DIpil Das

Introduction

What’s the Story?

Kohl’s and Macy’s are the two leading US department store chains. As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ revenue growth, store portfolios, digital sales, product diversification, shopper profiles, consumer purchasing patterns and inflation impacts and discuss their recent innovations in physical and digital retail. As the US department store sector has been under pressure due to accelerated digital and category shifts, it is innovating to remain competitive while attracting and retaining consumers in a challenging environment. Kohl’s is investing in its physical store format with plans to open 100 hyper-localized small-format stores over the next four years while Macy’s is focusing on digital retail, launching a curated marketplace in the second half of 2022.

In this report, we refer to the companies’ fiscal years, which for both companies end on the Saturday closest to January 31 of the following calendar year; fiscal 2021, for example, ended on January 29, 2022.

Why It MattersThe department store dates to Hudson’s Bay in 1670. The concept originated as a store where consumers could shop for the entire family. Embodying this idea in today’s world is challenging for three main reasons:

- It requires a costly merchandise assortment that understands the changing wants and needs of multiple consumers. Previously, it may have been easier to dress a family with department store fashion, but today, the range of specialized retailers means that each family member is likely to seek out items from a mix of stores and online retailers to suit their preferences and fulfill their fashion needs.

- As their name suggests, department stores were built to accommodate multiple departments, so stores are typically large, which is costly for retailers.

- Department stores had to catch up to digital-first counterparts with regards to e-commerce and align their digital strategies with physical stores. The US department store sector has faced challenges; in fiscal year 2019 (pre-pandemic), total sector sales fell by 4.7% overall, and in fiscal year 2020, department store sales fell by approximately 32.7%, according to Coresight Research estimates.

Kohl’s vs. Macy’s: Coresight Research Analysis

Together, Kohl’s and Macy’s comprise 52% of the US department store market, according to Coresight Research estimates. The two chains have different store formats and locations, categories, assortments and value propositions. Kohl’s is focused on value and has stores in predominantly off-mall locations, while Macy’s is mostly located in malls and has historically been focused on fashion categories.

Growth strategies at Kohl’s are focused on strengthening its women’s assortment and building store traffic through partnerships. Macy’s is focused on the consumer experience, including improving the digital experience, understanding the consumer through advanced analytics and growing its off-price presence. We explore how the two department store retailers are positioning themselves for the future.

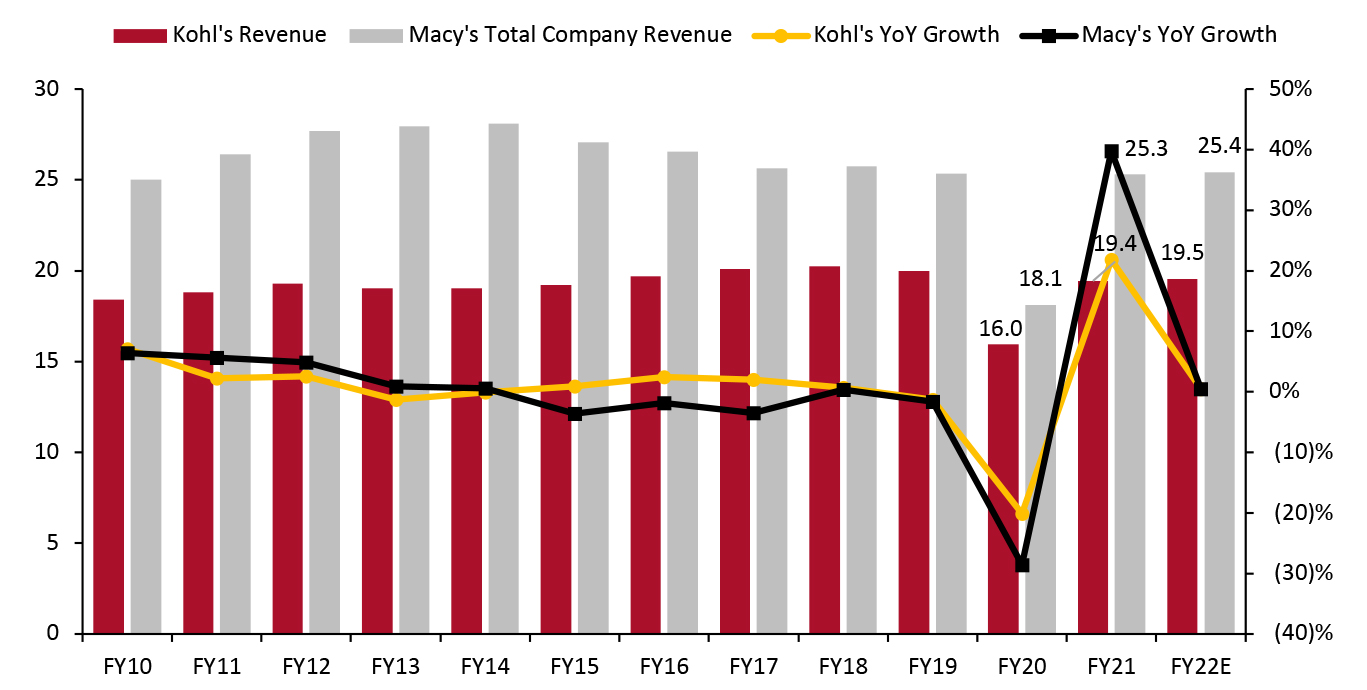

Revenue Growth Macy’s Secures the Market Leader Position Macy’s is the largest department store retailer in the US, with annual revenue of $25.3 billion in fiscal year 2021 across its banners, which includes Bloomingdale’s and Bluemercury stores. Kohl’s achieved $19.4 billion in revenue in the same fiscal year. Kohl’s had been closing the gap in terms of annual revenues and has been gaining market share, most significantly in fiscal year 2020 when Kohl’s revenues were $16.0 billion and Macy’s revenues were $18.1 billion, a $2.1 billion difference, mainly attributed to the steep decline that Macy’s saw in its apparel categories. However, in fiscal year 2021, Macy’s has reaffirmed its market position as the number one department store retailer in terms of revenues, with revenues $5.9 billion higher than Kohl’s. From fiscal year 2015 to fiscal year 2021, Kohl’s revenue compound annual growth rate was 0.2% while Macy’s was (1.1)%.Figure 1. Kohl’s vs. Macy’s (Company): Revenue (USD Bil.; Left Axis) and YoY % Change (Right Axis) [caption id="attachment_152245" align="aligncenter" width="699"]

Macy’s company revenue includes Bloomingdale’s and Bluemercury Fiscal year ends on January 30

Macy’s company revenue includes Bloomingdale’s and Bluemercury Fiscal year ends on January 30Source: Company reports/S&P Capital IQ/Coresight Research [/caption]

Store Portfolios

Focus on Smaller Format and Off-Price

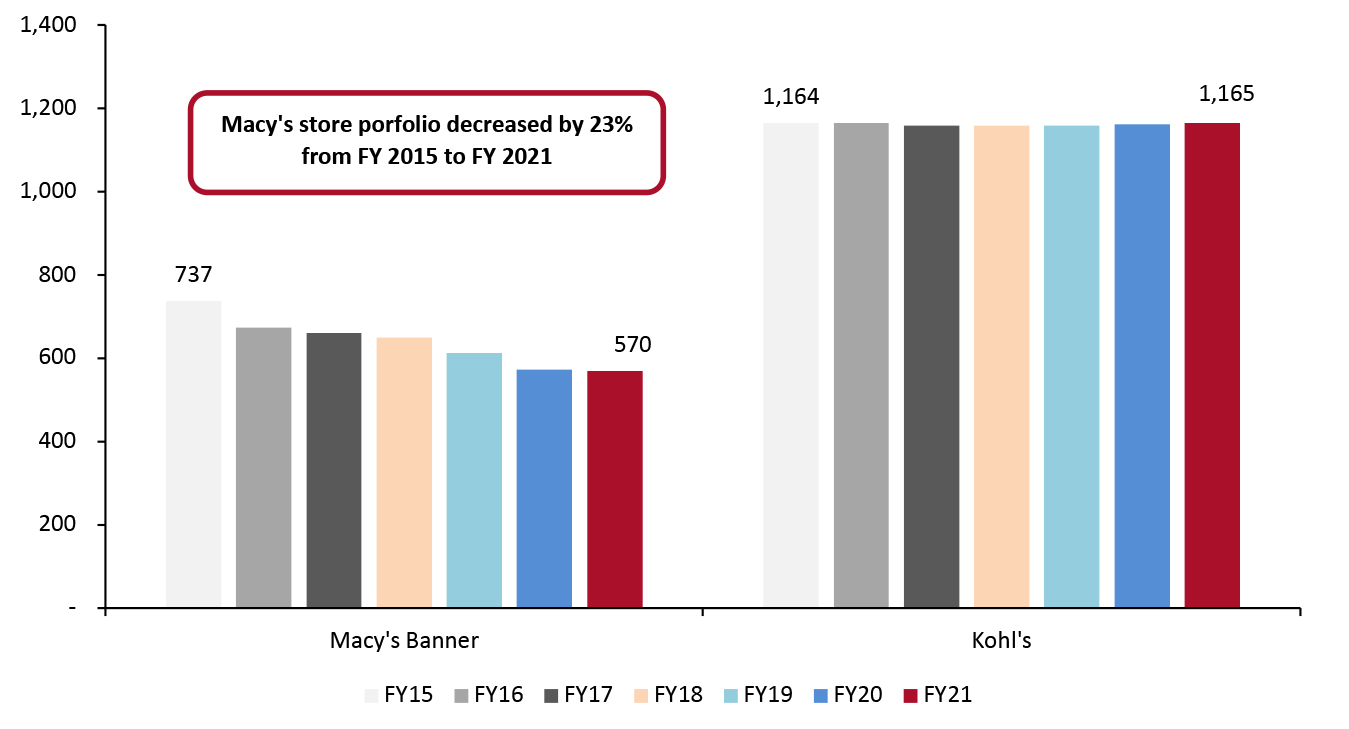

In recent years, Macy’s has been optimizing its store portfolio, while the brick-and-mortar presence of Kohl’s has remained stable.

As of the end of fiscal 2021, Kohl’s operates 1,165 stores—one more store than at end of fiscal year 2015. In terms of location, only 5.4% of Kohl’s stores are in community and regional malls, while 81.2% are in strip centers and 13.4% are free-standing stores.

Macy’s, a traditional mall anchor department store, has decreased its store portfolio by 167 stores in total since fiscal year 2015—a 23% decrease.

Figure 2. Kohl’s vs. Macy’s (Banner): Store Portfolio [caption id="attachment_152246" align="aligncenter" width="700"]

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage Source: Company reports [/caption]

Although Macy’s operated half as many banner stores as Kohl’s in fiscal 2021 (570 stores compared to 1,165 Kohl’s stores), it had 1.4 times the retail square footage. Macy’s operates larger, mall-based stores, with an average size of 138,000–179,000 square feet while Kohl’s average store size is 88,000 square feet.

Going forward, a retail trend is for stores to open smaller format stores and showrooms that provide reduced assortment and services while serving as another point of distribution and contact for the retailer.

Kohl’s announced at its Investor Day in March 2022 that it plans to expand its store portfolio with hyper-localized stores. Kohl’s plans to open 100 small-format stores, averaging 35,000 square feet, over the next four years with five stores opening in 2022. The smaller format provides real estate flexibility, allowing the retailer to enter markets and neighborhoods that cannot support a full-size store. The retailer has been testing this smaller format in various markets over the past few years, and it is expanding the pilot based on its success. Using data science, the small-format stores are developed based on the local customer and competitive market. For example, the first small-format store is set to open in Seattle and will include an expanded outdoor footprint, based on the retailer’s analysis of the market. Kohl’s projects over $500 million in sales, which is accretive, from its small-format stores. The retailer reported that it is targeting a 15% return on investment.

Macy’s is testing two small format, off-mall concepts and the company reported at its first quarter of fiscal year 2021 earnings presentation that it plans to open between five and 10 off-mall locations in 2022, a mix of Market by Macy’s, freestanding Backstage, Bloomie’s and Bloomingdale’s the Outlet. The company opened “Bloomie’s,” a small-format store including a tech-enabled stylist service model, and a restaurant experience. The company also expanded its “Market at Macy’s” store, opening its second store in January 2021; Market at Macy’s is an off-mall location that carries an assortment of items from the Macy’s banner store. This smaller-format concept measures approximately 20,000 square feet. The two new concepts are asset-light and provide the consumer with a different experience. The company is also planning to expand Macy’s Backstage, its store-within-a store off-price concept to 37 locations in 2022.

Digital Sales Moderated in FY 2021: Macy’s Digital Sales Outpace Kohl’s

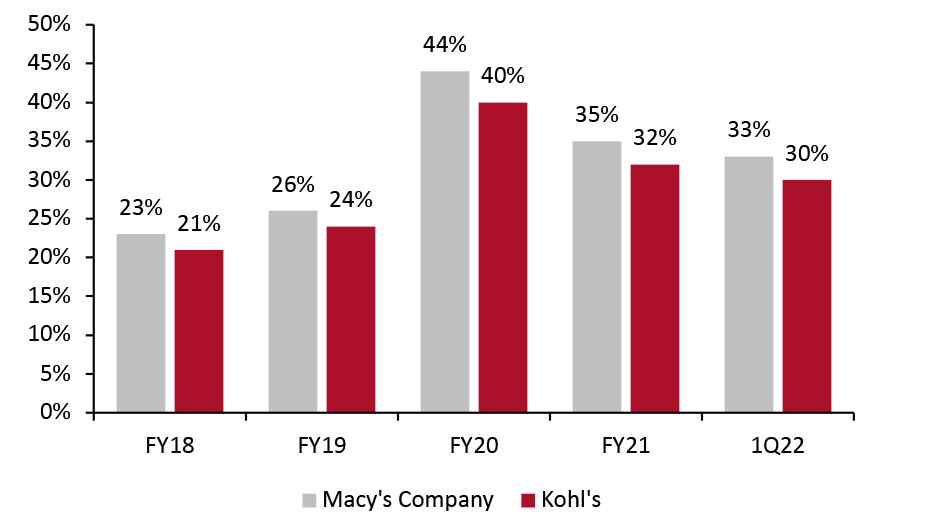

Across store portfolios, Macy’s and Kohl’s saw digital sales increase dramatically, with e-commerce penetration having grown from around 25% of all sales in fiscal 2019 to over 40% overall in fiscal 2020, moderating to low-to-mid 30% in fiscal year 2021, as shown in Figure 5.

For department store chains—which have a lot of real estate as we have previously described—e-commerce is complementary to their brick-and-mortar presence. Department stores need to determine how to drive traffic to both their stores and their digital channels so that the digital channel does not become a revenue replacement, but a revenue supplement.

Macy’s digital sales have outpaced Kohl’s. Macy’s has made investments in its digital business, such as making improvements to its website and merchandising and by investing in social commerce including livestreaming. The company aims to grow its digital business to $10 billion in revenue by 2023. In fiscal year 2022, the company expects digital sales to comprise 35% of sales as reported in their first quarter of fiscal year 2022 earnings.

Kohl’s reported at its Investor Day presentation in March 2022 that it is enhancing the digital experience to drive growth through optimizing its online assortment, enhancing discovery and shop-ability, and aiming to convert omnichannel customers. Kohl’s reported at its Investor Day that its digital sales totaled 32% of sales in fiscal year 2021, totaling $6 billion; its future goal is $8 billion. The company is also expanding buy online, pick up in-store (BOPIS) in all stores in 2022 and piloting self-service returns in 100 stores.

Figure 3. Kohl’s vs. Macy’s (Company): E-Commerce Penetration (% of Total Sales) [caption id="attachment_152247" align="aligncenter" width="699"]

Macy’s digital sales accounted for the total comparable sales on an owned basis; Kohl’s digital sales represent sales as a percent of net sales. The majority of Macy’s digital sales are from the Macy’s banner.

Macy’s digital sales accounted for the total comparable sales on an owned basis; Kohl’s digital sales represent sales as a percent of net sales. The majority of Macy’s digital sales are from the Macy’s banner. Source: Company reports [/caption] Product Diversification: Consumer Category Preferences Continue to Shift

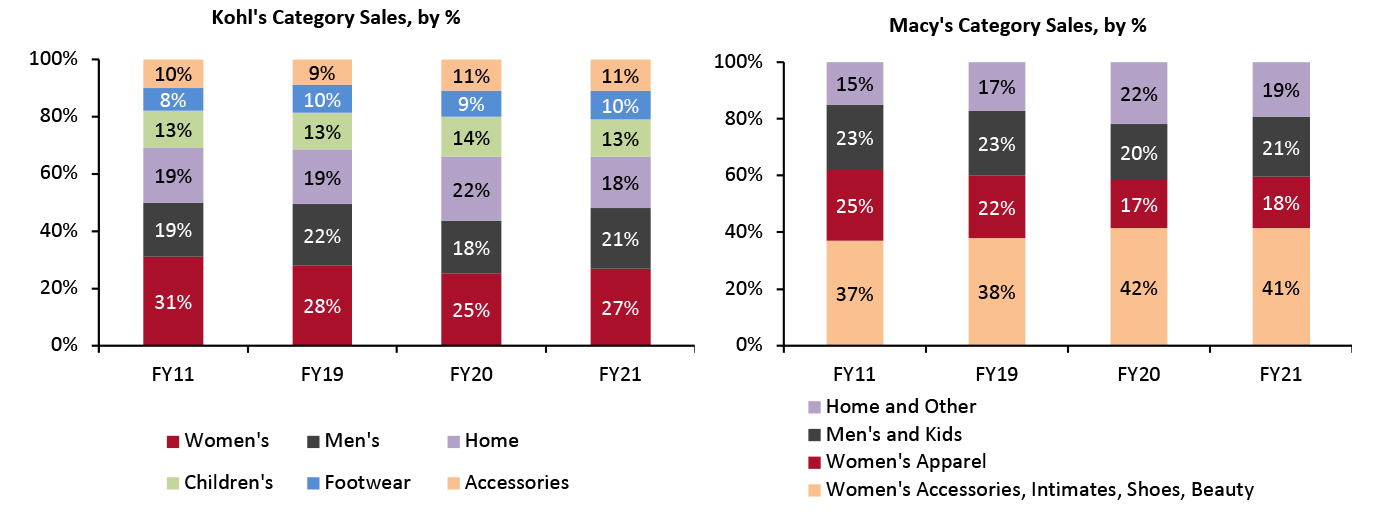

Consumers’ shopping preferences underwent rapid shifts due to lifestyle and work changes amid the Covid-19 pandemic, as demonstrated by fiscal 2020 and fiscal 2021 sales by category.

Apparel was one of the most impacted categories during the pandemic. At Kohl’s, women’s, men’s and children’s apparel sales represent a larger proportion of its total sales, comprising 60.8% in fiscal year 2021 compared to 39.6% at Macy’s during the same year.

Kohl’s apparel categories fared better during the peak of the pandemic, as its selections are more casual and active which is what consumers were seeking. Macy’s was hit harder, as a larger part of the retailer’s business is dedicated to apparel categories such as professional and dressier attire that became less relevant for consumers. However, Macy’s reported in its latest earnings results that it is seeing an acceleration of consumers shopping for dressier apparel including occasion-based looks. Therefore, we expect that Macy’s is positioned to return these categories to growth.

We analyze sales at Macy’s and Kohl’s to compare the category portfolio trend from ten years ago, fiscal year 2011, with pre-pandemic fiscal year 2019 and post-pandemic years 2020 and 2021 in Figure 4.

Figure 4. Kohl’s vs. Macy’s (Company): Sales Mix (% of Total Revenue) [caption id="attachment_152248" align="aligncenter" width="701"]

Source: Company reports[/caption]

Source: Company reports[/caption]

Below, we further compare the category strengths of the two retailers:

- The home category has been increasing at Macy’s as a percent of its total sales over the past ten years while home has decreased slightly at Kohl’s. Macy’s reported in the first quarter of fiscal year 2022 that the soft home category is beginning to slow.

- Macy’s largest and strongest category, “Women’s Accessories, Intimates, Shoes and Beauty,” has grown over the past 10 years. While there are no corresponding categories for Kohl’s, we predict Kohl’s Sephora partnership will help the retailer to become more of a destination for beauty, which may help to drive sales in adjacent categories as Kohl’s reported on its first quarter of fiscal year 2022 earnings call that half of its Sephora at Kohl’s customers are adding at least one other item to their basket, particularly from “women’s, active and accessories.”

Moving forward, Kohl’s is focusing on product category improvements, including a refocus of its women’s category, becoming a destination for the entire family and expanding active from 20% to at least 30% of the business. Active covers outdoor, footwear, athleisure and wellness. Macy’s is growing its product categories through the announcement of a curated marketplace which it plans to launch in the second half of 2022.

Shopper ProfilesMacy’s Average Consumer Is Slightly Younger with a Higher Income

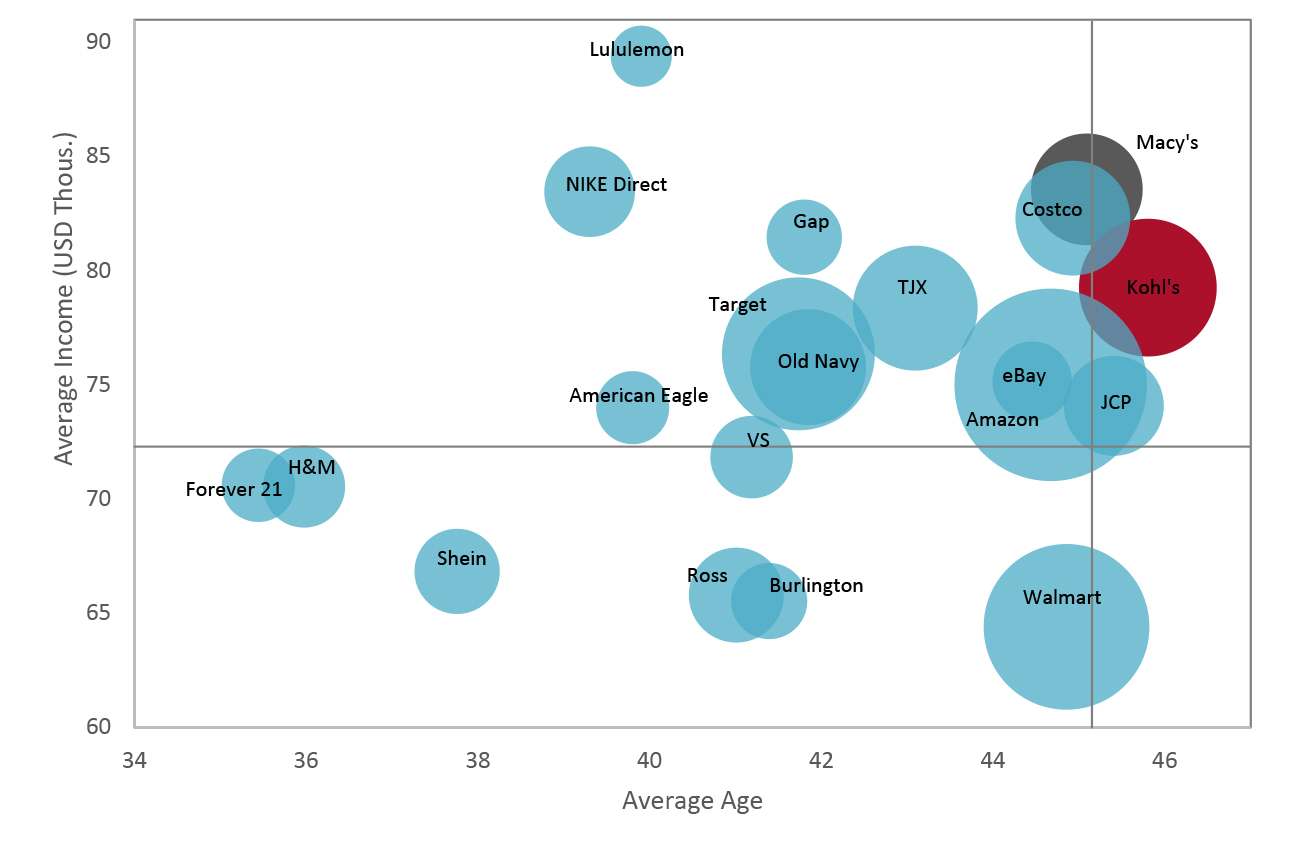

Coresight Research analyzed our survey data from February 2022 that asks consumers which retailers they purchase apparel and footwear from; we determined the average age and the average income of consumers that purchased from Kohl’s and Macy’s as shown in Figure 5. The average ages of consumers purchasing at Kohl’s and Macy’s are both in the mid-forties; the Kohl’s consumer is slightly older than Macy’s consumer. The consumer that purchases items at Macy’s has an average household income which is higher than Kohl’s, around $84,000 at Macy’s versus around $79,000 at Kohl’s.

Figure 5. Apparel and Footwear Shopper Profiles by Average Age and Household Income [caption id="attachment_152257" align="aligncenter" width="699"]

Base: 1,998 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed in February 2022

Base: 1,998 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed in February 2022 Bubble sizes represent the number of shoppers; cross-hairs represent the average of all those who had bought clothing or footwear in the past 12 months; all averages exclude under-18s; averages calculated using midpoints of age/income bands

Source: Coresight Research [/caption] Consumer Purchasing Patterns

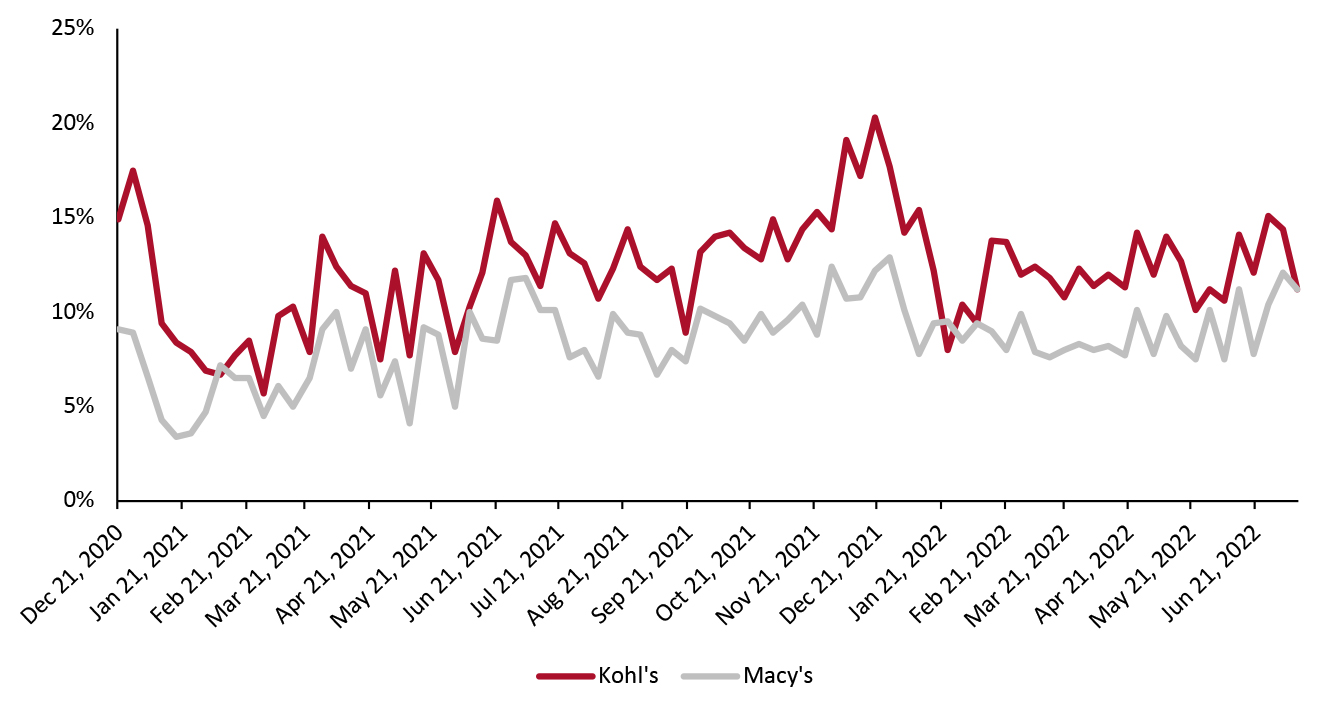

Kohl’s is proving to be a more popular destination for US nonfood shoppers than Macy’s, according to Coresight Research’s US Consumer Tracker. We ask consumers which retailers they have purchased nonfood products from within the past two weeks. As shown in Figure 6, since December 20, 2020, more consumers have responded that they have bought something at Kohl’s in the prior two weeks in all weeks through June 2022 except one survey week, January 24, 2022. On July 11, 2022, the percentage of consumers purchasing at each store was the same, 11.2%

Figure 6. US Consumers: Retailers at Which They Bought Nonfood Products in the Past Two Weeks (% of Respondents) [caption id="attachment_152258" align="aligncenter" width="701"]

Base: US respondents aged 18+, surveyed weekly

Base: US respondents aged 18+, surveyed weekly Source: Coresight Research [/caption]

Inflation Impacts as of the First Quarter of Fiscal Year 2022

Here we summarize Kohl’s and Macy’s most recent reports on inflation impacts on costs, price increases and the consumer response.

Kohl’s reported that its customer has been affected by inflation, with its average spend per customer going down during the first quarter of fiscal year 2022. Management said that its units per transaction have come under more pressure as consumers are being more mindful about what they are buying. The company has built an elasticity pricing model and is offering more value on highly elastic categories (like kids and private label) and conversely increasing prices in certain categories like dress apparel and dresses, for example. The national brands set their pricing. Kohl’s said that it has agility to change prices quickly in response to consumers. The company highlighted increased freight expense and heightened wage costs as major cost drivers.

Macy’s reported that all income tiers continue to shop at its banners, led by higher income and middle-income consumers; management said that its luxury sales were a standout during the quarter as shopping behavior among high-income consumers has so far remained less affected by inflation. It should be noted that the Macy’s management commentary on the consumer impact of inflation includes its Bloomingdales’ and Blue Mercury retail banners; its Bloomingdale banner is a luxury department store with a higher income consumer. The average unit retail (AUR) increased by 8% in the quarter driven by fewer promotions, its pricing optimization strategy and increased penetration of the category mix of furniture, fragrance and occasion-based apparel. The company is using predictive analytics to increase prices in selective categories; for example, management said it has been able to increase prices on some of its larger ticket items and premium products while it has not been able to increase prices on categories that are trending down, including soft home (textiles) and casual active. Macy’s reported it anticipates two major costs impacting its gross margin: higher fuel costs within its supply chain network (for package delivery) and markdowns needed to correct inventory levels within overstock categories.

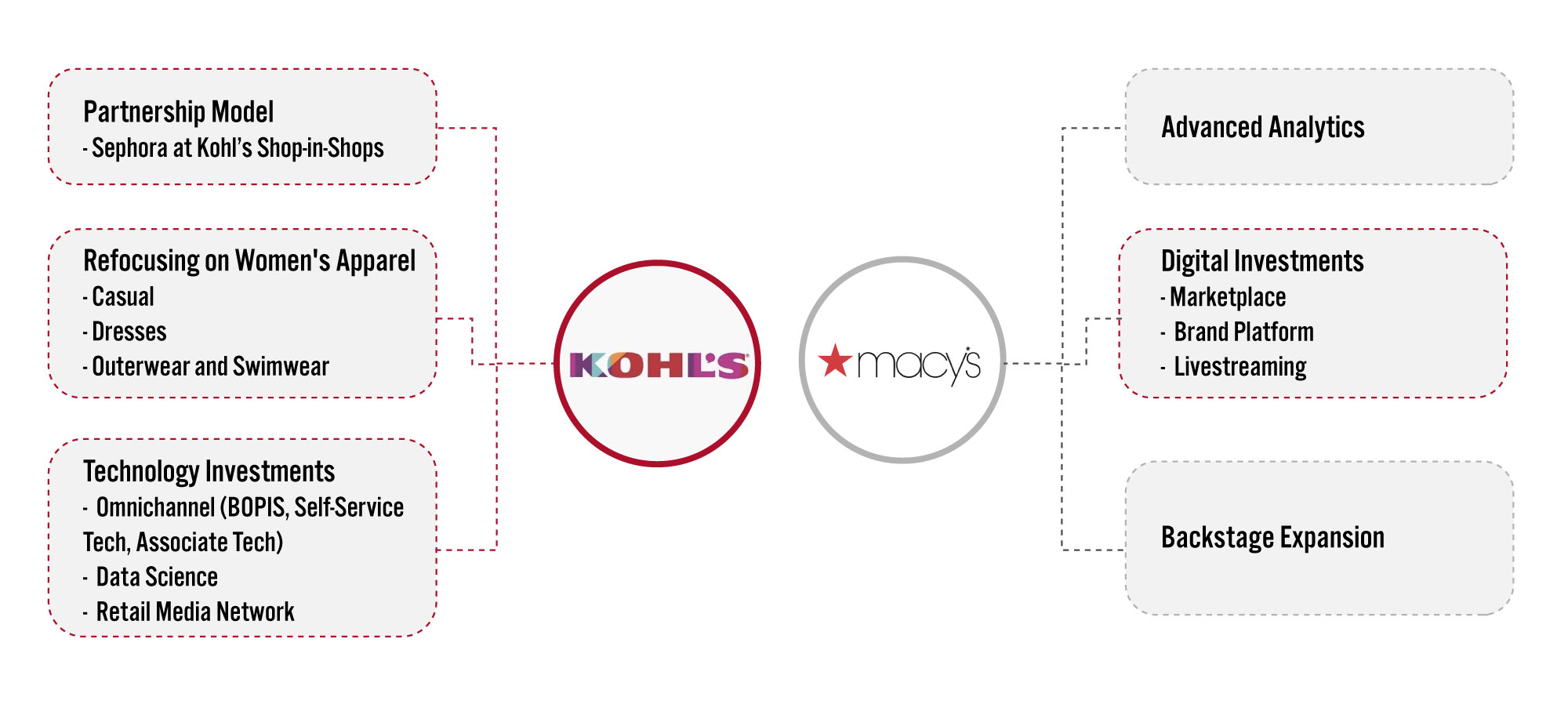

Innovations at Kohl’s and Macy’sBoth Kohl’s and Macy’s are innovating to stay relevant with their current customers and to reach new audiences. We summarize their recent innovations in Figure 7 and discuss each one below.

Figure 7. Innovations at Kohl’s and Macy’s [caption id="attachment_152250" align="aligncenter" width="700"]

Source: Company reports/Coresight Research [/caption]

Source: Company reports/Coresight Research [/caption]

Innovations at Kohl’s

Kohl’s is building its customer base, driving store traffic and broadening its categories through three key innovations: partnership models, refocused product categories and investments in technology.

1. Partnership Model To Drive Store Traffic and Build Customer Base

Kohl’s actively innovates using partnership models. Most notably, Kohl’s launched its Amazon Returns program in 2017, which helped to bring in younger consumers and drive traffic to its stores: The retailer reported on its fourth-quarter 2020 earnings call on March 2, 2021 that it identified 2 million new customers brought in by the Amazon Returns program, one-third of which are millennials.

Below, we highlight its most recent retail partnership.

Sephora at Kohl’s—On December 1, 2020, Kohl’s and Sephora announced a partnership to bring 200 Sephora shop-in-shop locations to Kohl’s department stores beginning in the fall of 2021, with products available online too, totaling 850 locations by 2023. Management highlighted the strength of its Sephora shop-in-shop business at its Investor Day in March 2022. Kohl’s plans to add 400 Sephora shop-in-shops in 2022 and 250 in the spring of 2023.

Kohl’s expects to grow its Sephora business to $2 billion; while Kohl’s did not provide specifics of the breakdown of the $2 billion in revenue, the retailer provided the following metrics on the Sephora shop-in-shops:

- The stores with Sephora shop-in-shops have seen a mid-single-digit sales lift in percentage terms as compared to non-Sephora stores.

- 25% of customers shopping Sephora are new to Kohl’s.

- 50% of customers are adding at least one other category to their cart.

- As Kohl’s adds more Sephora shop-in-shops to its portfolio, the growth that the retailer saw from its initial rollout—including new customer acquisition and increased sales to adjacent categories—is set to benefit its entire store portfolio.

Kohl’s and Sephora are exploring innovations. They are piloting an initiative where Sephora.com shoppers will have the choice of having the purchase shipped from Sephora, picking the purchase up from Sephora or picking the purchase up at a Sephora at Kohl’s location. Picking Sephora orders up at Kohl’s stores increases convenience for shoppers, as 80% of consumers live with 15 miles of a Kohl’s, according to the company. This option would also benefit Kohl’s as a traffic driver.

2. Kohl’s Plans To Reignite Growth of Women’s Apparel Business

As part of the company’s plan to become an active destination for the entire family, Kohl’s aims to revitalize its women’s business through four initiatives:

- Become a leader in women’s casual apparel: The company stated that a major growth driver for its women’s casual business will be denim, where it reported it holds the number-three market position—and it is the number-one retailer of Levi’s. In fiscal 2022, Kohl’s will enter the premium denim category with Buffalo Jeans and an exclusive offering from Levi’s Silver Tab.

Kohl’s is also leveraging its private brand Sonoma as a growth driver; Sonoma is a $1 billion-plus brand, and women represent half of that volume. Kohl’s is amplifying its brand offerings and repositioning Sonoma as its flagship brand. Moving forward, all Sonoma products will be 100% sustainably sourced. Management sees the opportunity to drive growth from Sonoma in bottoms and dresses.

- Grow dress business: Kohl’s is seeing strong customer interest in dresses, as “dresses” ranked as one of the top search terms on its digital platform. However, the retailer is underrepresented in the market in the dress category. Therefore, starting in spring 2022, Kohl’s increased its dress footprint in stores by 75% and created “dress destinations.” The retailer is also expanding its dress offerings across the Sonoma private label and national brands Lauren Conrad, Nine West and Simply Vera Vera Wang. Dresses will represent nearly half of the product portfolio from the Draper James RSVP line, according to Kohl’s.

- Expand outerwear and swimwear: Kohl’s said it can “own the seasons” by focusing on outerwear in the fall and swimwear in the spring. The company plans to focus its outerwear growth on relevant brands including Columbia, Land’s End and Eddie Bauer as well as curating in-store experiences and online assortments. Kohl’s added three exclusive swimwear brands that focus on a classic, contemporary or junior customer. The retailer will maintain swim shops in its southern stores all year round.

- Amplify inclusivity: Kohl’s said that while it has a well-established and trending business in plus-size apparel today, the retailer has an opportunity to expand its offerings across its private brands. Its teams are also focusing on diversity, equity and inclusion. Kohl’s is launching an exclusive brand, Tempo, focused on a younger, diverse consumer.

3. Tech Investments Including Omnichannel Shopping Enhancements and a Retail Media Network

Kohl’s management highlighted at its Investor Day that it has a strong omnichannel foundation, with customers shopping across both its stores and digital channels. Customers who shop across channels are four times more productive than store-only shoppers and they are six times more productive than digital-only shoppers. As more consumers are shopping both channels, the retailer is using technology to enhance the experience for its customers and store associates.

Stores fulfill approximately 40% of digital sales, including via BOPIS, drive up and ship-from-store. The company invested in better handheld devices for its store associates, which helps to make store-based fulfillment easier and more efficient for customers. Kohl’s is offering more customer convenience through self-service, including self-pickup of an order at a store, self-returns and self-checkout. The retailer tested self-service in 2021 with over one-quarter of its stores equipped with some form of self-service. By the end of 2022, all stores will have self-service pickup. Self-returns are currently available in over 100 stores. Kohl’s will continue to roll out this service to more stores over the next 18 months. Consumers scan the item, drop it into a bag and leave it in a designated box at a Kohl’s store. Kohl’s is testing self-service checkout.

As previously discussed, Kohl’s digital sales totaled $6 billion in fiscal 2021, and the company seeks to grow its business to $8 billion through several key initiatives. It is leveraging data science to personalize and localize its products (digitally and in stores) and messages to offer consumers better experiences.

Kohl’s is using data science and machine learning to make decisions at a product and consumer level—a more granular level than the company has previously employed. For example, Kohl’s is using data science to hyper-localize its product mix based upon local customer needs and preferences. In marketing, Kohl’s is using artificial intelligence (AI) to personalize its messaging to its customers based on customer spending, lifestyle interests and other patterns.

Kohl’s is investing in and testing a media network that includes third-party ads on its website and in emails. The retailer has over 1.7 billion website visits per year; management estimated that its media network could generate $200 million in ad sales over the next several years.

Innovations at Macy’s

Macy’s is innovating across three areas to build and engage with customers: investing in advanced analytics, focusing on digital capabilities and expanding off-price stores.

1. Using Advanced Analytics To Improve Decision Making

- Macy's reported that its ability to maintain its gross margin depends on its understanding of customer demand within and across categories. Macy's is using predictive analytics and data science to improve its understanding of the customer and applying it in three ways. First, it is shifting its promotional profile to be more personalized; second, it is predicting demand to improve the accuracy of its upfront buys for how it allocates inventory within and across markets which will help to drive better sell-throughs and higher inventory productivity; third, it is using dynamic pricing to change the timing, cadence and size of markdowns based on factors such as inventory availability, sell-throughs and demand patterns.

2. Investing in Digital Capabilities To Expand Product Selection and Increase Consumer Engagement

Macy’s has been focusing on several digital initiatives to expand its product selection, improve its website functionality and better connect with its customers. Here we highlight recent initiatives.

- Launching marketplace: In November 2021, Macy’s announced it was launching a curated digital marketplace which would expand the company’s assortment in existing categories and brands and introduce a range of new categories, by enabling carefully selected third-party merchants to sell their products on Macys.com and Bloomingdales.com. The marketplace platform is expected to launch in the second half of 2022.

- Launching style platform: In March 2022, Macy’s launched, “Own Your Style,” a brand platform that helps customers discover and express their unique personal style by connecting them with products, advice and inspiration.

- Livestreaming: Macy’s continues to invest in livestreaming. When a consumer logs onto Macys.com, Macy’s is hosting livestreaming sessions where customers can interact and purchase products.

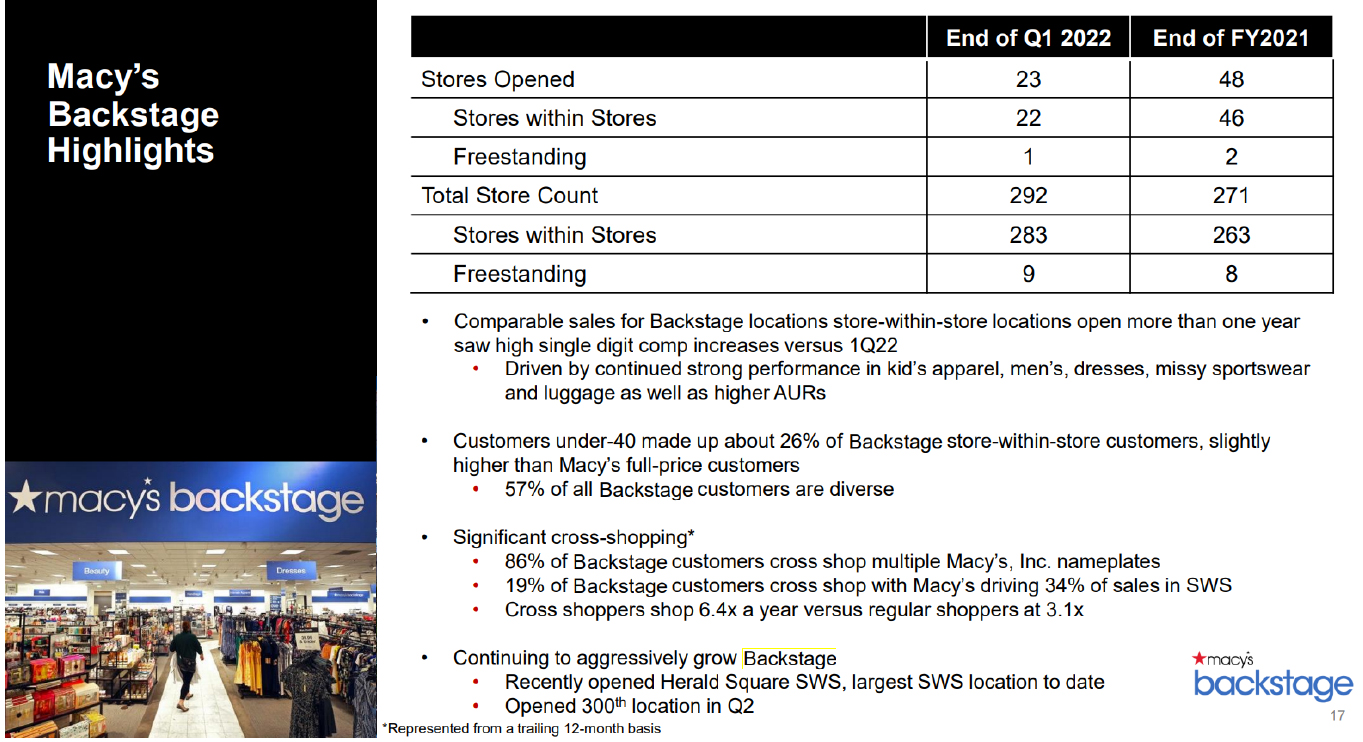

3. Investing in Macy’s Backstage

Macy’s is investing in its Backstage stores, as stores with Backstage outperform its stores without Backstage in terms of comparable sales, cross-shopping other categories, and higher average unit retail (AUR) across multiple categories as shown in the figure below. Macy’s plans to open 37 Backstage locations in 2022.

[caption id="attachment_152251" align="aligncenter" width="700"] Macy’s Backstage highlights

Macy’s Backstage highlights Source: Company reports [/caption]

What We Think

Kohl’s and Macy’s have very different growth and innovation strategies: Kohl’s is focused on strengthening its assortment, building its customer base and driving store traffic through partnerships, while Macy’s is focused on the customer experience, including digital initiatives, advanced analytics and expanding its off-price Backstage stores.

We expect that, given inflation and consumers’ abrupt change in apparel shopping preferences, Macy’s will be better positioned in the short term for three reasons. First, Macy’s reported that its customer has been less affected by inflation, while Kohl’s customer has been negatively affected. Macy’s reported its consumer inflationary impact across all of its banners which includes Bloomingdales and Blue Mercury; however, management reported that its customer had been less affected by inflation across all of its banners. Second, consumers have quickly changed their apparel shopping preferences to include more dressier styles, occasion wear, work wear, and elevated looks. Dressier apparel is a strength for Macy’s and the retailer reported on its first quarter earnings call of fiscal year 2022 that it is seeing consumers return to shop for occasion wear, dresses and looks for special events. Finally, Macy’s investments in digital will benefit the retailer, as it has focused on engaging with younger consumers with its styling brand platform and through livestreaming.

We expect that in the longer term as inflation begins to impact more Americans’ discretionary income, consumers will begin to shop at Kohl’s seeking value offerings. During recent earnings calls, retailers offering value fashion offerings including off-price retailers reported that during the last recessionary environment it took several earnings cycles before consumers began to trade down to value offerings. Thus, we predict that Kohl’s will also experience this trend; Kohl’s investments in its revamping its women’s business may help to support its apparel category.

We also expect that Kohl’s investments in its Sephora partnership will drive traffic and growth for the retailer, as evidenced by its first 200 stores. The department store is seeing positive results with new customers visiting its stores and 50% of these customers are purchasing other items while they are at the stores. As Kohl’s rolls out the Sephora stores to all its locations, this can provide a major benefit to Kohl’s in terms of customer acquisition and in growing its total business.