DIpil Das

Introduction

What’s the Story? Mid-size retailers need an operating model that fits their circumstances in order to properly compete with retail giants in the e-commerce channel. While giants such as Amazon have historically built their own infrastructure and operations, today’s mid-size retailers may not have the relative time or resources to similarly invest. Adding to that, any diversion of resources or attention from their core operations could pull away from business growth. In this report, we discuss external versus internal capabilities for e-commerce functions at mid-size retailers and the challenges that mid-size retailers face in their current operating model. We consider how a CaaS-based operating model can address companies’ pain points and support the scaling of e-commerce businesses. To set the context for the report, we lay out a few key segments and their respective definitions:- Total mid-size: the overall bracket, comprising companies with annual online revenue of $5 million to <$150 million

- Lower mid-size: annual online revenue of $5 million to <$50 million

- Intermediate mid-size: annual online revenue of $50 million to <$100 million.

- Upper mid-size: annual online revenue of $100 million to <$150 million.

- Read the first two reports in the series: The Evolving State of E-Commerce Infrastructure and Addressing Profitability Issues for Mid-Size E-Commerce Players.

Optimizing E-Commerce Infrastructure: Coresight Research x Nogin Analysis

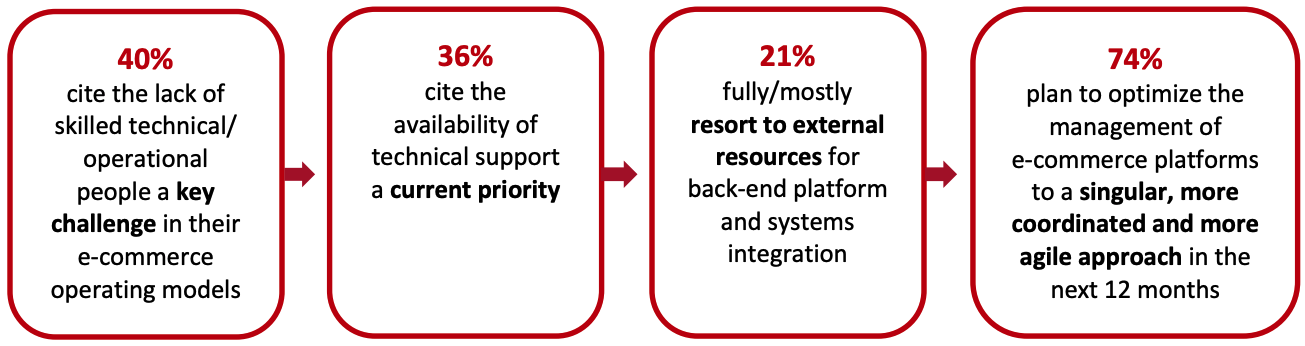

We summarize our key survey findings below, before presenting our analysis and exploring the implications of each in detail below.Figure 1. US Mid-Size Retailers: Key Findings (% of Respondents) [caption id="attachment_145376" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at US mid-size companies

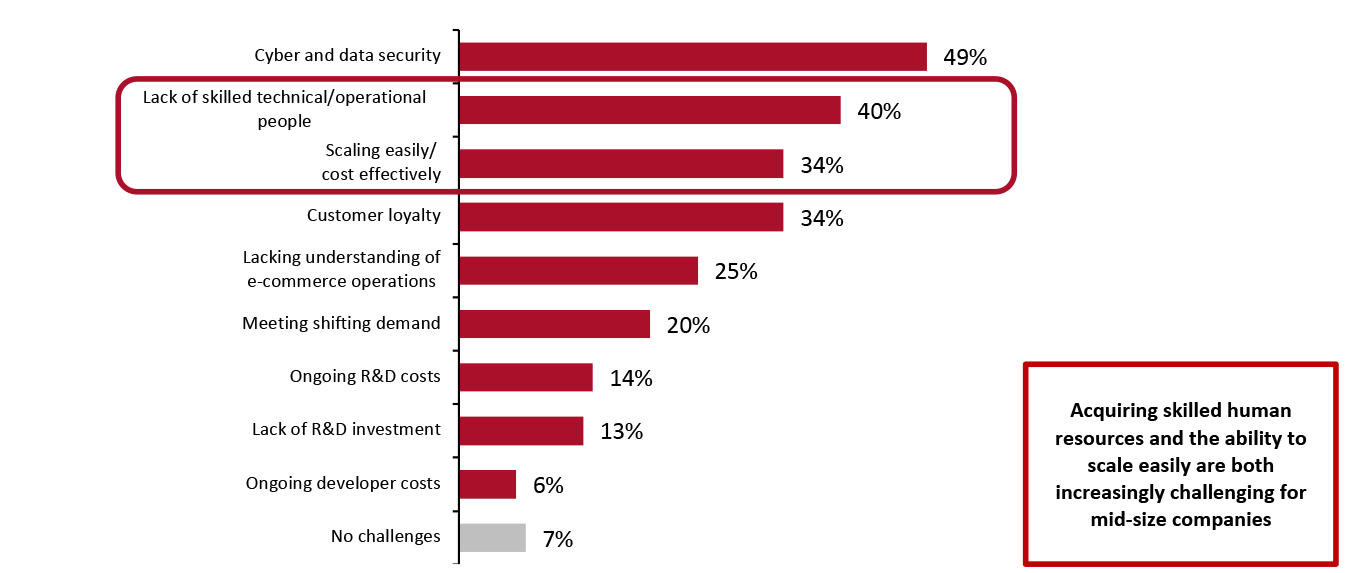

Base: 122 e-commerce leaders at US mid-size companies Source: Coresight Research [/caption] Challenges in Current E-Commerce Operating Models Mid-size retailers face a multitude of challenges in their current e-commerce operating models. Our survey found that having the needed skilled technical/operational resources and scaling easily/cost effectively are two of the top three challenges (see Figure 2). This is not surprising given that finding and maintaining skilled human resources can be difficult in today’s environment as companies compete for technical talent to increase their competitive edge. At the same time, skilled specialists that deliver results are also in high demand, posing recruiting challenges for mid-size retailers. In regards to scaling, the ability to scale up or down easily can help mid-size companies better improve profitability and control costs.

Figure 2. Mid-Size Companies: Challenges Presented by Current E-Commerce Operating Models (% of Respondents) [caption id="attachment_144846" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at US mid-size companies

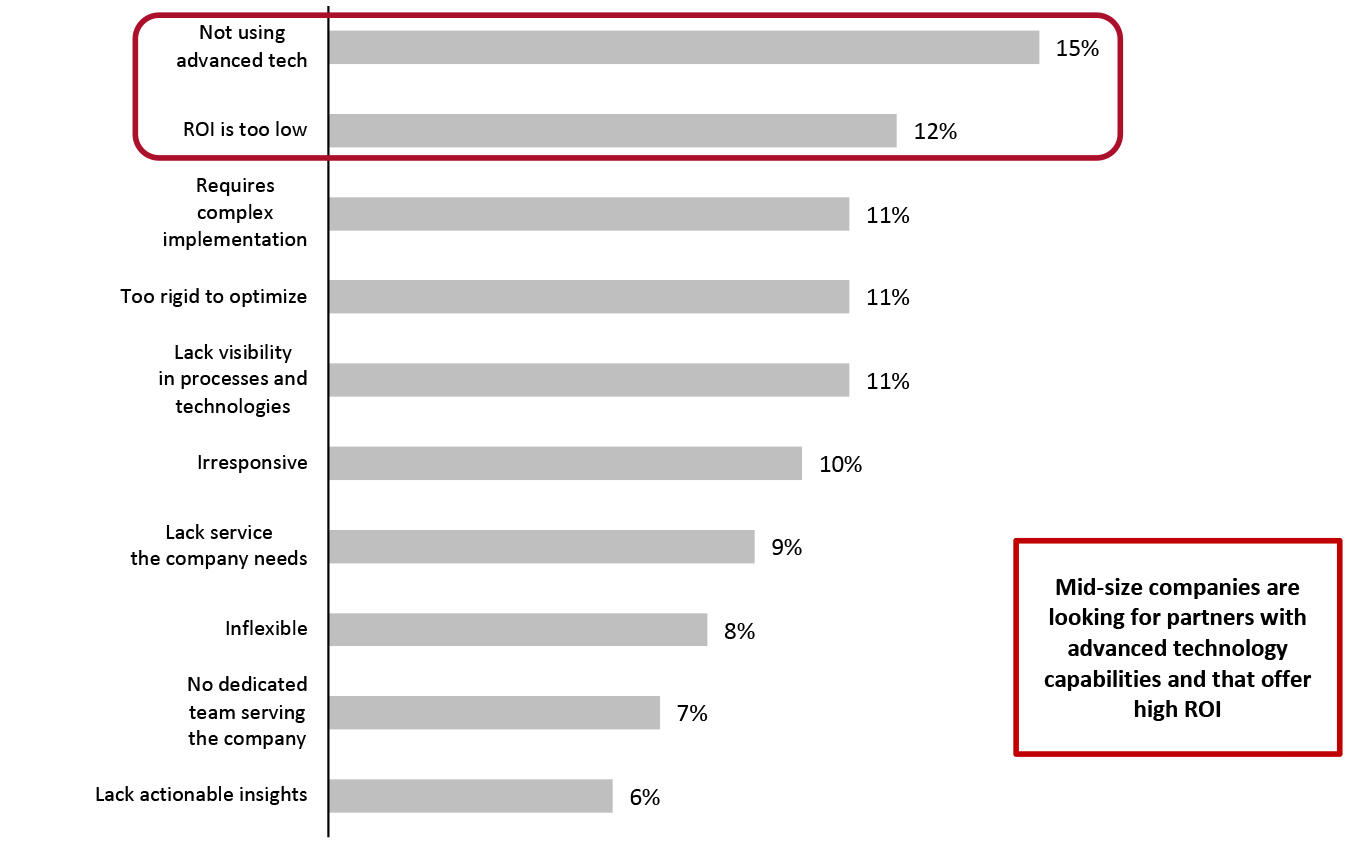

Base: 122 e-commerce leaders at US mid-size companies Source: Coresight Research [/caption] Advanced technologies are important to successful e-commerce operations: AI and machine learning can automate particular processes, while predictive analytics can help to provide insights for retailers to enhance their processes. However, when it comes to working with e-commerce platform/solution partners, the use of advanced technology was cited as the foremost challenge by surveyed mid-size companies (reported by 15% of respondents). Other challenges include low return on investment (ROI), complex implementation, the platform being too rigid to optimize and a lack of visibility into processes and technologies—all of which were cited by more than one in 10 respondents (see Figure 3).

Figure 3. Mid-Size Companies: Challenges in Working with E-Commerce Platform/Solution Partners (% of Respondents) [caption id="attachment_144847" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at US mid-size companies

Base: 122 e-commerce leaders at US mid-size companies Source: Coresight Research [/caption] The Value of External Support Mid-size retailers want technical support to be available when developing and maintaining their e-commerce infrastructure. The need for expert support has been heightened due to the recent pandemic-driven acceleration of e-commerce: 36% of mid-size companies in our survey reported that the availability of technical support is a current priority, and 32% brought in more technical expertise due to Covid-19. Furthermore, more mid-size companies are recognizing the value of technical support in facilitating e-commerce business growth, with 39% of respondents stating that they intend to prioritize technical support in the future. CaaS can potentially mitigate the need for technical support, as it provides the technology and support for mid-size companies needing it, with fast deployment and minimal errors. Having expert technical support can help mid-size retailers expand operations and realize potential cost savings, but whether this support is provided through in-house resources or external sources is a key consideration, which we will discuss further in the next section. Internal and External Resources: Finding the Right Combination There are three ways of providing resources to operate various e-commerce functions:

- Internal/In-house: A company licenses a platform or builds its own tech stack to execute its e-commerce strategy and manage retailer platforms in-house, allowing brand manufacturers to internally handle both strategy and execution.

- External: A partially managed or fully managed service (CaaS) through a service provider leads to variable instead of fixed personnel and equipment costs. CaaS e-commerce tech platforms, in particular, provide turnkey solutions that allow retailers to better focus in-house on brand building, removing concerns around technology and marketing.

- Hybrid model: Some business activities are delegated externally, while some remain in-house.

Figure 4. Advantages and Disadvantages of Internal vs. External Resources for E-Commerce Functions [wpdatatable id=1866]

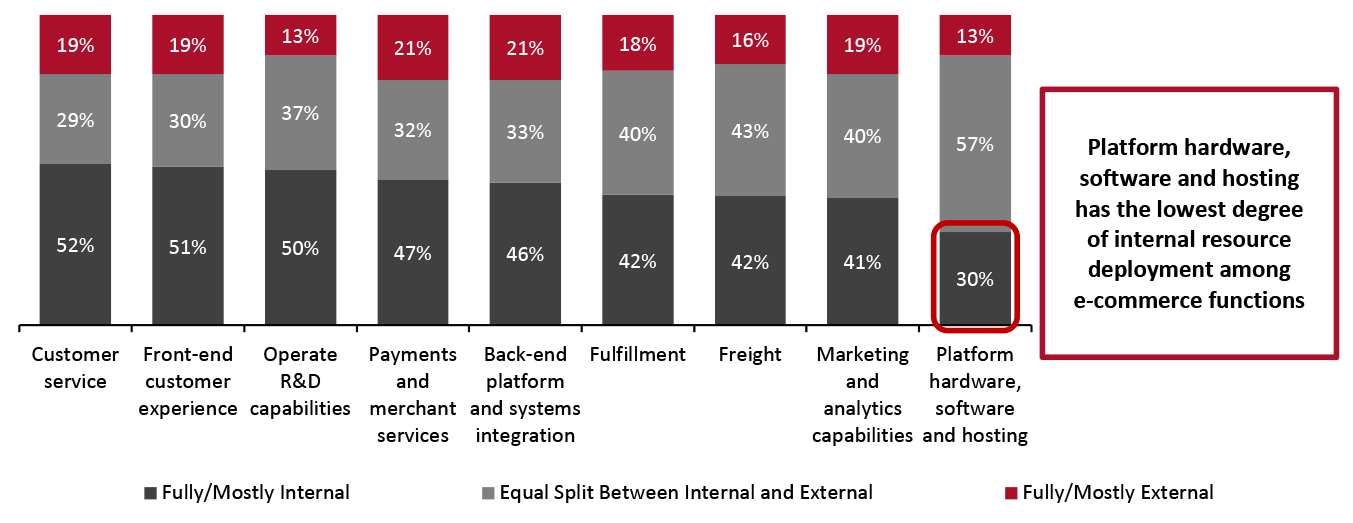

Source: Coresight Research Our survey found that all mid-size retailers use at least some degree of external resources in at least one e-commerce function (see Figure 5 below).

- The three e-commerce functions that see the highest amount of internal resource deployment are customer service (fully/mostly internal for 52% of mid-size companies), front-end customer service (51%) and operating R&D capabilities (50%).

- The three e-commerce functions that see the highest amount of external resource deployment are back-end platform and systems integration (fully/mostly external for 21% of mid-size companies), front-end customer service (19%) and marketing and analytics capabilities (19%).

Figure 5. Mid-Size Companies: Internal vs. External Resources for Different E-Commerce Functions (% of Respondents) [caption id="attachment_144848" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

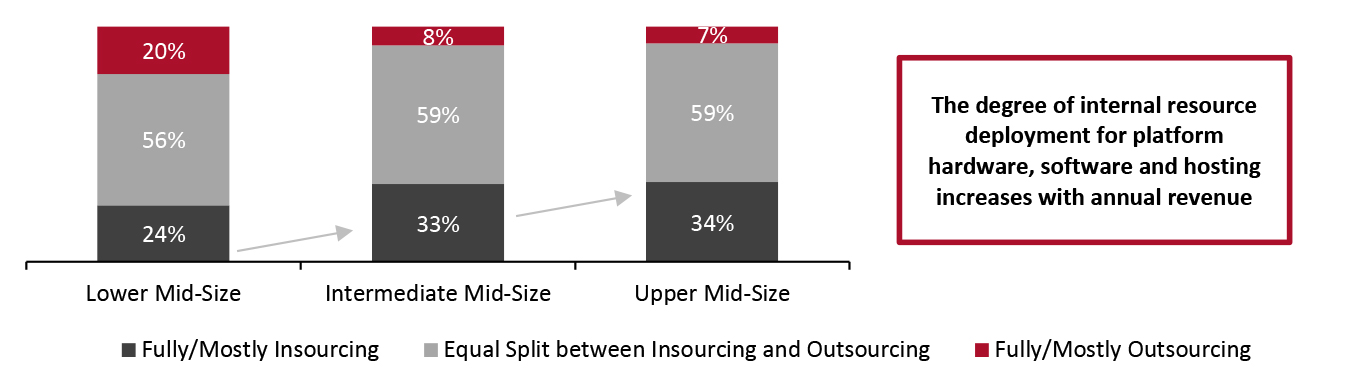

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] Interestingly, the degree of internal resources is correlated with a company’s annual revenue for platform hardware, software and hosting, our survey found: The higher the revenue, the more likely a mid-size company is to use internal resources for the e-commerce function. Only 24% of lower mid-size retailers reported that they handle platform hardware, software and hosting internally, while 34% of upper mid-size retailers report the same. Mid-size retailers that have high annual revenues are more likely to be able to afford the fixed costs of internal technical expertise for platform hardware, software and hosting.

Figure 6. Mid-Size Companies: Internal vs. External Resource Deployment of Platform Hardware, Software and Hosting, by Revenue (% of Respondents) [caption id="attachment_144849" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

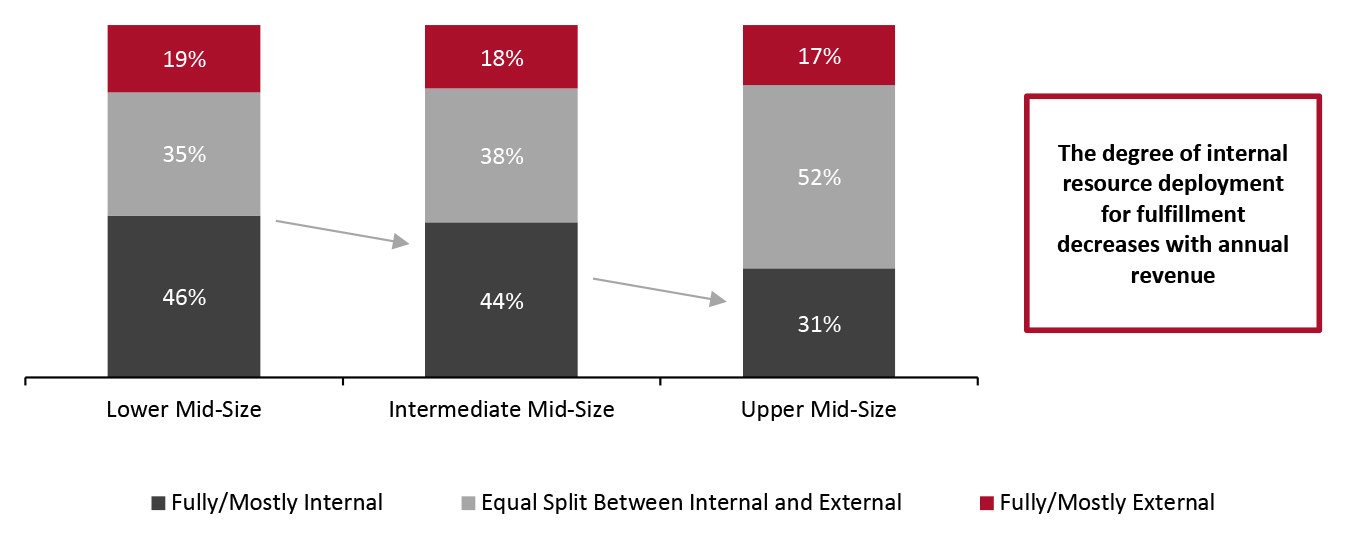

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] On the other hand, fulfillment is an e-commerce function for which the degree of internal resource deployment decreases with annual revenue: While 46% of lower mid-size companies handle fulfillment and freight internally, only 31% of upper mid-size retailers do the same. Fulfillment is a complex process that involves product storage, picking and packing—and it is often time-intensive. We see companies using external logistics providers for fulfillment services in order to save time and meet high consumer demand quickly. For example, in October 2021, Saks (the e-commerce arm of Saks Fifth Avenue) started using collaborative robots and a shared-space distribution network provided by American logistics company GXO, to meet surging demand for luxury fashion as the holiday season approached.

Figure 7. Mid-Size Companies: Internal vs. External Resource Deployment for Fulfillment, by Revenue (% of Respondents) [caption id="attachment_144850" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

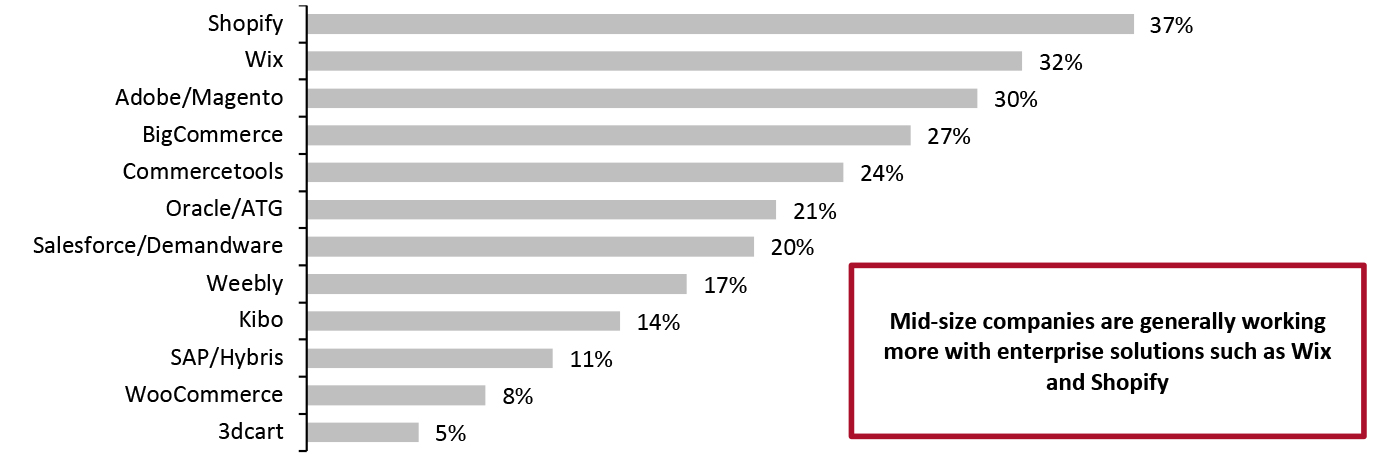

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] When using external e-commerce functions, more than one-third of mid-size retailers work with Shopify—and Wix and Adobe are also popular vendors (see Figure 8). While these solution providers may be able to integrate with major marketplaces such as Amazon and may have user-friendly interfaces that provide convenience to retailers, they often incur transaction fees; there can be costly monthly subscriptions for premium functionality; and these vendors’ solutions can be complex in terms of implementation. CaaS, on the contrary, integrates functionalities such as fulfillment into the platform without incurring extra premium costs.

Figure 8. Third-Party Solution Partners That Mid-Size Companies Work With on External E-Commerce Functions (% of Respondents) [caption id="attachment_144851" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

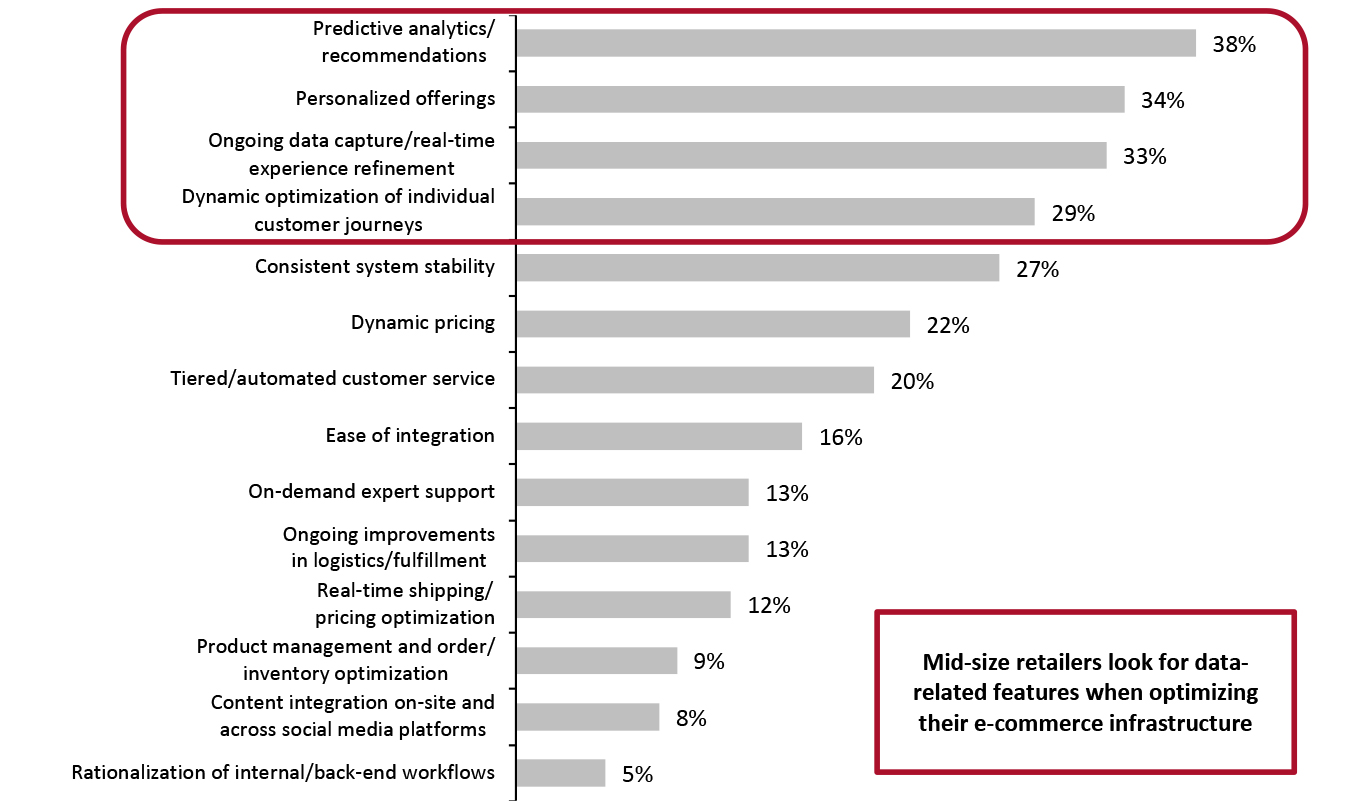

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] Desirable Features in E-Commerce Infrastructure Data analytics and personalization matter to mid-size retailers: 38% of respondents cited predictive analytics/recommendations as a top feature they look for in their e-commerce infrastructure; 34% cited personalized offerings, and 33% cited ongoing data capture/real-time experience refinement (see Figure 9).

Figure 9. Features That Mid-Size Companies Look for in Their E-Commerce Infrastructure (% of Respondents) [caption id="attachment_144852" align="aligncenter" width="700"]

Respondents were asked to select at least one and up to three options

Respondents were asked to select at least one and up to three options Base: 122 e-commerce leaders at mid-size companies

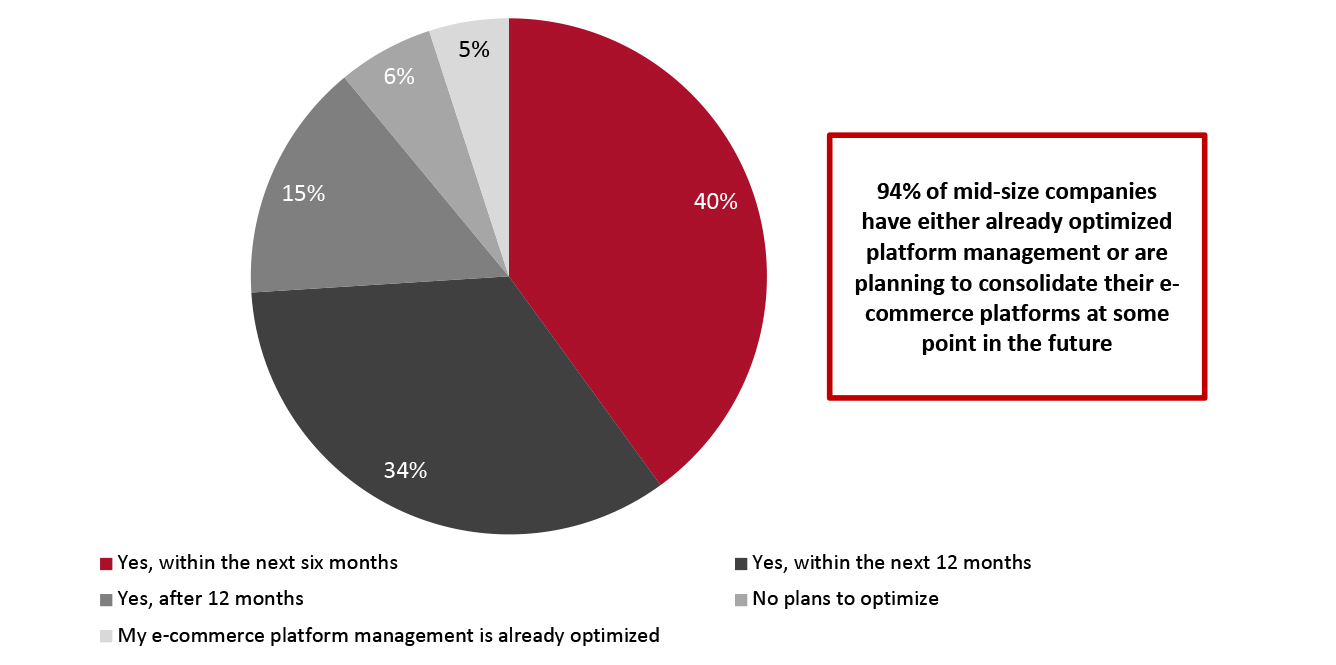

Source: Coresight Research [/caption] Mid-size retailers are seeking insights to better meet changing consumer demand and so maintain their competitive edge. When finding a platform/solution to facilitate their online business, 19% of surveyed mid-size retailers look for “great analytics, non-obvious insights and reporting” in an ideal e-commerce platform/solution partner. By leveraging predictive analytics, personalization technologies and insights, mid-size retailers can achieve some of their other objectives when finding a platform/solution to facilitate their online business, including acquiring new customers (cited by 35% of mid-size retailers in our survey), increasing customer loyalty (33%) and strengthening their brand (32%). It is common for mid-size retailers to use different software for different e-commerce functions, so it is not surprising that the ability to integrate software is important to them when looking for e-commerce solution providers: Our survey found that 34% of mid-size retailers look for compatibility and integration capabilities in an ideal e-commerce platform/solution partner. In addition, 16% of mid-size retailers cite the ease of integration as one of their top three most desired features in e-commerce infrastructure (as shown above in Figure 10). Furthermore, mid-size retailers are looking to consolidate their e-commerce platforms in order to operate more efficiently, save costs and achieve growth. Our survey found that 74% of mid-size companies plan to optimize e-commerce platform management from a disparate, uncoordinated approach to a singular and more coordinated one within the next 12 months (see Figure 10).

Figure 10. Mid-Size Companies: Plans To Consolidate E-Commerce Platforms (% of Respondents [caption id="attachment_144853" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption]

Nogin

Nogin’s Intelligent Commerce Platform is an e-commerce operating model based on CaaS, which uses ML (machine learning)-powered predictive models and enables continuous investment in R&D through cloud-based upgrades. It also runs on a generalist-specialist model and devotes technical expertise to cater to e-commerce businesses’ needs. Nogin’s Intelligent Commerce Platform enables the real-time diagnosis of problems and implementation of solutions, and provides on-demand access to third parties as integrated partners for additional services.What We Think

Mid-size retailers are looking to optimize their operating model by focusing internal resources on their core value proposition, then allocating supporting work to internal teams or external partners. They are typically looking for data analytics and personalization, expert technical support and ease of scaling in order to build their e-commerce infrastructure, many features which can be sourced externally. CaaS in particular is a fully managed e-commerce service that provides expert support on different e-commerce functions, from setup to marketing to fulfillment. Through advanced technologies such as AI, ML and predictive analytics, the data-driven model provides algorithms and insights to support retailers in tailoring their offerings to customers and increasing cost savings. CaaS has a high degree of customization and enables brands and retailers to easily scale up or down depending on their needs.Methodology

This study is based on the analysis of data from an online survey of 153 e-commerce leaders in US retail, fielded in October 2021. Respondents in the survey satisfied the following criteria:- Company annual revenues of any size

- Employee count of any number

- Retail sectors including apparel and fashion, beauty and personal care, cleaning supplies, food and grocery, health and wellness, home and garden, housewares, outdoors/sports, and pet supplies

- Online, offline, B2B (business-to-business) and wholesale retailers