Nitheesh NH

Introduction

What’s the Story? Dick’s Sporting Goods and Foot Locker are the largest US sporting goods specialty retailers. Sporting goods stores include retail stores specializing in the sale of sports and outdoor apparel, footwear and equipment. As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ revenues, as well as key strategies, business expansion, technology initiatives, digital enhancements to business operations, and environmental, social and governance (ESG) initiatives. Why It Matters Sportswear continues to be a key category in the US apparel and footwear specialty retail market, largely due to growing demand for athletic and outdoor apparel as well as the prevalent casualization trend. Dick’s Sporting Goods and Foot Locker accounted for a 28% share of total US sporting goods stores sales of $67 billion in 2021, we estimate using US Census Bureau data. In 2022, against very strong comparatives, Coresight Research estimates that the sector’s sales will be roughly flat and remain about $67 billion, following an estimated 24.6% growth in 2021 and 18.2% growth in 2020. For the overall US apparel and footwear specialty market, we estimate sales to be almost flat and remain around $282 billion, following estimated 38.0% growth in 2021 and a 24.0% decline in 2020. Both Dick’s Sporting Goods and Foot Locker have maintained their strong leadership positions for more than a decade. The scale and leading market position of the companies make for insightful comparison.Dick’s Sporting Goods vs. Foot Locker: Coresight Research Analysis

Company Overviews Figure 1 presents topline metrics for Dick’s Sporting Goods and Foot Locker.Figure 1. Company Overviews: Dick’s Sporting Goods and Foot Locker [wpdatatable id=1769]

*Both Dick’s Sporting Goods’ and Foot Locker’s latest reported fiscal years ended on January 30, 2021 Source: Company reports

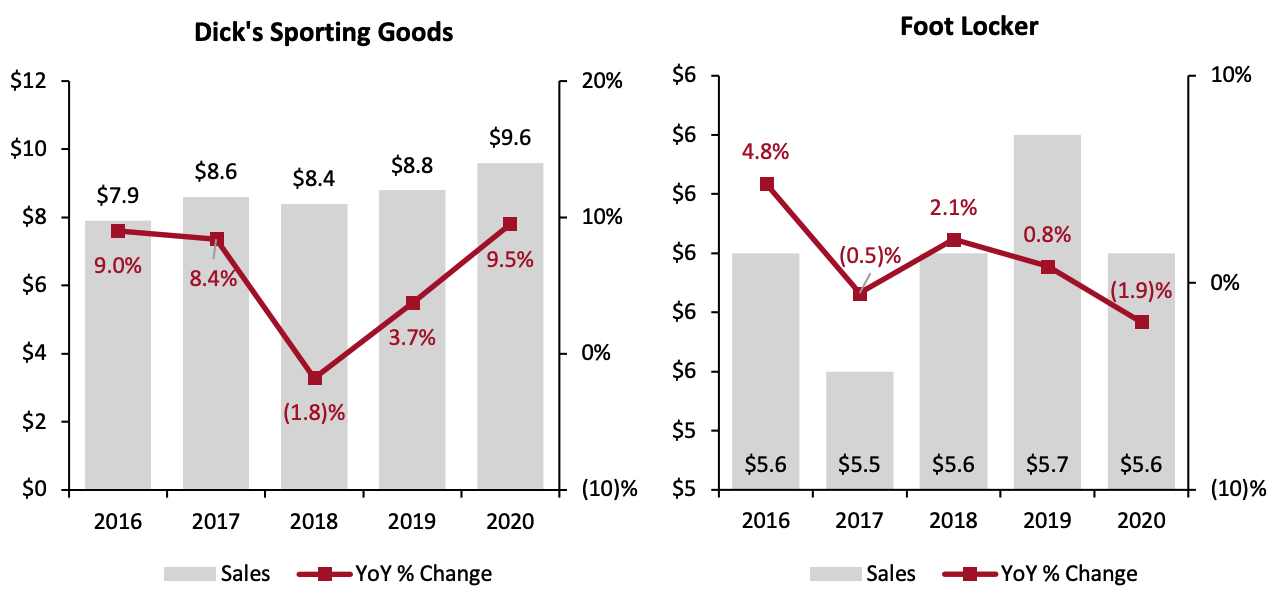

1. Revenue In the past five fiscal years, Dick’s Sporting Goods has outpaced Foot Locker in terms of revenue growth, with a CAGR of 6.0% versus 0.1% at Foot Locker. As of 2021, Dick’s Sporting Goods holds a market share of 18.4% of total US sporting goods store sales—with Foot Locker comprising a 10.0% share, according to our estimate using US Census Bureau data. The disparity in market share and revenue between the two companies is due to multiple factors, including different target consumer groups and consumer response to price and promotions. In fiscal 2020, Foot Locker’s US sales growth turned negative, mainly due to the company’s slow move towards ramping up its e-commerce operations during the beginning of the pandemic, when most of the stores were closed and pandemic-related restrictions were in place in the US.Figure 2. US: Dick’s Sporting Goods and Foot Locker, 2016–2020: Annual Revenue (Left Axis; USD Bil.) and YoY % Change [caption id="attachment_142419" align="aligncenter" width="700"]

Dick’s Sporting Goods’ and Foot Locker’s fiscal year ends on January 30

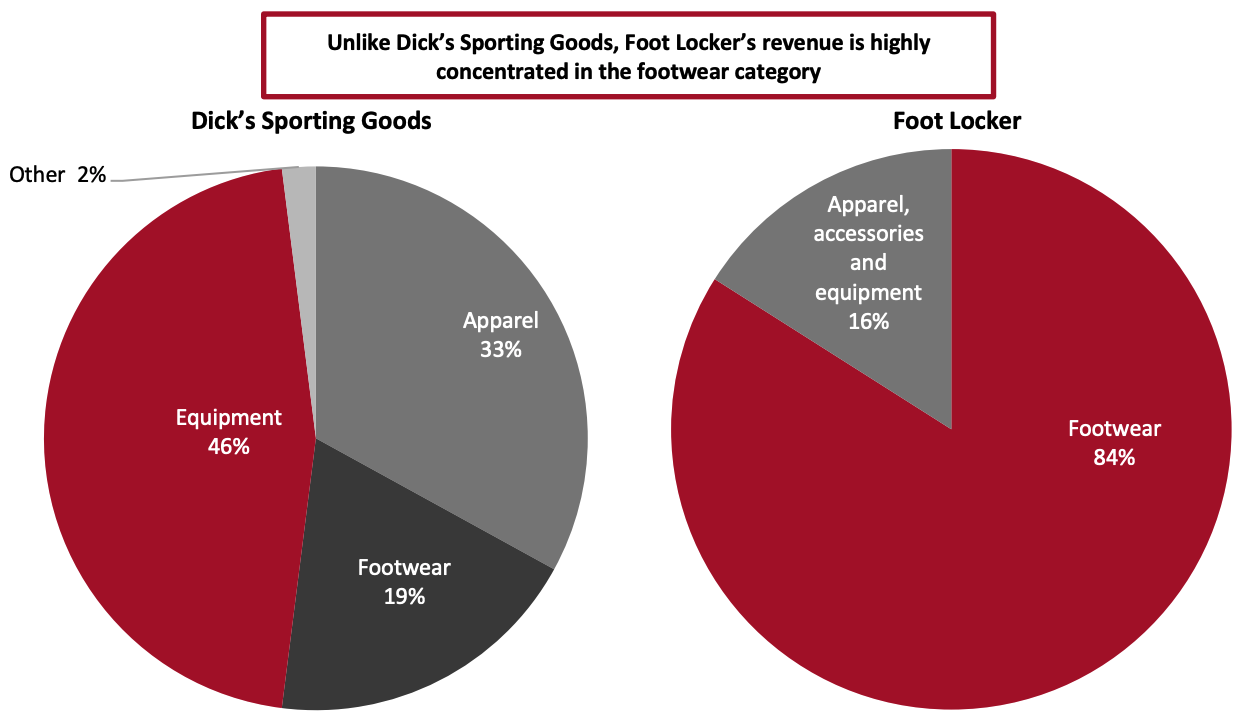

Dick’s Sporting Goods’ and Foot Locker’s fiscal year ends on January 30Source: Company reports[/caption] Revenue by Geography While Dick’s Sporting Goods generates all of its revenues from the US, Foot Locker generates a majority from this market. A total of 74% of Foot Locker’s sales in 2020 were from the US. Revenue by Category At present, there is limited overlap between Dick’s Sporting Goods’ and Foot Locker’s product categories. However, we expect the product mix overlap to increase in the near future as both retailers are expanding into each other’s dominant product categories. Foot Locker’s business is weighted toward footwear—with the category capturing 84% of sales, while apparel, accessories and equipment comprise the remaining 16% in its latest fiscal year, as shown in Figure 3. However, the retailer is betting on apparel to broaden its customer base after witnessing signs of strong growth in the category. In its second-quarter 2021 earnings call held in August 2021, Chief Commercial Officer Andrew Gray said the company is excited about apparel, which was “up double digits” year over year. Gray also stated that “men's, women's and kids' all delivered gains of over 20%” and the company has “a very strong pipeline of product and inventory in apparel.” The retailer is hiring more people who are focused on selling apparel. Foot Locker sees private labels as a means to expand its clothing business, unveiling its first private-label brand, LCKR by Foot Locker, in October 2021 after a three-year break from launching new brands. This is supported by the company’s focus on acquisitions, such as that of clothing and footwear retailer WSS in September 2021, which we discuss later in the report. In its second-quarter earnings call, CEO Richard Johnson said, “Our company's expertise in private-label apparel design and sourcing, along with the utilization of our Team Edition speed-to-market apparel facility, present opportunities to generate incremental apparel sales for WSS.” Foot Locker is also looking to expand its luxury apparel and accessories categories after the company saw recent success with resale platform GOAT in the apparel ecosystem. Foot Locker invested $100 million in 2019. In June 2021, GOAT’s CEO said that the company’s apparel sales grew 500% year over year in the prior 12 months. Unlike Foot Locker, Dick’s Sporting Goods’ business is weighted toward the apparel and equipment categories, which combined capture 79% of the company’s sales as of fiscal 2020 while footwear comprises 19% of the total sales. While footwear comprises a lesser proportion of Dick’s Sporting Goods’ sales, in its second-quarter 2021 earnings call held in August 2021, the company noted that it is gaining market share in the category. In the fiscal 2020 earnings call held in March 2021, management said that footwear is a key pillar of Dick’s Sporting Goods’ merchandising strategy, and the company will complete head-to-toe looks with a strong footwear assortment by the end of 2021. The company also noted that it will convert an additional 100 stores to premium full-service footwear by the end of 2021, taking the footwear experience to more than 60% of the chain. As of August 2021, the company has converted 65 out of 100 stores to premium full-service footwear stores. Earlier, in 2020, Dick’s Sporting Goods transitioned its footwear department to a premium full-service footwear deck and continued to expand it after witnessing growth in average unit retail (AUR) price of footwear.

Figure 3. Dick’s Sporting Goods and Foot Locker: Revenue by Category, Latest Fiscal Year (%) [caption id="attachment_142420" align="aligncenter" width="700"]

Dick’s Sporting Goods’ and Foot Locker’s fiscal year ended on January 30, 2021

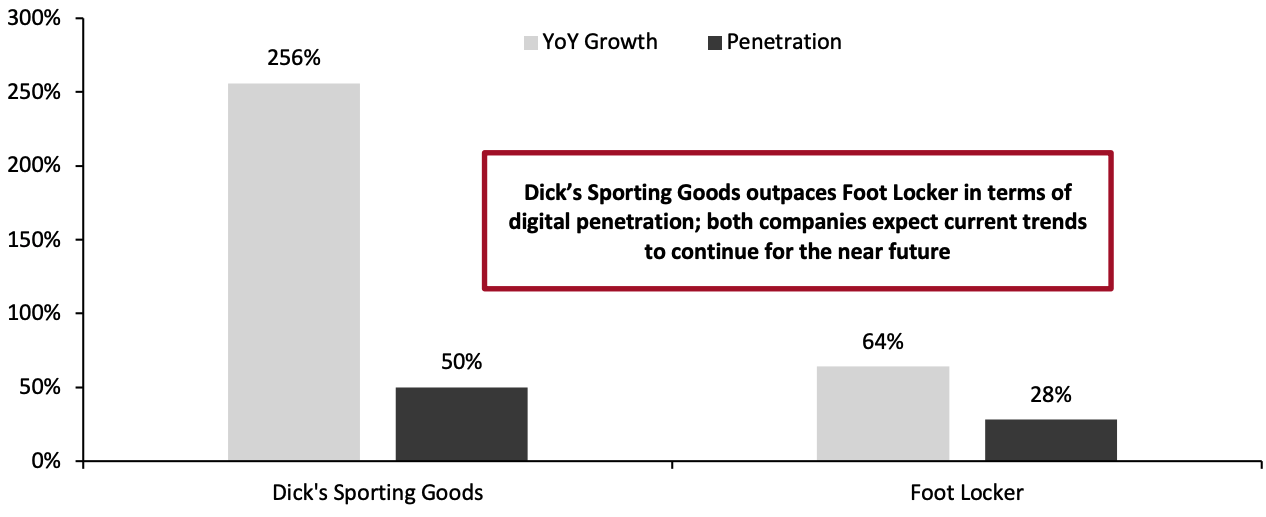

Dick’s Sporting Goods’ and Foot Locker’s fiscal year ended on January 30, 2021Source: Company reports[/caption] E-Commerce Revenue Both Dick’s Sporting Goods and Foot Locker are expanding their e-commerce businesses, with Dick’s Sporting Goods outpacing Foot Locker in terms of digital penetration. In fiscal 2020, Dick’s Sporting Goods’ e-commerce sales increased by 256% year over year and accounted for 50% of total sales, up from 16% in fiscal 2019. While the company’s digital penetration eased in 2021, management expects long-term digital penetration to again reach 50% within the next few years. Foot Locker’s global e-commerce sales were up 64% for fiscal 2020, accounting for 28% of the company’s total sales, up from 16% in fiscal 2019. Foot Locker does not provide e-commerce sales segregation by geographic region. The company expects current digital penetration trends to continue in fiscal 2022.

Figure 4. Dick’s Sporting Goods and Foot Locker: Global Online Revenue Growth and Digital Penetration, Latest Fiscal Year (%) [caption id="attachment_142421" align="aligncenter" width="700"]

Dick’s Sporting Goods’ and Foot Locker’s fiscal year ended on January 30, 2021

Dick’s Sporting Goods’ and Foot Locker’s fiscal year ended on January 30, 2021Source: Company reports[/caption] 2. Key Business Strategies We compare the latest business strategies reported by each company in March 2021, each of which focus on three key areas.

Figure 5. Dick’s Sporting Goods and Foot Locker: Key Business Strategies

| Dick’s Sporting Goods | Foot Locker |

|

Customer experience

|

Customer experience

|

Growth

|

Growth

|

Products and Stores

|

Productivity

|

Source: Company reports

3. Business Expansion Through Partnerships and M&A Activity Dick’s Sporting Goods and Foot Locker have become leading players through strategic partnerships, acquisitions, investments and calculated divestitures. However, while Foot Locker continues to ramp up its M&A activities, Dick’s Sporting Goods is looking to grow more organically in the near future, according to the company. Dick’s Sporting Goods: Key Strategic Partnerships On November 8, 2021, Dick’s Sporting Goods entered into a connected partnership agreement with NIKE to reach each other’s customers via joint loyalty programs and by providing them with access to exclusive products and offers. The alliance allows Dick’s Sporting Goods customers to connect their Dick’s Sporting Goods Scorecard accounts to NIKE membership accounts through Dick’s Sporting Goods’ mobile app. Furthermore, Dick’s Sporting Goods customers will have access to NIKE’s member-exclusive footwear and apparel launches and collections, including NIKE Air Force 1, launched on November 4, 2021. As part of this alliance, Dick’s Sporting Goods noted that it will work with NIKE to integrate physical and digital capabilities to deliver enhanced customer experience and forecast and fulfil shoppers’ evolving needs. Similarly, in September 2020, Dick’s Sporting Goods collaborated with apparel and footwear brand owner Under Armour to launch UA HOVR Breakthru, a basketball shoe developed specifically for women. The UA HOVR Breakthru, available exclusively through Dick’s Sporting Goods and Under Armour, takes into account the physiological components unique to a woman’s foot such as a narrower heel, the higher percentage of sensory receptors and the need for greater flexibility. Through this alliance, Dick’s Sporting Goods continues its push into the women’s footwear marketplace. In the company press release, Dick’s Sporting Goods CEO, Lauren Hobart, saidWe saw a gap in the market for a basketball shoe developed specifically for women and wanted to be able to offer this to our female customers but needed the support from a major footwear brand to create this type of shoe. We're thrilled that Under Armour stepped up to collaborate with us and produce a shoe we're all proud of. Our hope is that this is a big step forward on the availability of women's athletic equipment specifically designed for her.

Acquisitions/Divestiture To expand its business operations, Dick’s Sporting Goods has undertaken numerous acquisitions and with notable divestitures, too. In September 2020, Dick’s Sporting Goods sold two of its subsidiary Field & Stream’s locations to outdoor specialty retailer Sportsman’s Warehouse for $4.5 million. Field & Stream is a retailer of camping, fishing, hunting and related outdoor recreation merchandise. In late 2019, Dick’s Sporting Goods sold eight Field & Stream stores to Sportsman’s Warehouse for $28 million. The sale of these Field & Stream stores has marked Dick’s Sporting Goods’ move away from the hunting category. In August 2019, Dick’s Sporting Goods sold two of its technology subsidiaries, Affinity Sports and Sombrero, to global sports technology company Stack Sports for $45 million. As part of the transaction, Dick’s Sporting Goods entered into a long-term strategic agreement in which it will operate as the official retailer of Stack Sports. The two companies also partnered on mobile team management and live scorekeeping through Dick’s Sporting Goods’ GameChanger and Team Manager technologies. Alternatively, Dick’s Sporting Goods made several acquisitions in 2016 to expand its addressable market and build up its set of digital products for youth sports. This includes a $15 million acquisition of Sports Authority Holdings, $43 million acquisition of Golfsmith International, and acquisitions of Affinity Sports and GameChanger Media for undisclosed amounts. Below, in Figure 6, we have provided a full list of M&A and divestiture activity by Dick’s Sporting Goods.Figure 6. Dick’s Sporting Goods: Acquisitions and Divestitures [wpdatatable id=1770]

Source: Company reports

Foot Locker: Key Strategic Partnerships Like Dick’s Sporting Goods, Foot Locker has also been capitalizing on its strategic partnerships to enhance its customer experiences. In November 2019, Foot Locker collaborated with NIKE for the opening of a first-of-its-kind 9,000 square foot experiential location in the US, “NIKE Community Power Store,” that connects with shoppers through technology and localized approach to operations. It was Foot Locker’s first store to capitalize on the NIKE App at Retail technology, which is designed to improve the shopper experience and establish a connection with consumers via the NIKEPlus loyalty program. Through this alliance, Foot Locker’s customers have been utilizing NIKEPlus membership to access special features, including viewing real-time inventory availability. Similarly, in 2021, Foot Locker partnered with several companies and designers for business expansion. For example, on November 8, 2021, Foot Locker partnered with American streetwear designer Don Crawley for the launch of a lifestyle brand All City by Just Don. Foot Locker stated that the new brand complements the recent launch of its apparel private label LCKR by Foot Locker in expanding the retailer’s apparel business. As part of the collaboration, Foot Locker and Crawley will also host a series of creative summits in the US and Canada. Furthermore, Foot Locker collaborated with HGC Apparel in July 2021 for the launch of a new apparel collection at Foot Locker, Champs Sports and Footaction stores. Acquisitions/Investments Unlike Dick’s Sporting Goods, Foot Locker is focusing on growth through its recent acquisitions. In September 2021, Foot Locker acquired Eurostar (WSS), a US-based athletic apparel and footwear retailer, for $750 million. Foot Locker’s CEO Richard Johnson said, “WSS brings an expanded and differentiated customer base rooted in the rapidly growing Hispanic community, diversifies and enhances our product mix, and strengthens our footprint with a 100% off-mall store fleet located in key markets.” Likewise, in August 2021, Foot Locker entered into a definitive agreement to acquire Japan-based digitally led apparel and footwear retailer Text Trading Company, K.K. (atmos), for $360 million. atmos has 49 stores globally, including 39 in Japan, operating under the atmos banner and atmos pink. In fiscal 2020, atmos generated about $175 million of revenues, of which over 60% was generated through digital channels. Through this acquisition, Foot Locker is looking to accelerate its global reach with a highly strategic foothold in Japan while extending Foot Locker’s top-tier and premium offerings. In the company press release, Foot Locker’s management said that the acquisition is expected to be accretive to Foot Locker’s EPS in fiscal 2021. CEO Johnson saidatmos is uniquely positioned through its innovative retail stores, high digital penetration, and distinctive products that have made it a key influencer of youth and sneaker culture. With atmos, we are executing against our expansion initiative in the rapidly growing Asia-Pacific market, establishing a critical entry point in Japan and benefitting from immediate scale.

Below, we provide a full list of Foot Locker’s M&A activities.Figure 7. Foot Locker’s Acquisitions [wpdatatable id=1771]

Source: Company reports

In addition to acquisitions and unlike Dick’s Sporting Goods, Foot Locker has made several investments in recent years to move products more quickly and create a way to drive digital shoppers into stores. Some examples are:- $100 million investment in footwear resale platform GOAT in 2019

- $15 million investment in women’s activewear company Carbon38 in 2018

- $12.5 million investment in kid’s apparel company Rockets of Awesome in 2019

- $3 million investment in kid’s footwear company Super Heroic in 2019

- $2 million investment in Pensole Footwear Design Academy in 2019

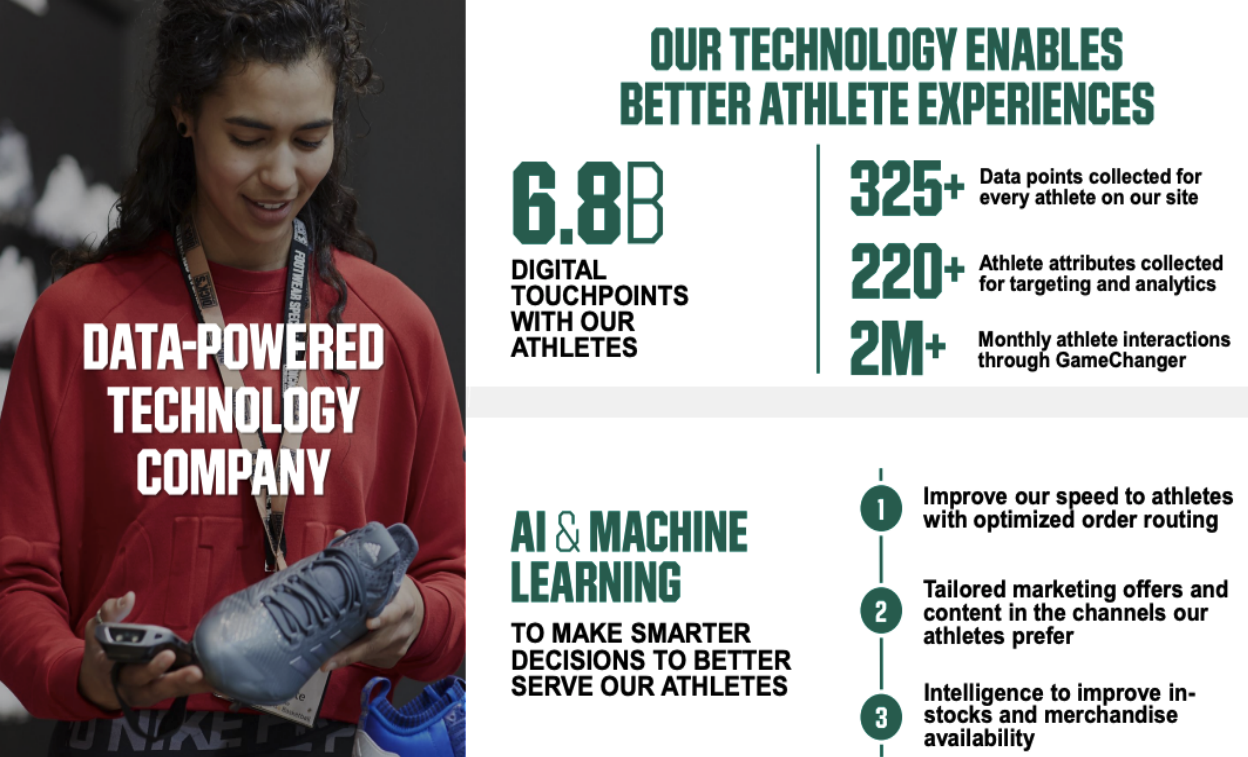

Dick’s Sporting Goods utilizes artificial intelligence (AI) and machine learning to improve in-stocks and merchandise availability and enhance tailored marketing

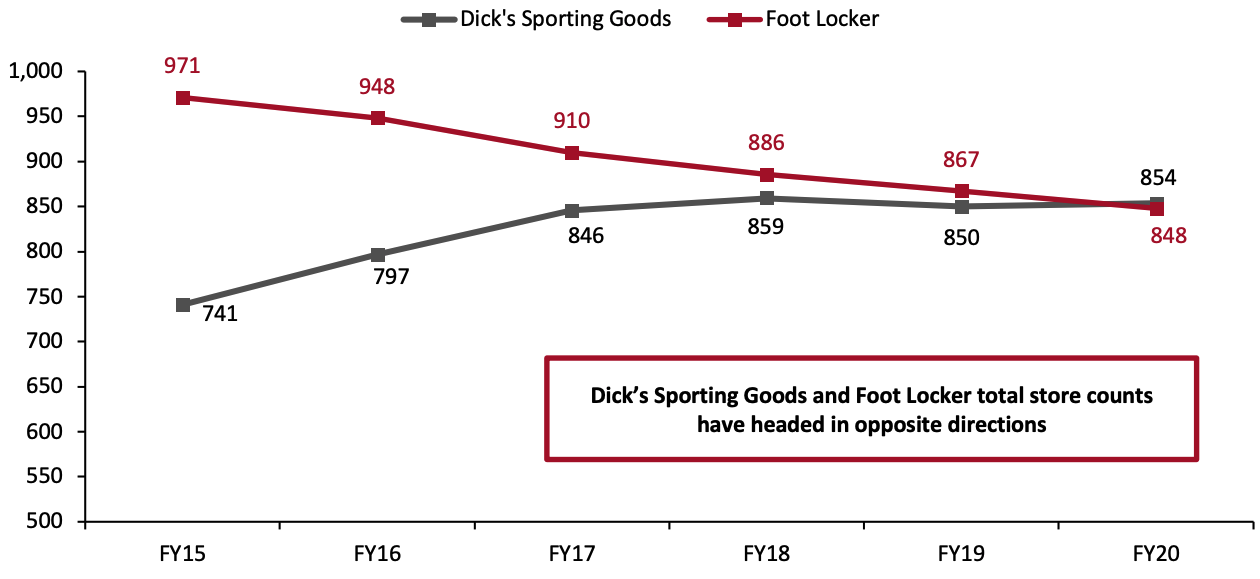

Dick’s Sporting Goods utilizes artificial intelligence (AI) and machine learning to improve in-stocks and merchandise availability and enhance tailored marketingSource: Dick’s Sporting Goods[/caption] Like Dick’s Sporting Goods, Foot Locker is also utilizing AI and data analytics to enhance its inventory management and targeted marketing and offer a personalized experience to its customers through its collaboration with Blue Yonder, a US-based supply chain and omnichannel commerce fulfilment service provider. Blue Yonder uses Foot Locker’s in-house data to provide the retailer services such as inventory optimization, retail planning and optimal customer order fulfilment. Foot Locker’s key source of data is its loyalty program FLX, which has over 25 million members and provides a range of information on shoppers buying behavior and preferences. Foot Locker’s loyalty program members spent over 75% more than nonmembers in the second quarter ended June 30, 2021, with their average order values being about 10% higher than nonmembers. 5. Omnichannel Approach Stores Strategy In recent years, Dick’s Sporting Goods has extended its store estates, while Foot Locker has been shrinking its store portfolio in the US. Dick’s Sporting Goods’ has expanded its store footprint in the US to 854 in fiscal 2020 from 741 in fiscal 2015. The company planned to open six DICK’s stores and eight specialty concept stores, including two outdoor stores, in fiscal 2021. In contrast, Foot Locker has shrunk its store network in the US from 971 in fiscal 2015 to 848 in fiscal 2020. The company has noted that most of these closures have been in under-productive stores located in lower-tier malls that witnessed lower traffic in recent years. Furthermore, Foot Locker’s brick-and-mortar traffic has been impacted by the growing US consumer shift toward online shopping. In the near future, Foot Locker will continue to rightsize its stores. By the end of fiscal 2021, the company planned to convert one-third of its 231 Footaction stores in the US, Canada and Puerto Rico into the Foot Locker banner and will close the rest in the next few years as leases expire.

Figure 8. US: Dick’s Sporting Goods and Foot Locker Store Numbers [caption id="attachment_142426" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Digital Capabilities Expansion

Both Dick’s Sporting Goods and Foot Locker are ramping up their digital operations, including expanding ship from store capabilities and offering/growing BOPIS and curbside pickup options through key partnerships and investments.

In February 2021, Dick’s Sporting Goods collaborated with payment service provider Adyen to unify the retailer’s payments infrastructure by integrating in-store, online and in-app purchases. In the press release, Dick’s Sporting Goods stated that the partnership will help the company to get a more centralized view of customer purchase data and help it to provide more personalized experiences for its shoppers. Similarly, in December 2020, Dick’s Sporting Goods collaborated with the online grocer platform Instacart for same-day delivery in over 150 Dick’s stores in the US. The partnership will further help the retailer to enhance its order fulfilment capabilities and improve shoppers’ experience.

Foot Locker spent $115 million on expanding its digital capabilities and supply chain initiatives in 2021. Like Dick’s Sporting Goods, Foot Locker is also advocating the need for speed and convenience in the delivery of purchased items. In September 2021, Foot Locker collaborated with crowdsourced, same-day delivery service provider Deliv to offer same-day delivery facility to its online consumers for an extra $5. As per the alliance, Foot Locker’s shoppers will also have the option to purchase in-store and get items delivered on the same day to a local destination of their preference. Foot Locker is expanding its BOPIS capability to launch Deliv’s service initially at five of its stores before rolling out across its over 1,300 stores in the US and Canada based on the initial performance. The company also noted that Deliv’s service will ultimately be rolled out across all of the retailer’s other brands, including Kids Foot Locker, Lady Foot Locker and Champ Sports.

In addition, Foot Locker is taking digital initiatives to combat bots from flooding the website and tackle supply chain delays. In November 2021, Foot Locker revamped its product launch reservation system, making online inventory available for launch reservations in order to ensure fairness for shoppers and keep product access away from bots. The new launch reservation system allows shoppers to sign up for product drops in advance of launch dates. The system lets Foot Locker’s customers have the launched products shipped directly to them or pick up their purchases from a nearby store.

6. ESG Initiatives

Both Dick’s Sporting Goods and Foot Locker have accelerated the pace of their activities to promote diversity, inclusion and sustainability.

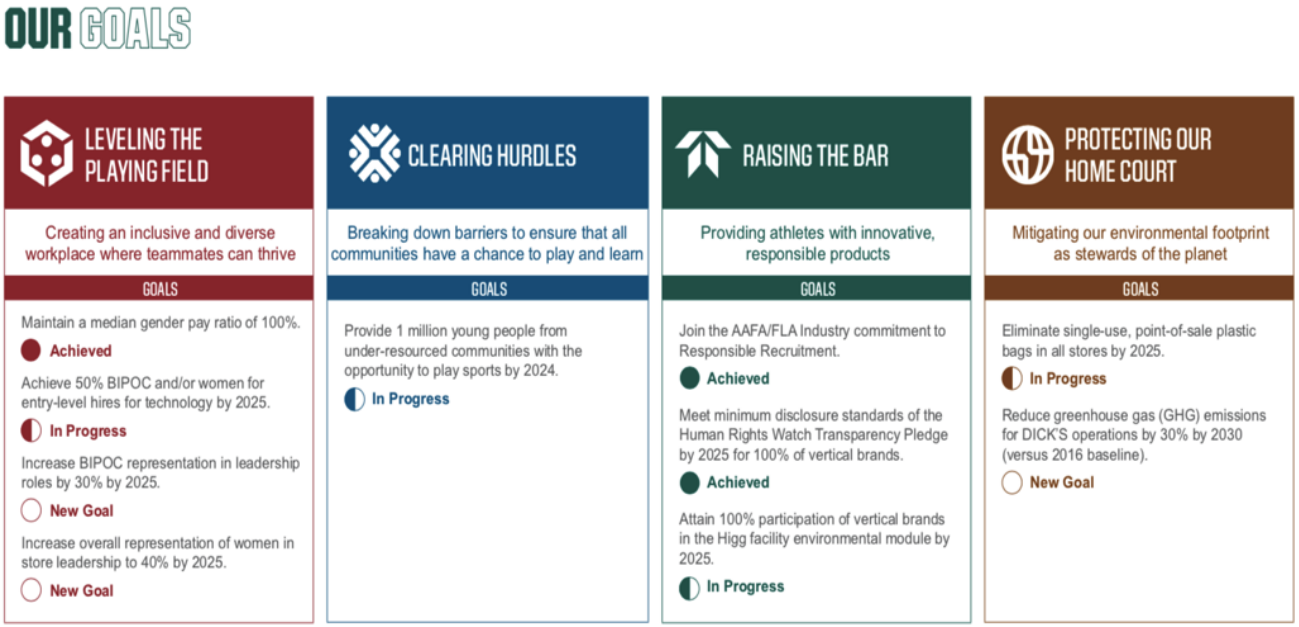

In September 2020, Dick’s Sporting Goods announced the following key goals and initiatives in its strategic plan:

Source: Company reports/Coresight Research[/caption]

Digital Capabilities Expansion

Both Dick’s Sporting Goods and Foot Locker are ramping up their digital operations, including expanding ship from store capabilities and offering/growing BOPIS and curbside pickup options through key partnerships and investments.

In February 2021, Dick’s Sporting Goods collaborated with payment service provider Adyen to unify the retailer’s payments infrastructure by integrating in-store, online and in-app purchases. In the press release, Dick’s Sporting Goods stated that the partnership will help the company to get a more centralized view of customer purchase data and help it to provide more personalized experiences for its shoppers. Similarly, in December 2020, Dick’s Sporting Goods collaborated with the online grocer platform Instacart for same-day delivery in over 150 Dick’s stores in the US. The partnership will further help the retailer to enhance its order fulfilment capabilities and improve shoppers’ experience.

Foot Locker spent $115 million on expanding its digital capabilities and supply chain initiatives in 2021. Like Dick’s Sporting Goods, Foot Locker is also advocating the need for speed and convenience in the delivery of purchased items. In September 2021, Foot Locker collaborated with crowdsourced, same-day delivery service provider Deliv to offer same-day delivery facility to its online consumers for an extra $5. As per the alliance, Foot Locker’s shoppers will also have the option to purchase in-store and get items delivered on the same day to a local destination of their preference. Foot Locker is expanding its BOPIS capability to launch Deliv’s service initially at five of its stores before rolling out across its over 1,300 stores in the US and Canada based on the initial performance. The company also noted that Deliv’s service will ultimately be rolled out across all of the retailer’s other brands, including Kids Foot Locker, Lady Foot Locker and Champ Sports.

In addition, Foot Locker is taking digital initiatives to combat bots from flooding the website and tackle supply chain delays. In November 2021, Foot Locker revamped its product launch reservation system, making online inventory available for launch reservations in order to ensure fairness for shoppers and keep product access away from bots. The new launch reservation system allows shoppers to sign up for product drops in advance of launch dates. The system lets Foot Locker’s customers have the launched products shipped directly to them or pick up their purchases from a nearby store.

6. ESG Initiatives

Both Dick’s Sporting Goods and Foot Locker have accelerated the pace of their activities to promote diversity, inclusion and sustainability.

In September 2020, Dick’s Sporting Goods announced the following key goals and initiatives in its strategic plan:

- Discontinue single-use plastic bags in the stores by 2025

- Reduce greenhouse gas emissions by 30% by 2030

- Increase Black, Indigenous, People of Color (BIPOC) representation in company leadership roles by 30% by 2025

- Grow overall representation of women in store leadership to 40% by 2025

- Provide 1 million young people with the opportunity to play sports by 2024

Dick’s Sporting Goods’ latest sustainability goals

Dick’s Sporting Goods’ latest sustainability goalsSource: Dick’s Sporting Goods[/caption] As compared to Dick’s Sporting Goods, Foot Locker’s long-term ESG goals are less quantifiable. Foot Locker presented its key actions promoting sustainability and diversity in its 2021 Impact Report, including:

- Reduce energy consumption in its corporate headquarters in New York by 35% by 2050

- Improve supply chain efficiency and ensure waste reduction

- Invest $200 million between fiscal 2020 and fiscal 2025 to support Foot Locker’s Black workforce and communities through the “Leading in Education and Economic Development” (LEED) initiative

- Reduce greenhouses gas emissions by energy conservation measures, which include retrofitting lighting; conducting preventative maintenance on heating, ventilation and air conditioning systems; implementing and monitoring energy management and building automation systems; and expanding its BOPIS offerings.

What We Think

We expect sportswear to continue to be a key category in the US apparel and footwear specialty retail market. In the near future, we anticipate that Dick’s Sporting Goods will retain its status as the largest sporting goods retailer in the US, with Foot Locker as its most threatening rival. Going forward, we expect both Dick’s Sporting Goods and Foot Locker to continue to focus on strengthening their assortments, driving online and store traffic through strategic partnerships, acquisitions and investments, and enhancing the consumer experience, including digital search and discovery, flexible payments and pickup and delivery. We expect these services to remain in demand with consumers, leaving behind retailers that do not offer such services. While there is limited overlap between Dick’s Sporting Goods’ and Foot Locker’s product categories currently, we expect the product mix overlap to increase as both retailers are aggressively expanding into each other’s dominant categories. Foot Locker is continuing to grow its apparel segment primarily through strategic acquisitions, investments and the launch of private labels. With Foot Locker’s extension in the apparel category and Dick’s Sporting Goods’ growing presence in the footwear category, the competition between these two retailers is likely to be fierce. Implications for Retailers- We see e-commerce as a significant opportunity for sporting goods retailers to drive sales as we expect many consumers to cement pandemic-driven online shopping habits in 2022 and beyond. However, we believe harnessing the digital consumer while also engaging consumers to bring them to the store will be key.

- Amid the rising e-commerce trend, data aggregated from customer bases will be central to sporting goods retailers staying ahead of their competition. We expect both Dick’s Sporting Goods and Foot Locker to continue to focus on data-driven marketing, personalization and inventory optimization to enhance customers’ experience.

- Retailers should continue to take proactive steps toward sustainability in order to win consumer trust and attract investors and employees in a dynamic retail landscape.

- Innovators have strong opportunities to partner with sporting goods retailers to drive the push into e-commerce expansion. Innovators can also support retailers in lowering inventory levels and improving efficiency, agility and resilience across their supply chains.