DIpil Das

The Coresight Research team joined Target’s 2020 Financial Investor Community Meeting webcast on March 3.

The three key themes of Target’s development are “value,” “differentiation” and “profitable growth.” While the company is focused on improving the digital experience, it is also testing creative store formats (differentiation), adding product assortment (value) and upgrading technological capabilities (to drive profitable growth).

These are the highlights of the event:

Target’s Omnichannel Fulfillment Strategy Continues to Drive Growth

In 4Q19, Target’s same-day services (Order Pick Up, Drive Up and Shipt) accounted for more than 80% of comparable digital sales growth. For all of FY19, same-day services grew more than 90%, accounting for nearly 75% of the company’s comparable digital sales growth.

Target has offered offered buy online, pick up in store (BOPIS) for some time. The company launched the service in Minneapolis in 2013 and has been rolling it out since. In FY19, BOPIS sales rose nearly 50%, and one-third of those picking up items made additional purchases while in the store.

Target launched drive-up services in the Minneapolis area in 2017, so customers don’t even need to enter the store to collect a BOPIS order: An employee brings it out to the customer’s car. In FY19, sales generated from drive up services grew more than 500%. Nearly 25% of drive up sales are incremental, which shows that if consumers have more options in how they collect purchases, they will spend more. As of March 2020, Target had rolled out drive up service to 1,750 stores.

Target acquired grocery delivery service Shipt for $550 million in 2017 to accelerate its digital fulfillment capabilities. As of March 2020, Target had more than 100,000 customers signed up for Shipt, and had signed on almost 100 other retail brands. Management believes growing Shipt inside and outside Target is an opportunity.

Starting in spring 2020, Target will test offering a curated assortment of fresh grocery and adult beverage items via BOPIS and drive up.

[caption id="attachment_104780" align="aligncenter" width="700"] Select companies that offer same-day shipping using Shipt

Select companies that offer same-day shipping using Shipt

Source: Target [/caption] Target Is Bringing Automation Throughout the Supply Chain to Help Stores Run Better and Solve Out-of-stock Problems Target is adding capacity to support replenishment and improve its end-to-end supply chain operations, leveraging machine learning to predict product demand. In 2019, the company used automation to lower out of stocks by more than 33% for nearly a third of its “essential” products. Management said it would add new categories to the system and learn how this improves the customer experience. The robotics solution Target has been building in the Minneapolis market over the past few years is designed to sort and organize millions of individual units, and can now fill boxes with the exact number of products needed. [caption id="attachment_104781" align="aligncenter" width="700"] Target used automation to lower out of stocks for almost a third of its “essential” merchandise

Target used automation to lower out of stocks for almost a third of its “essential” merchandise

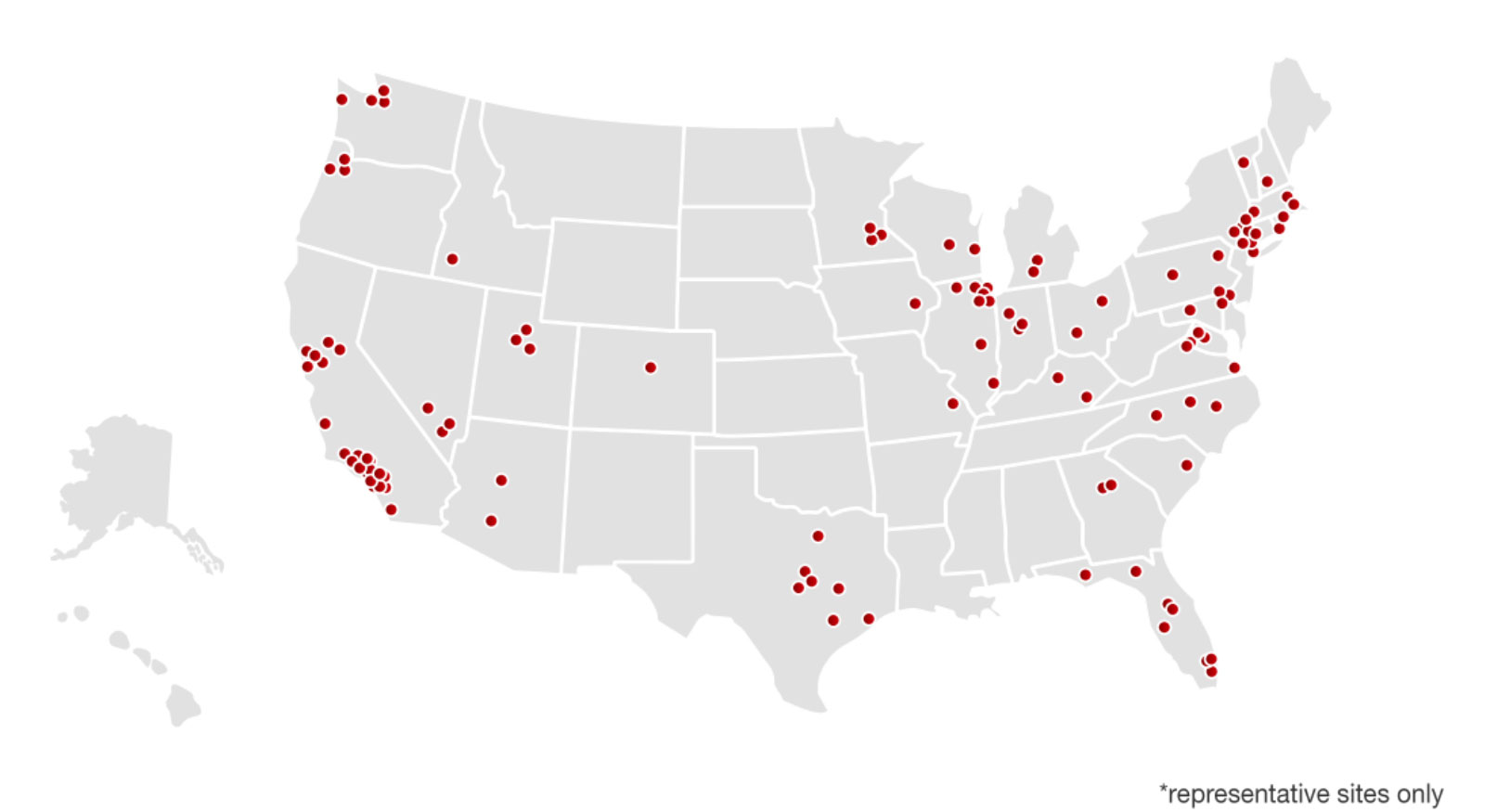

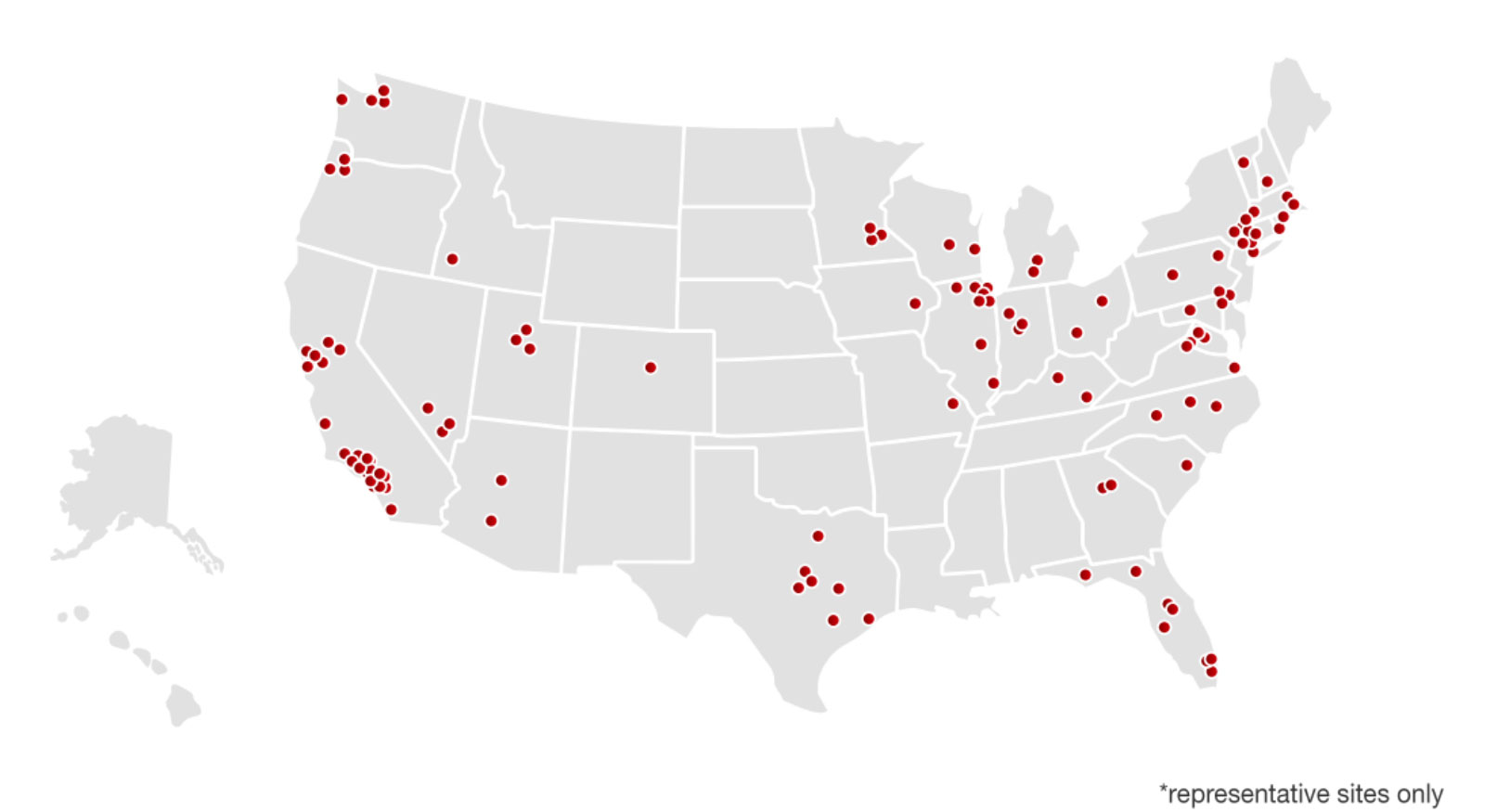

Source: Target [/caption] Target’s Path in Testing New-Format Stores Target wants to be an omnichannel leader with competitive fulfillment options and a differentiated store experience. Since 2014, the company has been testing small-format stores, and in 2019 opened more than 30—the most new small stores ever in one year. The company is also looking into how it can make its small-format stores more suitable for urban locations. The smallest location today is about 12,000 square feet. Target is also experimenting with in-store experiences by testing new design elements, such as front-of-store concepts in which the store is curated with fresh flower displays, hot coffee and products to create a friendly atmosphere. Target also lowered walls and removed counters in the concept store to make it easier for employees to connect with customers. Target is also reinventing store models by opening stores near iconic tourist destinations, such as Times Square, Disney World and the Las Vegas strip. [caption id="attachment_104782" align="aligncenter" width="700"] Distribution of Target’s small format stores

Distribution of Target’s small format stores

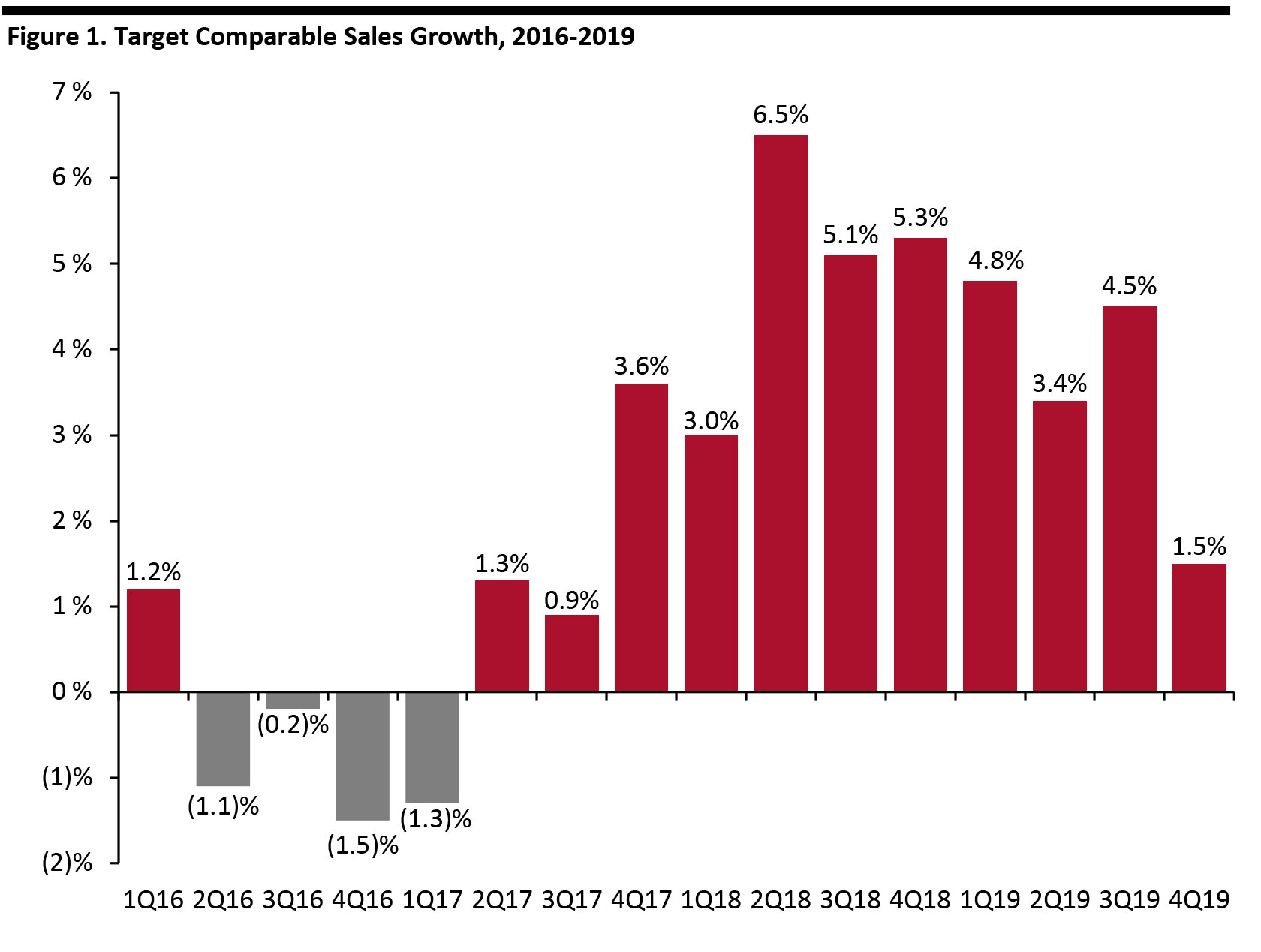

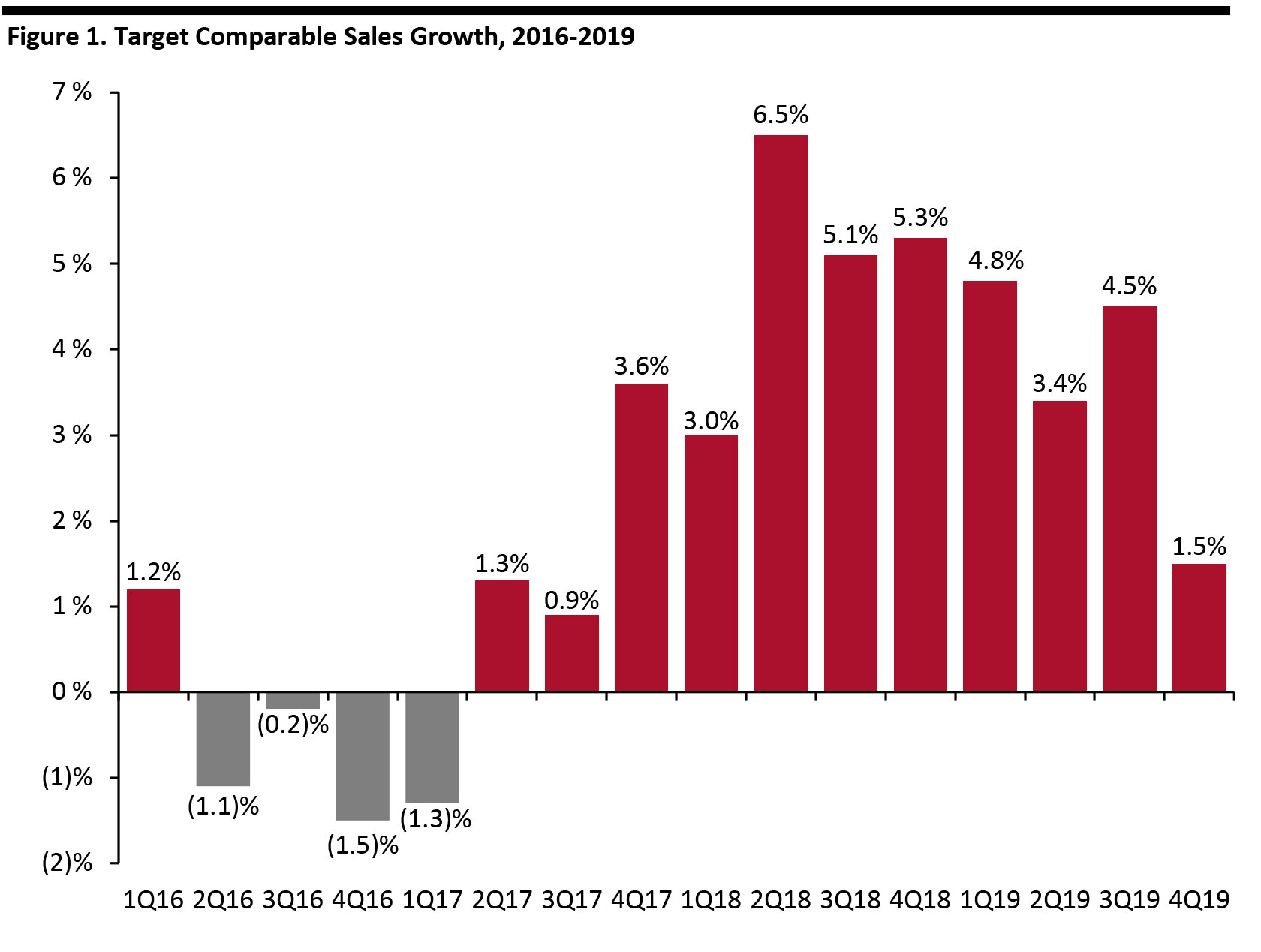

Source: Target [/caption] Fiscal 4Q19 and FY19 Results Target reported fiscal 4Q19 revenues of $23.4 billion, up 1.8% year over year, slightly missing the consensus estimate $23.41 billion. Adjusted EPS was $1.69, beating the consensus estimate of $1.65. Comparable sales grew 1.5%, beating the consensus estimate of 1.4% and reflecting comparable digital sales growth of 20%, driven by same-day fulfillment. Total FY19 revenues were $78.1 billion, up 3.7% year over year. Comparable sales increased 3.4%, reflecting comparable digital sales growth of 29%. Target had negative comparable sales from 2Q16 to 1Q17, due mainly to falling in-store traffic and the removal of pharmacy and clinic services. After building its digital capabilities, the company regained positive comparable sales starting 2Q17. [caption id="attachment_104783" align="aligncenter" width="700"] Source: Target[/caption]

A Category of One

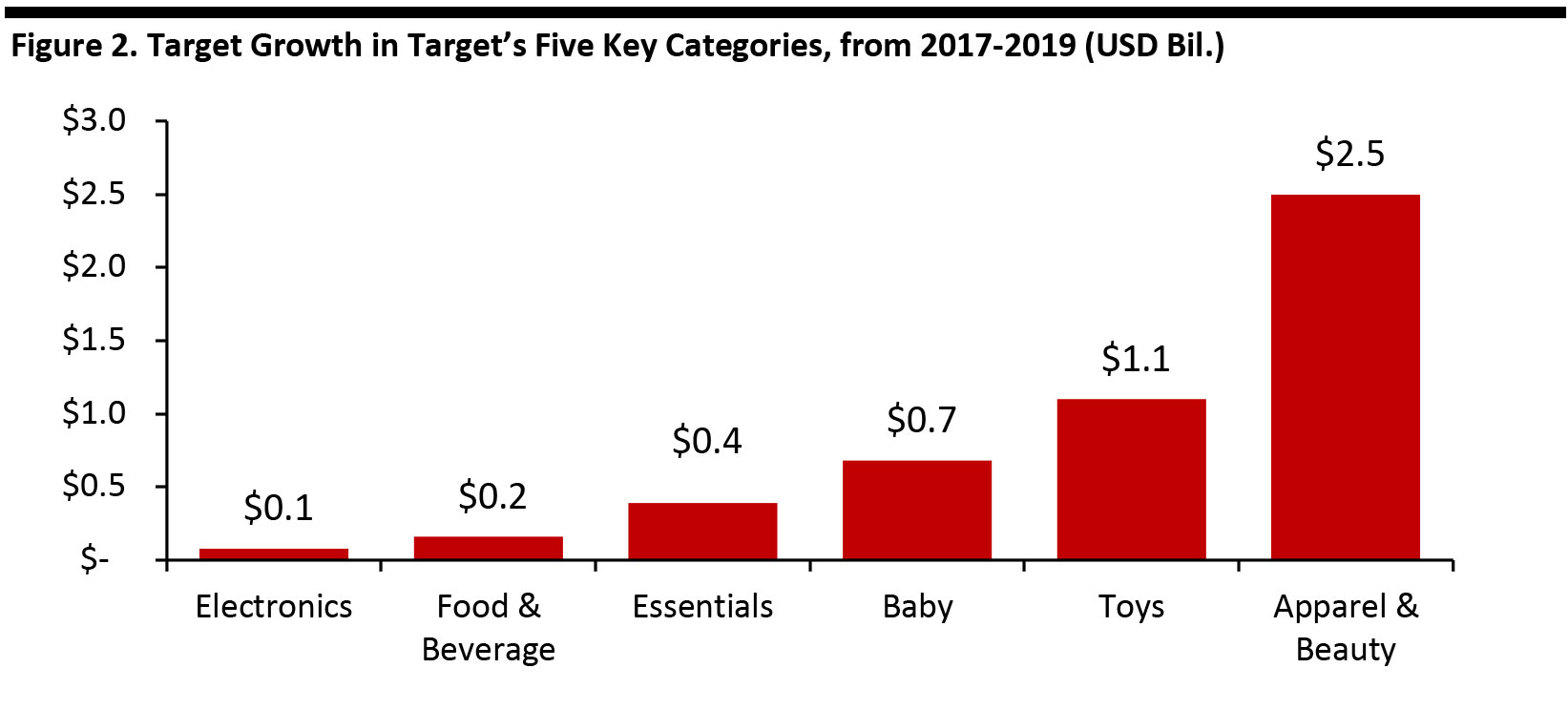

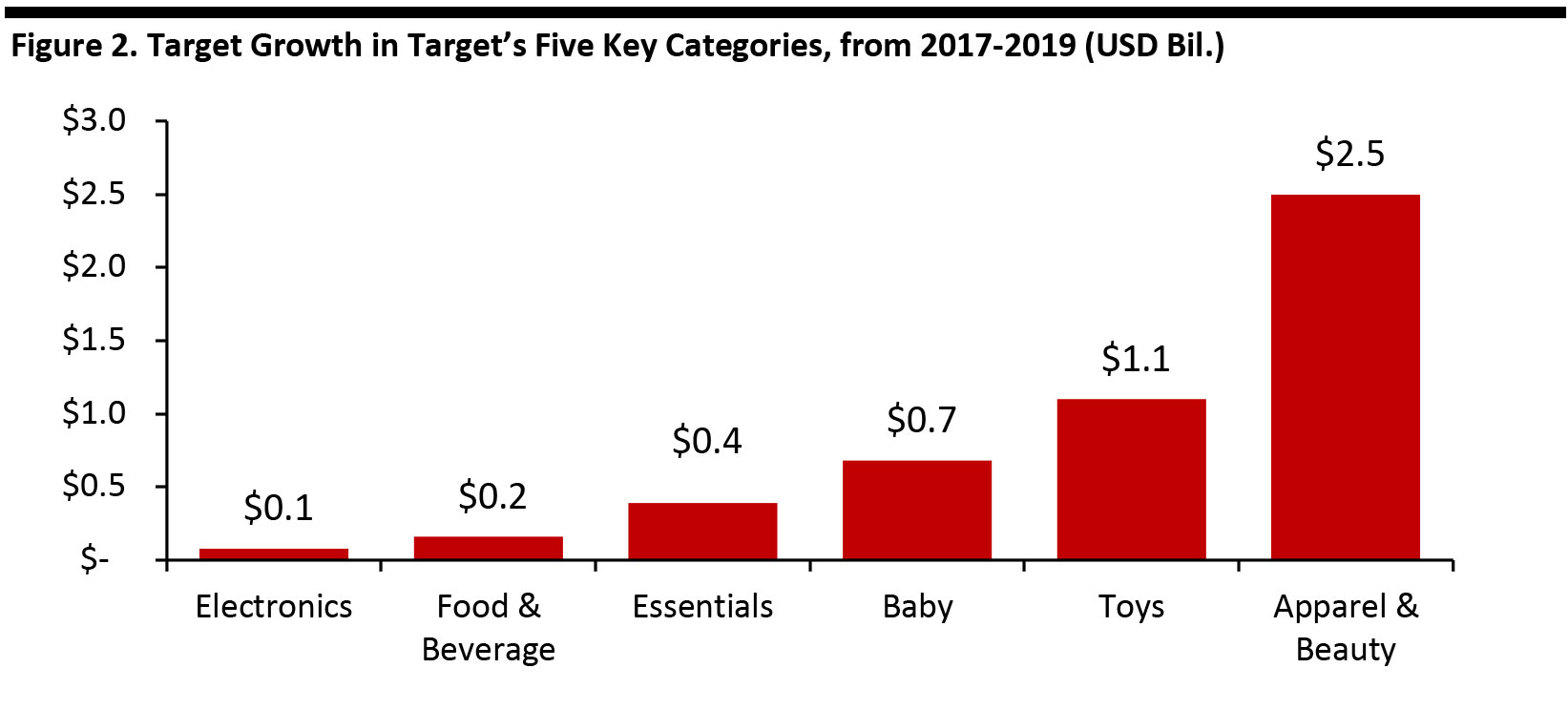

Target calls itself a “category of one,” asserting the company is unique in five key categories (hardlines; food and beverage; apparel; home; and, beauty), each of which generates roughly 20% of sales.

In FY19, Target delivered strong growth in apparel, beauty, household essentials and in food and beverage, offset by flat comps in toys. From 2017 to 2019, Target achieved sales of $2.5 billion in apparel and beauty, with almost $1.5 billion of that in the last year alone. Toys and baby products registered sales of about $1.8 billion in 2019.

[caption id="attachment_104793" align="aligncenter" width="700"]

Source: Target[/caption]

A Category of One

Target calls itself a “category of one,” asserting the company is unique in five key categories (hardlines; food and beverage; apparel; home; and, beauty), each of which generates roughly 20% of sales.

In FY19, Target delivered strong growth in apparel, beauty, household essentials and in food and beverage, offset by flat comps in toys. From 2017 to 2019, Target achieved sales of $2.5 billion in apparel and beauty, with almost $1.5 billion of that in the last year alone. Toys and baby products registered sales of about $1.8 billion in 2019.

[caption id="attachment_104793" align="aligncenter" width="700"] Source: Target[/caption]

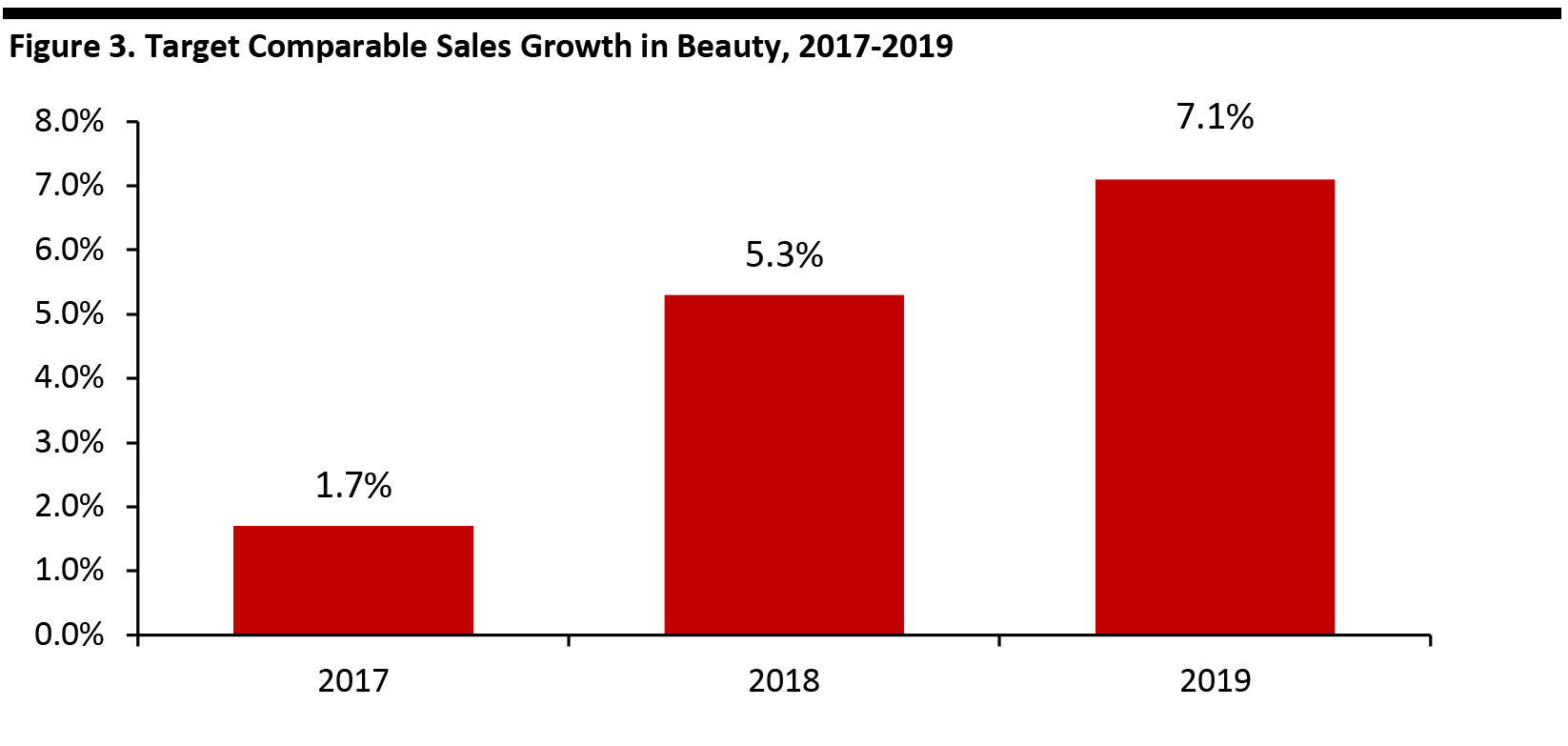

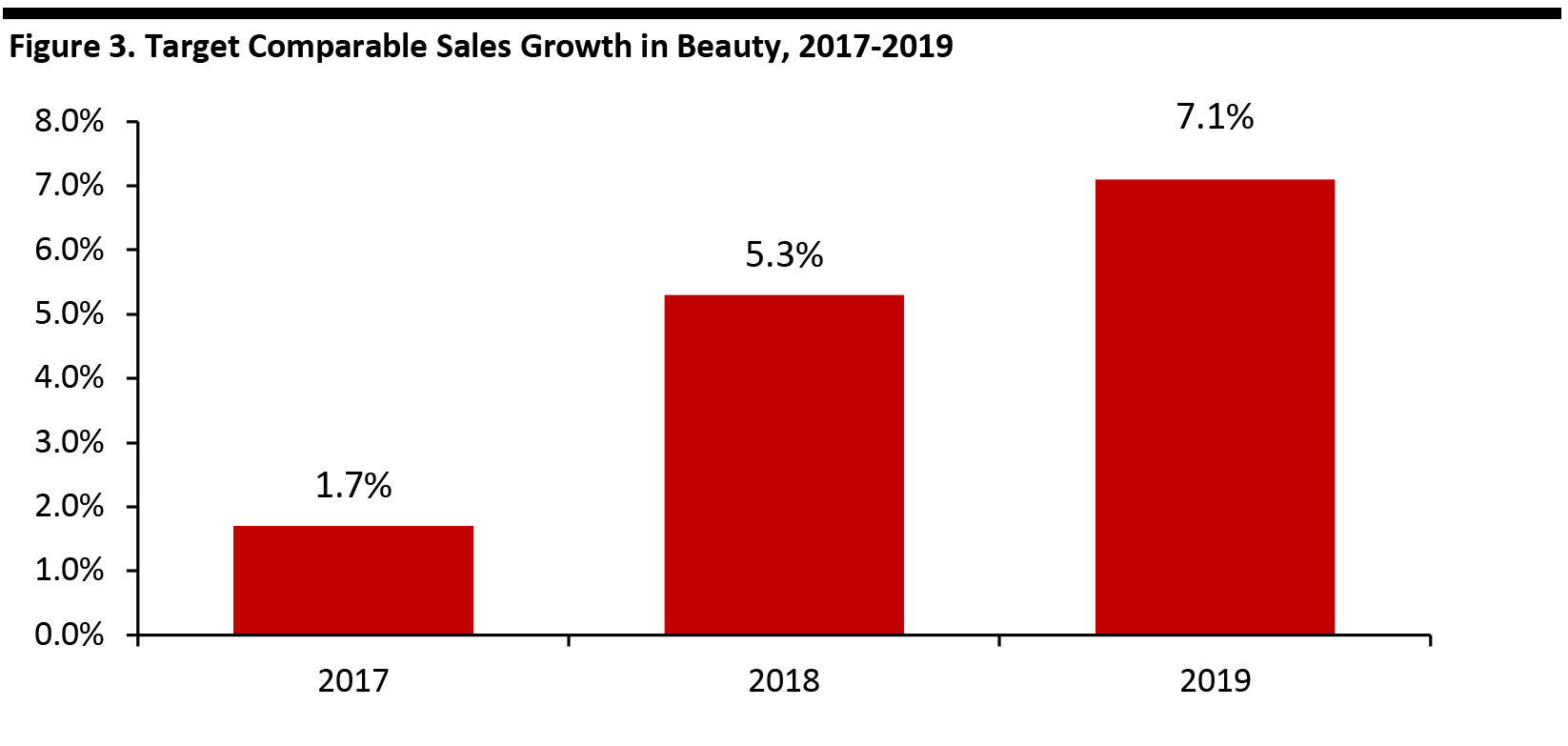

Specifically, comp growth in beauty accelerated from 1.7% in 2017 to 7.1% in 2019, out-performing the company average by approximately 1.5 percentage points over that period.

[caption id="attachment_104785" align="aligncenter" width="700"]

Source: Target[/caption]

Specifically, comp growth in beauty accelerated from 1.7% in 2017 to 7.1% in 2019, out-performing the company average by approximately 1.5 percentage points over that period.

[caption id="attachment_104785" align="aligncenter" width="700"] Source: Target[/caption]

Management Expects Sales Growth Momentum To Continue in 2020

Target provided guidance as follows:

Source: Target[/caption]

Management Expects Sales Growth Momentum To Continue in 2020

Target provided guidance as follows:

Select companies that offer same-day shipping using Shipt

Select companies that offer same-day shipping using Shipt Source: Target [/caption] Target Is Bringing Automation Throughout the Supply Chain to Help Stores Run Better and Solve Out-of-stock Problems Target is adding capacity to support replenishment and improve its end-to-end supply chain operations, leveraging machine learning to predict product demand. In 2019, the company used automation to lower out of stocks by more than 33% for nearly a third of its “essential” products. Management said it would add new categories to the system and learn how this improves the customer experience. The robotics solution Target has been building in the Minneapolis market over the past few years is designed to sort and organize millions of individual units, and can now fill boxes with the exact number of products needed. [caption id="attachment_104781" align="aligncenter" width="700"]

Target used automation to lower out of stocks for almost a third of its “essential” merchandise

Target used automation to lower out of stocks for almost a third of its “essential” merchandise Source: Target [/caption] Target’s Path in Testing New-Format Stores Target wants to be an omnichannel leader with competitive fulfillment options and a differentiated store experience. Since 2014, the company has been testing small-format stores, and in 2019 opened more than 30—the most new small stores ever in one year. The company is also looking into how it can make its small-format stores more suitable for urban locations. The smallest location today is about 12,000 square feet. Target is also experimenting with in-store experiences by testing new design elements, such as front-of-store concepts in which the store is curated with fresh flower displays, hot coffee and products to create a friendly atmosphere. Target also lowered walls and removed counters in the concept store to make it easier for employees to connect with customers. Target is also reinventing store models by opening stores near iconic tourist destinations, such as Times Square, Disney World and the Las Vegas strip. [caption id="attachment_104782" align="aligncenter" width="700"]

Distribution of Target’s small format stores

Distribution of Target’s small format stores Source: Target [/caption] Fiscal 4Q19 and FY19 Results Target reported fiscal 4Q19 revenues of $23.4 billion, up 1.8% year over year, slightly missing the consensus estimate $23.41 billion. Adjusted EPS was $1.69, beating the consensus estimate of $1.65. Comparable sales grew 1.5%, beating the consensus estimate of 1.4% and reflecting comparable digital sales growth of 20%, driven by same-day fulfillment. Total FY19 revenues were $78.1 billion, up 3.7% year over year. Comparable sales increased 3.4%, reflecting comparable digital sales growth of 29%. Target had negative comparable sales from 2Q16 to 1Q17, due mainly to falling in-store traffic and the removal of pharmacy and clinic services. After building its digital capabilities, the company regained positive comparable sales starting 2Q17. [caption id="attachment_104783" align="aligncenter" width="700"]

Source: Target[/caption]

A Category of One

Target calls itself a “category of one,” asserting the company is unique in five key categories (hardlines; food and beverage; apparel; home; and, beauty), each of which generates roughly 20% of sales.

In FY19, Target delivered strong growth in apparel, beauty, household essentials and in food and beverage, offset by flat comps in toys. From 2017 to 2019, Target achieved sales of $2.5 billion in apparel and beauty, with almost $1.5 billion of that in the last year alone. Toys and baby products registered sales of about $1.8 billion in 2019.

[caption id="attachment_104793" align="aligncenter" width="700"]

Source: Target[/caption]

A Category of One

Target calls itself a “category of one,” asserting the company is unique in five key categories (hardlines; food and beverage; apparel; home; and, beauty), each of which generates roughly 20% of sales.

In FY19, Target delivered strong growth in apparel, beauty, household essentials and in food and beverage, offset by flat comps in toys. From 2017 to 2019, Target achieved sales of $2.5 billion in apparel and beauty, with almost $1.5 billion of that in the last year alone. Toys and baby products registered sales of about $1.8 billion in 2019.

[caption id="attachment_104793" align="aligncenter" width="700"] Source: Target[/caption]

Specifically, comp growth in beauty accelerated from 1.7% in 2017 to 7.1% in 2019, out-performing the company average by approximately 1.5 percentage points over that period.

[caption id="attachment_104785" align="aligncenter" width="700"]

Source: Target[/caption]

Specifically, comp growth in beauty accelerated from 1.7% in 2017 to 7.1% in 2019, out-performing the company average by approximately 1.5 percentage points over that period.

[caption id="attachment_104785" align="aligncenter" width="700"] Source: Target[/caption]

Management Expects Sales Growth Momentum To Continue in 2020

Target provided guidance as follows:

Source: Target[/caption]

Management Expects Sales Growth Momentum To Continue in 2020

Target provided guidance as follows:

- For 1Q20 and FY20, a low-single-digit increase in comparable sales and a mid-single-digit increase in operating income.

- For 1Q20, adjusted EPS of $1.55 to $1.75.

- For FY20, adjusted EPS of $6.70 to $7.00.