DIpil Das

Introduction

What’s the Story? Aerie (owned by American Eagle Outfitters) and Victoria’s Secret (a spin-off from L Brands) are the largest retailers in the US women’s underwear market. While Aerie is relatively new with regard to its competitor, the company has struck the right chord with consumers through its diverse and inclusive campaigns and trend identification strategies. Victoria’s Secret lagged in these areas and is now playing catch-up through various transformation measures. As part of Coresight Research’s Head-to-Head series, we provide insights into the two retailers’ revenues, as well as operating margins, shopper profiles, key expansion strategies, digital strategies and environmental, social and governance (ESG) initiatives. Why It Matters The US women’s underwear market is set to grow from $12.9 billion in 2021 to $15.1 billion by 2026, with a sales CAGR of 3.1%, according to Euromonitor International and Coresight Research estimates. As of 2021, Victoria’s Secret brand holds a 26.7% share of the US women’s underwear market, while Aerie holds 9.6%. While Victoria’s Secret has maintained its leading position in the US women’s underwear market for more than a decade, Aerie is the fastest-growing women’s underwear retailer in the US. The scale and leading market position of the retailers make for insightful comparisons.Aerie vs. Victoria’s Secret: Coresight Research Analysis

Business Overview While this report focuses on the women’s underwear category, both retailers sell a wide range of apparel and accessories, including activewear, bottoms, dresses, loungewear, nightwear, swimwear and tops. Both Aerie and Victoria’s Secret also sell beauty and personal care products. We provide an overview of key metrics for Aerie and Victoria’s Secret in Figure 1.Figure 1. Company Overviews: Aerie and Victoria’s Secret [wpdatatable id=1898 table_view=regular]

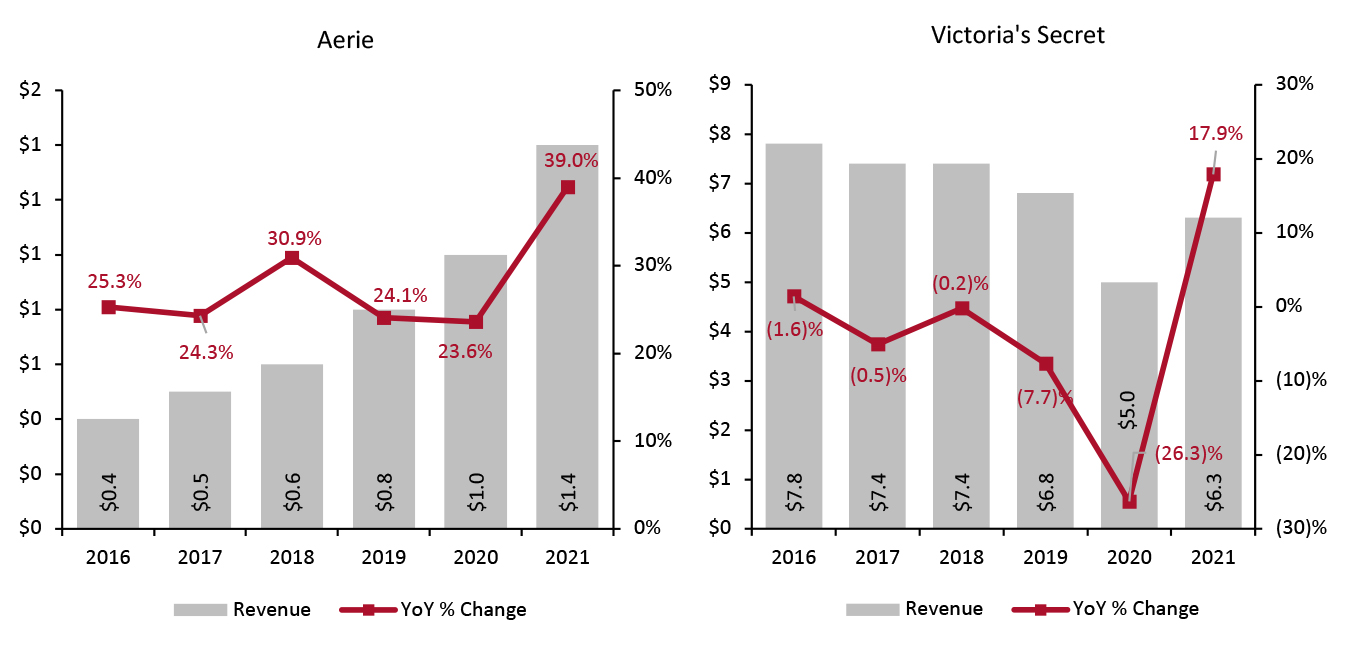

Both companies’ latest fiscal year ended on January 29, 2022 Source: Company reports/Coresight Research 1. Revenue Growth Over the past five fiscal years, Aerie has outpaced Victoria’s Secret in terms of revenue growth. From 2016–2021, Aerie reported a sales CAGR of 28.5% versus (4.2)% at Victoria’s Secret. Although Aerie is behind Victoria’s Secret in terms of total revenue, the former is quickly gaining a share of the US women’s underwear market. Below, we discuss the primary factors impacting revenue for these retailers. Aerie: Aerie has posted 29 consecutive quarters of double-digit sales growth since the third quarter of fiscal 2018. In its latest reported quarter (ended January 29, 2022), Aerie maintained strong growth momentum, with double-digit sales growth on a two-year basis. In its fourth-quarter 2021 earnings call, American Eagle Outfitters stated that Aerie remains on track to reach a new milestone of $2.2 billion (up from the previous target of $2.0 billion) in sales by 2023. American Eagle Outfitters expects to benefit from digital growth and expanding underpenetrated markets by opening 60–65 Aerie stores across the globe in fiscal 2022 and fiscal 2023. Aerie’s ability to identify emerging trends in apparel and act on them early has been a key revenue growth driver for the retailer. For instance, Aerie became a pioneer in casual and comfortable intimate clothing at the time when consumers were complaining that intimate apparel from Victoria’s Secret was uncomfortable, outdated and not targeted at women of all body sizes. Over the years, Aerie has become a “go-to brand” for casual and comfortable apparel—initially in intimate clothing and later in bottoms and tops. Moreover, Aerie has strongly benefitted from multi-channel retailing, with its digital channels witnessing robust growth since the beginning of the pandemic. Aerie’s key competitive advantage lies in its inclusive value proposition—for instance, its marketing campaigns focus on body positivity with unretouched images of women with disabilities and different body types, medical needs and racial backgrounds. Aerie started ramping up its inclusive and diverse initiatives in 2014 when it launched its first “AerieREAL” campaign featuring models of all sizes in photoshop-free images demonstrating that the “real you is the best you.” In August 2021, Aerie launched the “AerieREAL Voices” campaign to push real stories to the forefront and celebrate a community that promotes positivity and women’s empowerment. Over the years, Aerie’s brand ambassadors, also called AerieREAL Role Models, have struck a chord with consumers, particularly young audiences, who value body positivity, inclusion, social responsibility and a supportive community. We believe Aerie’s strong marketing message, branding tactics and early trend identification strategies will help it to continue to gain a share of the US women’s underwear market. Furthermore, we believe Aerie’s activewear line OFFLINE, launched in July 2020, will support the brand’s revenues in 2022 and beyond. Victoria’s Secret: Victoria’s Secret’s sales declines in recent years suggests a loss of customers over the period—likely due to the company falling out of step with shopper trends. While Victoria’s Secret was dealing with declining sales long before the coronavirus pandemic, the crisis has severely hurt the underwear company. In fiscal 2020, the company’s sales declined by 26.3% year over year, following a 7.7% decline in 2019. Although the company saw recovery in 2021, with sales increasing by 17.9% year over year to $6.3 billion, sales remain 7.4% below the 2019 level. One of the major reasons for the downfall of Victoria’s Secret is the company’s historical lack of diversity in its advertising campaigns, which stood in direct contrast to campaigns focused on inclusivity and women’s empowerment by competitors, including Aerie. For instance, Victoria’s Secret’s stores used outdated images in its advertising, including provocative and ornate underwear styles that were in line with shoppers seeking comfort and modern underwear styles. Moreover, in 2014, Victoria’s Secret faced a massive backlash over its “Perfect Body” campaign, featuring its “Angel” models. Similarly, the company came under fire for only hiring super-skinny models and excluding plus-size models for its annual Victoria’s Secret fashion show in 2018. We believe that Victoria’s Secret’s marketing decisions have substantially influenced the brand’s public perception. However, the company is accelerating its transformation efforts toward inclusivity and diversity, which includes the recent hiring of its first model with Down’s syndrome and the launch of a more inclusive partnership program called The VS Collective. We discuss Victoria’s Secret’s recent key transformation measures in more detail later in the report.

Figure 2. US: Aerie vs. Victoria’s Secret—Revenue (Left Axis; USD Bil.) and Revenue Growth (Right Axis; YoY %) [caption id="attachment_145663" align="aligncenter" width="700"]

Aerie’s and Victoria’s Secret’s latest fiscal year ended on January 29, 2022

Aerie’s and Victoria’s Secret’s latest fiscal year ended on January 29, 2022 Both retailers’ sales include apparel and beauty products, while their market share of the overall US women’s underwear market given earlier includes only underwear

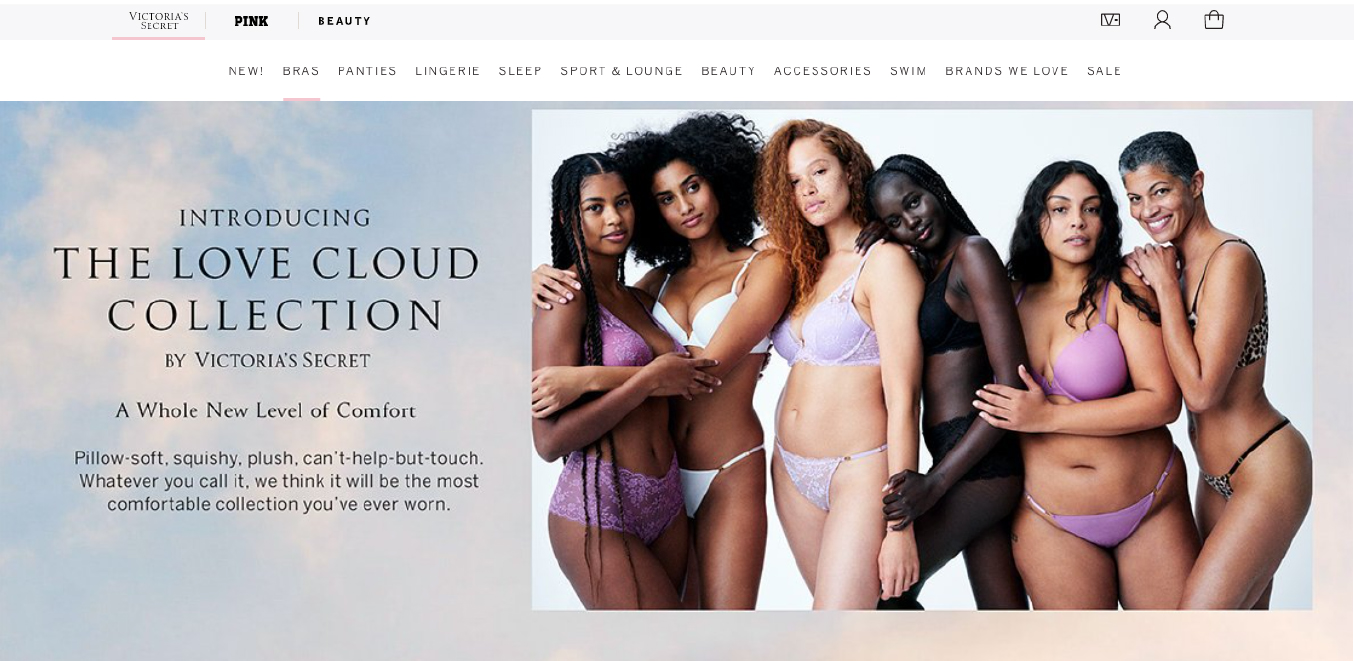

Source: Company reports [/caption] By Category Aerie and Victoria’s Secret do not provide a revenue breakdown by category. However, in their recent earnings calls, both retailers highlighted the key categories that are gaining momentum. Aerie: Aerie is witnessing robust demand for its core intimates, apparel, bralettes and swimwear categories, and is gaining substantial market share, according to the company’s management. Furthermore, the retailer is witnessing strong momentum in its OFFLINE activewear—centered around leggings, which is also one of the highest margin categories for the retailer. Victoria’s Secret: Victoria’s Secret is gaining strong sales momentum in activewear, leggings and shapewear categories, in addition to its core bras, lingerie and swimwear categories. Victoria’s Secret is launching new products and entering new categories to expand its addressable market. For instance, in February 2022, the company launched the Love Cloud collection, its biggest lingerie collection in the last six years, which witnessed encouraging results in the first few weeks since its launch. Victoria’s Secret noted that Love Cloud focuses on comfort while maintaining “sexiness” and functionality. The company’s Love Cloud marketing campaign features an artist and a firefighter, along with a diverse and inclusive group of models to reflect Victoria’s Secret’s new “commitment to welcoming and celebrating all women.” Furthermore, to fill the void in the pre-teen (aged 9–12) market for bras, underwear and comfortable clothing, the company will launch a new online-only underwear brand Happy Nation in fiscal 2022. Similarly, in spring 2022, Victoria’s Secret plans to launch plus-size lingerie collections in collaboration with the lingerie brand Elomi. Victoria’s Secret has also expanded into new product categories. Earlier, in October 2021, Victoria’s Secret launched its first mastectomy bra for women who undergo mastectomies due to breast cancer. In August 2021, Victoria’s Secret launched its Bare Infinity Flex bra with an innovative gel wire technology that helps the bra extend and retract to adapt to breast shape and structure as it fluctuates daily or monthly. In July 2021, the company launched its first maternity bra and sold 100,000 units in one week. We see Victoria’s Secret’s efforts to expand its product offerings as steps in the right direction to bolster its sales and regain its lost share of the US women’s underwear market. [caption id="attachment_145664" align="aligncenter" width="701"]

Victoria’s Secret launched its Love Cloud lingerie collection in February 2022

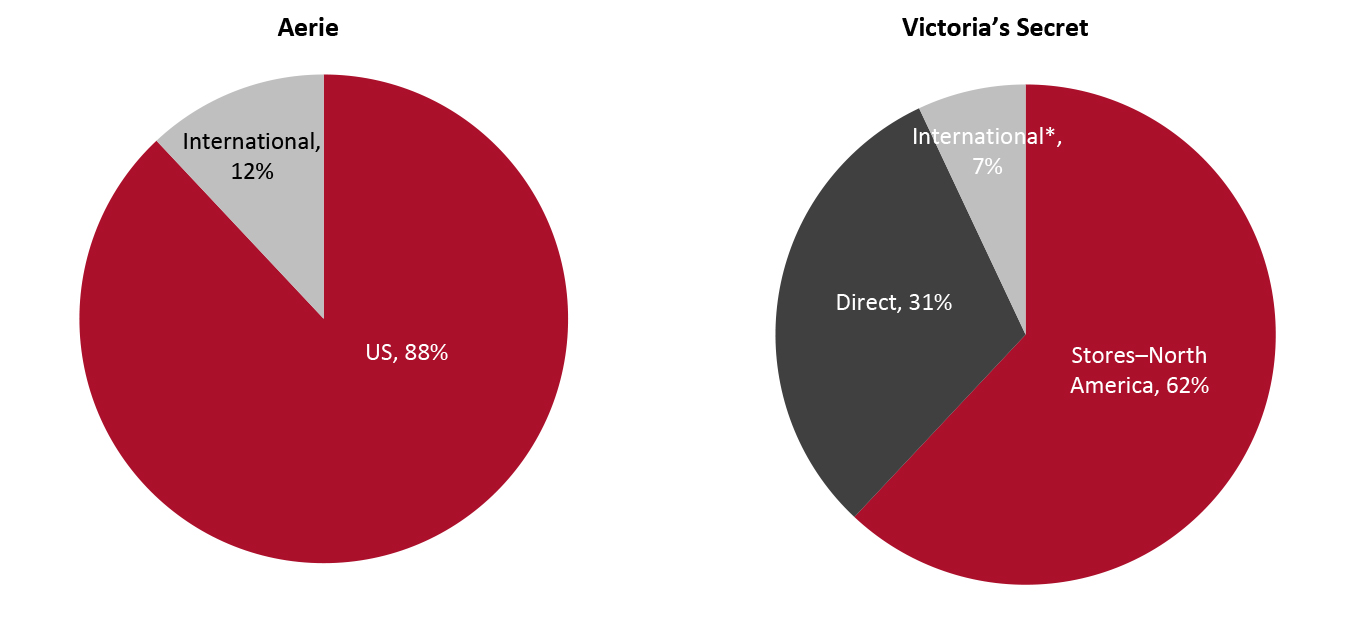

Victoria’s Secret launched its Love Cloud lingerie collection in February 2022 Source: Victoria’s Secret [/caption] By Geography Both Aerie and Victoria’s Secret generate most of their revenues from the US market. Aerie: In 2021, the US comprised about 88% of Aerie’s total sales. Aerie’s international strategy remains digitally-led and capital-light, with stores only in Canada and Mexico. We believe that Aerie has strong scope in the international markets to bolster its business expansion. Victoria’s Secret: Victoria’s Secret’s North American stores comprised 62% of its total sales in fiscal 2021. Victoria’s Secret Direct, the global direct sales arm of the company with major operations in the US, generated 31% of the company’s total revenues in fiscal 2021. In fiscal 2021, the company’s international segment—which includes royalties associated with franchised stores, wholesale sales and the company-operated stores in Greater China and the UK—generated 7% of its total revenues. Victoria’s Secret has active plans to expand internationally, focusing on its key foreign regions, such as China and the UK, through its recent partnerships with Hong Kong-based intimate apparel retailer Regina Miracle and the UK-based apparel retailer Next—which we discuss in detail later in the report. Furthermore, Victoria’s Secret plans to open more than 100 new stores internationally by 2024.

Figure 3. Aerie vs. Victoria’s Secret: Revenue by Geography, Fiscal 2021 (%) [caption id="attachment_145666" align="aligncenter" width="701"]

*Includes royalties associated with franchised stores, wholesale sales and the company-operated stores in Greater China and the UK Fiscal 2021, ended January 29, 2022

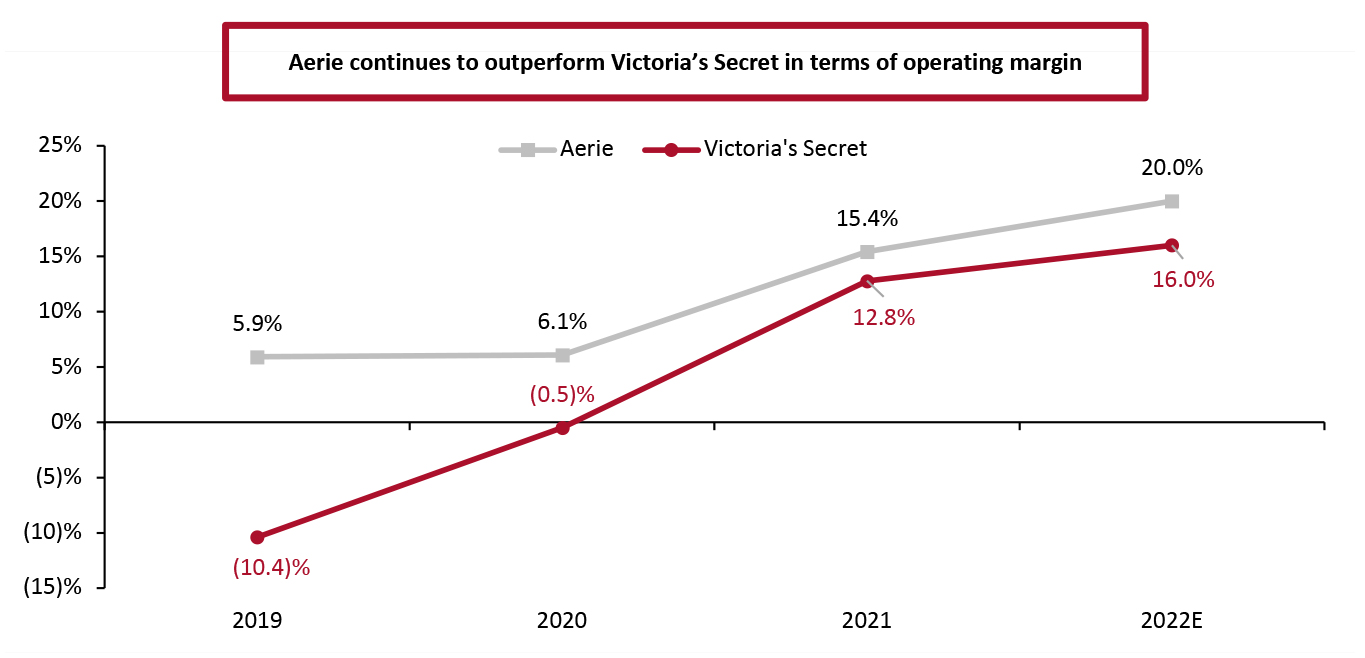

*Includes royalties associated with franchised stores, wholesale sales and the company-operated stores in Greater China and the UK Fiscal 2021, ended January 29, 2022 Source: Company reports [/caption] E-Commerce While both Aerie and Victoria’s Secret are expanding their e-commerce businesses, Aerie substantially outpaces Victoria’s Secret in terms of digital penetration. In 2021, Aerie’s e-commerce business represented nearly 50% of its sales, while Victoria Secret Direct, which operates its online business, comprised 31% of Victoria’s Secret’s sales. Neither company provides e-commerce sales segregation by geographic region. The reason Aerie has a bigger online business (in terms of digital penetration) than Victoria’s Secret is that the former was quicker in ramping up its digital operations, including expanding fulfillment capabilities and offering buy online, pick up in-store (BOPIS) and flexible payment facilities, among others. Victoria’s Secret is a little late in expanding its e-commerce capabilities and trying to play catchup—with plans to expand its BOPIS and ship-from-store capabilities in 2022. 2. Operating Margins In the past three years, Aerie has reported strong operating margins and substantially outperformed Victoria’s Secret, and the former is expected to outpace the latter in 2022 too. Aerie: Aerie reported an operating margin of 20% in fiscal 2021, despite headwinds related to industry-wide supply chain disruptions in Vietnam, where Aerie had a strong presence. In the fourth quarter of fiscal 2021, Aerie witnessed uneven inventory flows in its high-margin, high-demand leggings business, and it also took on elevated air freight costs of about $31 million to get its products on time—impacting Aerie’s operating margin by seven percentage points in the quarter. However, management expects the supply chain pressure to ease and margins to improve in fiscal 2022. For fiscal 2022, Aerie expects an operating margin of 20%. Victoria’s Secret: Victoria’s Secret’s operating margin turned positive in 2021 at 12.8%, following negative rates in 2019 and 2020. In the fourth quarter of the fiscal 2021 earnings call held in March 2022, the company noted that strong sales growth, combined with disciplined expense management and merchandise mix, is helping Victoria’s Secret to improve its operating margin. The company’s CEO Martin Waters said that Victoria’s Secret is focusing on several profit improvement initiatives, such as cutting back on sales promotions, doing more limited-edition collections and expanding its in-demand swimwear category assortments to increase margin dollars. For fiscal 2022, Victoria’s Secret expects its operating margin to be around the mid-teens.

Figure 4. Aerie vs. Victoria’s Secret: Operating Margin (%) [caption id="attachment_145665" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

3. Shopper Profiles

Aerie mainly targets customers aged 15–25, while Victoria’s Secret targets shoppers aged 13–50, according to company reports.

While Aerie’s popularity among young audiences remained intact, Victoria’s Secret is taking major steps to turn around its brand image and attract younger consumers. For instance, as mentioned earlier, Victoria’s Secret will launch a new online-only underwear brand Happy Nation for pre-teens (aged 9–12) in fiscal 2022. Through Happy Nation, Victoria’s Secret plans to target younger consumers and parents who are buying underwear and intimate apparel on behalf of their children—we think Happy Nation could be a serious competitor to Aerie among younger audiences.

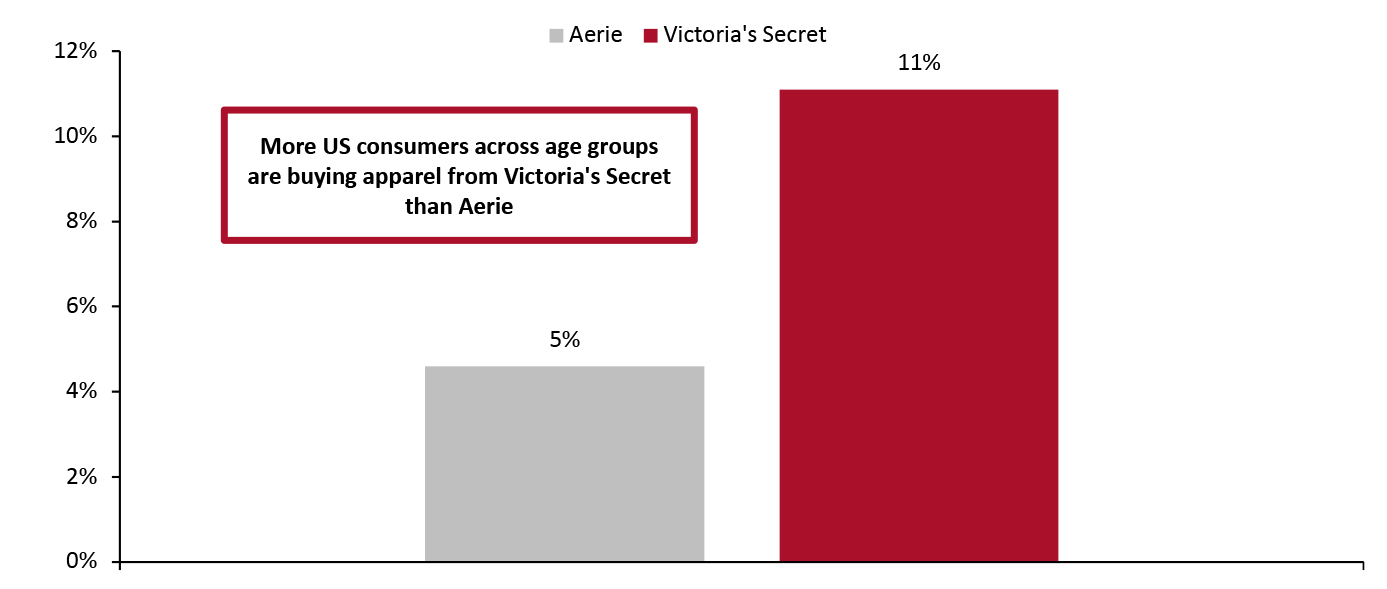

Our new survey data found that more US consumers are buying apparel from Victoria’s Secret as compared to Aerie. In Coresight Research’s proprietary survey of 2,138 US consumers aged 18 years or older, conducted on March 1, 2022, 11% of respondents said that they had purchased clothing from Victoria’s Secret in the past 12 months versus about 5% of respondents who said that they have purchased from Aerie (see Figure 5).

Source: Company reports/Coresight Research[/caption]

3. Shopper Profiles

Aerie mainly targets customers aged 15–25, while Victoria’s Secret targets shoppers aged 13–50, according to company reports.

While Aerie’s popularity among young audiences remained intact, Victoria’s Secret is taking major steps to turn around its brand image and attract younger consumers. For instance, as mentioned earlier, Victoria’s Secret will launch a new online-only underwear brand Happy Nation for pre-teens (aged 9–12) in fiscal 2022. Through Happy Nation, Victoria’s Secret plans to target younger consumers and parents who are buying underwear and intimate apparel on behalf of their children—we think Happy Nation could be a serious competitor to Aerie among younger audiences.

Our new survey data found that more US consumers are buying apparel from Victoria’s Secret as compared to Aerie. In Coresight Research’s proprietary survey of 2,138 US consumers aged 18 years or older, conducted on March 1, 2022, 11% of respondents said that they had purchased clothing from Victoria’s Secret in the past 12 months versus about 5% of respondents who said that they have purchased from Aerie (see Figure 5).

Figure 5. US Apparel Shoppers: Which Retailers Have They Purchased Clothing or Footwear From in the Past 12 Months (% of Respondents) [caption id="attachment_145668" align="aligncenter" width="699"]

Base: 2,138 US Internet users aged 18+ that had bought clothing or footwear in the past 12 months, surveyed on March 1, 2022

Base: 2,138 US Internet users aged 18+ that had bought clothing or footwear in the past 12 months, surveyed on March 1, 2022 The chart includes only Aerie’s and Victoria’s Secret’s data for comparison while it excludes other retailers

Source: Coresight Research [/caption] 4. Key Business Expansion Strategies We compare the key business strategies documented by each company. In March 2022, both Aerie and Victoria’s Secret laid out their strategies, which focus on the three key areas, as shown in Figure 6.

Figure 6. Aerie vs. Victoria’s Secret: Key Business Strategies [wpdatatable id=1899 table_view=regular]

Source: Company reports Key Strategic Partnerships Both Victoria’s Secret and Aerie have been capitalizing on their recent strategic partnerships; however, the former’s recent strategic collaborations are more vital in terms of business transformation and expansion as well as gaining long-term strategic advantage as compared to the latter’s collaborations. Victoria’s Secret: In January 2022, Victoria’s Secret entered a $45 million joint venture deal with China-based intimate apparel company Regina Miracle International to allow Regina Miracle to operate all Victoria’s Secret stores and related online businesses in China. Under the terms of the alliance, Victoria’s Secret will hold a 51% stake, while Regina Miracle will hold a 49% stake. Regina Miracle has been a supplier of Victoria’s Secret for more than 20 years, and we believe that this joint venture will enhance Victoria’s Secret’s China business. In the press release statement, Victoria’s Secret’s CEO Martin Waters said:

Together with Regina Miracle, we aim to grow the China business through joint investment in product development, distribution and marketing. This [joint venture] with Regina Miracle in China completes a multiyear repositioning of the international business of the company and we believe establishes a platform for accelerated sales and earnings growth in the market over the next several years.

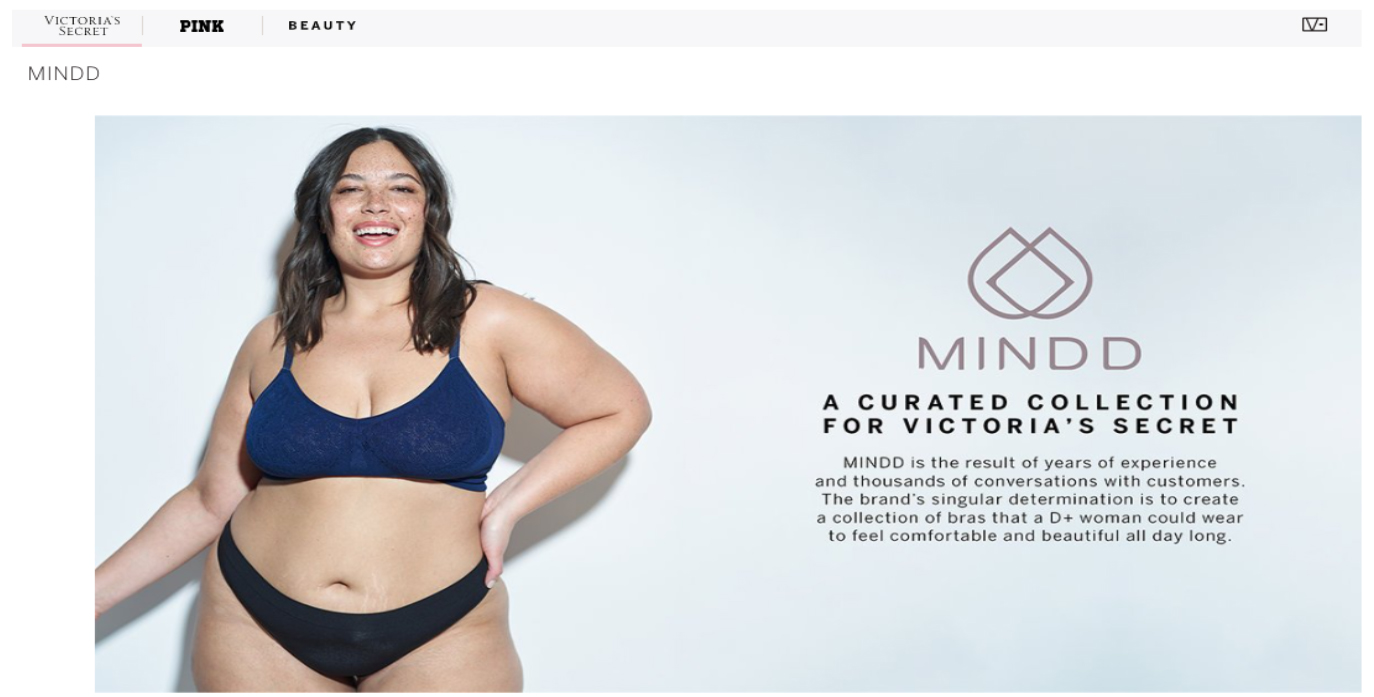

Earlier, in October 2021, Victoria’s Secret partnered with US-based bra company Mindd, which mainly caters to plus-size (D+ sizes) women. According to the terms of the alliance, Victoria’s Secret will be an exclusive retailer for Mindd products in the US. The two companies began working together in early 2021, launching a collection specifically for Victoria’s Secret consumers, which features Mindd bras, seamless underwear and bodysuits available through the “Brands We Love” platform. This collaboration marks a step forward for Victoria’s Secret to free itself of its previous sexist and body-shaming image—focusing on the male gaze—and continue its effort to cater to women on their own terms. Moreover, Victoria’s Secret is looking to expand in the UK plus-size intimate space through its collaboration with the UK-based lingerie brand Elomi in the second half of 2022. [caption id="attachment_145669" align="aligncenter" width="700"] Victoria’s Secret became an exclusive retailer of Mindd, the US-based bra company that mainly caters to plus sizes women, in October 2021

Victoria’s Secret became an exclusive retailer of Mindd, the US-based bra company that mainly caters to plus sizes women, in October 2021 Source: Victoria’s Secret [/caption] Earlier, in September 2020, Victoria’s Secret UK formed a joint venture with the UK-based apparel retailer Next Plc. Under the terms of the alliance, Next Plc. owns a 51% stake in the joint venture, while Victoria’s Secret owns 49%. The new joint venture operates all Victoria’s Secret stores in the UK and Ireland. Through this partnership, Victoria’s Secret aims to capitalize on Next’s capabilities and experience in the UK market to bolster its sales and profit. Aerie: As compared to Victoria’s Secret, Aerie’s recent partnerships have been less expansive but still notable. In August 2021, American Eagle Outfitters (parent company of Aerie) partnered with the US-based livestreaming platform Twitch. As part of the alliance, Aerie will get category exclusivity, “Always-On” in-stream branded integrations, custom segments, product placement and co-marketing rights, among others, on the livestreaming platform. Furthermore, Aerie will design an exclusive limited-edition clothing line based on the input of creators featured in the series.

- Coresight Research has extensive covering of livestreaming e-commerce. Click here to read more.

Figure 7. US: Aerie vs. Victoria’s Secret—Total Store Portfolio [caption id="attachment_145672" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Digital Expansion

Both Aerie and Victoria’s Secret are ramping up their digital operations, including expanding fulfillment capabilities and offering BOPIS and flexible payment facilities, among others. However, Aerie was quicker to embrace e-commerce than Victoria’s Secret.

Aerie: In the fourth quarter of fiscal 2021 ended January 29, 2022, American Eagle Outfitters launched several new online features and expanded its e-commerce capabilities, which will further bolster Aerie’s digital operations. The company expanded its Afterpay buy now, pay later capabilities to the app in the fourth quarter—which drove nearly one-third of its online sales and traffic in the quarter. COO Michael Rempell said:

Source: Company reports/Coresight Research[/caption]

Digital Expansion

Both Aerie and Victoria’s Secret are ramping up their digital operations, including expanding fulfillment capabilities and offering BOPIS and flexible payment facilities, among others. However, Aerie was quicker to embrace e-commerce than Victoria’s Secret.

Aerie: In the fourth quarter of fiscal 2021 ended January 29, 2022, American Eagle Outfitters launched several new online features and expanded its e-commerce capabilities, which will further bolster Aerie’s digital operations. The company expanded its Afterpay buy now, pay later capabilities to the app in the fourth quarter—which drove nearly one-third of its online sales and traffic in the quarter. COO Michael Rempell said:

App-based customers are the most engaged digital shoppers, spending 2.5x more annually than our web customers and transacting with us 3x more throughout the year. They are also more likely to be multichannel and multi-brand shoppers.

American Eagle Outfitters also introduced a new instant credit feature for product returns, which had a substantial impact on its sales recapture. About 75% of qualified shoppers opted for instant credit, with most of them utilizing it within two weeks. Similarly, American Eagle Outfitters doubled its returns processing rate per hour, which resulted in improved product availability for customers, better merchandise restock rates and higher full-price selling. The company has also successfully piloted a new mobile point-of-sale (POS) solution and has witnessed a remarkable increase in curbside pickup orders. Similarly, in June 2021, American Eagle Outfitters expanded its collaboration with FedEx subsidiary ShopRunner to offer same-day delivery in 50 cities across the US, up from just six cities during the pilot phase, which started in October 2020. Rempell said:ShopRunner’s free same-day delivery service allows us to build on our already strong omnichannel delivery platform and offer even more ways for our customers to quickly and easily shop the American Eagle and Aerie brands.

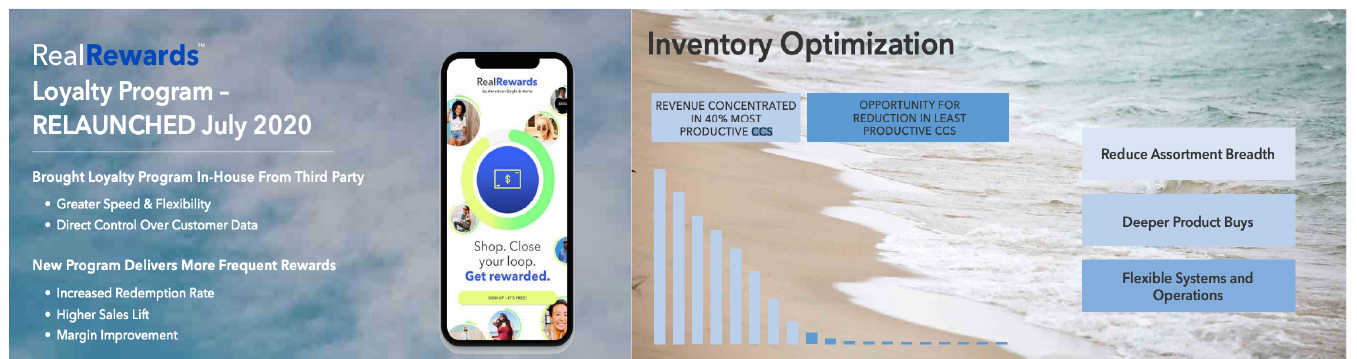

In addition, American Eagle Outfitters’ acquisition of its supply chain partner Quiet Logistics for $360 million in December 2021 marked the next step in the retailer’s ongoing supply chain transformation. Quiet Logistics serves more than 50 direct-to-consumer and omnichannel brands through its network of in-market fulfillment centers in Boston, Dallas, Jacksonville, Los Angeles and St. Louis. The logistics company utilizes automated technologies and access to labor pools outside of traditional hubs to enable product positioning close to stores and customers. During the fourth quarter, the company capitalized on Quiet Logistics’ capabilities to ship orders faster—with about a 35% reduction in delivery times, bringing benefits to both its customers and its operations. American Eagle Outfitters also plans to monetize its supply chain platform through Quiet Logistics by growing its third-party customer base—generating substantial revenue and profit stream for the company. Victoria’s Secret: As compared to Aerie, Victoria’s Secret is late in expanding its digital capabilities and is now playing catch-up. Victoria’s Secret first launched BOPIS in 450 of its stores in the second half of 2021, and the company plans to roll out BOPIS in all its stores by spring 2022. In fiscal 2022, Victoria’s Secret will also expand its ship-from-store capabilities to efficiently distribute online orders to customers. Furthermore, as previously mentioned, the company will launch its new digital-first brand Happy Nation in fiscal 2022. 5. Digital Strategies Both Aerie and Victoria’s Secret are utilizing data analytics and machine learning to enhance their inventory management operations and provide their customers with personalized product experiences and improved product searches. However, Aerie was an early adopter of data-driven technologies. Aerie: Aerie capitalizes on Google Cloud’s data and machine learning capabilities to enhance product assortment, pricing and promotion decisions and to improve the in-store experience. The migration of American Eagle Outfitters (Aerie’s parent company) to BigQuery, Google Cloud’s enterprise data warehouse, is helping Aerie to use all its clickstream data, coming from billions of hits to its mobile platforms and websites, to better understand online shopper activity in real-time. In addition, American Eagle Outfitters has also collaborated with cloud analytics platform Core Compete (owned by Accenture) to quickly conduct in-store testing on sales promotions using consumer data from times before the promotion begins and real-time sales performance. This is helping Aerie understand the effectiveness of various types of sales promotions in terms of sales conversion and customer reach. This understanding influences decisions on fixing ineffective sales promotions. A key source of consumer data for Aerie is American Eagle Outfitters’ digitized loyalty program launched in June 2020: Real Rewards by American Eagle and Aerie. About one-third of American Eagle Outfitter’s loyalty program members spent nearly twice that of its non-member customer annually in the trailing 12 months ended September 30, 2021. Similarly, in the fourth-quarter earnings call held in March 2022, American Eagle Outfitters noted that the relaunch of its loyalty program continued to pay off, and the customer data in the fourth quarter was remarkably strong—with the highest ever loyalty program members and highest average annual spend count from them since 2010. [caption id="attachment_145673" align="aligncenter" width="700"] Aerie capitalizes loyalty program data to enhance product assortment, and pricing and promotion decisions

Aerie capitalizes loyalty program data to enhance product assortment, and pricing and promotion decisions Source: Company website [/caption] Victoria’s Secret: Victoria’s Secret capitalizes on artificial intelligence (AI) and machine learning to offer personalization and drive sales. On its website, the “Pairs Perfectly With” section helps customers to complete their looks based on the browsed items. For instance, a shopper buying a bra would get suggestions from the section for a robe, slippers and pajamas. Victoria’s Secret has also collaborated with US-based robotics and e-commerce fulfillment technology company Nimble Robotics to automate its warehouses. Nimble combines AI, cameras and grippers to pluck items from bins that another automated system brings to workstations, typically staffed by people. Nimble claims to be 99.9% accurate in production and its AI-based integration requires no changes in the company’s existing warehouse system. Moreover, these robots help Victoria’s Secret to collect more proprietary data, such as in terms of customer demands and product returns, driving personalization and customer retention. Moreover, in February 2022, Victoria’s Secret joined the metaverse bandwagon after filing an application with the US Patent and Trademark Office. The company will offer non-fungible tokens (NFTs), along with images, information, photos, videos, recorded footage and experiences, among more offerings, in the field of apparel and accessories. Victoria’s Secret will also launch digital lingerie to dress an avatar and might also add digital runways to its virtual fashion shows. 6. ESG Initiatives While Aerie has been at the forefront of promoting diverse, inclusive and sustainable initiatives, Victoria’s Secret is scaling up its initiatives. Aerie: In 2020, Aerie announced the following key sustainable goals and initiatives in its strategic plan:

- Become carbon neutral in all its operations, including stores, distribution centers, corporate offices and business travel by 2030

- Reduce the carbon footprint in its supply chain by 40% by 2030 and by60% by 2040

- By 2023, Aerie aims to source 100% of its cotton from sustainable sources through its partnership with Better Cotton Initiative (BCI)

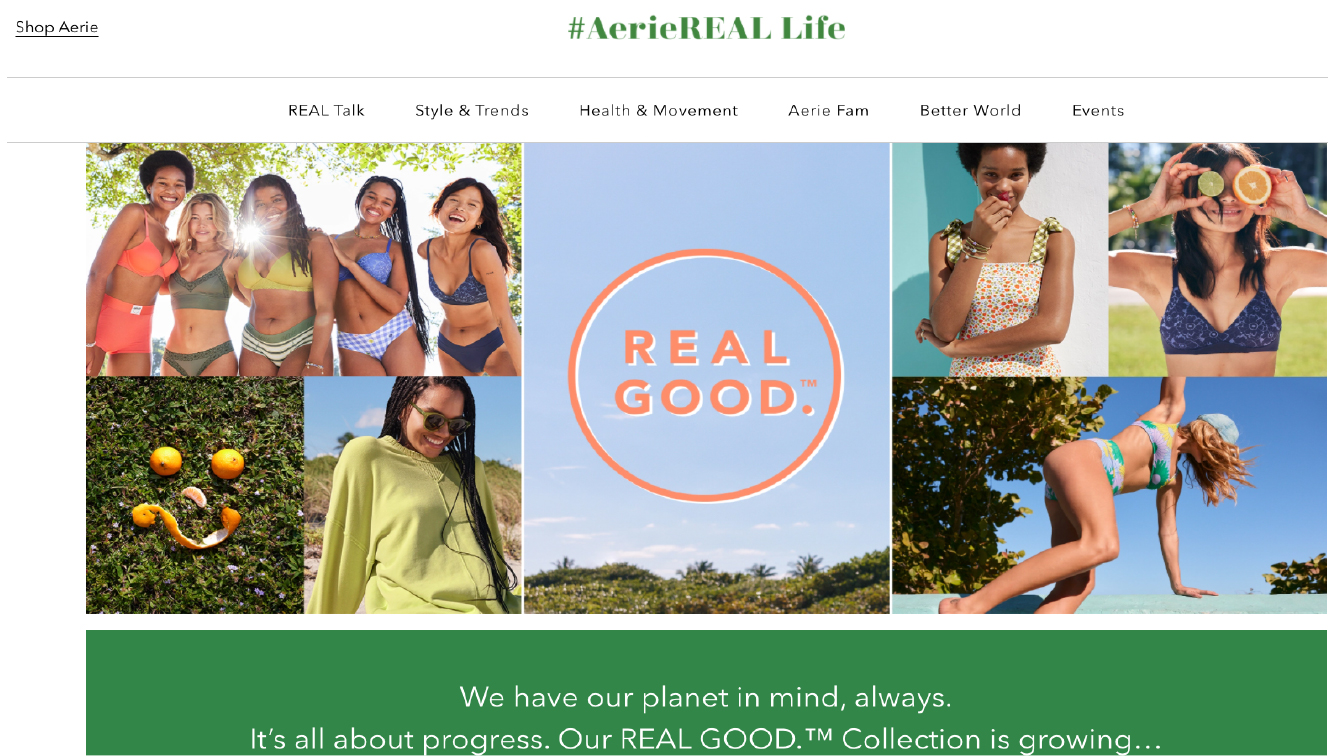

Aerie introduced its first-ever eco-friendly swimwear collection REAL GOOD in February 2020—made from recycled cotton and polyester

Aerie introduced its first-ever eco-friendly swimwear collection REAL GOOD in February 2020—made from recycled cotton and polyester Source: Company website [/caption] Victoria’s Secret: Victoria’s Secret is ramping up its initiatives that promote inclusivity and equitability. For instance, in February 2022, Victoria’s Secret collaborated for the first time with black transgender model Emira D’Spain, who has over 10 million TikTok followers. Similarly, in June 2021, the company announced an inclusive partnership program called The VS Collective. Under the program, the company collaborated with seven women who are advocates of diversity, inclusion and female empowerment: Indian actor and celebrity Priyanka Chopra Jonas, soccer player and gender-equity activist Megan Rapinoe, Girl Gaze founder Amanda de Cadenet, skier and Olympian Eileen Gu, and models Adut Akech Bior, Paloma Elsesser and Valentina Sampaio. Furthermore, Victoria’s Secret plans to release its first ESG report by the end of the first half of 2022, outlining its sustainable and ethical goals, measures and progress.

What We Think

In the near future, we anticipate that Victoria’s Secret will retain its status as the largest underwear company in the US, with Aerie as its most threatening rival. With Aerie’s growing strong presence and Victoria’s Secret’s substantial transformation and expansion measures, the competition between these two retailers is likely to be fierce. Aerie’s core message of women’s empowerment and body positivity resonates well with US consumers and will help it to continue to gain share in the US women’s underwear market. Furthermore, the retailer’s data-driven trend identification strategies, the ramp-up of its digital capabilities and synergy from Quiet Logistics’ acquisition will be key drivers for Aerie in 2022 and beyond. However, to maintain the strong growth momentum, Aerie should also continue to pursue opportunities to boost product innovation, grow its merchandise categories and expand its target audience to immensely cater to customers of all ages, instead of just focusing on younger consumers. Furthermore, Aerie should expand into newer markets—both domestic and international—through the opening of new stores and setting up collaborations and joint ventures with intimate apparel brands and retailers, similar to what Victoria’s Secret is pursuing. On the other hand, we believe that there are many signs of recovery continuing for Victoria’s Secret, including improving sales and margins, and consumers’ changing perception toward the company’s image in terms of diversity and inclusivity. The company is taking an aggressive approach toward the new brand messaging with new product lines. This includes the recent launch of comfortable and inclusive Love Cloud bra, and announcements to launch a new digital-first brand to serve the tween market with comfort and inclusivity and a plus-size collaboration with intimate brand Elomi in fiscal 2022. These follow the launch and strong performance of new products, such as the Bare Infinity Flex bra, a maternity bra and a mastectomy bra. We believe that the company’s transformation measures, such as the rollout of store refreshes (fixtures, lighting and mannequins), expansion of the “store of the future” in the off-mall locations and enhancement of digital capabilities, including ramp up of BOPIS and ship-from-store, have strong potential to bolster sales and margins, and expand Victoria’s Secret’s total addressable market. Implications for Retailers- We see e-commerce as a significant opportunity for underwear brands and retailers to drive sales as we expect many consumers to cement pandemic-driven online shopping habits in 2022 and beyond. However, we believe harnessing the digital consumer while also engaging consumers to bring them to the store will be key.

- Amid the rising e-commerce trend, data aggregated from customer bases will be central to underwear retailers and brands staying ahead of their competition. We expect both Aerie and Victoria’s Secret to continue to focus on data-driven personalization and inventory optimization to enhance customers’ experience.

- Retailers should continue to take proactive steps toward sustainability to win consumer trust and attract investors and employees in a dynamic retail landscape.

- Innovators have strong opportunities to partner with underwear brands and retailers to drive the push into e-commerce expansion. Innovators can also support retailers in lowering inventory levels and improving efficiency, agility and resilience across their supply chains.