DIpil Das

Source: Company reports/Coresight Research[/caption]

2Q19 and 1H19 Results

Sweden-based clothing company H&M reported 2Q19 and 1H19 results on June 27, as follows:

2Q19

Source: Company reports/Coresight Research[/caption]

2Q19 and 1H19 Results

Sweden-based clothing company H&M reported 2Q19 and 1H19 results on June 27, as follows:

2Q19

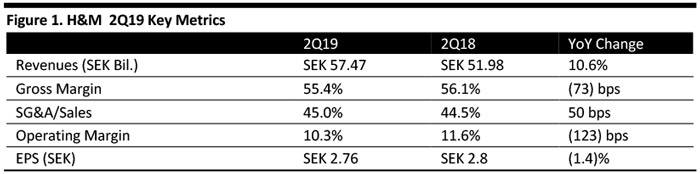

- Sales increased 6% year over year on a constant-currency basis to SEK 57.47 billion (up 10.6% as reported), compared to 4% growth in the previous quarter. Sales were ahead of the consensus estimate of SEK 57.15 billion recorded by StreetAccount.

- Online sales in the second quarter increased 20% on a constant-currency basis and 27% as reported.

- By region on a constant-currency basis, the US grew revenues 17%, France 2%, Spain 8%, Sweden 5%, the UK 5%, Russia 19% and China 8%. Revenues in Germany fell 2%, in Italy 1% and in the Netherlands 1%.

- Management said sales in Germany were negatively impacted by the “fine-tuning” the company undertook following the transition of the online platform at the beginning of the year. H&M noted that sales gradually picked up.

- The company grew gross profit 9.1% year over year to SEK 31.82 billion. Gross margin contracted 73 bps to 55.4%, slightly below consensus of 55.5%, due to investments in transformation work related to investments in AI, technology, logistics and its customer loyalty program. Higher purchase costs due to strengthening of the US dollar against the group’s basket of currencies also hurt gross margin.

- Costs for markdowns in relation to sales decreased around 1 percentage point.

- Operating margin contracted 123 bps to 10.3%, slightly below the consensus of 10.4%, due to increased overheads related to store and online expansion, as well as transformation work.

- Profit after financial items stood at SEK 5.93 billion, down 1.3% year over year.

- The company’s profit after tax was SEK 4.56 billion, down 1.5% year over year.

- EPS fell 1.4% year over year to SEK 2.76, missing the consensus of SEK 2.81.

- The company launched an online store in Mexico during the quarter.

- H&M’s sales increased 5% year over year on a constant-currency basis to SEK 108.5 billion (up 10.5% as reported).

- The company grew gross profit by 9.9% year over year to SEK 57,35 billion

- Gross margin contracted 32 basis points to 52.9%.

- Profit after financial items stood at SEK 6.97 billion, down 4.1% year over year.

- Profit after tax was SEK 5.37 billion, down 10.6% year over year.

- EPS fell 10.5% year over year to SEK 3.25.

- In June 27, 2019, H&M and Klarna expanded their current partnership agreement to provide frictionless payment service to consumers to include the US market. US consumers will be able to use the “buy now, pay later” service, enjoy a streamlined post-purchase experience for deliveries and returns that will be integrated into the H&M app and join H&M’s loyalty program.

- H&M upgraded its customer loyalty program and now has over 43 million members. The program is available in 19 markets, the US, Canada and Russia being the latest additions. By the autumn, the program will be integrated into the Chinese social media app WeChat.

- Members of H&M’s customer loyalty program will be able to shop and pay later, in store or online. The company plans to integrate its loyalty program into the H&M app in eight markets in 2019, beginning with Switzerland in August, and later the UK.

- Customers will see product visuals, including videos, in H&M online stores, giving customers a better understanding of online products.

- H&M has launched visual search in 29 markets and uses image recognition to help customers search products.

- H&M will offer next day delivery in 12 markets in 2019, is testing same-day delivery in others – and has launched it in some countries including the Netherlands and the UK.

- H&M launched a service that lets customers scan a QR code on a product in store to look for different sizes or colors online (if they don’t find what they want in store), then can make the purchase online. The company has launched the service in 11 markets and plans more in 2019

The H&M group continues to increase full-price sales, reduce markdowns and increase market share. We grew in the UK and Sweden, where we took market share despite challenging market conditions. By continuing to integrate our physical and digital channels we are making the shopping experience inspiring, easy and convenient for customers wherever we meet them. This and other extensive investments are driving costs in the short term. For example, our new online platform and our new logistics systems have not yet achieved full efficiency, but…have resulted in improvements such as faster and more flexible deliveries and a more seamless shopping experience. We have continued to develop our new digital features and during the spring we also substantially expanded H&M’s customer loyalty program, which now has more than 43 million members.

Outlook H&M outlined the following plans and guidance for FY19:- H&M plans to expand its online presence in Thailand, Indonesia and Egypt via franchise during the second half of 2019

- The company plans to launch H&M on Myntra, India’s largest e-commerce platform, and on Other Stories on Tmall in China.

- It plans to open H&M stores in Belarus and Tunisia (via franchise).

- H&M reduced its store opening target for 2019 and now plans a net addition of 130 stores compared to 175 stores targeted earlier (295 openings and 165 closures).