DIpil Das

What’s the Story?

P&G and Unilever dominate the global CPG industry, with their products sold in virtually every grocery store and found in the majority of consumers’ homes. As part of Coresight Research’s Head-to-Head series, we provide insights into four key elements of the two businesses, covering revenue growth and segmentation, as well as both companies’ digital transformation initiatives, approaches to product development and varying growth strategies. Also known as fast-moving consumer goods (FMCG), CPG comprises products that are sold quickly and at a relatively low cost, such as beverages, packaged groceries and toiletries.Why It Matters

The two global market leaders make for an insightful comparison—they have distinct outlooks on growth but indicate a common goal of improving their respective product offerings, notably in response to consumer demand changes amid the pandemic in 2020.P&G vs. Unilever: A Deep Dive

Company Overviews Both founded in the 19th century, P&G and Unilever are leading players in the global consumer goods industry. The two companies offer a plethora of everyday products under multiple categories, from beauty to home goods.Figure 1. Company Overview [wpdatatable id=954 table_view=regular]

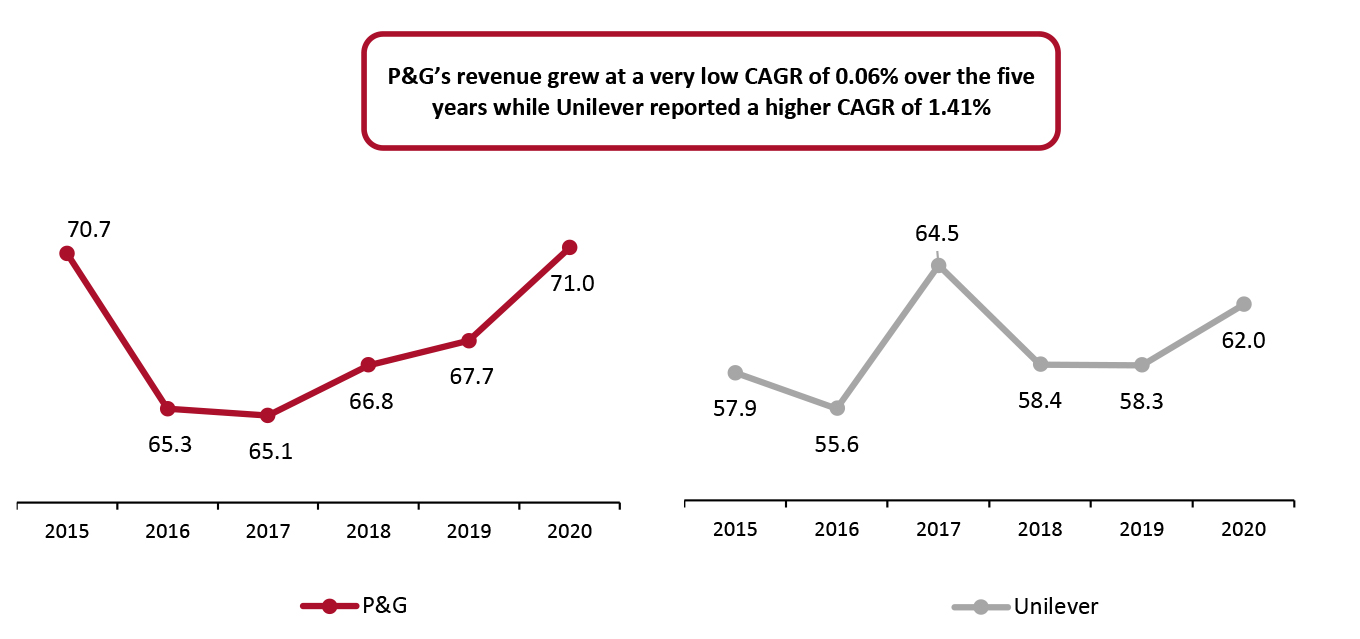

Source: Company reports/S&P Capital IQ/Coresight Research 1. Revenue From fiscal 2015 to 2020, both P&G and Unilever reported marginal revenue increases. In its fiscal 2020, P&G reported revenue of $71.0 billion while Unilever’s revenue reached $62.0 billion. P&G’s revenue grew at a very low CAGR of 0.06% from fiscal 2015 to 2020, whereas Unilever reported slightly better, albeit fairly marginal, revenue growth of 1.41% in the same period. P&G’s marginal revenue growth can be attributed to its move to divest around 41 of its lower-margin brands in 2016, to refine its focus on more significant brands. This led to a revenue decline of 7.7% during the year. From 2017 onward, the company has reported a low to mid-single-digit increase in its revenues. Although Unilever reported lower revenue than P&G, the former achieved a slightly better CAGR of 1.41% from 2015 to 2020. Unilever reported a 9.5% decline in revenues in 2018, which was largely on the back of the divestiture of its spreads business in 2017. The overall growth in Unilever’s revenue from 2015 to 2020, can be primarily attributed to consistent performance in its beauty and personal care segment over the five-year period.

Figure 2. P&G and Unilever: Revenue 2015–2020 (USD Bil.) [caption id="attachment_127370" align="aligncenter" width="725"]

Source: Company reports/S&P Capital IQ[/caption]

Revenue Segmentation by Product Category

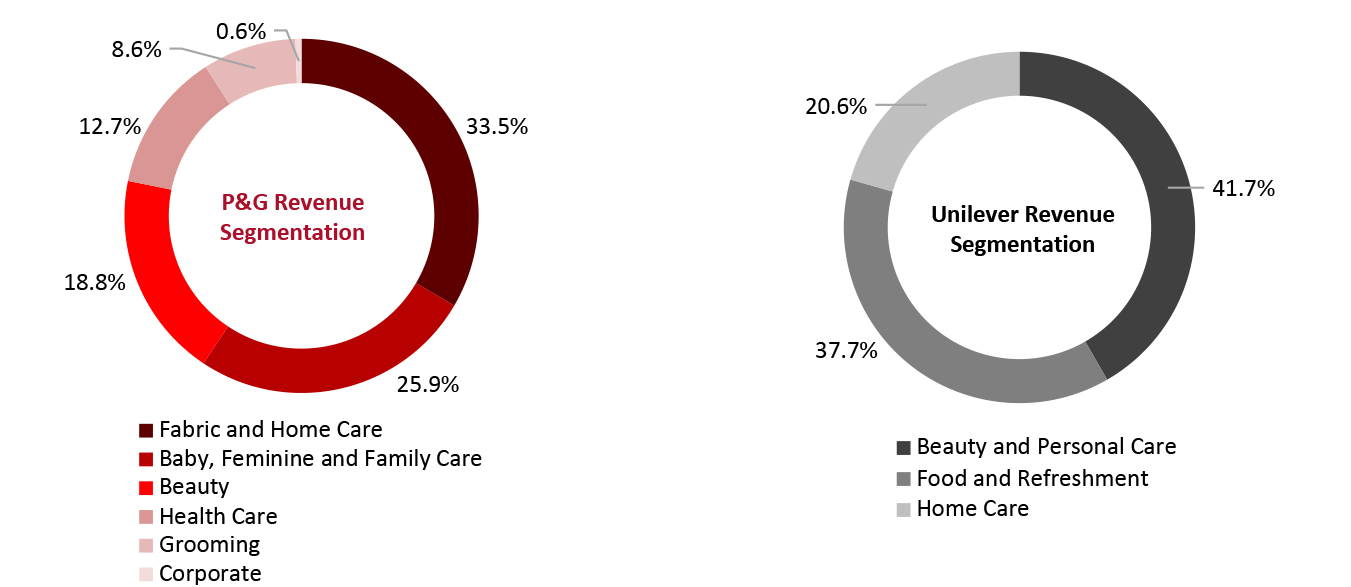

While P&G boasts multiple product categories, it is primarily focused on personal care products from diapers to soap to razors. Unilever operates in almost the same categories as P&G, but it also offers products in the food category. Unilever’s food and refreshment segment accounted for 37.7% of the company’s revenues in 2020.

Source: Company reports/S&P Capital IQ[/caption]

Revenue Segmentation by Product Category

While P&G boasts multiple product categories, it is primarily focused on personal care products from diapers to soap to razors. Unilever operates in almost the same categories as P&G, but it also offers products in the food category. Unilever’s food and refreshment segment accounted for 37.7% of the company’s revenues in 2020.

Figure 3. Revenue Segmentation, by Product Categories in 2020 (% Share of Revenue) [caption id="attachment_127371" align="aligncenter" width="725"]

Note: Totals may not sum due to rounding

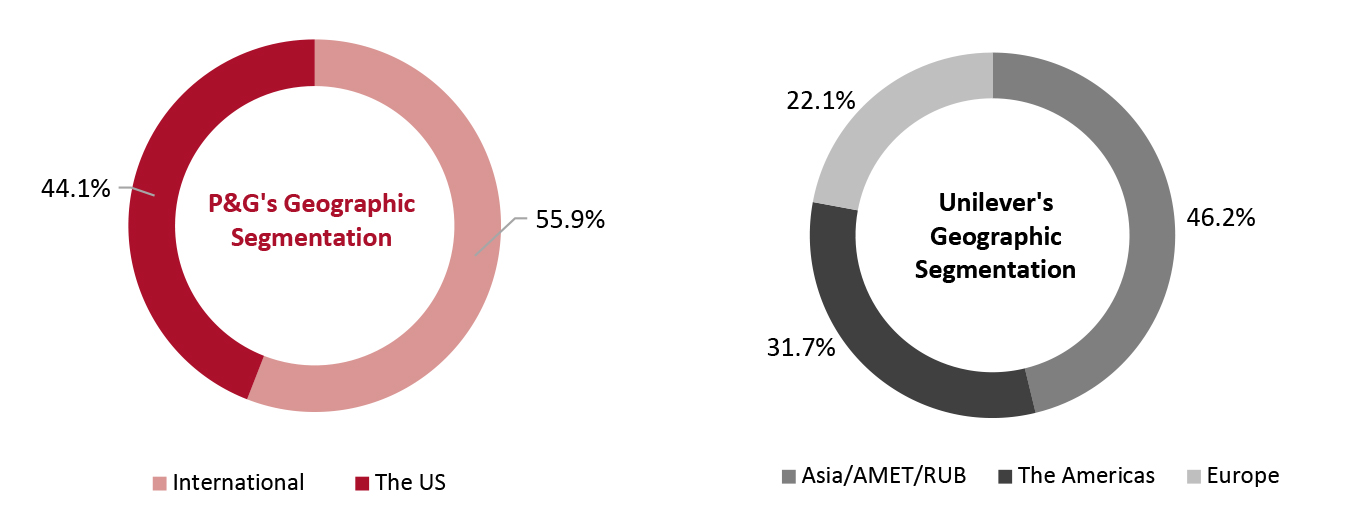

Note: Totals may not sum due to rounding Source: Company reports/S&P Capital IQ [/caption] Revenue Segmentation by Geography A notable geographic distinction between Unilever and P&G revenue segmentation is the former’s increased exposure in emerging markets and developing economies. We expect growing incomes and swiftly emerging middle classes in developing countries to fuel sales growth going forward. Moreover, increasing financial security is leading to an increase in purchasing power among consumers in emerging economies, which reflects favorably on Unilever’s revenue growth opportunities. Unilever generates a major share of its revenues, amounting to 46.2% in its fiscal 2020, in its AMET (Africa, Middle East and Turkey) and RUB (Russia, Ukraine, Belarus) regional clusters. Meanwhile, P&G generates its major revenue share in the US, amounting to 44.1% in fiscal 2020. Unilever reports that around 31.7% revenue share from its business in The Americas. Unilever’s home continent, Europe, accounts for the smallest regional share of the company’s revenue in 2020 at 22.1%. The US and China region account for the highest revenue share at P&G. During its first quarter of 2021, the company witnessed 16% year on year growth in the US and 12% growth in the Greater China region, with the rebound in China following the pandemic accelerating the company’s performance in the region.

Figure 4. Revenue Segmentation, by Geography (% of Revenue in 2020) [caption id="attachment_127372" align="aligncenter" width="725"]

Source: Company reports/S&P Capital IQ[/caption]

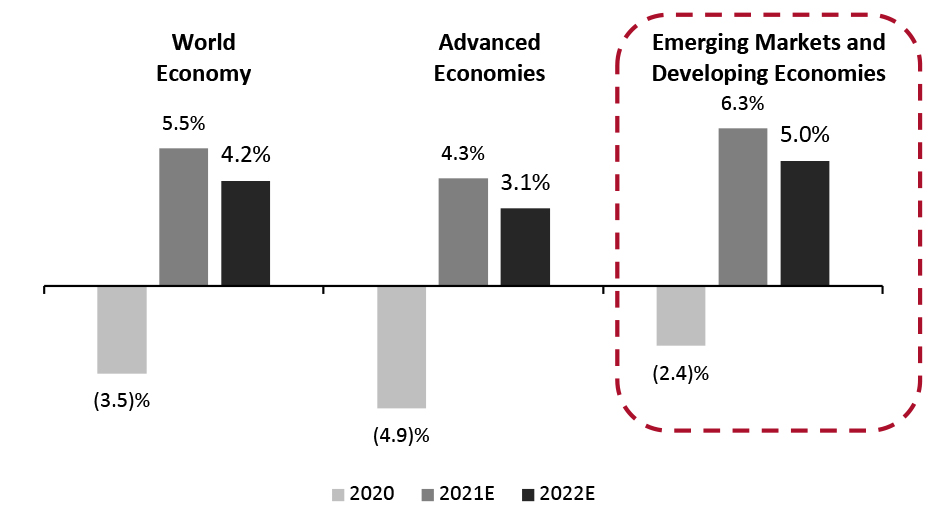

Unilever expects Argentina, Brazil and India to emerge as top growth markets in 2021 and beyond due to the company’s strong mass portfolio in the three markets—its Dove, Lux and Sunsilk brands, in particular, have a significant presence in each country. Figure 5 indicates strong opportunities in developing markets and emerging economies, as highlighted by the International Monetary Fund’s real GDP growth projections. Emerging markets and developing economies are set to outpace the world economy by 2022 and significantly surpass real GDP growth in advanced economies.

Source: Company reports/S&P Capital IQ[/caption]

Unilever expects Argentina, Brazil and India to emerge as top growth markets in 2021 and beyond due to the company’s strong mass portfolio in the three markets—its Dove, Lux and Sunsilk brands, in particular, have a significant presence in each country. Figure 5 indicates strong opportunities in developing markets and emerging economies, as highlighted by the International Monetary Fund’s real GDP growth projections. Emerging markets and developing economies are set to outpace the world economy by 2022 and significantly surpass real GDP growth in advanced economies.

Figure 5. World Economic Outlook Real GDP Growth Projections (%) [caption id="attachment_127373" align="aligncenter" width="725"]

Source: International Monetary Fund [/caption]

2. Digital Transformation

Digital transformation is a top priority for P&G and Unilever. We discuss recent developments toward digitalization at both companies.

Unilever has recently established two strategic partnerships within its digital transformation strategy. In 2019, Unilever partnered with Marsden Group on a customized digital twin solution that enabled the company to digitally replicate and analyze its entire manufacturing footprint for potential pain points. The solution leverages AI and machine learning algorithms to generate insights around process improvements and for predictive analysis.

The insights enabled Unilever to:

Source: International Monetary Fund [/caption]

2. Digital Transformation

Digital transformation is a top priority for P&G and Unilever. We discuss recent developments toward digitalization at both companies.

Unilever has recently established two strategic partnerships within its digital transformation strategy. In 2019, Unilever partnered with Marsden Group on a customized digital twin solution that enabled the company to digitally replicate and analyze its entire manufacturing footprint for potential pain points. The solution leverages AI and machine learning algorithms to generate insights around process improvements and for predictive analysis.

The insights enabled Unilever to:

- Optimize around 700 processes with RPA (robotic process automation) tools. Replacing these manual tasks with automated processes improved employee efficiency, freeing up time for important tasks that require human intervention.

- Enhance productivity by 3% compared to the prior year, with cost savings of €2.5 million ($2.8 million) in 2019 based on the implementation of RPA.

- In October 2020, the company announced plans to expedite digital transformation in its Singapore operations. It launched the iFuture digital capability program, through which it plans to train 50 employees to undertake new digital roles in P&G. By 2023, P&G plans to invest SG$50 million ($37.6 million) in the program.

- In October 2020, Unilever’s Liquid I.V. brand introduced a new version of its drink mixtures marketed as improving immunity. Named Hydration Multiplier+ Immune Support, the product is available across US retailers including Amazon, Costco and Walmart, as well as on Liquid-IV.com.

- SmartyPants announced plans to expandits vitamin product assortment with a range of new supplements, named Healthy Immunity Daytime, Healthy Immunity Nighttime and Healthy Kids Immunity. The brand which was acquired by Unilever in December 2020, states that the supplements use a combination of clinically proven ingredients to support and build strong immune systems.

- Hindustan Unilever Limited (HUL) launched a new mouth wash formula in December 2020, named Pepsodent Germicheck Mouth Rinse Liquid. According to HUL, the new product uses cetylpyridinium chloride (CPC) technology to reduce the viral load of SARS-CoV-2, the virus that causes Covid-19, by 99.9%.

Figure 6. P&G’s Acquisition and Divestment Activities: 2019–2020 [wpdatatable id=955 table_view=regular]

Source: Company reports/Coresight Research The majority of Unilever’s acquisitions are concentrated on beauty and personal care products. Figure 7 highlights acquisitions completed by Unilever in 2019 and 2020.

Figure 7. Unilever’s Acquisition Activities: 2019–2020 [wpdatatable id=956 table_view=regular]

Source: Company reports/Coresight Research