Web Developers

SALES BREAKDOWN BY SEGMENT AND BRAND

- Revenue was driven by strong momentum in all geographic regions. Particularly notable was robust revenue growth of 8.9% at constant currency rates in France, a market heavily impacted by lower tourism flows due to a series of terrorist attacks. Hermès’ luxury goods peers have all reported meaningful sales softness in France.

- In terms of product categories, the leather goods and saddlery business was the clear standout, with sales in 2Q16 increasing by 17.1% in constant currency terms. The group’s outperformance can be attributed to ongoing strong demand for certain handbag models, including the Constance, the Halzan and the Lindy, and the timeless Birkin and Kelly bags, which generate months-long waiting lists. The company continues to increase its leather goods production capacity to meet the brisk demand for its signature models.

- Sales in perfumes also climbed, by 11.3%. Ready-to-wear and accessories declined by 1.5%, silk and textiles declined by 4.2%, and watch sales increased by 4.2%.

GUIDANCE

- Hermès cautioned that it may not be able to achieve its medium-term revenue target of 8.0% annual growth in FY16 due to global economic and geopolitical headwinds.

- The company also expects 1H16 operating margin expansion of 100 basis points due to the positive impact of a foreign exchange hedging contract. Hermès will report profit data for 1H16 on September 14; the latest report covers revenues only.

HERMÈS PERFORMANCE VS. LUXURY GOODS PEERS

- Hermès is growing more robustly than the overall luxury goods market, which is expected to expand by 2.0% in constant currency terms in 2016, according to Bain & Company.

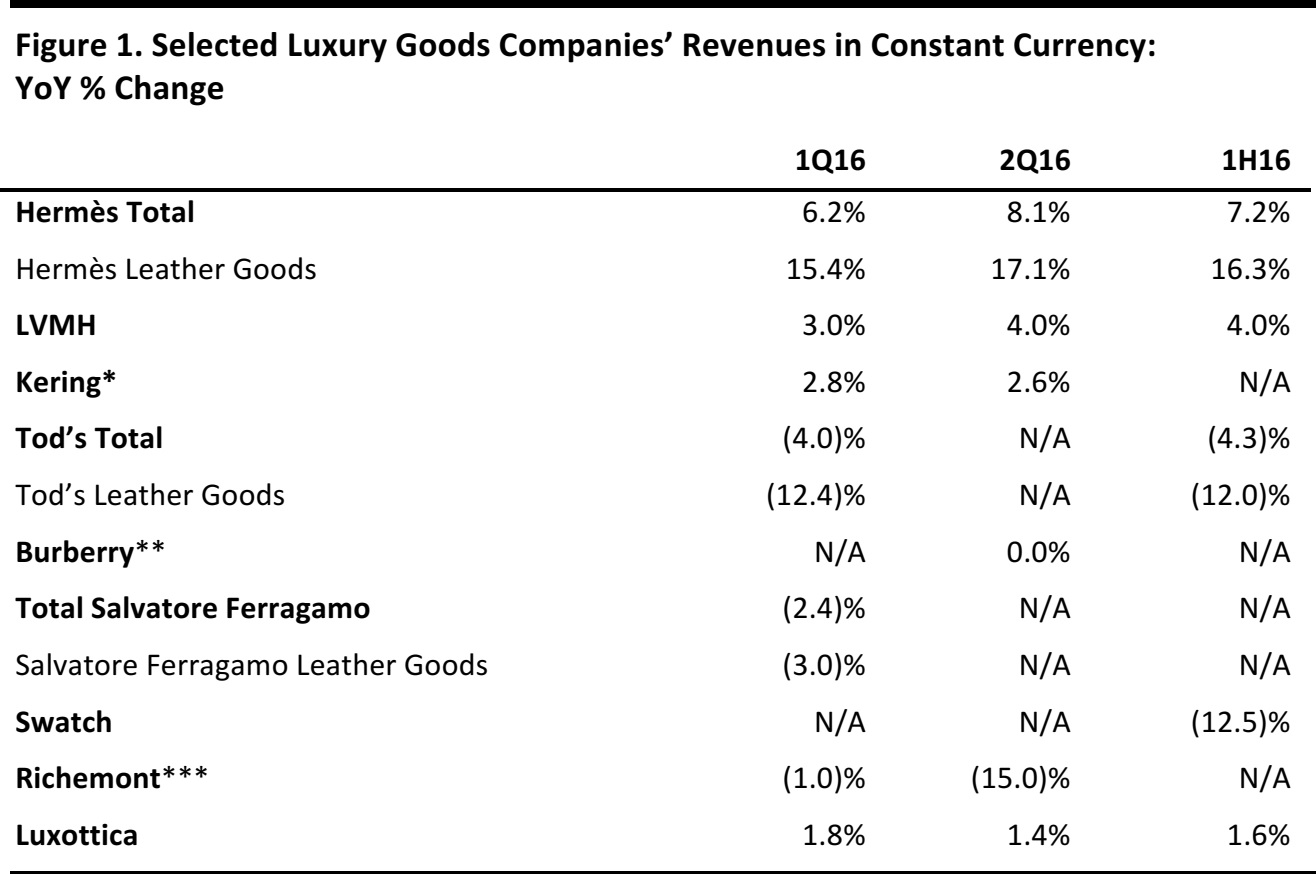

- Hermès’ striking outperformance can largely be attributed to strength in the leather goods and saddlery division, which contributed 47% to total FY15 revenues. The division posted remarkable revenue growth of 16.3% in constant currency in 1H16. Furthermore, the division’s revenues showed a quarterly accelerating trend, with 2Q16 constant currency revenue growth of 17.1%, which was even higher than the 15.4% growth reported in 1Q16.

- The company’s success can be attributed to several factors. For one, Hermès goods carry the highest price point in the industry, conveying uber-exclusivity. The second reason is the scarcity value behind some of its iconic handbag models, such as the Birkin and the Kelly, which generate waiting lists of more than a year. Although Hermès is increasing production capacity, consumer demand still outstrips supply, helping the company weather the luxury goods sector slowdown. The company has clearly mastered striking a very delicate balance: it remains a highly coveted brand without overexposure and satisfies enough demand to maintain brand and status recognition.

- Finally, while other brands have overexpanded their product ranges, distribution and retail outlets too quickly, Hermès is benefiting from its cautious, measured approach. So, while Hermès is increasing production of some of its models, its luxury goods peers are shrinking product assortments. For example, Burberry has reduced its number of main-market SKUs by 15% and has consolidated three fashion labels into one.

- Hermès’ further strengths include its customer relationships and exceptional brand recognition in its domestic market of France, where all of the company’s luxury retailer peers have been reporting lagging sales due to sharply lower tourism flows. LVMH reported 4% constant currency sales growth in 1H16, but flat growth in its fashion and leather goods division. Unlike Hermès, LVMH and Burberry both cited soft patterns in France due to lower tourist flows.

- Tod’s, Salvatore Ferragamo, Swatch, Richemont are all struggling amid ongoing uncertainty and volatility in the macroeconomic and geopolitical environments. Peer sales trends have tended toward negative to slight growth, showing much weaker patterns than at resilient powerhouse Hermès. Even accessible luxury eyewear distributer Luxottica reported weak 1H16 sales and lowered its FY16 guidance to 2%–3% organic sales growth, down from 5%–6% previously.

- Companies expect the challenging external environment to continue, particularly in the wholesale channels, where partners are ordering less inventory.