Nitheesh NH

Introduction

What’s the Story? Reliance Industries and Tata Group are two of India’s biggest conglomerates, each with diverse businesses across various sectors, including apparel, grocery and electronics. As part of Coresight Research’s Head-to-Head series, we provide insights into the many facets of these two Indian conglomerates, including their performances, business strategies, operating margins, brand portfolios and sustainability initiatives. Why It Matters Reliance Industries’ and Tata Group’s retail verticals rank in the top 10 retail companies in India by revenue (see Figure 1 below). Reliance Retail Ventures, a subsidiary of Reliance Industries, ranks number one with a 67.7% share of the top 10 companies’ fiscal 2021 (ended March 31, 2021, in India) combined revenue. Meanwhile, two of Tata Group’s retail companies—Titan Company and Trent Limited—hold a combined share of 11.4% of the top 10 companies’ 2021 combined revenue.Figure 1. India: Top 10 Retail Companies by Revenue, FY21

| Company Name | Retail Sector | Total Revenue, FY21 (USD Mil.) | YoY % Change | Share of Top 10 Combined Revenue (%) |

| Reliance Retail Ventures | Conglomerate (Apparel, electronics, grocery, jewelry and others) | $19,681.6 | (5.7)% | 67.7% |

| Avenue Supermarts | Grocery | $3,300.0 | (0.1)% | 11.4% |

| Titan Company (Tata) | Watches and accessories | $2,958.4 | 5.8% | 10.2% |

| Future Retail | Grocery and electronics | $866.5 | (68.0)% | 3.0% |

| Aditya Birla Fashion and Retail | Apparel | $717.5 | (38.5)% | 2.5% |

| Trent Limited (Tata) | Apparel, department stores, grocery, cash and carry, wholesale | $354.4 | (23.9)% | 1.2% |

| Spencer’s Retail | Grocery | $331.9 | (5.3)% | 1.1% |

| Future Lifestyle Fashions | Apparel | $311.2 | (62.8)% | 1.1% |

| Arvind Fashions | Apparel | $300.9 | (41.4)% | 1.0% |

| Shoppers Stop | Department stores | $239.1 | (48.3)% | 0.8% |

| Total | $29,061.5 | 100% | ||

| Total as a % of estimated consumer spending on retail in India | 3.6% | |||

This ranking excludes revenues from Tata Group’s privately held businesses, Infiniti Retail and Tata Cliq, as they do not provide revenue information; Fiscal year ended March 31, 2021 Source: S&P Capital IQ/Coresight Research

We estimate that India’s total consumer spending on core retail categories (food and non-alcoholic beverages; alcoholic beverages, tobacco and narcotics; clothing and footwear; furnishing, household equipment and routine household maintenance; and recreation and culture) will increase by 9.7% year over year in fiscal 2023 to $830.1 billion, based on data from India’s Ministry of Statistics and Programme Implementation (MOSPI). We expect this steady growth to continue following fiscal 2023, with spending totaling $1 trillion by fiscal 2025. Reliance Industries plans to acquire around 12 small grocery and nonfood brands for $6.5 billion by the end of 2022, consolidating its position within Indian retail and threatening other major Indian players. Tata Group is likewise looking to consolidate its retail position through various acquisitions in grocery and pharma, as well as the recent launch of its super app, Tata Neu. As Reliance Industries and Tata Group vie for supremacy in India’s retail sector, comparing the two will bring insights into both companies, as well as the country’s overall retail market.Reliance vs. Tata: Coresight Research Analysis

1. Business Overview Reliance Industries has an extensive portfolio covering many categories, including digital services, media and entertainment, oil refining, petrochemicals, retail and gas exploration and production businesses. Regarding retail specifically, Reliance Industries holds Reliance Retail Ventures and its subsidiary, Reliance Retail. Founded in 2006, Reliance Retail is one of the largest retailers in India and operates a chain of convenience stores, online stores, supermarkets and specialty retail locations. Likewise, Tata Group holds companies across various categories, such as aerospace and defense, consumer and retail, financial services, information technology, infrastructure, manufacturing (steel and auto), telecommunications and travel. Tata Group entered the retail world in 1998 by establishing the fashion and lifestyle chain Westside. Since then, Tata Group has launched or acquired various brands across consumer durables, tea and packaged drinking water, as well as set up various retail companies, including Infiniti Retail, Titan Company and Trent Limited. Titan Company and Trent Limited, along with the company’s consumer business, are housed under the Tata Consumer and Retail umbrella. Tata’s consumer business covers out-of-home retail, such as cafes and the food and beverage categories. In Figure 2 below, we provide a business overview of Reliance Industries and Tata Group, identifying and examining key metrics of the two conglomerates.Figure 2. Reliance Industries and Tata Group: Key Metrics

| Metric | Reliance Industries | Tata Group |

| Year Founded | 1973 | 1868 |

| Headquarters | Mumbai, Maharashtra, India | Mumbai, Maharashtra, India |

| Business Sectors | Digital services, media and entertainment, oil refining, petrochemicals, retail and gas exploration and production businesses | Aerospace and defense, consumer and retail, financial services, information technology, infrastructure, manufacturing, telecommunications and travel |

| No. of Publicly Listed Companies (as of December 31, 2021) | Seven | 29 |

| Countries of Operation | 107 | 100+ |

| Group Revenue (FY21, USD Bil.) | $73.8 | $103.0 |

| Retail Revenue* (FY21, USD Bil.) | $19.7 (Reliance Retail Ventures) | $4.8 (Titan Company, Trent Limited) |

| Market Capitalization (FY21, USD Bil.) | $168.6 | $242.0 |

| No. of Employees (FY21) | 236,334 | 800,000 |

| Retail Store Count (FY21) | 12,711 | Nearly 1,400: 1,909 under Titan Company; 400 under Trent Limited |

*Excludes revenues from Tata Group’s privately held businesses, Infiniti Retail and Tata Cliq, as they do not provide revenue information Fiscal year ended March 31, 2021 Source: Company reports/S&P Capital IQ/Coresight Research

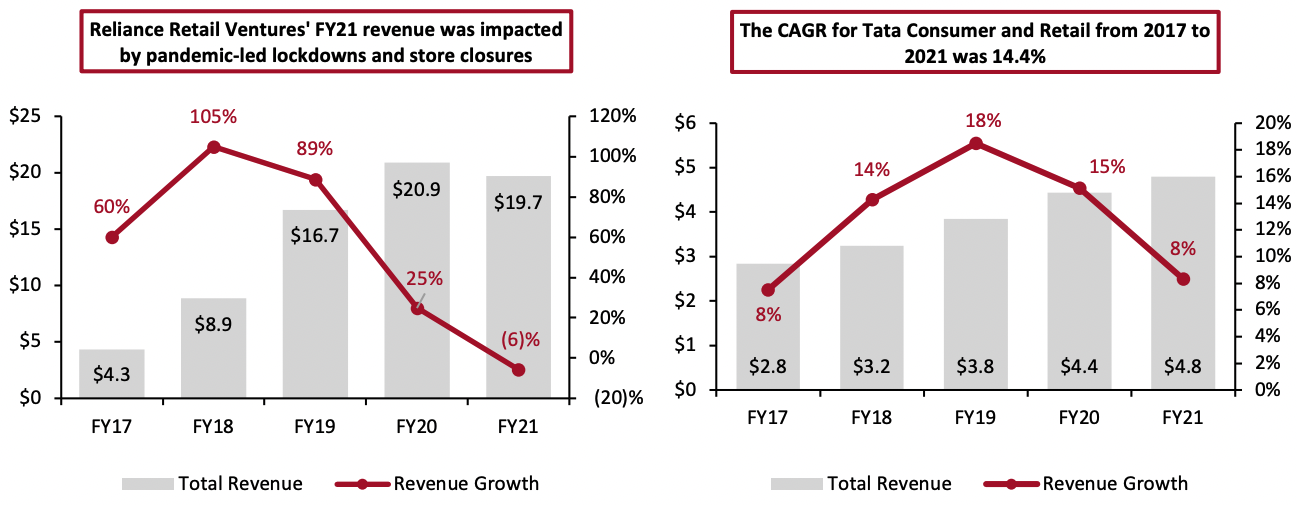

2. Revenue Growth and Performance While Reliance Retail Ventures registered a high CAGR of 69.4% between fiscal 2017 and fiscal 2020, pandemic-led impacts brought down its year-over-year growth rate to a single digit, 5.7%, in fiscal 2021, with revenue dropping to $19.7 billion. On the other hand, Tata Consumer and Retail recorded a CAGR of 16.3% between fiscal 2017 and fiscal 2020. While year-over-year growth rates slowed in 2021 compared to previous years, its higher 2021 revenues can be attributed to the improved performance of its consumer business and Titan Company.Figure 3. Reliance Retail Ventures and Tata Consumer and Retail Total Revenue (Left Axis; USD Bil.) and Revenue Growth (Right Axis; YoY %) [caption id="attachment_152954" align="aligncenter" width="700"]

Tata Consumer and Retail comprises Tata Group’s consumer business, Titan Company and Trent Retail

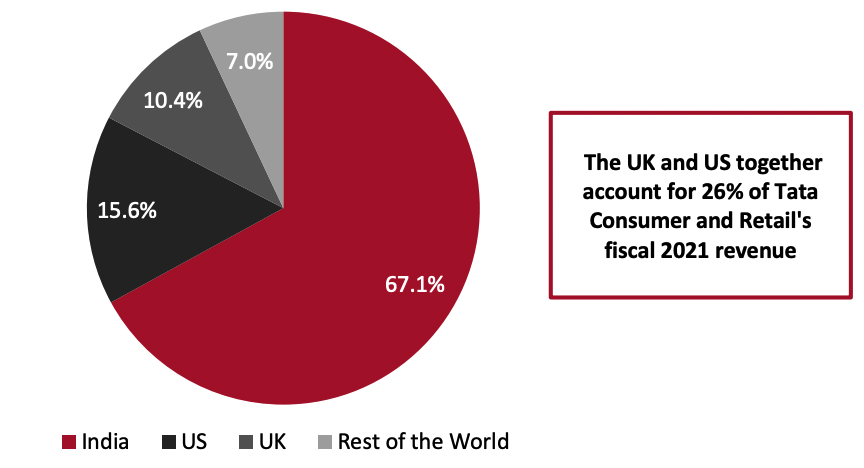

Tata Consumer and Retail comprises Tata Group’s consumer business, Titan Company and Trent RetailSource: Company reports[/caption] Reliance Retail Ventures dominates the retail market with more than four times the revenue of Tata Consumer and Retail, despite its revenue decline in 2021. From 2018 through 2020, the company saw growth in all business verticals. Reliance Retail attributes its retail growth during that period to its favorable product mix, store expansion (it hit 10,000 stores in 2019) and a surge in same-store sales—the company achieved ₹1 trillion ($12.8 billion) in turnover in 2019—according to its annual reports. However, in 2021, as stated, Reliance Retail Ventures’ performance declined due to pandemic-led restrictions in India, as 20% of the company’s stores were non-operational. At the same time, its open stores witnessed a 65% year-over-year decline in foot traffic, according to the company. Tata Consumer and Retail’s growth continued, albeit at a slower rate, in fiscal 2021. Its food and beverage segments registered year-over-year revenue growth of 36% and 18%, to $589.3 million and $312.8 million, respectively, in 2021. In the same year, its international beverages segment revenue grew by 8% year over year to $444.3 million. Titan Company’s jewelry business delivered higher sales in 2021, powered by wedding spending and travel retail, registering 11.3% year-over-year growth. However, Tata Group’s other public retail vertical, Trent Limited, which houses its apparel, lifestyle and grocery businesses, recorded a 24.0% year-over-year decline in revenue in 2021, to $354.4 million, due to temporary store closures and public pandemic restrictions. Geography While the majority of Tata Consumer and Retail’s revenue comes from India, one-third of its revenue for its consumer business comes from the UK, the US and other international markets, according to the company’s annual report (Figure 4 below). Likewise, Reliance Retail Ventures’ revenue primarily comes from the Indian market; however, it did export $18.6 billion worth of goods in fiscal 2021.

Figure 4. Tata Consumer and Retail: Revenue Split by Geography in FY21 (%) [caption id="attachment_152955" align="aligncenter" width="480"]

Source: Company reports[/caption]

3. Business Coverage—Retail and Consumer

Reliance Retail Ventures’ subsidiary, Reliance Retail, operates shopping malls, supermarkets and convenience, online and specialty stores. Reliance Retail has also built partnerships with renowned global brands, such as 7-Eleven. As such, the company is a relatively better retail player, given its large portfolio that caters to a wide consumer base.

Though Tata Group operates its retail business under various public and private banners, the conglomerate focuses more on its global consumer businesses. It recently integrated its foods and beverages businesses and has a more specific strategic growth plan for its consumer business compared to its retail banners (discussed later in this report).

Below, we look at key retail categories and brands for both companies (Figures 5 and 6), as well as Tata Group’s consumer business.

Source: Company reports[/caption]

3. Business Coverage—Retail and Consumer

Reliance Retail Ventures’ subsidiary, Reliance Retail, operates shopping malls, supermarkets and convenience, online and specialty stores. Reliance Retail has also built partnerships with renowned global brands, such as 7-Eleven. As such, the company is a relatively better retail player, given its large portfolio that caters to a wide consumer base.

Though Tata Group operates its retail business under various public and private banners, the conglomerate focuses more on its global consumer businesses. It recently integrated its foods and beverages businesses and has a more specific strategic growth plan for its consumer business compared to its retail banners (discussed later in this report).

Below, we look at key retail categories and brands for both companies (Figures 5 and 6), as well as Tata Group’s consumer business.

Figure 5. Reliance Retail’s Categories and Brands

| Category | Brands | Description |

| Apparel and footwear |

|

|

| Consumer electronics |  |

|

| Groceries and daily essentials |  |

|

| Jewelry |

|

|

| Toys |

|

|

| Consumer products | N/A |

|

| Online |  |

|

| Other businesses and categories | N/A

|

|

Source: Company reports/Coresight Research

Figure 6. Tata Group’s Retail Banners, Categories and Brands

| Retail Banner | Category | Brands | Description |

| Titan Company | Consumer and lifestyle |  |

|

| Trent Limited | Apparel, accessories, lifestyle, and grocery |  |

|

| Infiniti Retail | Consumer electronics |

|

Source: Company reports/Coresight Research

Tata Group’s consumer business spans the food, beverage and out-of-home retail categories.- Its beverage portfolio comprises coffee, packaged drinking water, tea, coffee and ready-to-drink beverages, such as juice and glucose-based hydration drinks.

- The company’s food assortment includes cereals, ready-to-cook items, snacks, small meals and spices.

- Its out-of-home retail offerings center around cafes and coffeehouses. Under out-of-home retail, Tata Consumer and Retail has Tata Starbucks Private Limited, a 50:50 joint venture company owned by Tata Consumer Products and the Starbucks Corporation, an American chain of coffeehouses.

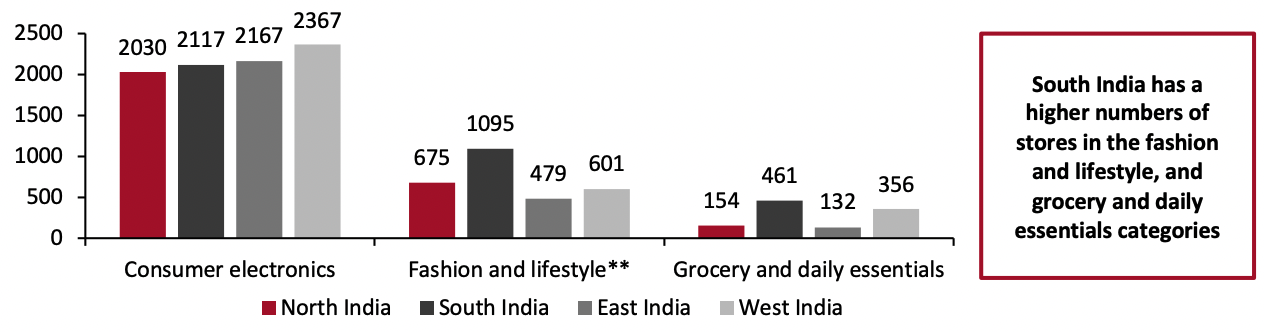

Figure 7. Reliance Retail Ventures’ Store Distribution by Geography and Categories* [caption id="attachment_152978" align="aligncenter" width="700"]

*Excludes 77 stores outside India

*Excludes 77 stores outside India**Fashion and lifestyle comprise apparel, footwear, jewelry, and toys

Source: Company reports[/caption] In total, Tata Group operates just under 1,900 stores as of fiscal 2021. Its retail arm, Trent Limited, has over 400 stores in the apparel, accessories, lifestyle, and grocery categories, while Titan Company has 1,909 stores spanning 2.5 million square feet (0.2 million square meters) across the apparel, accessories and lifestyle categories. Finally, under its Infiniti Retail banner, the conglomerate operates 150 stores of its consumer electronics brand, Croma. Below, Figure 8 shows the store count for each of Tata Group’s retail banners and the brands that operate under said banners.

Figure 8. Tata Trent and Titan Company’s Store Portfolio by Brands (Fiscal 2021)

| Retail Banner | Brand | Category | No. of Stores (FY21) |

| Trent Limited | Westside | Apparel, footwear, and accessories | 174 |

| Zudio | Apparel | 133 | |

| Star | Hypermarkets and supermarkets | 60 | |

| Zara | Apparel and accessories | 21 | |

| Booker | 9 | ||

| Landmark | Lifestyle and entertainment | 6 | |

| Utsa | Apparel and accessories | 4 | |

| Massimo Dutti | Apparel | 3 | |

| Total | 410 | ||

| Titan Company* | Titan | Watches, eyewear, and lifestyle | 1,096 |

| Tanishq | Jewelry | 218 | |

| Taneira | Apparel (Ethnic wear) | 14 | |

| Total | 1,328 | ||

| Infiniti Retail | Croma | Consumer electronics | 150 |

| Grand Total | 1,888 | ||

*Titan Company’s store count does not include franchise stores and has exclusive showrooms only as these counts are not included in the company’s annual report Source: Company reports/Company website

4. Growth Strategies According to its annual report, Reliance Retail focuses on transforming the retail landscape through its “New Commerce” model, encompassing producers, manufacturers, brands, retailers and consumers through the following initiatives:- Expand its retail footprint—Reliance Retail plans to grow its physical stores and digital platforms presence, aiming to operate two-thirds of its stores in Tier 2, 3 and 4 towns and cities in India, which are in a growth phase.

- Invest in building a connected supply chain—The company will build a modern supply chain infrastructure to link all sourcing locations through tech-enabled logistics, automated warehousing and a last-mile fulfillment ecosystem.

- Build partnerships with micro-small-and-medium enterprises (MSMEs)—Reliance Retail plans to partner with millions of traders and suppliers to digitally empower them to grow their businesses.

- Invest in design and product development—The company will continue to invest in building design and product development centers, creating high-quality products to meet its consumers’ needs.

- Develop digital technologies and platforms—Reliance Retail is developing solutions in analytics, augmented and virtual reality (AR and VR) technologies, deep learning algorithms and language processing, leveraging its Jio Platforms.

- Reliance Retail will also focus on new businesses and segments to strengthen its brands’ offerings.

- The company plans to establish itself as a key player in the wearables segment by the end of 2023 by improving its product and services.

- Titan Company wants to capitalize on the “watch as an accessory” opportunity by transforming its chain into a multi-brand watch outlet, strengthening its omnichannel offerings and increasing watch-related marketing.

- The company will augment its jewelry business through multi-pronged strategies in the wedding market, such as focusing on engagement rings and improving the state-level relevance through its “Many Indias” program.

- Finally, Titan Company aims to leverage its eyewear division’s competitive innovation advantage and utilize the market opportunities provided by the increased need for vision correction among the young population (due to increased screen time).

- Develop unique brand concepts to address different customer segments

- Focus on differentiating products and rolling new offerings out quickly

- Offer on-trend fashion at affordable prices

- Provide a superior browsing experience to consumers through attractive in-store displays and convenient and easy-to-navigate store layouts

- Improve brand offerings in key categories

- Targeted addition of 100 fashion stores by the end of 2023

- Expand physical stores to attractive markets

- Improve online store

- Scale up its supply chain, focusing on inventory and increasing freshness in its product offerings, especially food and grocery for its Star Bazaar chain

- Empower core businesses and accelerate growth—Tata Consumer Products will continue to invest in brand building, the “premiumization” of its product portfolio and its distribution in India and abroad, as well as develop alternate channels for growth.

- Boost digital and innovation—The company will increase its digitization investments and efforts in the areas of distribution, procurement, product development, sales and its supply chain. As a result, it hopes to push its innovation agenda, with a target of 4% of revenues from innovation in the upcoming years.

- Unravel synergies—Tata Consumer Products plans to explore alternate business models and achieve synergy through proper integration of its businesses.

- Look for new opportunities—The company will leverage industry trends to cater to consumer needs, piloting new product launches and reinvesting capital into businesses with high-growth potential.

- Build a future-oriented organization—Tata Consumer Products wants to redesign its organizational structure and improve its capabilities by focusing on research and development and digital transformation.

- Embed sustainability into business—The company will focus on building a sustainable and profitable business model for all its stakeholders.

- One such initiative is to transform India’s unorganized retail landscape by partnering with small merchants and traders to digitally empower them.

- Reliance Industries also plans to strengthen its omnichannel capabilities and build new e-commerce platforms by leveraging emerging technologies such as artificial intelligence (AI), blockchain, cloud computing and the Internet of Things (IoT) to create disruptive, value-adding solutions.

- The conglomerate will focus on analytics and AR/VR technologies to augment its retail business offerings.

- Reliance Industries also plans to increase its pan-India reach by scaling up its e-commerce platforms.

- The company will also leverage its other business verticals, such as Jio Platforms, to augment its digital capabilities and tech initiatives.

- Titan Company will continue leveraging new technologies, such as AI in design, IoT in gold plating and robotic automation in invoice processing, helping improve speed and accuracy while reducing overall costs.

- The company will concentrate on omnichannel marketing, rolling out AR/VR options, video chats, and endless aisles for a seamless shopping experience.

- Titan Company will continue pairing retail outlets, kiosks and multi-brand outlets with e-commerce websites, leveraging e-commerce channels to improve brand awareness, engagement and reach.

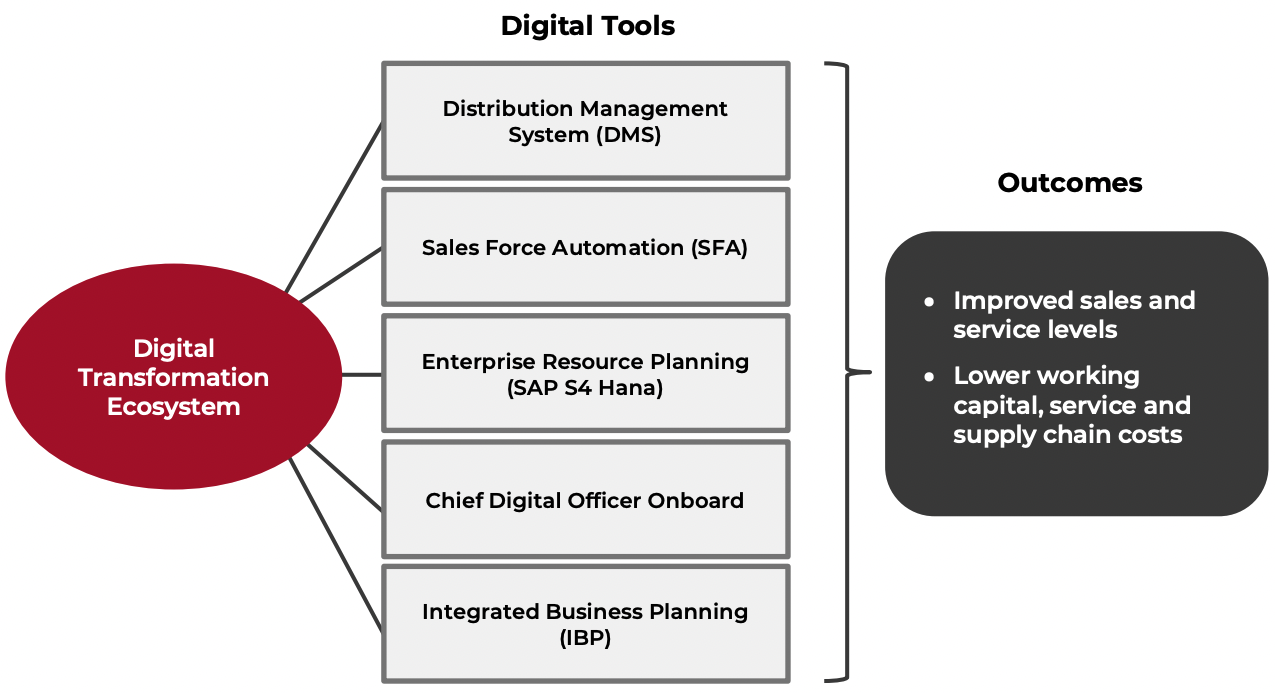

- Tata Consumer Products plans to embed digital tools such as Sales Force Automation (SFA) and Distribution Management Systems (DMS) in its sales and distribution network, as well as its supply chain, to bring in more efficiency to its business.

- It will also integrate multiple systems from the German software company SAP into a single SAP S4 Hana platform to develop operational efficiencies.

- The company will implement Integrated Business Planning (IBP), helping to create an efficient supply chain.

Figure 9. Tata Consumer Products’ Digital Transformation Tools and Anticipated Outcomes [caption id="attachment_152979" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

6. Sustainability Initiatives

In Figure 10, we summarize the sustainability accomplishments and initiatives by Reliance Industries and Tata Group.

Source: Company reports/Coresight Research[/caption]

6. Sustainability Initiatives

In Figure 10, we summarize the sustainability accomplishments and initiatives by Reliance Industries and Tata Group.

Figure 10. Sustainability Accomplishments and Initiatives by Reliance Industries and Tata Group

| Sustainability Initiatives | Reliance Industries | Tata Group |

| Environment-related Initiatives |

|

|

| Air emissions |

|

|

| Water management |

|

|

| Waste management |

|

|

| Energy efficiency |

|

|

| Carbon neutral |

|

|

Source: Company reports

Overall, Reliance Industries has more specific sustainability goals, which it tracks through performance and quantitative outputs. Tata Group has broader sustainability initiatives spanning ethical sourcing, recycling and energy conservation. Tata Group also claims that the recent integration of its food and businesses led to higher Scope 1 and 2 carbon emissions between 2019 and 2021. As a result, in 2021, it had to retread ground, instead of making substantial sustainability progress. 7. Recent Acquisitions by Reliance and Tata Figure 11 below shows the acquisitions by Reliance Retail and Tata Consumer Products between January 1, 2021, and May 31, 2022.Figure 11. Reliance Retail and Tata Acquisitions, 2021–22

| Date | Acquired Brand/Company | Description |

| Reliance Retail Acquisitions | ||

| March 2022 | Purple Panda Fashions | Reliance Retail acquired an 89% equity stake in Purple Panda Fashions, the company that owns lingerie and intimate wear brand Clovia for $121.7 million. |

| Abraham & Thakore | Reliance Retail purchased fashion, lifestyle, and designer luxury brand Abraham & Thakore to expand its presence in luxury retail. | |

| January 2022 | Dunzo | The company acquired a 25.8% stake in quick commerce startup Dunzo for $240 million as a foray into the quick commerce space. |

| Addverb Technologies | Reliance Retail acquired a 54% stake in robotics company Addverb Technologies for $132 million. The association offers opportunities to deploy robotics in various segments, such as retail, e-commerce, grocery and fashion. | |

| October 2021 | Manish Malhotra | The company acquired a 40% stake in fashion label and couture brand Manish Malhotra, diversifying its portfolio of designer labels across different price points. |

| Ritu Kumar | Reliance Retail acquired 52% equity in fashion label and designer-wear brand Ritu Kumar and now plans to develop and launch affordable collections with the brand. | |

| Milkbasket | It acquired a 96.5% stake in Milkbasket, a subscription-based micro-delivery service for grocery and daily essentials, for $40 million. | |

| September 2021 | Portico | In 2021, Reliance Retail completed its acquisition of home fashion brand Portico, a company that manufactures and sells bed and bath products. |

| July 2021 | Justdial | The company acquired a 15.7% stake in local search and e-commerce company Justdial for $469 million. The platform aims to digitalize the businesses of MSMEs. |

| Tata Consumer Products Acquisitions | ||

| February 2021 | Kottaram Agro Foods | Tata Consumer Products acquired 100% of ready-to-eat brand Soulfull’s parent company Kottaram Agro Foods for $20 million. |

Source: Company reports/The Economic Times/Times of India/Coresight Research

By the start of 2023, Reliance Retail plans to build a portfolio of 50 to 60 brands across the grocery, household, and personal care categories, acquiring small grocery and nonfood brands to do so. The company is also talking with approximately 30 local consumer brands to either fully acquire them or form JVs. Reliance Retail, through its above-mentioned and upcoming acquisitions, plans to take on CPG giants such as Unilever, Nestlé and PepsiCo in India. Tata Consumer Products is planning to strengthen its position in the CPG sector by acquiring five personal and homecare brands, according to the company. The planned acquisitions will enable the company to have a presence in new categories, including home cleaners, detergents and personal care.