DIpil Das

What’s the Story?

Kohl’s and Macy’s are the two leading department store chains in the US. As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ revenue growth and discuss their recent innovations in physical and digital retail. In this report, we refer to the companies’ fiscal years, which for both companies end on January 31 of the following calendar year; fiscal 2020, for example, ended on January 31, 2021.Why It Matters

The department store dates back to Hudson’s Bay in 1670. The concept originated as a store where consumers could shop for the entire family. Supporting this idea in today’s world is challenging for three main reasons:- It requires a merchandise assortment that understands the changing wants and needs of multiple consumers, which is costly. Previously, it may have been easier to dress a family with department store fashion, but today, the range of specialized retailers means that each family member is likely to seek out items from a mix of stores and online retailers to suit their preferences and fulfill their fashion needs.

- Department stores were built to accommodate multiple departments, so stores are typically large, which is costly for retailers.

- Department stores had to “catch up” to digital-first counterparts with regards to e-commerce and align their digital strategies with physical stores. The US department store sector has faced challenges; in 2019 (pre-pandemic), total sector sales fell by 10% overall, and in 2020, department store sales fell by 55%, according to Euromonitor International.

Kohl’s vs. Macy’s: A Deep Dive

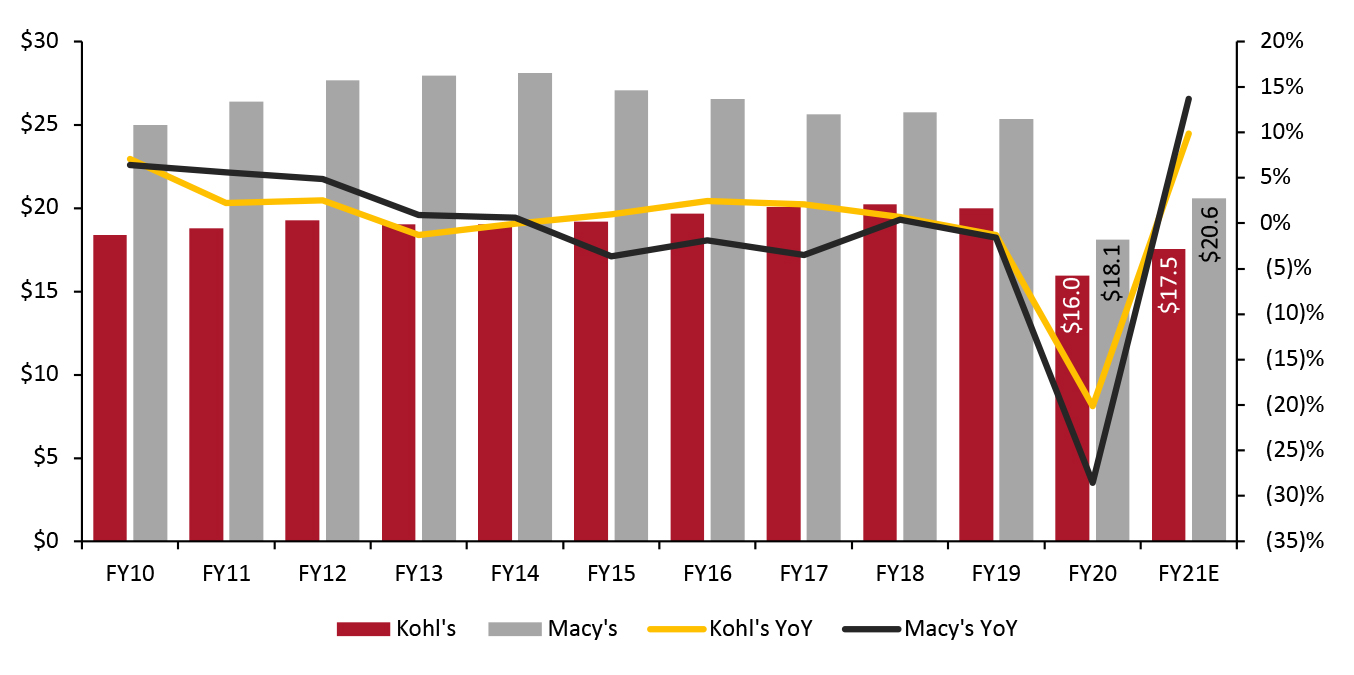

Revenue Growth Macy’s is the largest department store company in the US, with annual revenue of $18.1 billion in fiscal 2020 across its banners, which includes Bloomingdale’s and Bluemercury stores. Kohl’s follows closely behind, achieving $16.0 billion in revenue in the same fiscal year. Over the past five years, Kohl’s has been closing the gap in terms of annual revenues and has been gaining market share:- Kohl’s had a 23.8% market share in 2020, according to Euromonitor International—up from 17.6% in 2015. This represents greater overall gains than Macy’s, which had a 24.2% share of the department store market in 2020, up only slightly from 23.4% five years ago.

- The revenue gap has narrowed from $7.9 billion in fiscal 2015 to $2.1 billion in fiscal 2020. However, in fiscal 2021, we project the revenue gap to be $3.1 billion, with Macy’s taking back some of its lead over Kohl’s.

- Firstly, 95% of its stores are located off-mall, whereas the majority of Macy’s department stores are located in malls. US consumers have been hesitant about shopping in malls due to the increased risk of virus exposure in crowded public areas. Off-mall locations can also more easily offer curbside-pickup services with dedicated parking spaces—a service that has proved popular amid Covid-19.

- US unemployment peaked at 14.8% in April 2020 and remains elevated, according to the US Bureau of Labor Statistics (See our Leading Indicators of US Retail Sales series for more on the effects of macroeconomic indicators on retail sales.) As consumers have been conscious of budgets and spending, we believe that the value pricing at Kohl’s has given it a more competitive positioning than Macy’s.

- The Amazon Returns program at Kohl’s may have contributed to store traffic and bring additive sales into the store. Kohl’s identified 2 million new consumers attributed to its Amazon Returns program in fiscal 2020.

Figure 1. Kohl’s vs. Macy’s (Company): Revenue (USD Bil.; Left Axis) and YoY % Change (Right Axis) [caption id="attachment_126133" align="aligncenter" width="725"]

Macy’s company revenue includes Bloomingdale’s and Bluemercury

Macy’s company revenue includes Bloomingdale’s and Bluemercury Fiscal year ends on January 30

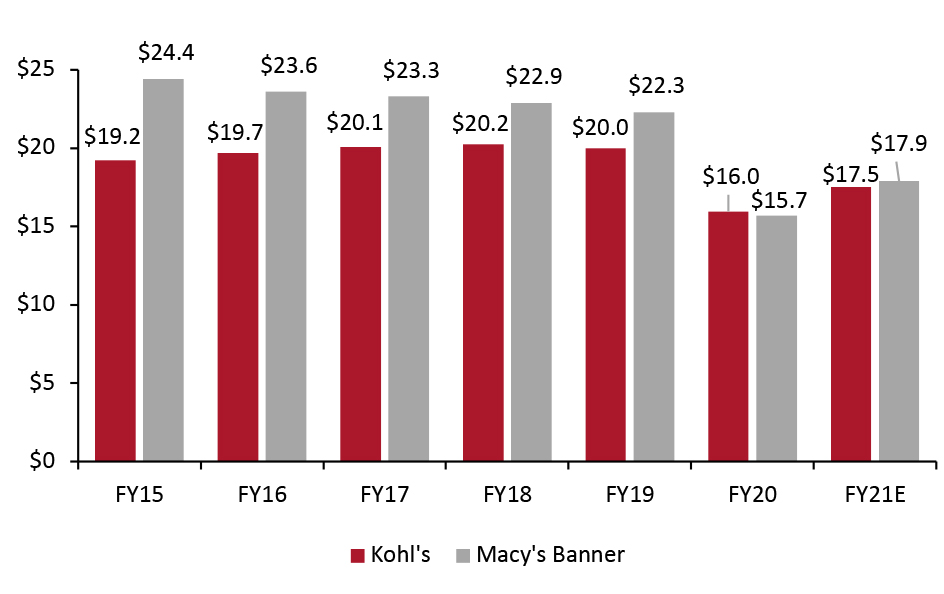

Source: Company reports/S&P Capital IQ/Coresight Research [/caption] Looking only at the Macy’s banner (excluding Bloomingdale’s and Bluemercury), Macy’s underperformed compared to Kohl’s in fiscal 2020 in terms of revenue. However, we estimate that the Macy’s banner will reach $17.9 billion in revenue in fiscal 2021—again surpassing the estimated revenue of Kohl’s, at $17.5 billion.

Figure 2. Kohl’s vs. Macy’s (Banner): Revenue (USD Bil.) [caption id="attachment_126134" align="aligncenter" width="725"]

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage

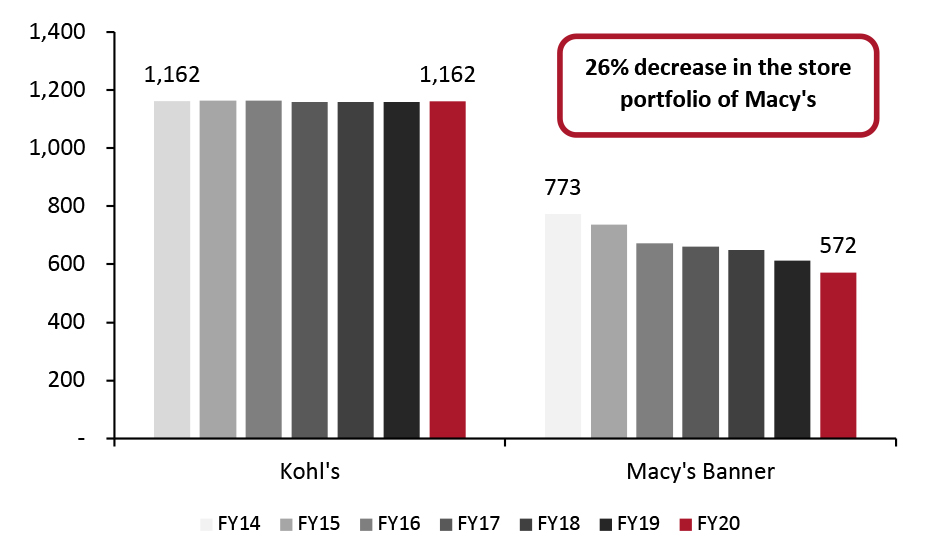

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage Source: Company reports/Coresight Research [/caption] Store Portfolio Kohl’s Stores Are More Productive Than Macy’s In recent years, Macy’s has been optimizing its store portfolio, while the brick-and-mortar presence of Kohl’s has remained stable. As of the end of fiscal 2020, Kohl’s operates 1,162 stores—the same number it had at the end of fiscal 2014. In terms of location, only 5% of Kohl’s stores are located in community and regional malls, while 81% are located in strip centers and 13% are free-standing stores. Macy’s, a traditional mall-anchor department store, has decreased its store portfolio by 201 stores in total since fiscal 2014—a 26% decrease. Macy’s announced in February 2020 that 125 stores will close over the next three years. On its earnings call for the fourth quarter of fiscal 2020 on February 23, 2021, the company said that 60 stores have closed or would be closing soon. These closures would reduce the retailer’s footprint in C and D malls: Following the closure of all 125 stores, 85% of the company’s store sales will come from A and B malls.

Figure 3. Kohl’s vs. Macy’s (Banner): Store Portfolio [caption id="attachment_126135" align="aligncenter" width="725"]

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage

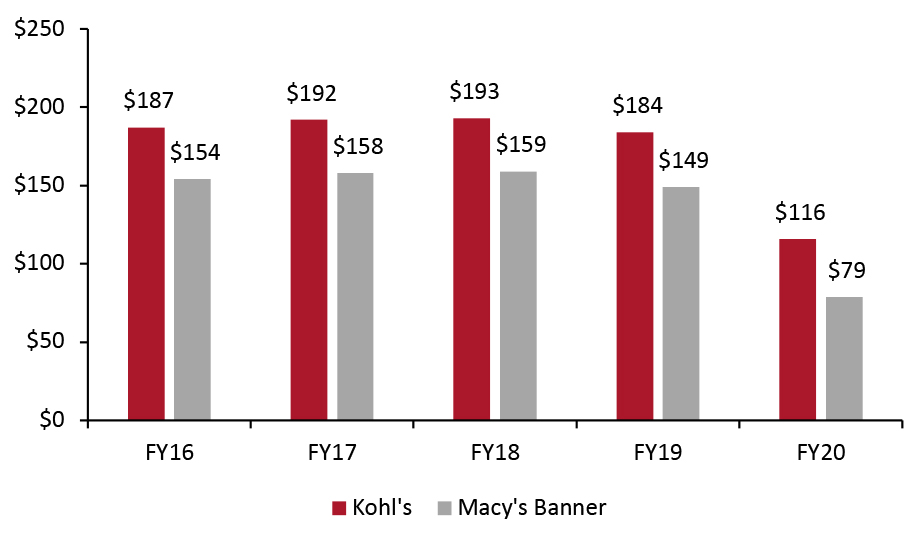

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage Source: Company reports [/caption] Although Macy’s operated half as many banner stores as Kohl’s in fiscal 2020 (573 stores compared to 1,162 Kohl’s stores), it had 1.4 times the retail square footage. Macy’s operates larger, mall-based stores, with an average size of 138,000–179,000 square feet. We disaggregated Macy’s banner sales and stores to calculate sales per square foot. At Macy’s banner stores, we estimate that this metric improved from an estimated $154 in fiscal 2016 to $159 in fiscal 2018 but has declined by 49% since. The company’s sales per square foot experienced a CAGR of (12)% from fiscal 2016 to 2020. Kohl’s has achieved consistently higher average sales per square foot than the Macy’s banner since fiscal 2016 (see Figure 4), although the retailer has also seen a decline in this metric from fiscal 2018 to fiscal 2020, of 40%. The company’s sales per sales foot experienced a (9)% CAGR from fiscal year 2016 to 2020.

Figure 4. Kohl’s vs. Macy’s (Banner): Estimated Sales per Square Foot ex. Digital Sales (USD) [caption id="attachment_126136" align="aligncenter" width="725"]

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage

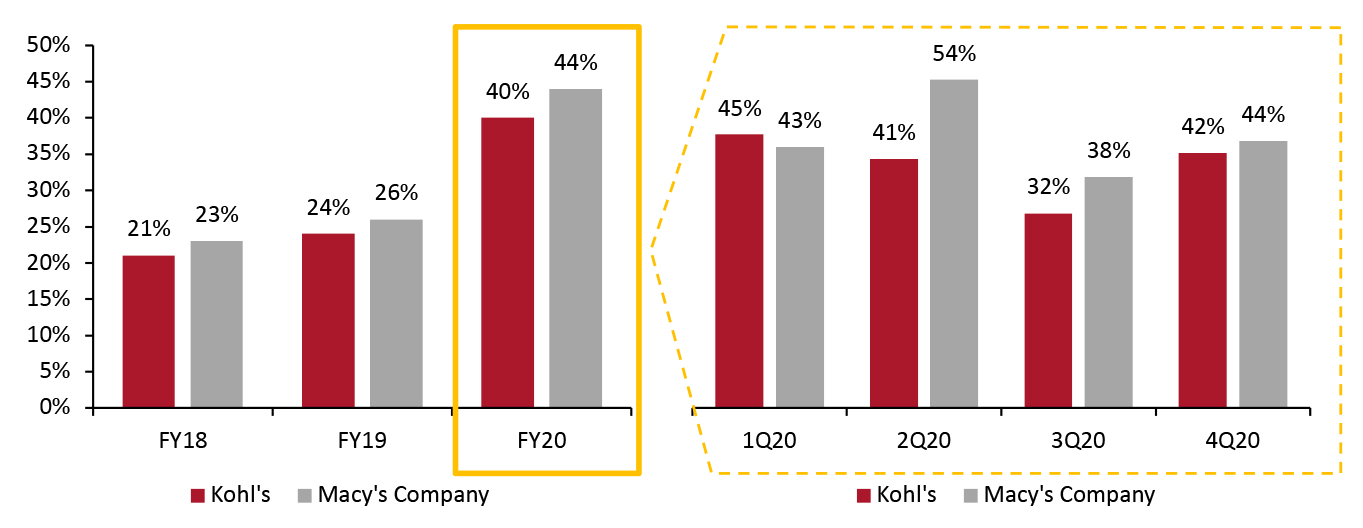

The Macy’s banner excludes Bloomingdale’s and Bluemercury but includes Macy’s Backstage Source: Company reports/Coresight Research [/caption] Going forward, a retail trend is for stores to open smaller format stores and showrooms that provide reduced assortment and services, and another point of distribution and contact for the retailer. Macy’s is testing two new store concepts. Firstly, it is testing off-mall stores in the Dallas, Atlanta, and the DC Metro areas, and the company will share its findings within the next year. Second, Macy’s opened its second “Market at Macy’s” store in January 2021, an off-mall location that will carry an assortment of items from the Macy’s banner store. This smaller-format concept measures approximately 20,000 square feet. The two new concepts are asset-light and provide the consumer with a different experience. We expect Macy’s may even trim its portfolio further to replace existing locations with smaller, off-mall stores. Digital Sales Are Accelerating Across store portfolios, Macy’s and Kohl’s are seeing digital sales increase dramatically, with e-commerce penetration having grown from around 25% of all sales in fiscal 2019 to over 40% overall in fiscal 2020, as shown in Figure 5. For department store chains—which have a lot of real estate as we have previously outlined—digital sales cannot replace physical store sales: E-commerce is complementary to their brick-and-mortar presence.

- Macy’s reported that it is investing in its digital business, such as by making improvements to its website and merchandising. The company reported on its latest earnings call that it plans to grow its digital business to $10 billion by 2022. In fiscal 2021, Macy’s expects digital sales to comprise 35% of total sales.

- Kohl’s reported on its fourth-quarter 2020 earnings call that it expects digital sales to be “slightly lower” in fiscal 2021 compared to fiscal 2020.

Figure 5. Kohl’s vs. Macy’s (Company): E-Commerce Penetration (% of Total Sales) [caption id="attachment_126137" align="aligncenter" width="725"]

Macy’s digital sales accounted for the total comparable sales on an owned basis; Kohl’s digital sales represent sales as a percent of net sales. The majority of Macy’s digital sales are from the Macy’s banner.

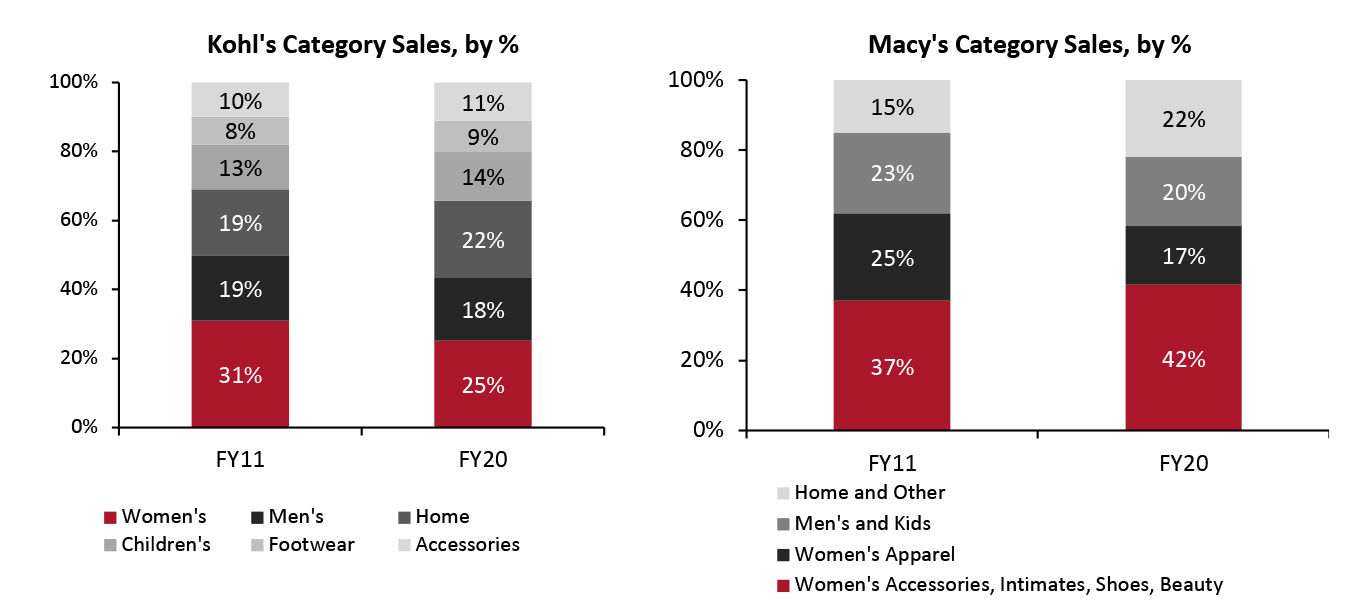

Macy’s digital sales accounted for the total comparable sales on an owned basis; Kohl’s digital sales represent sales as a percent of net sales. The majority of Macy’s digital sales are from the Macy’s banner. Source: Company reports [/caption] Product Diversification Consumers’ shopping preferences underwent rapid shifts due to lifestyle and work changes amid the Covid-19 pandemic, which fiscal 2020 sales by category demonstrate. These shifts proved significant at Macy’s: A larger part of the retailer’s business is dedicated to apparel categories that have been hit harder by the pandemic, such as professional attire. The combined categories of Women’s Apparel and Men’s and Kids totaled $11.0 billion in fiscal 2019 but declined to $6.4 billion in fiscal 2020. As a proportion of total sales, these categories comprised just 37% in fiscal 2020; if we look at the long-term change, this is a big drop from the 48% share in fiscal 2011. The Kohl’s portfolio, on the other hand, is more diversified. For example, Kohl’s “Children’s” and “Men’s” categories together represented 32% of total sales in fiscal 2020, versus 20% at Macy’s. We break down category sales at Macy’s and Kohl’s to compare fiscal 2011 with fiscal 2020 in Figure 6.

Figure 6. Kohl’s vs. Macy’s (Company): Sales Mix (% of Total Revenue) [caption id="attachment_126138" align="aligncenter" width="724"]

Source: Company reports [/caption]

Below, we compare and summarize category strengths of the two retailers:

Source: Company reports [/caption]

Below, we compare and summarize category strengths of the two retailers:

- Women’s apparel has been a challenge for both retailers as consumers turned to casual, comfortable and active apparel during the pandemic—away from professional attire. Women’s apparel represented 17% of sales ($2.9 billion) at Macy’s in fiscal 2020, versus 25% ($3.8 billion) at Kohl’s. As we discuss later, Kohl’s is focusing on improving its women’s apparel category moving forward.

- Home has grown at both retailers over the past 10 years. At Macy’s, the home category grew from 15% of sales in fiscal 2011 to 22% in fiscal 2020, while Kohl’s has seen its home business grow from 19% to 22% over the same period.

- Macy’s largest category is “Women’s Accessories, Intimates, Shoes and Beauty,” which comprised 42% ($7.2 billion) of sales in fiscal 2020. This category has grown from 37% of its business 10 years ago. This is a category of strength for Macy’s. While there are no corresponding categories for Kohl’s, we predict Kohl’s to gain share in this category with its Sephora partnership announcement (see later in this report). Kohl’s also highlighted that intimates is a product category it is focusing on in the revamp of its women’s business.

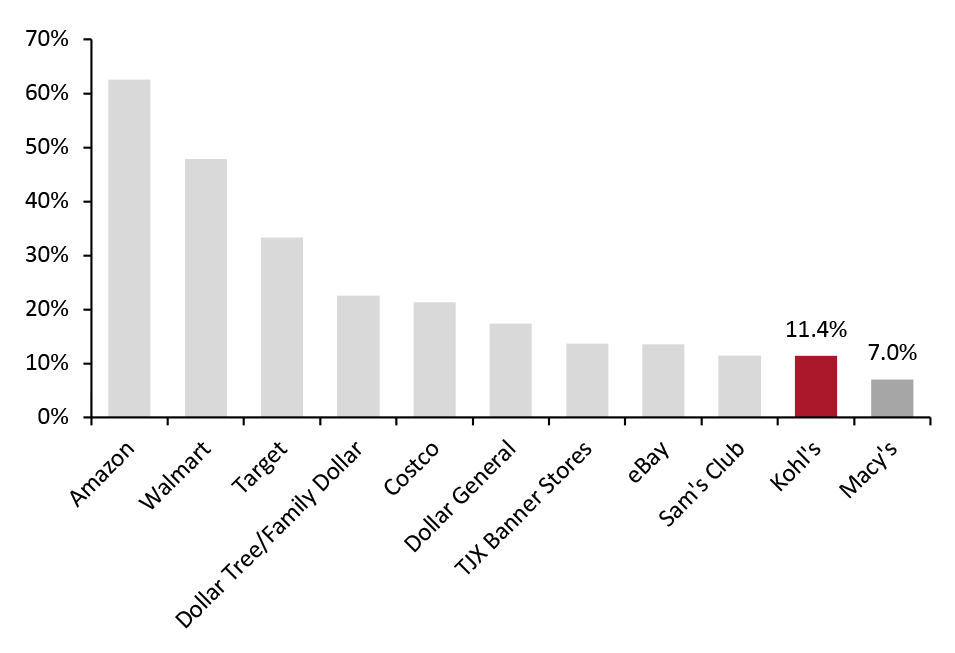

Figure 7. US Consumers: Retailers At Which They Bought Nonfood Products in the Past Two Weeks (% of Respondents) [caption id="attachment_126139" align="aligncenter" width="725"]

Base: US respondents aged 18+, surveyed on April 12, 2021

Base: US respondents aged 18+, surveyed on April 12, 2021 Source: Coresight Research [/caption] Innovations at Kohl’s and Macy’s Both Kohl’s and Macy’s are innovating to stay relevant with their current customers and to reach new audiences. We summarize their recent innovations in Figure 8 and discuss each one below.

Figure 8. Innovations at Kohl’s and Macy’s [caption id="attachment_126144" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Innovations at Kohl’s

Kohl’s is building its customer base, driving store traffic and broadening its categories through three key innovations: partnership models, emerging marketplaces and refocused product categories.

1. Partnership Models Drive Store Traffic and New Customers

Kohl’s actively innovates using partnership models. Most notably, Kohl’s launched its Amazon Returns program in 2017, which has helped to bring in younger consumers and drive traffic to its stores: The retailer reported on its fourth-quarter 2020 earnings call on March 2, 2021 that it identified 2 million new customers brought in by the Amazon Returns program, one-third of which are millennials.

Below, we highlight one of the department store chain’s most recent retail partnerships:

Source: Company reports/Coresight Research[/caption]

Innovations at Kohl’s

Kohl’s is building its customer base, driving store traffic and broadening its categories through three key innovations: partnership models, emerging marketplaces and refocused product categories.

1. Partnership Models Drive Store Traffic and New Customers

Kohl’s actively innovates using partnership models. Most notably, Kohl’s launched its Amazon Returns program in 2017, which has helped to bring in younger consumers and drive traffic to its stores: The retailer reported on its fourth-quarter 2020 earnings call on March 2, 2021 that it identified 2 million new customers brought in by the Amazon Returns program, one-third of which are millennials.

Below, we highlight one of the department store chain’s most recent retail partnerships:

- Sephora at Kohl’s—On December 1, 2020, Kohl’s and Sephora announced a partnership to bring 200 Sephora shop-in-shop locations to Kohl’s department stores from fall 2021, with products available online too. The "Sephora at Kohl's" partnership will total 850 physical locations by 2023, with each being a 2,500-square-foot space prominently displayed at the front of each store. The space will include over 100 curated brands. Kohl’s has 65 million consumers, 45 million (70%) of which are women. The shop-in-shops will provide another channel for consumers to discover products from Sephora and may help to drive traffic and potentially bring in new consumers to Kohl’s who may stop in to purchase something from Sephora and end up shopping other categories. The Sephora collaboration will enable Kohl’s to quickly upgrade its beauty category: The addition of 200 Sephora stores is an immediate, recognizable brand boost for Kohl’s, with an assortment of already established prestige and mass makeup products. While Kohl’s does not segment out its beauty sales, management reported that beauty sales as a proportion of total sales were in the “low single digits” in its third quarter of fiscal 2020, ended October 31, 2020. Management stated that Kohl’s is seeking to triple this penetration, and beauty has seen steady growth of 40% over the past five years.

- Kohl’s Wellness Market Shop-in-Shops—Kohl’s has launched a Wellness Market, a curated selection of products spanning home, beauty, personal wellness, baby and pet care, with an emphasis on products that offer clean, natural or sustainable attributes. Management reported on its third-quarter 2020 earnings call in November 2020 that the company is leveraging the marketplace to test new products and categories and “see how they come to life.” Under the umbrella of wellness, the Wellness Market is a way for the company to experiment and gain consumer insights to determine interests. The market includes “Clean self-care,” “Vitamins and Supplements” “Clean baby” “Clean home” and Clean pet” departments, covering wellness essentials such as deodorant, baby wipes and cleaning supplies. The Wellness Market includes national brands Method, Seventh Generation, Shea Moisture and The Honest Company.

Source: Kohls.com[/caption]

Source: Kohls.com[/caption]

- Curated by Kohl’s—Kohl’s has launched Curated by Kohl’s, an in-store and online market of emerging brands that rotate quarterly, with new products spanning apparel, accessories and home. Kohl’s partnered with Facebook on brand curation, identifying and engaging with brands that have built a strong online community on social media. On its second-quarter 2020 earnings call in August 2020, the company announced that it was expanding the Curated by Kohl’s market to 300 stores for the 2020 holiday season to “expand the newness and discovery options” for consumers. Management said that many of the brands are digitally native brands, so it is another avenue to introduce Kohl’s customers to emerging brands and a fresh assortment on a continual basis.

- Expand Activewear—Kohl’s is seeking to grow its activewear category from 20% to 30% of its business and become an active and casual lifestyle retailer for the whole family, covering multiple categories including active apparel and footwear, accessories, athleisure and outdoor. The company is devoting 20% more floorspace to this category to support this aim and has expanded active in 160 stores where the category outperformed, giving management confidence to grow the space across the fleet. Kohl’s is introducing an athleisure private-label men’s and women’s brand in March 2021, offering products made with performance fabrics and sustainable materials. The retailer is also expanding the placement of its Champion brand across men’s, women’s and kid’s due to its success: The brand grew 95% in the third quarter of fiscal 2020.

- Triple Beauty Sales—The company reported on its third-quarter 2020 earnings call that is sees beauty as a significant incremental opportunity, and it is aiming to at least triple sales in the category. While only a modest low-single-digit penetration of the Kohl’ business today, beauty has seen steady growth of nearly 40% over the past five years, according to management. In addition to partnering with Sephora (see above), Kohl’s also launched Lauren Conrad Beauty, a line of clean skin care and cosmetics, in October 2020. The department store also elevated its in-store beauty experience with an initial pilot in 12 stores in December 2019, which expanded to 62 stores in 2020. The expanded beauty shops double the store footprint previously dedicated to beauty and offer an elevated experience for customers to shop and discover new and existing brands, including wider aisles, brighter lights and updated fixtures. In addition to offering new brands, expanded stores offer The Beauty Checkout, an new initiative that Kohl’s launched with Facebook in October 2019 that brings emerging beauty brands on a rotating selection. The Beauty Checkout is available in over 200 stores and online.

- Focus on Outdoor Lifestyle—Kohl’s announced a partnership with Eddie Bauer in February 2021 to bring Eddie Bauer performance outerwear and apparel to approximately 500 stores and online this year. The department store chain is also doubling the number of stores offering Lands’ End products. Management said on its fourth-quarter 2020 earnings call that outdoor represents a large incremental growth opportunity for Kohl’s.

- Refocus the Women’s Category—Kohl’s is repositioning its women’s business to increase relevancy with consumers. The company put a new leadership team in place, exited eight down-trending brands and reduced the number of choices. Kohl’s is focusing on categories including athleisure, lounge, sleepwear and intimates.

- Partnership with Klarna—Macy’s announced its partnership with Klarna, a global flexible payment provider, in October 2020. The partnership will provide Macy’s customers the option to pay in four equal, interest-free installments at online checkout. Management reported at the Morgan Stanley Virtual Global Consumer Retail Conference on December 1, 2020 that the impetus for launching a flexible payment program came from “consistent call-outs” from its customers, particularly younger shoppers, who were seeking installment payment options. In its press release, Klarna reported that Macy’s is one of the first department stores to offer its customers Klarna’s “buy now, pay later” offering, which appeals to younger demographics—who increasingly prefer alternative ways to pay—but also to any consumer seeking flexibility and convenience. On its fourth-quarter 2020 call on February 23, 2021, management said that the Klarna partnership has been an accelerant in bringing new customers to Macy’s; about two-thirds of the customers from Klarna were previously unknown to Macy’s, and these customers are predominantly aged under 40, which is younger than Macy’s traditional customer.

- National Rollout of DoorDash—In order to help meet consumers’ desire for convenience and speed, Macy’s has expanded its fulfillment service options by partnering with same-day delivery service provider DoorDash. The partnership, which was announced in October 2020, offered same-day delivery from all Macy’s department stores in time for the 2020 holiday season. The company reported at the Morgan Stanley Virtual Global Consumer Retail Conference on December 1, 2020 that over 30% of its digital demand is fulfilled through its stores, which includes BOPIS (buy online, pick up in store), curbside pickup and ship-to-store. The DoorDash partnership therefore allows Macy’s to stay competitive as consumers increasingly seek convenient and fast delivery options.

- Enhanced Curbside Pickup—Macy’s launched curbside pickup quickly in spring 2020 to meet immediate customer needs at the onset of the Covid-19 pandemic. The department store chain reported that it recently completed a “significant upgrade” to its curbside offering, which includes an improved digital check-in experience and a new colleague app to quickly process curbside orders. Management reported that customers are “responding well to the enhanced experience.”

- Digital Functionality with Google—Macy’s is focusing on its digital capabilities to improve the customer experience. Naveen Krishna, Chief Technology Officer at Macy’s, presented in the session “How Google Cloud helps retailers transform the shopping experience” at the National Retail Federation on January 14, 2021. Krishna highlighted that Macy’s is looking at the entire customer shopping journey, from product search and discovery to checkout, pickup and delivery to assess how it can improve the entire experience. The company partnered with Google to improve its online search, filter and browse capabilities and improved the product pages on its website. Macy’s remerchandised how products were featured—particularly with the under-40 customer in mind and how brands and categories were marketing to this segment. The company reported 4 million new customers in the second quarter of fiscal 2020 and 3 million in the third quarter. Management said that the new customers are much younger and more diverse.

What We Think

Kohl’s and Macy’s have very different growth and innovation strategies: Kohl’s is focused on strengthening its assortment, building its customer base and driving store traffic through partnerships, while Macy’s is focused on the consumer experience, including digital search and discovery, flexible payments, and pickup and delivery. These strategies should capitalize on shifting consumer behaviors in different ways. Kohl’s is well placed to adapt to demand for activewear, and based on its category mix, the company is not over-reliant on women’s. In addition, its value proposition should stand it in good stead, at least in the short term, with consumers that remain more price-conscious due to the pandemic. Macy’s, on the other hand, is looking to appeal to consumer demand for convenience, both online and in-store, with the launch of new delivery services and payment options. With many retailers having pivoted quickly to offer BOPIS and flexible payment amid the pandemic, we expect these services to remain in demand with consumers going forward, leaving behind retailers that do not offer such services. Both companies’ increased e-commerce penetration—which grew from around 25% of all sales in fiscal 2019 to over 40% overall in fiscal 2020 at Kohl’s and Macy’s—presents positive indications that the retailers can remain competitive in the uncertain environment amid Covid-19 recovery. However, digital sales must be complementary to the companies’ extensive brick-and-mortar presence—and Macy’s in particular is looking to drive success in its physical store portfolio moving forward by expanding its smaller-format concepts and increasing its off-mall presence. Harnessing the digital consumer while also engaging consumers to bring them to the store will be key.Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved