DIpil Das

What’s the Story?

Various aspects of the retail supply chain were severely hit during the early months of the Covid-19 pandemic as nonessential businesses were forced to close and people had to shelter at home, culminating in major congestions at shipping ports in the US. In this report, we examine US imports as they affect the retail industry, including the impacts on ports and the rest of the supply chain.Why It Matters

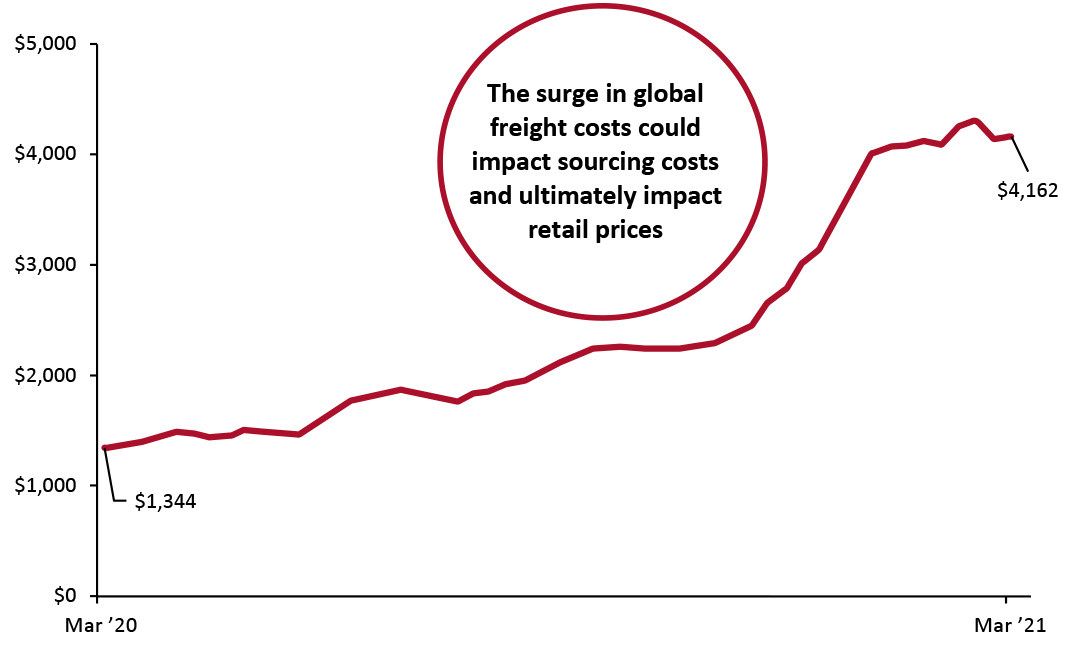

Supply chain constraints can affect retailers and end-consumers in a number of ways, such as delayed inventory replenishment and higher product prices. Lockdowns and forced shelter-at-home measures shifted consumers’ purchase priorities: Demand surged for comfortable lounge wear, furniture, homewares and home office equipment, for example. This upended retailers’ existing supply chain planning and compelled them to restock many categories earlier than they expected or modify inventory mixes in several product categories. It also slowed down the movement of goods that had low or no demand across several stages of their journey from factories to stores, with goods being left at ports. Average shipping costs have therefore increased significantly in the past 12 months, peaking in February 2021. The Freightos Baltic Index, which tracks and calculates freight prices in real time based on a weighted average of 12 major global shipping routes, recorded a near tripling in global container booking prices over the last year. A 40-foot container, which used to cost $1,344 on average in March 2020, costed $4,162 in March 2021, up over 200% year over year.Figure 1. Frieghtos Baltic Index [caption id="attachment_126296" align="aligncenter" width="724"]

Source: Freightos Baltic Index [/caption]

Source: Freightos Baltic Index [/caption]

US Imports and Port Congestion Impacts: In Detail

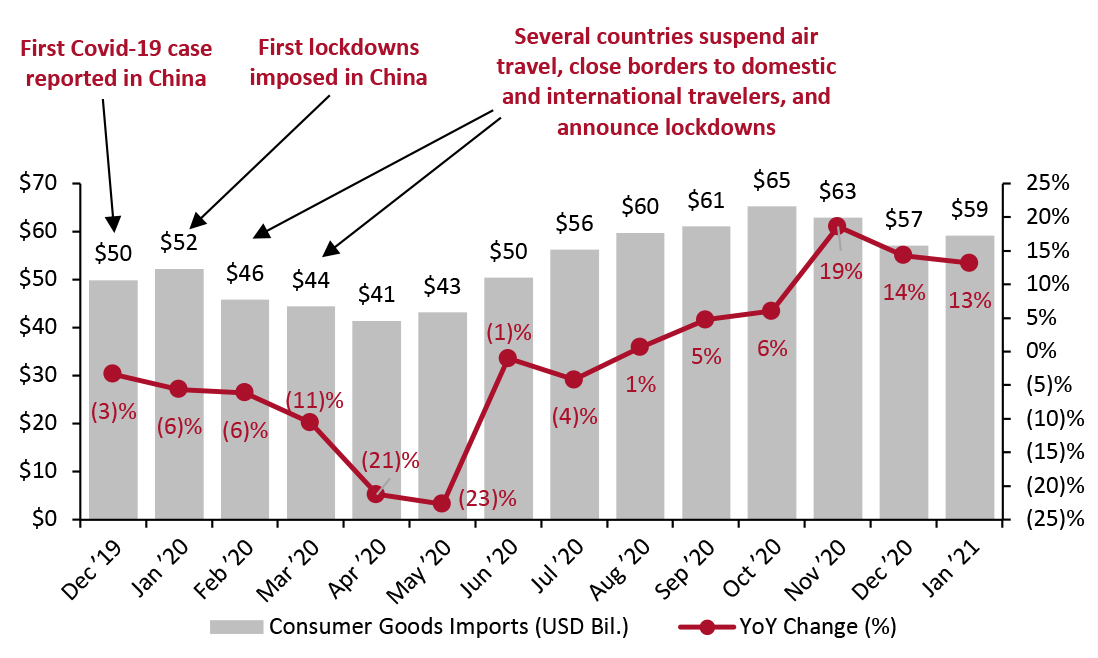

US Consumer Goods Imports Jumped 19% Year over Year in November US imports of consumer goods totaled $59 billion in January 2021, up 13% year over year, according to Census Bureau data. Consumer-goods imports have been higher than pre-pandemic levels; they had dropped to $44 billion in March 2020, when Covid-19 hit the US. The value of imports fell further to $41 billion in April, when shutdowns were more widespread and travel restrictions were imposed internationally. Since May 2020, import levels have been climbing back up, with the year-over-year growth levels back to positive in August and peaking in November, ahead of the holiday season when retail purchases tend to spike (see Figure 2).Figure 2. US Consumer Goods: Value of Imports (USD Bil., Left Axis) and Year-Over-Year Growth in Imports (%, Right Axis) [caption id="attachment_126297" align="aligncenter" width="725"]

Source: Census Bureau/Coresight Research [/caption]

Reduced Cargo Movement Through Waterways Drives Air Freight Up

With the dramatic shifts in import levels and with a majority of imports coming in through ships, US ports have been congested for the last several months. Some of the factors leading to this congestion are as follows:

Source: Census Bureau/Coresight Research [/caption]

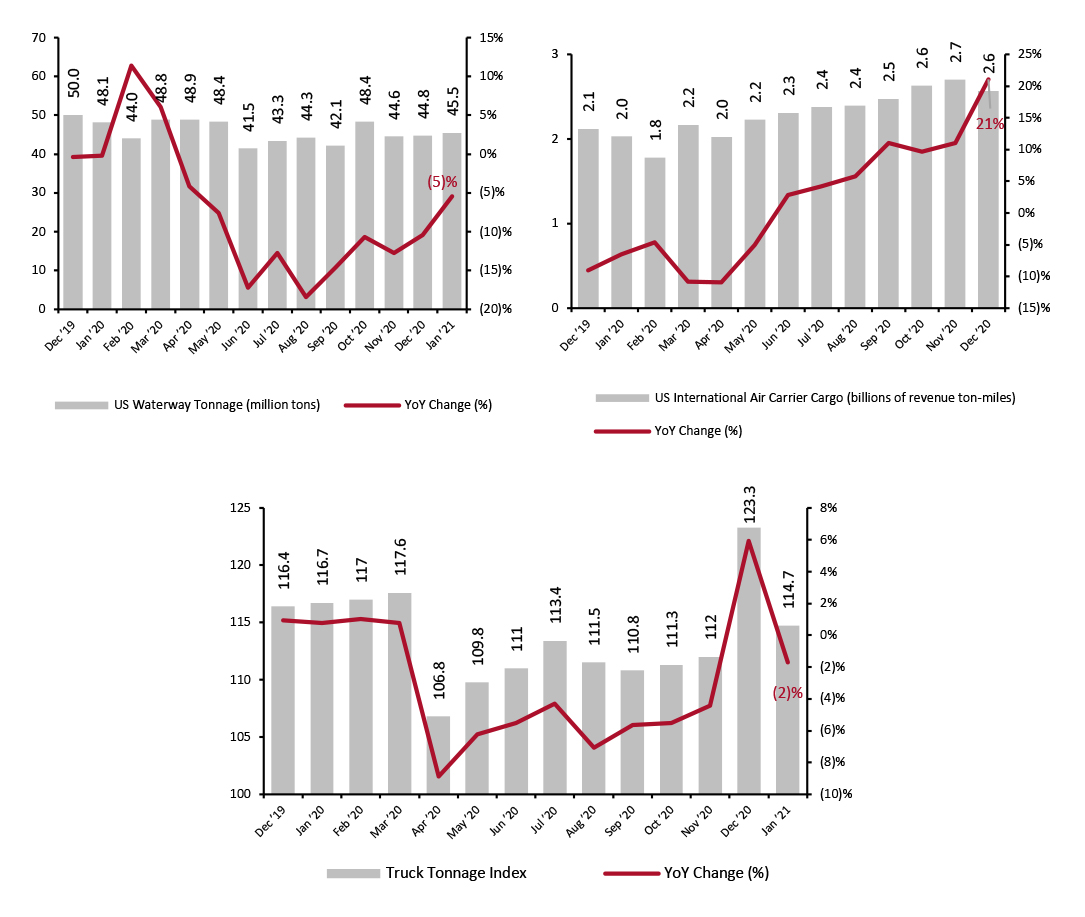

Reduced Cargo Movement Through Waterways Drives Air Freight Up

With the dramatic shifts in import levels and with a majority of imports coming in through ships, US ports have been congested for the last several months. Some of the factors leading to this congestion are as follows:

- A backlog of shipments from earlier months still needs to be processed.

- Companies left shipments on ships and in nearby warehouses instead of moving them to their own warehouses as demand dropped drastically in early 2020.

- As production across global manufacturing hubs has gradually resumed, and as retailers have started placing orders for new products, ships are bringing in new cargo and are awaiting processing alongside older cargo.

- Dock workers have been on leave due to Covid-19. In January 2021, 1,800 workers at California ports were off work due to Covid-19, of which 700—about 5% of the 15,000 Southern California dock workers—had contracted the virus and the rest were isolating while they awaited results, according to Eugene Seroka, Executive Director of the Port of Los Angeles.

Figure 3. Cargo Metrics: Waterways, Air and Road [caption id="attachment_126276" align="aligncenter" width="725"]

Source: BTS/Coresight Research[/caption]

How Have Retailers Been Handling These Supply Chain Disruptions

A number of retailers across the globe have experienced disruptions to their supply chains.

Source: BTS/Coresight Research[/caption]

How Have Retailers Been Handling These Supply Chain Disruptions

A number of retailers across the globe have experienced disruptions to their supply chains.

- At a Bank of America conference in early March 2021, Vivek Sankaran, CEO of Albertsons said that the company has experienced shortages across a number of categories over the last several months but expects this to ease over the second half of this year. Sankaran noted shortages in the categories of household cleaning and personal hygiene, and cooking and consumption at home, some of which was exacerbated by aluminum shortages prompted by high demand for canned foods and beverages.

- British fashion pure play ASOS stated in interim results in the six months to February 28, 2021, that its gross margin receded by 200 basis points due to pandemic-related freight and duty costs, among other factors. The company also remarked in its outlook that “freight rates [are] expected to remain at very elevated levels for the remainder of the second half.” On its earnings call held April 8, 2021, ASOS stated that it has put minimum thresholds in place for orders shipped outside the EU, the UK and the US, so that customers place meaningfully sized orders that justify additional costs associated with air freight. The company noted that this has resulted in higher average basket values as customers “shopped less frequently but bought bigger parcels.”

- Big Lots remarked at its earnings call in March 2021 that higher freight costs offset some markdown reductions it implemented in its fourth quarter. The retailer expects to experience “ongoing pressure from higher freight costs through the year.” It also expects to import some inventory earlier than it typically would, to mitigate freight costs associated with peak times.

- Costco, on its second-quarter earnings call in March 2021, stated that container shortages and port delays have caused higher freight costs and shortages in its furniture, sporting goods, lawn and garden, seafood, imported cheeses and oils categories. It expects these pressures to alleviate in the coming months.

- Dick’s Sporting Goods noted at the Bank of America conference that it is adequately stocked in most categories, and that it has shored up buffer stock as well. It is, however, experiencing delays in getting containers in China as well as higher import costs.

- Gap remarked on its earnings call in March 2021 that it incurred air shipment costs during its fourth quarter, as it freighted some of its merchandise to avoid port congestion. It also expects inventory levels to decrease toward the end of the ongoing first quarter and to end its second quarter with inventory up in the high single digits, as it anticipates further delays in stock movement due to port congestion.

- IKEA’s Singapore outpost remarked on social media in mid-January that the “global transport crisis has led to availability issues,” highlighting that 850 of the 8,500 articles in its Singapore range are facing shipment delays.

IKEA Singapore’s Facebook post informing customers of shipment delays.

IKEA Singapore’s Facebook post informing customers of shipment delays. Source: IKEA [/caption]

- Lowe’s stated at a UBS conference in March 2021 that it is “the fourth-largest importer in containers in the nation” and its scale has allowed it to be insulated to an extent from the ongoing crisis.

- Urban Outfitters said at the Bank of America conference in March 2021 that it uses air shipment for a majority of its apparel. While its Free People brand “airs almost all of its products,” the Anthropologie and Urban Outfitters banners use air transport “at a healthy rate.” The company added that the port congestion crisis is not so significant to its apparel supply but could impact its home category.

What We Think

International trade and businesses are gradually recovering, and imports are at higher levels than they were compared to a few months ago. With the vaccine rollout still limited to vulnerable groups and frontline workers, it may be a while before dock workers are able to be vaccinated. With a significant portion of the consumer population still working from and sheltering at home, demand for product categories centered around the home are likely to be elevated, so retailers will need to work on stocking accordingly—either by importing what is necessary or moving around relevant inventory in advance from warehouses and distribution centers closer to markets in the US. US ports are expected to be congested for the next several months, and the subsequent impacts are likely to ease only toward the second half of the year. Implications for Brands/Retailers- For the near term, brands and retailers are likely to have already put plans in motion—either stocking up early, leveraging buffer stock or considering alternative modes of transport such as air freight.

- Apparel brands and retailers and those selling certain products that can be air freighted may benefit from the short-term impact of reduced prices for air shipments. Retailers and brands of furniture, large appliances and others that buy at scale may be reliant on shipping by sea and may feel the impacts of the current crisis over a longer period than companies that have the flexibility to use air shipments.

- For the medium term, brands and retailers will need to rethink a number of aspects of their supply chain, such as the sourcing location mix, transport mix and lead times to insulate themselves from such congestions in the future. Even if the challenges begin to ease in the second half of the year, it may be a while before shipping processes return to pre-pandemic levels of “normalcy.”

- The long-drawn out impacts of production shutdowns, delayed shipping and shifts in consumer demand call for more resilience, agility and diversification in the supply chain, which we have highlighted as a trend to watch in 2021.

- Resilience through nearshoring and using new technologies could help supply chains withstand external shocks and return to a stable state.

- Implementing automation and concepts such as on-demand manufacturing can help retailers to quickly adapt to shifting consumer trends.

- Diversifying the supplier base as well as the transport mix can help mitigate risks and provide greater control over the supply chain. As the Belt and Road Initiative develops further—linking businesses in China with those in Africa, Asia and Europe—retailers and brands will have a wider supplier base to choose from in Asia that can use overland routes (road and rail transport) and possibly provide cost savings.

- Brands and retailers will want insights and analytics into the various combinations of suppliers and transport available to them and the risk factors associated with each. Technology companies whose tools can carry out such risk assessment will benefit.