Nitheesh NH

What’s the Story?

E-commerce has evolved into a cornerstone of the global economy, causing particular disruption in the retail sector over the past few years. The space has evolved in various directions, encompassing legacy behemoths such as Amazon to newer entrants such as Etsy, plus legacy brick-and-mortar retailers such as Walmart expanding online and DTC (direct-to-consumer) brands such as Harry’s expanding from online to launch an offline presence. Just as the retailers themselves have adapted to the changing environment and their ever-evolving competitors, so have the infrastructure and tools to support these companies.

At the dawn of the e-commerce sector, most e-commerce players built their own platforms (such as Amazon and Pets.com). Then, full-stack/integrated platforms such as Shopify entered the space, offering off-the-shelf solutions to new and smaller entrants, while enterprise players such as Salesforce Commerce Cloud and SAP provided more customized, costly solutions for larger players. Now, a new segment has emerged and is rapidly growing: commerce-as-a-service (CaaS). This segment builds on the increasingly modular nature of the broader online space and is enabled by the decentralized nature of the cloud.

CaaS offers new/smaller retailers and brands the ability to both spin up a new e-commerce site with speed and efficiency as well as quickly customize the back end (data access and processing layer) and front end (presentation layer, containing user interface) of the site, including extending/integrating the site’s front end outside of the base website (into social media, blogs, etc.).

Our new, three-part Headless Commerce report series explores the emerging commerce-as-a-service (CaaS) space in the US. We analyze the findings of an October 2021 Coresight Research survey of 153 e-commerce leaders from across various US retail sectors. In this report, we explore the impact of Covid-19 on e-commerce operations, the evolution of the e-commerce infrastructure landscape and the need for CaaS solutions.

The Headless Commerce report series is sponsored by Nogin, a CaaS full-stack e-commerce platform that includes R&D (research and development), sales optimization, machine learning, and AI (artificial intelligence)-driven marketing and fulfillment.

Why It Matters

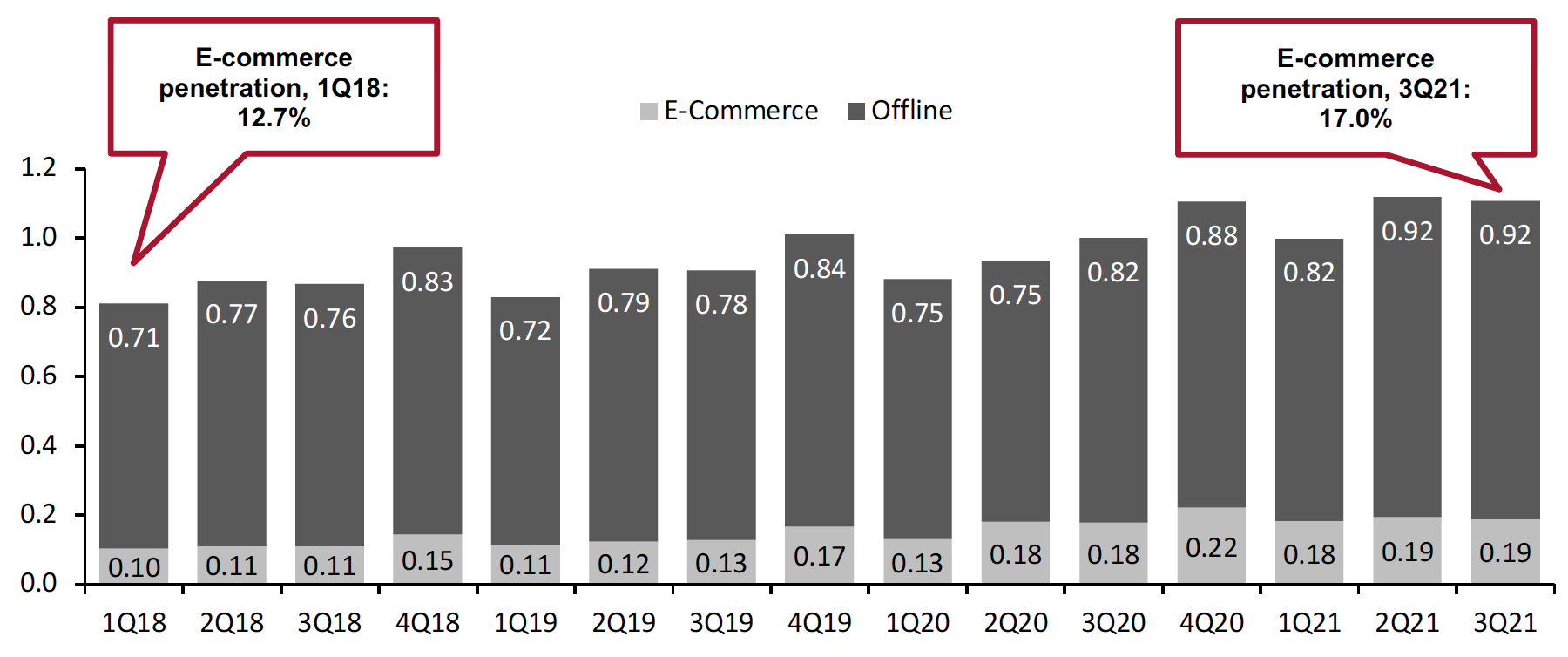

E-commerce had been gradually gaining share of the total US retail market prior to Covid-19, but the pandemic-led acceleration saw online sales reach a high of $222 billion in the fourth quarter of 2020—representing online penetration of 20.1%—according to Coresight Research analysis of US Census Bureau data. Latest data show that e-commerce penetration stood at 17.0% in the third quarter of 2021. We present quarterly retail sales in e-commerce and offline in Figure 1.

Figure 1. US Retail Sales (ex. Gasoline and Automobiles): Online vs. Offline (USD Trl.) [caption id="attachment_137551" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

While older and/or larger players already had the infrastructure in place to expand and capitalize on consumer-driven tailwinds, smaller players have been limited in their ability to innovate. We believe that by leveraging CaaS solutions, these companies can build the infrastructure needed to effectively and quickly adapt and scale. Such solutions also enable retail teams to remain focused on core strategies, which is critical in the ever-changing environment—macroeconomically, technologically and within retail.

The Evolving State of E-Commerce Infrastructure: Coresight Research x Nogin Analysis

The Impact of, and Response to, Covid-19

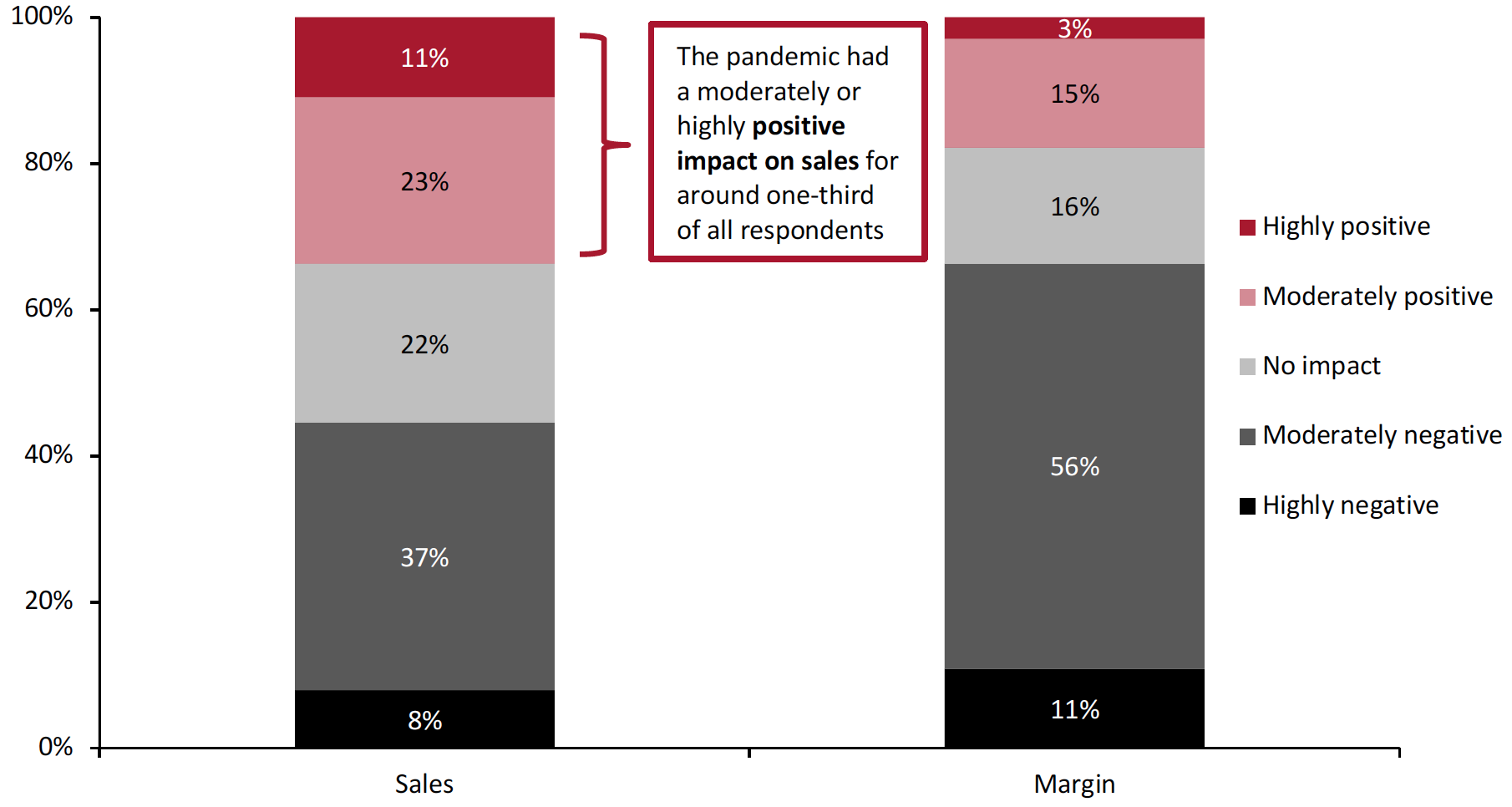

The recent widespread consumer shift to the online channel presented e-commerce sales opportunities. In our survey, around one-third (34%) of all respondents reported that the Covid-19 had a moderately or highly positive impact on sales, and a further 22% reported that the pandemic did not impact sales.

However, retailers had to adapt quickly to the pandemic-led disruption, and many measures they put in place negatively impacted margins—such as increased costs around personal protective equipment and socially distant scheduling reducing relative productivity. In addition, some companies may have seen a shift in sales to low-price/low-margin items, even if sales volumes did not decline. In our survey, two-thirds (67%) of respondents reported that Covid-19 caused a moderately or highly negative impact on margin, as shown in Figure 2.

Figure 2. Covid-19 Impact on E-Commerce Sales and Margin (% of Respondents)

[caption id="attachment_137552" align="aligncenter" width="700"] Base: 153 e-commerce leaders

Base: 153 e-commerce leadersSource: Coresight Research[/caption]

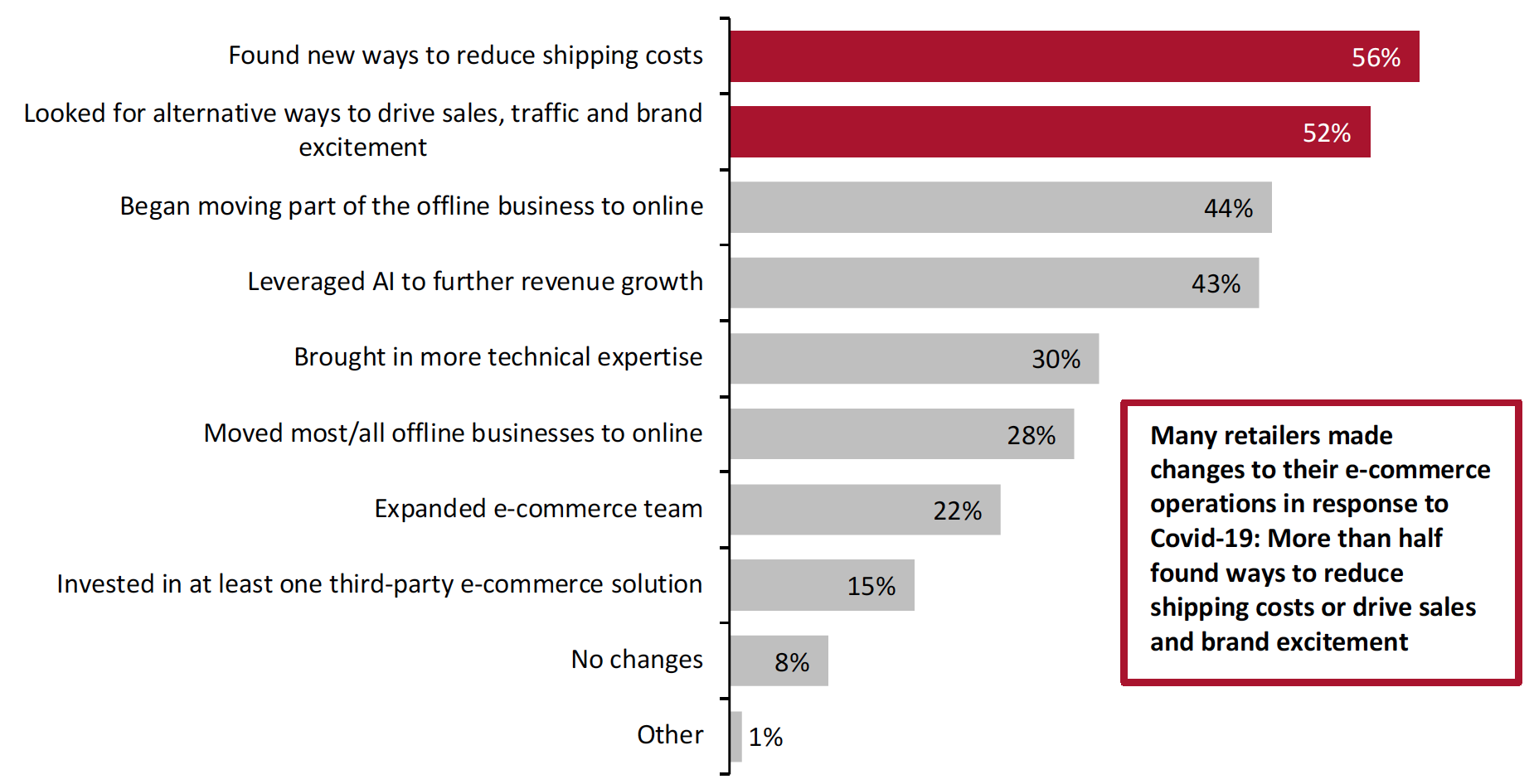

Many retailers made changes to their e-commerce operations in response to Covid-19: 56% of respondents reported that their organizations found ways to reduce shipping costs—making it the most widespread operational adjustment. This change was likely necessary as retailers rapidly scaled up e-commerce operations and invested in logistics/delivery services to meet stronger consumer demand for shorter fulfillment times, as well as being driven by the need to stand out against other online players offering competitive delivery options.

In addition, with the absence of more traditional offline ways to reach consumers, 52% of respondents said that their businesses looked for alternative ways to drive sales, and 44% began moving part of their offline business online.

Figure 3. Changes in E-Commerce Operations as a Result of Covid-19 (% of Respondents)

[caption id="attachment_137553" align="aligncenter" width="700"] Base: 153 e-commerce leaders

Base: 153 e-commerce leadersSource: Coresight Research[/caption]

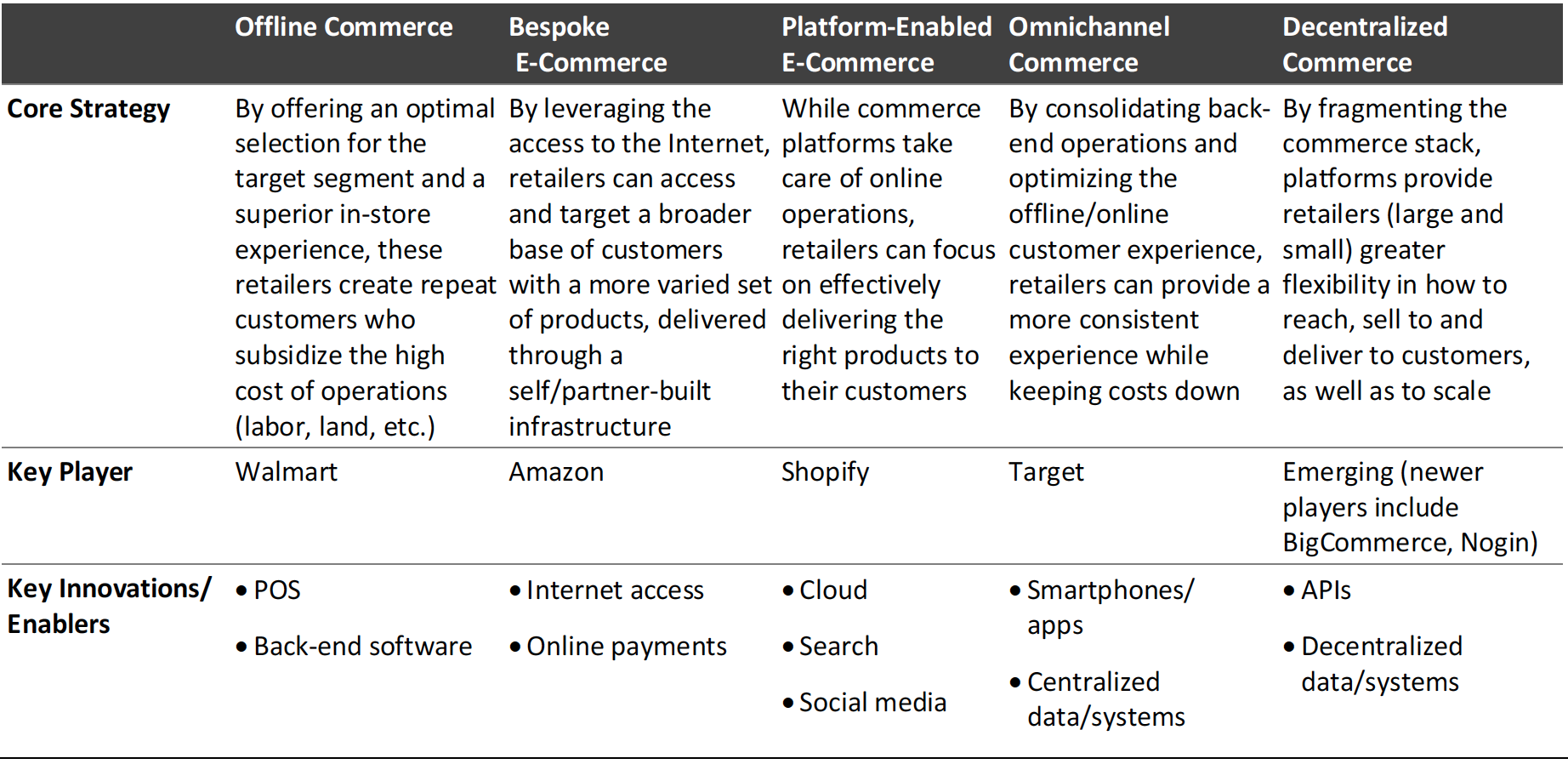

From Offline to Omnichannel and Beyond: The Evolution of Commerce

Commerce infrastructure and strategy continues to evolve both online and in the brick-and-mortar channel. We highlight the five key types of commerce in Figure 4 and explore the evolution of retail in detail below.

Figure 4. The Evolution of Retail: Five Key Types of Commerce

[caption id="attachment_137554" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

At the dawn of the Internet age, over 20 years ago, companies such as Pets.com, eBay and, of course, Amazon, sought to disrupt the traditional retail space by offering a less capital-intensive (no stores) and more accessible (online) shopping experience, with a potentially larger selection of items. Building up these websites took significant time and investment, as they were built from scratch (in the absence of the current landscape of tools and cloud infrastructure). Many of these companies, like Pets.com, going bust when the late 1990s’ Internet bubble burst, funding ran out and they could not pay off their debts.

As the e-commerce space evolved, players started to emerge to provide support for various aspects of e-commerce (PayPal and others for the payments side, for example) culminating in the full-stack offering of Shopify and other e-commerce platforms, offering a quick and easy solution for retailers to spin up a website and online sales operations. These platforms, while user-friendly, did limit retailers to a locked in set of features emulating a “traditional” e-commerce store (comprising a storefront, catalog of items, shopping cart and purchase functionality).

Around the same time, offline retailers made investments to move further online; a little later, they made concerted efforts to better merge these operations, particularly in the back end (infrastructure, warehousing, supply chain, data) to achieve the particular synergies that came from operating in an omnichannel manner. The embedded, generally immutable nature of these companies’ existing IT systems required them to typically extend these operations online, bringing large enterprise players such as Salesforce, SAP and more directly into e-commerce. The fragmented e-commerce landscape therefore became a more centralized, standardized space, which worked to accelerate market growth overall but also reduced the ability for individual players to innovate and break out of the shell.

However, enabled by tools such as the cloud, the commerce stack has recently evolved toward decentralization, as retailers look to better reach and serve their consumers (decentralized here meaning a system built up of and driven by disparate components instead of being dictated to/guided by one central system). With the use of standard APIs (application programming Interfaces) and consistent underlying architectures, retailers building their e-commerce operations on decentralized platforms have the ability to further innovate to compete directly and indirectly with larger players, while accelerating their own development with more agile R&D and operational tools.

The E-Commerce Infrastructure Market Landscape

We see five types of e-commerce platforms in the infrastructure market, which we define below.

- Proprietary: Proprietary solutions are home-grown platforms that are built internally and highly tailored/customized to the core, with original products and strategy—as implemented by Amazon, for example.

- Simple DIY: An off-the-shelf offering provides smaller retailers with a full-stack solution that allows for range of basic to more advanced e-commerce functionality, but generally limits the retailer to the capabilities and foundations of a third-party offering, with less ability to expand outside the core. The largest player in this segment continues to be Shopify, although other players such as Wix and Weebly compete in this space.

- Enterprise: Sophisticated, typically costly, enterprise solutions are built with a key, larger partner and are typically deployed by large multinational companies. Legacy market leaders include Salesforce, Adobe and SAP.

- Modular/headless: This newer model separates the back end from the front end but allows for integration/flexibility through APIs. Headless solutions are built through numerous third-party vendor offerings. Emerging players in the space include ElasticPath, CommerceTool and Skava.

- CaaS: This is another new model that offers greater separation between the front and back ends with different capabilities/functions. This provides retailers with flexibility to innovate and expand but also more standardization/consistency due to greater ownership/integration of the stack through a single CaaS vendor. Emerging players in the space include Nogin, BigCommerce and Cart.

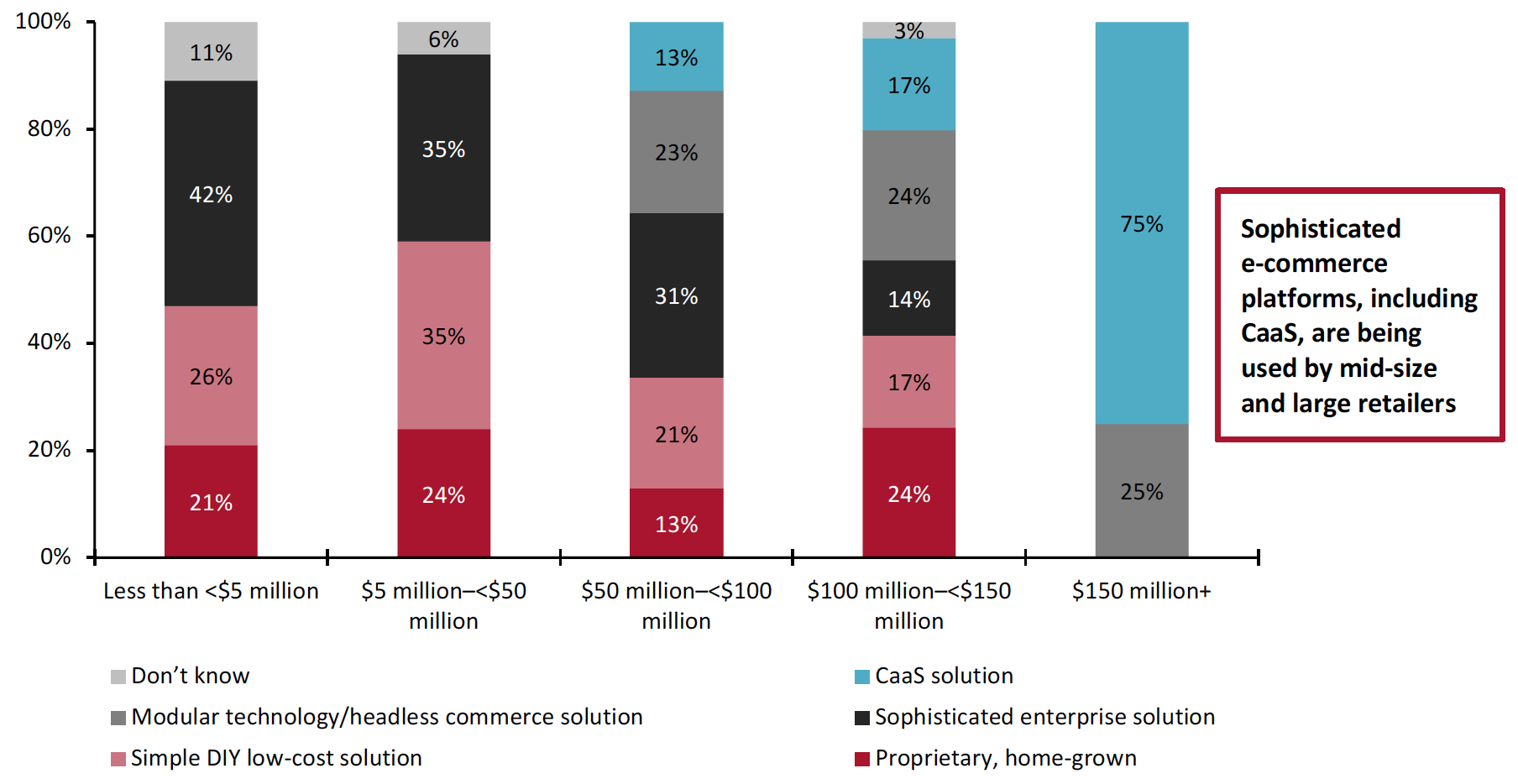

Interestingly, the largest retailers (those with revenues of $150 million or above) are already deploying more decentralized CaaS solutions (75%) or modular/headless technology (25%), according to our survey. Unsurprisingly, smaller retailers are still leveraging legacy proprietary, DIY and enterprise solutions, with no companies with under $50 million in revenue deploying modular commerce or CaaS solutions. Meanwhile mid-size retailers are leveraging and experimenting with a greater variety of solutions, as shown in Figure 5.

The adoption of decentralized solutions, CaaS in particular, among larger retailers indicates that e-commerce infrastructure is evolving to prioritize flexibility, scale and innovation.

Figure 5. Retailer E-Commerce Platform Types by Company Size (% of Respondents)

[caption id="attachment_137555" align="aligncenter" width="700"] Base: 153 e-commerce leaders

Base: 153 e-commerce leadersSource: Coresight Research[/caption]

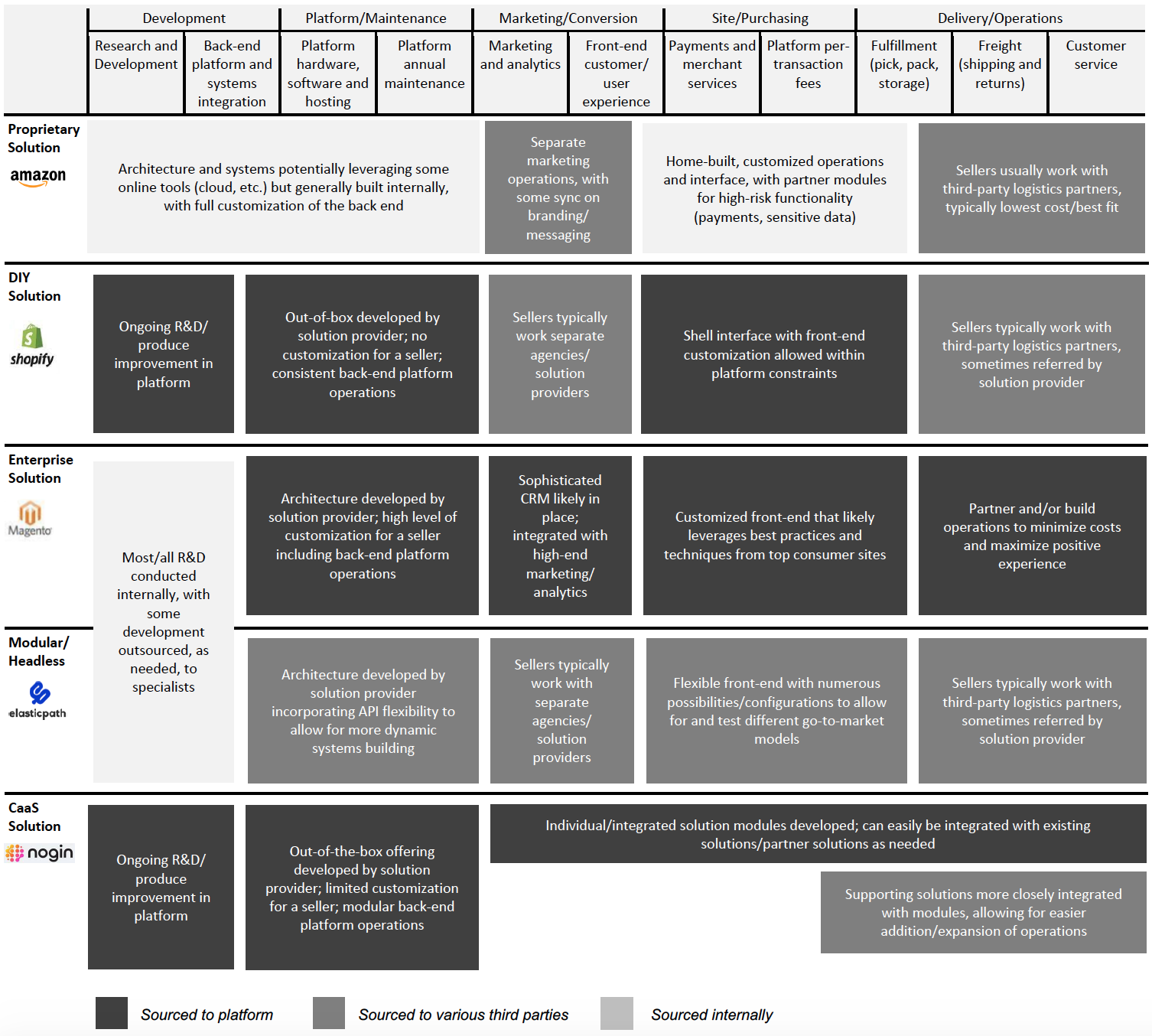

In Figure 6, we summarize how different facets of e-commerce infrastructure, ranging from development, platform/maintenance, marketing/conversion, site/purchasing to delivery/operations work in different e-commerce platform types.

Figure 6. How E-Commerce Platforms Work

[caption id="attachment_137556" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Why Should Retailers Move to Headless Commerce?

Existing Infrastructure: Retailer Satisfaction and Investment

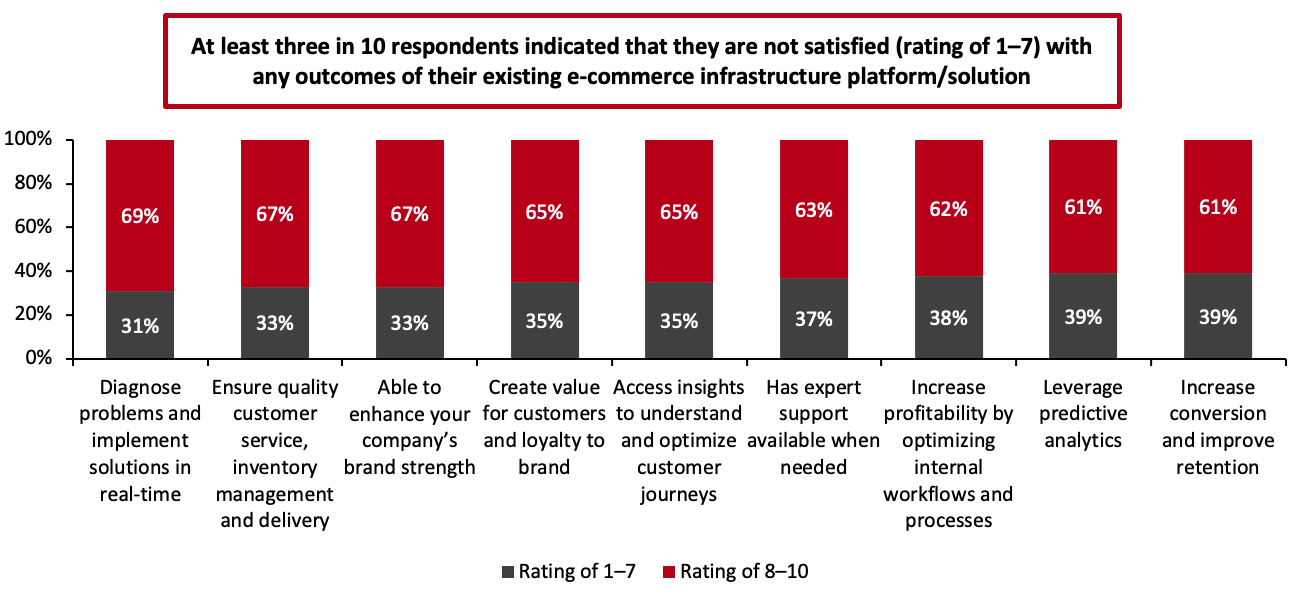

Our survey shows that there is room for improvement in e-commerce infrastructure: At least three in 10 respondents reported that they are not satisfied with any outcomes of their existing platforms/solutions (see Figure 7).

This indicates clear opportunity for different point solutions (covering a particular capability/area of the stack) and integrated solutions to offer more value.

Of the outcomes we asked about, the ability to diagnose problems had the greatest satisfaction level (69% of retailers rated this outcome “8,” “9,” or “10” out of 10 on a scale of satisfaction), followed by ensuring quality customer service and the ability to enhance brand strength (cited by 67% of respondents).

Increasing conversion and leveraging predictive analytics both fell to the bottom of the pack, with 39% rating these outcomes a “7” or below.

Figure 7. Level of Satisfaction with the Outcomes from Current E-Commerce Infrastructure Platforms/Solutions (% of Respondents)

[caption id="attachment_138121" align="aligncenter" width="700"] Respondents were asked to rank their satisfaction in each of the outcomes on a scale of “1” to “10”, with “10” representing the highest level of satisfaction

Respondents were asked to rank their satisfaction in each of the outcomes on a scale of “1” to “10”, with “10” representing the highest level of satisfactionBase: 153 e-commerce leaders

Source: Coresight Research[/caption]

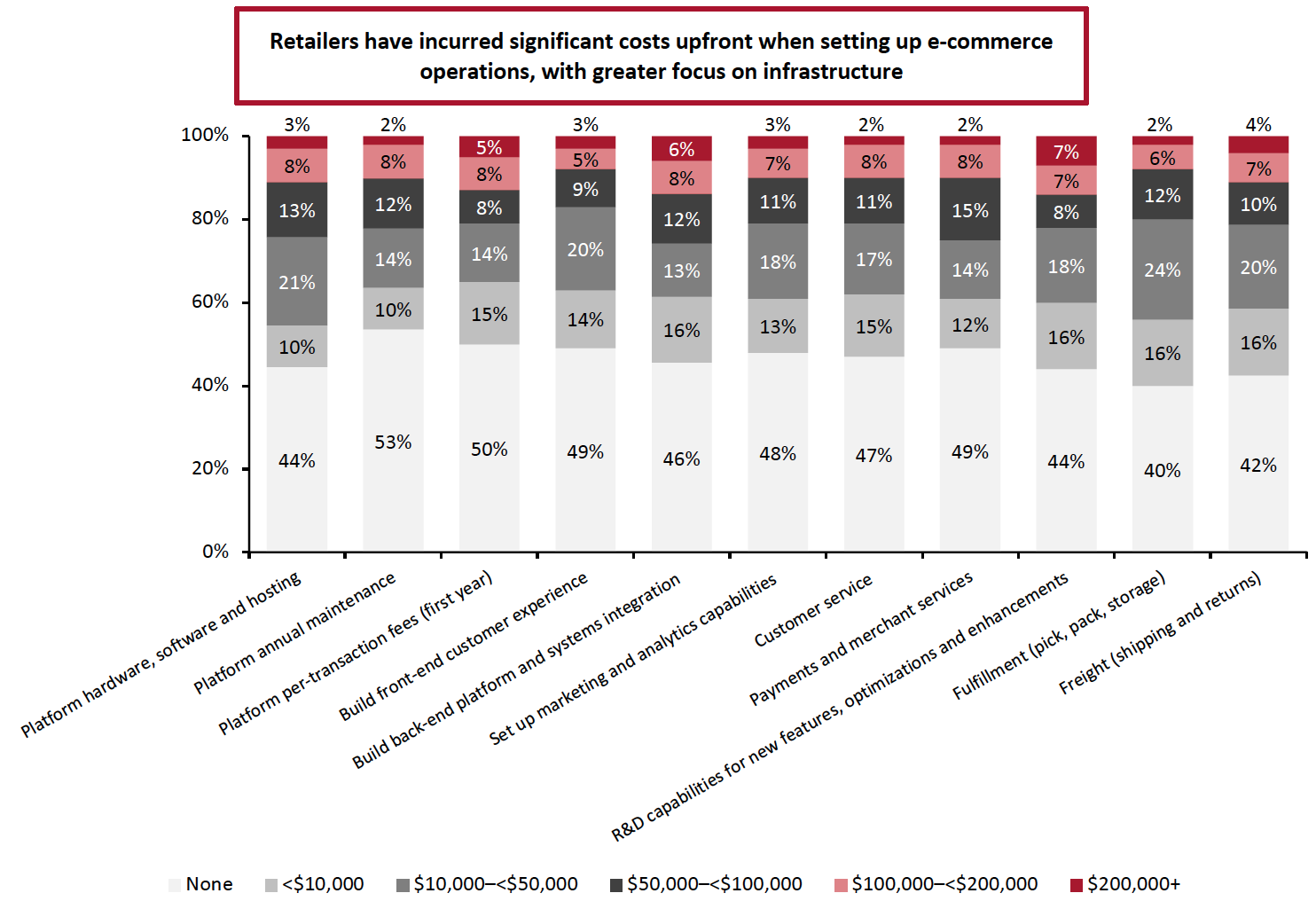

Our survey data show that retailers have incurred significant upfront costs when setting up their e-commerce operations, with a greater focus on infrastructure/back-end operations and R&D over front-end features (see Figure 8). The front end, however, requires ongoing investment into development, expansion and improvements. Setting up key services such as logistics and payments also requires upfront investment.

Solutions that reduce or eliminate these upfront costs while rolling them into operating expenses could be valuable down the line, to allow for easier scaling and expansion.

Figure 8. Initial Spend for Different Categories Involved in Setting Up Existing Webstore, by Company Size (% of Respondents)

[caption id="attachment_137558" align="aligncenter" width="700"] Base: 153 e-commerce leaders

Base: 153 e-commerce leadersSource: Coresight Research[/caption]

Desired E-Commerce Infrastructure Features

Retailers face challenges in customer targeting and acquisition, with heightened competition for clicks and limitations on data/privacy. In addition, financial pressures are being added by increasing competition in—and consumer demand for—fast and cheap delivery services.

Retailers need to feel secure about the stability of their infrastructure as well as its flexibility—and while legacy solutions have provided stability, it is unclear how flexibly they can adapt in the face of the widespread industry disruption. Headless and CaaS platforms allow vendors to build a firm foundation but are dynamic enough to navigate through choppier waters of e-commerce today.

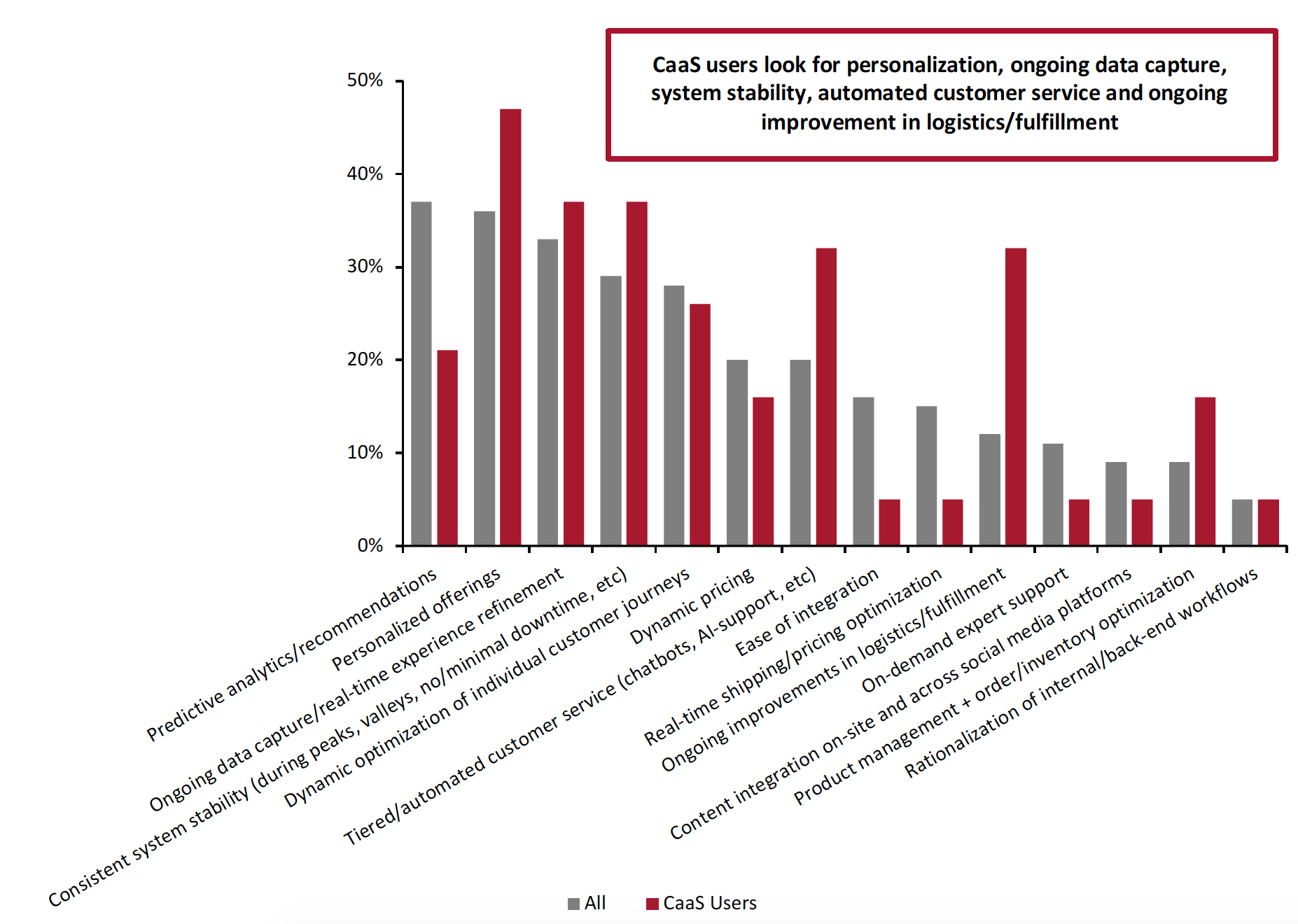

Retailers are generally most interested in e-commerce infrastructure features that help them better understand and target customers, today and in the future. Personalized offerings, ongoing data capture and predictive analytics/recommendations therefore remain at the forefront of retailers’ priorities, as shown in Figure 9.

However, CaaS users specifically diverge slightly from our total respondent base, highlighting system stability, automated customer service and improvements in logistics/fulfillment as key features they look for in e-commerce infrastructure, in addition to personalized offerings and ongoing data capture.

Figure 9. Features That Retailers and CaaS Users Are Looking for in E-Commerce Infrastructure (% of Respondents)

[caption id="attachment_137559" align="aligncenter" width="700"] Respondents were asked to select at least one and up to three features that they are looking for in e-commerce infrastructure

Respondents were asked to select at least one and up to three features that they are looking for in e-commerce infrastructureBase: 153 e-commerce leaders

Source: Coresight Research[/caption]

Retailer Perceptions of CaaS

- Barriers to Implementing CaaS Solutions

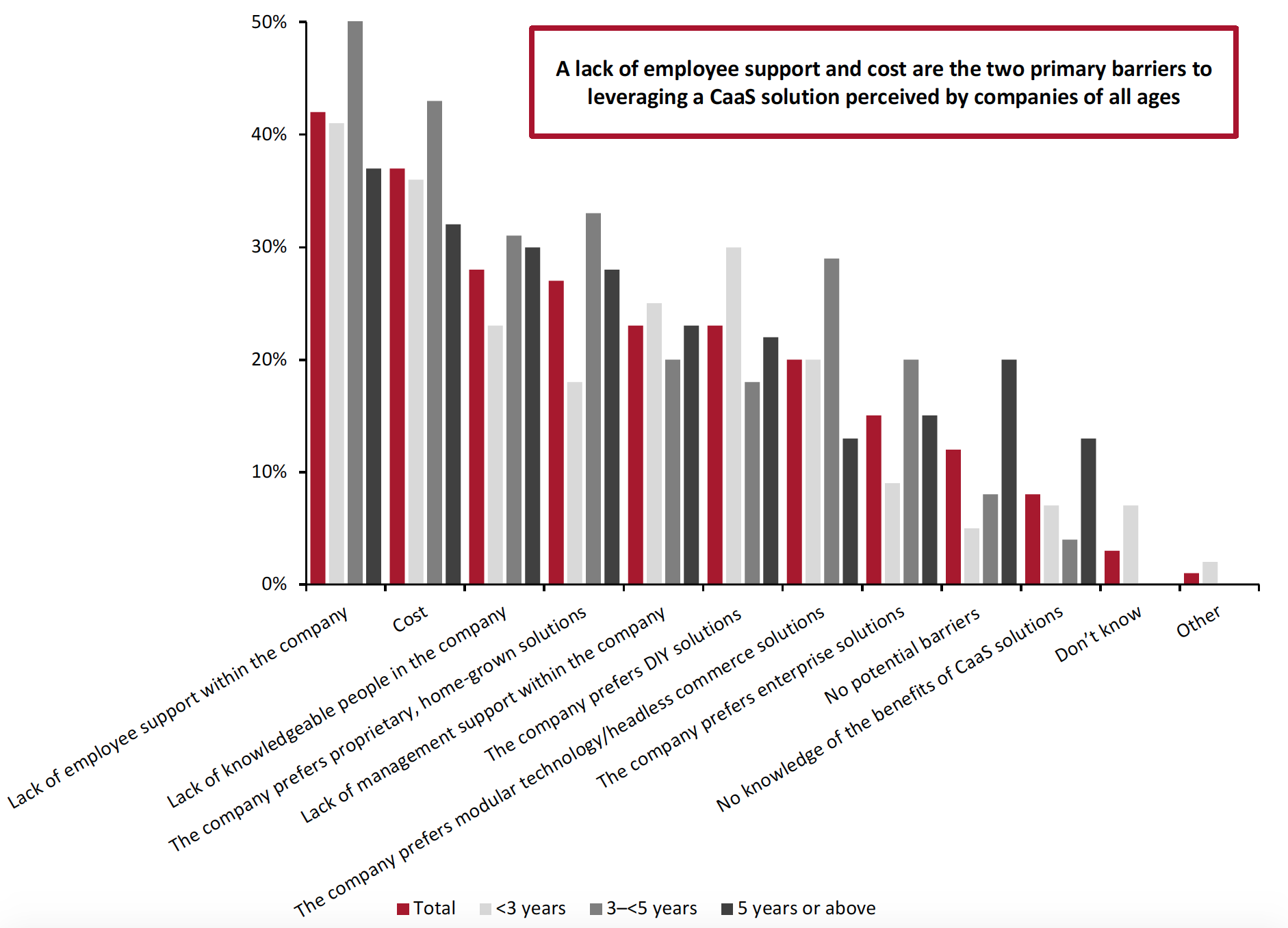

Retailers see obstacles to adopting a CaaS-type solution—most notably a lack of employee support (cited by 42% of respondents), cost (37%) and lack of knowledgeable people in the company (32%), as shown in the figure below.

Figure 10. Barriers to Leveraging a CaaS Solution, Breakdown by Company Age (% of Respondents)

[caption id="attachment_137560" align="aligncenter" width="700"] Base: 153 e-commerce leaders

Base: 153 e-commerce leadersSource: Coresight Research[/caption]

- Readiness for CaaS

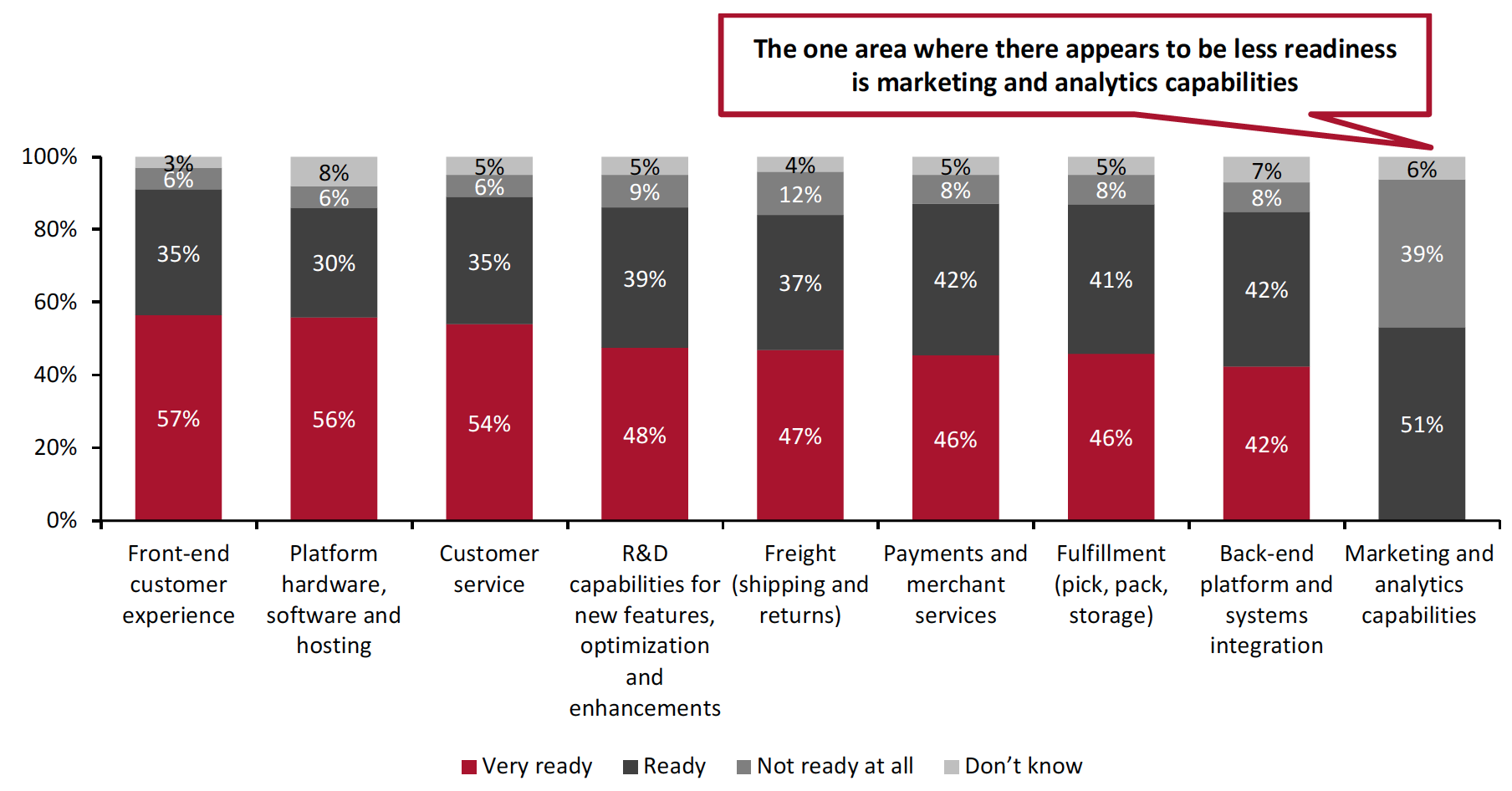

Most retailers indicate that all areas of their e-commerce business are ready for CaaS, with 85% or more indicating they are “ready” or “very ready” for CaaS in all but one area (see Figure 11).

The one area where there appears to be less readiness is marketing and analytics capabilities. This aligns with what’s been seen as a continued (yet narrowing) disconnect between store operations and marketing (partially driven by somewhat independent evolution of online marketing platforms). Given that a major benefit of CaaS is greater integration with, and more pliability of, the marketing function, greater understanding among retailers of this crucial feature may be needed.

Figure 11. Level of Readiness for CaaS Across E-Commerce Business Areas (% of Respondents)

[caption id="attachment_137561" align="aligncenter" width="700"] Base: 153 e-commerce leaders

Base: 153 e-commerce leadersSource: Coresight Research[/caption]

Nogin

Nogin, a CaaS full-stack e-commerce platform, allows for enterprise-level technology with a dynamic mindset and structure.

According to Nogin, startups using DIY solutions saw an average of 27% of revenue go to free shipping and 45% to digital marketing, whereas a CaaS solution could more the halve those cost percentages by better targeting and driving outcomes outside of the standard DIY processes with associate overheads and obsolete systems.

Nogin’s platform offers mid-size to larger retailers a full-stack solution with the flexibility to let retailers innovate and broaden. The following are some key benefits of Nogin’s CaaS platform, according to the company:

- Full-stack CaaS platform with R&D investment, sales optimization and machine learning for superior customer knowledge and future predictive commerce

- AI-driven marketing, fulfillment and expert support

- R&D included so clients never have to replatform

- Algorithm and advanced promo to increase return on ad spend, lower shipping costs, increase margin and increase sell-through while enhancing conversions

- Advanced e-commerce personnel and best practices

- Agile development approach to deploy expert enhancements across all clients

Case Studies

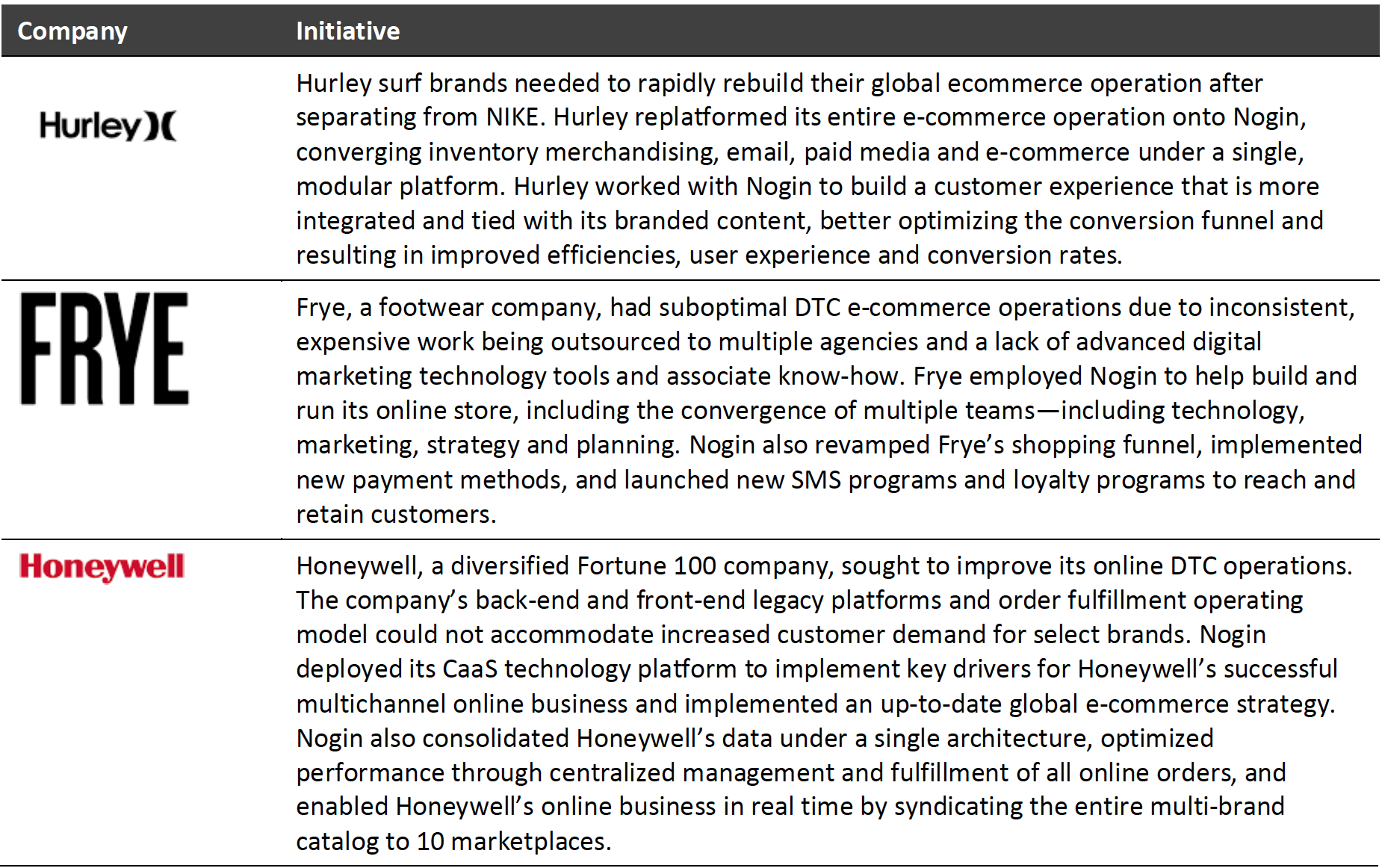

Companies deploying CaaS solutions are looking for more flexibility and to decouple from legacy systems. The case studies highlighted in Figure 12 (provided by Nogin) are all older companies with an offline and online presence that are looking to break out of the traditional mold toward a more dynamic, innovative, customer-facing experience.

Figure 12. CaaS Case Studies: How Selected Nogin Clients Are Improving the Customer Experience

[caption id="attachment_137562" align="aligncenter" width="700"] Source: Nogin/Coresight Research[/caption]

Source: Nogin/Coresight Research[/caption]

What We Think

Significant opportunity exists for retailers, large and small, to move their operations further away from the more traditional, centralized models, to more decentralized platforms. The decentralized, yet more interconnected, standardized setup of CaaS solutions is likely a more reliable option, especially for retailers looking for more stability and consistency, but any decentralized approach will offer greater flexibility and ability to innovate. Even larger retailers indicated awareness and having some level of decentralized solution (with 100% of retailers with $150 million or greater in annual revenue reporting as such), indicating that it is less a trend and more an industry shift.

As retailers look to build on the pandemic-accelerated shift to online sales, these types of solutions will offer them ways to better innovate and compete. The e-commerce vendors who can best differentiate themselves with singular point solutions to support different aspects of the stack, as well as broader foundational platforms, should be able to capitalize on this anticipated shift in spend toward decentralized solutions, leading to the growth of a new sector of e-commerce infrastructure.

Methodology

This study is based on the analysis of data from an online survey of 153 e-commerce leaders in US retail, fielded in October 2021. Respondents in the survey satisfied the following criteria:

- Company annual revenues of any size

- Employee count of any number

- Retail sectors including apparel and fashion, beauty and personal care, cleaning supplies, food and grocery, health and wellness, home and garden, housewares, outdoors/sports, and pet supplies

- Online, offline, B2B (business-to-business) and wholesale retailers