Nitheesh NH

Herbalife Nutrition Ltd.

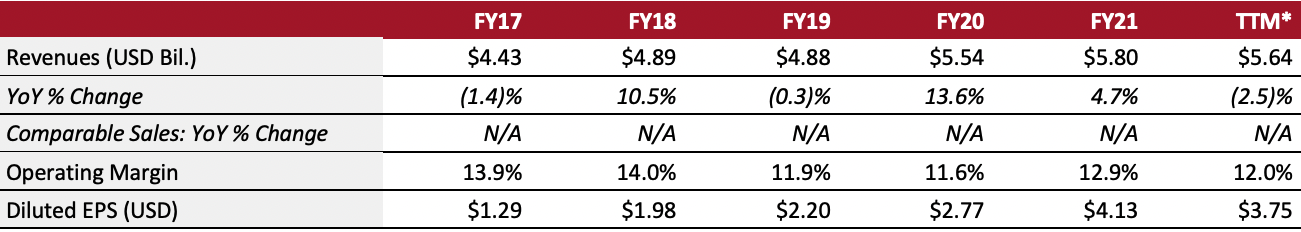

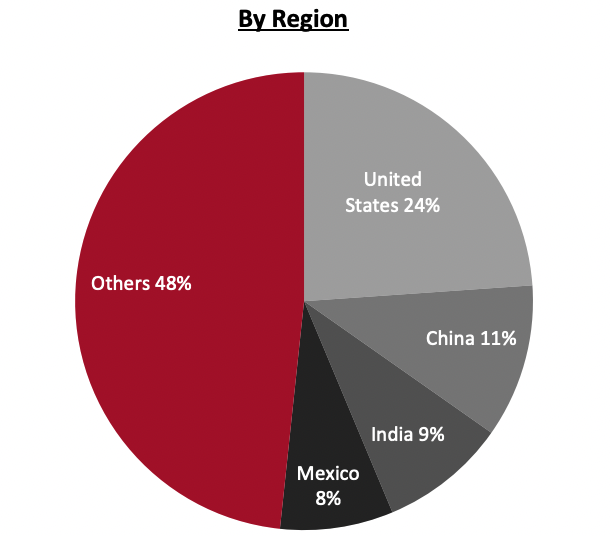

Sector: CPG Countries of operation: Over 95 countries and territories throughout Africa, the Americas, Asia, Europe and the Middle East Key product categories: Botanicals, drink mixes, herbs, herbal beverages, herbal supplements, minerals, other natural ingredients, skin and body care products and weight management products. Annual Metrics [caption id="attachment_152374" align="aligncenter" width="700"] Fiscal year ends on Dec 31 of the same calendar year

Fiscal year ends on Dec 31 of the same calendar year*Trailing 12 months ended March 31, 2022[/caption] Summary Founded in 1980 and headquartered in Los Angeles, Herbalife is a producer of health and personal care products that operates in 95 countries and territories throughout Africa, the Americas, Asia, Europe and the Middle East. The company provides a variety of energy, fitness, nutrition, sports and weight-management products through independent service providers, sales representatives and company-operated retail platforms. Company Analysis Coresight Research insight: Herbalife’s strategy is centered around facilitating sales via its distributors and creating new products specific to the demands of each of its markets. Pandemic restrictions have slowed business in China and Latin America, and the growth of distributors and new consumers has stalled, disrupting the company’s physical Nutrition Club operations. To combat this, as well as reach more Millennials and Gen Zers, Herbalife has supported its distributors’ move to e-commerce through centralized communication channels. This has also allowed the company to receive faster feedback and drive successful regional product launches.

| Tailwinds | Headwinds |

|

|

- Introduce new payment systems—Herbalife is experimenting with a new weekly commission system in Mexico, which replaces the monthly commissions, allowing Herbalife to expedite cash flow patterns.

- Invest in new technologies—This initiative, which aims to enhance local service centers, payment systems and infrastructure, member, finance, and HR operations, will cost $25–30 million, $13 million of which was paid in 2021. The company expects that annual cost savings will amount to $10–15 million, with some savings beginning in 2022.

- Increase prices globally in line with local CPIs—The company will take incremental pricing actions in the second quarter of 2022 to meet the increase in input and freight costs.

- Focus on winning categories—In 2022, Herbalife will focus on maintaining category leadership in weight management and health and wellness products. It also plans on becoming one of the top 10 brands in sports nutrition in the year.

- Implement a two-fold product development strategy—To retain existing customers, Herbalife will not only focus on products that address customers’ health and wellness requirements, but also invest in snacks and bars to improve convenience, fill gaps in product portfolios—specifically in its afternoon and evening options—and introduce new flavors to its product ranges.

- Launch new products regularly—Herbalife launched 400 new SKUs in 2021, 100 of which were in the company’s fast-growing sports and fitness category, resulting in 26% core product category growth in 2021.

- Localize products—Moving forward, Herbalife wants to localize products to make them more attractive to consumers. For example, the company plans to develop a local product research and development facility in India to accelerate product launches in the country.

- Support customer retention through digital initiatives—Herbalife’s strongest initiatives is its Preferred Customer Program, which launched in 34 markets globally in 2021 and represented 80% of the company’s volume point sales. The program allows customers to earn points for rewards and discounts. Other digital initiatives include facilitating a holistic distributor digital journey, boosting e-commerce capabilities and upgrading web functionalities.

- Continue to update its mobile applications—The HN Grow app, an “interactive learning tool for Herbalife Nutrition Independent Distributors,” is present in 44 countries, while the company’s main mobile app is live in 93 countries, as of Dec 31, 2021. The company plans to roll out application upgrades to both apps in 2022.

*Trailing 12 months ended Dec 31, 2020

*Trailing 12 months ended Dec 31, 2020Source: Company reports/S&P Capital IQ[/caption] Company Developments

| Date | Development | |

| May 3, 2022 | Herbalife plans to increase its margins through incremental pricing actions and cost control measures, offsetting rising input and freight costs. The company has already implemented various local sales initiatives to improve its distributors’ business engagement. | |

| February 24, 2022 | Herbalife opens its Global Business Service Center in Bangalore, India, which will be fully operational by the second half of 2022. The center has a contact center, creative services, an innovation center, a quality laboratory and a research and development facility to meet both global and local Indian growth. | |

| November 4, 2021 | Nutrition Clubs, which act as brick-and-mortar stores for Herbalife, announce new delivery and pick-up options, reaching new customers through digital . | |

| November 2, 2021 | Herbalife announces that consumer uncertainty, fueled by the Delta variant, led to a decrease in activity from new distributors and customers entering Herbalife’s channel. | |

| September 15, 2021 | The wellness trend connecting consumer nutrition to health accelerates Herbalife’s growth, with active sales in July and August increasing by 10% from the third quarter of 2022. | |

| September 14, 2021 | Herbalife becomes the global market leader in the $17.4 billion weight management category with an almost 20% market share. The company also has the number one meal replacement product in the world. | |

| August 3, 2021 | Herbalife Nutrition India emerges as the number one direct selling company in India, based on Herbalife’s market research store report. | |

- John O. Agwunobi—Chairman and CEO

- John G. DeSimone—President

- Susan B. Peterson—Founder

- Alexander R. Amezquita—Chief Financial Officer

- Bill Ferrante—Head of Investor Relations

Source: Company reports/S&P Capital IQ