DIpil Das

Introduction

What’s the Story? The Clorox Company and Reckitt Benckiser Group are global producers of household care, health and hygiene products. Their respective cleaning brands, Clorox and Lysol, rank among the top US household cleaning products by revenue. As part of Coresight Research’s Head-to-Head series, we provide insights into the two CPG (consumer packaged goods) companies’ revenues, operating margins, business strategies and their environmental, social and corporate governance (ESG) initiatives. Why It Matters We estimate that the US household care market, which was a substantial $64.9 billion market in 2021, will grow to an estimated $90.7 billion by 2026. Clorox and Reckitt are both well-established in the market, and the scale and leading market positions of these two companies make for insightful comparisons.Clorox vs. Reckitt: Coresight Research Analysis

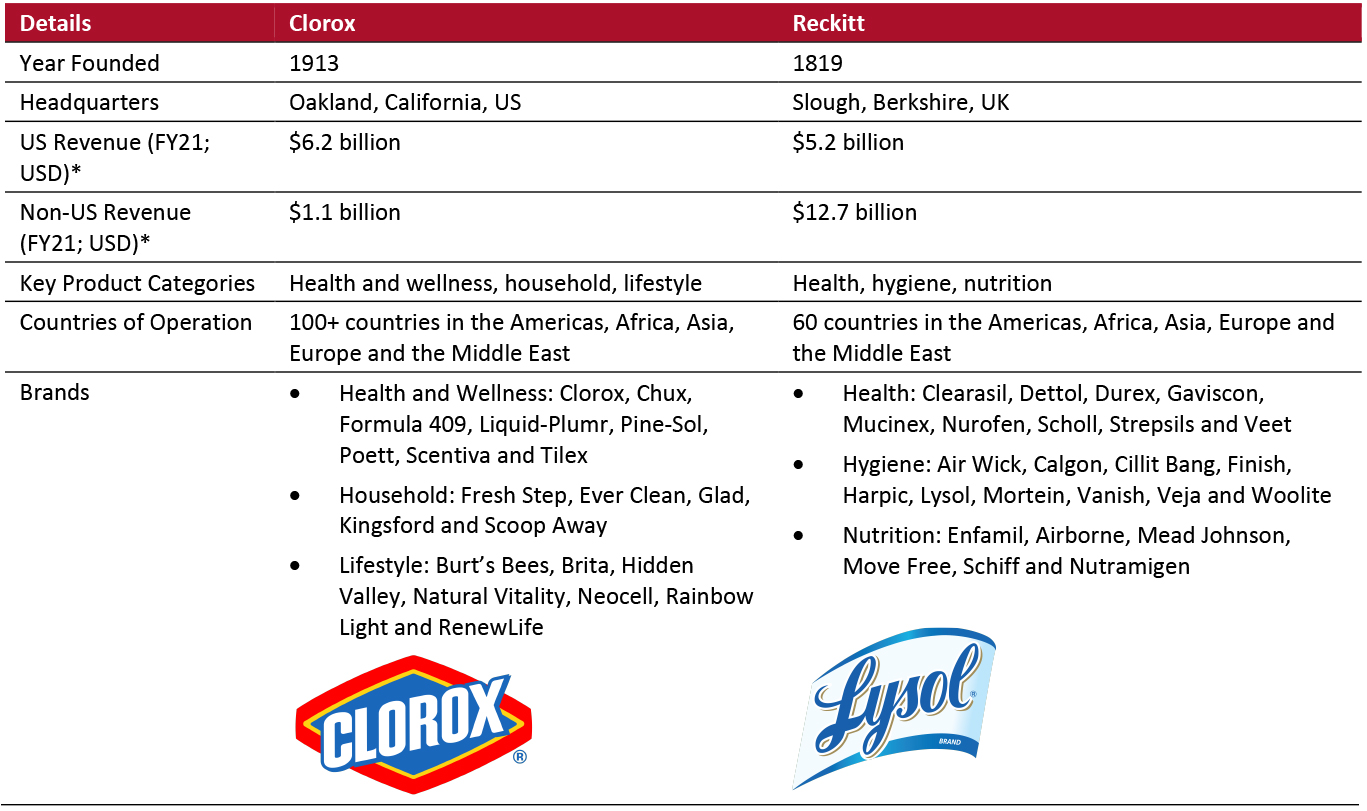

Business Overview We provide an overview of key metrics for Clorox and Reckitt in Figure 1.Figure 1. Clorox vs. Reckitt: Company Overviews [caption id="attachment_149306" align="aligncenter" width="700"]

*Revenue for Reckitt converted to USD at historical exchange rate from the day of the annual report release

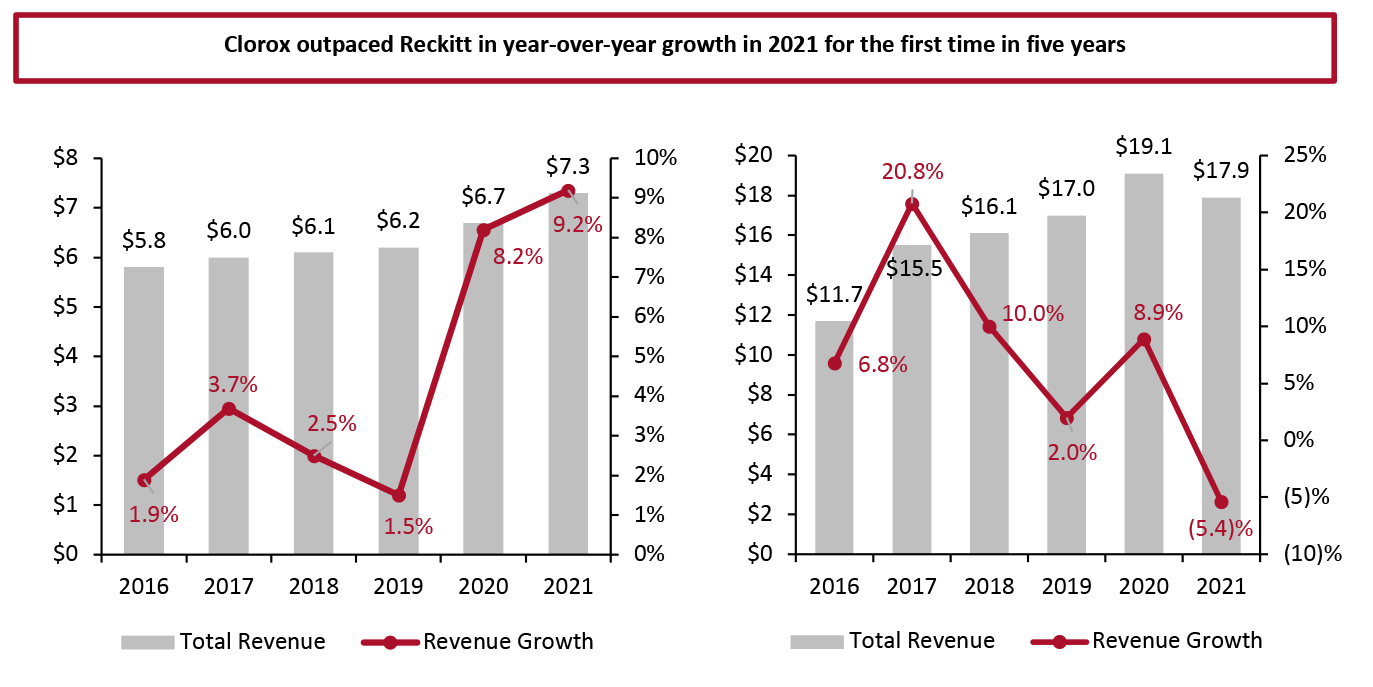

*Revenue for Reckitt converted to USD at historical exchange rate from the day of the annual report release Source: S&P Capital IQ [/caption] Revenue Growth Clorox outpaced Reckitt in year-over-year growth in 2021 for the first time in five years, with Clorox reporting 9.2% growth versus negative growth of (5.4)% at Reckitt. Below, we discuss the primary factors impacting revenue growth for these CPG brands. Clorox: Clorox expects that consumers will maintain the more stringent cleaning behaviors that they adopted during the pandemic, with less than 10% of consumers returning to pre-Covid-19 cleaning routines, according to a company presentation at the Consumer Analyst Group of New York (CAGNY) conference in February 2022. Furthermore, with people spending more time at home due to the widespread adoption of hybrid work options, Clorox believes that its increased penetration in the household care market and elevated dollar-per-buyer sales will remain post pandemic. The company has also reported that consumers’ increased sensitivity to the cleanliness of public spaces has benefited Clorox’s core business. The company hopes to retain the trust it built with customers during the pandemic by investing in advertising and customer engagement, with plans to spend $150 million on such initiatives in 2022 alone. Reckitt: Reckitt’s year-over-year growth declined in fiscal 2021 after five years of successive growth, two of which saw double-digit rates. The company attributed last year’s decline primarily to strong 2020 comparatives and its lagging Infant Formula and Child Nutrition business, which was complicated by cross-border trade restrictions with China. Reckitt sold the business in June 2021 at a loss of £2.5 billion ($3.5 billion). Despite its growth decline, Reckitt has increased or held its revenue share in 62% of its core category markets and saw all three of its key product categories win overall share growth, according to the company’s latest annual report. Its top product category was Health, which includes the company’s sanitation products. Like Clorox, Reckitt expects many consumers to maintain their Covid-19 cleaning habits post pandemic. CEO Laxman Narasimhan stated that the company believes “around 80% of [the company’s] consumers [will] retain many of their new improved habits post pandemic.” The company reported that half of its customers globally have increased the frequency of their new habits, leading to an increase in the number of heavy users, who make up the core of Reckitt’s business.

Figure 2. Clorox and Reckitt: Revenue* (Left Axis; USD Bil.) and Revenue Change (Right Axis; YoY %) [caption id="attachment_149307" align="aligncenter" width="699"]

*Revenue for Reckitt converted to USD at historical exchange rates

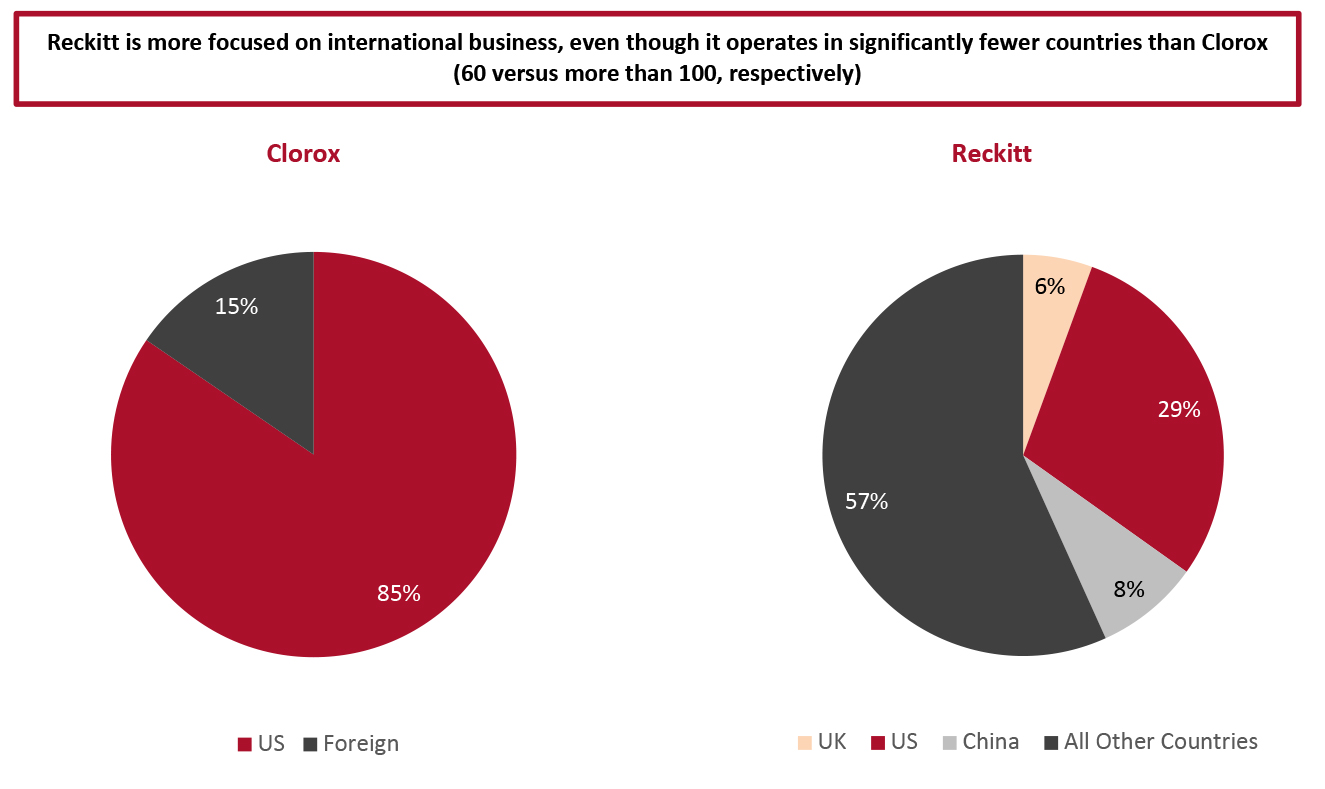

*Revenue for Reckitt converted to USD at historical exchange rates Source: S&P Capital IQ [/caption] By Geography Clorox’s US business makes up 85% of its total revenue, while Reckitt’s US business only accounts for 29% of its total revenue. The difference points to Reckitt’s focus on international business, even though it operates in significantly fewer countries than Clorox (60 versus more than 100, respectively). Clorox: With only 15% of the company’s revenue coming from international markets, the company holds weaker penetration rates and market share abroad than Reckitt. Internationally, Clorox has focused on cleaning and disinfecting products. In 2021, the company introduced its IGNITE strategy, which, among other initiatives, aims to increase growth by 2%–4%, primarily through expanding its international business, according to Clorox (we discuss this strategy further in a later section of this report). Reckitt: Reckitt currently plans to expand further into international markets by increasing its marketing spend and catering to the demands of specific markets.

- The company is keen to market Finish, its brand of dishwasher products, to Turkey, which has the world’s highest dishwasher penetration rate, and India, which has seen dishwasher demand quadruple since the onset of the Covid-19 pandemic.

- In the UK and the US, Reckitt has launched its first plant-based disinfectant, Dettol Tru Clean, due to increased demand for sustainable products.

- In China, the company started catering to the country’s large older population with its joint health brand, Move Free.

Figure 3. Clorox vs. Reckitt: Revenue by Geography, FY21 (%) [caption id="attachment_149308" align="aligncenter" width="700"]

Source: Company reports/S&P Capital IQ[/caption]

E-Commerce

E-commerce revenues from both companies are totaled by adding their direct sales to consumers through online platforms to the estimated e-commerce sales achieved by its brands through omnichannel distributors and retailer websites.

Clorox: Clorox’s e-commerce penetration doubled in 2021 to 13% of total revenue, according to the company. In August 2021, the company announced that it would invest $500 million over the next five years to accelerate its digital capabilities in response to the consumer shift to online shopping during the pandemic. This investment will go toward replacing Clorox’s ERP (enterprise resource planning) system and improving its data analytics capabilities, increasing productivity and the company’s understanding of online consumer behavior.

Reckitt: Reckitt currently has e-commerce capacities in every market it operates in, amounting to 12% of its revenue, per the company’s fiscal 2021 annual report. Currently, Reckitt says that its top 10 brands account for over 80% of e-commerce growth and over 70% of total e-commerce sales. The company aims to increase its e-commerce penetration to 25% by 2026 by focusing on its main brands and partnering with major platforms and companies, including Amazon and World of Content, a digital commerce company that aggregates and monitors companies’ content.

[caption id="attachment_149309" align="aligncenter" width="700"]

Source: Company reports/S&P Capital IQ[/caption]

E-Commerce

E-commerce revenues from both companies are totaled by adding their direct sales to consumers through online platforms to the estimated e-commerce sales achieved by its brands through omnichannel distributors and retailer websites.

Clorox: Clorox’s e-commerce penetration doubled in 2021 to 13% of total revenue, according to the company. In August 2021, the company announced that it would invest $500 million over the next five years to accelerate its digital capabilities in response to the consumer shift to online shopping during the pandemic. This investment will go toward replacing Clorox’s ERP (enterprise resource planning) system and improving its data analytics capabilities, increasing productivity and the company’s understanding of online consumer behavior.

Reckitt: Reckitt currently has e-commerce capacities in every market it operates in, amounting to 12% of its revenue, per the company’s fiscal 2021 annual report. Currently, Reckitt says that its top 10 brands account for over 80% of e-commerce growth and over 70% of total e-commerce sales. The company aims to increase its e-commerce penetration to 25% by 2026 by focusing on its main brands and partnering with major platforms and companies, including Amazon and World of Content, a digital commerce company that aggregates and monitors companies’ content.

[caption id="attachment_149309" align="aligncenter" width="700"] Promotional image announcing the partnership of Reckitt and World of Content

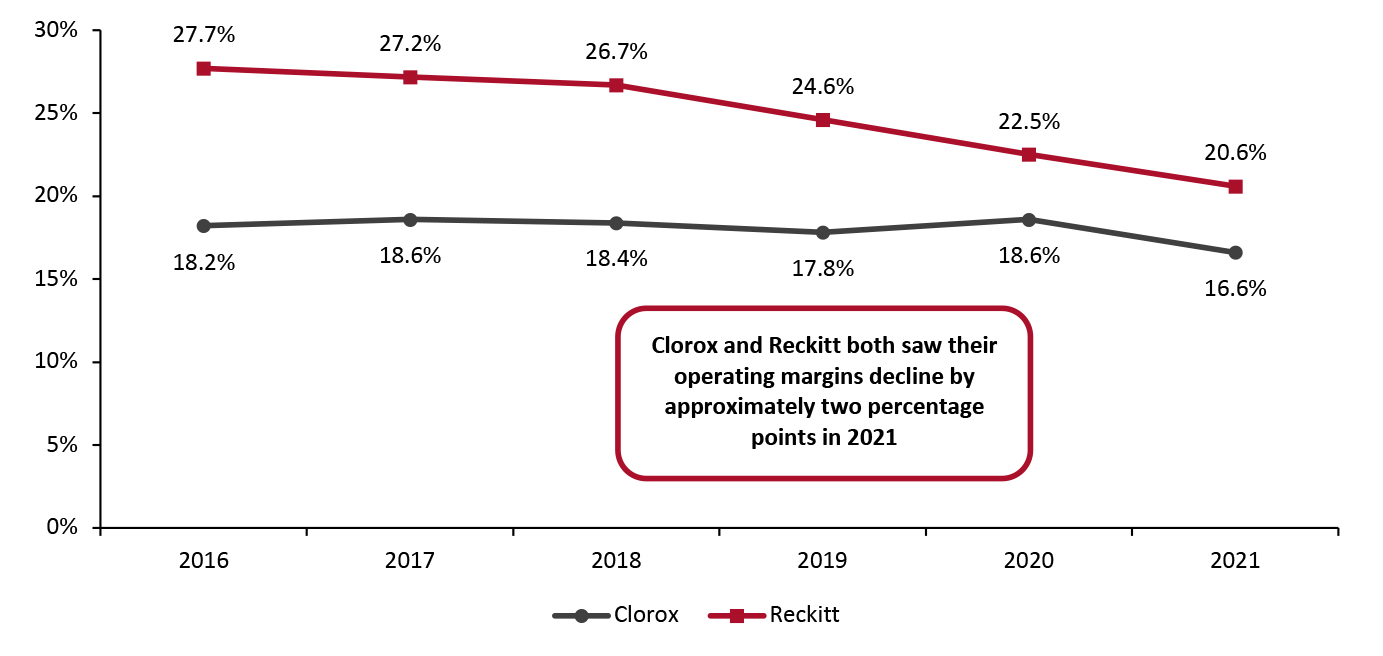

Promotional image announcing the partnership of Reckitt and World of Content Source: World of Content [/caption] Operating Margins Due to unfavorable headwinds from inflation and continued supply chain challenges, both Clorox and Reckitt saw their operating margins decline by 2.0 and 1.9 percentage points, respectively, in 2021. Clorox: Like many other companies, Clorox is adopting a pricing strategy to protect its margins from inflation and extra costs, which are set to grow by $500 million in fiscal 2022. While the company initially planned to raise the prices of 70% of its products in 2022, Clorox stated at the end of its second quarter that price increases will impact 85% of its portfolio. Clorox will still face inflation hurdles, as its pricing strategy takes 12–17 months, on average, to implement, meaning that the company struggles to keep up with rising inflation. Rising manufacturing and raw material costs, impacted by inflation, are the main drivers of price increases. Despite the price increases, Clorox expects consumers to continue purchasing its products due to their trust in the value and quality of Clorox’s products, especially as lower-income consumers cannot afford to have products fail and need to replace them. However, increased demand has a downside: Clorox reported that both increased demand and driver shortages are driving up logistics costs, forcing the company to move into the spot market, which sees 50%–75% higher costs than the primary carrier market. To hedge against inventory issues, Clorox ended the second quarter of 2022 with 65 days of inventory versus pre-pandemic levels of 55 days of stock. Although Clorox does not have a substantial presence in either country, it expects the Russia-Ukraine war to create a logistics headwind of $30 million. Reckitt: Like Clorox, Reckitt is experiencing increased supply chain costs, among other inflationary pressures. In fiscal 2021, goods inflation accelerated to 11% above 2020 levels, higher than the company’s 8%–9% predictions, leading to reduced margins. Material costs grew at a double-digit rate, while manufacturing costs grew by mid-single digits. To protect its margins, the company has raised prices on its products by 5.3%, per a company release at the end of the first quarter of 2021.

Figure 4. Clorox and Reckitt: Operating Margin (%) [caption id="attachment_149310" align="aligncenter" width="700"]

Source: S&P Capital IQ[/caption]

Brand Expansion Strategies

Clorox: Clorox remains focused on its leading brands, which make up 80% of its portfolio. Its IGNITE strategy aims to “leverage relevant consumer megatrends” to accelerate growth and reinvest in the company’s leading brands through advertising and innovation.

Source: S&P Capital IQ[/caption]

Brand Expansion Strategies

Clorox: Clorox remains focused on its leading brands, which make up 80% of its portfolio. Its IGNITE strategy aims to “leverage relevant consumer megatrends” to accelerate growth and reinvest in the company’s leading brands through advertising and innovation.

- During its CAGNY presentation in February 2022, Clorox stated IGNITE had already boosted household penetration, which now accounts for over two-thirds of its sales.

- Next, Clorox aims to achieve growth in the cleaning and disinfecting categories, of 3% and 5%, respectively, in 2022—up from average annual growth of 2%.

A Clorox ad leveraging the company’s public goodwill

A Clorox ad leveraging the company’s public goodwill Source: Clorox [/caption] Reckitt: Reckitt also continues to focus on its top brands, with 70% of its portfolio growing by a mid-single-digit rate in 2021. Specifically, the company’s hygiene business remains a growth driver, rising 7.5% year over year in 2021—for a two-year stack of 27%. Meanwhile, its health business saw flat growth, an improvement from 2020’s 10% decline from a mild cold and flu season. Reckitt’s prominent cleaning brand, Lysol, saw growth in the first half of 2021 before declining against strong comparatives in the second half, although the two-year stack of total revenue rose to approximately 90% compared to 2019. However, Reckitt expects Lysol to decline further in 2022 due to difficult year-over-year comps. Many of its other top brands—including Air Wick, Finish and Vanish—saw more consistent growth throughout the year, while another leading brand, Dettol, is poised to grow at a low-single-digit rate in 2022, according to the company. ESG Initiatives Clorox: Clorox has incorporated ESG initiatives into its IGNITE strategy and has created an internal Sustainability Center to ensure that ESG plans are implemented after creation. The company’s ESG initiatives are exemplified by the creation of Clorox Compostable Cleaning Wipes and the circular economy of its acquired brand, Burt’s Bees. Of particular importance is Clorox’s goal to reduce its virgin plastic usage to become more eco-friendly and reduce raw material costs, as resins are highly inflationary. Reckitt: Reckitt continues to work toward increased sustainability. At the start of 2021, the company launched its Finish “Quantum All-in-1” product, which eliminates the need for pre-rinsing when using a dishwasher and conserving water. Reckitt’s initiatives are working, as the company was recognized as a “top 1%” leader in sustainability in S&P Global’s 2022 Sustainability Yearbook, making it one of two companies in the CPG industry that has achieved the gold-class distinction.

Figure 5. Clorox vs. Reckitt: ESG Goals [wpdatatable id=2052]

Source: Clorox/Reckitt