Nitheesh NH

Introduction

What’s the Story? The global beauty market is experiencing strong growth, increasing by 10.6% in 2021; we define beauty as cosmetics, fragrance, haircare, and skincare. Within the global beauty market, Estée Lauder and L’Oréal are the two of the largest companies active today, holding a combined market share of 20%, according to Euromonitor International. As part of Coresight Research’s Head-to-Head series, we provide insights into the two beauty companies’ revenues, business strategies and operating margins. Why It Matters The global beauty market, as defined above, is a high-margin industry that generated $357 billion in revenue in 2021, up 10.4% year over year, according to Euromonitor International. We expect to see mid-to-high single digit growth through 2026, as the emotional benefits of beauty supplies at a low price point make it a go-to category for small indulgences, regardless of the macroeconomic environment. Consumers often use small luxury purchases, such as beauty products, as an escape—widely known as the “lipstick effect.” As L’Oréal stated in its 2021 annual report: “Beauty is synonymous with wellbeing, pleasure, confidence and self-esteem, at every stage in life. This phenomenon was stronger in 2021 with a consolidation between health/wellbeing and beauty.” Estée Lauder and L’Oréal are two of the most prominent beauty companies in the world, with portfolios spanning globally recognized brands to niche, cult products, making them a solid barometer of the state of the beauty market overall.Estée Lauder vs. L’Oréal: Coresight Research Analysis

Estée Lauder and L’Oréal are the two largest beauty companies in the world, manufacturing, marketing and selling cosmetics, fragrance, haircare and skincare globally. In Figure 1, we provide a snapshot comparison of the two companies, focusing on key metrics.Figure 1. Estée Lauder vs. L’Oréal: Company Overviews [wpdatatable id=2061 table_view=regular]

*L'Oréal revenue converted to USD at historical exchange rate from the day of the annual report Source: Company reports/Euromonitor International Limited 2022 © All rights reserved/S&P Capital IQ Coresight Research

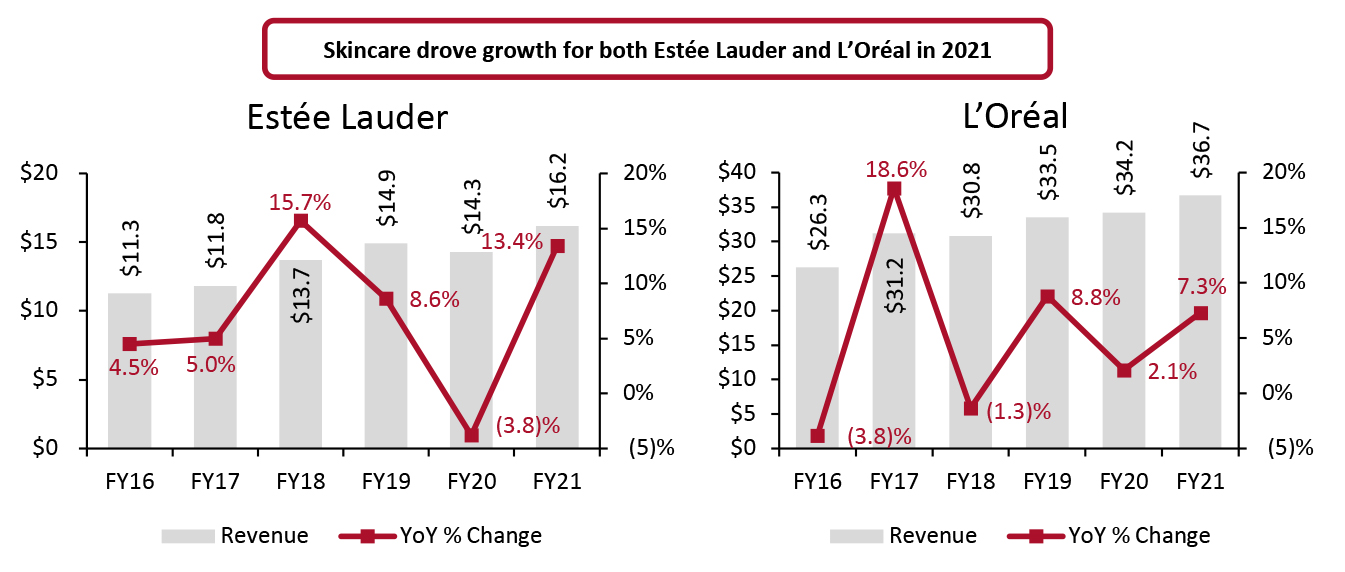

Revenue Estée Lauder: Over the past five years, Estée Lauder has outpaced L’Oréal in revenue growth, reporting a revenue CAGR of 9.3%—nearly double L’Oréal’s 5.3%. Recent revenue growth at Estée Lauder has been propelled by its skincare business, which expanded at a 16.4% CAGR between 2016 and 2021, followed by fragrance at a 5.3% CAGR. In fiscal 2021 specifically, the company’s skincare revenue grew by 28.5%, more than doubling the 12.7% growth achieved in fiscal 2020. In the same fiscal year, fragrance sales growth also accelerated, largely due to prestige fragrances, the company reported. L’Oréal: As stated, L’Oréal’s CAGR for the past five years was 5.3%. During that period, Active Cosmetics (which achieved a 16.1% CAGR) and L’Oréal’s largest division, L’Oréal Luxe (which spans all categories and saw a 10.0% CAGR), drove growth. L’Oréal’s overall five-year CAGR is less than Estée Lauder’s in part because of the size of the companies’ total revenues. It is worth mentioning that, in the past five years, L’Oréal added $10.4 billion to its annual revenue (based on historical exchange rates)—more than double the sales lift that Estée Lauder achieved during the same period ($4.9 billion).Figure 2. Estée Lauder vs. L’Oréal: Revenue* (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_149859" align="aligncenter" width="701"]

*L'Oréal revenue converted to USD at historical exchange rate from the day of the annual report

*L'Oréal revenue converted to USD at historical exchange rate from the day of the annual report Estée Lauder’s fiscal year ends June 30 of the same calendar year;

L’Oréal’s fiscal year ends December 31

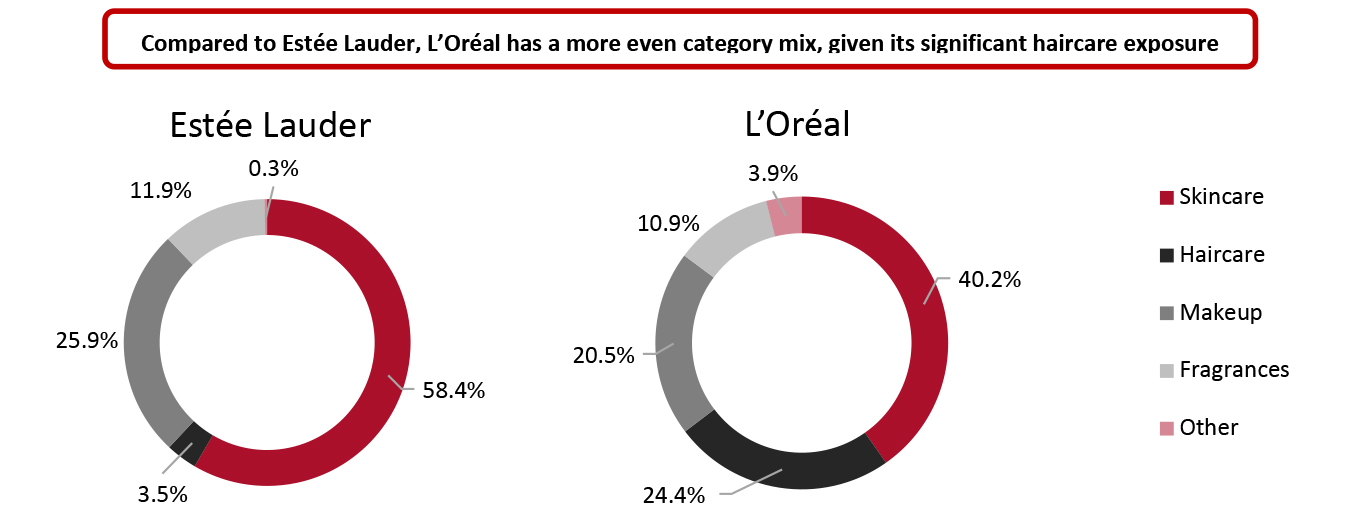

Source: Company reports/S&P Capital IQ [/caption] Categories Skincare is the largest product category for both companies, at 58.4% of total Estée Lauder sales and 40.2% of L’Oréal sales in fiscal 2021. However, after skincare, the companies begin to differentiate. Estée Lauder: At Estée Lauder, makeup and fragrance came in second and third place in 2021, at 25.9% and 11.9% of total sales, respectively. Haircare at the company is a relatively small business, comprising 3.5% of total sales. L’Oréal: After skincare, haircare came in number two in 2021 at L’Oréal, accounting for 24.4% of the company’s total sales, including €3.0 billion ($3.4 billion) in hair-color sales, one of the company’s best-performing segments. Given L’Oréal’s significant haircare exposure, makeup and fragrance have slightly smaller proportions than the same categories at Estée Lauder, bringing in 20.5% and 10.9% of total sales, respectively.

Figure 3. Estée Lauder vs. L’Oréal: FY21 Category Sales Mix [caption id="attachment_149860" align="aligncenter" width="701"]

Estée Lauder’s fiscal 2021 ended June 30, 2021; L’Oréal’s fiscal 2021 ended December 31, 2021

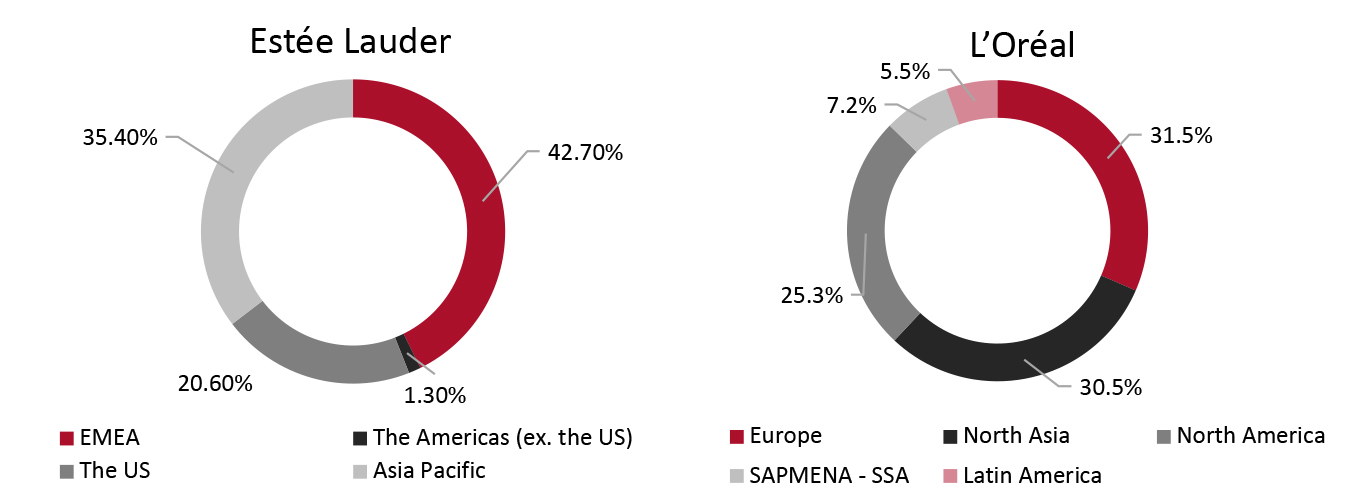

Estée Lauder’s fiscal 2021 ended June 30, 2021; L’Oréal’s fiscal 2021 ended December 31, 2021 Source: Company reports [/caption] E-Commerce and Physical Stores Estée Lauder: Of Estée Lauder’s total fiscal 2021 sales, 28% came from e-commerce sales—18% came from company-owned websites, while the other 10% came from the websites of its retail partners. Meanwhile, 72% of Estée Lauder’s sales occurred at brick-and-mortar retail locations. Specifically, 28% came from travel retail, 21% from department stores, 7% from company-operated, freestanding stores, 7% from multi-specialty retailers, 3% from perfumeries and 6% from “other.” In the US, many of the company’s 1,600 freestanding stores are under a single brand name, such as M·A·C, Jo Malone London, Aveda, Origins, Le Labo or DECIEM, though there are 200 multi-branded company stores, mostly in outlet malls. Authorized third parties also operate approximately 700 company-branded freestanding stores worldwide. L’Oréal: L’Oréal’s e-commerce was 28.9% of total 2021 sales—within a percentage point of Estée Lauder’s e-commerce total—representing a 25.7% growth in e-commerce sales for the company. “We have been able to seize the opportunities offered by the new digital channel,” L’Oréal CEO Nicolas Hieronimus wrote in the company’s fourth quarter of 2021 report. “At the same time, we are continuing to digitalize points of sale as part of an integrated omnichannel strategy.” Travel retail is very important to both L’Oréal and Estée Lauder. The companies mentioned double-digit travel retail growth in the first quarter of 2022, as travel continues to pick up in Europe and was strong China in until March. While Covid-19 continues to undermine travel retail in Asia, the construction of a mall on Hainan offers long-term promise in the region. By Geography Estée Lauder: At Estée Lauder, US sales accounted for 20.6% of total 2021 sales, or $3.4 billion. Meanwhile, mainland China accounted for $5.8 billion (35%) of 2021 sales at Estée Lauder, more than $2 billion more than the company’s domestic sales. Over the past three years, its China sales have achieved a 48.6% CAGR. The Europe, the Middle East and Africa (EMEA) region also remains strong for the company, bringing in nearly half of all 2021 revenue, at 42.7%. L’Oréal: While L’Oréal does not release sales numbers for specific countries any longer—the last time it reported domestic sales for France was in 2017—we estimate approximately 10% of total sales come from the company’s home country, while European sales represent 31.5% of total sales. In 2021, L’Oréal also gained market share in China, achieving 50% year-over-year growth in the country. According to the company, it broke beauty records during the Double 11 event on Tmall, a Chinese business-to-consumer online retail website run by Alibaba. L’Oréal will continue to focus more resources on the South Asia Pacific, Middle East, North Africa, Sub-Saharan Africa (SAPMENA – SSA) region, selecting Singapore as the location for its SAPMENA – SSA headquarters in April 2021.

- For more on China’s beauty market, see our presentation from the Cosmetic Executive Women’s (CEW’s) “State of the Industry: Retail Solutions for Now & the Future” event.

Figure 4. Estée Lauder and L’Oréal: FY21 Geographical Sales Mix [caption id="attachment_149861" align="aligncenter" width="700"]

Estée Lauder’s fiscal 2021 ended June 30, 2021; L’Oréal’s fiscal 2021 ended December 31, 2021

Estée Lauder’s fiscal 2021 ended June 30, 2021; L’Oréal’s fiscal 2021 ended December 31, 2021 Source: Company reports [/caption] Segments Estée Lauder: While both companies participate in the same beauty categories, Estée Lauder provides segment profits based on categories, while L’Oréal’s segmentation is based on market positioning. The different breakdowns highlight the importance Estée Lauder places on skincare, as the remaining segments have significantly lower sales and margins. The company’s makeup segment has been severely hit in the past three years due to work from home and social restrictions. However, now, cosmetics are enjoying a “renaissance,” according to Estée Lauder’s third quarter of fiscal 2022 call, leading to continued double-digit global growth. “The entire [makeup] category is flourishing again,” explained the CEO and President of Estée Lauder, Fabrizio Freda. “[Because] usage occasions of makeup are coming back: back to office, back to restaurants, back to parties, back to vacations.” L’Oréal: As stated, L’Oréal’s segmentation is based on division; for instance, L’Oréal Luxe includes products in the fragrance, makeup and skincare categories, while Active Cosmetics and Consumer Products are primarily cosmetics. The company’s segment margins have a spread of 500 basis points (bps) at most versus the 4000-bps spread at Estée Lauder. Active Cosmetics, which has the widest margin, is the newest group and is growing the most rapidly. Meanwhile, the two largest segments—Consumer Products and L’Oréal Luxe, which represent more than 75% of L’Oréal’s sales—continue to have 20% or better margins, as they have since 2016.

Figure 5. Estée Lauder vs. L’Oréal: Reporting Segments and Related Profit Margin, FY21 [wpdatatable id=2062 table_view=regular]

*L'Oréal sales converted to USD at historical exchange rate from the day of the annual report Estée Lauder’s fiscal 2021 ended June 30, 2021; L’Oréal’s fiscal 2021 ended December 31, 2021 Source: Company reports/S&P Capital IQ

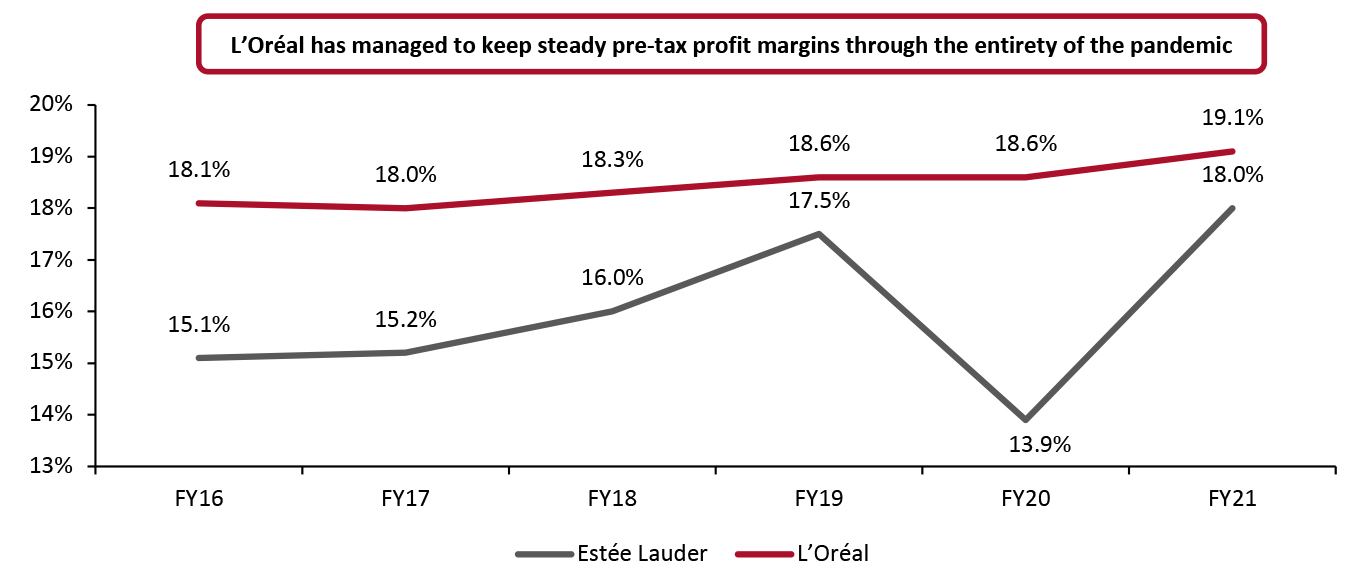

Profit Margins Estée Lauder: Estée Lauder has shown significant pre-tax margin improvement since 2016, up 290 bps through fiscal 2021. In the first three quarters of fiscal 2022, it saw even greater improvement, with its pre-tax margin up to 20.0%. During its third-quarter conference call, Estée Lauder management said they are looking for 70 bps of margin expansion by the end of the fiscal year. L’Oréal: L’Oréal has consistently superior pre-tax profit margins versus Estée Lauder from 2016 to 2021, though we expect the latter to overtake it in 2022. The company’s margins have exhibited modest improvement since 2017, with a 110 bps margin expansion and, notably, no deterioration during the pandemic.Figure 6. Estée Lauder vs. L’Oréal: Pre-Tax Profit Margins [caption id="attachment_149862" align="aligncenter" width="700"]

Estée Lauder’s fiscal year ends June 30 of the same calendar year; L’Oréal’s fiscal year ends December 31

Estée Lauder’s fiscal year ends June 30 of the same calendar year; L’Oréal’s fiscal year ends December 31Source: Company reports/S&P Capital IQ/Coresight Research [/caption] Business Strategies Marketing and Acquisitions Estée Lauder: Estée Lauder’s eponymous founder’s “high-touch” marketing strategy, “bringing the best to everyone we touch,” continues to inform the company’s marketing and growth strategies across all its beauty brands. Estée Lauder allocated $3.7 billion to advertising in fiscal 2021. While the company does say that its “marketing strategies vary by brand,” there are a few core strengths it plans to leverage for continued brand growth, according to its 2021 annual report:

- The quality of Estée Lauder products

- Consumer engagement

- Diverse brand offerings, channels and geographies

Figure 7. Estée Lauder vs. L’Oréal: Recent Brand Acquisitions [wpdatatable id=2063 table_view=regular]

Source: Company reports

Digital Expansion “Beauty and digital are a perfect match. Discovering beauty and buying products online has never been simpler. Digital is a tremendous booster for the beauty market, a trend that intensified in 2021,” L’Oréal stated in its 2021 annual report. Estée Lauder and L’Oréal are both transforming their business processes, focusing on expanding their digital offerings. Emerging technologies have created what L’Oréal calls “social beauty,” a new experience where beauty is meant to be shared with friends and family more often via social media and the internet. In our view, the metaverse, non-fungible tokens (NFTs) and other Web3 technologies will only accelerate this trend of social beauty. Both companies have filed trademarks to offer virtual perfumes and cosmetics and have started experimenting with NFTs and gamification (the application of game elements, such as points, to encourage engagement). Product Development and Sustainability Estée Lauder: At Estée Lauder, its 1,000-person Research & Development team creates new products, line extensions and packaging concepts, as well as improves, redesigns and reformulates existing products. The team’s technical expertise also ensures that the products meet global and company environmental standards, something more and more consumers demand. For instance, the company now has 100% net-zero carbon emissions, and 89% of its forest-based fiber cartons are certified by the Forest Stewardship Council, a non-profit organization that ensures timber is responsibly sourced and managed. L’Oréal: Similar to Estée Lauder, L’Oréal’s Research & Innovation team—more than 4,000 employees strong—develops new products, formulas, packaging and even online experiences, helping the company grow and meet its sustainability goals. Currently, among many other goals, the company is working to become completely carbon neutral and use only renewable energy by 2025. However, unlike Estée Lauder, L’Oréal spends 3.2% on innovation, nearly four times what the former does.What We Think

Estée Lauder and L’Oréal, as well as the beauty market as a whole, will benefit from increased digitalization, a renewed interest in wellness and the relaxing of pandemic-led restrictions, providing a strong long-term global outlook. We expect both will also benefit from the premiumization of fragrance and other beauty products, as well as the pent-up demand for travel and consumers’ desire to return to their pre-pandemic social schedules. If a recession hits, we believe the portfolios of Estée Lauder and L’Oréal will avoid sharp sales declines as the “lipstick effect” kicks in. However, analyzing the two companies reveals the power of scale, with L’Oréal employing four times as many research and development workers—and spending nearly 400% more on innovation—than Estée Lauder. This is a serious competitive advantage, especially as sustainability and digital innovation become increasingly important to consumers. Still, Estée Lauder has a large and profitable skincare business—which surpasses L’Oréal’s—making it a force to be reckoned with in the beauty market. Implications for Brands/Retailers- For retailers who already have a beauty assortment, there are likely beauty brands in the portfolios of either Estée Lauder and L’Oréal—or both—that resonate with your shoppers. Work with the companies to create exclusive events, sales or promotions that will help drive in-store and online traffic.

- For retailers who do not sell beauty products, adding beauty to retail merchandise can often increase various retail metrics, including units per transaction, average unit retail and overall profits, especially when those products come from brands like Estée Lauder and L’Oréal.

- For competing beauty brands, Estée Lauder and L’Oréal can follow the strategies put forth by Estée Lauder and L’Oréal: focus on marketing, digital expansion and premiumization.

- Beauty tech is an exciting category that includes virtual try-on tools both in-stores and online, through webcams and smartphone applications. Technology providers that can help create, implement and run these tools should work with beauty companies to develop new beauty tech innovations.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved