Nitheesh NH

Introduction

What’s the Story? Aldi and Lidl are two of the world’s most prominent players in the discount grocery retail market. The two companies have transformed the grocery retailing landscape, through their no-frills concept—which uses a basic store layout and a limited product assortment, consisting of mostly private-label products—and backed by operational efficiency. As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ business strategies, brand usage, growth strategies and e-commerce initiatives. Why It Matters Discounters have seen strong growth in recent years and have been a persistent thorn in the side of traditional food retailers, from a strategic perspective. Although discounters encountered a slight disruption in 2020, we expect that they will regain pace, and that their aggressive global store expansion will continue to accentuate competition with traditional grocers—with Aldi and Lidl leading from the front. The scale and dominant market position of the two companies make for insightful comparison.Aldi vs. Lidl: Coresight Research Analysis

1. Company Overview Aldi: Aldi Group comprises two associated but separate privately owned German retailers that operate value-focused grocery retail stores. The company was founded in 1946 and split legally in 1966; its two separate groups are Aldi Nord and Aldi Süd. They divide both Germany and international markets between them. Aldi Süd has expanded beyond Europe, with operations in Australia, China and the US, while Aldi Nord’s operations are mainly limited to Europe—although it also owns discount grocery chain Trader Joe’s in the US, which it acquired in 1979. Lidl: Lidl is privately owned by the Germany-based Schwarz Group, which also owns and operates supermarket chain Kaufland. Lidl operates as a discounter, while Kaufland is positioned as a one-stop discount hypermarket. Lidl operates 11,550 stores in 32 countries, alongside more than 200 distribution centers in 29 countries. Figure 1 provides an overview of key metrics for Aldi and Lidl:Figure 1. Company Overviews: Aldi and Lidl [wpdatatable id=1739]

Source: Company reports

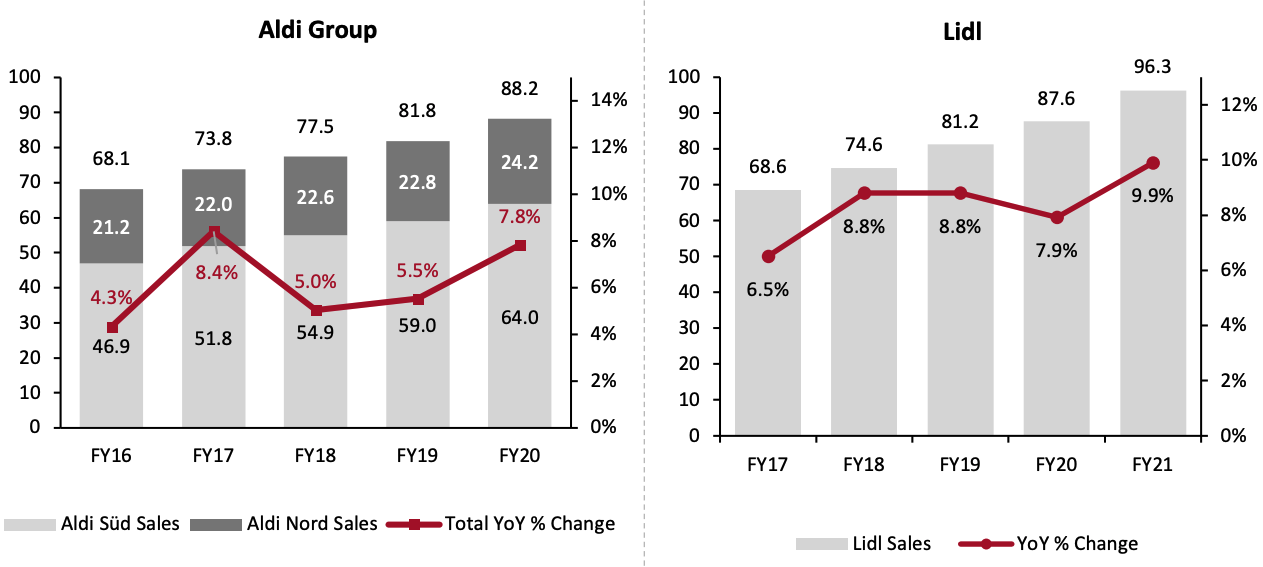

2. Sales Performance Aldi and Lidl enjoyed strong growth in the years leading up to the pandemic, backed by new store openings. However, during the crisis, both companies’ limited online presences became a major hindrance. Additionally, as customers consolidated shopping trips to minimize social contact, both companies’ limited product ranges and stock availability meant that most customers struggled to do a full shop in their stores—benefitting their traditional rivals. Still, sales at Lidl increased by 9.9% year over year in fiscal 2021 (ended February 28, 2021) while Aldi Group recorded 7.8% net sales growth in the fiscal year ended December 31, 2020. Aldi Süd subsequently reported net sales of €64 billion for 2021, level on those of 2020. Each of these three companies now publish net sales, as well as selected other metrics, representing a marked change from prior years, when disclosure was much more limited.Figure 2. Aldi and Lidl: Annual Net Sales (Left Axis; EUR Bil.) and YoY % Change [caption id="attachment_141953" align="aligncenter" width="700"]

Aldi’s fiscal year ends on December 31; Lidl’s fiscal year ends on February 28 or 29

Aldi’s fiscal year ends on December 31; Lidl’s fiscal year ends on February 28 or 29Aldi Süd’s FY16 and FY18 sales are estimated

Source: Euromonitor International Limited 2022 © All rights reserved/company reports[/caption] 3. Business Strategy Aldi and Lidl both focus on providing a no-frills shopping experience, characterized by limited choice, smaller stores and a very strong emphasis on private labels. Their stores typically span 8,000–20,000 square feet—compared to 48,466 square feet for an average US supermarket (per trade body FMI), with comparably lower staffing levels. To reduce costs, discounters often display items on shipping pallets and in the boxes in which they arrive. The stores are typically minimally decorated and offer a limited assortment of items—fewer than 2,000 stock-keeping units (SKUs). Private labels feature prominently in both Aldi and Lidl’s assortments. The share of private label in Aldi is around 90%, while it is approximately 80% for Lidl; this relative emphasis is the key differentiator between the two companies and brand discounters such as Dollar General, Dollar Tree or Poundland. However, Lidl has pioneered softening the “hard discount” model. This softening involves adding more major brands to its assortment, introducing premium lines and selectively flexing its format and offerings for international markets. Aldi (particularly Aldi Süd) has borrowed from its rival’s softer and more flexible approach to discount retail, adapting its store formats to suit new markets. For example, in China, Aldi Süd targets affluent customers with sought-after imported European products, contrasting with its model in most of its other markets. The shift away from a pure hard-discount model will pile on extra costs and chip out the economics of the limited range, no-frills discount model. However, both companies appear to be willing to make short-term sacrifices to build positions of strength in the long term.

Figure 3. Aldi and Lidl: Average SKUs per Store and Store Size [wpdatatable id=1740]

*Based on new store advertisements Source: Company reports

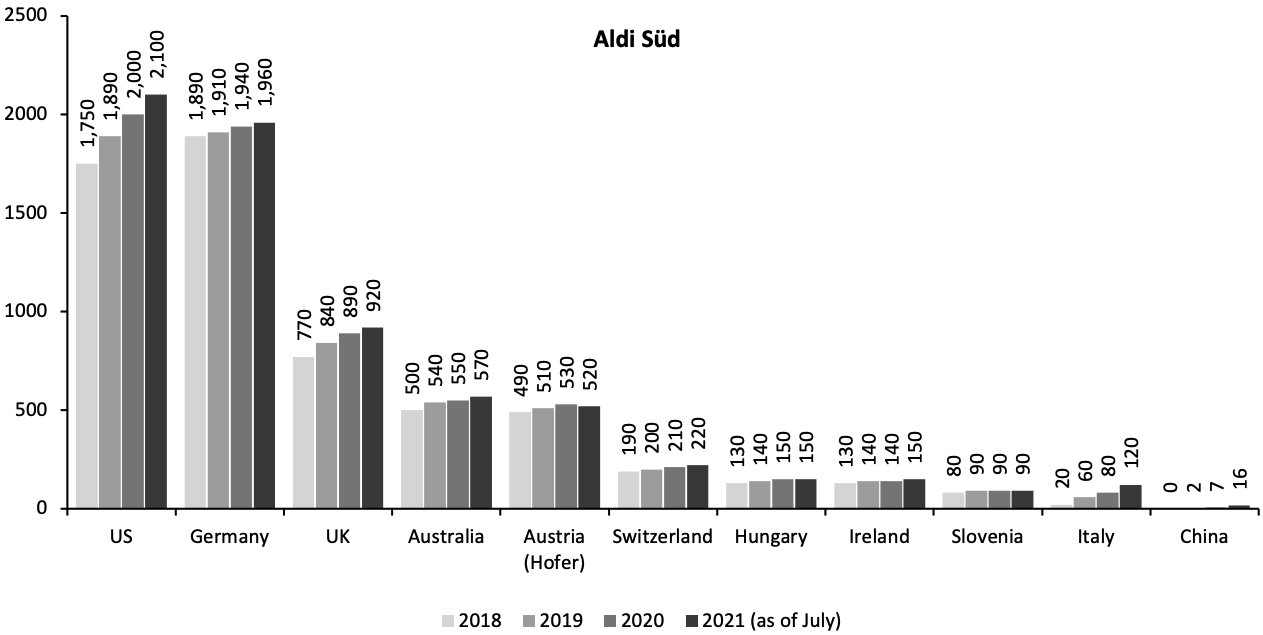

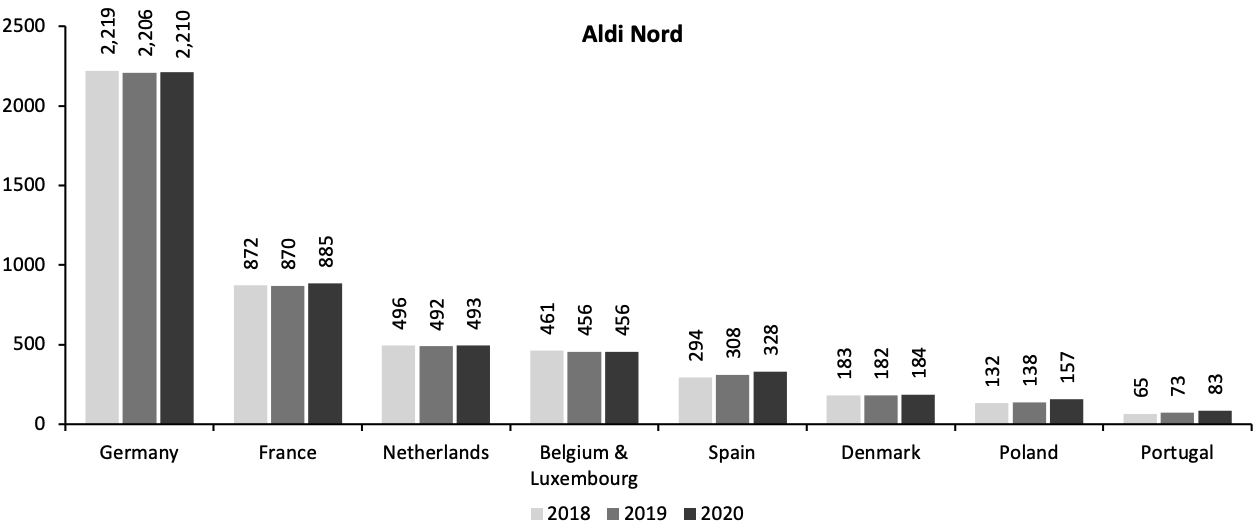

4. Growth Strategy With their domestic German market reaching saturation, both companies have been placing greater emphasis on generating sales internationally—focusing on expanding their brick-and-mortar footprint. Aldi has a much broader geographical presence, with operations in Australia, China and the US (through Trader Joe’s banner). Lidl’s activities, meanwhile, are mostly confined to Europe—although it entered the US in 2017. Aldi Australia: In Australia, Aldi Süd remains on a strong growth path, fueled by store expansion. It opened 24 stores in 2020 and plans to open another 20 in 2021, which will bring its total count to 590 stores in the country. China: After establishing an online presence in China through Alibaba’s Tmall Global marketplace in 2017, Aldi Süd opened its first physical stores in the country in June 2019. Since then, Aldi has expanded steadily, unveiling 20 stores in just two years. Western Europe: In Western Europe, Aldi Süd is driving its expansion, especially in the UK where it aims to boost its store count to 1,200 by 2025, from 930 stores as of November 2021. Aldi Nord acquired 547 outlets and three central warehouses from its French competitor Leader Price in December 2020, expanding its market position in France. US: Aldi is particularly ambitious in the US, the only international market where both Aldi Group entities are present. Aldi Süd is in the middle of a $5 billion expansion strategy in the country—it aims to become the third-largest grocery retailer by store count by the end of 2022, operating 2,500 stores. Aldi Nord-owned Trader Joe’s is also steadily expanding, although less aggressively than Aldi Süd. Eastern Europe: Aldi’s presence is limited in Eastern Europe, with operations in only three countries—Hungary, Poland and Slovenia. However, Aldi is accelerating its pace of development in those countries, planning further store openings. In Poland, Aldi Nord has set up eight regional expansion offices since November 2019, and opened 32 new stores in 2021.Figure 4. Global Store Count of Aldi Süd and Aldi Nord, by Country

[caption id="attachment_141957" align="aligncenter" width="700"]

[caption id="attachment_141957" align="aligncenter" width="700"] Source: Company reports[/caption]

Lidl

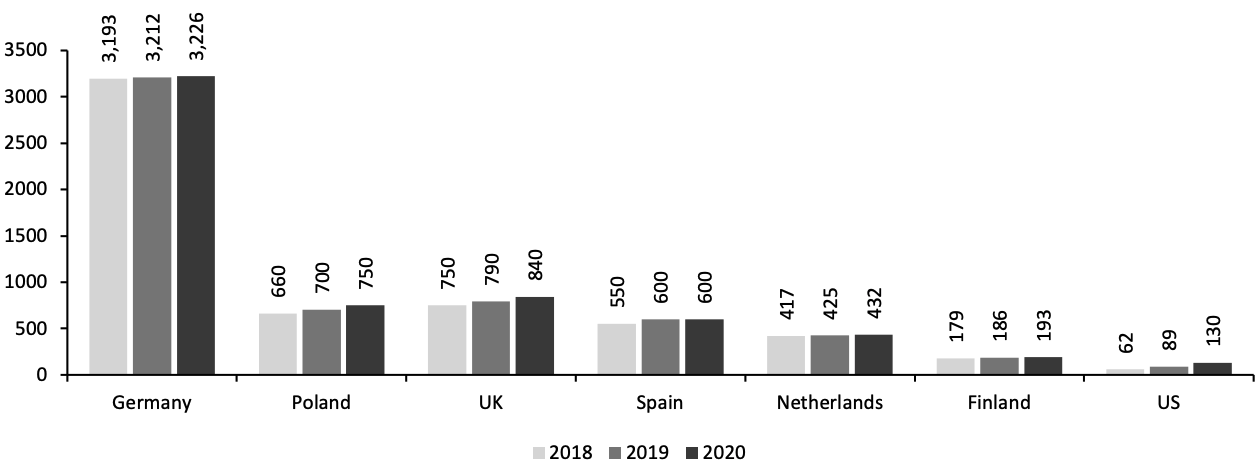

Western Europe: In the UK, Lidl reached 860 stores in July 2021 and is on track to reach 1,000 stores in its portfolio by the end of 2023. In France, Lidl acquired 33 outlets from the retailer Groupe Casino in 2019, further strengthening its store count of more than 1,500 in the country.

Eastern Europe: With a particularly strong presence in Western Europe, Lidl is rapidly expanding in Eastern Europe. The company has successfully entered Serbia and Croatia in recent years and aims to increase its presence in the Balkans, planning to also expand into Bosnia and Herzegovina in 2022.

US: In the US, Lidl’s store count reached 155 as of June 2021. The company plans to expand substantially—in April 2020, it announced that it is building a network of distribution centers along the East Coast that will service supply chain needs for around 1,500 stores.

Source: Company reports[/caption]

Lidl

Western Europe: In the UK, Lidl reached 860 stores in July 2021 and is on track to reach 1,000 stores in its portfolio by the end of 2023. In France, Lidl acquired 33 outlets from the retailer Groupe Casino in 2019, further strengthening its store count of more than 1,500 in the country.

Eastern Europe: With a particularly strong presence in Western Europe, Lidl is rapidly expanding in Eastern Europe. The company has successfully entered Serbia and Croatia in recent years and aims to increase its presence in the Balkans, planning to also expand into Bosnia and Herzegovina in 2022.

US: In the US, Lidl’s store count reached 155 as of June 2021. The company plans to expand substantially—in April 2020, it announced that it is building a network of distribution centers along the East Coast that will service supply chain needs for around 1,500 stores.

Figure 5. Global Store Count of Lidl, by Country [caption id="attachment_141958" align="aligncenter" width="700"]

Source: Company reports[/caption]

Though both companies have intensified their overseas expansion in recent years, it has been a mixed picture for Lidl. Following its market entry in the US, Lidl initially struggled to adapt to market conditions, and its chosen store sizes, locations and product ranges appeared inadequate to draw significant consumer interest. The company subsequently missed its growth target. Additionally, Lidl’s sister company Kaufland unexpectedly withdrew from the Australian market (where Aldi Süd successfully pioneered the discounter channel after its 2001 market entry) before any store openings in January 2020—despite committing $300 million and its first stores in the country already being under construction. In 2019, Lidl also withdrew its online presence in China through Tmall, JD.com and Kaola, citing economic considerations.

5. Brand Usage

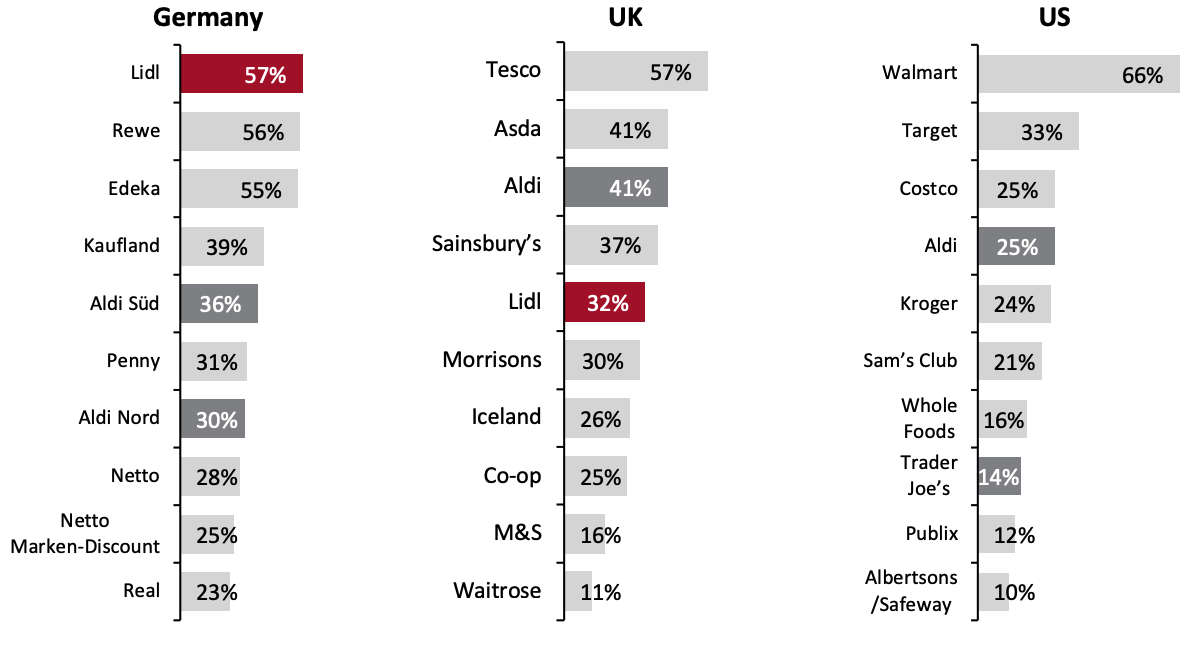

According to a Statista consumer survey of grocery shoppers undertaken in September 2021, Lidl is the most shopped grocer in Germany, the home market for both Aldi and Lidl. Aldi Süd ranked fifth while Aldi Nord was frequented by a third of respondents.

In the UK, sustained growth at Aldi and Lidl has eroded the aggregate share of the traditional Big Four grocery retailers. The survey found that Aldi is one of the top three grocery chains with a user share of 41%, while Lidl has captured the fifth position, above Morrisons.

In the US, Lidl is ranked outside the top 10 grocery retailers as its store footprint is insignificant, given that it entered the country only in 2017. Aldi, however, ranked fourth, and Trader Joe’s eighth.

Source: Company reports[/caption]

Though both companies have intensified their overseas expansion in recent years, it has been a mixed picture for Lidl. Following its market entry in the US, Lidl initially struggled to adapt to market conditions, and its chosen store sizes, locations and product ranges appeared inadequate to draw significant consumer interest. The company subsequently missed its growth target. Additionally, Lidl’s sister company Kaufland unexpectedly withdrew from the Australian market (where Aldi Süd successfully pioneered the discounter channel after its 2001 market entry) before any store openings in January 2020—despite committing $300 million and its first stores in the country already being under construction. In 2019, Lidl also withdrew its online presence in China through Tmall, JD.com and Kaola, citing economic considerations.

5. Brand Usage

According to a Statista consumer survey of grocery shoppers undertaken in September 2021, Lidl is the most shopped grocer in Germany, the home market for both Aldi and Lidl. Aldi Süd ranked fifth while Aldi Nord was frequented by a third of respondents.

In the UK, sustained growth at Aldi and Lidl has eroded the aggregate share of the traditional Big Four grocery retailers. The survey found that Aldi is one of the top three grocery chains with a user share of 41%, while Lidl has captured the fifth position, above Morrisons.

In the US, Lidl is ranked outside the top 10 grocery retailers as its store footprint is insignificant, given that it entered the country only in 2017. Aldi, however, ranked fourth, and Trader Joe’s eighth.

Figure 6. Top 10 Grocers that Consumers Buy Food and Products from for Everyday Use [caption id="attachment_141959" align="aligncenter" width="700"]

Base: 18+ Internet users (Germany: 3,081; UK: 2,063; US: 5,670)

Base: 18+ Internet users (Germany: 3,081; UK: 2,063; US: 5,670)Source: Statista Global Consumer Survey[/caption] 6. E-Commerce Strategy Grocery e-commerce has traditionally been an Achilles heel for discounters—the costs associated with picking, packing and delivering orders sit uneasily with their low-overhead, no-frills model. However, Aldi and Lidl have been gradually moving into e-commerce over several years, with trials or partial online offerings. Although the two retailers have adopted new tactics, they largely stem from the same core strategy—investments in low-cost assets, such as a basic mobile app, or trials that are high margin, such as delivery in non-grocery categories, including furniture, gadgets and mattresses. Nevertheless, both companies largely took a conservative approach to e-commerce prior to the pandemic. However, consumer demand for alternative shopping methods has spiked amid the crisis, and the two chains are looking toward a more aggressive omnichannel approach to stay competitive. Aldi: Aldi Nord and Aldi Süd are reportedly planning to merge their e-commerce activities in Germany and have jointly founded Aldi E-Commerce Verwaltungs GmbH, based in Düsseldorf. The two companies are planning to develop a grocery e-commerce solution that they can deploy jointly in their operating divisions. Internationally, Aldi (Aldi Süd in particular) has stepped up its omnichannel offerings and has partnered with third-party delivery companies to extend their online grocery proposition. Figure 7 below provides a timeline of Aldi’s e-commerce initiatives since March 2020.

Figure 7. Timeline of Aldi’s E-Commerce Initiatives from March 2020

| January 2022 | Aldi UK ends its trial with Deliveroo and says that it will focus on its click-and-collect service. |

| April 2021 | Aldi Nord teams up with on-demand delivery platform Glovo to test online grocery delivery service in Spain and Portugal. |

| March 2021 | Aldi UK extends click-and-collect service to more than 200 stores. |

| February 2021 | Aldi US announces plans to extend curbside pickup to 500 more stores in partnership with Instacart. |

| November 2020 | Aldi UK extends its trial with Deliveroo to 90 more UK stores, bringing the service to a total of 130 locations. |

| September 2020 | Aldi UK launches a trial of click-and-collect service at one of its stores in the Midlands. |

| May 2020 | Aldi US rolls out curbside pickup to nearly 600 stores across the country, in partnership with Instacart. Aldi US initially teamed up with Instacart in August 2017 to offer same-day delivery. |

| May 2020 | Aldi UK teams up with takeaway courier service Deliveroo to offer 30-minute grocery delivery of 150 essential items. |

Source: Company reports

Lidl: In Germany, Lidl is continuing to pursue its existing strategy of restricting its online offering to non-food products. However, internationally, Lidl has turned to third-party delivery firms to offer groceries online. For example, Lidl US has partnered with Shipt (in 2017) and Boxed (in 2019) for home delivery of grocery items. Similarly, the company teamed up with on-demand delivery platforms Lola Market in Spain in May 2019, Buymie in Ireland in January 2019, and Supermercato24 (rebranded as Everli) in Italy in January 2019. Lidl is currently behind Aldi in offering pickup services, with the company still trialing click-and-collect service at selected stores in Germany and Poland. Both Aldi and Lidl are tackling grocery e-commerce through various third-party partnerships and these offerings are proving popular with shoppers. However, by doing so, they fall short of replicating their advantages in store-based retail. Marked-up goods through these platforms can compromise their value proposition, while simultaneously interfering with the establishment of direct customer relationships—which their traditional rivals see as a key to making the proposition profitable over the long term. Additionally, introducing click-and-collect may initially look like a lower-cost way of moving into grocery e-commerce. However, we see real challenges for store picking and collection, given that Aldi and Lidl typically operate small stores. If discounters are willing to build scale in grocery e-commerce, using darks stores dedicated to picking online orders looks like a better option than in-store picking. Micro-fulfillment centers can also fit well with discounters’ limited assortment model, enabling a fast-picking rate and driving down labor costs.What We Think

Both Aldi and Lidl believe there is significant room for growth in their brick-and-mortar businesses. Additionally, both are shifting away from being pure discounters to becoming retailers with more a polished image, with high-quality standards, high transparency and using local production. As such, their aggressive real estate expansion and diversification will increase the competitive threat to traditional retailers, reshaping the grocery landscape in the coming years. Implications for Retailers- Aldi has been highly successful in the US, but it has built its reputation in the country over four decades. It is now leveraging its accumulated brand awareness and shopper trust with an aggressive expansion plan, which is designed in part to undercut Lidl’s expansion into the country.

- A limited online presence became a significant hindrance for both Aldi and Lidl during the pandemic. As other retailers enhance their private labels, and a growing percentage of grocery categories shift online, Aldi and Lidl will become more exposed to competition going forward. Discounters will need to strategize to aggressively compete in a retail ecosystem that places increasing emphasis on e-commerce.

- Unlike other traditional retailers, Aldi and Lidl have relied chiefly on organic expansion, dictated by their financial prudence and their status as privately-owned companies. However, they should also evaluate acquisitions or joint venture agreements for new market entries—as they are less risky options than organic growth, and would enable Aldi and Lidl to take advantage of their partners’ facilities and their knowledge of the market environment.