DIpil Das

Introduction

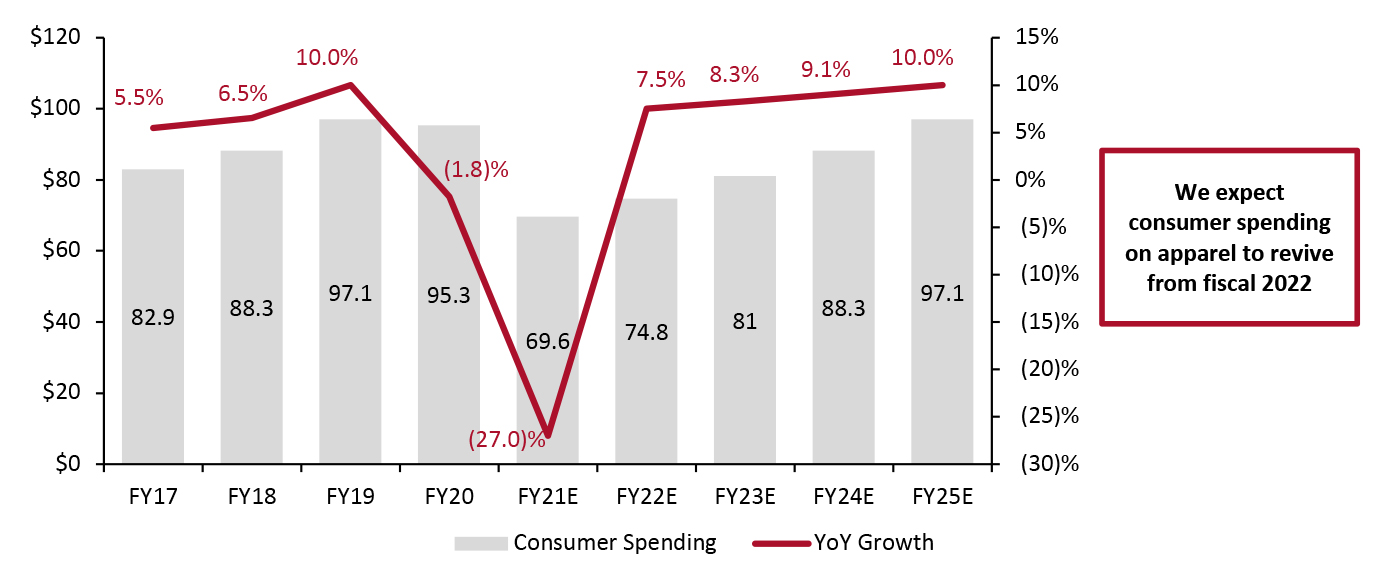

What’s the Story? Aditya Birla Fashion and Retail Limited (ABFRL) and Arvind Fashions Limited (AFL) are India’s leading apparel retailers (apparel comprises clothing, footwear and accessories). As part of Coresight Research’s Head-to-Head series, we provide insights into six key elements of their businesses: revenue growth, brands and product groups, store portfolios, e-commerce and digital initiatives, growth strategies, and sustainability initiatives. Why It Matters India’s consumer spending on apparel will increase by 7.5% year over year in FY22 (ending March 31, 2022), reaching $74.8 billion, Coresight Research estimates based on Ministry of Statistics and Programme Implementation (MOSPI) data released in January 2021 (latest available data). We expect to see increase consumer spending in the years following, with a return to pre-pandemic growth levels by FY25.Figure 1. India: Consumer Spending on Apparel (Left Axis, USD Bil.) and Growth (Right Axis, YoY % Change) [caption id="attachment_140882" align="aligncenter" width="700"]

Fiscal year runs from April 1 to March 31

Fiscal year runs from April 1 to March 31 Source: MOSPI/Coresight Research [/caption]

ABFRL vs. AFL: Coresight Research Analysis

Business Overview ABFRL and AFL are leading players in India’s apparel market, housing prominent Indian and international fashion and lifestyle brands. We provide a comparison of key facts and top-line figures for each company in Figure 2.Figure 2. Company Overviews: ABFRL vs. AFL [wpdatatable id=1692 table_view=regular]

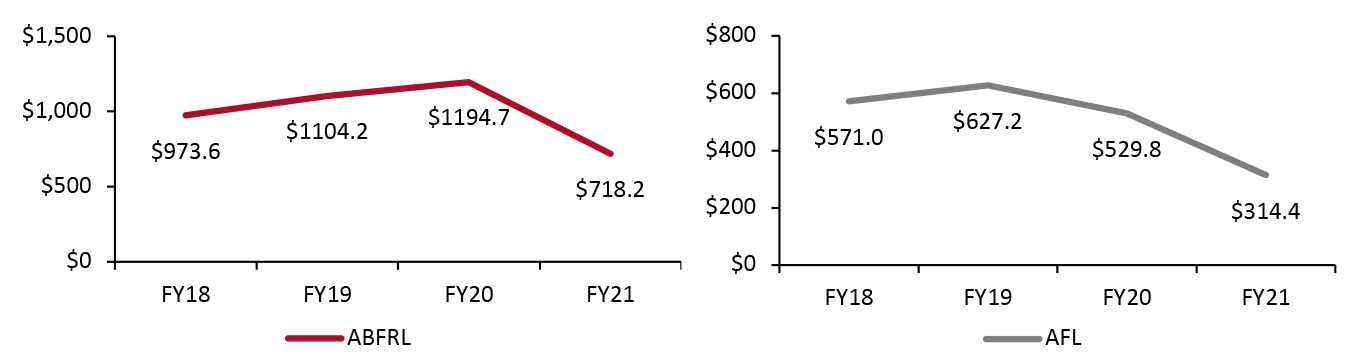

*See Figure 5 for the full list of brands Source: Company reports 1. Revenue Growth While ABFRL registered a CAGR increase of 10.8% from FY18 to FY20, the pandemic impacted its growth in FY21, with revenue dropping to $718.2 million—a year-over-year decline of 39.9%. AFL recorded an increase of 9.8% between FY18 and FY19. However, its revenue declined in FY20 to $529.8 million, with a year-over-year drop in growth of 15.5% and a further decline in FY21 of 41% year over year. This is largely due to actions taken by the company to exit poor performing brands, including GAP, The Children’s Place and Hanes. ABFRL dominates the market with more than twice the revenue of its competitor. We attribute ABFRL’s growth from FY18 to FY20 to the company’s continued investment in brand building, product design and a refreshed store experience over these years. Furthermore, to offset the impact of the Covid-19 pandemic on its business, the company made comprehensive cost reductions, aligned its product mix with changing consumer mindsets and accelerated its digital transformation. The company’s lifestyle brands—Allen Solly, Louis Philippe, Peter England and Van Heusen—continued to dominate their respective segments and accounted for 64% of the company’s FY21 revenue at ₹34.1 billion ($457.6 million), albeit with a 37% year-over-year decrease amid the pandemic. ABFRL’s value fashion brand Pantaloons contributed 35% of the company’s FY21 revenue, equating to ₹18.6 billion ($249.8 million). The brand focused on growing its online store Pantaloons.com in the year. Furthermore, we saw ABFRL’s decision to shift from a four-season cycle to a 12-season cycle in fiscal 2019 pay off, helping the company to keep ahead of fast-changing fashion trends and manage its inventory more efficiently.

Figure 3. ABFRL and AFL Revenue (USD Mil.) [caption id="attachment_140883" align="aligncenter" width="700"]

Conversions to USD are at average 2021 exchange rates

Conversions to USD are at average 2021 exchange rates Fiscal year runs from April 1 to March 31

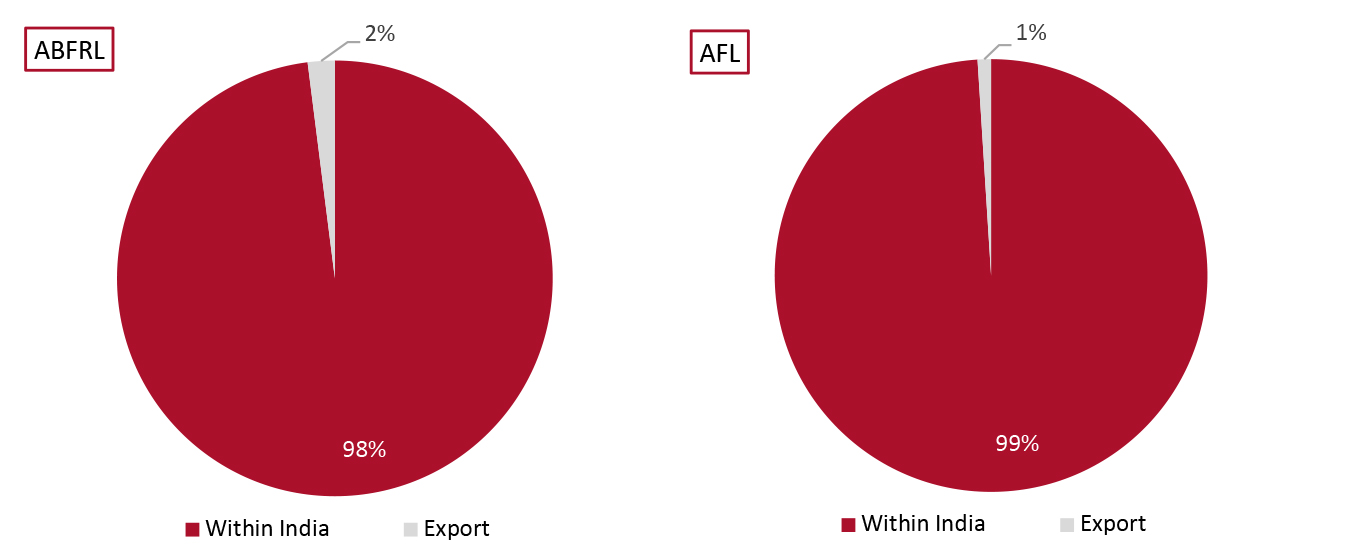

Source: Company reports [/caption] Geography Both companies’ revenues are concentrated in India, with a small percentage attributed to exports, as shown in Figure 4.

Figure 4. ABFRL vs. AFL: Percentage Revenue Split by Geography, FY21 [caption id="attachment_140884" align="aligncenter" width="700"]

Source: Company reports[/caption]

2. Business Coverage

ABFRL owns brands within the lifestyle, value fashion and ethnic wear categories, as well as working in partnership with several global brands. AFL focuses largely on casualwear, with a portfolio of brands across price points and fast growth categories.

In Figure 5 and Figure 6, we provide profiles of the brands owned by each company.

Source: Company reports[/caption]

2. Business Coverage

ABFRL owns brands within the lifestyle, value fashion and ethnic wear categories, as well as working in partnership with several global brands. AFL focuses largely on casualwear, with a portfolio of brands across price points and fast growth categories.

In Figure 5 and Figure 6, we provide profiles of the brands owned by each company.

Figure 5. ABFRL Product Groups and Brands [wpdatatable id=1688 table_view=regular]

Source: Company reports

Figure 6. AFL Product Groups and Brands [wpdatatable id=1689 table_view=regular]

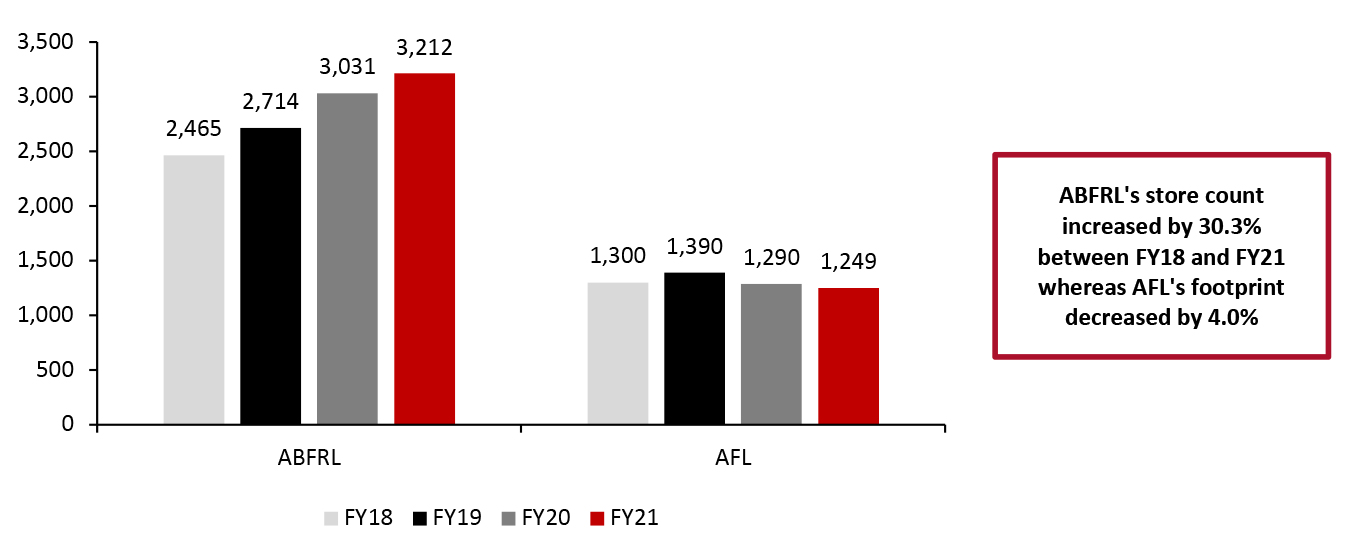

Source: Company reports 3. Sales Channels Store Portfolios Stores are an integral part of customer experiences in apparel purchases, given the importance attributed to trying on clothing and footwear before purchasing to check fit and style. According to the Festive Shopping Index 2021 survey by the Retailers Association of India (RAI) and customer management company LitmusWorld in October, 46% of consumers preferred standalone stores as a purchase channel for their festive season purchases compared to 37% in 2020. Apparel and jewelry were key categories that Indian consumers were inclined to shop for in standalone stores in the survey. ABFRL, in particular, has focused on building out its store portfolio in recent years. In Figure 7, we present both companies’ standalone store portfolios from FY18 to FY21.

Figure 7. ABFRL vs. AFL: Store Portfolio [caption id="attachment_140885" align="aligncenter" width="700"]

The count includes company-owned, franchise, department stores and shop-in-shop locations

The count includes company-owned, franchise, department stores and shop-in-shop locations Source: Company reports [/caption] ABFRL added 380 stores under its lifestyle brand business in FY21. Pantaloons added another 19 stores to its network in the year, taking its standalone total to 346 stores. Peter England’s small-town format focusing on Tier 2 and Tier 3 cities crossed the 300-store milestone in the year, too. ABFRL plans to expand its retail footprint for Peter England by 1,000 stores by FY23. Furthermore, the company plans to open 500 Allen Solly stores and 250 Pantaloons stores across 100 new towns in the period. In addition to standalone stores, the company has a presence across 24,000 multi-brand outlets and has 6,200 points of sale in department stores across India, as of FY20. While AFL has a smaller standalone store footprint than ABFRL, the retailer also operates shop-in-shop locations in department stores and has a strong online presence. The company plans to expand its distribution strength to Tier 3 and Tier 4 towns. In addition to the retail expansion through new store launches, store upgrades, and multi-category brand stores, AFL is also building a stronger omnichannel presence for U. S. Polo Assn., Flying Machine, Calvin Klein and Sephora. Figure 8 provides a breakdown of branded stores owned by ABFRL and AFL brands.

Figure 8. ABFRL vs. AFL: Store Portfolio, by Exclusive Branded Stores [wpdatatable id=1694 table_view=regular]

Brand store count includes only company-owned stores exclusive to each brand Source: Company reports/websites Online Digital transformation has been a top priority for both companies, accelerated by the pandemic. We discuss recent developments in digitalization at both companies. ABFRL has initiated several digital initiatives focusing on e-commerce, customer experience and customer engagement over the past three years.

- In FY21, the company adopted a brand-led e-commerce strategy–launching web portals and mobile apps for each of the brands, enabling seamless omnichannel capabilities.

- ABFRL scaled its e-commerce capacity by more than three times in FY21 compared to the prior year, according to the company. It is focused on “digital store” capabilities to help customers interact digitally with store associates to arrange pickup and alterations. The company also offers “endless aisle” capabilities enabling consumers to access the entire range of merchandise available in warehouses as well as stores.

- The company rolled out a platform to automate communication with customers through multiple channels, including e-mail, SMS, web, app, social and WhatsApp. The company also rolled out digital solutions for distributors and staff to maximize productivity.

- The company replaced its physical seasonal tradeshow with a digital tradeshow platform in FY20, enabling it to move from a 12-season cycle toward continuous product development. This allows ABFRL to respond rapidly to fashion trends and changing consumer needs, as well as gain better control of the end-to-end product development cycle.

- In FY21, AFL partnered with Walmart-owned Indian e-commerce marketplace Flipkart to accelerate Flying Machine’s online journey to become India’s top youth brand. The alliance has helped the company to apply consumer insights in product innovation and supply chain efficiency.

Figure 9. ABFRL’s Acquisitions of /Partnerships with Ethnic Wear Brands [wpdatatable id=1695 table_view=regular]

Source: Company reports AFL is focusing on strengthening its market share in casual wear and denim amid increased demand for informal clothing. According to the company, this strategy is centered on six high-conviction brands: U. S. Polo Assn., Tommy Hilfiger, Flying Machine, Arrow, Calvin Klein and Sephora.

Figure 10. AFL’s Growth Plans for Its High Conviction Brands, FY22 and Beyond [wpdatatable id=1690 table_view=regular]

Source: Company reports 5. Sustainability Initiatives We summarize sustainability initiatives by ABFRL and AFL in Figure 11.

Figure 11. Sustainability Initiatives by ABFRL and AFL, FY21 [wpdatatable id=1691 table_view=regular]

Source: Company reports