Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

1Q18 Results

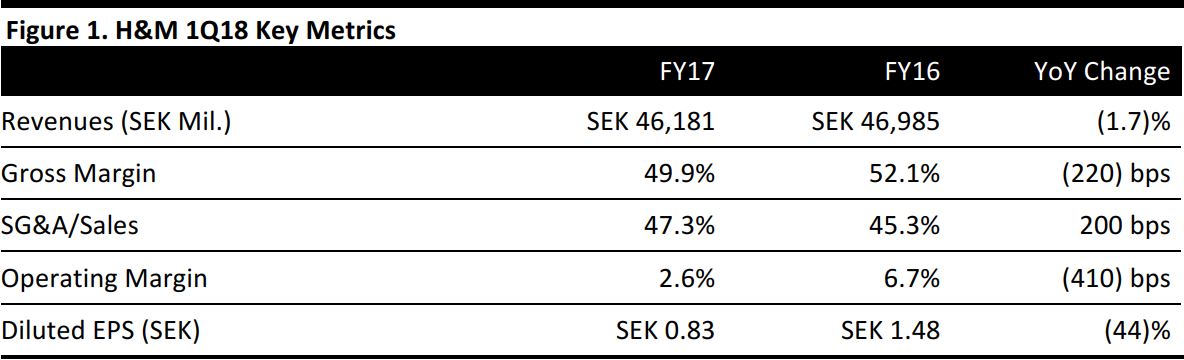

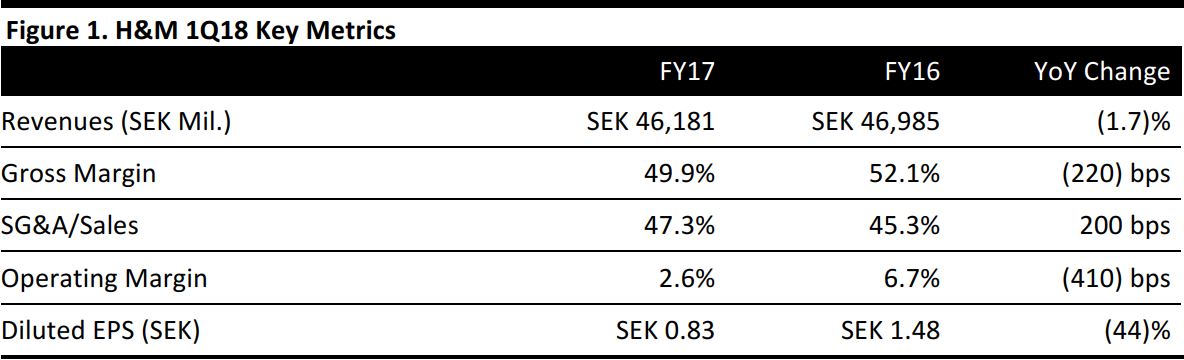

Swedish fashion group H&M announced absolute sales and profit data for 1Q18 on March 27. The company had already announced 1Q18 revenue growth

on March 15. At the time, H&M reported that total sales growth was flat in constant-currency terms in the first quarter ended February 28, 2018. Sales excluding VAT declined by 1.7% in reporting currency to SEK 46,181 million, slightly below the consensus estimate of SEK 46,330 million as recorded by S&P Capital IQ.

Sales including VAT fell by 1.5% in reporting currency to SEK 53,554 million.

The latest announcement provided the following additional details for 1Q18:

- Gross profit was SEK 23,040 million, down by 5.8% year over year. This yielded a gross margin of 49.9%, down by 220 basis points from the previous year and below the consensus estimate of 50.03%.

- SG&A as a percentage of sales was 47.3%, up by 200 basis points year over year.

- Operating income was SEK 1,208 million, down by 62% year over year, and resulting in a margin of 2.6%, which was down by 410 basis points from 1Q17.

- Profit for 1Q18 was SEK 1,372 million, down by 44.2%. Diluted EPS was SEK 0.83, above the SEK 0.66 consensus estimate, but down from SEK 1.48 in 1Q17.

- The company stated that it had a one-off positive tax income of SEK 399 million, as a result of US tax reforms introduced in the Tax Cuts & Jobs Act of 2017.

- Online sales grew by 20% and sales from new brands grew by 15%.

H&M remarked that “imbalances in the assortment for the H&M brand” prompted “substantial clearance sales.” The high levels of markdowns combined with the unusually cold winter weather hampered sales of the spring line and profit development in 1Q18, according to the company.

Despite these markdowns, H&M’s inventory climbed by a further 7% year over year in 1Q18; at constant currency, inventory was up 8%. The company cited weak 1Q18 sales and store expansion as factors behind the increase in inventory, but noted that inventory was higher than planned and that this would lead to increased markdowns in 2Q18.

Recent Developments

- India: H&M’s online store was launched in India on March 15.

- China: H&M and H&M Home were launched on China’s Tmall marketplace platform on March 21.

Outlook

CEO Karl-Johan Persson said that H&M’s transformation, which includes developing its brands, growing its markets and expanding online, is on track. The company expects to launch a new off-price marketplace brand Afound later this year. Also this year, H&M plans to open its first stores in Uruguay and Ukraine, and offer online shopping in 47 markets.

In FY18, the group expects sales from new business and online sales to grow by 25%, and to “achieve a somewhat better result” compared to FY17.

Analysts expect H&M’s revenues for FY18 to grow by 2.9% to SEK 205,732 million. The consensus estimate calls for operating profit to contract by 6.5% to SEK 19,229 million and diluted EPS to fall by 7.2% to SEK 9.08.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research