Nitheesh NH

What’s the Story?

Sephora and Ulta are the two largest beauty retailers in the US and have been competing for market dominance for years. As part of Coresight Research’s Head-to-Head series, we provide insights into six key elements of their businesses including the two companies’ sales performance and evolving store portfolios, as well as their product offerings and loyalty programs.Why It Matters

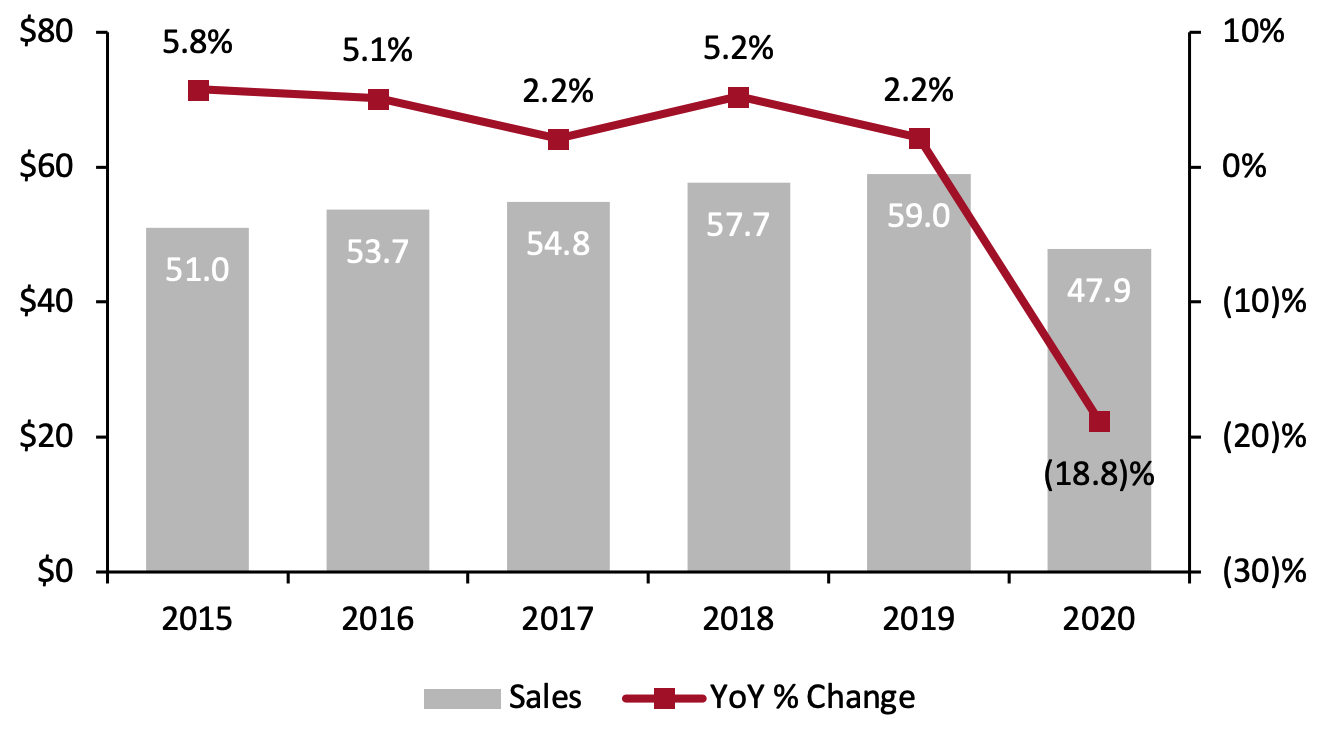

The overall US beauty market proved to be resilient amid the coronavirus pandemic, supported by increasing interest in wellness and self-care, which we identify as the pre-eminent multiyear trend for 2021. However, while consumer spending across all retailers on core beauty categories increased by 0.6% to $56.0 billion in 2020, according to the Bureau of Economic Analysis, US beauty specialist retailers saw sales decline by 18.8%—marking a significant change in direction from positive growth over the past five years. We expect the market to rebound by a high single-digit value in 2021. Figure 1. Beauty Specialist Retailers’ Sales, 2015–2020 (Left Axis USD Bil.) and YoY % Change [caption id="attachment_127154" align="aligncenter" width="720"] *Includes sales through specialist retailers of cosmetics, beauty products, fragrances, optical goods and other health and personal care products

*Includes sales through specialist retailers of cosmetics, beauty products, fragrances, optical goods and other health and personal care productsSource: US Census Bureau/Coresight Research[/caption] Sephora and Ulta lead the US beauty retail space, together accounting for 21% of sector revenue in 2020. As other players, such as department stores and drug store retailers, attempt to gain share in the competitive market, both Sephora and Ulta have been stepping up their business strategies to meet changing consumer demand.

Sephora vs. Ulta: A Deep Dive

Overview Sephora was acquired by LVMH in 1997, around 30 years after it was founded. As of December 2020, Sephora operates 2,021 stores in 35 countries, most of which are located in malls. Sephora focuses on mid-market to premium beauty products and offers beauty services and classes at most of its locations. The company offers more than 45,000 products from over 400 brands, as well as its private label, the Sephora Collection. Ulta Beauty is the largest beauty retailer in the US in terms of revenue. Predominantly located in high-traffic locations, its stores span an average of 10,000 square feet, including around 950 square feet dedicated to a full-service salon. Ulta also sells through its website, ulta.com. The company offers more than 25,000 prestige and mass products from around 500 well-established and emerging beauty brands, including Ulta’s private label, Ulta Beauty Collection. Figure 2. Overview: Sephora and Ulta [wpdatatable id=937]*Estimated by Coresight Research **Calculated prior to the pandemic Source: Company reports/ScrapeHero/WWD/Coresight Research

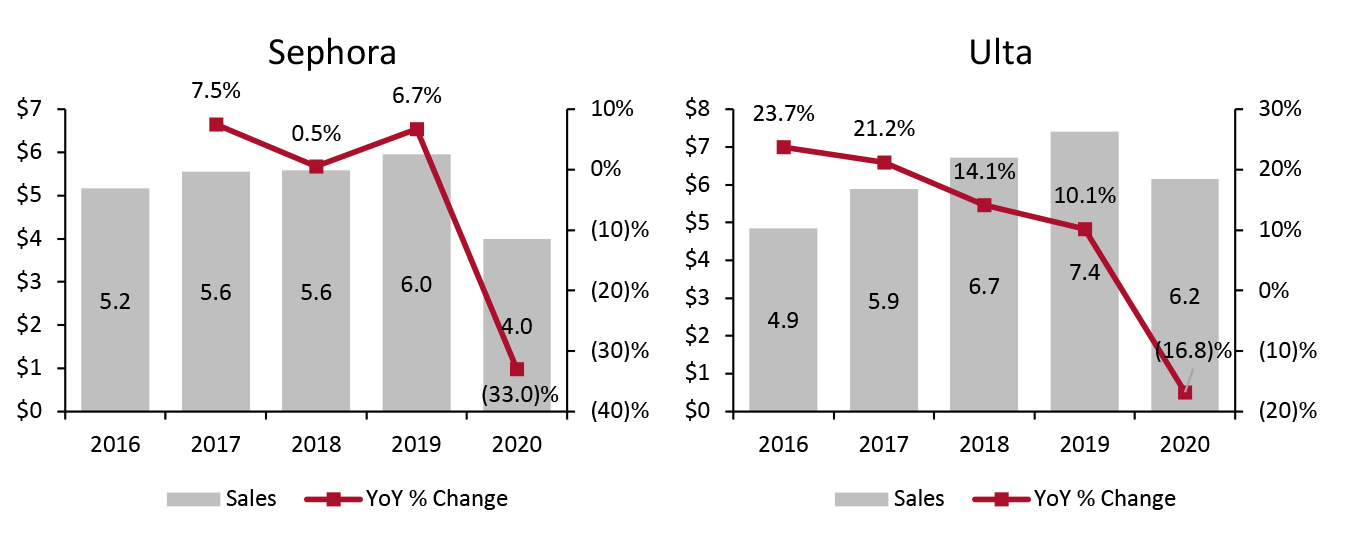

1. Sales Performance Ulta is the largest beauty retailer in the US, with sales of $6.2 billion in fiscal 2020, ended January 30, 2021, representing a year-over-year decline of 16.8% amid the pandemic. As Ulta carries more mass-market products than Sephora’s mid-market to high-end range, we estimate that the company’s sales were not hit as badly as Sephora. Sephora falls under LVMH’s Selective Retailing segment, which reported a year-over-year sales decline of 35% in its fiscal 2020, ended December 31, 2020. While specific financial disclosures on Sephora are limited, we estimate that US Sephora sales dropped by one-third last year. Looking further back, Ulta witnessed a strong double-digit sales uptick in fiscal 2016 and 2017, but the company’s growth has slowed down in recent years, which Ulta has attributed to sluggish growth in the overall color cosmetics market—cosmetics accounted for half of Ulta’s total sales from fiscal 2017 to 2019. We estimate that Sephora US saw roughly flat sales growth in fiscal 2018, returning to mid-to-high single-digit growth in fiscal 2019, with estimated revenues of $6 billion. Figure 3. Sephora and Ulta, 2016–2020: Annual Revenue (Left Axis; USD Bil.) and YoY % Change [caption id="attachment_127183" align="aligncenter" width="725"] Note: LVMH’s fiscal year ends December 31, Ulta’s fiscal year ends February 1

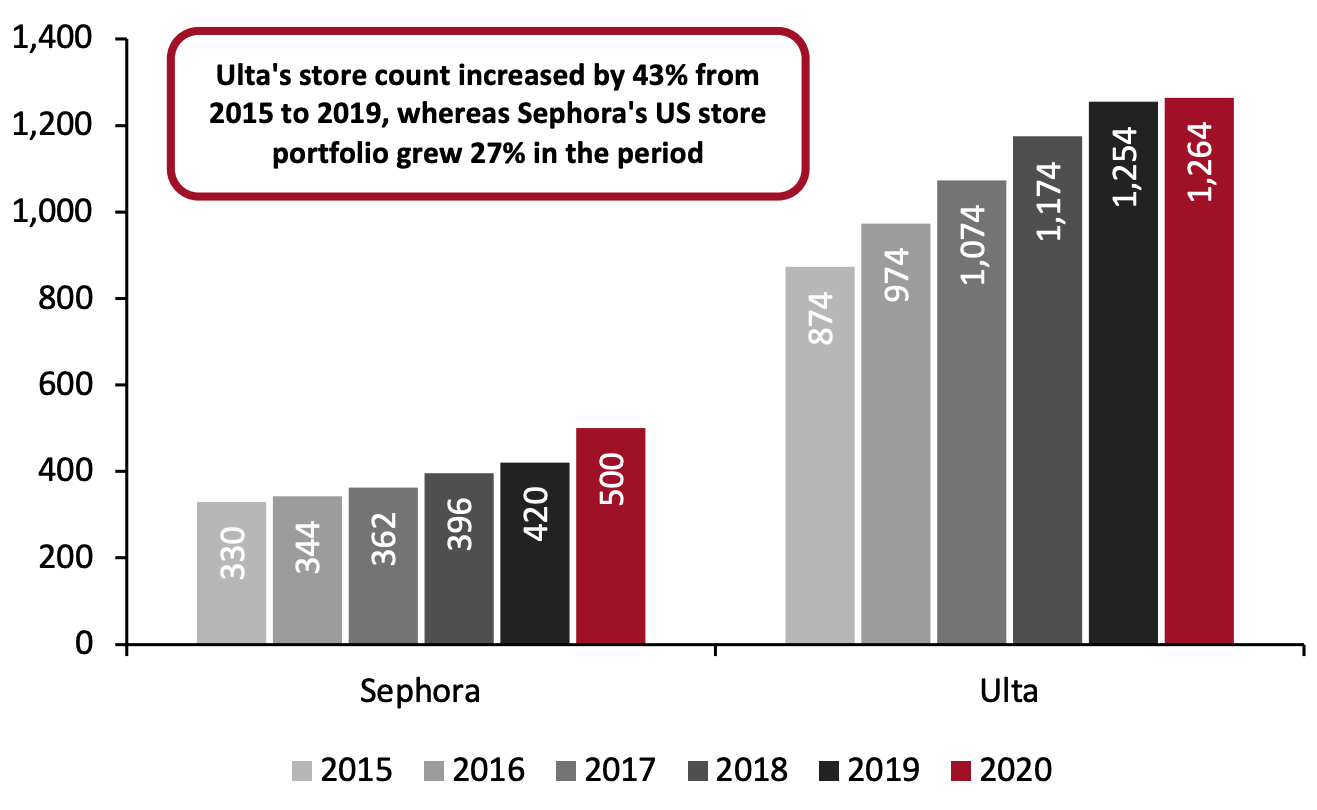

Note: LVMH’s fiscal year ends December 31, Ulta’s fiscal year ends February 1 Source: Company reports/Coresight Research [/caption] 2. Store Portfolio In the beauty market, stores play an increasingly important role in the consumer shopping journey. Some 46% of US consumers said that they want to see beauty products in person, according to a survey conducted by media company Digital Commerce 360 in August 2020. Ulta has been expanding its physical footprint in recent years, although at a decreasing pace year over year. The company only opened 10 net new stores in 2020, due to the pandemic. The pandemic also impacted the company’s plans to enter Canada, which it canceled in September 2020 to focus on its US operation amid the challenging retail environment. In its fourth-quarter 2020 earnings call, Ulta stated that it plans to open roughly 40 net new standalone stores, remodel 11 stores and relocate 10 stores in 2021 in the US. In the long term, Ulta is set on operating a network of 1,500–1,700 standalone stores. While Sephora has a smaller standalone store footprint than Ulta, as shown in Figure 3, the retailer also operates shop-in-shop locations in department store JCPenney, bringing its total store count to 1,089, as of February 2021. We discuss retail partnerships on shop-in-shop locations for the two retailers in the next section. At the beginning of 2020, Sephora announced its store expansion strategy for the year, featuring 100 smaller, community-focused stores in second-tier markets across North America throughout the year. Facing challenges amid the pandemic, the retailer did not meet its target but still opened around 80 stores, in 2020 according to the National Retail Federation. On February 25, 2021, Sephora announced plans to open 60 freestanding Sephora stores across Florida, Los Angeles, Nashville, the Pacific Northwest region and Texas in 2021. Including shop-in-shop locations, Ulta is set to open roughly 130 new stores in 2021, versus 260 for Sephora. Figure 4. US Standalone Store Portfolio: Sephora and Ulta [caption id="attachment_127157" align="aligncenter" width="720"]

Note: Sephora’s shop-in-shop locations are not included as historical data is not available. The store count is by fiscal year.

Note: Sephora’s shop-in-shop locations are not included as historical data is not available. The store count is by fiscal year.Source: Company reports/NRFI[/caption] Retail Partnerships Sephora and Ulta are both leveraging retail partnerships to expand their physical footprints going forward, having released their expansion plans at the end of 2020.

- November 11, 2020: Ulta Beauty announced its partnership with Target to bring at least 100 shop-in-shop locations to Target stores from 2021, with plans to scale up to hundreds of locations over time. Ulta Beauty products will also be made available online via Target’s website. The initial rollout will span across 40–50 of Ulta’s top-selling brands with a focus on the most productive stock-keeping units (SKUs).

- December 1, 2020: Sephora announced its partnership with Kohl’s to open 200 Sephora shop-in-shop locations within the retailer’s department stores and on its e-commerce site from fall 2021. The partnership will expand into at least 850 total physical locations by 2023. In an update in late April 2021, the retailer released details of its assortment of over 125 prestige brands that will be available at Kohl’s locations from August. Some 75% of the brands are exclusive to Sephora in the US. The partnership will expand Sephora’s demographic reach, providing the company access to Kohl’s extensive base of over 65 million consumers. This new shop-in-shop agreement is set to replace Sephora’s existing retail partnership with JCPenney, which is coming to an end in late 2022 after running for more than 10 years.

- The 850 shop-in-shop locations at Kohl’s translate to 185% growth by 2023 in Sephora’s US store base. This excludes the storefronts at JCPenney, which will be phased out by 2023. The partnership also increases Sephora’s off-mall presence and will help the chain move closer to consumers—Sephora’s Americas CEO Jean-André Rougeot stated that 90% of US consumers will be within 10 miles of a Sephora store (standalone or shop-in-shop) by 2023. The overlap between Sephora and Kohl’s locations is minimal, so the company only expects a small amount of sales cannibalization from the partnership.

- Sephora’s shop-in-shops at Kohl’s will more than twice as big as Ulta’s new locations in Target stores, thus featuring more products and brands and providing a larger channel to serve consumers.

| Private Label | |

| As of February 23, 2021, Ulta.com carries 445 products under the Ulta Beauty Collection banner, with all items priced under $25. Ulta Beauty Collection and permanent Ulta Beauty exclusive products represent 5.5% of the company’s annual sales, as of fiscal 2020. | As of February 23, 2021, the Sephora Collection range on Sephora.com sells 437 products, with prices of most beauty items coming in under $70. Sephora positions its private label Sephora Collection as an entry point for new consumers, with the aim of then introducing premium brands. |

| Exclusive Products | |

| Ulta offers two types of exclusive products: 1) Permanent exclusive products that consumers can only buy from Ulta, such as IT Cosmetics brushes and Tarte Double Duty Beauty cosmetics 2) Products that are temporarily exclusive as they are offered in advance of other retailers, such as items by digitally native brands ColourPop, Kylie Cosmetics and Morphe In fiscal 2020, permanent and temporary exclusive products accounted for 13.5% of Ulta’s annual sales. In 2019, Ulta launched its “Sparked at Ulta Beauty” platform, featuring a curated and evolving selection of emerging brands, available to consumers in selected stores and online. | Sephora owns exclusive US retail distribution rights for many niche brands, including Drunk Elephant, Huda Beauty, Fenty Beauty by Rihanna, Milk Makeup, Pat McGrath Labs and Rare Beauty by Selena Gomez. Sephora also collaborates with other brands to launch limited-edition products. Its latest launch featured co-branded makeup bags with premium fashion brand Brother Vellies in February 2021. In 2019, Sephora introduced its “Next Big Thing” initiative in stores and online to showcase either exclusive or limited-edition products. |

| Clean/Conscious Beauty | |

| Ulta introduced Conscious Beauty at Ulta Beauty in July 2020. The program is stricter than Sephora’s Clean Beauty standard, covering five key pillars—clean ingredients, cruelty-free, vegan, sustainable packaging and positive impact. Brands featured in the program include FEKKAI, KVD Beauty, Tarte, Tula, Pacifica and Ulta Beauty Collection. As of January 30, 2021, more than 230 brands are involved in the program. In June 2020, Ulta announced a partnership with clean beauty retailer Credo to bring Credo’s curated brands to 100 Ulta stores and its online site in the fall. As of February 23, 2021, 316 products from 25 brands are available in the Credo Collection on Ulta.com. | Sephora led the clean beauty trend in 2018, with the launch of a Clean Beauty category online and in-store, including a selection of products that avoid certain ingredients and offer more sustainable packaging and product sourcing. In July 2020, Sephora launched 11 clean beauty products by direct-to-consumer brand Beautycounter online and in-store. In August 2020, Sephora began to align its private label with its Clean Beauty initiative, unveiling four new Sephora Collection products with the Clean seal. The company is also transitioning all Sephora Collection skincare products to comply with its clean beauty initiative. As of February 23, 2021, more than 1,660 products on Sephora.com have the Clean seal representing less than 4% of the company’s total product assortment. |

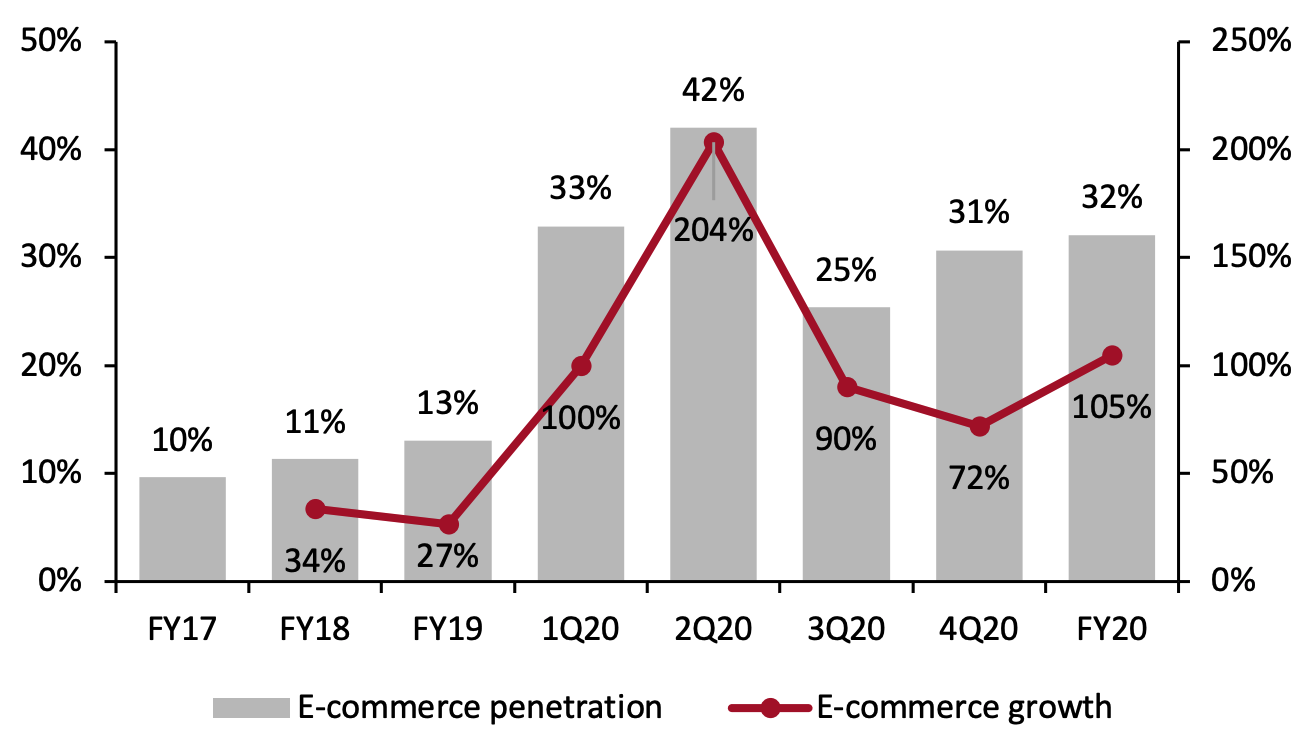

- Ulta launched curbside pickup in May 2020, on top of the buy online, pickup in store (BOPIS) service introduced in 2018. BOPIS represented 16% of Ulta’s e-commerce sales in its third quarter of fiscal 2020, double the penetration of the prior year.

- To meet high online demand, Ulta expanded its ship-from-store program to 105 stores, as of its third quarter of fiscal 2020.

Source: Company reports[/caption]

Sephora does not report specific e-commerce sales data, but Rougeot stated in August 2020 that e-commerce comprised almost 40% of Sephora US sales before the pandemic. In October 2020, Rougeot reported that Sephora’s online sales jumped 75% year over year since the beginning of the pandemic.

Sephora is an early adopter of digital innovations, launching features such as chatbot-enabled beauty advice and virtual makeup try-on long before the pandemic accelerated demand for these remote services. Nevertheless, Sephora boosted its online shopping experience in 2020 with the following initiatives:

Source: Company reports[/caption]

Sephora does not report specific e-commerce sales data, but Rougeot stated in August 2020 that e-commerce comprised almost 40% of Sephora US sales before the pandemic. In October 2020, Rougeot reported that Sephora’s online sales jumped 75% year over year since the beginning of the pandemic.

Sephora is an early adopter of digital innovations, launching features such as chatbot-enabled beauty advice and virtual makeup try-on long before the pandemic accelerated demand for these remote services. Nevertheless, Sephora boosted its online shopping experience in 2020 with the following initiatives:

- Sephora announced its “Reserve Online, Pick Up In Store” service in September 2020 to allow consumers to pay on collection, complementing its existing BOPIS offering. These curbside services are only available at a few stores, due to Sephora’s mall-centric store model.

- Sephora partnered with Instacart in September 2020 to offer same-day delivery on products from over 300 brands in more than 400 Sephora stores in North America.

- In June 2020, Sephora collaborated with Instagram on a digital storefront for shoppers to purchase products from more than 80 Sephora brands via Instagram Checkout. Users who shopped through Instagram can still earn membership points and use aftersales services.

- To attract younger consumers, in May 2020, Sephora introduced a buy now, pay later service on Sephora.com via payment firm Klarna.

Source: Company reports

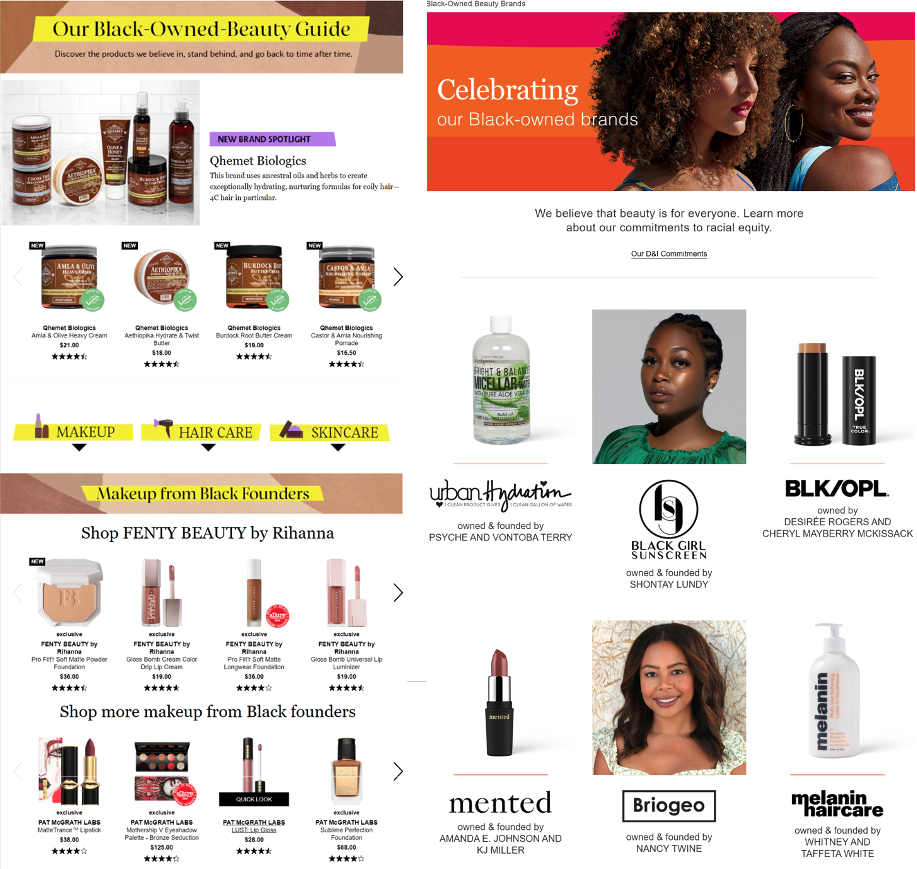

6. Diversity and Inclusion Initiatives Today’s consumers are demanding more from brands and retailers with regards to diversity and inclusion, driving a wave of new commitments among many US retailers. We discuss recent initiatives by Ulta and Sephora to improve diversity and inclusion within their businesses. In February 2021, Ulta appointed Tracee Ellis Ross, CEO and founder of PATTERN Beauty as the company’s Diversity and Inclusion Advisor. The company also announced diversity and inclusion commitments, reflecting a total planned investment of more than $25 million, focused on four key areas:- Amplifying and investing in underrepresented voices: Ulta will allocate $20 million to digital investments in “endemic and multi-cultural platforms,” more than doubling what it has spent over the last three years. Ulta also debuted its new MUSE platform (which stands for Magnify, Uplift, Support, Empower) to amplify Black voices in beauty.

- Black-owned brands: Ulta will double the number of Black-owned brands it carries by the end of 2021. The company will also dedicate $4 million in marketing support for Black-owned brands. As of February 2021, Ulta carries 15 Black-owned brands.

- Guest experiences: To improve in-store experiences, Ulta will distribute a $2 million investment in quarterly in-store training for associates to reinforce inclusivity and address unconscious bias.

- Associate experience: Ulta will double its diversity and inclusion training opportunities across the enterprise in 2021, launch inclusive recruitment efforts and establish a Diverse Leaders program.

- In February 2021, Sephora relaunched its Incubator Program, previously aimed at cultivating an international community of female beauty founders and supporting the launch of women-owned brands. This year, the program features 100% black, indigenous and people of color (BIPOC)-owned beauty brands. The program includes a Sephora-led curriculum, mentorship, merchandising support, potential funding and investor connections to eight participating brands. All brands will launch at Sephora upon completion of the program.

- In January 2021, Sephora released its first in-depth report on racial bias in US retail, with an action plan to tackle the issue in three key areas: marketing and merchandising, in-store experiences, and inclusive workplaces.

- Sephora announced its partnership with the Maryland State Department of Rehabilitative Services (MSDE DORS) in September 2020 to provide training to people with disabilities to expand their career opportunities.

- In June 2020, Sephora became the first US retailer to pledge 15% of its shelf space to Black-owned brands. As of February 2021, Sephora only offers nine Black-owned brands.

Black-owned beauty brands pages on Sephora.com (left) and Ulta.com (right)

Black-owned beauty brands pages on Sephora.com (left) and Ulta.com (right)Source: Sephora/Ulta[/caption]