Nitheesh NH

Introduction

What’s the Story? American Eagle Outfitters and Gap Inc. are the largest apparel and footwear specialist retailers in the US. As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ revenues, as well as sales channels, key strategies, target audiences, and environmental, social and governance (ESG) initiatives. Why It Matters We expect US apparel and footwear specialists to hold a resurgence in 2022. In 2022, against very strong comparatives, Coresight Research estimates the US apparel and footwear specialists’ sales will be roughly flat, remaining at around $282 billion. From 2022 to 2025, we expect the US apparel and footwear specialty sector to witness a sales CAGR of 0.5%. While Gap Inc. has maintained its leading position in the apparel specialty sector for more than a decade, American Eagle Outfitters is the fastest-growing apparel and footwear specialist in the US, mainly driven by its Aerie banner. The scale and leading market position of the companies result in worthwhile comparisons.American Eagle Outfitters vs. Gap Inc.: Coresight Research Analysis

Business Overview At the forefront of the industry, both companies sell accessories, apparel and footwear. We provide an overview of key metrics for American Eagle Outfitters and Gap Inc. in Figure 1.Figure 1. Company Overviews: American Eagle Outfitters and Gap Inc. [wpdatatable id=1708]

*Latest fiscal year, ended January 30, 2021 Source: Company reports/Coresight Research

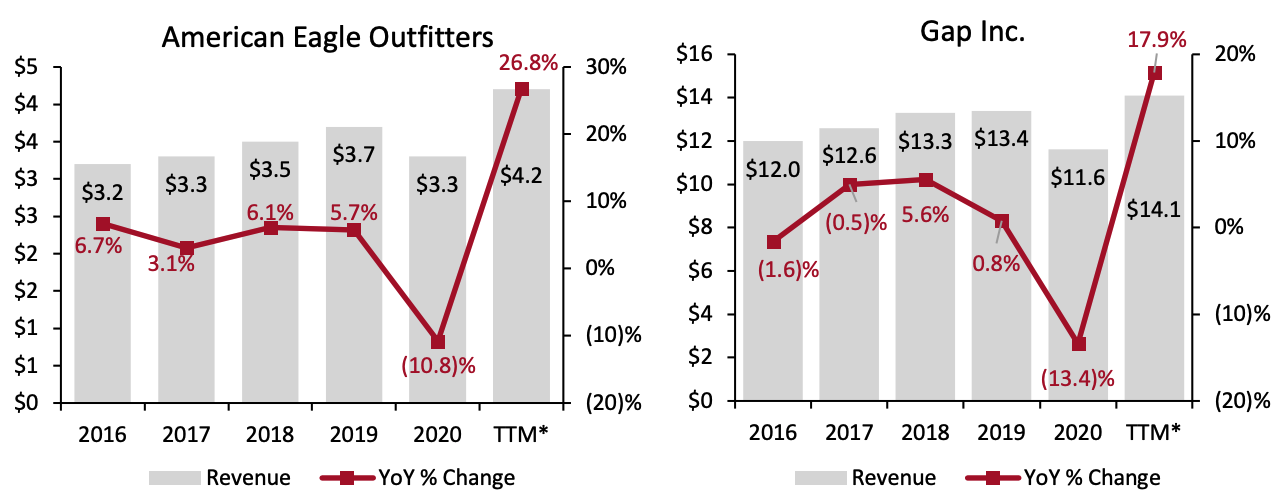

1. Revenue Growth In the past five fiscal years, American Eagle Outfitters has outpaced Gap Inc. in terms of revenue growth. From 2016 to 2019, American Eagle Outfitters reported a sales CAGR of 5.0% versus 3.7% at Gap Inc. In fiscal 2020, both the retailers posted sales declines; however, Gap’s decline was higher as compared to American Eagle Outfitters’ sales decline. Similarly, in the first nine months of 2021, American Eagle’s sales growth of 40.0% massively outperformed the 29.5% growth of Gap Inc.’s sales in the US. As of 2020, Gap Inc. held a 5.7% share of the highly fragmented US apparel and footwear specialty sector, while American Eagle Outfitters held a 1.6% share. Although American Eagle Outfitters is behind Gap Inc. in terms of total revenues, the former is quickly gaining market share. Below, we discuss the primary revenue drivers for both companies. American Eagle Outfitters: The Aerie brand, focused on intimate apparel, loungewear and underwear, remains the company’s key growth engine, posting 27 consecutive quarters of double-digit sales growth since the third quarter of fiscal 2018. In the company’s latest reported quarter (ended October 30, 2021), the Aerie banner maintained strong growth momentum, with double-digit sales growth on a two-year basis while the American Eagle (AE) banner saw strong sales improvement, posting single-digit sales growth on a two-year basis. By 2023, American Eagle Outfitters aims to achieve revenues of $5.5 billion, which will likely increase its sector share to 2.0%, from 1.6% in 2020. The growth will be mainly contributed by its Aerie banner. In the third-quarter earnings call, the company noted that Aerie remains on track to reach the milestone of $2 billion in sales by 2023. The company expects to benefit from digital growth and expanding underpenetrated markets by opening 60–65 Aerie stores across the globe annually. We believe Aerie’s brand popularity and strong assortment will continue to help American Eagle Outfitters in expanding its customer base. Furthermore, Aerie’s activewear line OFFLINE, launched in July 2020, will support the brand’s revenues in 2022 and beyond. Gap Inc.: Athleta and Old Navy have been the main growth drivers for Gap Inc. in recent years. On the other hand, sales weakness at the company’s Gap and Banana Republic banners are weighing on the company’s operating margins. In recent quarters, Gap Inc. has witnessed solid recoveries from the impact of the pandemic, mainly driven by strong activewear and athleisure sales under its Old Navy and Athleta banners. We believe that Old Navy will continue to benefit from the recent outstanding growth of value retail and from its off-mall locations, which comprise nearly 75% of its estate. We also believe that the banner will likely witness market share gains in 2022 across various categories, such as active, denim, dresses and childrenswear. In August 2021, the Old Navy brand announced that it will offer more of its women’s apparel in plus sizes as demand for extended apparel rises in the US. Coresight Research forecasts the US women’s plus-size apparel market will grow 7.6% year over year to around $37 billion in 2022, representing 22.2% of the total women’s apparel market, up from 21.4% in 2021. While Old Navy has been offering a limited selection of plus-size apparel since 2004, the latest effort is aimed toward seizing the opportunity in the extended size apparel market and positioning itself as a more inclusive banner. The Athleta brand remains well positioned to capitalize on the growth of the athletic apparel market, supported by a strong health and wellness trend and the growing casualization trend in the US apparel and footwear market.Figure 2. US: American Eagle Outfitters vs. Gap Inc.—Revenue (Left Axis; USD Bil.) and Revenue Growth (Right Axis; YoY %) [caption id="attachment_141396" align="aligncenter" width="700"]

Note: American Eagle Outfitters and Gap Inc.’s latest fiscal year ended January 30, 2021 *Trailing 12 months ended October 31, 2021

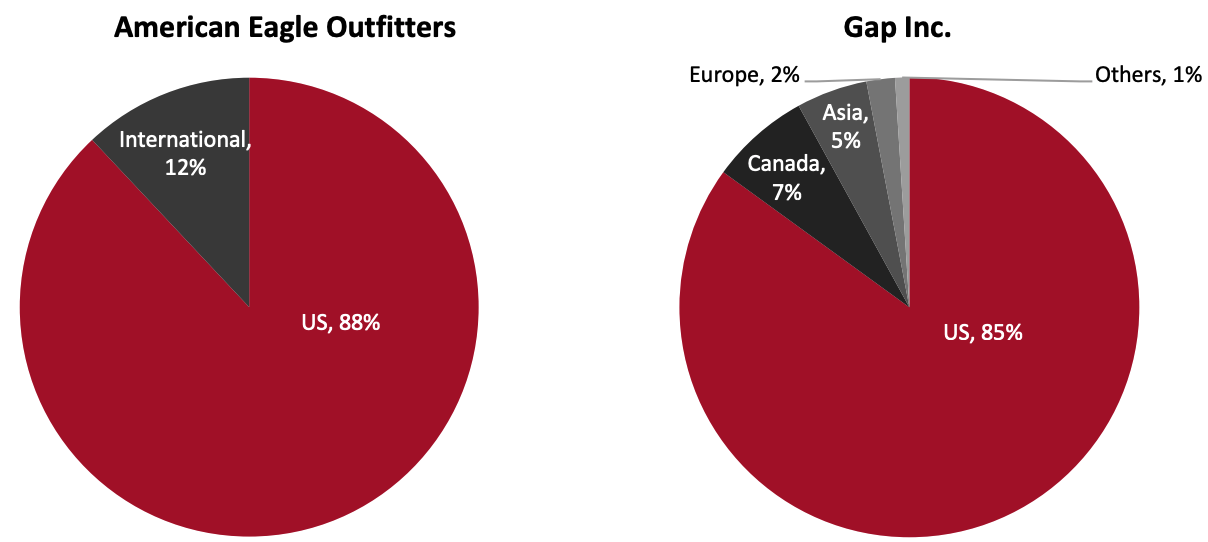

Note: American Eagle Outfitters and Gap Inc.’s latest fiscal year ended January 30, 2021 *Trailing 12 months ended October 31, 2021Source: Company reports[/caption] By Geography Both American Eagle Outfitters and Gap Inc. generate a majority of their revenues from the US market. In 2020, the US comprised 88% of American Eagle Outfitters’ total sales and 85% of Gap Inc.’s sales.

Figure 3. American Eagle Outfitters vs. Gap Inc.: Revenue by Geography, Latest Fiscal Year* (%) [caption id="attachment_141397" align="aligncenter" width="700"]

*Fiscal 2020, ended January 30, 2021

*Fiscal 2020, ended January 30, 2021Source: Company reports[/caption] By Category American Eagle Outfitters and Gap Inc. do not provide a revenue breakdown by category. However, in their recent earnings calls, both companies highlighted the key apparel categories that are gaining momentum. In the third quarter of the earnings call held in November 2021, American Eagle Outfitters’ management said that the company is seeing strong demand across all product categories, including its new activewear brand, OFFLINE by Aerie. CEO Jennifer Foyle said:

Core intimates, bralettes and apparel and swimwear saw strong demand. We continue to gain meaningful market share in swimwear as Aerie is becoming a true destination in the category. Aerie signature bralettes and leggings are showing incredible growth and also very pleased by the success of our OFFLINE activewear brand, which continues to gain traction.

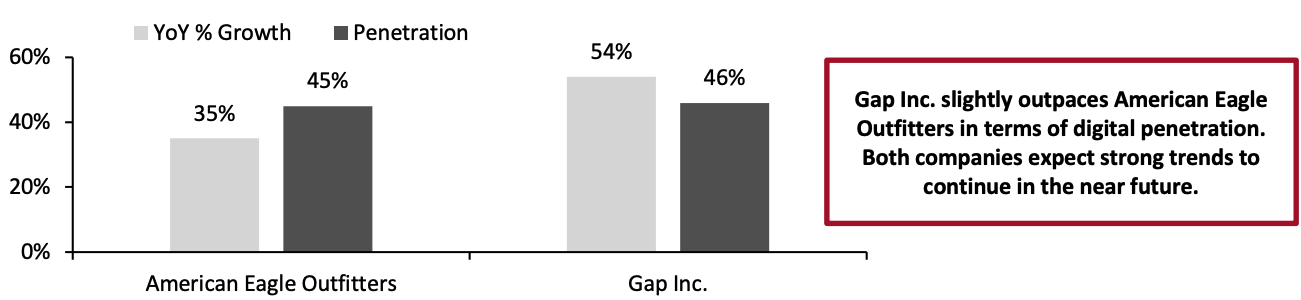

Similarly, in its third-quarter call, Gap Inc. noted that it is seeing strong growth in its childrenswear segment. CEO Sonia Syngal said, “Our kids and baby business has been a point of strength in both Old Navy and Gap. In between the two brands, we represent 9% of the market.” E-Commerce Both American Eagle Outfitters and Gap Inc. are expanding their e-commerce businesses, with Gap Inc. marginally outpacing American Eagle Outfitters in terms of digital penetration. Neither company provides e-commerce sales segregation by geographic region. American Eagle Outfitters: In fiscal 2020 ended January 30, 2021, the company’s e-commerce sales increased by 35% year over year and accounted for 45% of total sales, up from just 29% in fiscal 2019. While the company’s digital penetration slightly eased in 2021, it remained quite strong. In the first nine months of 2021, the company’s digital penetration was 35%. The company expects the current digital penetration trends to continue in fiscal 2022. Gap Inc.: Global e-commerce sales were up 54% for fiscal 2020 ended January 30, 2021, accounting for 46% of the company’s total sales, up from only 25% in fiscal 2019. In the first nine months of 2021, the company’s digital penetration remained strong at 38%. Management expects digital penetration to reach 50% by 2023.Figure 4. American Eagle Outfitters vs. Gap Inc.: Global Online Revenue Growth (YoY %) and Digital Penetration (Online Sales as a % of Total Sales), Latest Fiscal Year* [caption id="attachment_141399" align="aligncenter" width="700"]

*Fiscal 2020, ended January 30, 2021

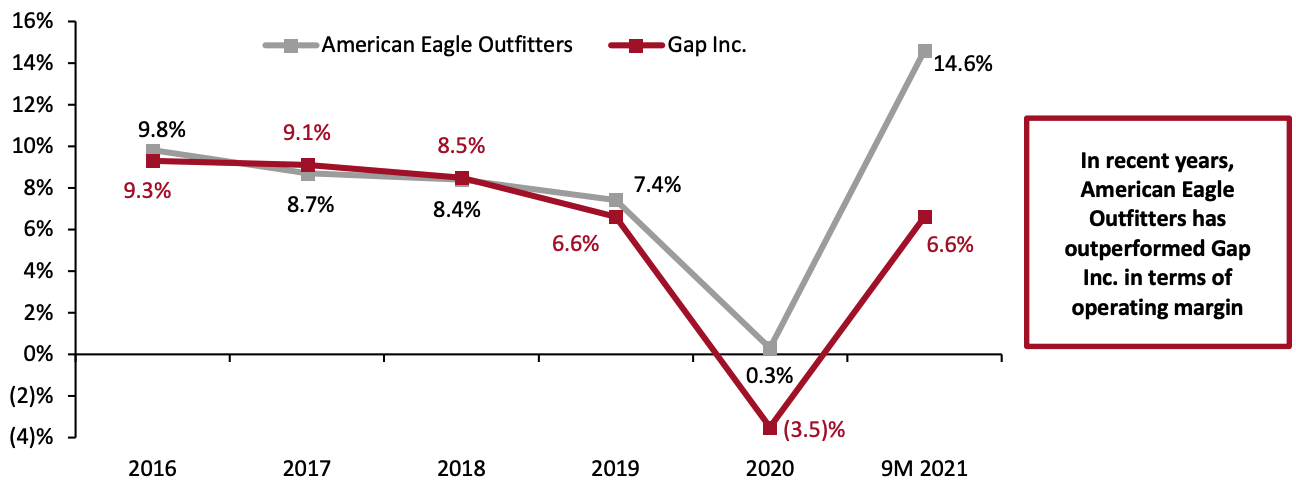

*Fiscal 2020, ended January 30, 2021Source: Company reports[/caption] 2. Operating Margins In the past couple of years, American Eagle Outfitters has outperformed Gap Inc. in terms of operating margins, mainly due to poor performance by the latter’s Gap and Banana Republic banners. By 2023, both American Eagle Outfitters and Gap Inc. aim to achieve a stabilized operating margin of 10% by achieving strong digital growth, delivering cost savings and rationalizing their store fleets.

Figure 5. American Eagle Outfitters vs. Gap Inc.: Operating Margin (%) [caption id="attachment_141402" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

3. Shopper Profiles

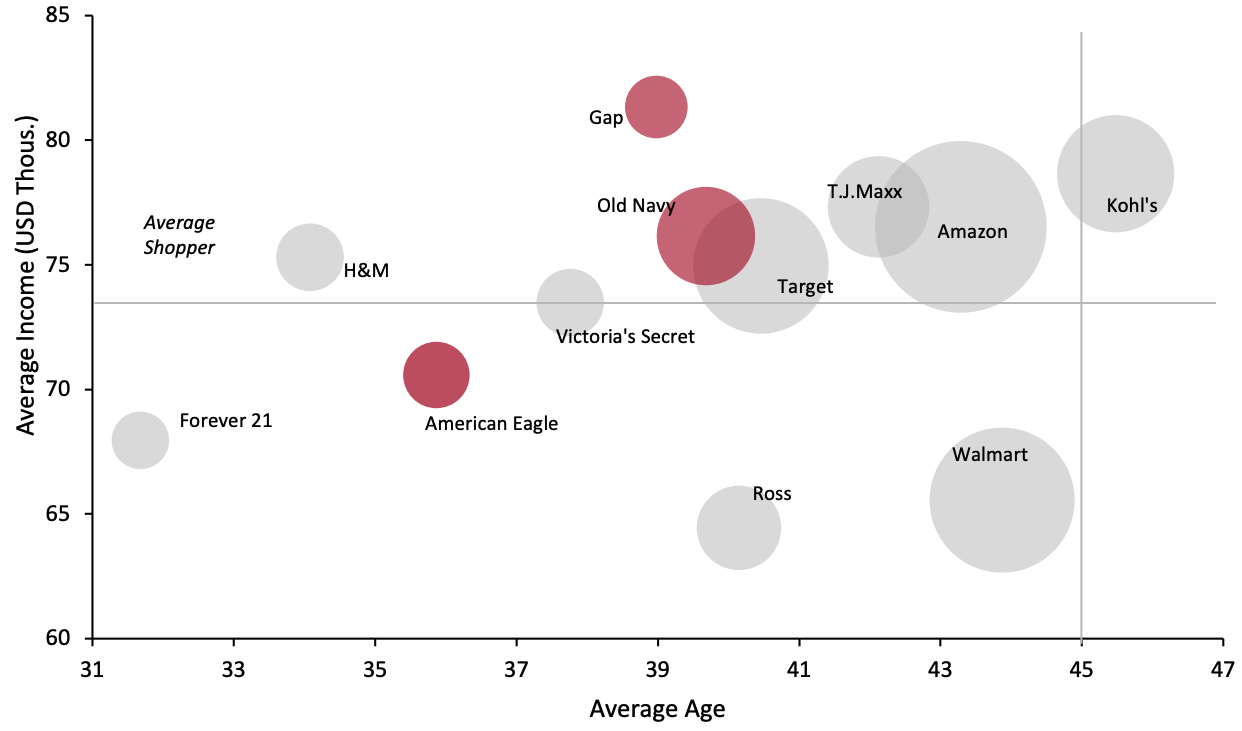

American Eagle Outfitters’ customers are, on average, younger but slightly less affluent than Gap Inc. customers, according to Coresight Research analysis.

The average age of AE’s 18+ customers comes in in the mid-30s, compared to the top end of the 30s for Gap and around 40 for Old Navy, according to Coresight Research’s analysis of a survey of 1,818 US clothing and footwear shoppers conducted in March 2021.; note that our survey was conducted only among those aged 18+, which is likely to skew the average higher versus actual shoppers, which will include some element of under-18s. The average age of the Aerie brand’s customers is 20, while the average ages of Athleta’s and Banana Republic’s target audiences are 40 and 30, respectively, according to company reports.

AE customers are less affluent when we compare them to Gap and Old Navy banners, and this is likely to be in part a reflection of the age profile.

Source: Company reports/Coresight Research[/caption]

3. Shopper Profiles

American Eagle Outfitters’ customers are, on average, younger but slightly less affluent than Gap Inc. customers, according to Coresight Research analysis.

The average age of AE’s 18+ customers comes in in the mid-30s, compared to the top end of the 30s for Gap and around 40 for Old Navy, according to Coresight Research’s analysis of a survey of 1,818 US clothing and footwear shoppers conducted in March 2021.; note that our survey was conducted only among those aged 18+, which is likely to skew the average higher versus actual shoppers, which will include some element of under-18s. The average age of the Aerie brand’s customers is 20, while the average ages of Athleta’s and Banana Republic’s target audiences are 40 and 30, respectively, according to company reports.

AE customers are less affluent when we compare them to Gap and Old Navy banners, and this is likely to be in part a reflection of the age profile.

Figure 6. Clothing/Footwear Shopper Profiles for American Eagle, Gap and Old Navy vs. Selected Competitors: Average Age and Average Annual Household Income (USD Thous.) [caption id="attachment_141404" align="aligncenter" width="700"]

Base: 1,818 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed in March 2021

Base: 1,818 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed in March 2021Bubble sizes represent number of shoppers; cross-hairs represent the average of all those who had bought clothing or footwear in the past 12 months; all averages exclude under-18s; averages calculated using midpoints of age/income bands

Source: Coresight Research[/caption] 4. Key Business Strategy We compare the key business strategies documented by each company. In March 2021, both American Eagle Outfitters and Gap Inc. laid out their strategies, which focus on four key areas, as shown in Figure 7.

Figure 7. American Eagle Outfitters vs. Gap Inc.: Key Business Strategies [wpdatatable id=1709]

Source: Company reports

5. Business Expansion Through M&A and Key Strategic Partnerships While both retailers are looking to bolster their businesses through acquisitions and strategic partnerships, Gap Inc. is more aggressive than American Eagle Outfitters, particularly in terms of partnerships. Below, we provide some of the recent key M&A activities and collaborations carried out by these two apparel and footwear specialists. M&A Gap Inc.: In October 2021, Gap Inc. acquired artificial intelligence (AI) and machine learning startup Context-Based 4 Casting (CB4), which utilizes predictive analytics and demand sensing to transform retail operations, enhance the customer experience and boost revenues. Sally Gilligan, Gap Inc.’s Chief Growth Transformation Officer, said:Gap has experience working with CB4’s world-class data scientists, so we understand the impact and the wide applications their science can have across sales, inventory and consumer insights, as well as its potential to unlock value and enhance the customer experience.

In addition, in August 2021, Gap Inc. acquired the e-commerce startup Drapr, which is built on technology that lets shoppers quickly create 3D avatars and virtually try on clothing. Gilligan said:Fit is the number one point of friction for customers and, through their advanced 3D technology, Drapr has shown it can help shoppers efficiently find the size and fit they need. We plan to leverage Drapr to help Gap Inc. improve the fit experience for our customers and accelerate our ongoing digital transformation.

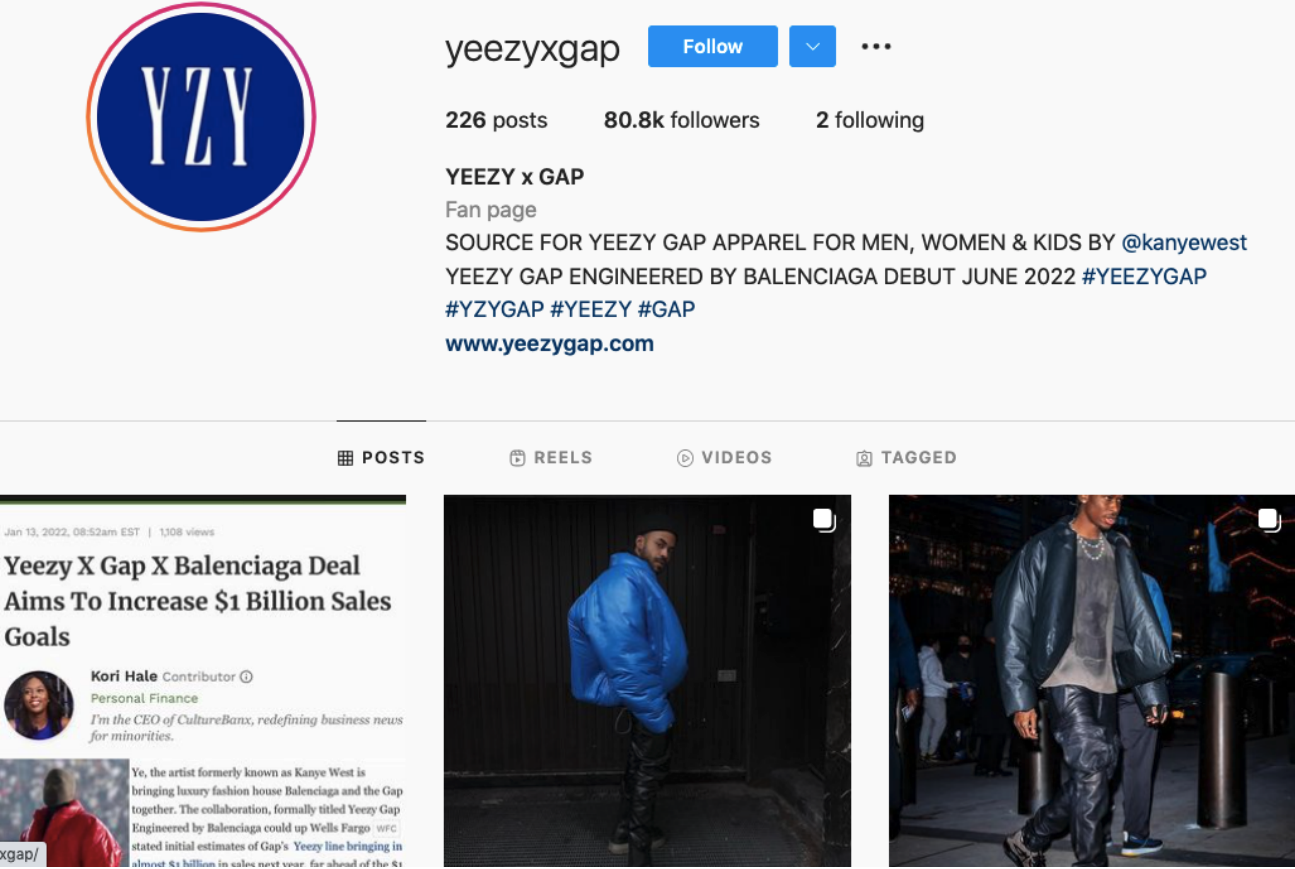

American Eagle Outfitters: Like Gap Inc., American Eagle Outfitters is also utilizing inorganic means to enhance its customer experience and boost sales. In December 2021, American Eagle Outfitters acquired its supply chain partner Quiet Logistics for $360 million in cash, marking the next step in the retailer’s ongoing supply chain transformation. Quiet Logistics serves more than 50 direct-to-consumer and omnichannel brands through its network of in-market fulfillment centers in Boston, Dallas, Jacksonville, Los Angeles and St. Louis. The logistics company utilizes automated technologies and access to labor pools outside of traditional hubs to enable product positioning close to stores and customers. This creates inventory efficiencies and freight cost savings to its clients relative to traditional third-party fulfillment networks. The acquisition will support American Eagle Outfitters’ ongoing growth while driving economies of scale as the retailer expands its customer base to other brands and other retailers seek advanced logistics capabilities. Quiet Logistics will continue to operate its business independently while being a wholly-owned subsidiary of American Eagle Outfitters. In the near future, we expect Gap Inc. and American Eagle Outfitters to acquire more innovative startups to drive business expansion, as well as an additive to their current offerings. Key Strategic Partnerships Both Gap Inc. and American Eagle Outfitters have been capitalizing on their recent strategic partnerships; however, the former’s recent strategic collaborations are more vital in terms of business expansion and gaining long-term strategic advantage as compared to the latter. Gap Inc.: In June 2021, Gap Inc. collaborated with Kanye West’s streetwear brand Yeezy for the launch of a new collection: Yeezy x Gap, round jackets in black and blue colors. It was the first product of the 10-year deal signed by the two companies in June 2020. Similarly, in September 2021, Yeezy x Gap rolled out a hoodie in six colors for both adults and kids. In the third quarter 2021 earnings call held in November 2021, Gap Inc. noted that the Yeezy x Gap hoodie delivered the most sales by an item in a single day in Gap.com history. Furthermore, Gap Inc.’s management said that more than 70% of the customers buying the Yeezy x Gap hoodie collection were new to the company. The collaboration is unlocking the power of a new audience for the apparel specialty retailer, particularly Gen Z and Gen X men from diverse backgrounds. The deal has a renewal option in June 2025—within five years of signing the agreement. At the five-year point, Gap Inc. expects the Yeezy x Gap collection to generate $1 billion in annual sales. Furthermore, in January 2022, Gap Inc. and Yeezy entered into a partnership with the Spanish luxury fashion company Balenciaga to launch a new collection, Yeezy x Gap by Balenciaga, in June 2022. We believe such brand mashups can help Gap to drive consumer engagement, tap new audiences and enhance brand status. [caption id="attachment_141405" align="aligncenter" width="700"] Yeezy x Gap page on Instagram

Yeezy x Gap page on InstagramSource: Instagram[/caption] In May 2021, Gap Inc. entered into a multi-year partnership with retail giant Walmart, through which it launched Gap Home, a new line of branded home décor products. Through this partnership, Gap Inc. aims to gain access to Walmart’s broad customer base. Furthermore, in October 2021, the apparel specialty retailer expanded its partnership with Walmart to introduce a furniture collection. In the company’s press release, Adrienne Gernand, Head of Gap Strategic Alliances, Licensing and Real Estate, said:

We have seen an incredible customer response to Gap Home since we launched in June. Through our partnership with Walmart, we are scaling the business quickly by entering new categories within the home space and introducing an assortment of items in select Walmart stores.

American Eagle Outfitters: As compared to Gap Inc., American Eagle Outfitters’ recent partnerships have been less expansive but still notable. In August 2021, American Eagle Outfitters partnered with the US-based livestreaming platform Twitch. As part of the alliance, the apparel specialty retailer will get category exclusivity, “Always-On” in-stream branded integrations, custom segments, product placement and co-marketing rights, among others, on the livestreaming platform. Furthermore, American Eagle Outfitters will design an exclusive limited-edition clothing line based on the input of creators featured in the series. Likewise, in July 2021, American Eagle Outfitters collaborated with Snapchat to launch the “Dress Yourself” augmented reality (AR) experience to allow shoppers to try on and buy selected looks from the collection in AR using the self-facing camera. 6. Data-Driven Personalization, Inventory Management and Marketing Both American Eagle Outfitters and Gap Inc. are utilizing data analytics and machine learning to enhance their inventory management operations and provide their customers with personalized product experiences and improved product searches, among others. American Eagle Outfitters: The retailer capitalizes on Google Cloud’s data and machine learning capabilities to enhance product assortment, pricing and promotion decisions, and improve the in-store experience. The migration to BigQuery, Google Cloud’s enterprise data warehouse, is helping American Eagle Outfitters to bring all of its clickstream data, coming from billions of hits, to its mobile platforms and websites to better understand online shopper activity in real-time. In addition, American Eagle Outfitters has also collaborated with cloud analytics platform Core Compete (owned by Accenture) to quickly conduct in-store testing on sales promotions using consumer data from times before the promotion begins and real-time sales performance. This is helping the retailer understand the effectiveness of various types of sales promotions in terms of sales conversion and customer reach. This understanding influences decisions on fixing ineffective sales promotions. A key source of consumer data is American Eagle Outfitters’ digitized loyalty program launched in June 2020: Real Rewards by American Eagle and Aerie. As of January 2021, the company had 19 million members under its loyalty program. About one-third of American Eagle Outfitter’s loyalty program members spent nearly twice that of its average customer annually in the trailing 12 months ended September 30, 2021. [caption id="attachment_141407" align="aligncenter" width="700"] American Eagle Outfitters capitalizes loyalty program data to enhance product assortment, and pricing and promotion decisions

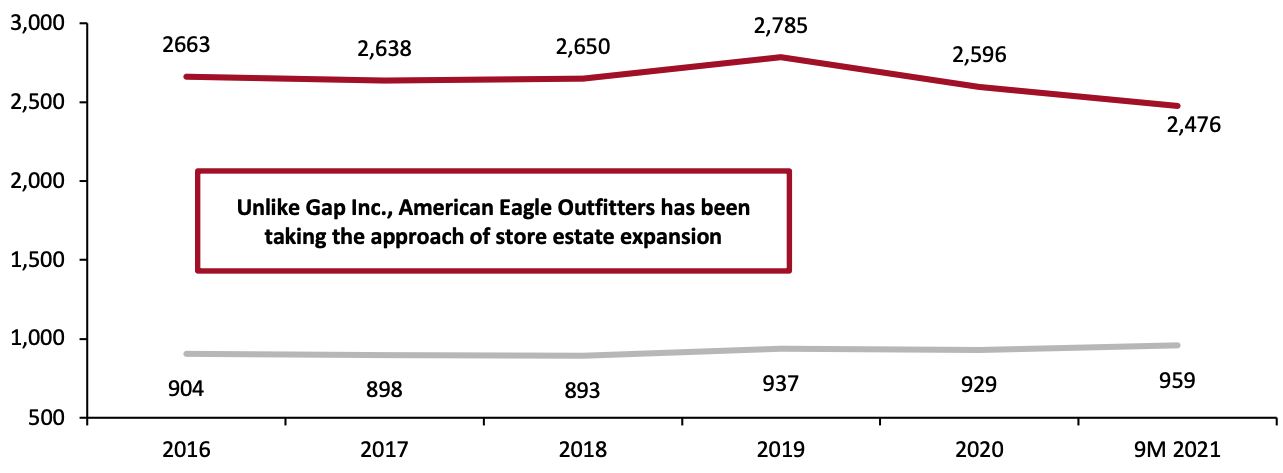

American Eagle Outfitters capitalizes loyalty program data to enhance product assortment, and pricing and promotion decisionsSource: Company website[/caption] Gap Inc.: In recent years, Gap Inc. has been applying advanced analytics to its existing shopper profile to look at their demographic, geographic and psychographic insights to drive relevant engagement with its customers through personalized emails, onsite experiences based on shopping channel preference, product affinity and loyalty status, further driving the product lifecycle. In 2018, Gap Inc. entered into a multi-year partnership with Microsoft to enhance all aspects of business, from in-store customer experience to inventory logistics to improved personalization analytics. By centralizing its data platform on Microsoft Azure, Gap Inc. applied data science and machine learning to deliver personalized marketing, merchandising and service for all brands in the retailer’s portfolio. Furthermore, Gap Inc. deployed Microsoft BI and Microsoft 365 solutions to empower its employees across its brands and functions with more creative ways to collaborate and share insights with one another. Like American Eagle Outfitters, Gap Inc’s key source of data comes from its combined loyalty program (one program for all banners), which has over 45 million members as of September 2021. These members are twice more likely to purchase across brands and thrice more likely to buy across shopping channels, as compared to non-members. 7. Brick-and-Mortar Strategy and Digital Expansion In recent years, American Eagle Outfitters has extended its total store estates in the US; however, while Aerie’s stores have grown in numbers, AE’s stores have shrunk. On the other hand, Gap Inc. has shrunk its store network in the US, with major closures seen in the Banana Republic and Gap banners. Going forward, American Eagle Outfitters will continue to expand its Aerie store estates (60–65 stores openings planned annually) while rationalizing AE stores. On the other hand, Gap Inc. focuses on expanding its store network of Athleta and Old Navy stores. In November 2021, Athleta opened a new 4,800-square-foot retail store in Toronto, its second company-operated store in Canada. Athleta sees this as an advance towards its goal to reach $2 billion in sales by 2023.

Figure 8. US: American Eagle Outfitters vs. Gap Inc.—Total Store Portfolio [caption id="attachment_141408" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Both American Eagle Outfitters and Gap Inc. are ramping up their digital operations, including expanding fulfillment capabilities and offering buy online, pick up in-store (BOPIS) and flexible payment facilities, among others, through key investments and partnerships.

American Eagle Outfitters: In fiscal 2020, American Eagle Outfitters spent $27.5 million in bolstering its digital capabilities, including expansion of distribution facilities and curbside pickups. The company guided for an even higher expenditure in digital capabilities for fiscal 2021, ending January 30, 2022.

Similarly, the company continues to expand its last-mile delivery capabilities, including through the recent acquisition of Quiet Logistics in December 2021. Furthermore, in June 2021, American Eagle Outfitters expanded its partnership with FedEx subsidiary ShopRunner to offer same-day delivery in 50 cities across the US, up from just six cities during the pilot phase commenced in October 2020. American Eagle Outfitters’ COO, Michael Rempell, said:

Source: Company reports/Coresight Research[/caption]

Both American Eagle Outfitters and Gap Inc. are ramping up their digital operations, including expanding fulfillment capabilities and offering buy online, pick up in-store (BOPIS) and flexible payment facilities, among others, through key investments and partnerships.

American Eagle Outfitters: In fiscal 2020, American Eagle Outfitters spent $27.5 million in bolstering its digital capabilities, including expansion of distribution facilities and curbside pickups. The company guided for an even higher expenditure in digital capabilities for fiscal 2021, ending January 30, 2022.

Similarly, the company continues to expand its last-mile delivery capabilities, including through the recent acquisition of Quiet Logistics in December 2021. Furthermore, in June 2021, American Eagle Outfitters expanded its partnership with FedEx subsidiary ShopRunner to offer same-day delivery in 50 cities across the US, up from just six cities during the pilot phase commenced in October 2020. American Eagle Outfitters’ COO, Michael Rempell, said:

ShopRunner’s free same-day delivery service allows us to build on our already strong omnichannel delivery platform and offer even more ways for our customers to quickly and easily shop the American Eagle and Aerie brands.

Gap Inc.: In September 2021, the retailer announced that it had launched new fulfillment capabilities ahead of the holiday season by investing more than $100 million in its fulfillment centers in Phoenix, Arizona and Gallatin, Tennessee. The new capabilities include increased automation and greater order processing power. Earlier in February 2021, Gap Inc. also announced plans to invest $140 million to open an 850,000-square-foot Customer Experience Center in Texas to support Old Navy’s expanding online business. The new facility, which is expected to be operational by August 2022, will feature automated technologies to meet customers’ evolving needs. 8. ESG Initiatives Both American Eagle Outfitters and Gap Inc. have accelerated the pace of their activities, promoting diversity, inclusion and sustainability. American Eagle Outfitters: The Aerie banner’s competitive advantage lies in its “inclusive” value proposition—for instance, its marketing campaigns focus on body positivity with unretouched images of women with disabilities and different body types, medical needs and racial backgrounds. Aerie’s marketing message and branding strategy will likely continue to broaden its customer base to include more young consumers and social media influencers. The company is also ramping up sustainable initiatives for its American Eagle banner. In September 2021, American Eagle Outfitters launched AE77, a new sustainably crafted premium denim brand for men and women. The collection is made up of 100% organic cotton, uses more sustainable manufacturing techniques and raw materials, and reduces water usage, reiterating the company’s commitment to sustainability. In January 2021, American Eagle Outfitters laid out sustainability goals during its Investor Day:- The company aims to be carbon neutral in its company-owned facilities by 2030, with a commitment to also reduce water usage and ensure sustainable material sourcing.

- By 2023, American Eagle Outfitters plans to reduce the water used to produce each pair of its jeans by 30% and achieve 100% sustainable cotton sourcing.

- Moreover, the company stated that it aims to reduce labeling on its products and convert labels to sustainably sourced materials where possible.

American Eagle Outfitter’ sustainably crafted denim brand AE77 store opened in New York City’s SoHo neighborhood in September 2021

American Eagle Outfitter’ sustainably crafted denim brand AE77 store opened in New York City’s SoHo neighborhood in September 2021Source: American Eagle Outfitters[/caption] Gap Inc.: The company highlighted its key actions promoting sustainability and diversity in its “Global Sustainability Report 2020” published in September 2021:

- Source 100% renewable energy by 2030 for globally owned and operated facilities

- Derive 100% of its cotton from more sustainable sources by 2025

- Become carbon neutral and water positive (creating more water than they are using) by 2050

- Eliminate single-use plastics by 2030

- Enhance access to drinking water and sanitation for 2 million people in India’s textile manufacturing communities by 2023

- Old Navy brand to use 100% sustainably sourced cotton by 2022

- Old Navy brand to eliminate plastic shopping bags by 2023 in Canada, Mexico and the US

Gap Inc.’s Pride 2021 campaign supporting the LGBTBQ+ community

Gap Inc.’s Pride 2021 campaign supporting the LGBTBQ+ communitySource: Company website[/caption]