DIpil Das

What’s the Story?

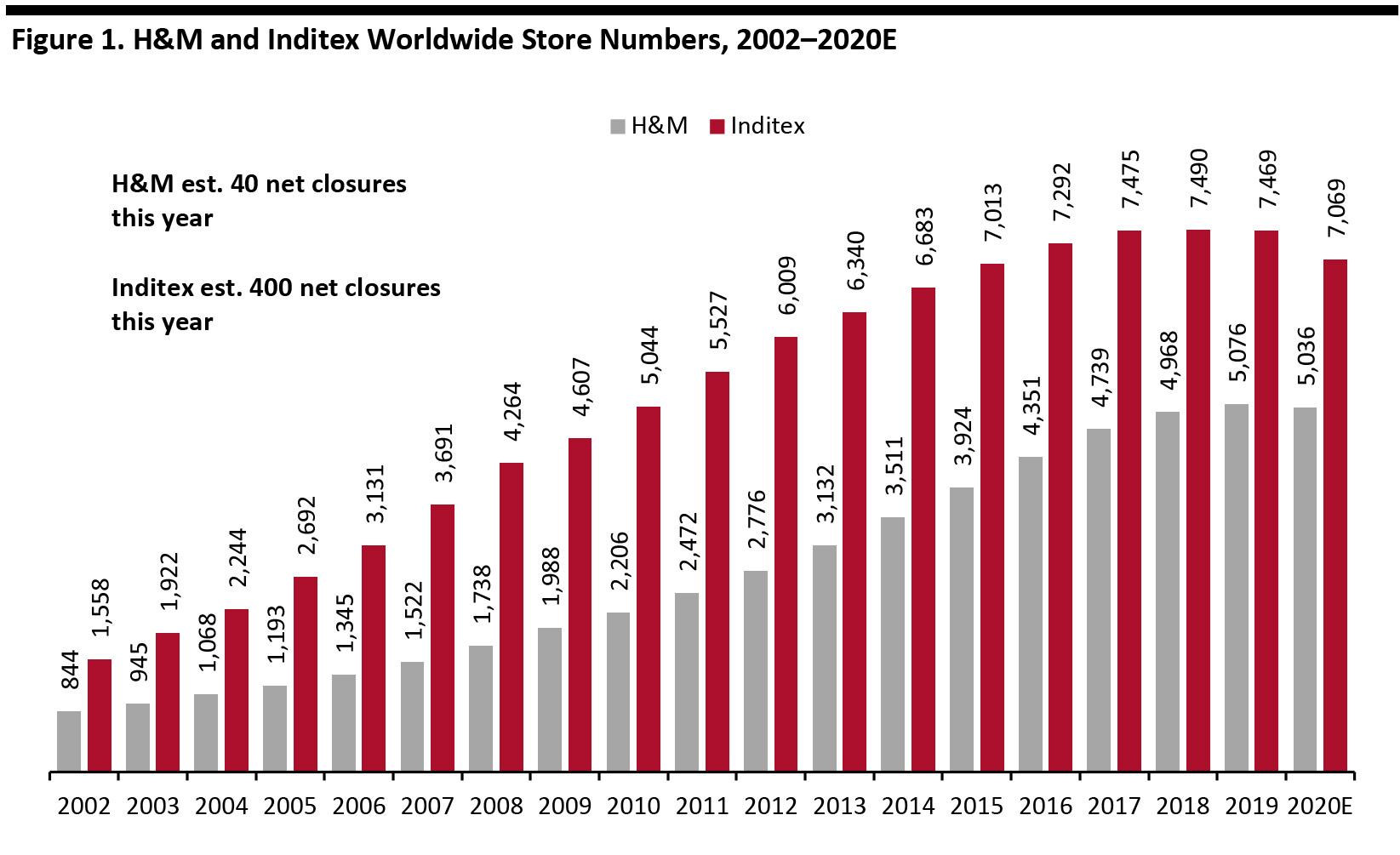

H&M and Inditex Change Course

Inditex began shrinking its store estate in the year ended January 2020, including in the US. For H&M, the year ending November 2020 is expected to be the first for many years in which the company will reduce its store count.- In the year ending November 2020, H&M expects to close around 170 stores and open 130, resulting in a net decline of 40 stores.

- In the next two years, Inditex expects to close 1,000–1,200 stores and open a gross total of 150 stores per year, for an estimated net decline of 400 in each of those two years.

Store numbers attributed to the closest calendar year: H&M’s year end is in November (so the year ending November 2019 has been attributed to 2019, for instance); Inditex’s year end is in January (so, for example, the year ending January 2020 has been attributed to 2019).

Store numbers attributed to the closest calendar year: H&M’s year end is in November (so the year ending November 2019 has been attributed to 2019, for instance); Inditex’s year end is in January (so, for example, the year ending January 2020 has been attributed to 2019). Source: S&P Capital IQ/company reports/Coresight Research [/caption] In the US:

- H&M had 593 stores as of November 2019, up from 578 one year earlier.

- Inditex had 1,580 stores as of January 2020, down from 1,635 one year earlier.

- H&M has outlined that the continued integration of physical and online stores is one key element of its strategy. It still has some way to go: As of November 2019, H&M operated in 74 markets, but an in-store returns service for online orders was available in only 16 of these, BOPIS (buy online, pick up in store) in only 14 and next-day delivery also in only 14 markets.

- Integration between stores and online is one of Inditex’s three focus areas (the other two being digitalization and sustainability). The company is aiming for online sales to account for over 25% of its total sales by 2022; management has not specified what the proportion is today, but in the year ended January 2019, e-commerce accounted for 12% of sales.

What We Think

Net closures by H&M and Inditex mark a reversal of course for the world’s two biggest apparel specialists, fueled by the coronavirus crisis. H&M said that the pandemic accelerated its transformation work related to digitalization, store portfolio, the supply chain and the organization.- The moves could imply that the world’s biggest apparel specialist retailers are expecting the recently elevated levels of online shopping and reduced demand for brick-and-mortar formats to persist.

- Companies are likely to have taken learnings from lockdowns—possibly including that they can retain greater sales than they expected through e-commerce and without stores.

- The plans confirm that the crisis will accelerate digitalization at retailers that have lagged.