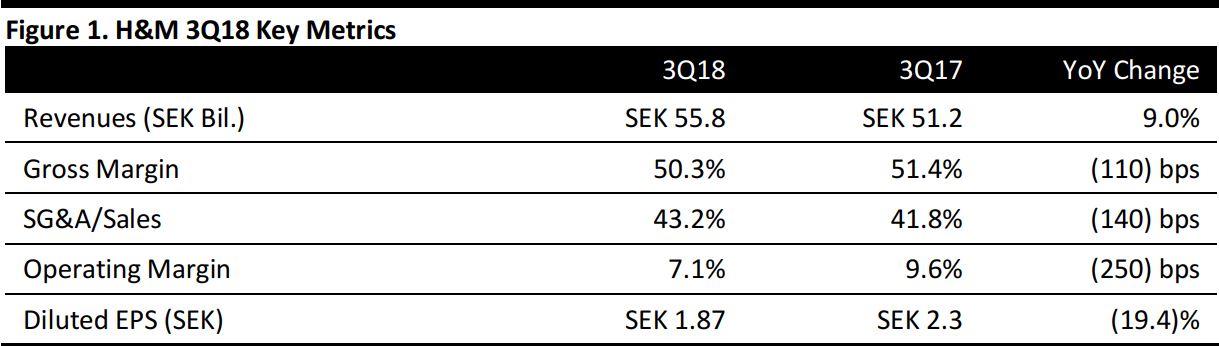

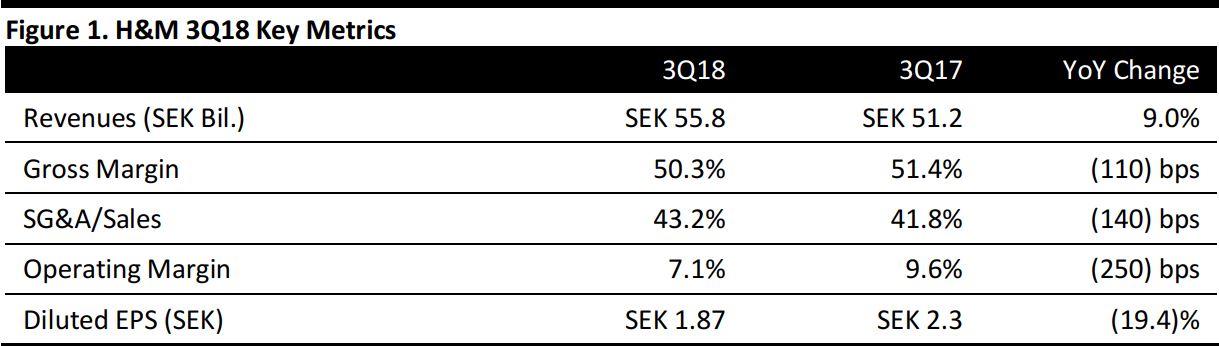

Swedish clothing company H&M announced absolute sales and profit data for 3Q18, which ended August 31, on September 27. The company had already announced revenue growth for 3Q18,

on September 17, reporting an acceleration in total sales from the second quarter.

Sales excluding value added tax (VAT) rose by 9.0% in reporting currency to SEK 55.8 billion. Sales including VAT grew by 9.1% as reported and by 4% at constant currency (CCY).

The latest announcement provided the following additional details for 3Q18:

- Gross profit was SEK 28.1 billion, up by 6.6% year over year. This yielded a gross margin of 50.3%, down by 110 basis points from the previous year. H&M stated that the markdowns in relation to sales grew by just 0.7 percentage points in 3Q18 as compared to 3Q17.

- SG&A as a percentage of sales contracted by140 basis points year over year.

- Operating income was SEK 4.0 billion versus analysts’ expectations of SEK 4.1 billion (down by 19.5% year over year), according to S&P Capital IQ. This led to a contraction of 250 basis points in the company’s operating margin, to 7.1%. H&M attributed increased expenses and the margin contraction to the expansion of its stores and online markets.

- Profit for the period was SEK 3.1 billion, down by 19.2% versus 3Q17. Diluted EPS was SEK 1.87, below the consensus estimate of SEK 1.91 and down 19.4% from SEK 2.3 in 3Q17.

- Online sales increased by 32% versus the corresponding period last year.

H&M remarked that the increased costs incurred by the company in implementing a new logistics system had led to the decline in profit margins. The company said that sales in the US, France, Italy and Belgium had fallen by 8% and that it had incurred SEK 400 million in exceptional costs while implementing the new logistics system in these markets during the spring.Sales in H&M’s 66 other markets were up by 8% at CCY.

Inventory climbed by 15% year over year (by 12% at CCY). H&M remarked that its inventory had been getting better as stock turnover on new products gradually increased. In 3Q18, the company opened a net 40 stores.

Recent Developments

- Ukraine: H&M opened its first store, in Kiev, on August 18.

- Stockholm: H&M Home launched its first standalone concept store in Biblioteksgatan in August. Among other features, this store showcases a smaller than usual assortment of selected clothing displayed in color-coordinated sections and will host invitation-only events.

Outlook

In 4Q18, H&M expects no increase in markdowns versus the corresponding period last year. The company also stated that sourcing costs will be slightly positive versus last year, mostly due to the weakening of the US dollar against its basket of currencies.

H&M will open its first store in Uruguay and COS is set to launch online in China and on Tmall in autumn 2018.

The company is increasingly integrating online and physical stores and aims to roll out online in all its existing markets. CEO Karl-Johan Persson said that “We are continuing to optimise the store portfolio in order to accommodate customers’ changed shopping patterns in the ongoing shift online. In the year to date this has meant a lower net addition of new stores within the group. We are also seeing that the shift provides opportunities to achieve even better lease terms for both new and existing stores.”

For FY18, analysts expect revenue to increase by 4.0%. The consensus estimate is a 16% decline in operating profits and 17% decline in diluted EPS.