Nitheesh NH

What’s the Story?

Adidas and NIKE are the world’s largest sportswear companies. As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ revenues, as well as sales channels, key strategies, and diversity and inclusion initiatives.Why It Matters

We expect sportswear to continue to be an essential market category in the global apparel and footwear market, largely due to the prevalent casualization trend. Adidas and NIKE account for a 28.8% share of total global sportswear sales, as of 2020, according to Euromonitor, and have maintained their leadership positions for more than a decade. The scale and leading market position of the companies makes for insightful comparison.Adidas vs. NIKE: A Deep Dive

Company Overviews At the forefront of the industry, both companies sell sportswear accessories, apparel, equipment and footwear. Figure 1 provides an overview of key metrics for Adidas and NIKE.Figure 1. Company Overviews: Adidas and NIKE [wpdatatable id=1208]

Source: Adidas/NIKE

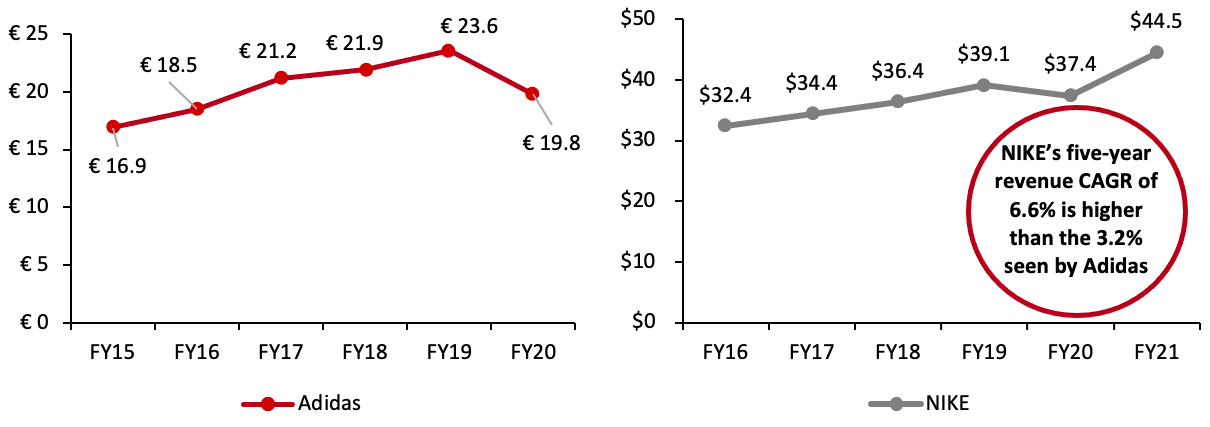

1. Revenue NIKE has outpaced Adidas in terms of revenue growth, with a CAGR of 6.6% from fiscal 2016 to 2021, while Adidas saw a lower CAGR of 3.2% over its last five fiscal years, from 2015 to 2020. Adidas posted revenue of €19.8 billion ($24.2 billion) in fiscal 2020, ended December 31, 2020, whereas NIKE reached $44.5 billion in revenue in its fiscal 2021, ended May 31, 2021. As of calendar year 2020, NIKE’s higher revenue equates to a larger market share, of 17.1% share of the total sportswear market—with Adidas comprising an 11.7% share, according to Euromonitor. The disparity in market share and revenue between the two companies is a function of multiple factors, including consumer response to different product attributes (quality, performance, color, design, price and brand appeal). We see sponsorship of sporting events and work with influencers and athletes as having a key impact: NIKE works with more top-tier sports leagues, athletes and influencers compared to Adidas.Figure 2. Revenue: Adidas and NIKE (Bil. in Reporting Currency) [caption id="attachment_131833" align="aligncenter" width="700"]

Note: Adidas’ fiscal year ends December 31; NIKE’s fiscal year ends May 31. USD conversion for Adidas revenue at a constant currency rate: $20.6 billion (FY15), $22.6 billion (FY16), $25.9 billion (FY17), $26.7 billion (FY18), $28.8 billion (FY19) and $24.2 billion (FY20).

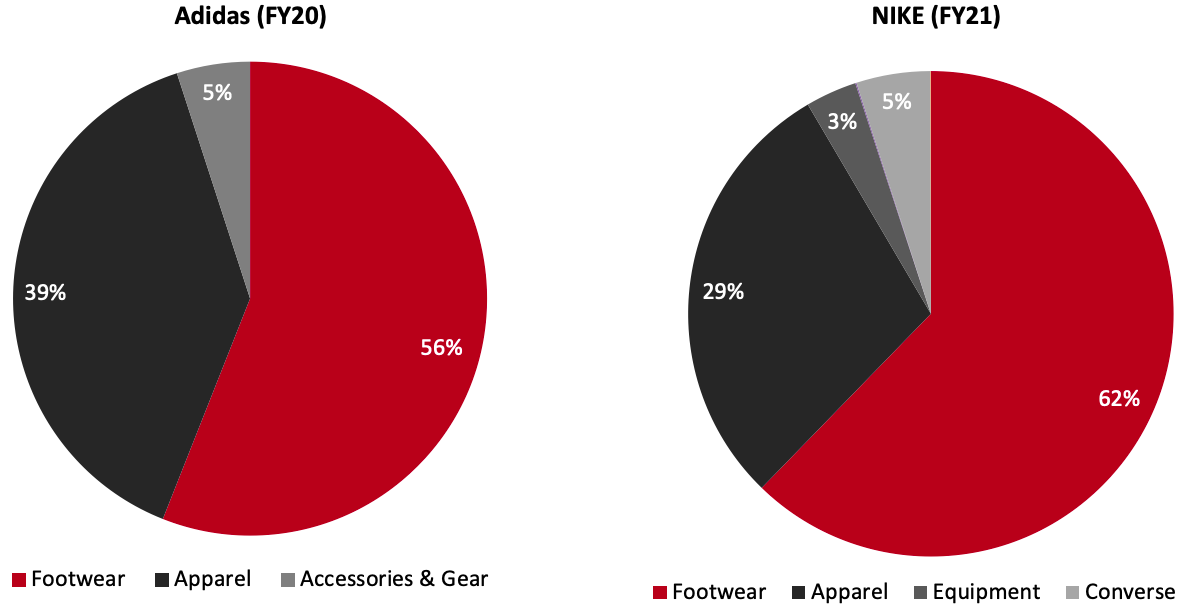

Note: Adidas’ fiscal year ends December 31; NIKE’s fiscal year ends May 31. USD conversion for Adidas revenue at a constant currency rate: $20.6 billion (FY15), $22.6 billion (FY16), $25.9 billion (FY17), $26.7 billion (FY18), $28.8 billion (FY19) and $24.2 billion (FY20).Source: Company reports[/caption] E-Commerce Revenue Both NIKE and Adidas’s businesses are weighted toward the footwear categories—with the category capturing 62% and 56% of sales at each company respectively in their latest fiscal years. This marks an increase from 60% in fiscal 2015 at NIKE. NIKE’s e-commerce sales accounted for 20% of total sales in fiscal 2021, up 66% on a currency-neutral basis at $9.1 billion. The company expects to reach 50% digital penetration within the next few years. Both Adidas and NIKE have mature e-commerce businesses, driven by their strong digital capabilities, product innovation and the impact of the pandemic on consumer shifts toward online shopping. Revenue by Category Both NIKE and Adidas’s businesses are weighted toward the footwear categories—with the category capturing 62% and 56% of sales at each company respectively in their latest fiscal years. This marks an increase from 60% in fiscal 2015 at NIKE. Also reflecting a strategic focus in footwear, Adidas reported that its apparel business captured 39% of total sales in fiscal 2020, compared to a 41% share in fiscal 2015 and 44.9% in fiscal year 2010. The company has reduced the scale of its apparel business to move toward a stronger balance between footwear and apparel in its offering. Figure 3 presents a revenue breakdown by product category for the two companies.

Figure 3. Adidas and NIKE: Revenue by Category, Latest Fiscal Year (%) [caption id="attachment_131834" align="aligncenter" width="700"]

Note: NIKE's Global Brand Divisions and Corporate category comprises the 1% not accounted for in the chart.

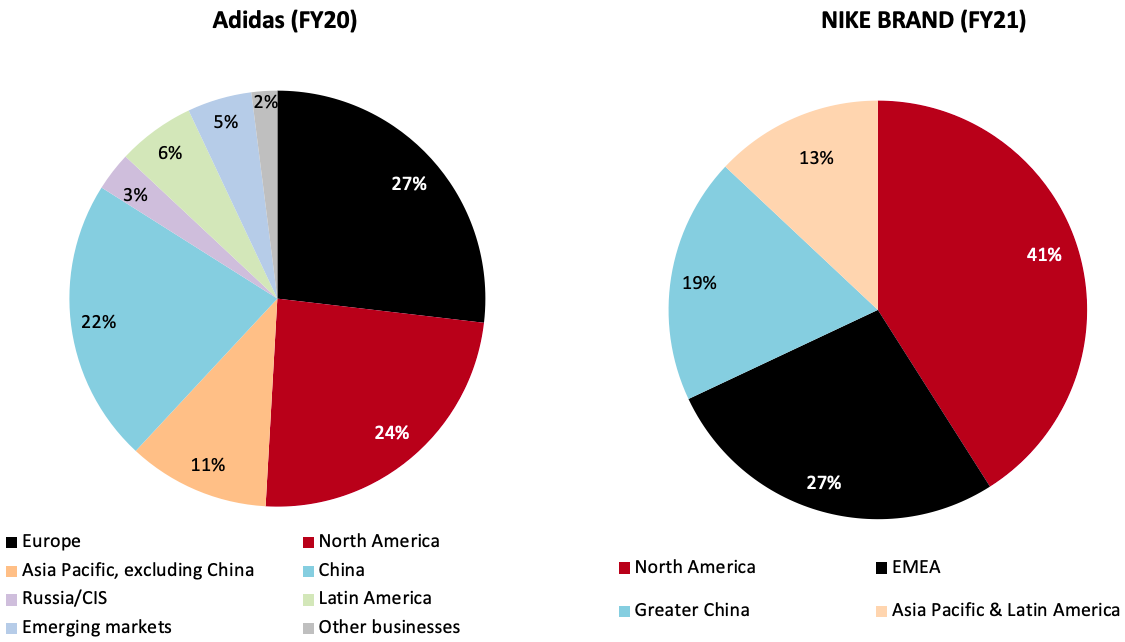

Note: NIKE's Global Brand Divisions and Corporate category comprises the 1% not accounted for in the chart.Source: Company reports[/caption] Revenue by Geography The NIKE brand has a deeper penetration into the North America market compared to Adidas, with the two generating 41% and 24% of total sales in the region in their latest fiscal years, respectively. This largely reflects NIKE’s origins as a US company with deeper roots in the market. Exploring both companies’ sales exposure in China further, the NIKE brand saw a lower proportion of its sales (19%) in the market compared to Adidas (22%), largely due to the scale of its business, but a higher absolute sales value at $8.3 billion in NIKE’s fiscal 2021 versus the €4.4 billion ($5.4 billion) reported by Adidas in fiscal 2020. The higher sales generation by NIKE is consistent with its earlier entry into the China market, in 1981—nine years earlier than the entry by Adidas in 1990. Furthermore, NIKE adopted a China-specific strategy to expand into lower-tier cities in China earlier than Adidas. NIKE has a bigger share of China’s sportswear market, accounting for 25.6% in calendar year 2020, compared to 17.4% for Adidas, according to Euromonitor.

Figure 4. Adidas and NIKE: Revenue by Geography, Latest Fiscal Year (%) [caption id="attachment_131844" align="aligncenter" width="700"]

Source: Company reports[/caption]

2. Sales Channel

We have seen both Adidas and NIKE shift their sales channels toward direct-to-consumer (DTC) and away from wholesale amid the pandemic given the greater resiliency of DTC sales. In addition, DTC is more effective in gaining customer insights and can help to improve top and bottom lines.

In fiscal 2020, Adidas attributed 41% of sales to DTC channels—comprising the company’s own retail and e-commerce business. The company expects its DTC business to account for around half of its net sales by 2025, which will see a reduction in its wholesale business from the current 59% share.

NIKE has a higher exposure to wholesale channels, with DTC comprising around 39% of the company’s sales in fiscal 2021. In a bid to scale up its DTC business, the company announced plans in August 2020 to cut ties with third-party retailers (wholesale accounts according to NIKE, including Belk, Bob's Stores, Boscov's, City Blue, Dillard's, EbLens, Fred Meyer, VIM, and Zappos) and then dropped a further three in March 2021—namely DSW, Macy’s and Urban Outfitters. We expect NIKE to continue to lower its reliance on the wholesale channel over the next few years.

3. Key Strategies

App Strategy

Both Adidas and NIKE have built mature app ecosystems with offerings focused on workout and run tracking, normal purchases and exclusive product drops.

We believe that NIKE’s apps offer more engaging experiences than the Adidas equivalents. For instance, NIKE has created apps focused around community sharing, livestreaming and leveraged elements of popular culture such as emojis with a sport celebrity twist, as we discuss in Figure 4.

NIKE’s latest app SNKRS, launched in December 2020, facilitated the company’s first-ever product drop via livestreaming. The company reported a 100% sell-through of the newly released Air Jordan 4 PSG in under two minutes. This livestreaming capability is now fully launched in both North America and the EMEA region and the company has plans to implement the offering in Japan. We see NIKE’s move toward in-app live interaction as providing strong opportunity to boost consumer engagement.

Source: Company reports[/caption]

2. Sales Channel

We have seen both Adidas and NIKE shift their sales channels toward direct-to-consumer (DTC) and away from wholesale amid the pandemic given the greater resiliency of DTC sales. In addition, DTC is more effective in gaining customer insights and can help to improve top and bottom lines.

In fiscal 2020, Adidas attributed 41% of sales to DTC channels—comprising the company’s own retail and e-commerce business. The company expects its DTC business to account for around half of its net sales by 2025, which will see a reduction in its wholesale business from the current 59% share.

NIKE has a higher exposure to wholesale channels, with DTC comprising around 39% of the company’s sales in fiscal 2021. In a bid to scale up its DTC business, the company announced plans in August 2020 to cut ties with third-party retailers (wholesale accounts according to NIKE, including Belk, Bob's Stores, Boscov's, City Blue, Dillard's, EbLens, Fred Meyer, VIM, and Zappos) and then dropped a further three in March 2021—namely DSW, Macy’s and Urban Outfitters. We expect NIKE to continue to lower its reliance on the wholesale channel over the next few years.

3. Key Strategies

App Strategy

Both Adidas and NIKE have built mature app ecosystems with offerings focused on workout and run tracking, normal purchases and exclusive product drops.

We believe that NIKE’s apps offer more engaging experiences than the Adidas equivalents. For instance, NIKE has created apps focused around community sharing, livestreaming and leveraged elements of popular culture such as emojis with a sport celebrity twist, as we discuss in Figure 4.

NIKE’s latest app SNKRS, launched in December 2020, facilitated the company’s first-ever product drop via livestreaming. The company reported a 100% sell-through of the newly released Air Jordan 4 PSG in under two minutes. This livestreaming capability is now fully launched in both North America and the EMEA region and the company has plans to implement the offering in Japan. We see NIKE’s move toward in-app live interaction as providing strong opportunity to boost consumer engagement.

Figure 5. Adidas vs. NIKE: App Ecosystem [wpdatatable id=1209]

Source: Adidas/NIKE

Business Strategy We compare three key business strategies documented by each company. Adidas updated its five-year strategic plan in 2021 and focuses on:- Strengthening the credibility of Adidas: According to the company, credibility refers to delivering ground-breaking innovations in sports, as well as cutting-edge fashion items that are culturally connected. To successfully deliver on this initiative, Adidas intends to build a clearer brand image in its Sport and Lifestyle segments, with a focus on football, running, training and outdoor in the former and on athleisure in the latter. Adidas expects the segments to account for more than 95% of its revenue growth by 2025. Although the company overall expects to build stronger capabilities in sports and lifestyle business, it makes some adjustment to its brand portfolio for better development. For example, the company entered a definitive agreement to sell Reebok, a sportswear brand, to Authentic Brands Group in August 2021, aiming to focus more efforts on growing adidas brand.

- Creating a unique customer experience: Adidas plans to accelerate its transformation into a DTC-led business, fueled by more personalized offerings in both its digital and physical stores. The company expects its DTC business to account for around 50% of total sales and generate more than 80% of its targeted top-line growth by 2025. This will be accompanied by a move toward a member-ship led business as Adidas continues to invest in e-commerce and expand its membership program. The company plans to build an industry-leading program comprising exclusive products and personalized stories and experiences for members. Furthermore, Adidas reported that it will expand its membership program through its engagement in megacities. The company will add six more target cities (Beijing, Berlin, Dubai, Mexico City, Moscow and Seoul) to its current portfolio of key cities (London, Los Angeles, New York, Tokyo, Paris and Shanghai).

- Expanding the company’s activities in sustainability: Adidas plans for “nine out of 10” of its items to be sustainable by 2025, compared to six in 10 currently. Adidas intends to innovate through “three loops”—items made from recycled materials, circular items that can be remade into something else at the end of their life, and regenerative items made with natural and renewable materials. Adidas announced that it will launch a vegan, fully recyclable and biodegradable version of its popular lifestyle shoe, Stan Smith, in 2022. A timeline of sustainability initiatives is available in our Adidas Investor Day 2021 report.

- Innovation: The company aims to design innovative products that incorporate technology to improve appeal and performance. For instance, its recently launched Zoom 10 Invincible Run sneaker is designed with materials marketed as helping to prevent injury.

- Increasing speed to market: NIKE continues to optimize its supply and management to maintain healthy inventory levels and respond to the market rapidly. The company’s Express Lane system identifies the fastest delivery routes to allow products to reach customers more quickly, offering. increased flexibility and responsiveness in serving consumer demand while driving higher profitability. The company continues to scale radio-frequency identification (RFID) capabilities across stores in EMEA, enabling better product allocation and replenishment. NIKE is testing consumer-facing RFID capabilities, such as self-checkout, in its stores in Korea.

- Connect with consumers directly: NIKE continues to make significant investments in digital technologies and information systems under NIKE Direct—its consumer-facing platform for company news, stories and updates. NIKE focuses on engaging and serving members using multiple mediums, including livestreaming and social media platforms. The company also continues to innovate the services offered to its NIKE members, hosting its first globally coordinated member day in 2020, for instance. The event offered early product access, activity rewards and exclusive discounts across stores and online.

- Global committee to accelerate inclusion and equality

- Mandatory diversity and inclusion training for all employees

- US target to fill at least 30% of all new positions with Black and LatinX staff

- Investment of $120 million through 2025 in the US toward ending racism and supporting Black communities

- Ensure women make up 45% of leadership roles

- Ensure racial minorities are represented in 35% of leadership roles

- Advancing ethical manufacturing processes

What We Think

We expect sportswear to continue to be an essential market category in the global apparel and footwear market. Over the next three to five years, we anticipate that NIKE will retain its status as the largest global sportswear company, with a higher revenue rival Adidas, driven by the company’s stronger digital capabilities and top-tier brand collaboration. Implications for Brands/Retailers- NIKE entered the China market earlier than Adidas and adopted a China-specific strategy to expand sales into lower-tier cities. We recommend that retailers and brands with plans to improve their position in the China market consider opportunities presented by lower-tier cities.

- The DTC selling channel allows brands to launch products faster and increase control over customer data, pricing and brand management. However, as the model will likely bring more supply chain pressure and advertising costs it is important that brands choose appropriate distribution models and strategies to realize higher profit margins. For brands that want to increase DTC sales, we recommend that they focus on facilitating value-aligned and engaging consumer experiences.

- Although Adidas and NIKE are now looking to bypass traditional, multi-brand distribution channels to sell directly to consumers, we expect that some sportswear brands will be cautious in giving up existing customer bases developed through multi-brand channels. Therefore, we foresee other sportswear brands leveraging the power of third-party marketplaces and retail giants to sustain top-line growth.