DIpil Das

Introduction

What’s the Story?Anta and Li-Ning are China’s largest sportswear brand owners. They are both also part of the Coresight 100, our focus list of retailers, brand owners and retail-related firms. As part of Coresight Research’s Head-to-Head series, we provide insights into the two companies’ revenues, as well as brand positioning, sales channels and key strategies.

Why It MattersWe expect sportswear to continue to be an essential market category in the global apparel and footwear market. We anticipate that the prevalent casualization trend will continue for the next few years, though we predict occasion wear categories will recover strongly in the US and overshadow casual wear and sportswear wear temporarily in 2022. There are opportunities for global brands and retailers to capture in China’s sportswear market, though domestic brand owners, such as Anta, Li-Ning and Xtep, are rising. China’s sportswear market will grow with a CAGR of 13.3% from 2016 to 2026, according to Euromonitor International.

NIKE has maintained its leadership position in China’s sportswear market for more than a decade, and captured 25.2% of the market in 2021, according to Euromonitor International. Anta, a domestic brand owner that has been among top five companies for the decade, overtook Adidas to become the second largest sportswear company in 2021 and captured 16.2% of the market, indicating the growing power of domestic sportswear brands in China. Li-Ning, the second largest domestic sportswear brand owner in China, grew 1.6 basis point shares of the market from 2016 to 2021.

Some global brands and retailers such as Adidas, Columbia Sportswear and New Balance are losing shares, while others such as Lululemon, Skechers and Under Armour are gaining shares. In this fast-changing retail environment where global brands and retailers are facing fierce competition, global supply chain restrictions and lockdowns in China due to the pandemic, it is necessary to offer implications to global sportswear brands and retailers that have exposure to China market or aim to expand their businesses in China. Learning about the top two largest sportswear retailers can be a starting point.

Anta vs. Li-Ning: Coresight Research Analysis

Company OverviewsAt the forefront of the sportswear industry in China, both companies sell sportswear accessories, apparel, equipment and footwear. Figure 1 provides an overview of key metrics for Anta and Li-Ning. Li-Ning was founded earlier than Anta but has fewer stores as of December 2021.

Figure 1. Company Overviews: Anta and Li-Ning [wpdatatable id=2145]

Source: Company reports Brand Portfolios: Core Brands Have Different Market Focuses

Both Anta and Li-Ning own multiple brands, but have different market focuses. Anta’s core brand ANTA is positioned as a functional sportswear brand, targeting the mass market. The company’s other brands, including DESCENTE, FILA and KOLON sport, targeting the high-end market. Anta aims to expand its reach into the high-end apparel and equipment market, as illustrated by the company’s move to acquire Amer Sports in March 2019.

Li-Ning’s core brand LI-NING is positioned as a functional sportswear brand, targeting the high-end market. The company’s other brands, including Double Happiness, Kason, as well as the China market of Danskin, target the mass market. The company is also expanding its penetration into the high-end apparel and equipment market. In contrast with Anta, it is leveraging its core brand LI-NING to expand into the high-end market. The company has been promoting its brand by increasing the prices of LI-NING products, upgrading the designs, and launching exclusive product lines such as the luxury sports line LI-NING1990 in 2021. In January 2021, Li-Ning announced plans to buy Clarks footwear for $69 million and the transaction is expected to close in 2022. We expect the acquisition to help Li-Ning expand its portfolio and grow sales while rebooting Clarks.

Figure 2. A Comparison of Selected Brands: Anta vs. Li-Ning [wpdatatable id=2146]

Source: Company reports Revenue: Anta Has Outpaced Li-Ning in Revenue Growth

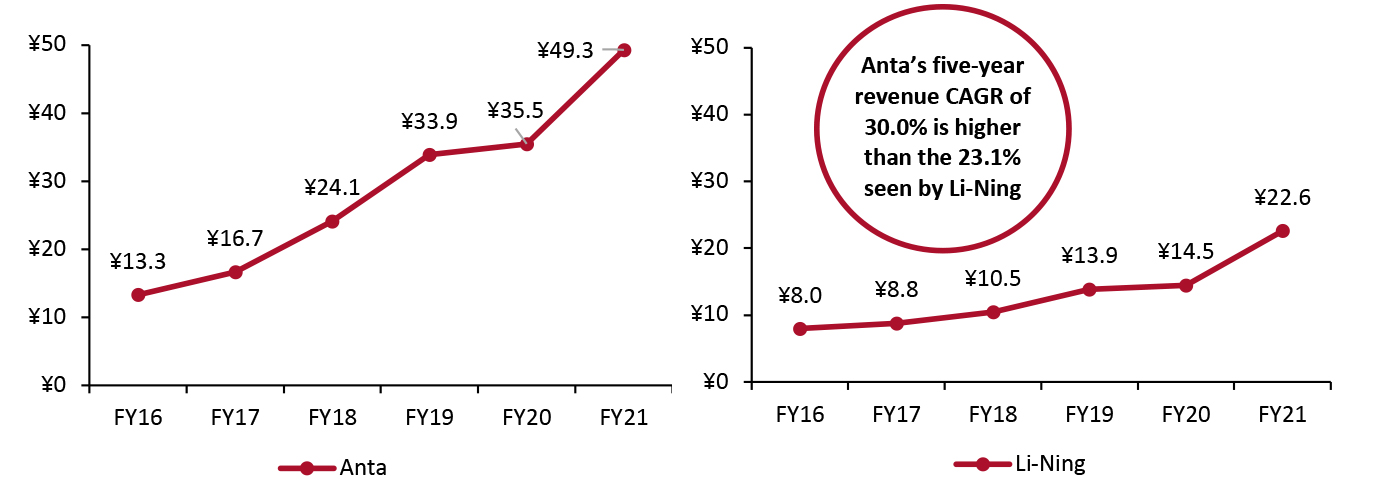

Anta has outpaced Li-Ning in terms of revenue growth, with a CAGR of 30.0% from fiscal 2016 to 2021, while Li-Ning saw a relatively lower CAGR of 23.1% over the same time period. Anta posted revenue of ¥49.3 billion ($7.7 billion) in fiscal 2021, ended December 31, 2021, whereas Li-Ning reached ¥22.6 billion ($3.5 billion) revenue in its fiscal year 2021.

As of December 31, 2021, Anta’s higher revenue equates to a larger market share, a 16.2% share of the total sportswear market—with Li-Ning comprising an 8.2% share, according to Euromonitor International.

The disparity in market share and revenue between the two companies is a function of multiple factors, including consumer response to different product attributes (quality, performance, color, design, price and brand appeal). We see stronger market positioning and third-tier city expansion strategy as having a key impact: Fila (positioned as a high-end fashion sports brand targeting consumers in a wide range of age groups) captured almost half of the company’s business in 2021; ANTA targets the mass market. Anta has been aggressively increasing the number of stores in the first-to-third tier cities in the recent decade.

Figure 3. Revenue: Anta and Li-Ning (RMB Bil.) [caption id="attachment_152121" align="aligncenter" width="701"]

Note: Anta’s and Li-Ning’s fiscal year ends December 31; USD conversion for Anta revenue at a constant currency rate: $2.1 billion (FY16), $2.6 billion (FY17), $3.8 billion (FY18), $5.3 billion (FY19), $5.5 billion (FY20) and $7.7 billion (FY21); USD conversion for Li-Ning revenue at a constant currency rate: $1.3 billion (FY16), $1.4 billion (FY17), $1.6 billion (FY18), $2.2 billion (FY19), $2.3 billion (FY20) and $3.5 billion (FY21)

Note: Anta’s and Li-Ning’s fiscal year ends December 31; USD conversion for Anta revenue at a constant currency rate: $2.1 billion (FY16), $2.6 billion (FY17), $3.8 billion (FY18), $5.3 billion (FY19), $5.5 billion (FY20) and $7.7 billion (FY21); USD conversion for Li-Ning revenue at a constant currency rate: $1.3 billion (FY16), $1.4 billion (FY17), $1.6 billion (FY18), $2.2 billion (FY19), $2.3 billion (FY20) and $3.5 billion (FY21) Source: Company reports [/caption] E-Commerce Revenues: Both Companies Have Mature E-Commerce Businesses

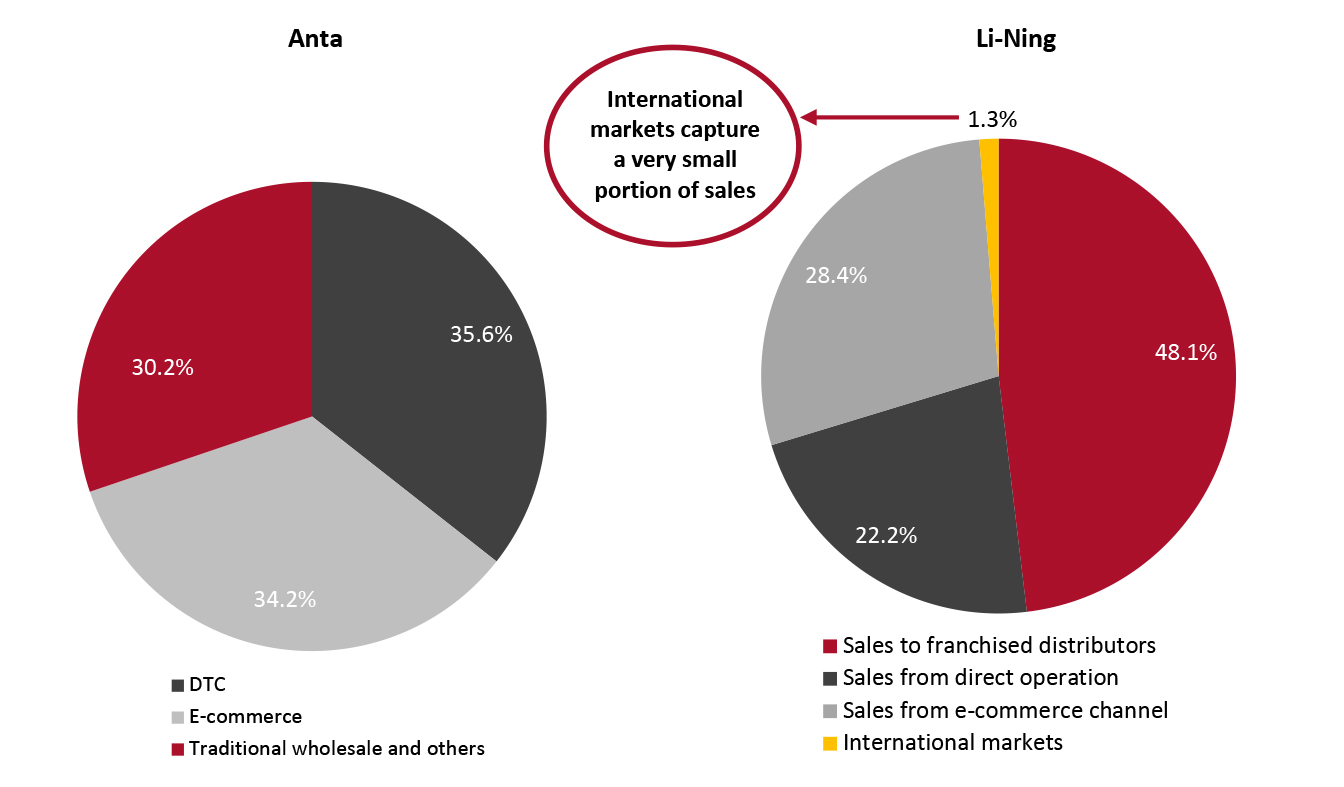

Anta e-commerce sales were up 61.6% on a currency-neutral basis for fiscal 2021, exceeding ¥8.2 billion ($1.3 billion) and accounting for 34.2% of the company’s total sales.

Li-Ning’s e-commerce sales accounted for 28.4% of total sales in fiscal 2021, up 58.4% on a currency-neutral basis at ¥6.4 billion.

Both Anta and Li-Ning have mature e-commerce businesses, driven by their strong digital capabilities, product innovation and the impact of the pandemic on consumer shifts toward online shopping. As of July 6, 2022, Anta has a total of 21.4 million followers on its Tmall store and Li-Ning has 26.3 million followers.

In 2021, Anta expanded its own e-commerce stores and continued to utilize the traditional e-commerce platforms including T-mall, JD.com, Pinduoduo and VIP.com. According to the company, it has fine-tuned the mix of the exclusive online products and in-season products among various e-commerce channels according to the features of the channels to optimize the merchandise selection mechanism. In early 2022, Anta served as the official sportswear provider of the Beijing 2022 Winter Olympics, and promoted its products online with Olympics champions.

[caption id="attachment_152122" align="aligncenter" width="700"] Anta’s advertisement introduces its fanny pack, which is also used by Olympics Champion Eileen Gu

Anta’s advertisement introduces its fanny pack, which is also used by Olympics Champion Eileen Gu Source: Tmall [/caption]

In 2021, Li-Ning was committed to exploring new breakthroughs in e-commerce creativity. For example, it continued to roll out a series of marketing campaigns on e-commerce festivals. It also devoted more efforts to promote functional products on livestreaming platforms such as Douyin, boosting consumer penetration and education regarding Li-Ning products.

[caption id="attachment_152123" align="aligncenter" width="700"] LI-NING’s livestreaming sessions on Douyin in September 2021, which introduced the brand’s products that showed up at 2021 Spring/Summer Paris Fashion Week

LI-NING’s livestreaming sessions on Douyin in September 2021, which introduced the brand’s products that showed up at 2021 Spring/Summer Paris Fashion Week Source: Douyin [/caption] Revenue by Category: Both Companies Weighted Toward Apparel

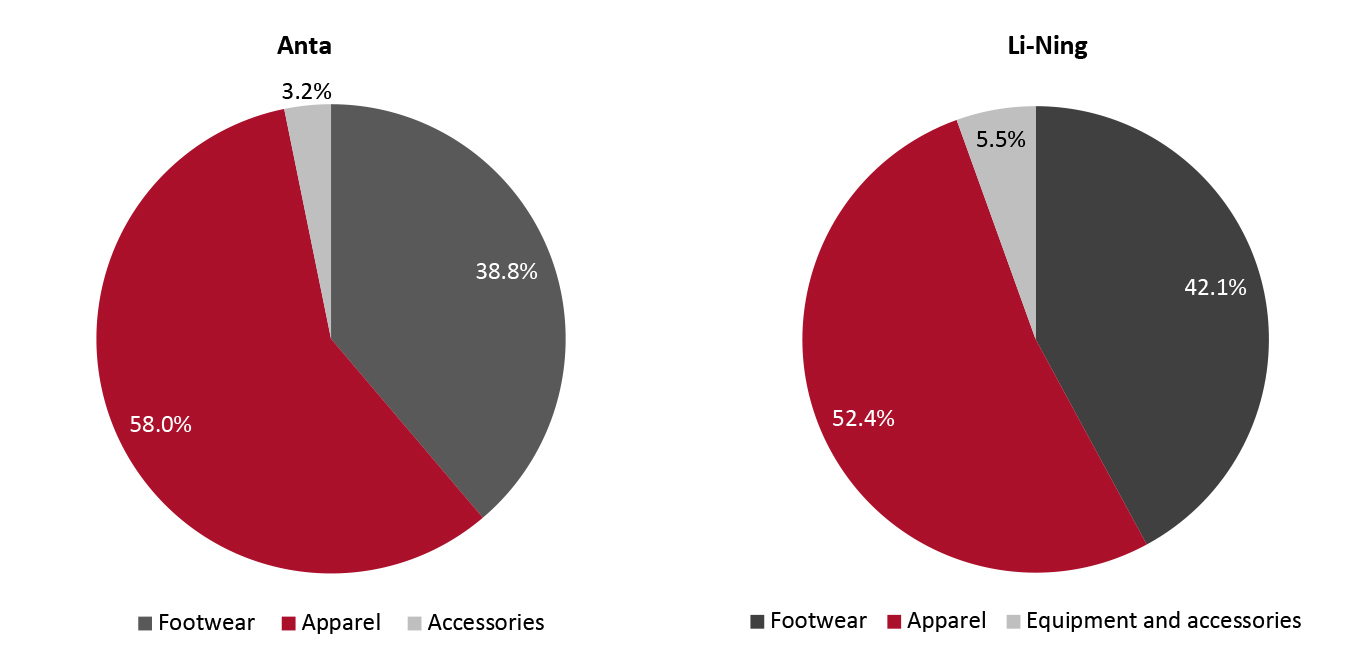

Both Anta and Li-Ning’s businesses are weighted toward the apparel category—with the category capturing 58.0% and 52.4% of sales at each company respectively in their latest fiscal years, compared to 50.3% and 44.0% in fiscal 2015.

Figure 4 presents a revenue breakdown by product category for the two companies.

Figure 4. Anta and Li-Ning: Revenue by Category, Fiscal Year 2021 (%) [caption id="attachment_152124" align="aligncenter" width="700"]

Source: Company reports[/caption]

Sales Channels: Li-Ning Has Higher Exposure to Wholesale Channels

Source: Company reports[/caption]

Sales Channels: Li-Ning Has Higher Exposure to Wholesale Channels

Anta and Li-Ning have different strategies regarding sales channels. We have seen Anta shift its sales channels toward direct-to-consumer and e-commerce amid the pandemic given the increasing number of online consumers and the resiliency of the DTC model. DTC is more effective in gaining customer insights and helping Anta improve margins, according to the company. In fiscal 2021, Anta attributed 35.6% of sales to DTC channels, comprising the company’s own retail business, compared to only 9.3% in 2020.

Li-Ning has a higher exposure to wholesale channels, with sales to retailers (termed franchised distributors by the company) comprising almost half of the company’s sales in fiscal 2021. We expect Li-Ning to continue to rely on the wholesale channel over the next few years, because of its large, deeply rooted franchise network.

Figure 5. Anta and Li-Ning: Revenue by Channel, Fiscal Year 2021 (%) [caption id="attachment_152125" align="aligncenter" width="700"]

Source: Company reports[/caption]

Key Strategies: Both Companies Aim To Expand Product Categories

Source: Company reports[/caption]

Key Strategies: Both Companies Aim To Expand Product Categories

We compare key business strategies documented by each company.

In December 2021, Anta released its new 10-year strategy, “Single-focus, multibrand, globalization”, which focuses on three core areas:

- Single-focus: Anta’s focus is to promote its core brand ANTA and make every effort to produce quality apparel and footwear.

- Multibrand: In addition to promoting its core brand, Anta will continue to execute its development strategies “Rooted in and Known for Performance Sport” and “Brand Transformation and Growth” in 2022 and 2023, reinforcing its leading position among Chinese sportswear brands.

- Globalization: Anta will unlock global brands’ growth potential in the China market, while also making Anta a representative Chinese sportswear brand with a global footprint. It will leverage ANTA and Amer Sports to achieve globalization in terms of brand portfolio, market position, value chain composition and governance structure. The acquisition of Amer Sports has shown the company’s hope to strengthen developments in China, Europe and North America.

Li-Ning focuses its business around the single-brand, multi-category, diversified channel strategy:

- Single-brand: Although Li-Ning owns and manages multi brands, it focuses on enhancing its core LI-NING brand. The company aims to convey LI-NING’s unique brand value by incorporating elements of both Chinese and popular culture and bolstering the brand’s core competitiveness in the field of professional sports.

- Multi-category: The company focuses on basketball, badminton, running, training and sports casual categories. It leverages scientific research to develop products in terms of their professional sports attributes. The company continues to pay attention to new markets such as the female fitness market, focusing on yoga, cross-fit and dance.

- Diversified channel: The company continues to leverage wholesale, direct-to-consumer and e-commerce channels to expand sales. Wholesale of LI-NING brand, excluding international and LI-NING YOUNG brand, saw a 55% sales increase in fiscal year 2021, according to the company, with the number of stores increasing by 7 over fiscal year 2020. For direct-to-consumer channel, the company proactively launched big stores with high efficiency in 2021, including flagship stores, while continuing to optimize the visual image of stores and consumers’ sports experience. With the pandemic recovery, sell-through from directly operated stores increased by 53.5% year over year in fiscal year 2021, according to the company. The company is also responding closely to consumers’ preferences and needs by expanding its online presence.

What We Think

We expect sportswear to continue to be an essential market category in the global apparel and footwear market. Over the next three to five years, we anticipate that Anta will retain its status as the largest sportswear company in China, with a higher revenue than rival Li-Ning, driven by the company’s stronger brand positioning and more aggressive expansion.

Implications for Global Sportswear Brands/Retailers- Anta was established later than Li-Ning but has outpaced Li-Ning in terms of revenue growth, largely driven by Anta’s expansion into lower-tier cities. We recommend that brands and retailers with plans to improve their position in the China sportswear market consider opportunities presented by lower-tier cities.

- The DTC selling channel allows brands to launch products faster and increase control over customer data, pricing and brand management. However, as the model will likely bring more supply chain pressure and advertising costs, it is important that brands choose appropriate distribution models and strategies to realize higher profit margins. For brands that want to increase DTC sales, we recommend that they focus on facilitating value-aligned and engaging consumer experiences.

- Although Anta and Li-Ning are building their own e-commerce platforms, we still expect to see strong product sell-throughs through third-party marketplaces and retail giants. In China, Tmall, JD.com and Pinduoduo are good entry points for brands and retailers to enter the market. Livestreaming is also one important strategy for brands who want to have more conversations directly with consumers.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved