DIpil Das

What’s the Story?

The health and wellness movement has made great strides over the past few years and the trend only intensified during the pandemic. CPG companies are positioning themselves and their brands to appeal to consumers as they focus their attention on leading healthier lifestyles. We discuss four key health and wellness trends in the CPG industry.Why It Matters

We expect wellness to remain the pre-eminent multiyear trend driving consumer spending shifts in 2022, only amplified by the pandemic prompting consumers to focus more on mental and physical wellness.Health and Wellness in CPG: Coresight Research Analysis

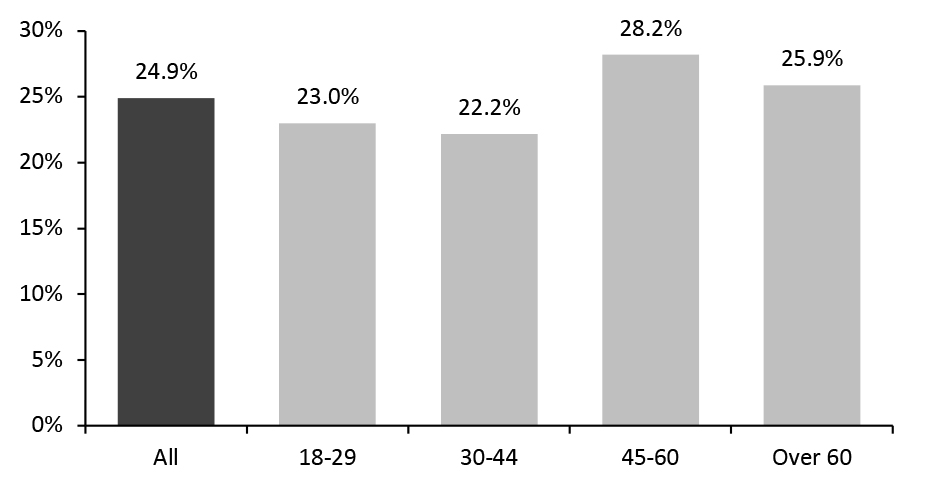

Coresight Research’s US Consumer Tracker found in December 2020 that one-quarter of US consumers expect to retain the changed behavior of focusing more on health and wellbeing in the long term, as shown in Figure 1.Figure 1. US Consumers That Expect to Retain the Changed Behavior of Focusing More on Health and Wellbeing Post Crisis, by Age (% of Respondents) [caption id="attachment_137645" align="aligncenter" width="700"]

Base: 438 US respondents aged 18+ surveyed on December 15, 2020

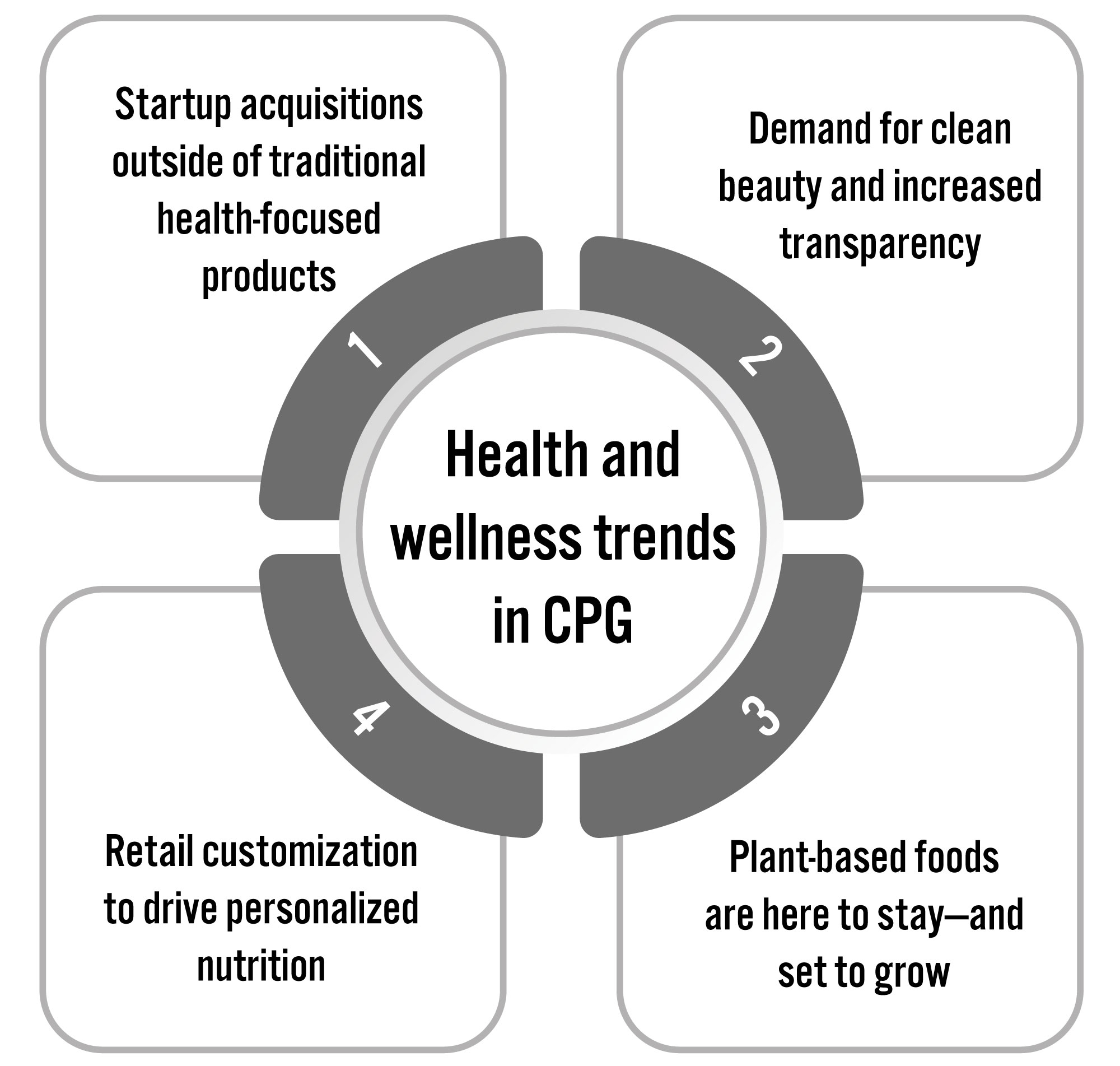

Base: 438 US respondents aged 18+ surveyed on December 15, 2020 Source: Coresight Research [/caption] According to the most recent report by the Centers for Medicare and Medicaid Services from December 2019, US health expenditure reached an estimated $4.01 trillion in 2020 and is projected to hit $6.19 trillion in 2028, an increase of 54.3%. Although much of this is covered by insurance—which can also present a financial burden—there are still out-of-pocket costs, which are projected to reach $1,603 per person per year in 2028, up 31.1% from 2020. With consumers facing higher healthcare costs in the coming years, we expect to see many turn to the wellness movement to prevent chronic diseases and limit exposure to health-related financial pressures. We anticipate that consumers will look to health and wellness products and trends in the adoption of healthier lifestyle choices. Figure 2 presents four key health and wellness trends in the CPG industry, which we discuss below.

Figure 2. Key Trends in Health and Wellness in the CPG Industry [caption id="attachment_137646" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Startup Acquisitions Outside of Traditional Health-Focused Products

CPG companies are expanding their health and wellness scope by acquiring startup brands, with many going beyond just buying out vitamin and supplement startups.

The acquired companies range across several CPG categories, including snacks and water supplements, focusing on new and innovative products compared to the more traditional health and wellness offerings.

Source: Coresight Research[/caption]

1. Startup Acquisitions Outside of Traditional Health-Focused Products

CPG companies are expanding their health and wellness scope by acquiring startup brands, with many going beyond just buying out vitamin and supplement startups.

The acquired companies range across several CPG categories, including snacks and water supplements, focusing on new and innovative products compared to the more traditional health and wellness offerings.

- In May 2021, Nestlé Health Sciences acquired functional hydration tablet maker Nuun for an undisclosed amount. The move followed the company’s $5.7 billion acquisition of several core brands from nutrition and supplements maker The Bountiful Company in April 2021.

- In April 2021, Unilever acquired Onnit, a Texas-based nutrition supplements brands for an undisclosed sum. The purchase follows the company’s acquisition of electrolyte drink mix brand Liquid IV in November 2020.

- Mondelez acquired keto-friendly chocolate brand Hu for $340 million in January 2021.

- Confectionery, food and pet product manufacturer Mars acquired healthy snacks and bars company Kind North America in November 2020.

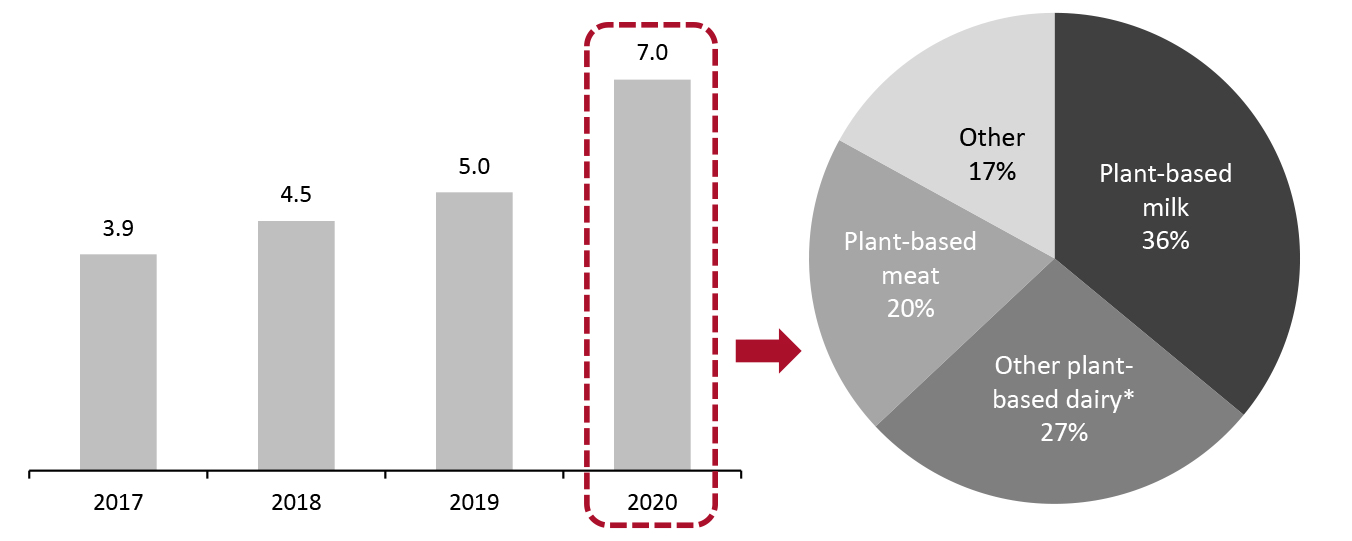

Figure 3. 2020 US Plant-Based Food and Beverage Sales: In Total (USD Bil., Left) and by Product (% of Total; Right) [caption id="attachment_137647" align="aligncenter" width="700"]

*Includes plant-based butter, creamer, ice-cream and yogurt

*Includes plant-based butter, creamer, ice-cream and yogurt Source: The Good Food Institute [/caption] Unilever and Danone are setting the standard for plant-based alternatives, alongside pure-play companies. As part of its Future Foods commitment, announced by Unilever in November 2020, the company plans to sell €1 billion ($1.2 billion) worth of plant-based meat substitutes and dairy alternatives worldwide annually within five to seven years. The company partnered with food-tech company Enough in June 2021 and microalgae specialist company Algenuity in May to scale up plant-based product development. Unilever-owned ice cream brand Ben and Jerry’s introduced three new varieties of plant-based ice cream made from sunflower butter in 2020. In October 2018, Danone pledged to triple its global plant-based sales from €1.7 billion ($1.9 billion) to around €5 billion ($5.7 billion) by 2025. In February 2021, Danone announced an agreement to acquire Earth Island, owner of plant-based brand Follow Your Heart, which according to the firm, will expand its plant-based food and drink portfolio and contribute to reaching its ambitious target. However, CPG companies will face significant competition from retailers, many of which are enthusiastic about the emerging plant-based food category. For example, Kroger launched a plant-based Simple Truth collection in 2019 and added 53 new plant-based items in its fiscal 2021. Many retailers plan to double down on this category in light of increased consumer demand for plant-based products in 2021 and beyond. Similarly, Albertsons announced plans in December 2020 to introduce 50 new plant-based products across categories such as meat, dairy, frozen and snacks to its O Organics and Open Nature brands in 2021. The company has recognized the plant-based category as a “key segment of growth” for the future. 4. Retail Customization To Drive Personalized Nutrition We expect personalized nutrition offerings to piggyback on broader demand for customized experiences in the current retail environment. Personalized nutrition is defined as developing customized nutrition guidelines based on an individual’s unique microbiome and genetic profiles. The concept aims to replace the one-size-fits-all approach to nutrition, providing consumers with tailored products to suit their specific needs. Companies that offer personalized nutrition services provide recommendations (such as meal plans, grocery lists, recipes and exercises) that meet consumers’ personal nutritional and health needs and help prevent nutrition-related chronic diseases. Personalization is an emerging trend across consumer industries, such as personalized shopping experiences and made-to-order fashion items or tailored holidays. This emerging trend creates an opportunity for the food industry too, which has lagged behind in offering a customized experience. The ability to customize diets and exercise plans based on an individual’s microbiome and genetics may be the next frontier in nutrition counseling. A personalized nutrition plan may help increase compliance and help consumers target dietary goals that align with what works with their bodies. Personalized nutrition spans multiple industries, from medical diagnosis firms to extract and interpret microbiome/genetic test results, to wearable tech companies that offer ongoing interactive feedback to users and food product suppliers to meet nutritional product requirements. Most of the current personalized nutrition market participants are startups. That said, the growing role of personalization within the food industry has been acknowledged by larger CPG companies, including Nestlé, Danone and Unilever.

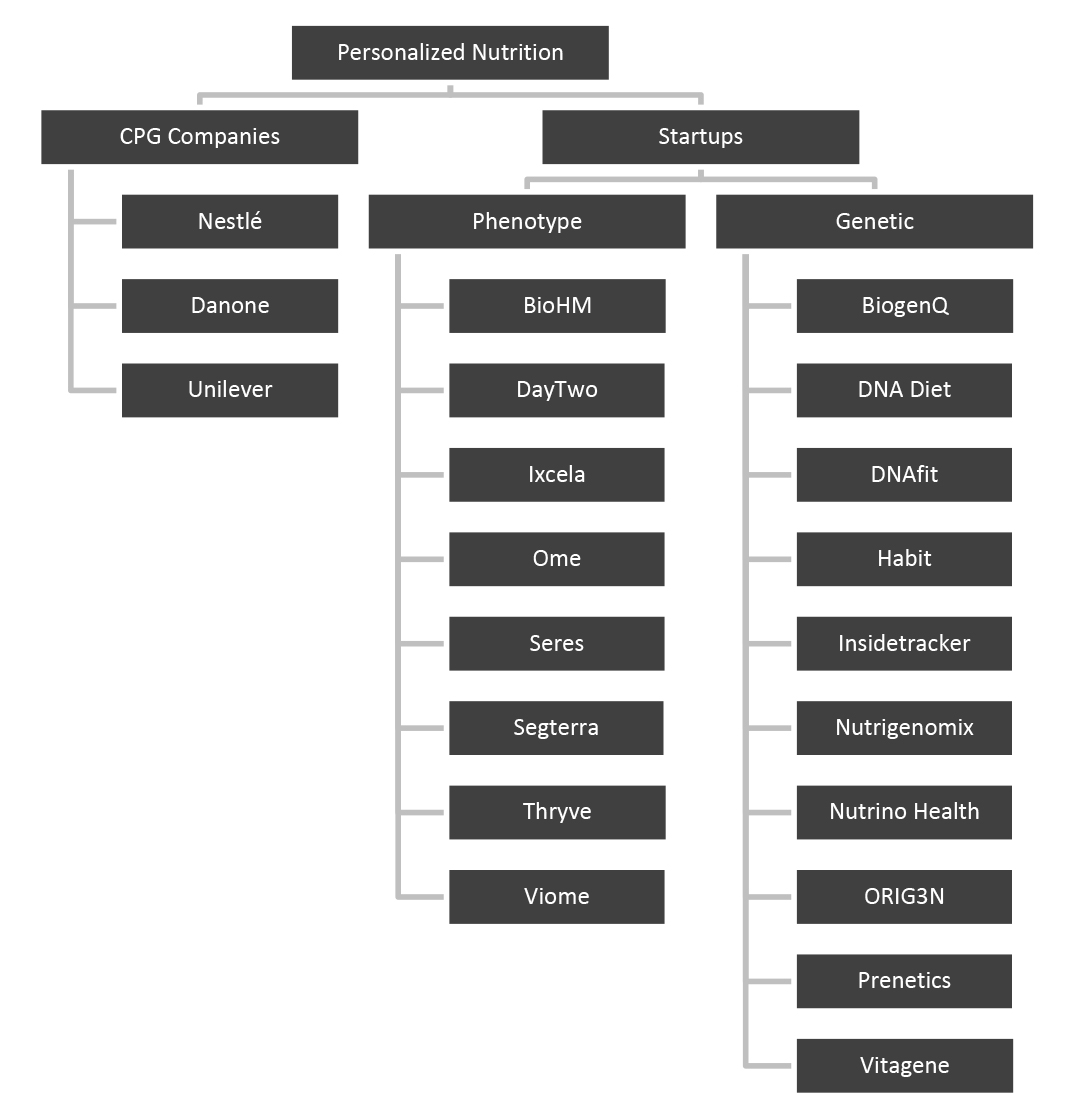

Figure 4. Major Players in the Personalized Nutrition Market [caption id="attachment_137648" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Nestlé has identified personalized nutrition as a major growth opportunity. The company partnered with the University of California San Diego Center for Microbiome Innovation in November 2019 to accelerate the development of innovative nutritional solutions. In September 2018, the company launched a Wellness Ambassador program in Japan where users are asked to provide genetic information and then submit photos of their food via a messaging app called Line. The algorithm then recommends lifestyle changes and specifically formulated supplements to enhance the user's diet. Additionally, the company acquired Persona Nutrition which offers personalized vitamin subscriptions based on lifestyle choices.

Danone is moving toward more personalized food solutions, driven by its innovation arm Manifesto Ventures. The company invested in Mitte in August 2018, which offers a personal hydration experience at home and in July 20219 it invested in Nutricia, which specializes in personalized nutrition products for children.

In November 2020, pharmaceutical and life sciences company Bayer acquired US-based personalized direct-to-consumer (DTC) nutrition company Care/of, which helps consumers build a nutrition supplement routine specially tailored to their needs. In February 2021, American supplement manufacturer Nature’s Way acquired German personalized nutrition company Baze, which offers an at-home blood test and provides custom vitamin supplements and nutrition plans targeting identified nutritional deficiencies.

Despite the presence of a number of players in the market, the personalized nutrition market remains very much in its infancy. One of the most significant barriers to the widespread adoption of personalized nutrition is a lack of depth in research studies to support the thesis that individuals following a DNA or microbiome-based diet can enjoy notable health benefits.

As the space gains greater focus, we expect to see an increase in academic studies in the area, the findings of which will likely be critical to the growth outlook for personalized nutrition. We anticipate that startups may not be the frontrunners in this space in the long term, especially as CPG giants increase their activities in this field and leverage their financial strength to acquire emerging innovators.

Source: Coresight Research[/caption]

Nestlé has identified personalized nutrition as a major growth opportunity. The company partnered with the University of California San Diego Center for Microbiome Innovation in November 2019 to accelerate the development of innovative nutritional solutions. In September 2018, the company launched a Wellness Ambassador program in Japan where users are asked to provide genetic information and then submit photos of their food via a messaging app called Line. The algorithm then recommends lifestyle changes and specifically formulated supplements to enhance the user's diet. Additionally, the company acquired Persona Nutrition which offers personalized vitamin subscriptions based on lifestyle choices.

Danone is moving toward more personalized food solutions, driven by its innovation arm Manifesto Ventures. The company invested in Mitte in August 2018, which offers a personal hydration experience at home and in July 20219 it invested in Nutricia, which specializes in personalized nutrition products for children.

In November 2020, pharmaceutical and life sciences company Bayer acquired US-based personalized direct-to-consumer (DTC) nutrition company Care/of, which helps consumers build a nutrition supplement routine specially tailored to their needs. In February 2021, American supplement manufacturer Nature’s Way acquired German personalized nutrition company Baze, which offers an at-home blood test and provides custom vitamin supplements and nutrition plans targeting identified nutritional deficiencies.

Despite the presence of a number of players in the market, the personalized nutrition market remains very much in its infancy. One of the most significant barriers to the widespread adoption of personalized nutrition is a lack of depth in research studies to support the thesis that individuals following a DNA or microbiome-based diet can enjoy notable health benefits.

As the space gains greater focus, we expect to see an increase in academic studies in the area, the findings of which will likely be critical to the growth outlook for personalized nutrition. We anticipate that startups may not be the frontrunners in this space in the long term, especially as CPG giants increase their activities in this field and leverage their financial strength to acquire emerging innovators.

What We Think

The pandemic has seen consumers place a heightened emphasis on preventative health and wellness, including healthier eating habits, using products without toxic ingredients and exercising more to maintain a healthier lifestyle. This presents opportunities for CPG companies to incorporate healthier options into their product ranges to drive sales. Implications for Brands- Health and wellness startups typically excel in catering to niche categories using unique strategies and channels. Legacy CPG companies should look to partner, invest in or acquire these startups to stay connected with the emerging consumer ecosystem and understand new market trends.

- Personalized nutrition is still a niche concept, yet the broader tailwinds of a more health- and wellness-orientated consumer, and the rising demand for customized experience across consumer industries more generally, should support further development. As the availability of empirical studies related to personalized nutrition is low, companies interested in venturing into the space should proactively look for partnerships with other players such as universities, research institutes and technology vendors to release research proving the effectiveness of DNA and microbiome-based diets.