DIpil Das

Introduction

What’s the Story? Mid-size brands or retailers (companies with annual online revenues of between $5 million and $150 million) struggle to compete with e-commerce giants such as Amazon because they do not have a comparable amount of data or the funds to invest as heavily in technology and R&D (research and development). Consumers now have enterprise-level commerce expectations—i.e., a seamless online shopping experience coupled with one-click checkout and fast, cheap/free shipment (associated with giants such as Amazon, Target and Walmart)—when interacting with mid-size brands/retailers, making it even more difficult for these mid-size businesses to maintain superior customer experiences. Many e-commerce companies try to play Amazon’s game by offering heavy discounts and free shipping, which negatively impacts both the top and bottom lines—resulting in businesses often losing money in the online channel. In this report, we explore the levers of profitability in e-commerce business, how CaaS (commerce-as-a-service) ensures profitability and growth for mid-size companies, and why mid-size brands and retailers should capitalize on AI (artificial intelligence), ML (machine learning) and predictive analytics. To set the context for the report, we lay out below a few key segments and their respective definitions:- Total mid-size: the overall bracket, comprising companies with annual online revenue of $5 million to <$150 million

- Lower mid-size: annual online revenue of $5 million to <$50 million

- Intermediate mid-size: annual online revenue of $50 million to <$100 million

- Upper mid-size: annual online revenue of $100 million to <$150 million

- Read the first report in the series on the evolving state of e-commerce infrastructure.

- According to a survey of 40 consumer goods CEOs conducted by The Food Industry Association (FMI) and management consultancy McKinsey & Company in June 2021, e-commerce profitability was ranked among the top three priorities for 38% of respondents.

- More than one in four US CPG executives believe that low profitability is their number-one concern with regards to e-commerce, according to a poll conducted during a June 2020 webinar by McKinsey & Company.

- Rodney McMullen, CEO of Kroger, acknowledged on the company’s earnings call for the first quarter of 2020, held in June 2020, that profitability is a challenge for e-commerce.

- Target said in its earnings call for the first quarter of 2020, held in May 2020, that it started looking at new technology and sort centers in order to keep up with consumer demand and drive down costs.

Addressing Profitability Issues for Mid-Size E-Commerce Players: Coresight Research x Nogin Analysis

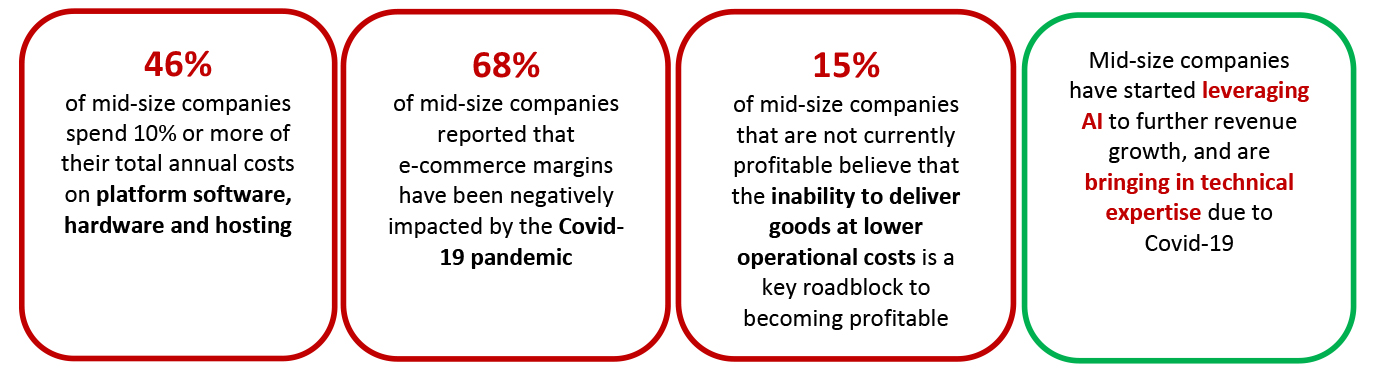

In Figure 1, we summarize our key survey findings, before presenting our analysis and exploring the implications of each in detail below.Figure 1. Addressing Profitability Issues for Mid-Size E-Commerce Players: Key Survey Findings [caption id="attachment_140500" align="aligncenter" width="701"]

Base: 122 e-commerce leaders at mid-size companies

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] Overview of E-Commerce Costs The issue of profitability can be analyzed through the unit economics of e-commerce—the profit or loss per order (after deducting all variable costs) that contributes to overall business performance. It is therefore of paramount importance to understand the various costs involved in e-commerce, which we outline below.

- Direct Costs

- Platform hardware, software and hosting: Costs relating to the infrastructure or build of an e-commerce solution

- Platform annual maintenance: Costs around standard upgrades, security updates and tools to boost ongoing traffic growth

- Platform per-transaction fees: The fee businesses pay to process customer payments

- Front-end customer experience: Product, development and maintenance costs to guide and enhance shopper interactions (such as product detail pages and drop-down menus) as well as employee/merchant interactions (such as inventory, shipping and customer service)

- Back-end platform and systems integration: Product, development and maintenance costs required to manage the data access layer that holds products, orders and customer information

- Marketing and analytics capabilities: Costs to set up, deploy and manage marketing campaigns (email, SEM, affiliates, paid media, etc.)

- Customer service: Costs associated with AI, email and phone support for webstore orders and follow-ups

- Payments and merchant services: Costs associated with facilities handling electronic card transactions

- R&D capabilities: Development costs to build new capabilities, features, optimizations and enhancements

- Fulfillment: Costs associated with pick, pack and storage services

- Freight: Costs associated with shipping and returns

- Hidden Costs

- Incomplete/disjointed customer data/profiles:Discounting more than necessary can be due to an incomplete view of a particular customer, caused by a lack of data or siloing of data that limits the ability to properly target and price (can be mitigated/improved with integrated data platforms). More integrated data platforms have led to 20% less discounting with similar conversion rates, according to Nogin.

- Manual/standard approach to free shipping:Taking a moremanual and/or one-size-fits-all approach to shipping drives up costs and/or discounting without increasing sales. With data and AI, shipping costs can improve considerably, from 9% of sales to 5%, according to Nogin.

- Inconsistent approach to returns: A lack of analysis and integrated data leads to 20% greater returns, according to Nogin.

- “Traditional” merchandising/planning model:A lack of data-driven planning leads to slow replenishment and excess inventory due to poor technology and fulfillment visibility.

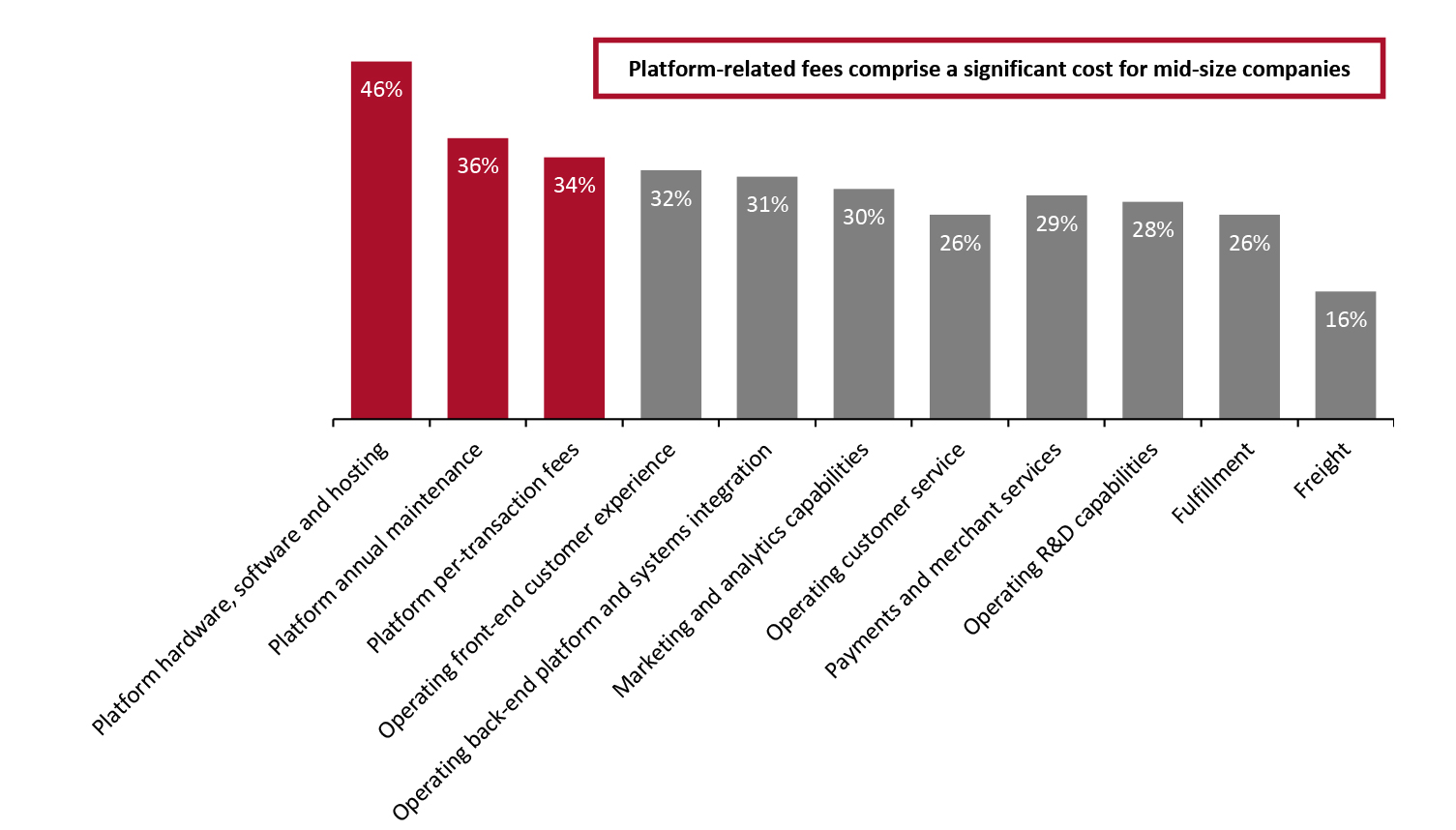

Figure 2. Mid-Size Companies: E-Commerce Areas on Which Companies Spend 10% or More of Overall Annual Costs (% of Respondents) [caption id="attachment_140501" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption]

- Looking at the initial spend for the three platform-related fees, significant proportions of all mid-size companies will spend $100,000 or more, which is very high. Among all mid-size companies, 11% reported that they initially spend $100,000 or more on platform hardware, software and hosting.

- 10% initially spend $100,000 or more on platform annual maintenance.

- 15% initially spend $100,000 or more on first-year platform per-transaction fees.

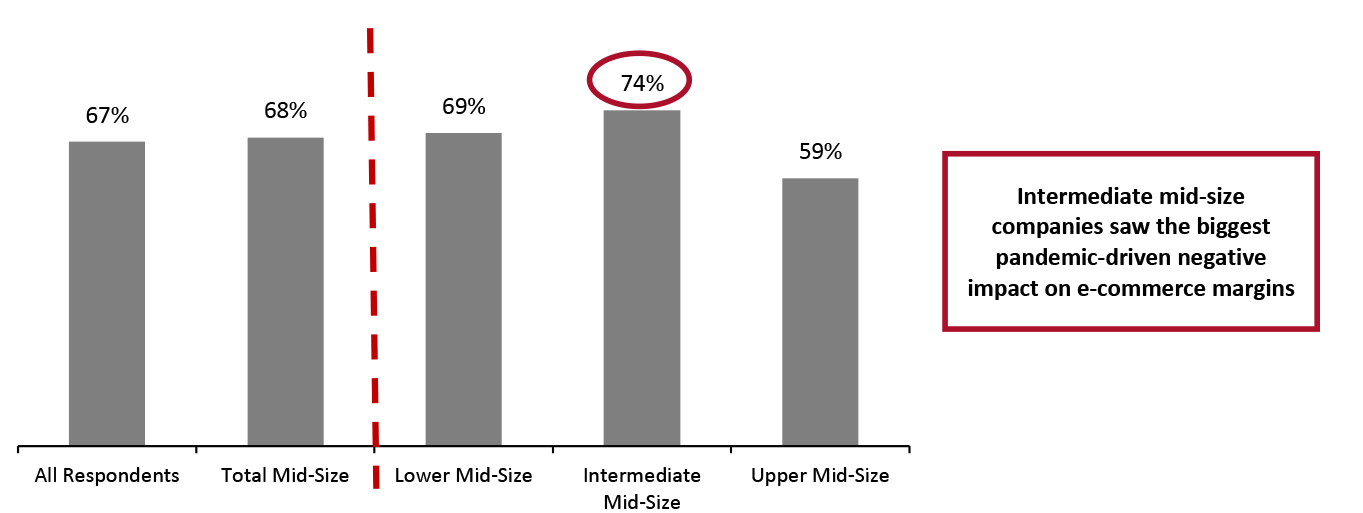

Figure 3. Companies That Reported a Moderately or Highly Negative Impact on E-Commerce Margins due to Covid-19 (% of Respondents) [caption id="attachment_140502" align="aligncenter" width="700"]

Base: 153 e-commerce leaders

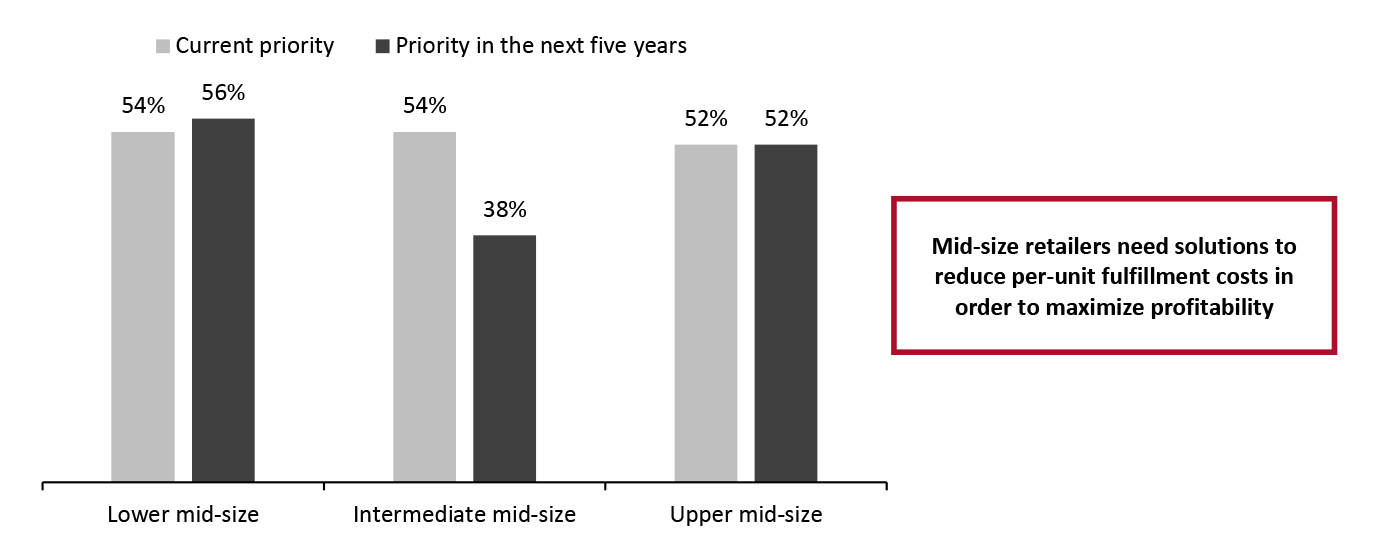

Base: 153 e-commerce leaders Source: Coresight Research [/caption] Last-Mile Fulfillment Fulfillment is a longstanding barrier to profitability in online retailing. As a variable cost, fulfillment expenses rise as sales increase—unlike store-based costs, which are largely fixed. Compounding this challenge, shoppers have come to expect ever faster and more convenient, yet inexpensive, shipping, placing the financial burdens of delivery largely on the shoulders of retailers. For retailers without stores to leverage as collection points, home delivery brings higher costs than in-store pickup. For example, Target has claimed that it is about 90% cheaper on average when a customer picks up an online order in one of its stores versus the retailer shipping the item to their home. It is not surprising that, besides Target, retailers such as Best Buy and Dick’s Sporting Goods have also turned stores into mini warehouses and touted curbside pickup in order to save on shipping costs. In fact, our survey found that among currently profitable mid-size retailers, 13% cited last-mile fulfillment costs as a key obstacle to achieving greater profitability through their webstores. In addition, among mid-size retailers that are not currently profitable, 15% cited the inability to deliver goods at lower operational costs as a key roadblock to their companies being profitable. Mid-size retailers therefore need solutions to reduce per-unit fulfillment costs, especially as they rapidly scale up e-commerce operations, or they may struggle to turn a profit. They need to couple this with investment into logistics/delivery services to meet stronger demand for shorter fulfillment times and to meet industry delivery standards/expectations being set by enterprise retail players. Not surprisingly, more than half of all mid-size companies in our survey cited improved fulfillment as a current priority, and more than four in 10 stated that it will be a priority in the next five years.

Figure 4. Mid-Size Companies: Whether Improved Fulfillment Is a Current Priority or a Priority in the Next Five Years (% of Respondents) [caption id="attachment_140503" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

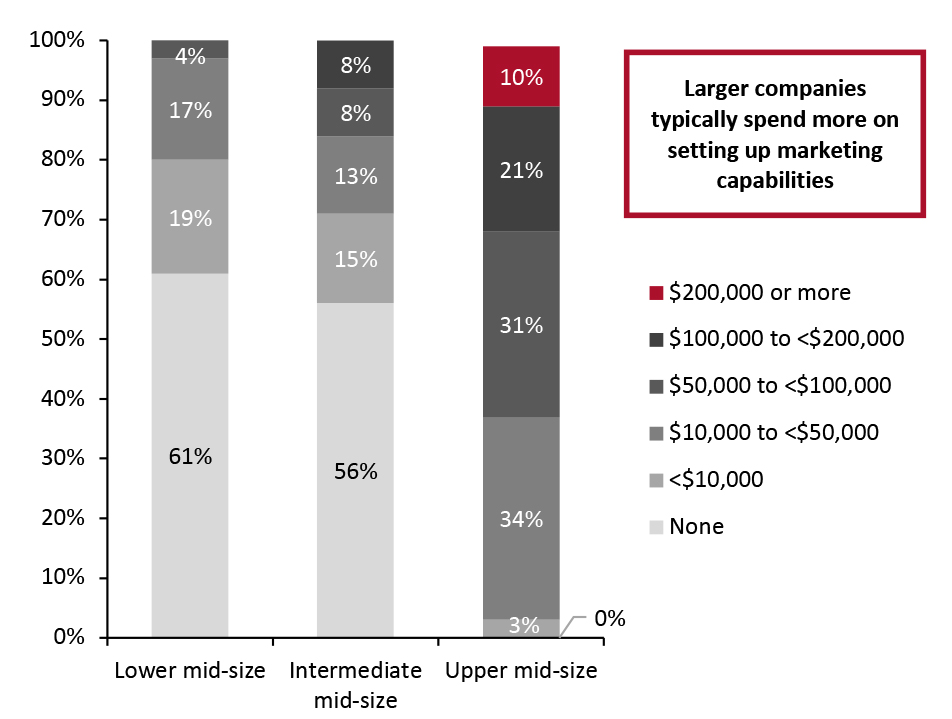

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] Overspending on Marketing and Promotions Marketing represents another hurdle to profitability when selling online—especially for those companies that do not have the marketing benefit of physical stores. Ad spending can be high even for large companies with the most sophisticated means of measuring ROI (return on investment), and the challenges of balancing spending with driving growth can be even greater for mid-size firms. While mid-size retailers must spend on marketing in order to increase brand awareness and so compete with retail giants, they often lack insights into who to target promotions at and what marketing strategies to adopt, ultimately leading to overspending on marketing and ultimately impacting profitability. From our survey, 21% of total mid-size retailers that are not currently profitable cite overspending in marketing as a key profitability roadblock. That said, the setup of marketing and analytics capabilities does not come cheap: 31% of upper mid-size companies in our survey cited that their initial spend on these capabilities was $100,000 or more, and 8% of intermediate mid-size retailers reported the same.

Figure 5. Mid-Size Companies: Initial Spend for Setup Marketing and Analytics Capabilities (% of Respondents) [caption id="attachment_140504" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at total mid-size companies

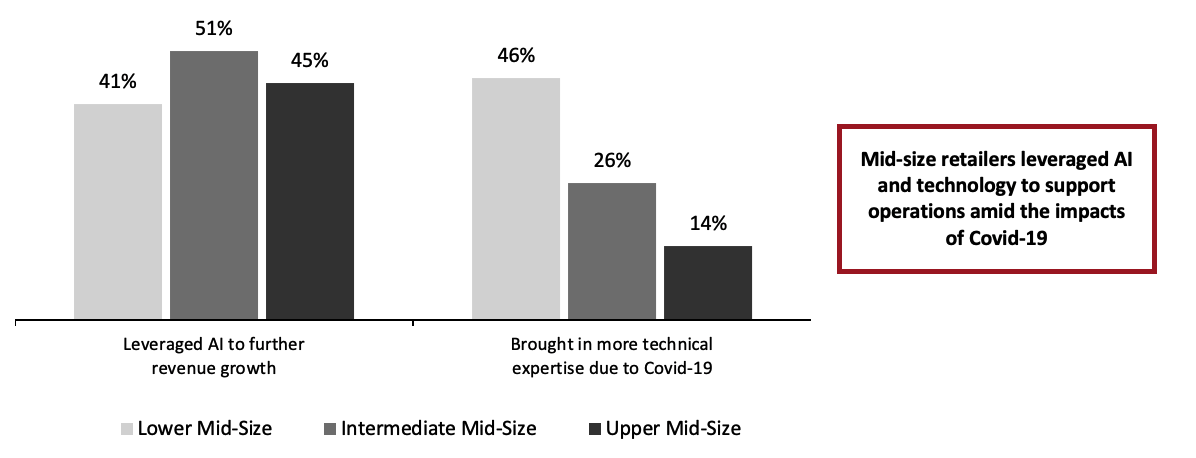

Base: 122 e-commerce leaders at total mid-size companies Source: Coresight Research [/caption] Among our survey respondents, 31% of all mid-size retailers—and an even higher 38% of intermediate mid-size retailers—consider overspending avoidance to be a key goal when finding and/or building a platform/solution to facilitate their e-commerce businesses. This poses opportunities for solution providers that have capabilities such as data analytics and ML that can help retailers avoid overspending in marketing. The Importance of AI and Technology on Revenue AI can be a powerful tool for mid-size retailers to maximize profitability if they want to compete with retail giants, save fulfillment costs and refrain from overspending on marketing.

- Since December 2019, Google AI has been helping retailers such as Home Depot and Kohl’s in creating better promotions and recommendations, and improving margins through dynamic pricing.

- Stor.ai, an end-to-end digital commerce platform for grocers, recently launched a grocery picking app that supports retailers in improving efficiency by combining multiple product-picking strategies when managing inventories and fulfilling orders. By using smart tools, retailers can improve pickers’ average UPH (units picked per hour), awareness of item availability and real-time decision making. This means that retailers can maximize the number and range of orders processed without increasing costs.

Figure 6. Mid-Size Companies: Selected Actions Taken Due to Covid-19 (% of Respondents) [caption id="attachment_140506" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

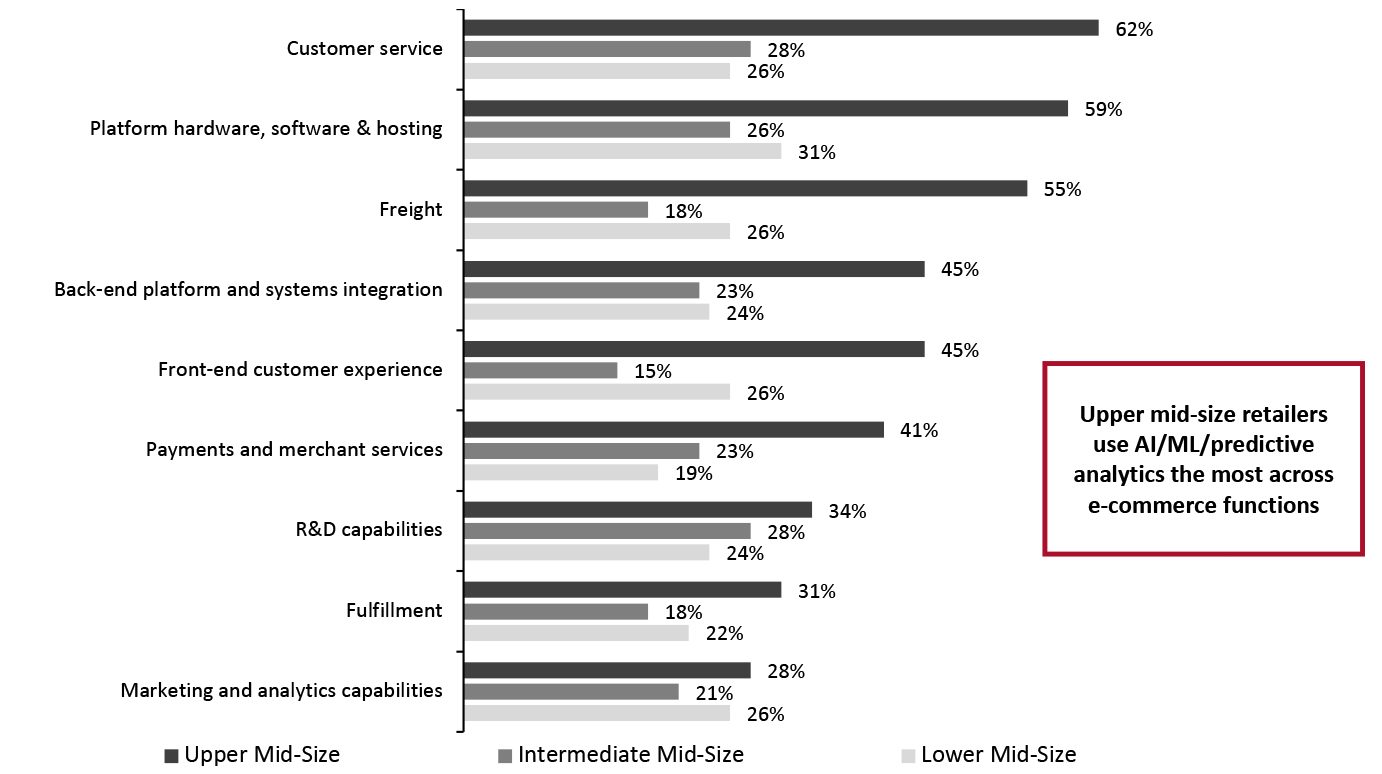

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] Among all mid-size retailers, the upper mid-size segment saw the highest proportions report the embedding of AI/ML/predictive analytics across various e-commerce functions—with the top three being customer service (62%), platform hardware, software and hosting (59%) and freight (55%).

Figure 7. Mid-Size Companies That Have Embedded AI/ML/Predictive Analytics in Different E-Commerce Functions (% of Respondents) [caption id="attachment_140507" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

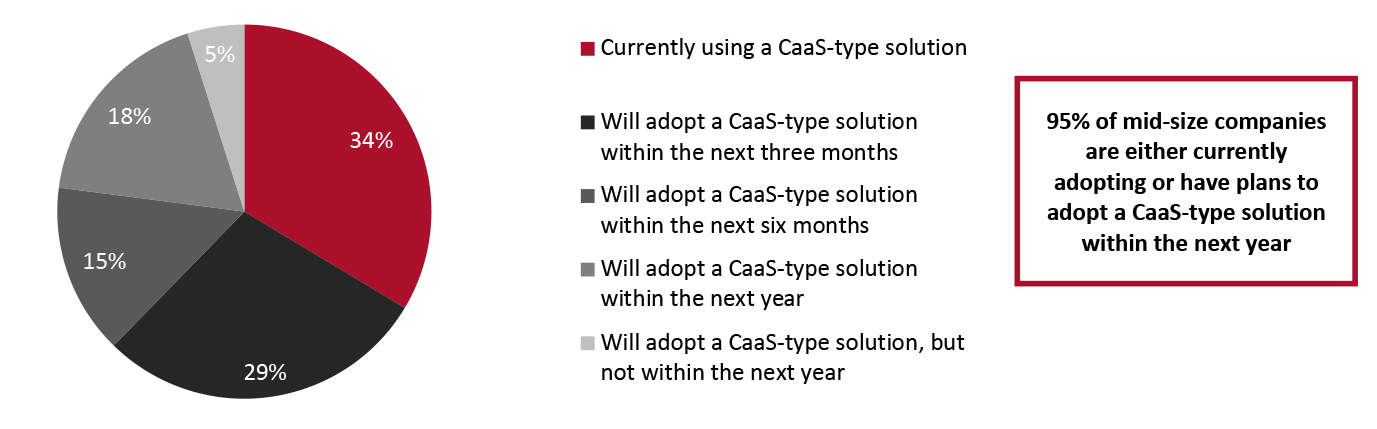

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] How Can a CaaS Approach Help Improve Profitability? CaaS is a new model that offers greater separation between the front and back ends of a platform, which have different capabilities/functions. The CaaS model provides retailers with flexibility to innovate and expand but also more standardization/consistency due to greater ownership and integration of the stack through a single CaaS vendor. (See our first report in the Headless Commerce series for a more detailed background of CaaS.) CaaS/headless commerce solutions can also bring higher profitability for retailers compared with DIY (off-the-shelf) and enterprise solutions through better internal workflows and processes with a full-managed service model and availability of technical expertise. Our survey found the following:

- 39% of all retailers using CaaS/headless commerce solutions are satisfied with how their current e-commerce infrastructure solution increases profitability by optimizing internal workflows and processes. Only 16% of DIY solution users reported the same.

- While just 5% of all retailers using CaaS/headless commerce solutions reported that ROI is too low, 19% of enterprise solution users and 14% of DIY solution users stated the same.

- Low or no platform development costs through an agile approach

- Lower fulfillment costs through order management systems

- Lower marketing costs through data-driven intelligent promotionsand access to scale

- Lowor no R&D costs through cloud-based R&D upgrades

Figure 8. Mid-Size Companies: Adoption of CaaS-Type Solutions (% of Respondents) [caption id="attachment_140508" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption]

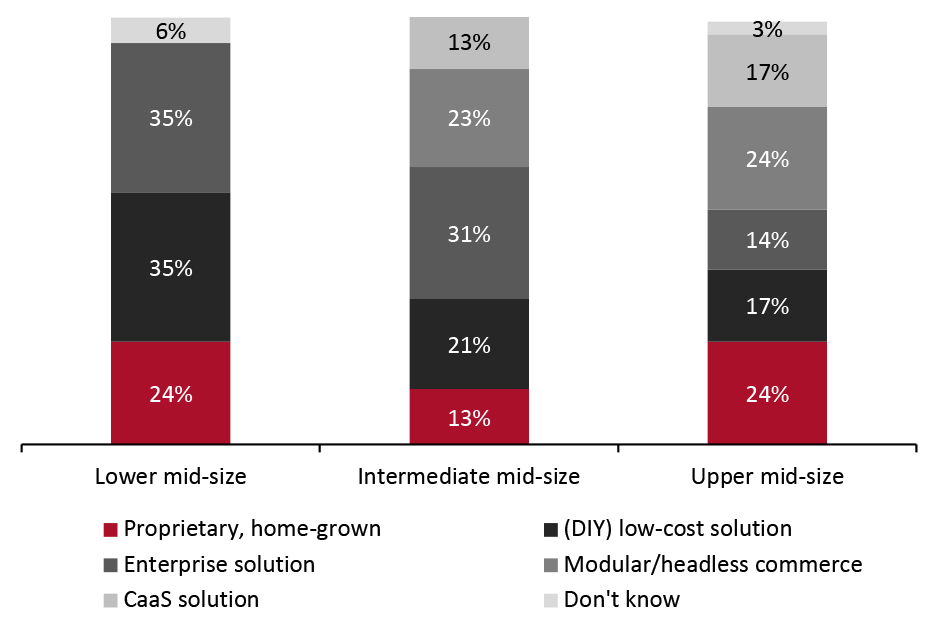

Figure 9. Mid-Size Companies: E-Commerce Platform Types Currently Used (% of Respondents) [caption id="attachment_140509" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at mid-size companies

Base: 122 e-commerce leaders at mid-size companies Source: Coresight Research [/caption] We believe that by leveraging CaaS solutions, mid-size companies can build the infrastructure needed to effectively and quickly adapt and scale. Such solutions also enable retail teams to remain focused on core strategies, which is critical in the ever-changing environment. Nogin According to Nogin, its CaaS offerings can help brands and retailers achieve savings across various categories—specifically, 30%–40% savings on fulfillment and returns; 40% on free shipping; 10%–20% on discounting and promotions through data intelligence; and 20%–30% on marketing spend through algorithms, leading to increased sales, profits and conversion rates. Case Study: Bluestar For instance, Justice moved its online store to the Nogin Intelligent Platform (a CaaS solution) from a legacy enterprise e-commerce platform in July 2021. By leveraging Nogin’s AI, predictive analytics and R&D technology, the company reduced shipping costs via free-shipping conversion algorithms, and decreased discounting via customer behavior and interest analytics, according to Nogin.

What We Think

Mid-size retailers must take steps to maximize profitability in their e-commerce business—particularly in the current pandemic-impacted environment, which has seen companies significantly increase their fulfillment and marketing costs. CaaS solutions offer advantages and capabilities specific to addressing the profitability issue for mid-size retailers through ML algorithms, cloud-based R&D upgrades, order management systems and an agile platform-build approach. All of these will not only save costs for mid-size retailers but also help them thrive in an era of headless commerce, with better agility and flexibility.Methodology

This study is based on the analysis of data from an online survey of 153 e-commerce leaders in US retail, fielded in October 2021. Respondents in the survey satisfied the following criteria:- Company annual revenues of any size

- Employee count of any number

- Retail sectors including apparel and fashion, beauty and personal care, cleaning supplies, food and grocery, health and wellness, home and garden, housewares, outdoors/sports, and pet supplies

- Online, offline, B2B (business-to-business) and wholesale retailers