DIpil Das

What’s the Story?

Kering and LVMH are the two leading houses in the global luxury sector and own a host of top brands. As part of Coresight Research’s Head-to-Head series, we provide insights into four key elements of the two businesses, covering revenue, markets of operation, digital strategies and business expansion.Why It Matters

The luxury sector is at the brink of transformation—it is increasingly digitalized and more and more young consumers are shopping for luxury than ever before. As brands evolve to keep up with the modern luxury consumer, we explore how global luxury leaders Kering and LVMH have grown to cater to this consumer while remaining vestiges of culture, design and value of a bygone era.Kering vs. LVMH: Coresight Research Analysis

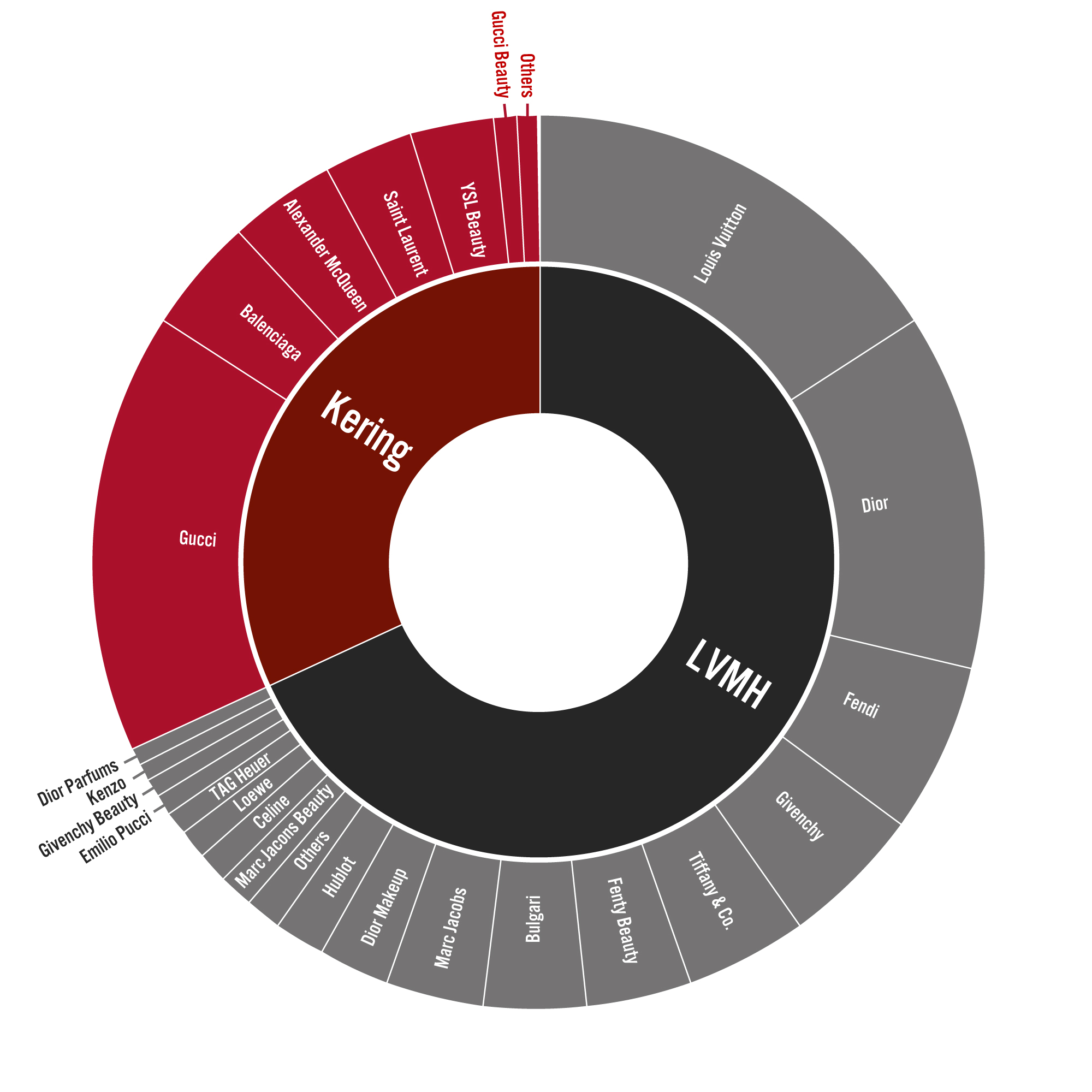

Overview LVMH was formed through the merger of Moët Hennessy (established in the 18th century by wine trader Claude Moët) and Louis Vuitton (founded in the 19th century by luxury luggage maker Louis Vuitton). Kering, on the other hand, was established as the Pinault Group in 1963 and specialized in timber trading. The company’s first true foray into luxury was with its acquisition of a 42% stake in Gucci Group in 1999, which it progressively increased to finally own 99.4% by 2004. The Pinault Group was rebranded as Pinault-Printemps-Redoute in 1994, as PPR in 2005 and finally became known as Kering in 2013. Both conglomerates have come to command leading shares in the personal luxury goods market with a slew of acquisitions of major names in the sector. They operate across mature and emerging markets across the world through directly operated stores, wholesale distribution and e-commerce. We provide a comparison of key facts and top-line figures for each company in Figure 1.Figure 1. Company Overviews: Kering and LVMH [wpdatatable id=1370 table_view=regular]

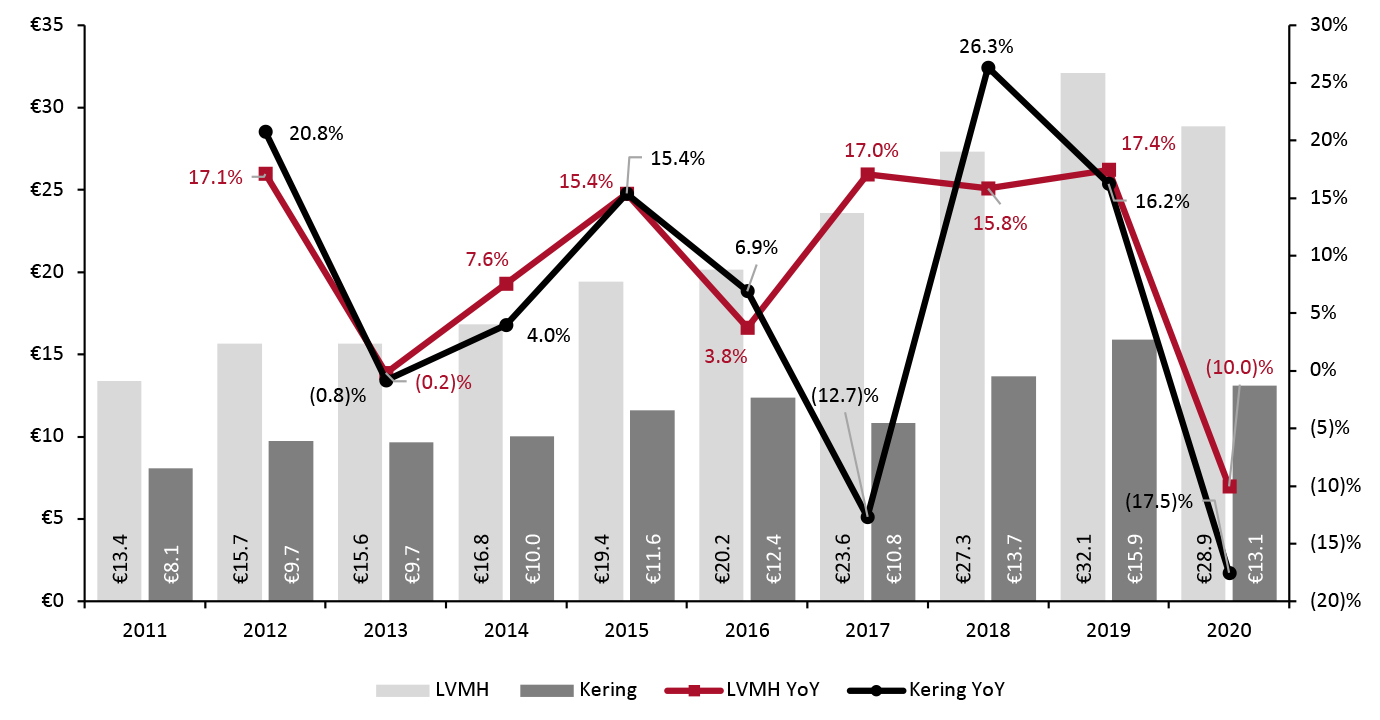

Source: Company reports/Coresight Research 1. Revenue Growth LVMH is the world’s largest luxury conglomerate, with its latest total annual revenues reaching €44.7 billion ($52.1 billion). Excluding the company’s selective retailing segment of €10.2 billion ($11.8 billion), wines and spirits segment of €4.8 billion ($5.6 billion) and its Other and Holding Companies segment of €868 million ($1.0 billion), which consists of hospitality businesses, an amusement park, a newspaper and a yacht-making company, LVMH recorded revenue of €28.9 billion ($33.5 billion) in 2020, down 10.0% from 2019. We exclude these business segments in our discussion of LVMH to keep the focus on consumable product categories in which it directly competes with Kering. LVMH has experienced fairly steady growth over the years thanks to continued acquisitions, as shown in Figure 2. Kering’s revenues amounted to €13.1 billion in 2020, down 17.5% from 2019. The company’s growth has been uneven, primarily due to its rationalization activities. In 2018, Kering spun off sports brand Puma to its own shareholders, leaving the company with a 9.8% stake, and designer Stella McCartney bought back the 50% stake that Kering owned in her brand.

Figure 2. Kering vs LVMH*: Revenue (EUR Bil.; Left Axis) and YoY % Change (Right Axis) [caption id="attachment_134794" align="aligncenter" width="725"]

*LVMH revenue excludes hospitality, media, selective retailing, and wines and spirits

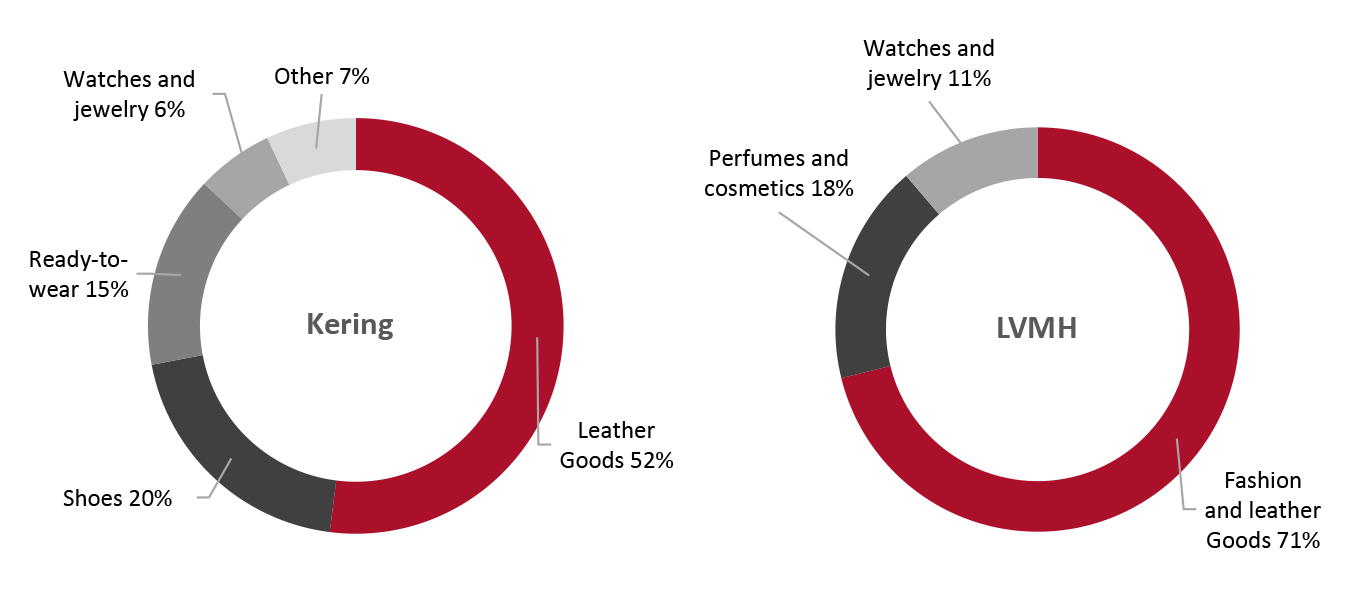

*LVMH revenue excludes hospitality, media, selective retailing, and wines and spirits Source: Company reports/Coresight Research [/caption] Revenue by Product Category Kering and LVMH are strong players in the luxury fashion and leather goods segment. At LVMH, the segment contributed 71% of the company’s revenue in 2020, as shown in Figure 3, amounting to €21.2 billion ($24.8 billion). Leather goods form 52% of Kering’s revenue, with shoe sales accounting for a further 20% and ready-to-wear apparel accounting for a further 15%—amounting to €11.4 billion ($13.4 billion) in total.

- LVMH

- Kering

Figure 3. Kering vs. LVMH: 2020 Revenue by Product Category [caption id="attachment_134795" align="aligncenter" width="725"]

*LVMH revenue excludes hospitality, media, selective retailing, wines and spirits

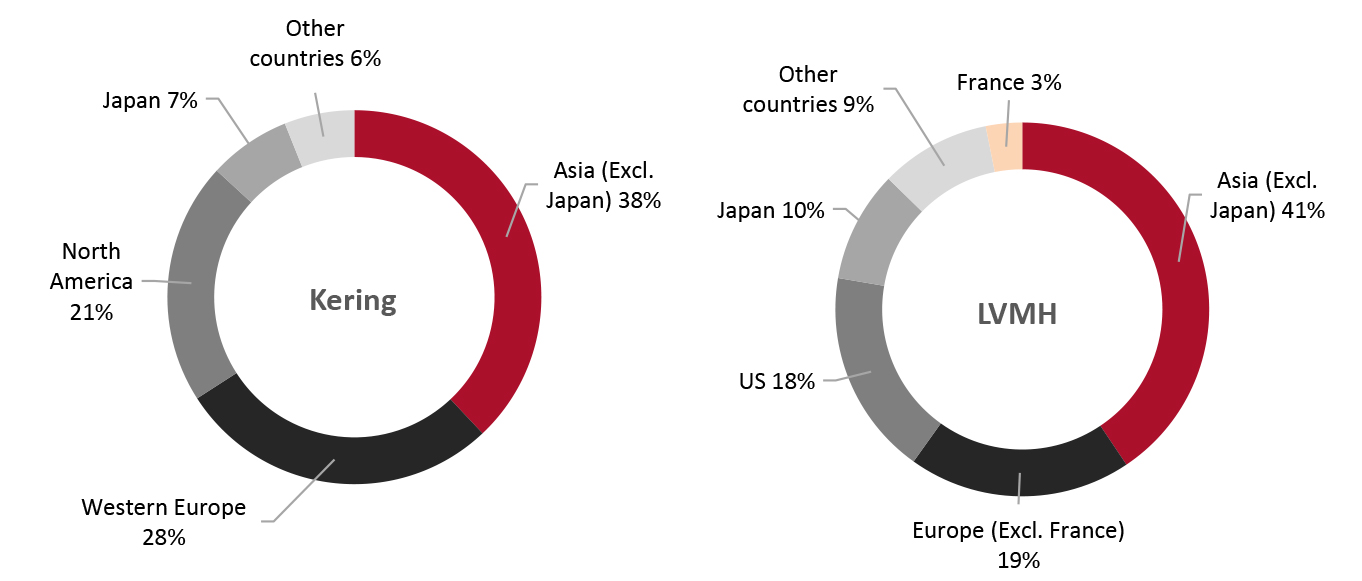

*LVMH revenue excludes hospitality, media, selective retailing, wines and spirits Source: Company reports/Coresight Research [/caption] 2. Markets of Operation Both companies have a near-even split in their markets of operation. Kering’s top markets are Asia (excluding Japan), Western Europe and North America while LVMH’s are Asia (excluding Japan), the US and Europe (excluding France), as shown in Figure 4. China is of increasing interest for both companies as Chinese consumers establish themselves as the vanguard in luxury consumption. Both Kering and LVMH are building out their China penetration.

- Click here to read our Think Tank on China’s luxury consumption.

Figure 4. Kering vs. LVMH: Revenues by Geography, 2020 [caption id="attachment_134796" align="aligncenter" width="724"]

*LVMH revenue excludes hospitality, media, selective retailing, wines and spirits

*LVMH revenue excludes hospitality, media, selective retailing, wines and spirits Source: Company reports/Coresight Research [/caption] 3. Digital Strategies While both companies made significant strides in their digital transformation in 2020, including enhancing digital shopping experiences and launching virtual stores, they continue to explore and invest in a range of different technologies and innovative digital solutions. E-Commerce 2020 was the year of e-commerce for Kering and LVMH alike. LVMH’s online penetration rates “increased significantly” in 2020, up from 9% in 2019, as stated on its January 2021 earnings call. The company did not divulge information the 2020 rate, explaining that “because it is high, it is not sustainable.” Kering’s online penetration increased from 7% in 2019 to 13% in 2020. The rate continued to rise significantly and the company posted 108% growth in its first quarter of 2021, taking penetration to 14%. Social Media LVMH has a stronger social media presence than Kering, which can be attributed to the much larger number of brands that it owns—75 (including all business units) versus 12 at Kering. LVMH’s namesake brand Louis Vuitton has slightly fewer Instagram followers at 44.4 million than Kering’s top brand Gucci, which has 44.5 million followers, as of June 9, 2021. Collectively, major brands at LVMH have amassed 190.3 million Instagram followers, while Kering has 88.8 million followers on Instagram.

Figure 5. Kering and LVMH: Instagram Followers, by Beauty, Fashion, Jewelry, Leather Goods and Watch Brands [caption id="attachment_134797" align="aligncenter" width="725"]

As of June 9, 2021

As of June 9, 2021 Source: Instagram/Coresight Research [/caption] Brands from both companies also actively engage with consumers on short-video platforms, such as Snapchat and TikTok, where they can reach a younger audience compared to Instagram. Gucci’s campaigns on TikTok, such as #AccidentalInfluencer and #GucciModelChallenge, have garnered tens of millions of views, as of September 2021. LVMH’s Christian Dior has frequently partnered with Snap, Inc., the owner of Snapchat. For instance, in 2020 the company leveraged the platform to promote its fall release of the B27 sneaker line using Snapchat Lenses. Users could virtually try on the sneakers using these lenses and purchase them directly through the Snapchat app. In addition, on June 7, 2021, Dior launched a line of colorful accessories for men with two new Snapchat lenses that enable virtual try-on. Amid pandemic-related social distancing requirements, Kering and LVMH brands canceled their in-person fashion shows in 2020 and earlier in 2021. Instead, Balenciaga, Dior Gucci and Louis Vuitton livestreamed many of their events. Dior hosted a livestreamed discussion panel with key opinion leaders in China after its Spring 2021 show in January, hosting the stream on Weibo. Gamification Brands from both companies have explored retail gamification to engage shoppers and boost sales, Gucci has leveled up on this front through its gaming platform collaborations. The brand partnered with Roblox to launch a virtual garden named Gucci Garden in May 2021, allowing users to experience its campaigns through the platform. In February 2021, Gucci also collaborated with Nintendo game Animal Crossing to integrate products from its #ForeverGuilty campaign into the game’s virtual world, including perfume shelves with Gucci’s perfume collection and a Gucci blanket. Moreover, Kering’s Balenciaga unveiled its Fall 21 collection in December 2020 with a dystopian video game Afterworld, in which users could take a virtual walk through the game’s environment and view items from the show. LVMH released a collection in 2019 in collaboration with the League of Legends, by Riot Games but it has not experimented with gaming more recently. Innovation Both companies demonstrate an interest in the startup and innovation space. LVMH’s startup accelerator Station F identifies and incubates emerging tech startups. Most recently, its incubator participant Replika Software, which provides a turnkey social selling solution for brands, raised an undisclosed amount in Series A funds from LVMH Luxury Ventures and L’Oréal Bold, the investment arms of both of these companies. Kering operates a Materials Innovation Lab for, which aims to pioneer the development of sustainable materials. The Lab works with Kering’s houses to incorporate sustainability practices into their supply chains, and partners with startups to expand its innovation solutions. Kering is also part the Mylo consortium, comprising Adidas, Lululemon, Stella McCartney, along with Bolt Threads, a US-based biotech firm that makes sustainable materials for the fashion sector. The latest development in the consortium is a synthetic leather material made from the root structure of mushrooms. The consortium was formed to bring Mylo to the market with products made from the material. Kering and LVMH forged a blockchain partnership in April 2021, along with Switzerland-based luxury goods company Richemont, named Aura Blockchain Consortium. The solution aims to “address the shared challenges of communicating authenticity, responsible sourcing and sustainability in a secure digital format for luxury brands,” according to the press release. 4. Business Expansion Kering and LVMH have become global leaders through strategic acquisitions and calculated divestitures. In the near term, however, both companies are looking to grow organically. LVMH completed the acquisition of jewelry company Tiffany & Co. in January 2021 for $16.1 billion, and is not looking to undertake any new merger and acquisition (M&A) activities in the near future. On its April 2021 earnings call, CFO Jean-Jacques Gulony stated that “integrating Tiffany is very important for us, and we don't want to dilute our efforts by going on to new ventures that could make our life complicated and make us, from a management viewpoint, less efficient.” Over previous years, LVMH has acquired several beauty, fashion and jewelry brands. From the late 1990s to the early 2000s, the company acquired four beauty brands in close succession— Benefit Cosmetics, Fresh, Hard Candy and Urban Decay. It still owns Benefit Cosmetics and Fresh but has since sold the other two brands. LVMH has pared less profitable businesses or those that do not align with its core luxury strategies, such as fashion label Donna Karan in 2016 and Michael Kors in 2003, in which the group once held a 33% stake. LVMH focuses on six pillars for growth, as established in its 2020 annual report:

- Decentralized organization to ensure brands function autonomously and are agile in responding to market changes

- Organic growth through investments in brands and employees to foster innovation and creativity

- Vertical integration to ensure control across the value chain, from sourcing and production to retailing

- Creating synergies within the group’s divisions to leverage each unit’s individual competencies

- Maintaining savior-faire by developing proprietary skills, crafts and initiatives and passing them down to younger generations to ensure their continuity

- Balance across business segments and geography to diversify risks amid economic uncertainties

- Progressing on its sustainability commitments, such as minimizing its environmental footprint, enhancing traceability, improving diversity, and developing new collections and business models with a sustainability focus.

- Deploying innovative market approaches by adapting fashion calendars and collections to the “new normal,” digitalizing design processes and showrooms, improving customer experience with technology, and growing brand visibility with social commerce and livestreaming.

- Growing control over distribution by adapting its directly operated store network to market demand, improving its own websites, reducing the overall share of the wholesale channel and developing integration across omnichannel platforms.

- Investing in growth platforms, namely increasing production capacity in Italy, investing in artificial intelligence (AI)-powered technology for demand forecasting and logistics planning, and improving information systems and cybersecurity.

What We Think

LVMH is the undisputed leader in luxury due to its sheer scale of revenues and operations, and the number of brands under its wing. The conglomerate also has a richer legacy and deeper expertise within luxury compared to Kering. Based on the latest fiscal year results, Kering is €26 billion ($30 billion) away from being on par with LVMH in terms of revenue. Kering’s smaller operations likely make it more agile when responding to market changes, disruptions and crises. It has made bold moves with its brands Balenciaga and Gucci when it comes to embracing technology, which has resonated well with the increasingly younger luxury audience. Kering’s flexibility to embrace new trends quickly make it more accessible, positioning it for growth and possibly eventually reach the level of LVMH’s top brands. The two companies take a differing approach to growth, although both are taking an organic approach in the near term. Kering’s activities are more focused on tech and engaging with a younger audience, while LVMH’s brands are less engaged with technology, possibly because they do not want to diminish luxury’s traditionally personal, customer-centric service. Implications for Brands/Retailers- Kering and LVMH are looking to increase control over distribution, which will put wholesale buyers at a disadvantage.

- Although both companies are looking at organic growth in the near term, they will inevitably look to acquire independent, pure luxury brands in the future, to grow their capacity and market.

- As retail technology applications tend to be created for retail in general and do not focus on the exclusivity of luxury, technology companies should look to develop applications tailored to the luxury sector. Blockchain technology and sustainable materials innovation have immense scope for success in luxury.

- As Kering and LVMH look to increase control of distribution, they are likely to want to open more directly operated stores in prime locations in high-growth markets. Firms that are able to offer these retail spaces will stand to benefit from this shift from wholesale.

Appendix Figure 1. LVMH: Acquisitions and Divestitures

[wpdatatable id=1368 table_view=regular]Source: Company reports

Appendix Figure 2. Kering: Acquisitions and Divestitures

[wpdatatable id=1369 table_view=regular]Source: Company reports