albert Chan

Introduction

What’s the Story?

ASOS and Zalando are the largest e-commerce retailers in Western Europe’s online apparel and footwear retail space.

As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ business model and revenues, as well as operating margins, shopper profiles, key strategic partnerships and sustainable initiatives.

Why It Matters

The apparel and footwear e-commerce market in Western Europe is set to grow from $90.0 billion in 2021 to $122.6 billion by 2026, at a sales CAGR of 6.4%, according to Euromonitor International. As of 2021, Zalando held a 9.6% share of the market, while ASOS held 2.9%.

While Zalando has maintained its leading position in Western Europe’s apparel and footwear e-commerce market for more than a decade, ASOS is steadily gaining market share. The scale and leading market positions of the online retailers make for insightful comparisons.

ASOS vs. Zalando: Coresight Research Analysis

Business Overview

Both retailers sell a wide range of apparel, footwear and accessories, including activewear, bottoms, dresses, loungewear, nightwear, swimwear and tops. Both ASOS and Zalando also sell beauty and personal care products.

We provide an overview of key metrics for ASOS and Zalando in Figure 1.

Figure 1. Company Overviews: ASOS and Zalando [wpdatatable id=1994] *Zalando’s latest fiscal year ended on December 31, 2021 and ASOS’s latest fiscal year ended on August 31, 2021 Source: Company reports/Coresight Research

1. Business Models—Shift Toward Becoming Fashion Marketplaces

While Zalando operates an online fashion store, its business model is substantially geared toward becoming a marketplace, where apparel and footwear brands can sell their products. On the other hand, ASOS mainly operates an online fashion store and has recently launched a few programs toward building a fashion marketplace. Below, we discuss Zalando’s and ASOS’s key business models—highlighting the main differences in their revenue generation strategies.Zalando

Figure 2. Zalando’s Business Model

[caption id="attachment_147955" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Zalando is rapidly shifting to become a marketplace, where fashion brands can not only sell their products but also access various tools to track and enhance their performance. Zalando generates revenues in four ways:

- Online Fashion Store: The fashion store is the company’s main sales channel, comprising Zalando apps and its website—selling third-party and owned brands. Unlike ASOS, Zalando’s private label business, which Zalando runs in collaborations with its supply chain partners, is very small. The company also runs an off-price segment called Zalando Lounge—which sells last season’s fashion items at a discount. Zalando Lounge contributed about 13% to the company’s total revenues in fiscal 2021 ended December 31, 2021.

- Partner Programs: Zalando’s Partner Program and Connected Retail program comprise its marketplace offerings that allow brands to sell directly to consumers on Zalando’s sites—taking advantage of Zalando’s millions of customers. (Partner Program enables brands to integrate their listings into Zalando’s Fashion Store, while Connected Retail allows brick-and-mortar retailers to list items on the site and ship orders from store.) While participating fashion brands, under the Partner Program and Connected Retail program, often handle logistics and returns, Zalando offers them various payment processes. Zalando receives a percentage-based commission for each direct sale on its platform. Zalando continues to expand its partner programs by introducing new brands on an ongoing basis. By 2025, the company expects its Partner Program and Connected Retail program to contribute nearly 50% of its gross merchandise value (GMV), up from 30% in 2021.

- Fulfillment Services: Over the years, Zalando has invested in building an efficient transportation and warehousing network—known as Zalando Fulfillment Solutions (ZFS)—and the company generates revenues by holding and shipping stock on behalf of other brands. Using ZFS, apparel brands can store their products in one of Zalando’s warehouses and ship them to consumers upon sale. Through ZFS, Zalando allows global fashion brands the opportunity to enter European markets, as well as save money that would have been incurred building a supply chain network. In fiscal 2021 ended December 31, 2021, the number of items shipped via ZFS grew 100% year over year. Zalando plans to convert more of its partner retailers to ZFS clients—Zalando targets shipping 75% of all partner items by ZFS by 2025, compared to 55% in 2021.

- Marketing Services: Zalando also generates revenues through its marketing service business, known as Zalando Media Solutions (ZMS). ZMS often creates dedicated advertising campaigns for brands’ social media channels and also advertises certain products under “sponsored tags.” Fashion brands pay fixed fees to use ZMS services. In fiscal 2021, ZMS benefitted from the continued strong demand of its brand partners for Zalando’s advertising products, and it reported revenue growth of about 95% year over year. The company remained optimistic about its marketing services potential and expects ZMS to contribute 3–4% of GMV over the long term, from around 2.0% of the company’s GMV in fiscal 2021.

Figure 3. ASOS’s Business Model

[caption id="attachment_147957" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Unlike Zalando, which generates a substantial portion of its revenues from partner programs, and by offering fulfillment and marketing services, ASOS’s Partner Fulfils program and marketing services are in nascent stages, and it generates most of its revenues from its online fashion store. However, ASOS is gradually developing its offerings geared towards becoming a fashion marketplace.

- Online Fashion Store: Like Zalando, ASOS sells both owned and third-party brands. However, as compared to Zalando, ASOS has a substantial upper hand in terms of private labels—which contribute about 40% of ASOS’s revenues. ASOS is looking to further expand its private labels.

- Partner Fulfils: Launched in the UK in November 2021, in partnership with apparel and footwear brand owners Adidas and Reebok, ASOS’s Partner Fulfils model capitalizes inventory from its brand partners to allow ASOS’s customers access to more products while retaining ASOS’s curated edits. Similar to Zalando’s Partner Program and Connected Retail program, Partner Fulfils allows ASOS to collect commissions on the inventory supplied and sold by brands on the ASOS platform. While ASOS’s Partner Fulfils program is very new (versus Zalando’s Partner Program and Connected Retail program), it is witnessing strong momentum. In the first half of fiscal 2022, ending February 28, 2022, the company sold more than 77,000 units through Partner Fulfils, contributing about 8% of Adidas’s and nearly 7% of Reebok’s sales on the ASOS platform in the UK. Furthermore, ASOS is working on new integration partners, and plans to onboard additional fashion brands into the Partner Fulfils program by the end of fiscal 2022 ending August 2022. Moreover, the online retailer will expand its Partner Fulfils program into additional European countries by the end of fiscal 2022.

- Advertising and Marketing Services: ASOS is steadily expanding its marketing business ASOS Media Group—which was launched in September 2020. ASOS Media Group allows brand partners to engage with ASOS’s over 26 million active customers—increasing the brand partner’s exposure and accelerating their revenues on the ASOS platform. To enable more sophisticated campaigns, enhance customer reach and drive automation for brand partners, ASOS Media Group is using a suite of advertising tools, including Google’s Ad Manager technology.

- Alternative Wholesale/Dropship Model: ASOS is also testing an alternative wholesale/dropship model—where the company is exploring its ability to serve more customers through new platforms or partnerships by receiving and fulfilling orders which have been taken on a non-ASOS platform (brand partner platforms) in new geographies—such as Japan and the Middle East and North Africa (MENA). Brand partner platforms will help ASOS to test demand for the latter’s products in new territories before the online retailer invests and tap new customers and/or new collaborations. The alternative wholesale model could also provide a technical foundation to ASOS for selling through social commerce in case it adopts it in the future, according to the company.

2. Fast-Fashion Positioning and Pricing Strategies

Fast-Fashion Positioning

ASOS is a fast-fashion retailer and designs around 30% of its private label products in season, according to Coresight Research analysis of the company’s reported data on factory locations and lead time to market. About 28% of ASOS’s supplier factories are close to its headquarter in London. Fast fashion is manufactured with short lead times in response to fashion trends and consumer demand—ASOS takes two to six weeks to get items from design to sale and replenishes its stock of existing designs within two weeks.

In contrast, Zalando designs just around 15% of its private-label clothes (as mentioned earlier, Zalando’s private-label offering is relatively very small) in season in response to current trends, while 85% of products are ordered months in advance. Only about 14% of the retailer’s private-label suppliers are close to its headquarter in Berlin, Germany. Most of Zalando’s private label manufacturing capacity is in Asia, which is a cheaper sourcing destination compared to Europe and requires greater lead times due to shipping.

However, as compared to ASOS’s two weeks replenishment period, Zalando replenishes its stock, including third-party and owned, in a shorter time—Zalando, through ZFS, executes replenishment within a week cycle time.

Similarly, while ASOS releases around 1,500 new products per week, Zalando adds an average of about 15,000 new items every week. This suggests that the cost of failure of trying different colors and fabrics is lower for Zalando than for ASOS.However, as compared to ASOS’s two weeks replenishment period, Zalando replenishes its stock, including third-party and owned, in a shorter time—Zalando, through ZFS, executes replenishment within a week cycle time.

Pricing Strategies

ASOS and Zalando deploy different pricing strategies. While ASOS keeps product prices very low and makes more frequent and aggressive markdowns, Zalando’s prices are relatively higher, reflecting its premium branded offering, and the company takes a subtler approach to price reduction—mainly through its off-price segment Zalando Lounge. Indicating the relative strength of premium brands at Zalando, pencil skirts retail in the range of $11–$150 before markdowns at ASOS, while at Zalando they retail in the range of $14–$790.

3. Financial Metrics: Revenue, Operating Margins, Marketing and Fulfillment Rates

Revenue

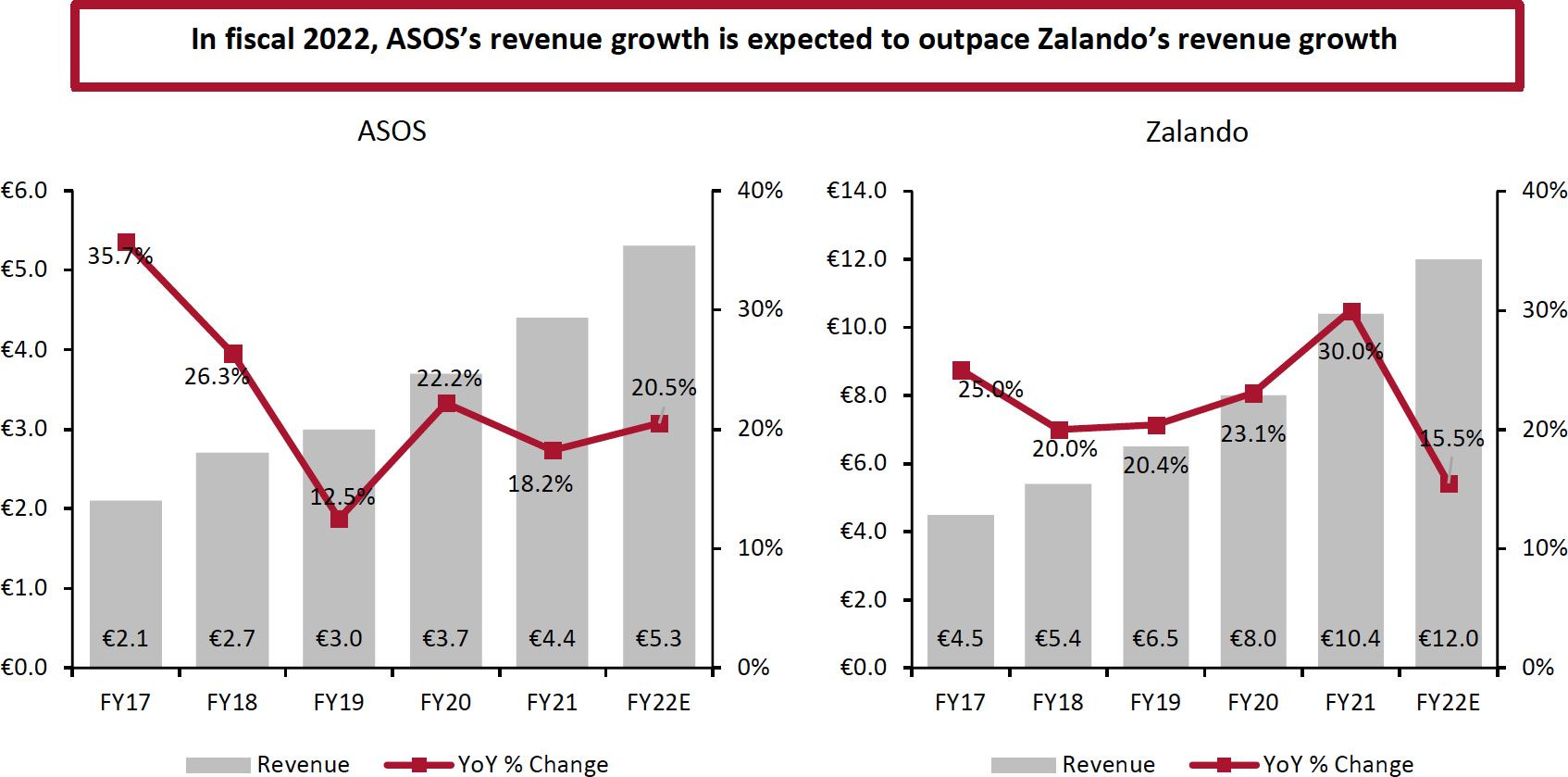

Over the past five fiscal years, both ASOS and Zalando have reported robust revenue growth, with Zalando slightly outpacing ASOS in terms of growth. From fiscal 2017 to fiscal 2021, Zalando reported a sales CAGR of 23.6% versus 22.7% at ASOS. However, in fiscal 2022, ASOS’s revenue growth is expected to outpace Zalando’s revenue growth.

Below, we discuss the primary factors impacting revenue for these retailers.

Zalando: Zalando’s positioning as one of the leading online fashion retailers in Europe, along with its expertise in technology, has helped the company to retain its dominant position in Western Europe’s online apparel and footwear market. Zalando remains optimistic about its near-term revenue growth. The company targets reaching annual revenues of €20 billion ($24 billion) by 2025, up from about €8 billion ($10 billion) in 2020, equating to a revenue CAGR of around 20%. Additionally, Zalando aims to grow its GMV to more than €30 billion ($36 billion) by 2025, up from €11 billion ($13 billion) in 2020, at a CAGR of 20–25%.

We believe that Zalando’s Partner Program and its Connected Retail program will continue to be advantageous for the company as competition in the multi-brand retailer space remains intense, and as leading brand owners such as Adidas and NIKE cut ties with their retail partners to focus on their direct-to-consumer (DTC) operations. The partner programs will not only help Zalando to scale its operations and revenues but also lower its exposure to inventory risk when partner brands convert to ZFS. Other key growth drivers for Zalando include improved data-driven personalization and inventory management as well as new market entries.

ASOS: ASOS continues to leverage both ongoing strong demand for online apparel shopping and consumer preferences for casual wear and sportswear, driving the company’s sales growth. Furthermore, the successful integration of the recently acquired Topshop and Topman brands is driving sales for ASOS in the US. These acquired brands’ sales have increased by triple digits between February 2021 and February 2022. Additionally, we believe the strategic partnership with US-based department store Nordstrom, which now sells the acquired brands, along with ASOS’s venture brands and ASOS Design, will drive ASOS’s growth in the US: ASOS fully launched its brands in selected Nordstrom stores and on Nordstrom.com during the first half of fiscal 2022.

Like Zalando, ASOS also remains positive about its near-term revenue growth. By 2025, ASOS targets achieving annual sales of £7.0 billion ($9.6 billion)—at a CAGR of 15.7% between 2021 and 2025. The company aims to achieve this by growing its private-label offerings, expanding partner fulfillment across Europe to represent 5% of its GMV and continually growing its UK overall business while doubling the size of ASOS in the US and EU.

Figure 4. US: ASOS vs. Zalando—Revenue (Left Axis; EUR Bil.) and Revenue Growth (Right Axis; YoY %) [caption id="attachment_147959" align="aligncenter" width="700"]

Zalando’s latest fiscal year ended on December 31, 2021 and ASOS’s latest fiscal year ended on August 31, 2021

Zalando’s latest fiscal year ended on December 31, 2021 and ASOS’s latest fiscal year ended on August 31, 2021Note: ASOS’s revenue has been converted from GBP to EUR using a constant exchange rate as of December 31, 2020

Source: Company reports/Coresight Research[/caption]

By Geography

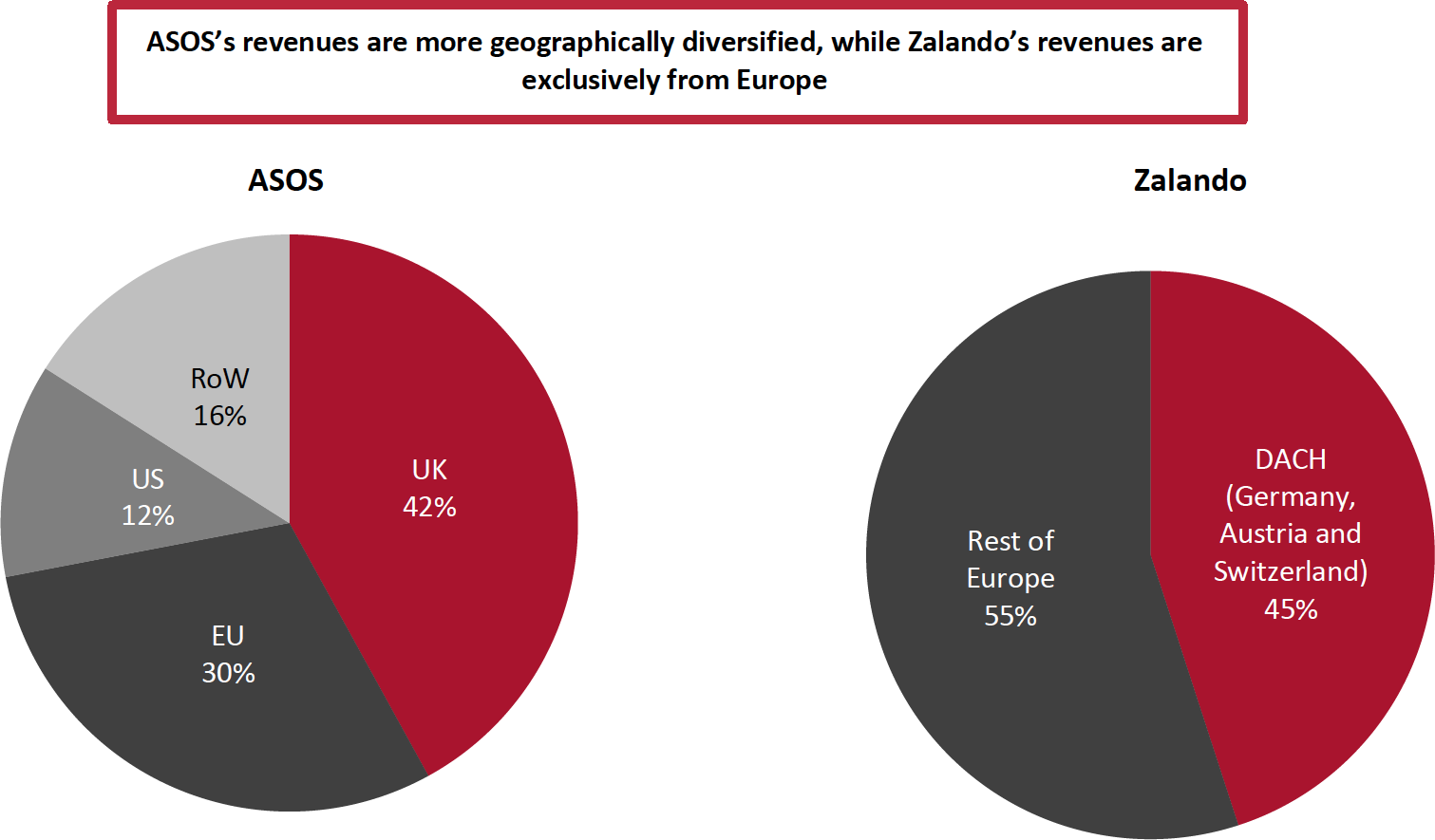

While both ASOS and Zalando have put international expansions at the heart of their strategies, ASOS generates a substantial portion of its revenues outside of Europe unlike Zalando, which generates all of its revenues from Europe.

After entering the international market in 2006, ASOS has massively expanded its global presence. Sales outside of the UK accounted for 58% of the total in fiscal 2021 ended August 31, 2021. The US remains one of the key markets for ASOS, contributing about 12% of the total sales, while the rest of the world (RoW), which includes a few new markets, such as Australia, China and Russia, contributes 16% of the company’s total revenues.

On the other hand, Zalando generates 100% of its revenues from Europe, with Austria, Germany and Switzerland (referred to as DACH by the company) being the primary markets, contributing about 45% of its total revenues.

Zalando continues to expand into new European countries. In 2021, Zalando entered six additional markets: Croatia, Estonia, Latvia, Lithuania, Slovakia and Slovenia. Furthermore, the company is looking to expand its presence in France and Italy, where it has a 6% population penetration (active customers as a percentage of the total population), versus 21% population penetration in the DACH region as of 2021.

Figure 5. ASOS vs. Zalando: Revenue by Geography, Fiscal 2021 (%) [caption id="attachment_147960" align="aligncenter" width="700"]

ASOS’s latest fiscal year ended on August 31, 2021 and Zalando’s latest fiscal year ended on December 31, 2021

ASOS’s latest fiscal year ended on August 31, 2021 and Zalando’s latest fiscal year ended on December 31, 2021Source: Company reports[/caption]

By Category

ASOS and Zalando do not provide a revenue breakdown by category. However, in their recent earnings calls, both retailers highlighted the key categories that are gaining momentum.

ASOS: ASOS is witnessing robust demand for its casual wear, sportswear and swimwear categories, according to the company’s management. Furthermore, the retailer is seeing a strong pickup in demand for dresswear, which is one of ASOS’s core categories. In the first half of fiscal 2022 earnings call held in April 2022, ASOS’s management said that the company’s strategic priorities are to double down on its beauty and sportswear categories in 2022.

Zalando: Zalando is gaining strong sales momentum in casual wear, sportswear and childrenswear categories; however, the company’s occasion-based categories, such as dresses, are picking up slowly and the sales remain below pre-Covid levels. Moreover, in the 2021 earnings call held in March 2022, Zalando noted that supply chain disruptions are causing shortages in certain key areas, mainly in the footwear and sportswear categories.

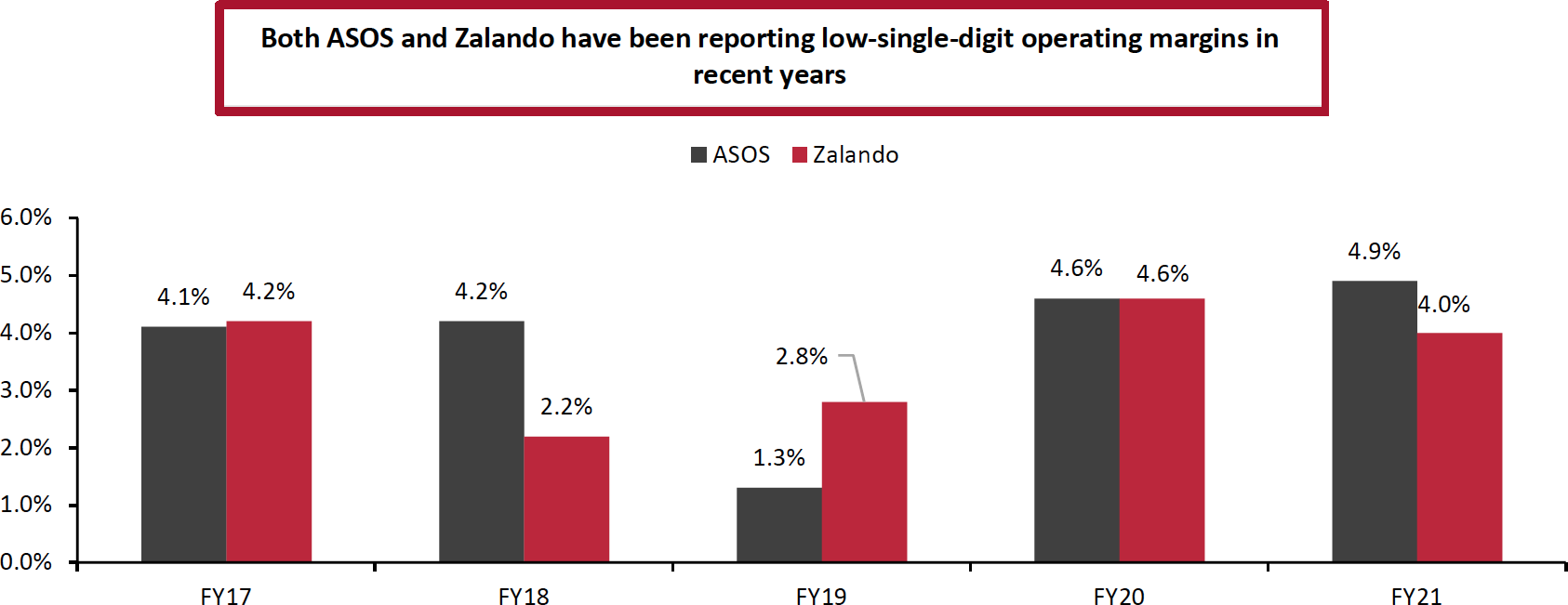

Operating Margins

Both ASOS and Zalando are neck-and-neck in terms of operating margins. In the past five years, both online retailers have reported operating margins in the low-single digits. For fiscal 2022, both ASOS and Zalando continue to expect positive margins.

In the next section, we discuss both retailers’ marketing and fulfillment cost ratios, analyzing how ASOS and Zalando are performing in terms of managing their key operating costs.

Figure 6. ASOS vs. Zalando: Operating Margin (%) [caption id="attachment_147962" align="aligncenter" width="700"]

Zalando’s fiscal year ends on December 31 and ASOS’s fiscal year ends on August 31

Zalando’s fiscal year ends on December 31 and ASOS’s fiscal year ends on August 31Source: Company reports/Coresight Research[/caption]

Marketing and Fulfillment Cost Ratios

Marketing Cost Ratios

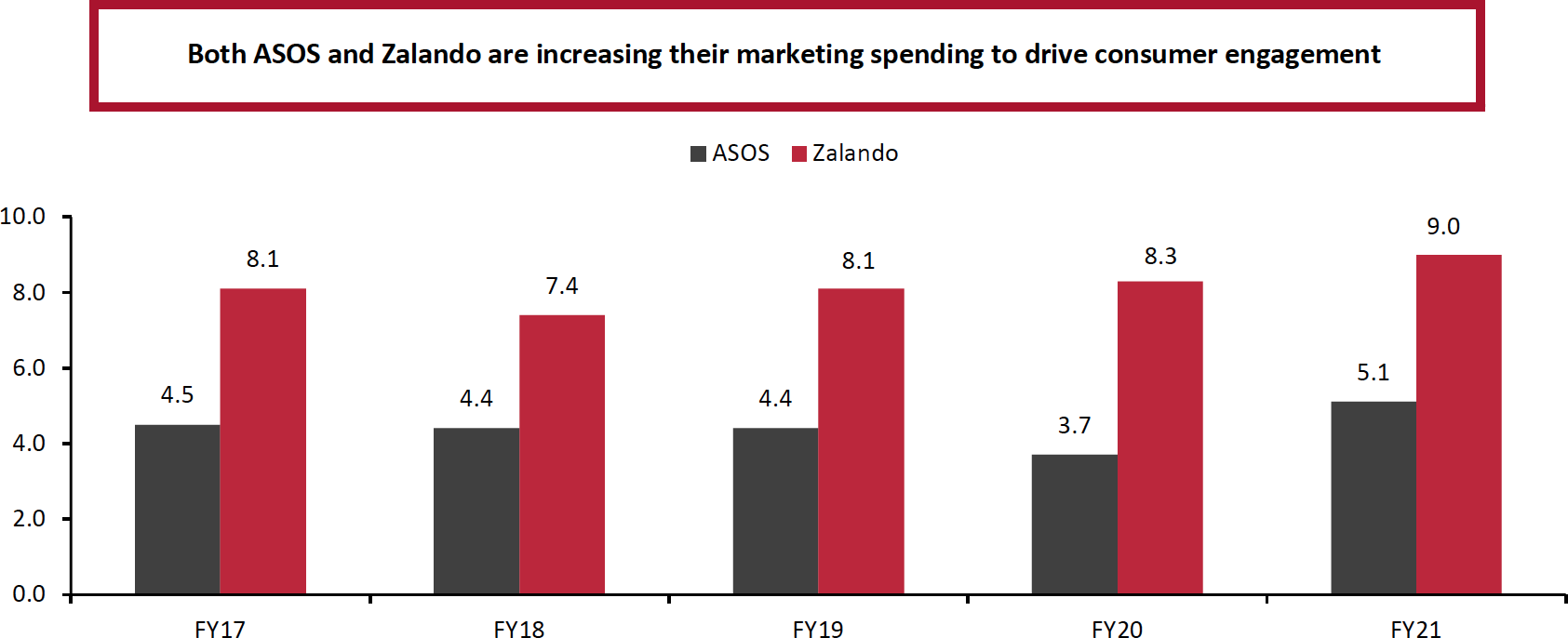

Marketing cost ratio (marketing or advertising costs as a proportion of revenue) is an important benchmark for pure-play retailers, such as ASOS and Zalando—as customer acquisition costs have long been flagged as a challenge for online retailers that do not have the marketing advantages that come with physical storefronts. While both ASOS and Zalando witnessed increased marketing cost ratios in fiscal 2021, the former continues to outperform the latter.

In fiscal 2021 ended August 2021, ASOS’s marketing cost ratio increased by 140 basis points (bps) year over year to 5.1 as the company invested in digital marketing channels to boost new customer acquisition. Additionally, the company’s marketing cost ratio increased by 50 bps in the first half of fiscal 2022, ending February 28, 2022. Furthermore, in the next three to four years, the company expects its marketing cost ratio to increase to 6.0, as it plans to double its marketing investment in the US to broaden its customer reach there through its Topshop offerings and expand products offerings in Nordstrom’s store.

Like ASOS, Zalando’s marketing cost ratio also increased. It rose to 9.0 in fiscal 2021 ended December 31, 2021, from 8.3 in fiscal 2020 as the company scaled up its investment in digital marketing and social media. This included major launch campaigns across its six new markets mentioned earlier and efforts to raise brand awareness, drive customer engagement and acquisition, and increase traffic to its platforms.

Figure 7. ASOS vs. Zalando: Marketing Cost Ratio [caption id="attachment_147963" align="aligncenter" width="700"]

Zalando’s fiscal year ends on December 31 and ASOS’s fiscal year ends on August 31

Zalando’s fiscal year ends on December 31 and ASOS’s fiscal year ends on August 31Source: Company reports/Coresight Research[/caption]

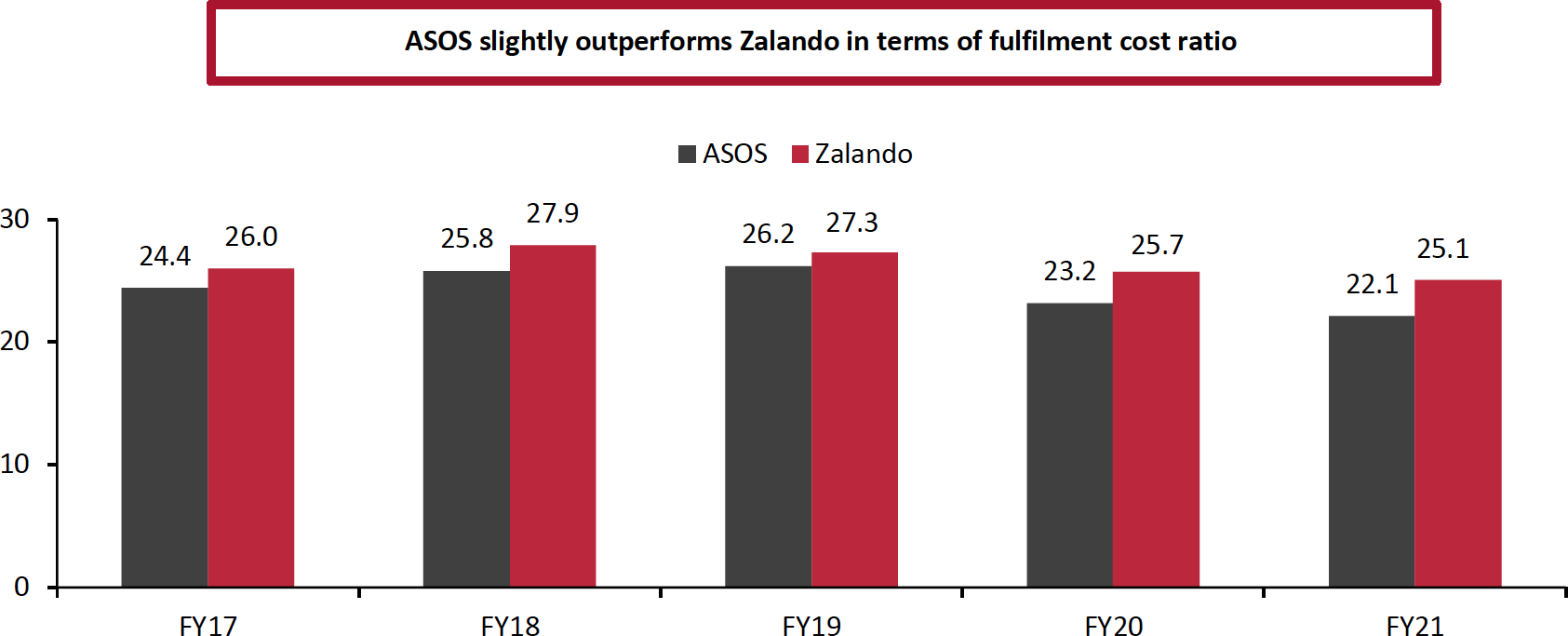

Fulfillment Costs Ratios

Fulfillment costs continue to be a more significant challenge than marketing costs for both ASOS and Zalando— fueled by consumer demand for free delivery and (variously) two-day, one-day and same-day delivery. Both ASOS and Zalando have poured money into fulfillment to compete, sending fulfillment cost ratios upward.

However, in 2021, both ASOS and Zalando managed to drive down the fulfillment-cost ratios, as they saw some apparent benefits of the jump in scale.

In its fiscal 2021 earnings call held in October 2021, ASOS noted that it saw greater efficiencies in its automated Europe hub but greater fulfillment from its manual US warehouse proved a counterbalancing drag on margins.

Similarly, in its fiscal 2021 earnings call held in March 2022, Zalando noted that improvement in its fulfillment cost ratio in 2021 overall was supported by more favorable return rates. Zalando also benefitted from higher utilization of its fulfillment centers as demand increased.

Both ASOS and Zalando are expanding their logistics networks to support their international operations’ growth and bolster their services offerings, including same-day delivery and geo-localized delivery. In fiscal 2021, ASOS expanded its fourth fulfillment center in Lichfield. In the first half of the fiscal 2022 earnings call held in April 2022, the company noted that the fulfillment center is performing ahead of the original capacity expectations, adding 1 million units more capacity than originally planned—translating into higher throughput. In the earnings call, management said that its strengthened warehouse and logistics network is enabling the company to provide next-day delivery to 85% of its global customers.

Similarly, Zalando plans to expand its fulfillment capabilities substantially by 2023, through the addition of four new fulfillment centers to its existing network of 13 fulfillment centers, increasing the count to 17.

Figure 8. ASOS vs. Zalando: Fulfillment Cost Ratio [caption id="attachment_147964" align="aligncenter" width="700"]

Zalando’s fiscal year ends on December 31 and ASOS’s fiscal year ends on August 31

Zalando’s fiscal year ends on December 31 and ASOS’s fiscal year ends on August 31Source: Company reports/Coresight Research[/caption]

4. Customer Profiles

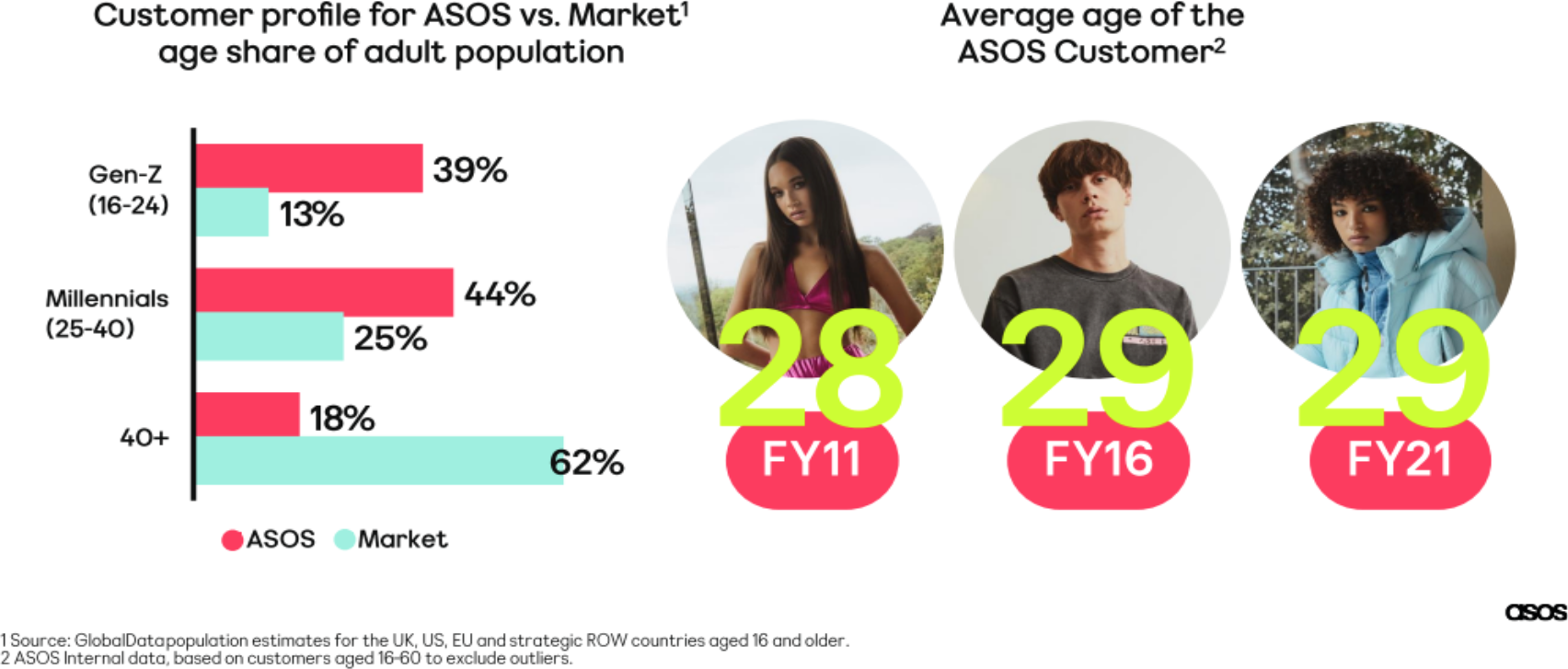

ASOS’s customers are, on average, younger than Zalando’s customers, according to company reports.

More than 80% of ASOS’s customers are millennials or Gen Zers, with the average age of customers staying consistent at around 29 over the past 10 years. On an average annual basis, the company’s younger customers spend 30% more on fashion as compared to older customers—these younger consumers spend 50% more of their disposable income than their older counterparts.

[caption id="attachment_147965" align="aligncenter" width="550"] ASOS’s shopper profile

ASOS’s shopper profileSource: ASOS[/caption]

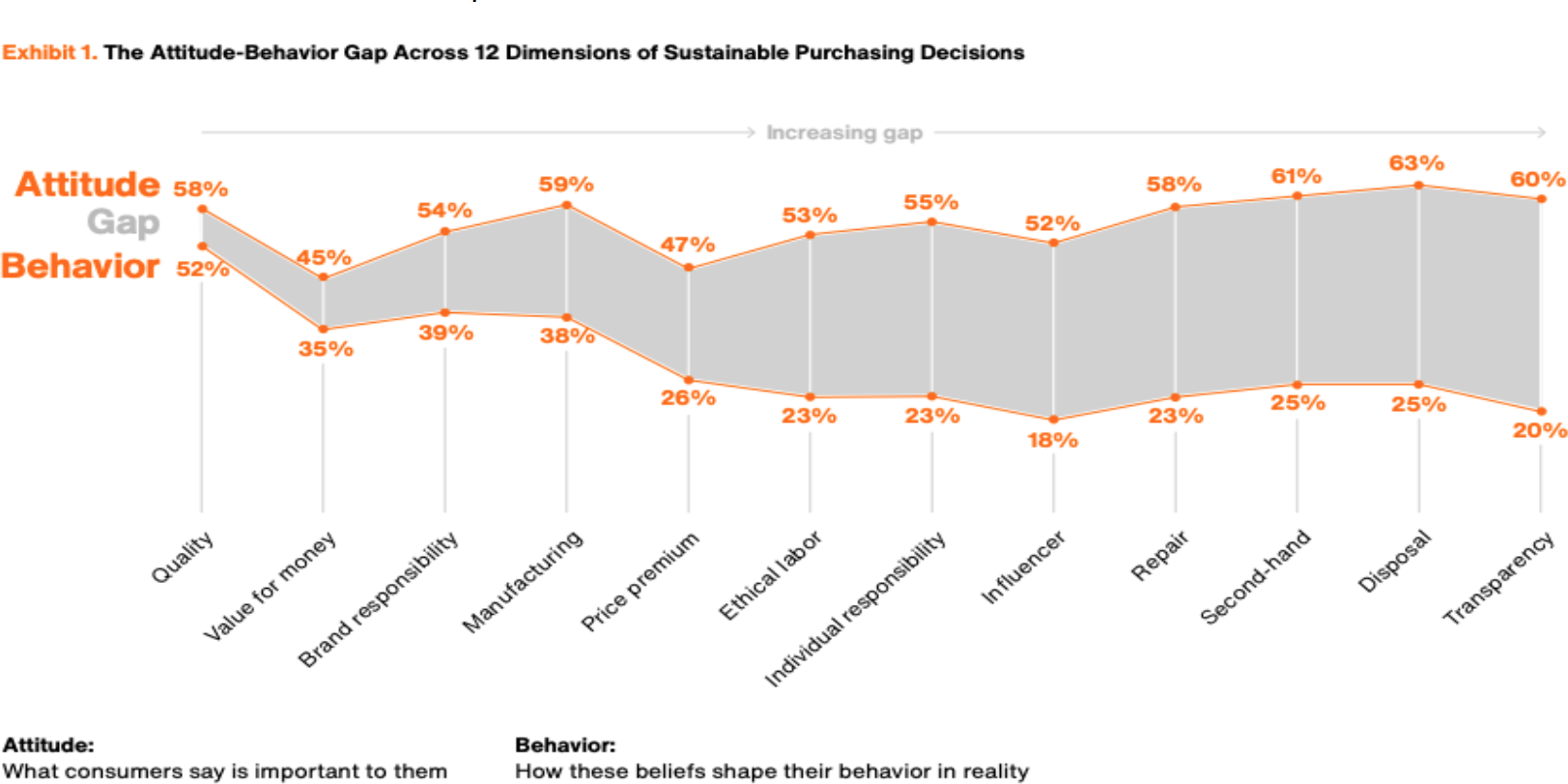

On the other hand, Zalando has a slightly broader target audience than ASOS. The average age of Zalando’s customers is 35. To understand its target consumer demand and preferences in-depth, Zalando regularly conducts surveys across its operational geographies. For instance, in April 2021, Zalando surveyed 2,500 customers aged 22–35 to understand shoppers’ attitudes and behavior. The survey helped Zalando to understand that consumers care about sustainability but struggle to act on it. The survey also found that about 35% of customers would choose a discount deal over a sustainable product owing to the value for money. About 58% of them said that the quality of the products is equally important.

[caption id="attachment_147966" align="aligncenter" width="550"] Zalando’s Attitude-Behavior Gap survey conducted in April 2021

Zalando’s Attitude-Behavior Gap survey conducted in April 2021Source: Zalando[/caption]

5. Automation and Data-Driven Inventory Management and Personalization

Automation of Fulfillment Centers

While both ASOS and Zalando are accelerating automation in their fulfillment centers to improve efficiency in picking, packing and delivery as well as reduce costs, the former has reported higher benefits of automation than the latter in recent earnings calls.

ASOS: ASOS has fully automated its Barnsley and Eurohub warehouses and remains on track to automate its Atlanta and Lichfield warehouses by the end of fiscal 2023. Recently, in the fiscal 2021 earnings call held in October 2021, ASOS’s management said that automating its US warehouse in Atlanta will increase the warehouse stockholding capacity by 50% to 15.5 million units, with a warehouse throughput of 3.1 million units per week. Furthermore, the company forecasts that the Atlanta warehouse automation will lead to a total net sales throughput expansion of more than £2.0 billion ($2.7 billion) over the two years following completion.

In addition, in its fiscal 2021 earnings call, ASOS noted that the automation of Eurohub in 2019 has helped the company to save around £80.0 million ($109.6 million) of non-strategic costs in the past two years through a 36% reduction in overall warehousing costs. Similarly, in its fiscal 2020 earnings conference call in October 2020, ASOS’s management stated that the Eurohub automation had improved the company’s delivery propositions in Germany and France, with an improvement in the number of picked units per hour of 57% and 14% for packed units.

Zalando: Zalando is ramping up the automation of its Lahr fulfillment center in Germany. Between August 2019 and September 2021, Zalando used eight TORU robots on real customer orders at its Lahr fulfillment center, working in collaboration with robotics company Magazino. The TORU robots work hand in hand with logistics employees and pick up about 3,000 products per day. In October 2021, Zalando added ten new TORU robots, increasing the count to 18. In addition, the company aims to install 28 robots in total by June 30, 2022.

In the company’s press release, Carl-Friedrich zu Knyphausen, Director of Logistics Development at Zalando, said that the initial test was successful in terms of error-free handling of the company’s products (e.g., shoe cartons)—any lost time due to errors was made up for by the robot’s improved efficiency as compared to humans.

In November 2021, Zalando implemented automation through autonomous mobile robots (AMR), provided by BMW Group–owned logistics company idealworks. AMR help Zalando’s employees in Mönchengladbach with transport by moving packed orders between two sorters in the shipping area—AMR can drive up to eight kilometers per hour on a 50-meter route, according to Zalando.

[caption id="attachment_147967" align="aligncenter" width="550"] Zalando’s logistics robot TORU, developed by Magazino, at its distribution center in Lahr, Germany

Zalando’s logistics robot TORU, developed by Magazino, at its distribution center in Lahr, GermanySource: Zalando[/caption]

Data-Driven Inventory Management and Personalization

Both ASOS and Zalando have robust data infrastructures, with a focus on customization and personalization.

ASOS: ASOS’s personalization and recommendation models utilize an algorithm to forecast consumer demand based on past purchases and their browsing behavior—the online retailer tailors the sort order of products that it shows to customers. The company uses first-party data and has also adopted open data source models from Google and Facebook. The company has also partnered with Visual Search and Fit Technologies, which utilizes predictive algorithms to provide ASOS’s shoppers with artificial intelligence (AI)-enabled features that help them find the right products they want in terms of size and fit. At its Investor Day event held in November 2021, the company noted that the AI deployment has led to an overall improvement of 0.8%–2.7% in customer conversion rates in 2021. In the US and Australia, ASOS observed a 2.2% growth in consumer conversion rates. Similarly, ASOS deploys markdown optimization algorithms within the back office, which recommend the appropriate discount for each product to its customers.

Zalando: The company’s custom-built, proprietary IT systems continue to enable data-driven decisions across the business. Since December 2020, Zalando has been using Amazon Web Services (AWS) as its cloud provider, capitalizing on AWS’s machine learning service to reduce the time it takes to design, launch and scale new features for its e-commerce platforms. AWS enables Zalando’s engineering teams to utilize customer purchase data to create personalized shopping features, such as size and individual product recommendations, as well as for predicting a customer’s outfit preferences and for inventory forecasting. AWS also helps Zalando to offer digital avatars that allow customers to try on clothes virtually to determine the fit.

6. Key Strategic Partnerships

Both ASOS and Zalando have been capitalizing on their recent strategic partnerships; however, we think the former’s recent strategic collaborations are more vital in terms of business expansion and gaining long-term strategic advantage as compared to the latter’s approach.

ASOS:

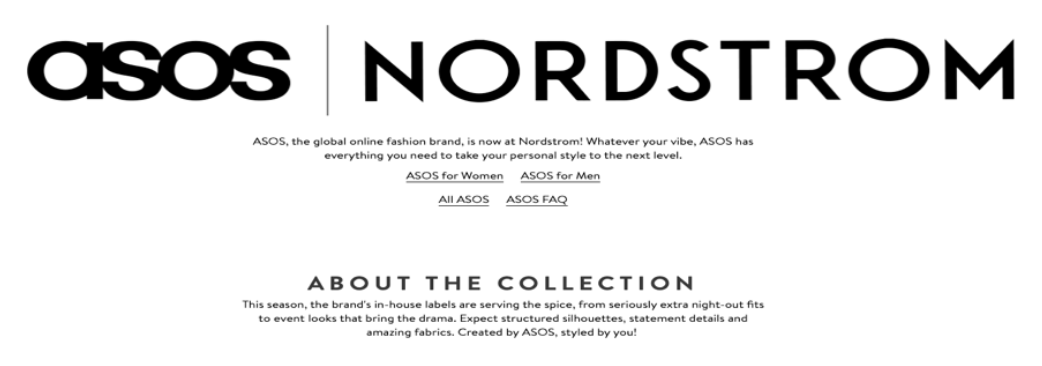

- In July 2021, ASOS entered into a joint venture agreement with US-based department store Nordstrom to sell ASOS merchandise across the Nordstrom store and provide ASOS’s customers a place for pickup and return of online orders. The partnership provided ASOS with a desired large physical footprint in ASOS’s growing US market. In November 2021, ASOS debuted its first drop, featuring ASOS Design, ASOS EDITION and ASOS Luxe ranges, in two Nordstrom stores. Furthermore, in February 2022, ASOS extended this offer to two additional retail concepts: Glass Box concept featuring a curated assortment of ASOS styles with a wall-to-wall digital screen; and a pop-up in store with 120 options at The Grove in Los Angeles. The company plans to further expand its ASOS merchandise to about 10 Nordstrom stores by August 2022.

ASOS rolled out ASOS Design, ASOS EDITION and ASOS Luxe ranges in two Nordstrom stores in November 2021

ASOS rolled out ASOS Design, ASOS EDITION and ASOS Luxe ranges in two Nordstrom stores in November 2021Source: Nordstrom[/caption]

- In September 2021, ASOS entered into a three-year, multi-million-dollar deal with the gaming company Fnatic, which will see both companies co-develop online and offline activations and digital content. As part of the alliance, ASOS logos will feature on all kits available on Fnatic, spanning 200 championships across 30 sports. Through this partnership, ASOS looks to capitalize on Fnatic’s 30 million users, mainly from the Gen-Z demographic.

Zalando:

- In June 2021, Zalando entered a partnership with US-based beauty retailer Sephora (owned by luxury conglomerate LVMH) to sell Sephora’s products on Zalando’s platform. We believe this collaboration will help Zalando elevate its beauty proposition and expand its presence in the beauty category. In the press release, Zalando noted that the online retailer will capitalize on its technology and e-commerce expertise to capture the sizeable opportunity in the beauty market.

Zalando entered a strategic partnership with Sephora in June 2021

Zalando entered a strategic partnership with Sephora in June 2021Source: Zalando[/caption]

- In January 2022, Zalando collaborated with consumer electronics company Apple and Beats to expand Zalando’s range of lifestyle products, including Apple Airpods, HomePods, Watches and other Apple accessories, along with Beats tech accessories. Zalando’s expanded lifestyle range is available in Austria, France, Germany, Italy and Switzerland. In the press release, Zalando noted that the addition of two consumer electronics brands on its platform is in line with the online retailer’s vision to be the “go-to-place for fashion and lifestyle.”

7. Sustainability

Both ASOS and Zalando continue to be at the forefront of sustainable initiatives.

ASOS: In September 2021, ASOS published its “Fashion with Integrity – 2030 Strategy” report, highlighting its key sustainability goals and initiatives.

- Aim to be carbon neutral in its direct operations by 2025 and achieve net-zero carbon emissions across its value chain by 2030.

- Ensure 100% of ASOS’s own-brand products and packaging are made from sustainable or recycled materials by 2030.

- Make sure that the third-party brands on ASOS’s platform are signed up to the new ASOS Ethical Trade policy and the Transparency Pledge by 2025.

Zalando: In March 2022, Zalando published its Sustainability Progress Report 2021, highlighting its key commitments toward sustainability.

- Reduce carbon emissions emerging from its business by 80% by 2025, as compared to 2017.

- Expand its sustainable product assortments to 25% by 2023 from 22% of its GMV in 2021.

- Raise the recycled content requirement standard of its branded products from 20% in 2020 to 30% in 2023.

- Move away from a linear fashion industry toward a circular pattern of consumption through recycling and reuse. Zalando aims to extend the lifespan of over 50 million of its products by 2023.

What We Think

We believe that the apparel and footwear online retail market in Western Europe will remain strong, and Zalando will retain its status as the largest company in the market, with ASOS as its closest rival. With ASOS’s recent initiatives, such as the rollout and expansion of the Partner Fulfils program geared toward becoming a fashion marketplace, growth of marketing services and testing of an alternate wholesale/drop shipping model, we believe the contest between the two online retailers to gain market shares will heat up substantially.

We expect ongoing automation of ASOS’s fulfillment centers to improve the company’s delivery efficiency and reduce fulfillment costs in the long term. Additionally, we believe that the acquired Topshop and Topman brands will continue to bring opportunities for ASOS in the US through the recent strategic joint venture with Nordstrom.

However, when compared head-to-head with Zalando, we perceive the latter to be a more diversified and developed business than ASOS. Zalando pushed earlier into the marketplace model, fulfillment services and retail media, and it has more prominently tapped opportunities in off-price, sustainability and resale. Zalando has been ahead of many competitors on exploiting opportunities and tapping consumer trends. We view Zalando’s Partner Program and Connected Retail programs as key long-term growth drivers for the company, continuing Zalando’s shift from retailer to marketplace. Other key growth drivers include improved data-driven personalization and inventory management and entries into new geographic locations.

Both ASOS and Zalando have announced commitments in sustainability, which we see as a positive move to resonate with today’s consumers.

Implications for Brand Owners and Retailers

- Brands and retailers should invest in autonomous delivery technologies, such as delivery robots, to improve efficiency and reduce costs in the long term. Similarly, automating logistics networks will help retailers to meet increased consumer demand for fast delivery and standardize the order fulfillment process, as well as increase overall accuracy.

- When competing with huge pure-play retailers such as ASOS and Zalando, retailers should ensure that their websites stand out through digital personalization, exclusive offers and discounts, early access to sales and an attractive loyalty program, among other initiatives.

- Retailers must leverage customer data to gain valuable insights into market localization. Furthermore, identifying potential local competitors ahead of time will also serve retailers well.

Implications for Technology Vendors

- Technology companies have significant opportunities to collaborate with retailers on automation and robotics technologies for warehousing, fulfillment efficiency and storage capacity.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved