DIpil Das

The Coresight Research team participated in the webinar “Introduction to Tmall Global—China’s Premiere E-Commerce Platform” on February 12 to hear more about the Alibaba ecosystem and how western companies can leverage the platform as a springboard to entering the China market.

There Is Still Plenty of Room for Global Brands To Enter the China Market

China is expected to pass the US to become the largest retail market in 2021, when it will value $5.8 trillion, according to Tmall Global and PwC—which also predicted that online penetration in China’s overall retail market will reach 35% in 2020.

Demand for imported goods is also on the rise, creating opportunities for global brands. China’s cross-border e-commerce market was worth $144.1 billion in 2019, up 18.5% year over year. Entering China through an online channel has the advantage of lower barriers, rapid access to a large consumer base and, in many cases, more favorable import tax rates.

Tmall Global Consumers Are Younger and More Willing To Spend

On Tmall Global, 46% of customers are recent entrants to China’s fast-growing middle class: Unlike their far more frugal parents, they want the best for their family and prioritize safety and quality over price alone. In addition, more than 60% of customers are young millennials, who tend to want new experiences and styles and are less sensitive to price.

Tmall Global provides a channel for international brands to test the China market, and it offers a variety of business solutions. In 2019, the number of new brands on Tmall Global grew by 300% year over year, and more than 80 overseas brands generated approximately ¥100 million ($14.3 million) in annual revenue.

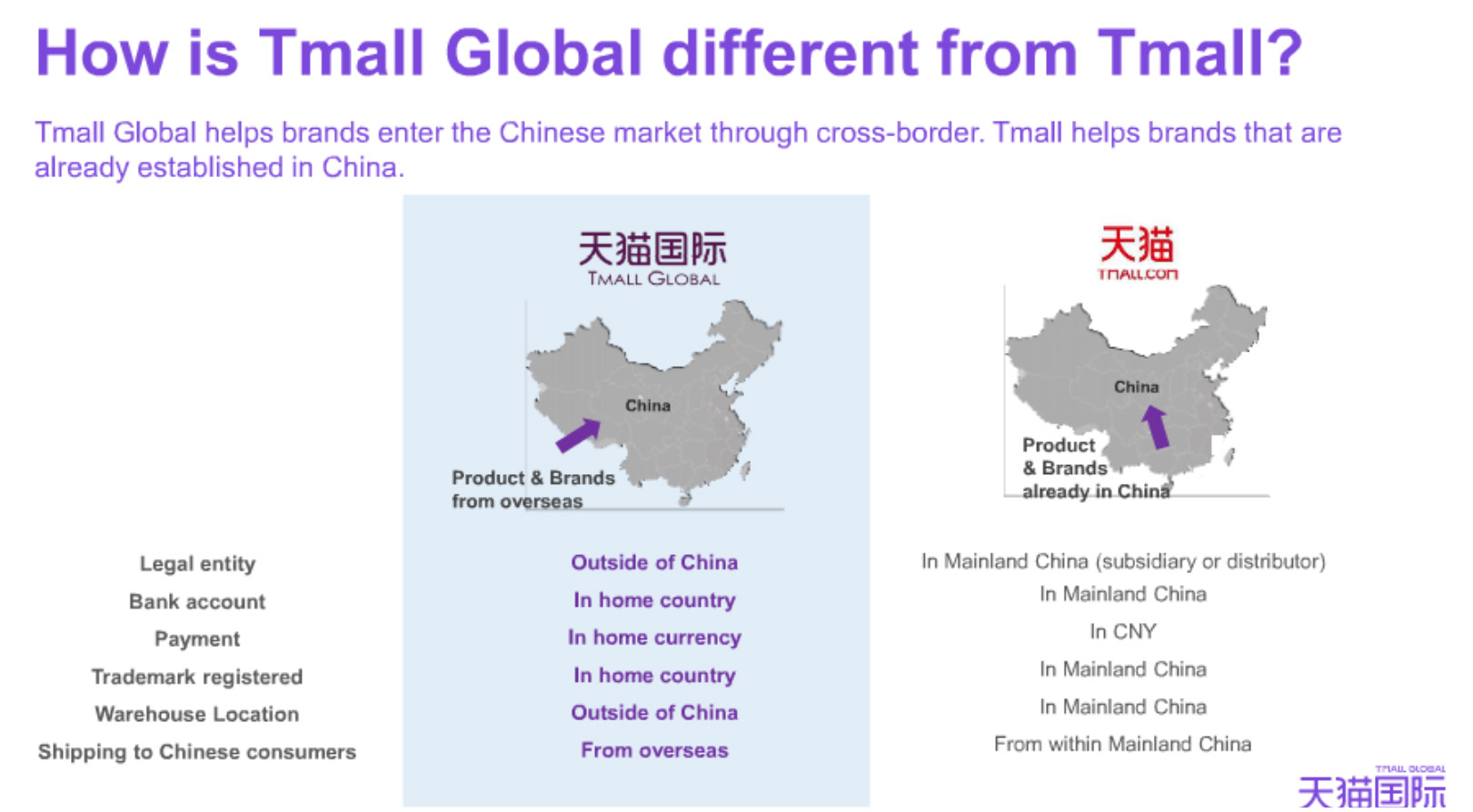

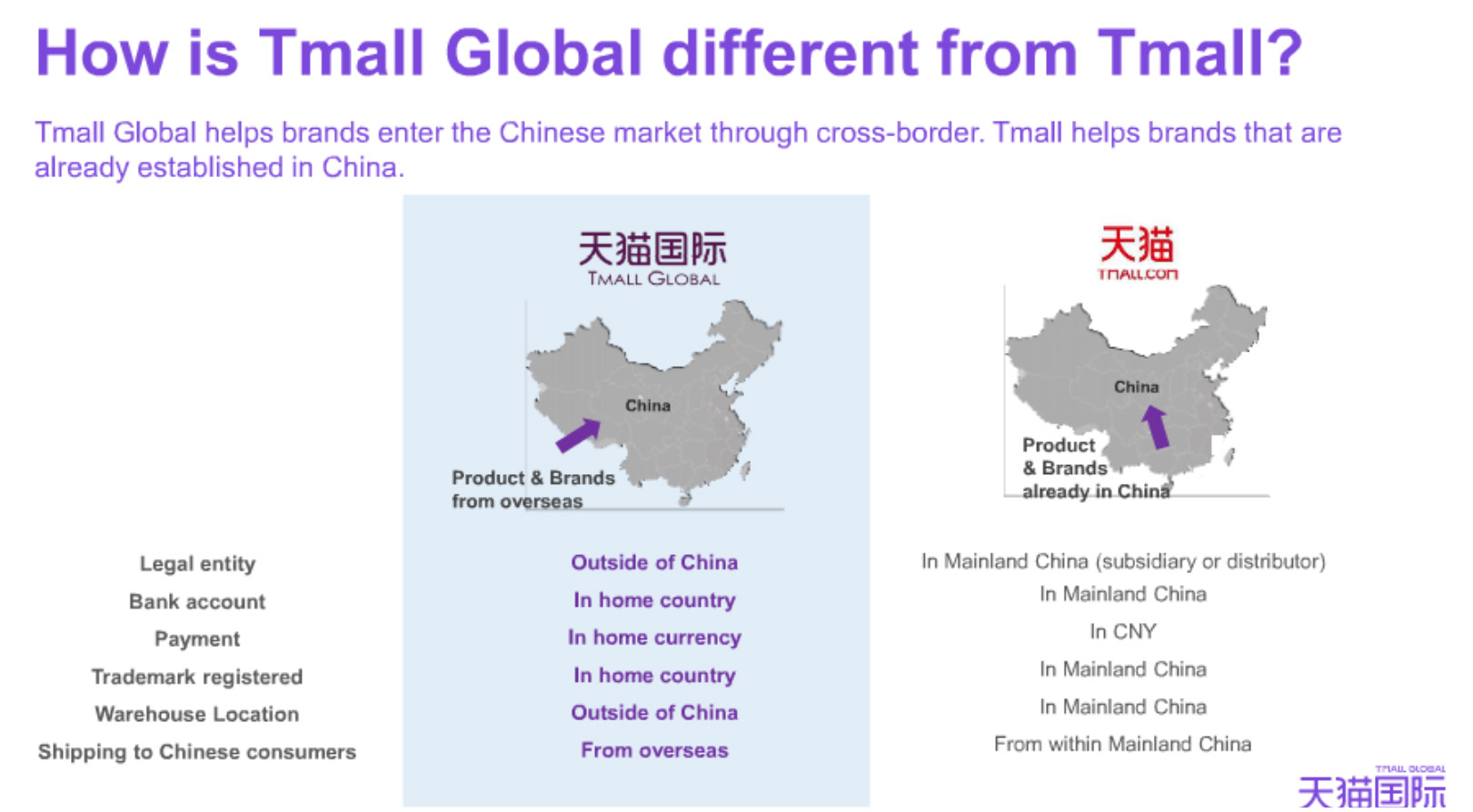

[caption id="attachment_103587" align="aligncenter" width="700"] Tmall Global and Tmall comparison

Tmall Global and Tmall comparison

Source: Tmall Global [/caption] Livestreaming E-Commerce Is a Fast-Growing Trend in China Combining livestreaming with live marketing has become a major force in China’s e-commerce scene, akin to a digital version of the US TV shopping channel QVC. On Singles’ Day 2019, Tmall Global generated $2.9 billion sales through livestream marketing. More than 100 key opinion leaders (KOLs) each promoted products that generated sales of ¥10 million ($1.4 million). This was driven by demand from middle- and lower-tier cities, where livestream marketing is particularly popular. These markets represent a huge, largely untapped opportunity for this innovative way of engaging with—and selling to—consumers. [caption id="attachment_103588" align="aligncenter" width="700"] P&G partners with top livestream KOL Viya

P&G partners with top livestream KOL Viya

Source: P&G [/caption] Showcases from North America Evereden launched on Tmall Global in 2019, but the brand has grown rapidly and was ranked among the top 10 brands in the baby care category during the Chinese New Year shopping period (in early January 2020). By using celebrity endorsements and livestreaming, Evereden increased its brand recognition and found the right mix of products for Chinese consumers [caption id="attachment_103589" align="aligncenter" width="700"] Evereden’s flagship store on Tmall Global

Evereden’s flagship store on Tmall Global

Source: Evereden [/caption] Fenty Beauty, created by singer Rihanna but now part of LVMH, entered China when it launched a flagship store on Tmall Global in September 2019. The brand’s vision is to make Fenty Beauty accessible to digitally savvy Chinese consumers while staying true to its 100% cruelty-free commitment. In November 2019, Tmall also hosted a livestream chat with influencers Viya Huang and Kim Kardashian. Viewed by over 13 million, the stream sold 15,000 bottles of Kardashian's perfume--and boosted brand awareness. [caption id="attachment_103590" align="aligncenter" width="700"] Fenty Beauty flagship store on Tmall Global promoting male beauty

Fenty Beauty flagship store on Tmall Global promoting male beauty

Source: Fenty Beauty [/caption] Vitafusion launched on Tmall in 2019, and within one year it generated multi-million-RMB sales. The best-selling product is its Sleep Well gummies, which combine melatonin with extracts of herbs believed to induce sleep, with 100,000 units sold since the product’s launch. [caption id="attachment_103591" align="aligncenter" width="700"] Vitafusion Valentine’s Day collaboration with Juhuasuan.com, Alibaba's sales and digital marketing platform

Vitafusion Valentine’s Day collaboration with Juhuasuan.com, Alibaba's sales and digital marketing platform

Source: Vitafusion [/caption]

Tmall Global and Tmall comparison

Tmall Global and Tmall comparison Source: Tmall Global [/caption] Livestreaming E-Commerce Is a Fast-Growing Trend in China Combining livestreaming with live marketing has become a major force in China’s e-commerce scene, akin to a digital version of the US TV shopping channel QVC. On Singles’ Day 2019, Tmall Global generated $2.9 billion sales through livestream marketing. More than 100 key opinion leaders (KOLs) each promoted products that generated sales of ¥10 million ($1.4 million). This was driven by demand from middle- and lower-tier cities, where livestream marketing is particularly popular. These markets represent a huge, largely untapped opportunity for this innovative way of engaging with—and selling to—consumers. [caption id="attachment_103588" align="aligncenter" width="700"]

P&G partners with top livestream KOL Viya

P&G partners with top livestream KOL Viya Source: P&G [/caption] Showcases from North America Evereden launched on Tmall Global in 2019, but the brand has grown rapidly and was ranked among the top 10 brands in the baby care category during the Chinese New Year shopping period (in early January 2020). By using celebrity endorsements and livestreaming, Evereden increased its brand recognition and found the right mix of products for Chinese consumers [caption id="attachment_103589" align="aligncenter" width="700"]

Evereden’s flagship store on Tmall Global

Evereden’s flagship store on Tmall Global Source: Evereden [/caption] Fenty Beauty, created by singer Rihanna but now part of LVMH, entered China when it launched a flagship store on Tmall Global in September 2019. The brand’s vision is to make Fenty Beauty accessible to digitally savvy Chinese consumers while staying true to its 100% cruelty-free commitment. In November 2019, Tmall also hosted a livestream chat with influencers Viya Huang and Kim Kardashian. Viewed by over 13 million, the stream sold 15,000 bottles of Kardashian's perfume--and boosted brand awareness. [caption id="attachment_103590" align="aligncenter" width="700"]

Fenty Beauty flagship store on Tmall Global promoting male beauty

Fenty Beauty flagship store on Tmall Global promoting male beauty Source: Fenty Beauty [/caption] Vitafusion launched on Tmall in 2019, and within one year it generated multi-million-RMB sales. The best-selling product is its Sleep Well gummies, which combine melatonin with extracts of herbs believed to induce sleep, with 100,000 units sold since the product’s launch. [caption id="attachment_103591" align="aligncenter" width="700"]

Vitafusion Valentine’s Day collaboration with Juhuasuan.com, Alibaba's sales and digital marketing platform

Vitafusion Valentine’s Day collaboration with Juhuasuan.com, Alibaba's sales and digital marketing platform Source: Vitafusion [/caption]